UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 11, 2014

MannKind Corporation

(Exact name of registrant as specified in its charter)

| Delaware |

000-50865 |

13-3607736 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 28903 North Avenue Paine Valencia, California |

91355 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area code: (661) 775-5300

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On August 11, 2014, MannKind Corporation issued a press release announcing its financial results for the quarter ended June 30, 2014. A copy of the press release is attached as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

The information in this Current Report is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is furnished herewith:

|

99.1

|

Press Release of MannKind Corporation dated August 11, 2014, reporting MannKind's financial results for the quarter ended June 30, 2014.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

MannKind Corporation

(Registrant)

|

August 11, 2014

(Date) |

|

/s/ MATTHEW J. PFEFFER

Matthew J. Pfeffer

Corporate Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

Number

|

Description

|

|

99.1

|

Press Release of MannKind Corporation dated August 11, 2014, reporting MannKind's financial results for the quarter ended June 30, 2014.

|

EXHIBIT 99.1

MannKind Corporation Reports 2014 Second Quarter Financial Results

VALENCIA, Calif., Aug. 11, 2014 (GLOBE NEWSWIRE) -- MannKind Corporation (Nasdaq:MNKD) today reported financial results for the second quarter ended June 30, 2014.

For the second quarter of 2014, total operating expenses were $69.8 million, compared to $41.6 million for the second quarter of 2013, an increase of $28.2 million, largely due to an increase in non-cash stock compensation expense of $30.5 million. In the second quarter of 2014, the settlement terms for certain performance-based awards were modified requiring reclassification of these performance grants from equity awards to liability awards and resulting in incremental stock-based compensation expense. Research and development (R&D) expenses increased by $10.2 million to $37.3 million for the second quarter of 2014 compared to $27.1 million for the same quarter in 2013. This 38% increase in R&D expense was primarily due to increased non-cash stock compensation expense of $13.1 million and increased commercial readiness costs of $1.4 million offset by a $4.2 million decrease in clinical trial related expenses. General and administrative (G&A) expenses increased by $18.0 million to $32.5 million for the second quarter of 2014 compared to $14.5 million in the second quarter of 2013. This 124% increase in G&A expense was primarily due to increased non-cash stock compensation expense of $17.3 million.

For the first six months of 2014, operating expenses totaled $111.3 million, compared to $78.0 million in the first half of 2013. The increase of $33.3 million was largely due to an increase in non-cash stock compensation of $36.2 million. Total R&D expenses for the six months ended June 30, 2014 increased by $10.1 million compared to the same period in 2013, primarily due to a $15.5 million increase in non-cash stock compensation expense along with a $2.7 million increase in spending on commercial readiness. This 19% increase was offset by an $8.3 million decrease in clinical expenses upon the completion of the Affinity studies in the second quarter of 2013. G&A expenses increased by $23.2 million, or 94%, to $47.8 million for the first half of 2014 as compared to $24.6 million in the same period in 2013, primarily due to increased non-cash stock compensation expense of $20.7 million and an increase in consulting and legal fees of $1.5 million related to financing transactions and associated filings.

The net loss applicable to common stockholders for the second quarter of 2014 was $73.4 million, or $0.19 per share based on 380.8 million weighted average shares outstanding, compared to a net loss applicable to common stockholders for the second quarter of 2013 of $46.1 million, or $0.16 per share based on 284.0 million weighted average shares outstanding. The number of common shares outstanding at June 30, 2014 was 394,036,984.

Cash and cash equivalents were $41.2 million at June 30, 2014, compared to $35.8 million in the first quarter of 2014. In the second quarter of 2014, $16.3 million in proceeds from warrant and stock option exercises were received in addition to $20.0 million from Tranche B notes purchased by Deerfield. Subsequently, on July 18, 2014, $40.0 million in Tranche 4 notes were purchased by Deerfield under the provisions of the facility agreement upon FDA approval of AFREZZA. Currently, up to $70.0 million of additional sales of Tranche B notes to Deerfield remain available and there is also $30.1 million of available borrowings under the amended loan arrangement with The Mann Group.

Conference Call

MannKind management will host a conference call to discuss these results today at 5:00 p.m. Eastern Time. To participate in the call please dial (800) 708-4540 or (847) 619-6397 and use the participant passcode: 36435006. Those interested in listening to the conference call live via the Internet may do so by visiting the Company's website at http://www.mannkindcorp.com.

A telephone replay will be accessible for approximately 14 days following completion of the call by dialing (888) 843-7419 or (630) 652-3042 and use the participant passcode: 36435006#. A replay will also be available on MannKind's website for 14 days.

About MannKind Corporation

MannKind Corporation (Nasdaq:MNKD) focuses on the discovery, development and commercialization of therapeutic products for patients with diseases such as diabetes. MannKind maintains a website at www.mannkindcorp.com to which MannKind regularly posts copies of its press releases as well as additional information about MannKind. Interested persons can subscribe on the MannKind website to e-mail alerts that are sent automatically when MannKind issues press releases, files its reports with the Securities and Exchange Commission or posts certain other information to the website.

