UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

June 5, 2014

Date of report (Date of earliest event reported)

Universal Insurance Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-33251 |

|

65-0231984 |

| (State or other jurisdiction

of incorporation or organization) |

|

(Commission file number) |

|

(IRS Employer

Identification No.) |

1110 W. Commercial Blvd., Fort Lauderdale, Florida 33309

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (954) 958-1200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

| ITEM 1.01 |

Entry into a Material Definitive Agreement. |

In connection with the election of Ralph

J. Palmieri and Richard D. Peterson as directors of Universal Insurance Holdings, Inc. (the “Company”), the Company entered into Indemnification Agreements with each of Messrs. Palmieri and Peterson on June 5, 2014. Pursuant to the

indemnification agreements, and subject to the exceptions and limitations provided therein, the Company will indemnify and hold harmless each of Messrs. Palmieri and Peterson to the fullest extent permitted by law against any and all liabilities and

expenses in connection with any proceeding to which he was, is or becomes a party arising out of his services as an officer, director, employee, agent or fiduciary of the Company or its subsidiaries. The foregoing description is qualified in its

entirety by reference to the text of the form of Indemnification Agreement, which is filed as Exhibit 10.1 and is incorporated herein by reference.

The Company also entered into a Director Services Agreement with each of Messrs. Palmieri and Peterson on June 5, 2014, pursuant to which

each will receive an annual fee of $85,000 for services rendered as a director of the Company. The foregoing description is qualified in its entirety by the text of the Director Services Agreements with Messrs. Palmieri and Peterson, which are filed

as Exhibits 10.2 and 10.3, respectively, and are incorporated herein by reference.

| ITEM 5.07 |

Submission of Matters to a Vote of Security Holders. |

At the Company’s Annual

Meeting of Shareholders held on June 5, 2014, the Company’s shareholders voted on three proposals, the final voting results of which are provided below.

Proposal No. 1: Election of Directors. The following individuals were elected to the Company’s Board of Directors by the holders of

the Company’s common stock, Series M Preferred Stock and Series A Preferred Stock, voting together as one class:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

For |

|

|

Withheld |

|

|

Broker Non-Votes |

|

| Scott P. Callahan |

|

|

14,044,072 |

|

|

|

9,337,177 |

|

|

|

7,593,133 |

|

| Sean P. Downes |

|

|

22,079,873 |

|

|

|

1,301,376 |

|

|

|

7,593,133 |

|

| Darryl L. Lewis |

|

|

22,490,178 |

|

|

|

891,071 |

|

|

|

7,593,133 |

|

| Ralph J. Palmieri |

|

|

21,848,597 |

|

|

|

1,532,652 |

|

|

|

7,593,133 |

|

| Richard D. Peterson |

|

|

22,525,508 |

|

|

|

855,741 |

|

|

|

7,593,133 |

|

| Michael A. Pietrangelo |

|

|

20,065,288 |

|

|

|

3,315,961 |

|

|

|

7,593,133 |

|

| Ozzie A. Schindler |

|

|

22,524,983 |

|

|

|

856,266 |

|

|

|

7,593,133 |

|

| Jon W. Springer |

|

|

21,760,093 |

|

|

|

1,621,156 |

|

|

|

7,593,133 |

|

| Joel M. Wilentz |

|

|

22,380,306 |

|

|

|

1,000,943 |

|

|

|

7,593,133 |

|

2

Proposal No. 2: The shareholders approved, on an advisory basis, the compensation of the

named executive officers.

|

|

|

|

|

| For: |

|

|

11,636,206 |

|

| Against: |

|

|

11,549,532 |

|

| Abstain: |

|

|

195,511 |

|

| Broker Non-Votes: |

|

|

7,593,133 |

|

Proposal No. 3: The shareholders voted to ratify the appointment of Plante & Moran, PLLC as the

Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014.

|

|

|

|

|

| For: |

|

|

29,891,928 |

|

| Against: |

|

|

588,614 |

|

| Abstain: |

|

|

493,840 |

|

| Broker Non-Votes: |

|

|

0 |

|

| ITEM 9.01 |

Financial Statements and Exhibits. |

10.1 Form of Indemnification Agreement (incorporated by reference to the Company’s Current

Report on Form 8-K, filed with the Securities and Exchange Commission on November 15, 2012).

10.2 Director Services Agreement, dated June 5,

2014, by and between the Company and Ralph J. Palmieri.

10.3 Director Services Agreement, dated June 5, 2014, by and between the Company and

Richard D. Peterson.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

| Date: June 5, 2014 |

|

|

|

|

|

UNIVERSAL INSURANCE HOLDINGS, INC. |

|

|

|

|

|

|

|

|

|

|

/s/ Frank C. Wilcox |

|

|

|

|

|

|

Frank C. Wilcox |

|

|

|

|

|

|

Chief Financial Officer |

4

Exhibit 10.2

UNIVERSAL INSURANCE HOLDINGS, INC.

DIRECTOR SERVICES AGREEMENT

This DIRECTOR SERVICES AGREEMENT is made as of this 5th day of June, 2014 (the

“Agreement”), by and between Universal Insurance Holdings, Inc., a Delaware corporation (the “Company”), and Ralph J. Palmieri (the “Director”).

WHEREAS, the Company wishes to enter into this Agreement with the Director to provide for the terms and conditions under which the Director

shall serve as a non-executive member of the Board of Directors of the Company (the “Board”); and

WHEREAS, the Director wishes

to serve in such capacity under the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants

contained herein, the parties hereto, intending to be legally bound, agree as follows:

1. Position. Subject to the terms and

conditions of this Agreement, the Director shall serve as a non-executive member of the Board; provided, however, that the Director’s continued service on the Board shall be subject to any necessary approval by the Company’s

stockholders.

2. Duties.

(a) During the Directorship Term (as defined in Section 5 hereof), the Director shall serve as a member of the Board, and the Director

shall make reasonable business efforts to attend all Board meetings, serve on appropriate subcommittees and as a director or officer of any subsidiary and/or affiliate as reasonably requested by the Board, make himself available to the Company at

mutually convenient times and places, attend external meetings and presentations, as appropriate and convenient, and perform such duties, services and responsibilities and have the authority commensurate to such position.

