- Net sales for first quarter fiscal year

2015 were $896.9 million

- Operating income for first quarter

fiscal year 2015 was $240.5 million and included a settlement gain,

net of legal fees, of $134.7 million related to the Eaton

litigation and $8.7 million of costs related to the Jefferson

Street/Red Oak facility transition. Excluding these items,

operating income was $114.6 million, reflecting an operating margin

of 13%

- Net income for first quarter fiscal

year 2015 was $128.2 million, or $2.46 per diluted share, which

included non-recurring items totaling $103.3 million pre-tax ($66.1

million after tax or $1.27 per diluted share). Excluding these

items, earnings per share were $1.19 per diluted share

- Adjusted earnings before interest,

taxes, depreciation and amortization (Adjusted EBITDA) for first

quarter fiscal year 2015 were $134.4 million, reflecting an

Adjusted EBITDA margin of 15%

- Cash flow utilization from operations

for first quarter fiscal 2015 was $6.8 million prior to pension

contributions of $45.2 million

Triumph Group, Inc. (NYSE: TGI) today reported financial results

for its first quarter of fiscal year 2015, which ended June 30,

2014.

“Triumph’s fiscal year is off to a solid start with adjusted

first quarter results coming in slightly above the upper end of our

guidance,” said Jeffry D. Frisby, Triumph’s President and Chief

Executive Officer. “We had a productive quarter, having

successfully completed the acquisition of GE Aviation’s hydraulic

actuation business and transitioning into the Red Oak facility. In

addition, same store backlog grew both sequentially and year over

year, demonstrating the strong demand for our products and services

from our global customers. The 747-8 program remains on schedule

with performance in line with our expectations. We remain focused

on execution relative to customer commitments while increasing

profitability, expanding margins and generating strong cash flow in

order to maximize returns to our shareholders.”

Net sales for the fiscal first quarter of 2015 were $896.9

million, a five percent decrease compared to fiscal first quarter

2014 net sales of $943.7 million. Organic sales for the quarter

decreased six percent primarily due to production rate cuts on the

747-8 and V-22 programs, lower revenues on the 767 program and the

shifting of several C-17 shipments into the second quarter of

fiscal year 2015.

Net income for the first quarter of fiscal year 2015 was $128.2

million, or $2.46 per diluted share, compared to $79.0 million, or

$1.50 per diluted share, for the first quarter of the prior fiscal

year. Results in the first quarter of fiscal year 2015 included

$8.7 million pre-tax ($5.6 million after tax or $0.11 per diluted

share) of costs related to the Jefferson Street/Red Oak facility

transition and $22.6 million pre-tax ($14.5 million after tax or

$0.28 per diluted share) of costs related to the refinancing of the

Senior Notes due 2018. Also included in the quarter’s results was a

gain of $134.7 million pre-tax ($86.2 million after tax or $1.65

per diluted share), net of legal fees, related to the settlement of

the Eaton litigation. Excluding these non-recurring items totaling

$103.3 million pre-tax ($66.1 million after tax or $1.27 per

diluted share), earnings per share for the first quarter of fiscal

year 2015 were $1.19 per diluted share. The prior fiscal year’s

quarter included approximately $3.6 million pre-tax ($2.3 million

after tax or $0.04 per diluted share) of non-recurring costs

related to the Jefferson Street facility move. Excluding these

items, earnings per share for the prior fiscal year’s first quarter

were $1.54 per diluted share. The number of shares used in

computing diluted earnings per share for the quarter was 52.1

million shares.

Adjusted earnings before interest, taxes, depreciation and

amortization (Adjusted EBITDA) for the first quarter of fiscal year

2015 were $134.4 million and reflected an Adjusted EBITDA margin of

fifteen percent. This compares to Adjusted EBITDA of $168.1 million

and an Adjusted EBITDA margin of eighteen percent in the prior

fiscal year’s first quarter.

For the quarter ended June 30, 2014, cash flow utilization from

operations was $6.8 million before pension contributions of $45.2

million; after these contributions, cash flow utilization from

operations was $52.1 million. As previously announced, the company

enhanced both the strength and flexibility of its balance sheet by

refinancing its high yield debt due 2018 and redeeming its 2.625%

Convertible Senior Subordinated Notes due 2026, which effectively

resulted in the repurchase of an approximate 284,000 shares. This

was in addition to the repurchase of 750,000 shares of stock during

the quarter under the company’s existing 5.5 million share

repurchase authorization. As of June 30, 2014, approximately 4.5

million shares remained under the share repurchase

authorization.

