UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 4, 2014

Aastrom Biosciences, Inc.

(Exact name of registrant as specified in its charter)

|

Michigan |

|

000-22025 |

|

94-3096597 |

|

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

24 Frank Lloyd Wright Drive, Lobby K,

Ann Arbor, Michigan |

|

48105 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (734) 418-4400

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Item 5.02 (c)

Appointment of Chief Financial Officer

On June 4, 2014, Aastrom Biosciences, Inc. (the “Company”) announced that Gerard Michel, MS, MBA, has been appointed to the position of Chief Financial Officer and Vice President, Corporate Development of the Company, effective as of June 2, 2014.

Mr. Michel’s Employment Terms

Mr. Michel, age 51, was formerly CFO and VP, Corporate Development of Biodel from November 2007 to May 2014 where he oversaw strategic development, fundraising and capital structure management, marketing efforts, investor management, and financial reporting and internal controls. From August 2002 to November 2007, Mr. Michel served as Chief Financial Officer, VP of Corporate Development of NPS Pharmaceuticals, where he led the first syndicated royalty monetization, the structure of which has been widely copied and used to create new sources of capital for biotechnology companies. He received his bachelor’s degree with a major in Biology and Geology from the University of Rochester, his master’s degree from the University of Rochester School of Medicine and Dentistry and an M.B.A. from the Simon School of Business at the University of Rochester.

Pursuant to an employment offer letter between the Company and Mr. Michel, signed on May 18, 2014 (the “Employment Agreement”), Mr. Michel will receive an initial annual base salary of $350,000 and his base salary shall be reviewed annually by the Company. Under the Employment Agreement, Mr. Michel will also be eligible to receive cash incentive compensation as determined by the Company. Mr. Michel’s target annual incentive compensation shall be 40% of his then-current base salary. Under the Employment Agreement, contingent on the approval of the Company’s Board of Directors, the Company will grant to Mr. Michel an option to purchase 45,000 shares of the Company’s common stock pursuant to the Company’s equity plan.

Mr. Michel is also entitled to participation in the Company-sponsored group health, dental and vision programs, as those plans may be amended from time to time, and will receive standard relocation costs and benefits in connection with his relocation to Boston, Massachusetts. The Employment Agreement contains other customary terms and conditions. The foregoing description of the Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the actual Employment Agreement which is attached as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On June 4, 2014, we issued a press release announcing the appointments set forth in Item 5.02 of this Current Report on Form 8-K. A copy of the press release is attached hereto as Exhibit 99.1.

Pursuant to General Instruction B.2 of Form 8-K, this information filed under this item number and Exhibit 99.1 are not deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall this item number and Exhibit 99.1 be incorporated by reference into our filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as expressly set forth by specific reference in such future filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

10.1 Employment Agreement with Gerard Michel, dated May 13, 2014.

99.1 Press Release issued June 4, 2014.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Aastrom Biosciences, Inc. |

|

|

|

|

|

Date: June 4, 2014 |

By: |

/s/ DOMINICK C. COLANGELO |

|

|

|

Name: Dominick C. Colangelo |

|

|

|

Title: Chief Executive Officer and President |

3

Exhibit 10.1

Employment Offer Letter

May 13, 2014

Gerard Michel

Dear Gerard,

It is with great pleasure that I extend an offer for you to join Aastrom Biosciences, Inc. (the “Company”). Employment with the Company is contingent upon compliance with necessary Immigration Laws, satisfaction of any routine pre-employment contingencies and execution of a Confidentiality, Nondisclosure and Assignment Agreement.

Based on our agreement, your title will be Chief Financial Officer and Vice President, Corporate Development and you will report directly to me. Your employment will commence on June 2, 2014. Your compensation will consist of the following:

1) Annual Base Salary — $350,000 paid semi-monthly ($14,583.33 semi-monthly rate).

2) Annual Target Bonus — you will be eligible to receive a discretionary cash bonus of up to 40% of your base salary based on performance and the achievement of certain corporate and personal goals.

3) Options — you will be eligible to receive an option to purchase 45,000 shares of the Company’s common stock based on the terms of the Company’s 2009 Omnibus Incentive Plan and contingent upon approval by the Board of Directors of the Company.

4) Benefits — you will be eligible to participate in the Company’s benefit programs including Medical/Dental/Vision insurance, Life & Disability insurance and 401(k) savings plan, subject to the terms and conditions of those plans, as amended from time to time

5) Paid Time Off (PTO) — you will be eligible to accrue Paid Time Off at the rate of 16.67 hours per month (25 days per year).