(b) The Director will use his best efforts to promote the interests of the Company. The Company recognizes that (i) the Director may be a

full-time executive employee of another entity and that his responsibilities to any such entity must have priority and (ii) the Director may sit on the Board of Directors of other entities. As such, the Director will use reasonable business

efforts to coordinate his respective commitments so as to fulfill his obligations to the Company and, in any event, will fulfill his legal obligations as a member of the Board. Other than as set forth above, the Director will not, without the prior

written approval of the Board, engage in any other business activity which could materially interfere with the performance of his duties, services and responsibilities hereunder or which is in violation of the reasonable policies established from

time to time by the Company; provided that the foregoing shall in no way limit his activities on behalf of (i) any current employer and its affiliates or (ii) any board of directors of other entities on which he currently sits.

Further, the Director shall complete and verify annually such questionnaires as reasonably may be requested by the Company.

3. Monetary Remuneration.

(a) Fees and Compensation. During the Directorship Term (as defined below), the Director shall receive the following compensation and benefits

in consideration of the services rendered in Section 2: an annual fee of U.S. $85,000.

The Director’s status during the term of

this Agreement shall be that of an independent contractor and not, for any purpose, that of an employee or agent with authority to bind the Company in any respect. All payments and other consideration made or provided to the Director under Sections

3 and 4 hereof shall be made or provided without withholding or deduction of any kind, and the Director shall assume sole responsibility for discharging, all tax or other obligations associated therewith.

(b) Expense Reimbursements. During the Directorship Term, the Company shall reimburse the Director for all reasonable out-of-pocket expenses

incurred by the Director in attending any in-person meetings, provided that the Director complies with the generally applicable policies, practices and procedures of the Company for submission of expense reports, receipts or similar documentation of

such expenses. Any reimbursements for allocated expenses (as compared to out-of-pocket expenses of the Director) must be approved in advance by the Company.

4. Equity Arrangements. Subject to the Board’s approval, the Company may from time to time grant equity awards to the Director

including, without limitation, non-qualified stock options to purchase shares of common stock of the Company. The terms and conditions of any such awards shall be as specified in a “Notice of Grant of Non-Qualified Stock Option Award to

Non-Employee Director” substantially in the form attached hereto as Exhibit A or in such other form agreement as approved by the Board.

5. Directorship Term. The “Directorship Term,” as used in this Agreement, shall mean the period commencing on the date hereof

and terminating on the earliest of the following to occur:

(a) death of the Director (“Death”);

(b) termination of the Director’s service as a member of the Board by the mutual agreement of the Company and the Director;

(c) failure of the Company’s stockholders to elect the Director in the Company’s annual election of directors to serve on the Board

for the next succeeding year;

(d) resignation by the Director from the Board if after the date hereof, the Director’s employer

determines that the Director’s continued service on the Board conflicts with his fiduciary obligations to such employer (a “Fiduciary Resignation”); and

(e) resignation by the Director from the Board if the board of directors or the chief executive

officer of the Director’s employer requires the Director to resign and such resignation is not a Fiduciary Resignation.

6.

Director’s Representation and Acknowledgment. The Director represents to the Company that his execution and performance of this Agreement shall not be in violation of any agreement or obligation (whether or not written) that he may have

with or to any person or entity, including without limitation, any prior employer. The Director hereby acknowledges and agrees that this Agreement (and any other agreement or obligation referred to herein) shall be an obligation solely of the

Company, and the Director shall have no recourse whatsoever against any stockholder of the Company or any of their respective affiliates with regard to this Agreement.

7. Director Covenants.

(a) Unauthorized Disclosure. The Director agrees and understands that in the Director’s position with the Company, the Director has been

and will be exposed to and receive information relating to the confidential affairs of the Company, including but not limited to technical information, business and marketing plans, strategies, customer information, other information concerning the

Company’s products, promotions, development, financing, expansion plans, business policies and practices, and other forms of information considered by the Company to be confidential and in the nature of trade secrets. The Director agrees that

during the Directorship Term and thereafter, the Director will keep such information confidential and will not disclose such information, either directly or indirectly, to any third person or entity without the prior written consent of the Company;

provided, however, that (i) the Director shall have no such obligation to the extent such information is or becomes publicly known or generally known in the Company’s industry other than as a result of the Director’s

breach of his obligations hereunder and (ii) the Director may, after giving prior notice to the Company to the extent practicable under the circumstances, disclose such information to the extent required by applicable laws or governmental

regulations or judicial or regulatory process. This confidentiality covenant has no temporal, geographical or territorial restriction. Upon termination of the Directorship Term, the Director will promptly return to the Company all property, keys,

notes, memoranda, writings, lists, files, reports, customer lists, correspondence, tapes, disks, cards, surveys, maps, logs, machines, technical data or any other tangible product or document which has been produced by, received by or otherwise

submitted to the Director in the course or otherwise as a result of the Director’s position with the Company during or prior to the Directorship Term, provided that, the Company shall retain such materials and make them available to the

Director if requested by him in connection with any litigation against the Director under circumstances in which (i) the Director demonstrates to the reasonable satisfaction of the Company that the materials are necessary to his defense in the

litigation, and (ii) the confidentiality of the materials is preserved to the reasonable satisfaction of the Company.

(b)

Non-Solicitation. During the Directorship Term and for a period of one (1) year thereafter, the Director shall not interfere with the Company’s relationship with, or endeavor to entice away from the Company, any person who, on the date of

the termination of the Directorship Term, was an employee or customer of the Company or otherwise had a material business relationship with the Company.

(c) Remedies. The Director agrees that any breach of the terms of this Section 7 would

result in irreparable injury and damage to the Company for which the Company would have no adequate remedy at law; the Director therefore also agrees that in the event of said breach or any threat of breach, the Company shall be entitled to an

immediate injunction and restraining order to prevent such breach and/or threatened breach and/or continued breach by the Director and/or any and all entities acting for and/or with the Director, without having to prove damages, in addition to any

other remedies to which the Company may be entitled at law or in equity. The terms of this paragraph shall not prevent the Company from pursuing any other available remedies for any breach or threatened breach hereof, including but not limited to

the recovery of damages from the Director. The Director acknowledges that the Company would not have entered into this Agreement had the Director not agreed to the provisions of this Section 7.