Segment Results

Aerostructures

The Aerostructures segment reported net sales of $611.9 million

in the first quarter of fiscal year 2015 compared to $651.9 million

in the prior year period. Organic sales for the quarter declined 6%

primarily due to production rate cuts on the 747-8 program, lower

revenues on the 767 program and the shifting of several C-17

shipments into the second quarter of fiscal year 2015, as

previously discussed. Operating income for the first quarter of

fiscal year 2015 was $70.9 million, compared to $100.4 million for

the prior year period, and included a net unfavorable cumulative

catch-up adjustment on long-term contracts of $0.7 million. The

segment’s operating results for the quarter also included $8.7

million of pre-tax charges related to the Jefferson Street/Red Oak

facility transition. The segment’s operating margin for the quarter

was twelve percent. Excluding the Jefferson Street/Red Oak facility

transition costs, the segment’s operating margin for the quarter

was thirteen percent.

Aerospace Systems

The Aerospace Systems segment reported net sales of $219.9

million in the first quarter of fiscal year 2015 compared to $219.5

million in the prior year period. Organic sales for the quarter

declined 5% primarily due to production rate cuts on the V-22

program and decreased military sales. Operating income for the

first quarter of fiscal year 2015 was $37.4 million compared to

$42.6 million for the prior year period. The segment’s operating

margin for the quarter was seventeen percent.

Aftermarket Services

The Aftermarket Services segment reported net sales in the first

quarter of fiscal year 2015 of $67.6 million compared to $74.4

million in the prior year period. Organic sales for the quarter

declined 9% due to the timing of completion of certain contracts

and continued military weakness. Operating income for the first

quarter of fiscal year 2015 was $10.5 million compared to $11.2

million for the prior year period. Operating margin for the quarter

was sixteen percent.

Outlook

Mr. Frisby continued, “We expect to see our performance

strengthen as we move through fiscal 2015, particularly in the

second half of the year. We remain focused on execution and

supporting our vision to expand Triumph’s global presence and

achieve balance in our segments, end markets and customers. We will

continue to leverage our deep customer relationships and pursue

strategic growth opportunities to create additional value for

shareholders.”

Based on current projected aircraft production rates and a

weighted average share count of 51.6 million shares, the company

reaffirmed its fiscal year 2015 revenue guidance of $3.8 to $3.9

billion and its full year earnings per share guidance of $5.75 to

$5.90 per diluted share, excluding the non-recurring items. The

company reaffirmed its Adjusted EBITDA guidance for fiscal year

2015 of $665.0 million to $680.0 million, which excludes the impact

of non-recurring items, and expects to generate free cash flow

available for debt reduction, acquisitions and share repurchases

after pension contributions for the fiscal year of approximately

$385.0 million.

Adjusted Earnings Per Share - Non-GAAP $ 5.75 - $5.90

Non-Recurring Costs/(Income): Jefferson Street/Red Oak

Facility Transition Costs $ 0.31 Refinancing Costs Related

to the Senior Notes Due 2018 $ 0.28 Settlement Gain, Net of

Legal Fees, Related to Eaton Litigation ($1.67 )

Earnings Per Share – GAAP $ 6.83 - $6.98

Conference Call

Triumph Group will hold a conference call tomorrow, July 31 at

8:30 a.m. (ET) to discuss the fiscal year 2015 first quarter

results. The conference call will be available live and archived on

the company’s website at http://www.triumphgroup.com. A slide

presentation will be included with the audio portion of the

webcast. An audio replay will be available from July 31st to August

7th by calling (888) 266-2081 (Domestic) or (703) 925-2533

(International), passcode #1640970.

About Triumph Group

Triumph Group, Inc. headquartered in Berwyn, Pennsylvania,

designs, engineers, manufactures, repairs and overhauls a broad

portfolio of aerostructures, aircraft components, accessories,

subassemblies and systems. The company serves a broad, worldwide

spectrum of the aviation industry, including original equipment

manufacturers of commercial, regional, business and military

aircraft and aircraft components, as well as commercial and

regional airlines and air cargo carriers.

More information about Triumph can be found on the company’s

website at www.triumphgroup.com.

