Company Announces Conference Call on August 14, 2014

HIRAM, GA /

eTeligis/, 7/30/2014 8:50:00 AM - Labor SMART,

Inc. (OTCQB: LTNC) (the "Company"), a leader in providing on-demand

blue collar staffing primarily in the southeastern United States,

today issued the following letter to shareholders:

Dear Fellow Shareholder,

It's certainly been a very exciting first half of 2014. We are on

track to post a record year for Labor SMART.

There has been so much accomplished and the outlook continues to be

so strong that I felt it important to correspond with you directly

and highlight our accomplishments as well as provide an outlook for

the remainder of the year.

Briefly, our highlights:

- Most significant is the most recent - we are now self-insured

in 14 states. This is a key part of our growth strategy as it has

the potential to improve our cash flow and lower our cost of sales.

Already this has had an immediate positive effect on our gross

profit margins.

- Record revenues continue to be achieved on a monthly basis. In

June alone we recorded $2,209,702. Furthermore at those branches

that have been open for a year or more, revenue increased by 23

percent, year-over-year.

- Expansion has been strong. We doubled our footprint from 15

offices to 30 in the first six months of 2014. This expansion has

been geographic as well with an entry into the Western US with new

offices in Denver and Texas as well as our recent acquisition in

Oklahoma.

- Our gross margins are increasing monthly - this is a stated

goal of the company to continue to improve our gross margins. As

noted above, the recent self-insurance will contribute

substantially to achieving this goal sooner than we originally

planned.

- Our client base continues to increase and we are seeing repeat

business on a regular basis. This repeat business is a strong

endorsement of both your company and the workers we supply to these

businesses. As our footprint has expanded, so has the number of

clients we service across multiple cities. We continue to diversify

our client roster to include non-seasonal types of customers, such

as those in the hospitality industry.

- The addition of Jay Reynolds to our team as Director of

Business Development. Jay brings a strong background and is leading

our sales team as we enhance our sales culture and continue to

execute our business plan.

- We negotiated better terms with Transfac Capital on funding

against our accounts receivable to 85% from the 70% earlier level.

This improvement is as a result of the strengthening of our

business position.

These are significant achievements in the first half of 2014, which

as you will recall, started off with three months of very slow

economic growth due to weather-related issues nationwide. At Labor

SMART we were an anomaly as we achieved record revenues during all

three of these months - something that we had not anticipated and

which frankly was a very pleasant surprise for us. This unusual

weather did however cause a slow start to our expansion season for

2014.

Now, the challenges ahead....and we are confident that we can meet

them head on and surmount them.

- The growth of the company - while growth is extremely important

to provide additional revenue, it is also costly and time consuming

to bring new branch offices on board. It can take six to nine

months for a new branch to reach a profitable sales level and 12-18

months for a new branch to produce the long term revenue level we

expect, which is at a run rate of $1.5 million annually per

office.

- Our convertible debt is a challenge. We have taken steps to

secure this in small tranches so that no one individual or entity

can force conversion. We continue to pay the overwhelming majority

of this debt with cash, thereby keeping dilution to a minimum.

Since inception, we have strived to take advantage of every

resource available to us to grow as quickly as necessary to reach

critical mass, which I believe has been achieved. While convertible

debt is not ideal, it has provided us the quick capital that was

needed to grow from startup to 30 branch offices in 2 years. With

less than $3 million in paid in capital, we have built a business

that should generate millions in profits in the years to come. Now,

it is time to remove this debt from the balance sheet and graduate

to more traditional funding for future growth. Therefore, we are

aggressively exploring our options to achieve this in the best

manner possible for the company and its shareholders.

- Acquisitions. Our business is highly fragmented. We intend to

continue to acquire other offices. We have very specific criteria

however, and the most important is that the work culture be similar

to our existing commitment to customers. There are many potential

targets that we are considering at the present time.

- General economic conditions - as the economy continues to gain

strength our customer mix may continue to change - we believe it

will grow as construction picks up and large companies bring

manufacturing back to the US - with a significant presence in our

strong area of the country - the Southeastern US. This is both a

challenge as well as an opportunity in that the worker pool may

become smaller, yet the potential for business grows. We believe we

are equipped and nimble enough to deal with this

challenge/opportunity should it arise.

I'd like to expand a little on what I consider major fundamental

changes to our organization, but first I need to provide some

background. Our operating plan, growth strategy, and even revenue

projections since inception, were drafted and prepared long before

Labor SMART began its rapid growth. In fact, in early 2011 my

original "Waffle House napkin" projection for revenue in 2012 was

only $4 million. We actually came in at $7.1million. The 2013

projection was only $12 million. We produced over $16.6 million. I

prepared these projections based on a combination of expected

scenarios, obstacles, opportunities, and challenges. Each year, the

world class Labor SMART team has delivered above and beyond my

expectations.

One of the critical components of the five year plan launched in

2012 was to quickly scale our business to a size that would be big

enough to secure a large deductible insurance policy for worker's

compensation, and this would need to be achieved no later than

2016. Being substantially self-insured puts us in the driver's seat

for one of our largest expense items. I anticipated us being able

to achieve this goal sometime in 2015. Yet again, the Labor SMART

team delivered beyond my expectations when we bound a large

deductible policy on June 14, 2014, a full year ahead of

schedule.