The provisions of this Section 7 shall survive any termination of the Directorship Term, and the existence of any claim or cause of

action by the Director against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement by the Company of the covenants and agreements of this Section 7.

8. Indemnification. The Company agrees to indemnify the Director for his activities as a director of the Company to the fullest extent

permitted by law, and to cover the Director under any directors and officers liability insurance obtained by the Company.

9.

Non-Waiver of Rights. The failure to enforce at any time the provisions of this Agreement or to require at any time performance by the other party of any of the provisions hereof shall in no way be construed to be a waiver of such provisions

or to affect either the validity of this Agreement or any part hereof, or the right of either party to enforce each and every provision in accordance with its terms. No waiver by either party hereto of any breach by the other party hereto of any

provision of this Agreement to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions at that time or at any prior or subsequent time.

10. Notices. Every notice relating to this Agreement shall be in writing and shall be given by personal delivery or by registered or

certified mail, postage prepaid, return receipt requested; to:

If to the Company:

Universal Insurance Holdings, Inc.

1110 W. Commercial Boulevard

Fort Lauderdale, Florida 33309

with a copy to:

K&L Gates LLP

1601 K Street, NW

Washington, DC 20006

Telephone: (202) 778-9050

Attention: Alan J. Berkeley, Esq.

If to the Director:

To the Director’s most recent address on file with the Company.

Either of the parties hereto may change their address for purposes of notice hereunder by giving notice in writing to such other party

pursuant to this Section 10.

11. Binding Effect/Assignment. This Agreement shall inure to the benefit of and be binding upon

the parties hereto and their respective heirs, executors, personal representatives, estates, successors (including, without limitation, by way of merger) and assigns. Notwithstanding the provisions of the immediately preceding sentence, neither the

Director nor the Company shall assign all or any portion of this Agreement without the prior written consent of the other party.

12.

Entire Agreement. This Agreement (together with the other agreements referred to herein) sets forth the entire understanding of the parties hereto with respect to the subject matter hereof and supersedes all prior agreements, written or oral,

between them as to such subject matter.

13. Severability. If any provision of this Agreement, or any application thereof to any

circumstances, is invalid, in whole or in part, such provision or application shall to that extent be severable and shall not affect other provisions or applications of this Agreement.

14. Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Delaware,

without reference to the principles of conflict of laws. All actions and proceedings arising out of or relating to this Agreement shall be heard and determined in any Delaware state or federal court and the parties hereto hereby consent to the

jurisdiction of such courts in any such action or proceeding; provided, however, that neither party shall commence any such action or proceeding unless prior thereto the parties have in good faith attempted to resolve the claim, dispute or cause of

action which is the subject of such action or proceeding through mediation by an independent third party.

15. Legal Fees. The parties hereto agree that the non-prevailing party in any dispute,

claim, action or proceeding between the parties hereto arising out of or relating to the terms and conditions of this Agreement or any provision thereof (a “Dispute”), shall reimburse the prevailing party for reasonable attorney’s

fees and expenses incurred by the prevailing party in connection with such Dispute; provided, however, that the Director shall only be required to reimburse the Company for its fees and expenses incurred in connection with a Dispute, if the

Director’s position in such Dispute was found by the court, arbitrator or other person or entity presiding over such Dispute to be frivolous or advanced not in good faith.

16. Modifications. Neither this Agreement nor any provision hereof may be modified, altered, amended or waived except by an instrument

in writing duly signed by the party to be charged.

17. Counterparts. This Agreement may be executed in two or more counterparts,

each of which shall be deemed to be an original but all of which together shall constitute one and the same instrument.

(remainder of this page intentionally left blank)

IN WITNESS WHEREOF, the Company has caused this Director Services Agreement to be executed by

authority of its Board of Directors, and the Director has hereunto set his hand, on the day and year first above written.

|

|

|

| Universal Insurance Holdings, Inc. |

|

|

| By: |

|

/s/ Sean P. Downes |

| Name: Sean P. Downes |

| Title: President and Chief Executive Officer |

|

|

|

|

| DIRECTOR |

|

|

| By: |

|

/s/ Ralph J. Palmieri |

| Name: Ralph J. Palmieri |

|

|

|

|

Exhibit A

Form of Notice of Grant of Non-Qualified Stock Option Award to Non-Employee Director

NOTICE OF GRANT OF NON-QUALIFIED STOCK OPTION AWARD

TO NON-EMPLOYEE DIRECTOR PURSUANT TO THE

UNIVERSAL INSURANCE HOLDINGS, INC.

2009 OMNIBUS INCENTIVE PLAN, AS AMENDED

FOR GOOD AND VALUABLE CONSIDERATION, Universal Insurance Holdings, Inc. (the “Company”) hereby grants, pursuant to the provisions of

the Company’s 2009 Omnibus Incentive Plan, as amended (the “Plan”), to the Optionee designated in this Notice of Grant of Non-Qualified Stock Option Award to Non-Employee Director (the “Notice of Grant”) an option to

purchase the number of shares of common stock of the Company set forth in the Notice (the “Shares”), subject to the restrictions as outlined below in this Notice and the additional provisions set forth in the attached Terms and Conditions

of Stock Option Award (collectively, the “Agreement”). The Optionee further acknowledges receipt of the information statement describing important provisions of the Plan. Capitalized words not otherwise defined in this Notice of Grant have

the meaning set forth in the accompanying Terms and Conditions.

|

|

|

| Optionee: |

|

Type of Option: Non-Qualified Stock Option |

| Exercise

Price per Share: $ |

|

Date of Grant: |

| Total Number of Shares:

|

|

Expiration Date: |

| |

|

| Vesting Schedule: |

|

|

| |

| Vesting is

accelerated in full upon a Change in Control under Section 2(c). |

| |

|

Exercise After Termination of Service:

Termination of Service for any reason other than death: if non-vested, the Option expires immediately and if vested, the Option remains exercisable for

thirty (30) days following the Optionee’s Termination of Service with the Board.

Termination of Service due to death: the entire Option, whether vested or non-vested, is exercisable by the Optionee’s Beneficiary for six

(6) months after the Optionee’s Termination of Service.

