U.S. Global Investors’ Near-Term Tax Free Fund Earns 5-Star Rating

September 17 2014 - 9:12AM

Business Wire

U.S. Global Investors, Inc. (NASDAQ: GROW), a boutique

registered investment advisory firm specializing in natural

resources and emerging markets, has earned the coveted 5-star

Morningstar rating for its Near-Term Tax Free Fund (NEARX) for the

3-year performance period. The fund was ranked in the Morningstar

category of Municipal National Short-Term funds. Only the top 10

percent of funds in each category receive five stars.

The fund has a 4-star rating for its 5- and 10-year performance

periods as well as for its overall performance.

“During this prolonged environment of low interest rates and

volatile global stock markets, investors and financial advisors

have appreciated the steady performance and the tax-free income

that the Near-Term Tax Free Fund has delivered,” said Frank Holmes,

CEO and chief investment officer.

The Near-Term Tax Free Fund has generated consistent positive

total returns (yield + appreciation) for investors for 13 years in

a row. The fund invests primarily in investment-grade municipal

bonds with relatively short maturities and seeks to provide

tax-free monthly income by investing in debt securities issued by

state and local governments from across the country. The fund is

managed by Director of Research John Derrick, CFA, who has 20 years

of experience, alongside Frank Holmes.

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 40 years

when it began as an investment club. Today, U.S. Global Investors,

Inc. (www.usfunds.com) is a registered investment advisor that

focuses on profitable niche markets around the world. Headquartered

in San Antonio, Texas, the company provides money management and

other services to U.S. Global Investors Funds and other

international clients.

Please consider carefully a fund’s investment objectives, risks,

charges and expenses. For this and other important information,

obtain a fund prospectus by visiting www.usfunds.com or by calling

1-800-US-FUNDS (1-800-873-8637). Read it carefully before

investing. Distributed by U.S. Global Brokerage, Inc.

Total Annualized Returns as of 06/30/2014

Fund One-Year Five-Year Ten-Year

Gross ExpenseRatio

Expense RatioAfter Waivers

Near-Term Tax Free Fund(NEARX)

3.68% 3.07% 3.16% 1.21% 0.45%

Past performance does not guarantee future results.

Bond funds are subject to interest-rate risk; their value

declines as interest rates rise. Tax-exempt income is federal

income tax free. A portion of this income may be subject to state

and local income taxes, and if applicable, may subject certain

investors to the Alternative Minimum Tax as well. The Near-Term Tax

Free Fund may invest up to 20% of its assets in securities that pay

taxable interest. Income or fund distributions attributable to

capital gains are usually subject to both state and federal income

taxes. The Near-Term Tax Free Fund may be exposed to risks related

to a concentration of investments in a particular state or

geographic area. These investments present risks resulting from

changes in economic conditions of the region or issuer. Though the

Near-Term Tax Free Fund seeks minimal fluctuations in share price,

it is subject to the risk that a decline in the credit quality of a

portfolio holding could cause a fund’s share price to decline.

Morningstar Overall Rating™ among 164 Municipal National

Short-Term funds as of 08/31/2014 based on risk-adjusted

return.

Morningstar™

**** Overall/[164] ***** 3-Year/[164] ****

5-Year/[135] **** 10-Year/[103]

Morningstar ratings based on risk-adjusted return and number of

fundsCategory: Municipal National Short-Term FundsThrough:

08/31/2014

Morningstar Ratings are based on risk-adjusted return. The

Morningstar Rating for a fund is derived from a weighted-average of

the performance figures associated with its three-, five- and

ten-year Morningstar Rating metrics. Past performance does not

guarantee future results. For each fund with at least a three-year

history, Morningstar calculates a Morningstar Rating™ based on a

Morningstar Risk-Adjusted Return measure that accounts for

variation in a fund’s monthly performance (including the effects of

sales charges, loads, and redemption fees), placing more emphasis

on downward variations and rewarding consistent performance. The

top 10% of funds in each category receive 5 stars, the next 22.5%

receive 4 stars, the next 35% receive 3 stars, the next 22.5%

receive 2 stars and the bottom 10% receive 1 star. (Each share

class is counted as a fraction of one fund within this scale and

rated separately, which may cause slight variations in the

distribution percentages.)

U.S. Global Investors, Inc.Susan Filyk, 210-308-1286Investor

Relationssfilyk@usfunds.com

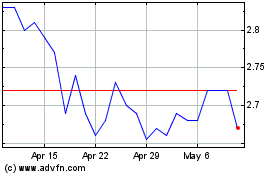

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Mar 2024 to Apr 2024

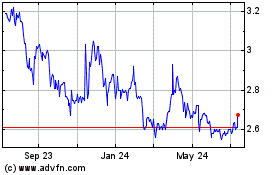

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Apr 2023 to Apr 2024