Statements in this release which are not historical facts are

forward-looking statements under the provisions of the Private

Securities Litigation Reform Act of 1995, including statements of

expectations of or assumptions about future aerospace market

conditions, aircraft production rates, financial and operational

performance, revenue and earnings growth, profitability and

earnings results for fiscal year 2015. All forward-looking

statements involve risks and uncertainties which could affect the

company’s actual results and could cause its actual results to

differ materially from those expressed in any forward looking

statements made by, or on behalf of, the company. Further

information regarding the important factors that could cause actual

results to differ from projected results can be found in Triumph

Group’s reports filed with the SEC, including our Annual Report on

Form 10-K for the fiscal year ended March 31, 2014.

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES (in

thousands, except per share data) Three Months

Ended June 30, CONDENSED STATEMENTS OF

INCOME 2014 2013 Net sales $

896,905 $ 943,683 Operating income 240,524 141,346

Interest expense and other 42,360 19,710 Income tax expense

69,921 42,593 Net income $ 128,243 $ 79,043

Earnings per share - basic: Net income $ 2.48 $ 1.56

Weighted average common shares outstanding - basic 51,691

50,815 Earnings per share - diluted: Net

income $ 2.46 $ 1.50 Weighted average common shares

outstanding - diluted 52,089 52,806 Dividends

declared and paid per common share $ 0.04 $ 0.04

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES (dollars in

thousands, except per share data) BALANCE SHEET

Unaudited Audited June 30, March 31,

2014 2014 Assets Cash and cash equivalents $

25,465 $ 28,998 Accounts receivable, net 667,202 517,707 Inventory,

net of unliquidated progress payments of $189,976 and $165,019

1,202,163 1,111,767 Rotable assets 43,230 41,666 Deferred income

taxes 46,898 57,308 Prepaid and other current assets 25,249

24,897 Current assets 2,010,207 1,782,343

Property and equipment, net 965,424 930,973 Goodwill

1,867,668 1,791,831 Intangible assets, net 976,464 978,182 Other,

net 38,849 69,954 Total assets $

5,858,612 $ 5,553,283

Liabilities &

Stockholders' Equity Current portion of long-term debt $

43,323 $ 49,575 Accounts payable 301,808 317,334 Accrued expenses

237,814 273,290 Current liabilities

582,945 640,199 Long-term debt, less current portion

1,714,310 1,500,808 Accrued pension and post-retirement benefits,

noncurrent 448,767 508,524 Deferred income taxes, noncurrent

386,686 385,085 Other noncurrent liabilities 372,356 234,756

Stockholders' Equity:

Common stock, $.001 par value, 100,000,000

shares authorized, 52,460,920 and 52,459,020 shares issued

52 52 Capital in excess of par value 856,496 866,281 Treasury

stock, at cost, 1,037,112 and 300,000 shares (70,178 ) (19,134 )

Accumulated other comprehensive loss (14,629 ) (18,908 ) Retained

earnings 1,581,807 1,455,620 Total

stockholders' equity 2,353,548 2,283,911

Total liabilities and stockholders' equity $

5,858,612 $ 5,553,283

FINANCIAL DATA (UNAUDITED) TRIUMPH GROUP,

INC. AND SUBSIDIARIES (dollars in thousands)

SEGMENT DATA Three Months Ended June

30, 2014 2013 Net sales:

Aerostructures $ 611,863 $ 651,888 Aerospace Systems 219,852

219,526 Aftermarket Services 67,608 74,353 Elimination of

inter-segment sales (2,418 ) (2,084 ) $ 896,905

$ 943,683 Operating income (loss):

Aerostructures $ 70,866 $ 100,387 Aerospace Systems 37,352 42,643

Aftermarket Services 10,504 11,279 Corporate 121,802

(12,963 ) $ 240,524 $ 141,346

Depreciation and amortization: Aerostructures $ 24,979 $ 26,313

Aerospace Systems 9,517 8,539 Aftermarket Services 1,877 1,877

Corporate 1,178 1,205 $ 37,551 $

37,934 Amortization of acquired contract liabilities:

Aerostructures $ (5,117 ) $ (6,141 ) Aerospace Systems

(3,850 ) (5,009 ) $ (8,967 ) $ (11,150 ) Capital

expenditures: Aerostructures $ 15,369 $ 45,945 Aerospace Systems

5,663 4,432 Aftermarket Services 1,680 4,152 Corporate 365

1,700 $ 23,077 $ 56,229

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND

SUBSIDIARIES(dollars in thousands)

Non-GAAP Financial Measure Disclosures

We prepare and publicly release quarterly unaudited financial

statements prepared in accordance with GAAP. In accordance with

Securities and Exchange Commission (the “SEC”) guidance on

Compliance and Disclosure Interpretations, we also disclose and

discuss certain non-GAAP financial measures in our public releases.