In no event may this Option be exercised after the Expiration Date as provided above.

|

By signing below, the Optionee agrees that this Non-Qualified Stock Option Award is granted under and governed by the terms

and conditions of the Plan and this Agreement.

|

|

|

|

|

|

|

| Optionee |

|

|

|

Universal Insurance Holdings, Inc. |

|

|

|

|

| |

|

|

|

By: |

|

|

|

|

|

|

|

|

Title: |

| Date: |

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

TERMS AND CONDITIONS OF STOCK OPTION AWARD

1. Grant of Option. The Option granted to the Optionee and described in the Notice of Grant is subject to the terms and conditions of

the 2009 Omnibus Incentive Plan, as amended (the “Plan”), which is incorporated by reference in its entirety into these Terms and Conditions of Stock Option Award (“Terms and Conditions”).

The Board of Directors of the Company (the “Board”) has authorized and approved the Plan, which has been approved by the

stockholders of the Company. The Board has approved an award to the Optionee of a number of shares of the Company’s common stock, conditioned upon the Optionee’s acceptance of the provisions set forth in this Agreement within 60 days after

this Agreement is presented to the Optionee for review. For purposes of this Agreement, any reference to the Company shall include a reference to any Affiliate.

This Option is a Non-Qualified Stock Option.

The Company intends that this Option not be considered to provide for the deferral of compensation under Section 409A of the Code and

that this Agreement shall be so administered and construed. Further, the Company may modify the Plan and this Award to the extent necessary to fulfill this intent.

2. Exercise of Option.

(a) Right to Exercise. This Option shall be exercisable, in whole or in part, during its term in accordance with the Vesting Schedule

set out in the Notice of Grant and with the applicable provisions of the Plan and this Agreement. No Shares shall be issued pursuant to the exercise of an Option unless the issuance and exercise comply with applicable laws. Assuming such compliance,

for income tax purposes the Shares shall be considered transferred to the Optionee on the date on which the Option is exercised with respect to such Shares. The Board may, in its discretion, accelerate vesting of the Option.

(b) Method of Exercise. The Optionee may exercise the Option by delivering an exercise notice in a form approved by the Company (the

“Exercise Notice”) which shall state the election to exercise the Option, the number of Shares with respect to which the Option is being exercised, and such other representations and agreements as may be required by the Company. The

Exercise Notice shall be accompanied by payment of the aggregate Exercise Price as to all Shares exercised. This Option shall be deemed to be exercised upon receipt by the Company of such fully executed Exercise Notice accompanied by the aggregate

Exercise Price.

(c) Acceleration of Vesting on Change in Control. Subject to the exceptions contained in Section 6.05 of the

Plan, in the event of a Change in Control, all Options outstanding on the date of the Change in Control that have not previously vested or terminated under the terms of this Agreement shall be immediately and fully vested and exercisable.

3. Method of Payment. If the Optionee elects to exercise the Option by submitting an Exercise Notice under Section 2(b) of this

Agreement, the aggregate Exercise Price (as well as any applicable withholding or other taxes) shall be paid by cash or check; provided, however, that the Board may consent, in its discretion, to payment in any of the following forms, or a

combination of them:

(a) cash or check;

(b) a “net exercise” (as described in the Plan) or such other consideration received by

the Company under a cashless exercise program approved by the Company in connection with the Plan;

(c) surrender of other Shares owned by

the Optionee which have a Fair Market Value on the date of surrender equal to the aggregate Exercise Price of the Exercised Shares and any applicable withholding; or

(d) any other consideration that the Board deems appropriate and in compliance with applicable law.

4. Non-Transferability of Option. This Option may not be transferred in any manner otherwise than by will or by the laws of descent or

distribution and may be exercised during the lifetime of the Optionee only by the Optionee; provided, however, that the Optionee may transfer the Options (i) pursuant to a qualified domestic relations order (as defined by the Code or the rules

thereunder) or (ii) to any member of the Optionee’s Immediate Family or to a trust, limited liability company, family limited partnership or other equivalent vehicle, established for the exclusive benefit of one or more members of his

Immediate Family by delivering to the Company a Notice of Assignment in a form acceptable to the Company. No transfer or assignment of the Option to or on behalf of an Immediate Family member under this Section 5 shall be effective until the

Company has acknowledged such transfer or assignment in writing. “Immediate Family” means the Optionee’s parents, spouse, children, siblings, and grandchildren. Following transfer, the Options shall continue to be subject to the same

terms and conditions as were applicable immediately prior to transfer. In the event an Option is transferred as contemplated in this Section 5, such Option may not be subsequently transferred by the transferee except by will or the laws of

descent and distribution. The terms of the Plan and this Agreement shall be binding upon the executors, administrators, heirs, successors and assigns of the Optionee.

5. Term of Option. This Option may be exercised only within the term set out in the Notice of Grant, and may be exercised during such

term only in accordance with the Plan and the terms of this Agreement.

6. Withholding.

(a) The Committee shall determine the amount of any withholding or other tax required by law to be withheld or paid by the Company with

respect to any income recognized by the Optionee with respect to the Award.

(b) The Optionee shall be required to meet any applicable tax

withholding obligation in accordance with the provisions of Section 11.05 of the Plan.

(c) Subject to any rules prescribed by the

Committee, the Optionee shall have the right to elect to meet any withholding requirement (i) by having withheld from this Award at the appropriate time that number of whole shares of common stock whose fair market value is equal to the amount

of any taxes required to be withheld with respect to such Award, (ii) by direct payment to the Company in cash of the amount of any taxes required to be withheld with respect to such Award or (iii) by a combination of shares and cash.

7. Defined Terms. Capitalized terms used but not defined in the Agreement shall have the meanings set forth in the Plan.

8. Optionee Representations. The Optionee hereby represents to the Company that the

Optionee has read and fully understands the provisions of the Notice, this Agreement and the Plan and the Optionee’s decision to participate in the Plan is completely voluntary. Further, the Optionee acknowledges that the Optionee is relying

solely on his or her own advisors with respect to the tax consequences of this stock option award.

9. Limitations on Exercises.

Notwithstanding the other provisions of this Agreement, no option exercise or issuance of shares of Common Stock pursuant to this Agreement shall be effective if (i) the shares reserved under the Plan are not subject to an effective

registration statement at the time of such exercise or issuance, or otherwise eligible for an exemption from registration, or (ii) the Company determines in good faith that such exercise or issuance would violate any applicable securities or

other law, regulation or Company policy.

