Current Report Filing (8-k)

August 01 2014 - 10:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act Of 1934

|

Date of Report (Date of earliest event reported)

|

August 1, 2014

|

|

THE PROCTER & GAMBLE COMPANY

|

|

(Exact name of registrant as specified in its charter)

|

|

Ohio

|

|

1-434

|

|

31-0411980

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification Number)

|

|

One Procter & Gamble Plaza, Cincinnati, Ohio

|

|

45202

|

|

(Address of principal executive offices)

|

|

Zip Code

|

|

(513) 983-1100

|

|

45202

|

|

(Registrant's telephone number, including area code)

|

|

Zip Code

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

ITEM 7.01 REGULATION FD DISCLOSURE

On August 1, 2014, The Procter & Gamble Company (the "Company") issued a press release announcing its fourth quarter results and hosted a conference call related to those results. The Company is furnishing on Form 8-K a series of slides referenced in the conference call which are also posted on the Company's website. This 8-K is being furnished pursuant to Item 7.01, "Regulation FD Disclosure."

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

THE PROCTER & GAMBLE COMPANY

BY: /s/ Susan S. Whaley

Susan S. Whaley

Assistant Secretary

August 1, 2014

EXHIBIT(S)

99. Informational Slides Provided by The Procter & Gamble Company dated August 1, 2014.

August 1, 2014 Procter & Gamble Earnings Release:FY 2014 & Q4 FY 2014 Results

Fiscal Year 2014Business Results

Fiscal Year 2014 ResultsOrganic Sales Growth* 3% 3% 3% * Restated for Pet Care

Fiscal Year 2014 ResultsCore EPS Growth* * Restated for Pet Care

Returning Value to Shareholders $ billions FY 2014 Past 10 FY’s Dividends 6.9 51.1 Share Repurchase 6.0 52.9* Value to Shareholders 12.9 104.0 % of Net Earnings 110% 97% * Excludes Gillette repurchases

Apr - Jun 2014 (Q4 FY 14)Business Results

Apr – Jun 14 (Q4 FY 14) ResultsOrganic Sales Growth* Organic sales grew 2% in a very challenging macro environment. 2% 4% 4% 4% 3% * Restated for Pet Care

Apr – Jun 14 (Q4 FY 14) ResultsCore EPS Growth* Core EPS growth includes 170 basis points of operating margin improvement driven by productivity savings. * Restated for Pet Care

Apr – Jun 14 (Q4 FY 14) ResultsCurrency Neutral Core EPS Growth* Excluding the impact of foreign exchange, currency-neutral core earnings per share increased 25% for the quarter. * Restated for Pet Care

Fiscal Year 2014Non-Core Restructuring Spending* FY 14 FY 14 FY 14 FY 14 FY 14 ($MM Before Tax) JAS OND JFM AMJ TOTAL Cost of Goods Sold 62 52 90 100 304 SG&A 4 34 45 53 136 Total Non-Core Restructuring 66 86 135 153 440 * Restated for Pet Care

Apr – Jun 14 (Q4 FY 14) ResultsBeauty Segment Flat Pricing, Flat MixOrganic Volume: i Mid-singles Developed, i Low singles DevelopingP&G global value share declined 0.4 points versus year agoNet Earnings include the the sale of the Latin American Pert business. Salon and Prestige grew above segment average behind productivity improvements. -3% -3% Organic Sales Organic Volume Net Earnings

By Category Organic Volume Growth IYA Organic Volume Growth IYA Organic Volume Growth IYA By Category Global Developed Developing Hair Care - - - Skin Care - - - Personal Cleansing - - - Deodorants ++ - ++ Cosmetics ~= + - Prestige + ~= ++ Salon Professional - - - Apr – June 14 (Q4 FY 14) ResultsBeauty Segment ++ represents growth above 3%, + represents growth of 2-3%, ~= represents growth of 1% to decline of 1%; - represents decline greater than 1%. Company average = Flat.