And here we are. One of the driving necessities behind our rapid

organic expansion (getting big enough to be self-insured), has been

secured. For Labor SMART, rapid organic expansion is no longer a

requirement to meet our future goals, and for the first time since

inception, goals that we set years ago need to be adjusted to

reflect the better than expected reality we in which we now

operate.

While we intend to continue and even hasten our growth, some course

adjustments need to be made that will help us concentrate on

achieving overall profitability while growing at the same time.

First, with our new self-insurance, we needed to "clean out" any

book of business that didn't fit squarely in our model and that

task has been completed as of last week. Compared to 2013, we have

shed approximately $320,000 average monthly revenue in low margin,

higher risk business. These adjustments to our business mix will

have a minor negative impact on 2014 revenue and a very positive

impact on 2014 gross profit margins. Additionally and more

importantly, we have reduced our risk exposure from a safety and

credit perspective and will continue to take a risk averse position

in regards to safety. The effects of shedding this business

requires a reduction of 2014 revenue projections from $30 million

to $25-27 million but at the same time an increase in our 2014

gross margin projections from our original goal of reaching 22%

gross margin by Q4 to our new goal of 23.5% gross margin for the

entire year and reaching 25% in Q4 2014.

Second, we need to evaluate the most effective way to continue

rapid revenue growth, while showing profitability. Expanding

organically takes a dramatic toll on our profitability, as costs

are expensed and cannot be amortized over time. Now that our

organization has reached a sizeable scale, it is my belief that we

must take advantage of our scale, our world class infrastructure

and our lowered workers compensation costs to grow the company even

faster, but more through acquisitions than organic growth.

Therefore, we are adjusting our growth strategy for 2015 to reflect

a much higher appetite for acquisitions.

Historically, we have been able to execute acquisitions at a

multiple of 1-2 times EBITDA. I expect to expand this range up to

as much as 4 times EBITDA, which is still extremely below public

valuation and very accretive to Labor SMART earnings. The

acquisitions we have completed were structured in such a way that

allows for up to a 100% return on cash within 24 months and all

have been purchased with cash plus seller notes, with no Labor

SMART stock being issued. I believe this is a sound acquisition

model than can be replicated. Labor SMART has an experienced

management team that can quickly and efficiently integrate $20-40

million in acquisitions next year.

As I said at the beginning, 2014 so far has been a banner year for

your company and all signs point to that continuing in the

remaining months.

With all of this good news and opportunity, I know that many of you

are very concerned about the share price of the company. Obviously,

I share that concern as the single largest shareholder. We believe

the current share price certainly does not reflect either the value

of the company at its present time or the potential that we see on

the horizon. While we are just as disappointed in the current level

of our share price, we believe that as we perform and continue to

build this business the share price will reflect that value and

provide superior returns to early investors in our young company.

One important point to remember is that we still are an emerging

growth company and not yet able to uplist to a major exchange and

as a result, our shares can oftentimes be traded in ways that have

absolutely nothing to do with our underlying business. The key

focus remains growing the business - and as the business grows that

will become reflected in the value of the company as seen in its

market cap.

Very shortly we will file our 10Q for the second quarter and six

month period ending June 27, 2014. On August 14 at 10AM Eastern

Time, we will hold a conference call to review our second quarter

results as well as the content of this letter and provide updates

to our business plan. The call information is below:

Conference ID: 82219278

Participants' toll-free dial-in number (U.S. and Canada): (855)

582-8078

I invite all shareholders to attend. There will be a time allotted

for Q&A and I look forward to speaking with you.

We tell our story to new investors and will continue to do so in

the future. If you have any questions please feel free to contact

either Bev Jedynak at 312-943-1123 (bjedynak@janispr.com) or Jim

Janis, 312-882-9535 (junglejimjanis@yahoo.com) of Martin E. Janis

& Company, Inc., our public relations/investor relations

firm.

Please know that all of us at Labor SMART, in whatever role we

play, are committed to becoming THE leader in the blue-collar,

on-demand staffing industry and with your support, we can continue

in this endeavor.

Thank you,

C. Ryan Schadel

President & CEO

Safe Harbor Statement

This letter and the accompanying release contain statements that

constitute forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. These statements

appear in a number of places in this release and include all

statements that are not statements of historical fact regarding the

intent, belief or current expectations of Labor SMART, Inc., its

directors or its officers with respect to, among other things: (i)

financing plans; (ii) trends affecting its financial condition or

results of operations; (iii) growth strategy and operating

strategy. The words "may", "would", "will", "expect", "estimate",

"can", "believe", "potential", and similar expressions and

variations thereof are intended to identify forward-looking

statements. Investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties, many of which are beyond Labor SMART,

Inc.'s ability to control, and that actual results may differ

materially from those projected in the forward-looking statements

as a result of various factors. More information about the

potential factors that could affect the business and financial

results is and will be included in Labor SMART, Inc.'s filings with

the U.S. Securities and Exchange Commission.

CONTACT:

Bev Jedynak

312-943-1123

bjedynak@janispr.com

Jim Janis

312-882-9535

junglejimjanis@yahoo.com

SOURCE: Labor SMART, Inc.

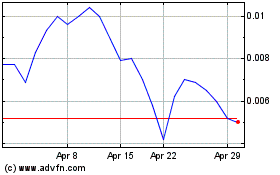

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Apr 2023 to Apr 2024