10. Miscellaneous.

(a) Notices. All notices, requests, deliveries, payments, demands and other communications which are required or permitted to be

given under this Agreement shall be in writing and shall be either delivered personally or sent by registered or certified mail, or by private courier, return receipt requested, postage prepaid to the parties at their respective addresses set forth

herein, or to such other address as either shall have specified by notice in writing to the other. Notice shall be deemed duly given hereunder when delivered or mailed as provided herein.

(b) Waiver. The waiver by any party hereto of a breach of any provision of this Agreement shall not operate or be construed as a waiver

of any other or subsequent breach.

(c) Entire Agreement. This Agreement and the Plan constitute the entire agreement between the

parties with respect to the subject matter hereof.

(d) Binding Effect; Successors. This Agreement shall inure to the benefit of

and be binding upon the parties hereto and to the extent not prohibited herein, their respective heirs, successors, assigns and representatives. Nothing in this Agreement, express or implied, is intended to confer on any person other than the

parties hereto and as provided above, their respective heirs, successors, assigns and representatives any rights, remedies, obligations or liabilities.

(e) Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware.

(f) Headings. The headings contained herein are for the sole purpose of convenience of reference, and shall not in any way limit or

affect the meaning or interpretation of any of the terms or provisions of this Agreement.

(g) Conflicts; Amendment. The provisions

of the Plan are incorporated in this Agreement in their entirety. In the event of any conflict between the provisions of this Agreement and the Plan, the provisions of the Plan shall control. This Agreement may be amended at any time by written

agreement of the parties hereto.

(h) No Right to Continued Employment. Nothing in this Agreement shall confer upon the Optionee

any right to continue in the employ or service of the Company or affect the right of the Company to terminate the Optionee’s employment or service at any time.

(i) Further Assurances. The Optionee agrees, upon demand of the Company or the Board, to

do all acts and execute, deliver and perform all additional documents, instruments and agreements which may be reasonably required by the Company or the Board, as the case may be, to implement the provisions and purposes of this Agreement and the

Plan.

Exhibit 10.3

UNIVERSAL INSURANCE HOLDINGS, INC.

DIRECTOR SERVICES AGREEMENT

This DIRECTOR SERVICES AGREEMENT is made as of this 5th day of June, 2014 (the

“Agreement”), by and between Universal Insurance Holdings, Inc., a Delaware corporation (the “Company”), and Richard D. Peterson (the “Director”).

WHEREAS, the Company wishes to enter into this Agreement with the Director to provide for the terms and conditions under which the Director

shall serve as a non-executive member of the Board of Directors of the Company (the “Board”); and

WHEREAS, the Director wishes

to serve in such capacity under the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants

contained herein, the parties hereto, intending to be legally bound, agree as follows:

1. Position. Subject to the terms and

conditions of this Agreement, the Director shall serve as a non-executive member of the Board; provided, however, that the Director’s continued service on the Board shall be subject to any necessary approval by the Company’s

stockholders.

2. Duties.

(a) During the Directorship Term (as defined in Section 5 hereof), the Director shall serve as a member of the Board, and the Director

shall make reasonable business efforts to attend all Board meetings, serve on appropriate subcommittees and as a director or officer of any subsidiary and/or affiliate as reasonably requested by the Board, make himself available to the Company at

mutually convenient times and places, attend external meetings and presentations, as appropriate and convenient, and perform such duties, services and responsibilities and have the authority commensurate to such position.

(b) The Director will use his best efforts to promote the interests of the Company. The Company recognizes that (i) the Director may be a

full-time executive employee of another entity and that his responsibilities to any such entity must have priority and (ii) the Director may sit on the Board of Directors of other entities. As such, the Director will use reasonable business

efforts to coordinate his respective commitments so as to fulfill his obligations to the Company and, in any event, will fulfill his legal obligations as a member of the Board. Other than as set forth above, the Director will not, without the prior

written approval of the Board, engage in any other business activity which could materially interfere with the performance of his duties, services and responsibilities hereunder or which is in violation of the reasonable policies established from

time to time by the Company; provided that the foregoing shall in no way limit his activities on behalf of (i) any current employer and its affiliates or (ii) any board of directors of other entities on which he currently sits.

Further, the Director shall complete and verify annually such questionnaires as reasonably may be requested by the Company.

3. Monetary Remuneration.

(a) Fees and Compensation. During the Directorship Term (as defined below), the Director shall receive the following compensation and benefits

in consideration of the services rendered in Section 2: an annual fee of U.S. $85,000.

The Director’s status during the term of

this Agreement shall be that of an independent contractor and not, for any purpose, that of an employee or agent with authority to bind the Company in any respect. All payments and other consideration made or provided to the Director under Sections

3 and 4 hereof shall be made or provided without withholding or deduction of any kind, and the Director shall assume sole responsibility for discharging, all tax or other obligations associated therewith.

(b) Expense Reimbursements. During the Directorship Term, the Company shall reimburse the Director for all reasonable out-of-pocket expenses

incurred by the Director in attending any in-person meetings, provided that the Director complies with the generally applicable policies, practices and procedures of the Company for submission of expense reports, receipts or similar documentation of

such expenses. Any reimbursements for allocated expenses (as compared to out-of-pocket expenses of the Director) must be approved in advance by the Company.

4. Equity Arrangements. Subject to the Board’s approval, the Company may from time to time grant equity awards to the Director

including, without limitation, non-qualified stock options to purchase shares of common stock of the Company. The terms and conditions of any such awards shall be as specified in a “Notice of Grant of Non-Qualified Stock Option Award to

Non-Employee Director” substantially in the form attached hereto as Exhibit A or in such other form agreement as approved by the Board.