Hair Care organic sales were down slightly with growth in Head & Shoulders behind the Fresh Scent technology innovation mainly off-set by declines in Rejoice and Nice N Easy. Pantene organic global sales were flat.Skin Care volume declined as U.S. shipments growth behind the Q3 launches of Olay Regenerist Luminous and new Fresh Effects products was more than off-set by continued challenges in China.Personal Cleansing value share was about flat as growth in Safeguard, Old Spice and Secret was off-set by declines in smaller brands.Antiperspirants and deodorants (APDO) shipments were up mid-single digits and global value share increased nearly 0.5 points led by Old Spice product and commercial innovation across markets and expansion into Brazil.Cosmetics volume grew low single digits behind Q3 innovations and some lift from pipeline shipments for the new innovations launching in the U.S. in the September quarter.Prestige volume increased led by growth in Fragrances behind recent innovation in Hugo Boss and Lacoste.Salon Professional organic sales were down with growth from Illumina and Innosense innovation more than off-set by market contraction in North America and Europe. Apr – Jun 14 (Q4 FY 14) ResultsGlobal Beauty Highlights

Apr – Jun 14 (Q4 FY 14) ResultsGrooming Segment +6% Pricing, -1% MixOrganic Volume: Flat Developed, h Low singles DevelopingP&G global value share declined 0.1 points versus year agoStrong sales growth and productivity improvements drove Net Earnings. 7% 2% 19%

By Category Organic Volume Growth IYA Organic Volume Growth IYA Organic Volume Growth IYA By Category Global Developed Developing Blades & Razors + ~= + Pre & Post Shave - - ~= Braun & Appliances ~= ~= ++ Apr – Jun 14 (Q4 FY 14) ResultsGrooming Segment ++ represents growth above 3%, + represents growth of 2-3%, ~= represents growth of 1% to decline of 1%; - represents decline greater than 1%. Company average = Flat.

Blades & Razors volume, sales and global value share were up versus year ago. Shipments were strong in Western Europe, Central & Eastern Europe the Middle East & Africa and Latin America largely due to marketing and product innovation supporting the FIFA World Cup. North America Blades & Razors volume declined slightly as shipments from the launch of the new FlexBall razor were off-set by declines from market contraction.Appliances shipments increased due to continued leverage of the Cooltec innovation and strong in-store execution. Apr – Jun 14 (Q4 FY 14) ResultsGlobal Grooming Highlights

Apr – Jun 14 (Q4 FY 14) ResultsHealth Care Segment Flat Pricing, +1% Mix Organic Volume: i Low singles Developed, Flat Developing P&G global value share increased 0.3 points versus year agoNet Earnings: Productivity savings were more than offset by end of year partnership true up expenses. Organic Sales Organic Volume Net Earnings

By Category Organic Volume Growth IYA Organic Volume Growth IYA Organic Volume Growth IYA By Category Global Developed Developing Oral Care ~= ~= ~= Personal Health Care - - - Apr – Jun 14 (Q4 FY 14) ResultsHealth Care ++ represents growth above 3%, + represents growth of 2-3%, ~= represents growth of 1% to decline of 1%; - represents decline greater than 1%. Company average = Flat.

Oral Care shipments increased low single digits, and global value share was up nearly 0.5 points. Strong growth in Western Europe and in Central & Eastern Europe, Middle East & Africa from the expansion markets was partially off-set by continued challenges in China.Personal Health Care volume declined versus year ago largely due to continuing impacts from a weak cough and cold season across markets. Apr – Jun 14 (Q4 FY 14) ResultsGlobal Health Care Highlights

Apr – Jun 14 (Q4 FY 14) ResultsFabric & Home Care Segment -1% Pricing, Flat MixOrganic Volume: Flat Developed, h Mid-singles DevelopingP&G global value share increased 0.1 points versus year agoNet Earnings: Productivity savings were more than offset by currency headwinds. Organic Sales Organic Volume Net Earnings -1%

By Category Organic Volume Growth IYA Organic Volume Growth IYA Organic Volume Growth IYA By Category Global Developed Developing Fabric Care + - ++ Home Care ~= ~= + Batteries ++ ++ ~= P&G Professional ++ ++ ++ Apr – Jun 14 (Q4 FY 14) ResultsFabric & Home Care ++ represents growth above 3%, + represents growth of 2-3%, ~= represents growth of 1% to decline of 1%; - represents decline greater than 1%. Company average = Flat.