Forward-Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties. Words such as "believes", "anticipates", "plans", "expects", "intend", "will", "goal", "potential" and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon the Company's current expectations. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, the risks detailed in MannKind's filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended December 31, 2013 and periodic reports on Form 10-Q and Form 8-K. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. All forward-looking statements are qualified in their entirety by this cautionary statement, and MannKind undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date of this press release.

(Tables to follow)

|

MannKind Corporation |

|

(A Development Stage Company) |

|

Condensed Consolidated Statements of Operations |

|

(Unaudited) |

|

(In thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative period |

|

|

|

|

|

|

from February 14, |

|

|

|

|

|

|

1991 (date of |

|

|

Three months ended |

Six months ended |

inception) to |

|

|

June 30, |

June 30, |

June 30, |

|

|

2014 |

2013 |

2014 |

2013 |

2014 |

|

Revenue |

$ — |

$ — |

$ — |

$ — |

$3,166 |

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

37,323 |

27,052 |

63,506 |

53,450 |

1,640,798 |

|

General and administrative |

32,523 |

14,533 |

47,752 |

24,572 |

533,138 |

|

In-process research and development costs |

— |

— |

— |

— |

19,726 |

|

Goodwill impairment |

— |

— |

— |

— |

151,428 |

|

Total operating expenses |

69,846 |

41,585 |

111,258 |

78,022 |

2,345,090 |

|

|

|

|

|

|

|

|

Loss from operations |

(69,846) |

(41,585) |

(111,258) |

(78,022) |

(2,341,924) |

|

Other income (expense) |

(370) |

15 |

(6,260) |

38 |

(9,162) |

|

Interest expense on note payable to related party |

(721) |

(1,689) |

(1,435) |

(3,378) |

(46,569) |

|

Interest expense on senior convertible notes |

(2,429) |

(2,866) |

(6,471) |

(5,729) |

(61,557) |

|

Interest income |

1 |

1 |

2 |

2 |

37,006 |

|

|

|

|

|

|

|

|

Loss before benefit for income taxes |

(73,365) |

(46,124) |

(125,422) |

(87,089) |

(2,422,206) |

|

Income tax benefit |

— |

— |

— |

— |

382 |

|

|

|

|

|

|

|

|

Net loss |

(73,365) |

(46,124) |

(125,422) |

(87,089) |

(2,421,824) |

|

Deemed dividend related to beneficial conversion feature of convertible preferred stock |

— |

— |

— |

— |

(22,260) |

|

Accretion on redeemable preferred stock |

— |

— |

— |

— |

(952) |

|

|

|

|

|

|

|

|

Net loss applicable to common stockholders |

$ (73,365) |

$ (46,124) |

$ (125,422) |

$ (87,089) |

$ (2,445,036) |

|

|

|

|

|

|

|

|

Net loss per share applicable to common stockholders — basic and diluted |

$ (0.19) |

$ (0.16) |

$ (0.33) |

$ (0.31) |

|

|

|

|

|

|

|

|

|

Shares used to compute basic and diluted net loss per share applicable to common stockholders |

380,770 |

284,044 |

374,810 |

282,062 |

|

|

|

|

|

|

|

|

|

MannKind Corporation |

|

(A Development Stage Company) |

|

Condensed Consolidated Balance Sheet |

|

(Unaudited) |

|

(in thousands) |

|

|

|

|

|

|

June 30, 2014 |

December 31, 2013 |

|

|

|

|

|

Assets |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents |

$ 41,214 |

$ 70,790 |

|

Prepaid expenses and other current assets |

3,696 |

5,485 |

|

Total current assets |

44,910 |

76,275 |

|

Property and equipment — net |

183,533 |

176,557 |

|

Other assets |

7,863 |

5,814 |

|

Total |

$ 236,306 |

$ 258,646 |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity (Deficit) |

|

|

|

Current liabilities |

$ 119,233 |

$ 127,794 |

|

Senior convertible notes |

98,889 |

98,439 |

|

Note payable to related party |

49,521 |

49,521 |

|

Other liabilities |

15,040 |

13,605 |

|

Stockholders' equity (deficit) |

(46,377) |

(30,713) |

|

Total |

$ 236,306 |

$ 258,646 |

CONTACT: Company Contact:

Matthew J. Pfeffer

Chief Financial Officer

661-775-5300

mpfeffer@mannkindcorp.com

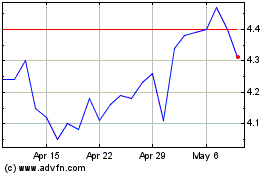

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Apr 2024 to May 2024

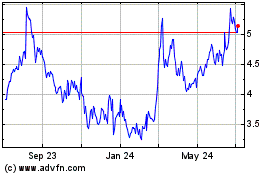

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From May 2023 to May 2024