5. Directorship Term. The “Directorship Term,” as used in this Agreement, shall mean the period commencing on the date hereof

and terminating on the earliest of the following to occur:

(a) death

of the Director (“Death”);

(b) termination of the Director’s service as a member of the Board by the mutual agreement of

the Company and the Director;

(c) failure of the Company’s stockholders to elect the Director in the Company’s annual election

of directors to serve on the Board for the next succeeding year;

(d) resignation by the Director from the Board if after the date hereof,

the Director’s employer determines that the Director’s continued service on the Board conflicts with his fiduciary obligations to such employer (a “Fiduciary Resignation”); and

(e) resignation by the Director from the Board if the board of directors or the chief executive

officer of the Director’s employer requires the Director to resign and such resignation is not a Fiduciary Resignation.

6.

Director’s Representation and Acknowledgment. The Director represents to the Company that his execution and performance of this Agreement shall not be in violation of any agreement or obligation (whether or not written) that he may have

with or to any person or entity, including without limitation, any prior employer. The Director hereby acknowledges and agrees that this Agreement (and any other agreement or obligation referred to herein) shall be an obligation solely of the

Company, and the Director shall have no recourse whatsoever against any stockholder of the Company or any of their respective affiliates with regard to this Agreement.

7. Director Covenants.

(a) Unauthorized Disclosure. The Director agrees and understands that in the Director’s position with the Company, the Director has been

and will be exposed to and receive information relating to the confidential affairs of the Company, including but not limited to technical information, business and marketing plans, strategies, customer information, other information concerning the

Company’s products, promotions, development, financing, expansion plans, business policies and practices, and other forms of information considered by the Company to be confidential and in the nature of trade secrets. The Director agrees that

during the Directorship Term and thereafter, the Director will keep such information confidential and will not disclose such information, either directly or indirectly, to any third person or entity without the prior written consent of the Company;

provided, however, that (i) the Director shall have no such obligation to the extent such information is or becomes publicly known or generally known in the Company’s industry other than as a result of the Director’s

breach of his obligations hereunder and (ii) the Director may, after giving prior notice to the Company to the extent practicable under the circumstances, disclose such information to the extent required by applicable laws or governmental

regulations or judicial or regulatory process. This confidentiality covenant has no temporal, geographical or territorial restriction. Upon termination of the Directorship Term, the Director will promptly return to the Company all property, keys,

notes, memoranda, writings, lists, files, reports, customer lists, correspondence, tapes, disks, cards, surveys, maps, logs, machines, technical data or any other tangible product or document which has been produced by, received by or otherwise

submitted to the Director in the course or otherwise as a result of the Director’s position with the Company during or prior to the Directorship Term, provided that, the Company shall retain such materials and make them available to the

Director if requested by him in connection with any litigation against the Director under circumstances in which (i) the Director demonstrates to the reasonable satisfaction of the Company that the materials are necessary to his defense in the

litigation, and (ii) the confidentiality of the materials is preserved to the reasonable satisfaction of the Company.

(b)

Non-Solicitation. During the Directorship Term and for a period of one (1) year thereafter, the Director shall not interfere with the Company’s relationship with, or endeavor to entice away from the Company, any person who, on the date of

the termination of the Directorship Term, was an employee or customer of the Company or otherwise had a material business relationship with the Company.

(c) Remedies. The Director agrees that any breach of the terms of this Section 7 would

result in irreparable injury and damage to the Company for which the Company would have no adequate remedy at law; the Director therefore also agrees that in the event of said breach or any threat of breach, the Company shall be entitled to an

immediate injunction and restraining order to prevent such breach and/or threatened breach and/or continued breach by the Director and/or any and all entities acting for and/or with the Director, without having to prove damages, in addition to any

other remedies to which the Company may be entitled at law or in equity. The terms of this paragraph shall not prevent the Company from pursuing any other available remedies for any breach or threatened breach hereof, including but not limited to

the recovery of damages from the Director. The Director acknowledges that the Company would not have entered into this Agreement had the Director not agreed to the provisions of this Section 7.

The provisions of this Section 7 shall survive any termination of the Directorship Term, and the existence of any claim or cause of

action by the Director against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement by the Company of the covenants and agreements of this Section 7.

8. Indemnification. The Company agrees to indemnify the Director for his activities as a director of the Company to the fullest extent

permitted by law, and to cover the Director under any directors and officers liability insurance obtained by the Company.

9.

Non-Waiver of Rights. The failure to enforce at any time the provisions of this Agreement or to require at any time performance by the other party of any of the provisions hereof shall in no way be construed to be a waiver of such provisions

or to affect either the validity of this Agreement or any part hereof, or the right of either party to enforce each and every provision in accordance with its terms. No waiver by either party hereto of any breach by the other party hereto of any

provision of this Agreement to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions at that time or at any prior or subsequent time.

10. Notices. Every notice relating to this Agreement shall be in writing and shall be given by personal delivery or by registered or

certified mail, postage prepaid, return receipt requested; to:

If to the Company:

Universal Insurance Holdings, Inc.

1110 W. Commercial Boulevard

Fort Lauderdale, Florida 33309

with a copy to:

K&L Gates LLP

1601 K Street, NW

Washington, DC 20006

Telephone: (202) 778-9050

Attention: Alan J. Berkeley, Esq.

If to the Director:

To the Director’s most recent address on file with the Company.

Either of the parties hereto may change their address for purposes of notice hereunder by giving notice in writing to such other party

pursuant to this Section 10.

11. Binding Effect/Assignment. This Agreement shall inure to the benefit of and be binding upon

the parties hereto and their respective heirs, executors, personal representatives, estates, successors (including, without limitation, by way of merger) and assigns. Notwithstanding the provisions of the immediately preceding sentence, neither the

Director nor the Company shall assign all or any portion of this Agreement without the prior written consent of the other party.

12.

Entire Agreement. This Agreement (together with the other agreements referred to herein) sets forth the entire understanding of the parties hereto with respect to the subject matter hereof and supersedes all prior agreements, written or oral,

between them as to such subject matter.

13. Severability. If any provision of this Agreement, or any application thereof to any

circumstances, is invalid, in whole or in part, such provision or application shall to that extent be severable and shall not affect other provisions or applications of this Agreement.

14. Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Delaware,

without reference to the principles of conflict of laws. All actions and proceedings arising out of or relating to this Agreement shall be heard and determined in any Delaware state or federal court and the parties hereto hereby consent to the

jurisdiction of such courts in any such action or proceeding; provided, however, that neither party shall commence any such action or proceeding unless prior thereto the parties have in good faith attempted to resolve the claim, dispute or cause of

action which is the subject of such action or proceeding through mediation by an independent third party.