Currently, the non-GAAP financial measure that we disclose is

Adjusted EBITDA, which is our net income before interest, income

taxes, amortization of acquired contract liabilities, curtailments,

settlements and early retirement incentives, legal settlements,

depreciation and amortization. We disclose Adjusted EBITDA on a

consolidated and an operating segment basis in our earnings

releases, investor conference calls and filings with the SEC. The

non-GAAP financial measures that we use may not be comparable to

similarly titled measures reported by other companies. Also, in the

future, we may disclose different non-GAAP financial measures in

order to help our investors more meaningfully evaluate and compare

our future results of operations to our previously reported results

of operations.

We view Adjusted EBITDA as an operating performance measure and

as such we believe that the GAAP financial measure most directly

comparable to it is net income. In calculating Adjusted EBITDA, we

exclude from net income the financial items that we believe should

be separately identified to provide additional analysis of the

financial components of the day-to-day operation of our business.

We have outlined below the type and scope of these exclusions and

the material limitations on the use of these non-GAAP financial

measures as a result of these exclusions. Adjusted EBITDA is not a

measurement of financial performance under GAAP and should not be

considered as a measure of liquidity, as an alternative to net

income (loss), income from continuing operations, or as an

indicator of any other measure of performance derived in accordance

with GAAP. Investors and potential investors in our securities

should not rely on Adjusted EBITDA as a substitute for any GAAP

financial measure, including net income (loss) or income from

continuing operations. In addition, we urge investors and potential

investors in our securities to carefully review the reconciliation

of Adjusted EBITDA to net income set forth below, in our earnings

releases and in other filings with the SEC and to carefully review

the GAAP financial information included as part of our Quarterly

Reports on Form 10-Q and our Annual Reports on Form 10-K that are

filed with the SEC, as well as our quarterly earnings releases, and

compare the GAAP financial information with our Adjusted

EBITDA.

Adjusted EBITDA is used by management to internally measure our

operating and management performance and by investors as a

supplemental financial measure to evaluate the performance of our

business that, when viewed with our GAAP results and the

accompanying reconciliation, we believe provides additional

information that is useful to gain an understanding of the factors

and trends affecting our business. We have spent more than 15 years

expanding our product and service capabilities partially through

acquisitions of complementary businesses. Due to the expansion of

our operations, which included acquisitions, our net income has

included significant charges for depreciation and amortization.

Adjusted EBITDA excludes these charges and provides meaningful

information about the operating performance of our business, apart

from charges for depreciation and amortization. We believe the

disclosure of Adjusted EBITDA helps investors meaningfully evaluate

and compare our performance from quarter to quarter and from year

to year. We also believe Adjusted EBITDA is a measure of our

ongoing operating performance because the isolation of non-cash

income and expenses, such as amortization of acquired contract

liabilities, depreciation and amortization, and non-operating

items, such as interest and income taxes, provides additional

information about our cost structure, and, over time, helps track

our operating progress. In addition, investors, securities analysts

and others have regularly relied on Adjusted EBITDA to provide a

financial measure by which to compare our operating performance

against that of other companies in our industry.

Set forth below are descriptions of the financial items that

have been excluded from our net income to calculate Adjusted EBITDA

and the material limitations associated with using this non-GAAP

financial measure as compared to net income:

- Legal settlements may be useful to

investors to consider because they reflect gains or losses from

disputes with third parties. We do not believe that these earnings

necessarily reflect the current and ongoing cash earnings related

to our operations.

- Curtailments, settlements and early

retirement incentives may be useful to investors to consider

because it represents the current period impact of the change in

defined benefit obligation due to the reduction in future service

costs. We do not believe these charges (gains) necessarily reflect

the current and ongoing cash earnings related to our

operations.

- Amortization of acquired contract

liabilities may be useful for investors to consider because it

represents the non-cash earnings on the fair value of below market

contracts acquired through acquisitions. We do not believe these

earnings necessarily reflect the current and ongoing cash earnings

related to our operations.