Fabric Care volume increased low single digits led by strong volume and share growth in Greater China behind the launch of the single-chamber unit dose and Ariel powder and liquid detergent focused growth plans. U.S. Fabric Care value share grew for the month of June with Tide up nearly 1.5 share points. Total U.S. fabric care volume declined due to a contracting market from high levels of competitive activity.Home Care shipments were in-line versus year ago, and global value share was in-line or growing in all regions. Central & Eastern Europe, Middle East & Africa led the growth behind strong innovations.Batteries volume grew mid-single digits, and global value share increased over 2 points. U.S. shipments increased high single digits, and value share was up over 3.5 points due to distribution gains in several customers and the launch of the Quantum innovation. Apr – Jun 14 (Q4 FY 14) ResultsGlobal Fabric & Home Care Highlights

Apr – Jun 14 (Q4 FY 14) ResultsBaby, Feminine & Family Care Segment +3% Pricing, Flat MixOrganic Volume: i Low singles Developed, h Mid-singles DevelopingP&G global value share declined 0.4 points versus year agoNet Earnings: Productivity savings were more than offset by currency headwinds. Organic Sales Organic Volume

By Category Organic Volume Growth IYA Organic Volume Growth IYA Organic Volume Growth IYA By Category Global Developed Developing Baby Care + ~= + Feminine Care ~= - ++ Family Care - - ++ Apr – Jun 14 (Q4 FY 14) ResultsBaby, Feminine & Family Care ++ represents growth above 3%, + represents growth of 2-3%, ~= represents growth of 1% to decline of 1%; - represents decline greater than 1%. Company average = Flat.

Baby Care organic sales were up high single digits with the fastest growth in the U.S. and Latin America. In the U.S., value share was up 1.5 points versus year ago behind continued momentum from the innovation and pricing implemented across the line-up in the September quarter.Feminine Care volume increased low-single digits driven by growth in developing markets behind market expansion and innovation.Family Care shipments were down versus year ago primarily due to increased competitive promotional activity. Apr – Jun 14 (Q4 FY 14) ResultsGlobal Baby, Feminine & Family Care Highlights

Fiscal Year 2015 Guidance

FY 2015 Key Drivers of Value Creation: InnovationProductivityFocus TSR

FY 2015 GuidanceOrganic Sales & EPS Growth – No Change FY’15 Organic Sales Growth Low to Mid-Single Digits Currency -1% All-in Sales Growth Low Single Digits Core Earnings Per Share Growth Mid-Single Digits All-in Earnings Per Share Growth Mid-Single Digits

FY 2015 GuidanceCash Generation & Usage Free Cash Flow Productivity: ~ 90%Capital Spending, % Sales: 4% to 5%Dividends: ~$7BShare Repurchase: $5-7B

FY 2015 GuidanceRisks Not Included in Guidance Further currency weaknessUnrest in the Middle East and Eastern EuropeFurther pricing controls and import restrictionsAny major portfolio movesFurther market size contraction

ReferenceSelected Financial InformationRestatement for Pet Care

Reference Selected Financial InformationRestatement for Pet Care Q1 Amounts in Millions Except Per Share Amounts Three Months Ending September 30 Three Months Ending September 30 Three Months Ending September 30 Three Months Ending September 30 Amounts in Millions Except Per Share Amounts GAAP GAAP CORE (NON-GAAP) CORE (NON-GAAP) 2013 2012 2013 2012 Net Sales 20,830 20,342 20,830 20,342 COPS 10,574 10,112 10,512 10,013 Gross Margin 10,256 10,230 10,318 10,329 SG&A 6,136 6,341 6,133 6,122 Operating Income 4,120 3,889 4,185 4,207 Dil. Net EPS from Cont Ops $1.03 $0.95 $1.05 $1.04