15. Legal Fees. The parties hereto agree that the non-prevailing party in any dispute,

claim, action or proceeding between the parties hereto arising out of or relating to the terms and conditions of this Agreement or any provision thereof (a “Dispute”), shall reimburse the prevailing party for reasonable attorney’s

fees and expenses incurred by the prevailing party in connection with such Dispute; provided, however, that the Director shall only be required to reimburse the Company for its fees and expenses incurred in connection with a Dispute, if the

Director’s position in such Dispute was found by the court, arbitrator or other person or entity presiding over such Dispute to be frivolous or advanced not in good faith.

16. Modifications. Neither this Agreement nor any provision hereof may be modified, altered, amended or waived except by an instrument

in writing duly signed by the party to be charged.

17. Counterparts. This Agreement may be executed in two or more counterparts,

each of which shall be deemed to be an original but all of which together shall constitute one and the same instrument.

(remainder of this

page intentionally left blank)

IN WITNESS WHEREOF, the Company has caused this Director Services Agreement to be executed by

authority of its Board of Directors, and the Director has hereunto set his hand, on the day and year first above written.

|

|

|

| Universal Insurance Holdings, Inc. |

|

|

| By: |

|

/s/ Sean P. Downes |

| Name: Sean P. Downes |

| Title: President and Chief Executive Officer |

|

|

|

|

| DIRECTOR |

|

|

| By: |

|

/s/ Richard D. Peterson |

| Name: Richard D. Peterson |

|

|

|

|

Exhibit A

Form of Notice of Grant of Non-Qualified Stock Option Award to Non-Employee Director

NOTICE OF GRANT OF NON-QUALIFIED STOCK OPTION AWARD

TO NON-EMPLOYEE DIRECTOR PURSUANT TO THE

UNIVERSAL INSURANCE HOLDINGS, INC.

2009 OMNIBUS INCENTIVE PLAN, AS AMENDED

FOR GOOD AND VALUABLE CONSIDERATION, Universal Insurance Holdings, Inc. (the “Company”) hereby grants, pursuant to the provisions of

the Company’s 2009 Omnibus Incentive Plan, as amended (the “Plan”), to the Optionee designated in this Notice of Grant of Non-Qualified Stock Option Award to Non-Employee Director (the “Notice of Grant”) an option to

purchase the number of shares of common stock of the Company set forth in the Notice (the “Shares”), subject to the restrictions as outlined below in this Notice and the additional provisions set forth in the attached Terms and Conditions

of Stock Option Award (collectively, the “Agreement”). The Optionee further acknowledges receipt of the information statement describing important provisions of the Plan. Capitalized words not otherwise defined in this Notice of Grant have

the meaning set forth in the accompanying Terms and Conditions.

|

|

|

| Optionee: |

|

Type of Option: Non-Qualified Stock Option |

| Exercise

Price per Share: $ |

|

Date of Grant: |

| Total Number of Shares:

|

|

Expiration Date: |

| Vesting Schedule: |

|

|

| |

|

Vesting is accelerated in full upon a Change in Control under Section 2(c).

|

| |

|

Exercise After Termination of Service:

Termination of Service for any reason other than death: if non-vested, the Option expires immediately and if vested, the Option remains exercisable for

thirty (30) days following the Optionee’s Termination of Service with the Board.

Termination of Service due to death: the entire Option, whether vested or non-vested, is exercisable by the Optionee’s Beneficiary for six

(6) months after the Optionee’s Termination of Service.

In no event may this Option be exercised after the Expiration Date as provided above.

|

By signing below, the Optionee agrees that this Non-Qualified Stock Option Award is granted under and governed by the terms

and conditions of the Plan and this Agreement.

|

|

|

|

|

|

|

| Optionee |

|

|

|

Universal Insurance Holdings, Inc. |

|

|

|

|

| |

|

|

|

By: |

|

|

|

|

|

|

|

|

Title: |

| Date: |

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

TERMS AND CONDITIONS OF STOCK OPTION AWARD

1. Grant of Option. The Option granted to the Optionee and described in the Notice of Grant is subject to the terms and conditions of

the 2009 Omnibus Incentive Plan, as amended (the “Plan”), which is incorporated by reference in its entirety into these Terms and Conditions of Stock Option Award (“Terms and Conditions”).

The Board of Directors of the Company (the “Board”) has authorized and approved the Plan, which has been approved by the

stockholders of the Company. The Board has approved an award to the Optionee of a number of shares of the Company’s common stock, conditioned upon the Optionee’s acceptance of the provisions set forth in this Agreement within 60 days after

this Agreement is presented to the Optionee for review. For purposes of this Agreement, any reference to the Company shall include a reference to any Affiliate.

This Option is a Non-Qualified Stock Option.

The Company intends that this Option not be considered to provide for the deferral of compensation under Section 409A of the Code and

that this Agreement shall be so administered and construed. Further, the Company may modify the Plan and this Award to the extent necessary to fulfill this intent.

2. Exercise of Option.

(a) Right to Exercise. This Option shall be exercisable, in whole or in part, during its term in accordance with the Vesting Schedule

set out in the Notice of Grant and with the applicable provisions of the Plan and this Agreement. No Shares shall be issued pursuant to the exercise of an Option unless the issuance and exercise comply with applicable laws. Assuming such compliance,

for income tax purposes the Shares shall be considered transferred to the Optionee on the date on which the Option is exercised with respect to such Shares. The Board may, in its discretion, accelerate vesting of the Option.

(b) Method of Exercise. The Optionee may exercise the Option by delivering an exercise notice in a form approved by the Company (the

“Exercise Notice”) which shall state the election to exercise the Option, the number of Shares with respect to which the Option is being exercised, and such other representations and agreements as may be required by the Company. The

Exercise Notice shall be accompanied by payment of the aggregate Exercise Price as to all Shares exercised. This Option shall be deemed to be exercised upon receipt by the Company of such fully executed Exercise Notice accompanied by the aggregate

Exercise Price.

