Current Report Filing (8-k)

August 14 2014 - 1:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): January 7, 2014

FILED ON AUGUST

14, 2014

_______________________________

Hannover House,

Inc.

(Exact name of

registrant as specified in its charter)

_________________

| Wyoming |

000-28723 |

91-1906973 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation or Organization) |

File Number) |

Identification No.) |

1428 Chester

Street, Springdale, AR 72764

(Address of Principal Executive Offices) (Zip Code)

479-751-4500

(Registrant’s telephone number, including area code)

f/k/a "Target

Development Group, Inc."

f/k/a "Mindset

Interactive Corp."

330 Clematis

Street, Suite 217, West Palm Beach, Florida 33401 (561) 514-0936

(Former name or former address and former fiscal year, if changed since last report)

_______________________________

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 1 —

REGISTRANT'S BUSINESS AND OPERATIONS

| Item 1.01 |

Entry into a Material Definitive Agreement. Debt

Conversion Transactions - During the calendar year-to-date for 2014, Hannover House, Inc. ("Company")

has entered into a variety of “Debt Conversion” transactions and direct stock-equity issuances in exchange for

debt forgiveness or value credits from key, eligible creditors and obligations. The initial announcement of such

planned activity was previously disclosed in an OTC Markets filing on August 7, 2013 and again (with additional specificity

as to the restoration of the Company’s prior Authorized Share Count to 700-million), in a Form 8-K filing posted on November

19, 2013. The Company’s plans for issuing shares for debt forgiveness was discussed at length during an open-discussion

forum at the annual shareholder’s meeting, held February 21, 2014 at the Grand Hyatt Hotel in New York City. The consensus

among attendees at the shareholder’s meeting was that the conversion of debts into equity was a valuable tool for managers

to utilize judiciously in order to preserve cash resources for growth.

Beginning on January 7, 2014, and continuing through to

the date of this disclosure (August 14, 2014), the Company authorized both the issuance of new shares and the retirement of

shares, with a net increase in total outstanding shares growing by a total of 26,466,938. Theequity-issuance

transactions have resulted in direct payments or credits against corporate obligations totaling $365,300 in value. There

have been four Debt Conversion transactions, the first to Deer Valley Management, LLC in January, the second and third

to MaremmanoCorporation in April and June, and the final transaction to JSJ Investments, Inc. on July 31, 2014.

Additionally, shares were issued directly to nine creditors for full or significant reductions of corporate obligations. As

of the date of this filing, Company believes that all shares issued under the four Debt Conversions transactions

have been sold by the receiving parties into the marketplace.

The total share count now in issue for Hannover House, Inc.

(OTC: HHSE) as of the date of this filing is 606,699,303, according to the Company’s Transfer Agent, Standard Registrar &

Transfer Co., Inc., Draper, Utah.