Reference Selected Financial InformationRestatement for Pet Care Q2 Amounts in Millions Except Per Share Amounts Three Months Ending December 31 Three Months Ending December 31 Three Months Ending December 31 Three Months Ending December 31 Amounts in Millions Except Per Share Amounts GAAP GAAP CORE (NON-GAAP) CORE (NON-GAAP) 2013 2012 2013 2012 Net Sales 21,897 21,737 21,897 21,737 COPS 10,884 10,609 10,832 10,555 Gross Margin 11,013 11,128 11,065 11,182 SG&A 6,490 6,699 6,449 6,602 Operating Income 4,523 4,429 4,616 4,580 Dil. Net EPS from Cont Ops $1.17 $1.38 $1.20 $1.21

Reference Selected Financial InformationRestatement for Pet Care Q3 Amounts in Millions Except Per Share Amounts Three Months Ending March 31 Three Months Ending March 31 Three Months Ending March 31 Three Months Ending March 31 Amounts in Millions Except Per Share Amounts GAAP GAAP CORE (NON-GAAP) CORE (NON-GAAP) 2014 2013 2014 2013 Net Sales 20,178 20,205 20,178 20,205 COPS 10,366 10,093 10,276 10,043 Gross Margin 9,812 10,112 9,902 10,162 SG&A 6,407 6,751 6,063 6,339 Operating Income 3,405 3,361 3,839 3,823 Dil. Net EPS from Cont Ops $0.89 $0.87 $1.02 $0.98

Reference Selected Financial InformationRestatement for Pet Care Q4 Amounts in Millions Except Per Share Amounts Three Months Ending June 30 Three Months Ending June 30 Three Months Ending June 30 Three Months Ending June 30 Amounts in Millions Except Per Share Amounts GAAP GAAP CORE (NON-GAAP) CORE (NON-GAAP) 2014 2013 2014 2013 Net Sales 20,157 20,297 20,157 20,297 COPS 10,636 10,577 10,535 10,519 Gross Margin 9,521 9,720 9,622 9,778 SG&A 6,281 6,761 6,173 6,652 Operating Income 3,240 2,651 3,449 3,126 Dil. Net EPS from Cont Ops $0.89 $0.64 $0.95 $0.79

Reference Selected Financial InformationRestatement for Pet Care FY Amounts in Millions Except Per Share Amounts Twelve Months Ending June 30 Twelve Months Ending June 30 Twelve Months Ending June 30 Twelve Months Ending June 30 Amounts in Millions Except Per Share Amounts GAAP GAAP CORE (NON-GAAP) CORE (NON-GAAP) FY 2014 FY 2013 FY 2014 FY 2013 Net Sales 83,062 82,581 83,062 82,581 COPS 42,460 41,391 42,155 41,130 Gross Margin 40,602 41,190 40,907 41,451 SG&A 25,314 26,552 24,818 25,715 Operating Income 15,288 14,330 16,089 15,736 Dil. Net EPS from Cont Ops $3.98 $3.83 $4.22 $4.02