(c) Acceleration of Vesting on Change in Control. Subject to the exceptions contained in Section 6.05 of the

Plan, in the event of a Change in Control, all Options outstanding on the date of the Change in Control that have not previously vested or terminated under the terms of this Agreement shall be immediately and fully vested and exercisable.

3. Method of Payment. If the Optionee elects to exercise the Option by submitting an Exercise Notice under Section 2(b) of this

Agreement, the aggregate Exercise Price (as well as any applicable withholding or other taxes) shall be paid by cash or check; provided, however, that the Board may consent, in its discretion, to payment in any of the following forms, or a

combination of them:

(a) cash or check;

(b) a “net exercise” (as described in the Plan) or such other consideration received by

the Company under a cashless exercise program approved by the Company in connection with the Plan;

(c) surrender of other Shares owned by

the Optionee which have a Fair Market Value on the date of surrender equal to the aggregate Exercise Price of the Exercised Shares and any applicable withholding; or

(d) any other consideration that the Board deems appropriate and in compliance with applicable law.

4. Non-Transferability of Option. This Option may not be transferred in any manner otherwise than by will or by the laws of descent or

distribution and may be exercised during the lifetime of the Optionee only by the Optionee; provided, however, that the Optionee may transfer the Options (i) pursuant to a qualified domestic relations order (as defined by the Code or the rules

thereunder) or (ii) to any member of the Optionee’s Immediate Family or to a trust, limited liability company, family limited partnership or other equivalent vehicle, established for the exclusive benefit of one or more members of his

Immediate Family by delivering to the Company a Notice of Assignment in a form acceptable to the Company. No transfer or assignment of the Option to or on behalf of an Immediate Family member under this Section 5 shall be effective until the

Company has acknowledged such transfer or assignment in writing. “Immediate Family” means the Optionee’s parents, spouse, children, siblings, and grandchildren. Following transfer, the Options shall continue to be subject to the same

terms and conditions as were applicable immediately prior to transfer. In the event an Option is transferred as contemplated in this Section 5, such Option may not be subsequently transferred by the transferee except by will or the laws of

descent and distribution. The terms of the Plan and this Agreement shall be binding upon the executors, administrators, heirs, successors and assigns of the Optionee.

5. Term of Option. This Option may be exercised only within the term set out in the Notice of Grant, and may be exercised during such

term only in accordance with the Plan and the terms of this Agreement.

6. Withholding.

(a) The

Committee shall determine the amount of any withholding or other tax required by law to be withheld or paid by the Company with respect to any income recognized by the Optionee with respect to the Award.

(b) The Optionee shall be required to meet any applicable tax withholding obligation in accordance with the provisions of Section 11.05

of the Plan.

(c) Subject to any rules prescribed by the Committee, the Optionee shall have the right to elect to meet any withholding

requirement (i) by having withheld from this Award at the appropriate time that number of whole shares of common stock whose fair market value is equal to the amount of any taxes required to be withheld with respect to such Award, (ii) by

direct payment to the Company in cash of the amount of any taxes required to be withheld with respect to such Award or (iii) by a combination of shares and cash.

7. Defined Terms. Capitalized terms used but not defined in the Agreement shall have the meanings set forth in the Plan.

8. Optionee Representations. The Optionee hereby represents to the Company that the

Optionee has read and fully understands the provisions of the Notice, this Agreement and the Plan and the Optionee’s decision to participate in the Plan is completely voluntary. Further, the Optionee acknowledges that the Optionee is relying

solely on his or her own advisors with respect to the tax consequences of this stock option award.

9. Limitations on Exercises.

Notwithstanding the other provisions of this Agreement, no option exercise or issuance of shares of Common Stock pursuant to this Agreement shall be effective if (i) the shares reserved under the Plan are not subject to an effective

registration statement at the time of such exercise or issuance, or otherwise eligible for an exemption from registration, or (ii) the Company determines in good faith that such exercise or issuance would violate any applicable securities or

other law, regulation or Company policy.

10. Miscellaneous.

(a) Notices. All notices, requests, deliveries, payments, demands and other communications which are required or permitted to be

given under this Agreement shall be in writing and shall be either delivered personally or sent by registered or certified mail, or by private courier, return receipt requested, postage prepaid to the parties at their respective addresses set forth

herein, or to such other address as either shall have specified by notice in writing to the other. Notice shall be deemed duly given hereunder when delivered or mailed as provided herein.

(b) Waiver. The waiver by any party hereto of a breach of any provision of this Agreement shall not operate or be construed as a waiver

of any other or subsequent breach.

(c) Entire Agreement. This Agreement and the Plan constitute the entire agreement between the

parties with respect to the subject matter hereof.

(d) Binding Effect; Successors. This Agreement shall inure to the benefit of

and be binding upon the parties hereto and to the extent not prohibited herein, their respective heirs, successors, assigns and representatives. Nothing in this Agreement, express or implied, is intended to confer on any person other than the

parties hereto and as provided above, their respective heirs, successors, assigns and representatives any rights, remedies, obligations or liabilities.

(e) Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware.

(f) Headings. The headings contained herein are for the sole purpose of convenience of reference, and shall not in any way limit or

affect the meaning or interpretation of any of the terms or provisions of this Agreement.

(g) Conflicts; Amendment. The provisions

of the Plan are incorporated in this Agreement in their entirety. In the event of any conflict between the provisions of this Agreement and the Plan, the provisions of the Plan shall control. This Agreement may be amended at any time by written

agreement of the parties hereto.

(h) No Right to Continued Employment. Nothing in this Agreement shall confer upon the Optionee

any right to continue in the employ or service of the Company or affect the right of the Company to terminate the Optionee’s employment or service at any time.

(i) Further Assurances. The Optionee agrees, upon demand of the Company or the Board, to

do all acts and execute, deliver and perform all additional documents, instruments and agreements which may be reasonably required by the Company or the Board, as the case may be, to implement the provisions and purposes of this Agreement and the

Plan.

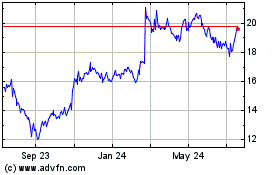

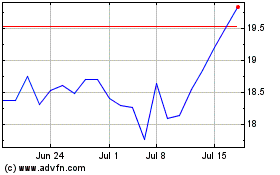

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Apr 2023 to Apr 2024