6) Commuting to Boston; Relocation — For up to the first fifteen (15) months of your employment, Aastrom will reimburse you for reasonable travel and lodging expenses in accordance with our regular company policy; provided, however, that the total sum of such reimbursements shall not exceed $30,000 of actual expenses. Upon your relocation to Boston during this period, you will be eligible for reimbursement of relocation expenses in accordance with Aastrom policy.

This letter summarizes the key points regarding the terms of your employment with the Company. I speak for all of us at Aastrom when I say that we look forward to you joining our team. Please do not hesitate to contact me if I can answer any questions.

|

Regards, |

Accepted and Agreed, |

|

|

|

|

|

|

|

|

/s/ Gerard Michel |

|

|

Gerard Michel |

|

|

|

|

/s/ Dominick Colangelo |

|

|

|

Dominick Colangelo |

|

May 18, 2014 |

|

President and CEO |

|

Date |

2

Exhibit 99.1

|

|

|

Aastrom Biosciences

Domino’s Farms, Lobby K

24 Frank Lloyd Wright Drive

Ann Arbor, MI 48105

T 734 418–4400 F 734 665–0485

www.aastrom.com |

Aastrom Announces Appointment of Gerard Michel as Chief Financial Officer and Vice President, Corporate Development

Accomplished industry veteran brings extensive history of successful corporate development, fundraising and capital management to Aastrom

ANN ARBOR, Mich., June 4, 2014 (GLOBE NEWSWIRE) – Aastrom Biosciences, Inc. (Nasdaq: ASTM), the leading developer of patient-specific expanded cellular therapies for the treatment of severe diseases and conditions, today announced the appointment of Gerard Michel, MS, MBA, as chief financial officer and vice president, corporate development.

Mr. Michel was formerly chief financial officer and vice president, corporate development of Biodel, where he oversaw strategic development, fundraising and capital structure management, marketing efforts, investor management, and financial reporting and internal controls.

Prior to his role at Biodel, Mr. Michel served as chief financial officer and vice president of corporate development of NPS Pharmaceuticals, where he led the first syndicated royalty monetization, the structure of which has been widely copied and used to create new sources of capital for biotechnology companies.

“With his considerable experience in business development, raising capital and executing successful financial transactions, Gerard significantly strengthens our senior team in finance, investor relations and corporate development,” said Nick Colangelo, president and chief executive officer of Aastrom. “Gerard has successfully led many efforts to secure top-tier financing and has raised hundreds of millions of dollars throughout his career. He also brings extensive experience in corporate management and in positioning company assets for advantageous licensing and partnering opportunities. We look forward to having his insights and expertise as we focus on advancing Aastrom’s business strategy in the years ahead.”

About Aastrom Biosciences

Aastrom Biosciences is the leader in developing patient-specific expanded cellular therapies for use in the treatment of patients with severe diseases and conditions. Aastrom markets three autologous cell therapy products in the United States and European Union for the treatment of cartilage repair and skin replacement, and is developing ixmyelocel-T, a patient-specific multicellular therapy for the treatment of advanced heart failure due to ischemic dilated cardiomyopathy. For more information, please visit Aastrom’s website at www.aastrom.com.

The Aastrom Biosciences, Inc. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=3663

http://www.globenewswire.com/newsroom/prs/?pkgid=3663

This document contains forward-looking statements, including, without limitation, statements concerning clinical trial plans and progress, objectives and expectations, clinical activity timing, intended product development, anticipated milestones, potential advantages of our product candidates and the commercial success of our products, all of which involve certain risks and uncertainties. These statements are often, but are not always, made through the use of words or phrases such as “anticipates,” “intends,” “estimates,” “plans,” “expects,” “we believe,” “we intend,” and similar words or phrases, or future or conditional verbs such as “will,” “would,” “should,” “potential,” “could,” “may,” or similar expressions. Actual results may differ significantly from the expectations contained in the forward-looking statements. Among the factors that may result in differences are the inherent uncertainties associated with the clinical trial and product development activities, regulatory approval requirements, competitive developments, product commercialization and the availability of resources and the allocation of resources among different potential uses. These and other significant factors are discussed in greater detail in Aastrom’s Annual Report on Form 10-K for the year ended December 31, 2013, filed with the Securities and Exchange Commission (“SEC”) on March 13, 2014, Quarterly Reports on Form 10-Q and other filings with the SEC. These forward-looking statements reflect management’s current views and Aastrom does not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this release except as required by law.

CONTACT: Media contact:

David Salisbury

Berry & Company

dsalisbury@berrypr.com

(212) 253-8881

Investor contact:

Chad Rubin

The Trout Group

crubin@troutgroup.com

(646) 378-2947

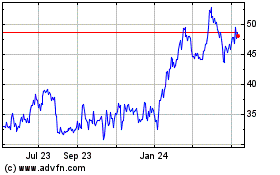

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024