Forward Looking Statements Certain statements in this release or presentation, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believe,” “project,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectation and assumptions, which are subject to risks and uncertainties that may cause results to differ materially from the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events or otherwise. Risks and uncertainties to which our forward-looking statements are subject include: (1) the ability to achieve business plans, including growing existing sales and volume profitably and maintaining and improving margins and market share, despite high levels of competitive activity, an increasingly volatile economic environment, lower than expected market growth rates, especially with respect to the product categories and geographical markets (including developing markets) in which the Company has chosen to focus, and/or increasing competition from mid- and lower tier value products in both developed and developing markets; (2) the ability to successfully manage ongoing acquisition, divestiture and joint venture activities to achieve the Company’s overall business strategy, as well as cost and growth synergies in accordance with the stated goals of these transactions, and without impacting the delivery of base business objectives; (3) the ability to successfully manage ongoing organizational changes and achieve productivity improvements designed to support our growth strategies, while successfully identifying, developing and retaining particularly key employees, especially in key growth markets where the availability of skilled or experienced employees may be limited; (4) the ability to manage and maintain key customer relationships; (5) the ability to maintain key manufacturing and supply sources (including sole supplier and plant manufacturing sources); (6) the ability to successfully manage regulatory, tax and legal requirements and matters (including, but not limited to, product liability, patent, intellectual property, price controls, import restrictions, environmental and tax policy) and to resolve pending matters (including the pending competition law inquiries in Europe) within current estimates; (7) the ability to successfully manage the financial, legal, reputational and operational risk associated with third party relationships, such as suppliers, contractors and external business partners; (8) the ability to successfully implement, achieve and sustain cost improvement plans and efficiencies in manufacturing and overhead areas, including the Company's outsourcing arrangements; (9) the ability to successfully manage volatility in foreign exchange rates, as well as our debt and currency exposure (especially in certain countries with currency exchange, import authorization or pricing controls, such as Venezuela, Argentina, China, India and Egypt); (10) the ability to maintain our current credit rating and to manage fluctuations in interest rate, increases in pension and healthcare expense, and any significant credit or liquidity issues; (11) the ability to manage continued global political and/or economic uncertainty and disruptions, especially in the Company's significant geographical markets, due to a wide variety of factors, including but not limited to, terrorist and other hostile activities, natural disasters and/or disruptions to credit markets, resulting from a global, regional or national credit crisis; (12) the ability to successfully manage competitive factors, including prices, promotional incentives and trade terms for products; (13) the ability to obtain patents and respond to technological advances attained by competitors and patents granted to competitors; (14) the ability to successfully manage increases in the prices of commodities, raw materials and energy, including the ability to offset these increases through pricing actions; (15) the ability to develop effective sales, advertising and marketing programs; (16) the ability to stay on the leading edge of innovation, maintain the positive reputation of our brands and ensure trademark protection; and (17) the ability to rely on and maintain key information technology systems and networks (including Company and third-party systems and networks), the security over such systems and networks, and the data contained therein. For additional information concerning factors that could cause actual results to materially differ from those projected herein, please refer to our most recent 10-K, 10-Q and 8-K reports.

The Procter & Gamble Company: Reg G Reconciliation of Non-GAAP measures

In accordance with the SEC's Regulation G, the following provides definitions of the non-GAAP measures used in Procter & Gamble's August 1, 2014 earnings call and associated slides with the reconciliation to the most closely related GAAP measure. The measures provided are as follows:

|

1.

|

Organic Sales Growth – page 1

|

|

2.

|

Core EPS and Currency-neutral Core EPS – page 2

|

|

3.

|

Core Operating Profit Margin – page 3

|

|

4.

|

Core Gross Margin – page 3

|

|

5.

|

Core Selling, General & Administrative Expenses (SG&A) as a % of Net Sales – page 4

|

|

6.

|

Core Effective Tax Rate – page 4

|

|

7.

|

Free Cash Flow / Free Cash Flow Productivity – page 5

|

1. Organic Sales Growth:

Organic sales growth is a non-GAAP measure of sales growth excluding the impacts of acquisitions, divestitures and foreign exchange from year-over-year comparisons. We believe this provides investors with a more complete understanding of underlying sales trends by providing sales growth on a consistent basis. Organic sales is also one of the measures used to evaluate senior management and is a factor in determining their at-risk compensation. The reconciliation of reported sales growth to organic sales is as follows:

|

Total P&G

|

|

Net Sales Growth

|

|

Foreign Exchange Impact

|

|

Acquisition/ Divestiture Impact*

|

|

Organic Sales Growth

|

|

Fiscal Year 2012

|

3%

|

|

0%

|

|

0%

|

|

3%

|

|

AMJ 2013

|

3%

|

|

2%

|

|

-1%

|

|

4%

|

|

Fiscal Year 2013

|

1%

|

|

2%

|

|

0%

|

|

3%

|

|

JAS 2013

|

2%

|

|

2%

|

|

0%

|

|

4%

|

|

OND 2013

|

1%

|

|

2%

|

|

0%

|

|

3%

|

|

JFM 2014

|

0%

|

|

3%

|

|

1%

|

|

4%

|

|

AMJ 2014

|

-1%

|

|

2%

|

|

1%

|

|

2%

|

|

Fiscal Year 2014

|

1%

|

|

2%

|

|

0%

|

|

3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April – June (AMJ) 2014

|

|

Net Sales Growth

|

|

Foreign Exchange Impact

|

|

Acquisition/ Divestiture Impact*

|

|

Organic Sales Growth

|

|

Beauty

|

-5%

|

|

2%

|

|

0%

|

|

-3%

|

|

Grooming

|

5%

|

|

2%

|

|

0%

|

|

7%

|

|

Health Care

|

-1%

|

|

1%

|

|

0%

|

|

0%

|

|

Fabric Care and Home Care

|

-2%

|

|

2%

|

|

1%

|

|

1%

|

|

Baby, Feminine, and Family Care

|

1%

|

|

2%

|

|

0%

|

|

3%

|

|

Total P&G

|

-1%

|

|

2%

|

|

1%

|

|

2%

|

*Acquisition/Divestiture Impact includes rounding impacts necessary to reconcile net sales to organic sales.

2. Core EPS and Currency-neutral Core EPS: Core EPS is a measure of the Company's diluted net earnings per share from continuing operations, adjusted for charges in FYs 2014, 2013, and 2012 for incremental restructuring due to increased focus on productivity and cost savings, charges in FYs 2014 and 2013 for the balance sheet impacts from foreign exchange policy changes and the devaluation of the foreign currency exchange rate in Venezuela, charges in FYs 2014, 2013, 2012, and 2011 related to European legal matters, a holding gain in FY 2013 on the buyout of our Iberian joint venture (JV), impairment charges in FY 2013 and 2012 for goodwill and indefinite lived intangible assets, and a significant adjustment to income tax reserves in FY 2011. We do not view these items to be part of our sustainable results. We believe the Core EPS measure provides an important perspective of underlying business trends and results and provides a more comparable measure of year-on-year earnings per share growth. Core EPS is also one of the measures used to evaluate senior management and is a factor in determining their at-risk compensation.

Currency-neutral Core EPS is a measure of the Company's Core EPS growth excluding the impact of foreign exchange. We believe the Currency-neutral Core EPS measure provides a more comparable view of year-on-year earnings per share growth.

The table below provides a reconciliation of diluted net earnings per share to Core EPS and Core EPS to Currency-neutral Core EPS:

|

CORE EPS & CURRENCY-NEUTRAL CORE EPS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMJ 13

|

|

AMJ 12

|

|

JAS 13

|

|

JAS 12

|

|

OND 13

|

|

OND 12

|

|

JFM 14

|

|

JFM 13

|

|

AMJ 14

|

|

FY 11

|

|

FY 12

|

|

FY 13

|

|

FY14

|

|

|

Diluted Net Earnings Per Share

|

|

$0.64

|

|

$1.24

|

|

$1.04

|

|

$0.96

|

|

$1.18

|

|

$1.39

|

|

$0.90

|

|

$0.88

|

|

$0.89

|

|

$3.93

|

|

$3.66

|

|

$3.86

|

|

$4.01

|

|

|

Earnings from discontinued operations

|

|

-

|

|

($0.51)

|

|

($0.01)

|

|

($0.01)

|

|

($0.01)

|

|

($0.01)

|

|

($0.01)

|

|

($0.01)

|

|

-

|

|

($0.13)

|

|

($0.60)

|

|

($0.03)

|

|

($0.03)