- Amortization expenses may be useful for

investors to consider because it represents the estimated attrition

of our acquired customer base and the diminishing value of product

rights and licenses. We do not believe these charges necessarily

reflect the current and ongoing cash charges related to our

operating cost structure.

- Depreciation may be useful for

investors to consider because they generally represent the wear and

tear on our property and equipment used in our operations. We do

not believe these charges necessarily reflect the current and

ongoing cash charges related to our operating cost structure.

- The amount of interest expense and

other we incur may be useful for investors to consider and may

result in current cash inflows or outflows. However, we do not

consider the amount of interest expense and other to be a

representative component of the day-to-day operating performance of

our business.

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND

SUBSIDIARIES(dollars in thousands)

Non-GAAP Financial Measure Disclosures (continued)

- Income tax expense may be useful for

investors to consider because it generally represents the taxes

which may be payable for the period and the change in deferred

income taxes during the period and may reduce the amount of funds

otherwise available for use in our business. However, we do not

consider the amount of income tax expense to be a representative

component of the day-to-day operating performance of our

business.

Management compensates for the above-described limitations of

using non-GAAP measures by using a non-GAAP measure only to

supplement our GAAP results and to provide additional information

that is useful to gain an understanding of the factors and trends

affecting our business.

The following table shows our Adjusted EBITDA reconciled to our

net income for the indicated periods (in thousands):

Three Months Ended June 30, 2014

2013 Adjusted Earnings before Interest,

Taxes, Depreciation and Amortization (EBITDA): Net Income $

128,243 $ 79,043 Add-back: Income Tax Expense 69,921 42,593

Interest Expense and Other 42,360 19,710 Gain on Legal Settlement,

net (134,693 ) - Amortization of Acquired Contract Liabilities

(8,967 ) (11,150 ) Depreciation and Amortization 37,551

37,934 Adjusted Earnings before

Interest, Taxes, Depreciation and Amortization ("Adjusted EBITDA")

$ 134,415 $ 168,130 Net Sales $ 896,905

$ 943,683 Adjusted EBITDA Margin 15.1 %

18.0 %

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES (dollars in

thousands) Non-GAAP Financial Measure Disclosures

(continued) Adjusted Earnings before Interest, Taxes,

Depreciation and Amortization (EBITDA):

Three Months Ended June 30,

2014

Segment Data

Aerospace

Aftermarket

Corporate

/

Total

Aerostructures

Systems

Services

Eliminations

Net Income $ 128,243 Add-back: Income Tax Expense

69,921 Interest Expense and Other

42,360

Operating Income (Loss) $ 240,524 $ 70,866 $ 37,352 $ 10,504

$ 121,802 Gain on Legal Settlement (134,693 ) - - - (134,693

) Amortization of Acquired Contract Liabilities (8,967 ) (5,117 )

(3,850 ) - - Depreciation and Amortization

37,551 24,979

9,517 1,877

1,178 Adjusted Earnings (Losses) before

Interest, Taxes, Depreciation and Amortization ("Adjusted EBITDA")

$ 134,415 $

90,728 $ 43,019

$ 12,381 $

(11,713 ) Net Sales

$

896,905 $ 611,863

$ 219,852 $

67,608 $ (2,418

) Adjusted EBITDA Margin

15.1 % 15.0

% 19.9 %

18.3 % n/a

Adjusted Earnings before Interest, Taxes,

Depreciation and Amortization (EBITDA): Three Months Ended

June 30, 2013 Segment Data

Aerospace

Aftermarket

Corporate

/

Total

Aerostructures

Systems

Services

Eliminations

Net Income $ 79,043 Add-back: Income Tax Expense

42,593 Interest Expense and Other

19,710

Operating Income (Loss) $ 141,346 $ 100,387 $ 42,643 $

11,279 $ (12,963 ) Amortization of Acquired Contract

Liabilities (11,150 ) (6,141 ) (5,009 ) - - Depreciation and

Amortization

37,934

26,313 8,539

1,877 1,205

Adjusted Earnings (Losses) before Interest, Taxes, Depreciation and

Amortization ("Adjusted EBITDA")

$

168,130 $ 120,559

$ 46,173 $

13,156 $ (11,758

) Net Sales

$ 943,683

$ 651,888 $

219,526 $ 74,353

$ (2,084 )

Adjusted EBITDA Margin 18.0 % 18.7 % 21.5 % 17.7 % n/a

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND

SUBSIDIARIES(dollars in thousands)

Non-GAAP Financial Measure Disclosures (continued)

Adjusted income from continuing operations before income taxes,

adjusted income from continuing operations and adjusted income from

continuing operations diluted per share, before non-recurring costs

has been provided for consistency and comparability. These measures

should not be considered in isolation or as alternatives to income

from continuing operations before income taxes, income from

continuing operations and income from continuing operations per

diluted share presented in accordance with GAAP. The following

table reconciles income from continuing operations before income

taxes, income from continuing operations and income from continuing

operations per diluted share, before non-recurring costs.