|

| |

|

SECTION

8 — OTHER EVENTS

SECTION 9 —

FINANCIAL STATEMENTS AND EXHIBITS

| Item 9.01 |

Financial Statements and Exhibits. |

| |

(a) Financial statements of businesses acquired. Not Applicable. |

| |

(b) Pro forma financial information. Not Applicable. |

| |

(c) Shell company transactions. Not Applicable. |

| |

(d) Exhibits. |

INDEX TO EXHIBITS

| Exhibit No. |

|

Description |

| 99.1 |

|

Chart of HHSE Share Issuances / Chart of Debt Reductions & Classifications |

| |

|

|

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| Date: August 14, 2014 |

Hannover House, Inc. |

|

| |

By |

/s/ Eric F. Parkinson |

|

| |

|

Name: Eric F. Parkinson

Title: C.E.O. |

|

EXHIBIT 99.1

Chart of HHSE Share Issuances / Chart of Debt Reductions & Classifications

| HHSE Share Count |

|

|

|

| |

|

|

|

|

| |

|

Change From |

Baseline |

|

| Date |

Total Outstanding |

Prior 6-Mo. |

Percentage |

|

| 12/31/2009 |

461,206,692 |

0% |

100% |

|

| 6/30/2010 |

461,206,692 |

0% |

100% |

|

| 12/31/2010 |

471,958,775 |

2.33% |

102.33% |

|

| 6/30/2011 |

486,495,139 |

3.08% |

105.48% |

|

| 12/31/2011 |

476,511,945 |

-2.05% |

103.32% |

|

| 6/30/2012 |

491,238,217 |

3.09% |

106.51% |

|

| 12/31/2012 |

489,965,532 |

-0.26% |

106.24% |

|

| 6/30/2013 |

550,334,514 |

12.32% |

119.32% |

|

| 12/31/2013 |

583,732,365 |

6.70% |

126.57% |

|

| 6/30/2014 |

582,441,217 |

-0.22% |

126.29% |

|

| Current |

606,699,303 |

4.45% |

131.55% |

|

| |

|

|

|

|

| Note: |

Increased share count includes 10-mm shares to TCA |

|

| |

which are subject to return, and 27-mm shares to |

|

| |

Ahnume Business Consultants (considered as "long" hold) |

|

| |

|

|

|

|

| HHSE Debt Structure |

|

|

|

|

| |

|

|

Amount |

Amount |

|

| |

|

|

As Of |

As Of |

|

| Category |

Description |

|

12/31/2010 |

12/31/2013 |

|

| Accounts Payable |

Ongoing-Current |

|

$ 627,996 |

$ 148,522 |

|

| Accrued Royalties |

Ongoing-Current |

|

$ 96,150 |

$ 303,829 |

|

| Prod. Acquis. Due |

Short-Term Toxic Debt |

|

$ 1,696,000 |

$ 157,260 |

|

| Accrued Wages |

Ongoing-Current |

|

$ 15,400 |

$ - |

|

| Taxes Payable |

Short-Term Toxic Debt |

|

$ 14,983 |

$ 5,585 |

|

| Hounddog P&A |

Long-Term Obligation |

|

$ 753,964 |

$ 826,624 |

|

| Bank Notes Payable |

Long-Term Obligation |

|

$ 18,528 |

$ 358,031 |

|

| Addl. Long Term Payables |

Long-Term Obligation |

|

$ 1,012,664 |

$ 2,753,427 |

* |

| Separate "12" Advance Debt |

Short-Term Toxic Debt |

|

$ 500,000 |

$ - |

|

| "12" P&A Loans |

Short-Term Toxic Debt |

|

$ 312,500 |

$ - |

|

| Executive Loans to Co. |

Long-Term Obligation |

|

$ - |

$ 169,840 |

|

| Executive Salary Deferrals |

Long-Term Obligation |

|

$ 758,724 |

$ 1,063,996 |

|

| Interstar & EE Smith Debts |

Disputed as of 12-31-10 |

|

$ 571,556 |

Included Above |

|

| |

|

|

|

|

|

| |

TOTAL ALL CATEGORIES: |

|

$ 6,378,465 |

$ 5,787,114 |

|

| |

|

|

|

|

|

| |

Amount From Period Considered Short Term or Toxic |

|

$ 3,834,585 |

$ 615,196 |

|

| |

Percentage from Period as Short Term or Toxic |

|

60.12% |

10.63% |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Note: Self funding / Self-liquidating obligation of |

|

|

|

|

| $1.5-mm on the 12-31-2013 balance sheet for intl. |

|

|

|

|

| presales is excluded from debt structure analysis |

|

|

|

|

| |

|

|

|

|

|

| * Note: TCA Loan and the balances due to Andersons |

|

|

|

|

| and Southern Star for "12" P&A are included under |

|

|

|

|

| Addl Long Term Payables for the 12-31-2013 summary |

|

|

|

|

| |

|

|

|

|

|

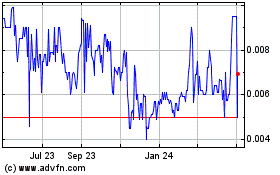

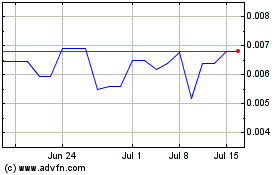

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Apr 2023 to Apr 2024