|

|

|

Diluted Net Earnings Per Share from continuing operations

|

|

$0.64

|

|

$0.73

|

|

$1.03

|

|

$0.95

|

|

$1.17

|

|

$1.38

|

|

$0.89

|

|

$0.87

|

|

$0.89

|

|

$3.80

|

|

$3.06

|

|

$3.83

|

|

$3.98

|

|

|

Incremental restructuring charges

|

|

$0.02

|

|

$0.08

|

|

$0.02

|

|

$ 0.09

|

|

$0.03

|

|

$0.04

|

|

$0.04

|

|

$0.03

|

|

$0.04

|

|

-

|

|

$0.20

|

|

$0.18

|

|

$0.12

|

|

|

Venezuela devaluation impacts

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

$0.10

|

|

$0.08

|

|

-

|

|

-

|

|

-

|

|

$0.08

|

|

$0.09

|

|

|

Charges for European legal matters

|

|

$0.04

|

|

-

|

|

-

|

|

$0.01

|

|

-

|

|

-

|

|

-

|

|

-

|

|

$0.02

|

|

$0.10

|

|

$0.03

|

|

$0.05

|

|

$0.02

|

|

|

Gain on buyout of Iberian JV

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

($0.21)

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

($0.21)

|

|

-

|

|

|

Impairment charges

|

|

$0.10

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

$0.51

|

|

$0.10

|

|

-

|

|

|

Significant Adjustment to Income Tax Reserve

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

($0.08)

|

|

-

|

|

-

|

|

-

|

|

|

Rounding impacts

|

|

($0.01)

|

|

-

|

|

-

|

|

($0.01)

|

|

-

|

|

-

|

|

($0.01)

|

|

-

|

|

-

|

|

($0.01)

|

|

($0.01)

|

|

($0.01)

|

|

$0.01

|

|

|

Core EPS

|

|

$0.79

|

|

$0.81

|

|

$1.05

|

|

$1.04

|

|

$1.20

|

|

$1.21

|

|

$1.02

|

|

$0.98

|

|

$0.95

|

|

$3.81

|

|

$3.79

|

|

$4.02

|

|

$4.22

|

|

|

Percentage change vs. prior period

|

|

-2%

|

|

|

|

1%

|

|

|

|

-1%

|

|

|

|

4%

|

|

|

|

20%

|

|

|

|

-1%

|

|

6%

|

|

5%

|

|

|

Currency impact to earnings

|

|

$0.07

|

|

|

|

$0.08

|

|

|

|

$0.11

|

|

|

|

$0.12

|

|

|

|

$0.04

|

|

|

|

|

|

|

|

$0.35

|

|

|

Currency-neutral Core EPS

|

|

$0.86

|

|

|

|

$1.13

|

|

|

|

$1.31

|

|

|

|

$1.14

|

|

|

|

$0.99

|

|

|

|

|

|

|

|

$4.57

|

|

|

Percentage change vs. prior period

|

|

6%

|

|

|

|

9%

|

|

|

|

8%

|

|

|

|

16%

|

|

|

|

25%

|

|

|

|

|

|

|

|

14%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note – All reconciling items are presented net of tax. Tax effects are calculated consistent with the nature of the underlying transaction.

3. Core Operating Profit Margin: This is a measure of the Company's operating margin adjusted for the current and prior year charges related to incremental restructuring due to increased focus on productivity and cost savings, the current and prior year charges for the balance sheet impacts from the foreign exchange policy changes and the devaluation of the foreign currency exchange rate in Venezuela, the current and prior year charges related to European legal matters and the prior year impairment charges for goodwill and indefinite lived intangible:

|

|

|

AMJ 14

|

|

AMJ 13

|

|

|

Operating Profit Margin

|

|

16.1%

|

|

13.1%

|

|

|

Incremental restructuring

|

|

0.8%

|

|

0.3%

|

|

|

Venezuela devaluation

|

|

-

|

|

-

|

|

|

European legal matters

|

|

0.3%

|

|

0.5%

|

|

|

Goodwill/Intangible impairment

|

|

-

|

|

1.5%

|

|

|

Rounding

|

|

-0.1%

|

|

-

|

|

|

Core Operating Profit Margin

|

|

17.1%

|

|

15.4%

|

|

|

Basis point change

|

|

170

|

|

|

|

4. Core Gross Margin: This is a measure of the Company's gross margin adjusted for the current and prior year charges related to incremental restructuring due to increased focus on productivity and cost savings:

|

|

|

AMJ 14

|

|

AMJ 13

|

|

|

Gross Margin

|

|

47.2%

|

|

47.9%

|

|

|

Incremental restructuring

|

|

0.5%

|

|

0.3%

|

|

|

Rounding

|

|

-

|

|

-

|

|

|

Core Gross Margin

|

|

47.7%

|

|

48.2%

|

|

|

Basis point change

|

|

(50)

|

|

|

|

5. Core Selling, General and Administration Expense (SG&A) as a percentage of sales: This is a measure of the Company's SG&A as a percentage of sales adjusted for the current and prior year charges related to incremental restructuring due to increased focus on productivity and cost savings, the current and prior year charges for the balance sheet impacts from the devaluation of the foreign currency exchange rate in Venezuela, and the current and prior year charges related to European legal matters:

|

|

|

AMJ 14

|

|

AMJ 13

|

|

|

SG&A as a % NOS

|

|

31.2%

|

|

33.3%

|

|

|

Incremental restructuring

|

|

-0.3%

|

|

-

|

|

|

Venezuela devaluation

|

|

-

|

|

-

|

|

|

European legal matters

|

|

-0.3%

|

|

-0.5%

|

|

|

Rounding

|

|

-

|

|

-

|

|

|

Core SG&A as a % NOS

|

|

30.6%

|

|

32.8%

|

|

|

Basis point change

|

|

(220)

|

|

|

|

6. Core Effective Tax Rate:

This is a measure of the Company's effective tax rate adjusted for current and prior year charges for incremental restructuring and the current and prior year charges for the balance sheet impacts from the devaluation of the foreign currency exchange rate in Venezuela. The table below provides a reconciliation of the effective tax rate to the Core effective tax rate:

|

|

AMJ 14

|

|

FY 14

|

|

Effective Tax Rate

|

19.1%

|

|

21.4%

|

|

Tax impact of Venezuela devaluation impacts

|

-

|

|

-0.3%

|

|

Tax impact of European legal matters

|

-0.3%

|

|

-0.1%

|

|

Tax impact of restructuring

|

0.2%

|

|

-0.1%

|

|

Rounding

|

-

|

|

0.1%

|

|

Core Effective Tax Rate

|

19.0%

|

|

21.0%

|

7. Free Cash Flow / Free Cash Flow Productivity:

Free Cash Flow: Free cash flow is defined as operating cash flow less capital spending. We view free cash flow as an important measure because it is one factor in determining the amount of cash available for dividends and discretionary investment. The reconciliation of free cash flow is provided below (amounts in millions):

Free cash flow productivity: Free cash flow productivity is defined as the ratio of free cash flow to net earnings. The Company's long-term target is to generate free cash flow at or above 90 percent of net earnings. Free cash flow productivity is also a measure used to evaluate senior management and is a factor in determining their at-risk compensation. The reconciliation of adjusted free cash flow productivity is provided below (amounts in millions):

|

|

Operating Cash Flow

|

Capital Spending

|

Free Cash Flow

|

Net Earnings

|

Free Cash Productivity

|

|

FY 2014

|

$13,958

|

($3,848)

|

$10,110

|

$11,785

|

86%

|

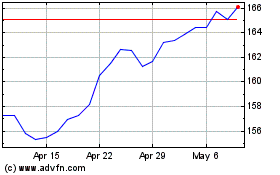

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Aug 2024 to Sep 2024

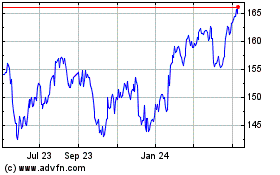

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Sep 2023 to Sep 2024