Three Months Ended

June 30,

2014

Pre-tax

After-tax

Diluted

EPS

Location

on

Financial

Statements

Income from Continuing Operations- GAAP $ 198,164 $ 128,243 $ 2.46

Non-Recurring Costs: Gain on Legal Settlement (134,693 )

(86,204 ) (1.65 ) Corporate Refinancing Costs 22,615 14,474 0.28

Corporate Relocation Costs 2,997 1,918 0.04 Aerostructures

(Primarily) Jefferson Street Move: Disruption 3,360 2,150 0.04

Aerostructures (EAC) ** Accelerated Depreciation 2,375

1,520 0.03

Aerostructures (EAC) ** Adjusted Income from Continuing

Operations- non-GAAP $ 94,818 $ 62,101

$ 1.19 *

Three Months Ended

June 30,

2013

Pre-tax

After-tax

Diluted

EPS

Location

on

Financial

Statements

Income from Continuing Operations- GAAP $ 121,636 $ 79,043 $ 1.50

Non-Recurring Costs: Relocation Costs (including interest)

1,321 851 0.02 Aerostructures (Primarily) Jefferson Street Move:

Disruption 1,551 999 0.02 Aerostructures (EAC) ** Accelerated

Depreciation 758 488

0.01 Aerostructures (EAC) ** Adjusted Income

from Continuing Operations- non-GAAP $ 125,266

$ 81,381 $ 1.54 * * Difference

due to rounding.

**

EAC- estimated costs at completion with

respect to contracts within the scope of Accounting Standards

Codification 605-35, "Revenue Recognition-Construction-Type and

Production-Type Contracts"

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND

SUBSIDIARIES(dollars in thousands)

Non-GAAP Financial Measure Disclosures (continued)

Cash provided by operations, before pension contributions has

been provided for consistency and comparability. We also use free

cash flow available for debt reduction as a key factor in planning

for and consideration of strategic acquisitions, stock repurchases

and the repayment of debt. This measure should not be considered in

isolation, as a measure of residual cash flow available for

discretionary purposes, or as an alternative to operating results

presented in accordance with GAAP. The following table reconciles

cash provided by operations, before pension contributions to cash

provided by operations, as well as cash provided by operations to

free cash flow available for debt reduction.

Three Months Ended June 30, 2014

2013 Cash flow from operations, before

pension contributions $ (6,843 ) $ 37,682 Pension contributions

45,209 25,800 Cash (used in) provided

by operations (52,052 ) 11,882

Less:

Capital expenditures 23,077 56,229 Dividends 2,056

2,069

Free cash flow available for debt

reduction, acquisitions and share repurchases

$ (77,185 ) $ (46,416 )

We use "Net Debt to Capital" as a measure of financial leverage.

The following table sets forth the computation of Net Debt to

Capital:

June 30, March 31,

2014 2014

Calculation of

Net Debt

Current portion $ 43,323 $ 49,575 Long-term debt 1,714,310

1,500,808 Total debt 1,757,633 1,550,383 Less:

Cash 25,465 28,998 Net debt $ 1,732,168

$ 1,521,385

Calculation of

Capital

Net debt $ 1,732,168 $ 1,521,385 Stockholders' equity

2,353,548 2,283,911 Total capital $ 4,085,716

$ 3,805,296 Percent of net debt to capital

42.4 % 40.0 %

Triumph Group, Inc.Sheila G. SpagnoloVice President, Tax &

Investor Relations610-251-1000sspagnolo@triumphgroup.com

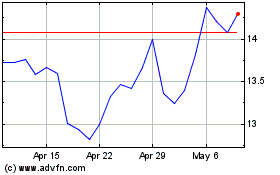

Triumph (NYSE:TGI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Triumph (NYSE:TGI)

Historical Stock Chart

From Sep 2023 to Sep 2024