Aastrom Biosciences, Inc. (Nasdaq:ASTM), the leading developer of

patient-specific, expanded multicellular therapies for the

treatment of severe, chronic cardiovascular diseases, today

reported financial results for the quarter ended March 31, 2014.

Aastrom reported a net loss for the quarter ended March 31, 2014

of $6.0 million, or $1.26 per share, compared to $5.5 million, or

$3.00 per share, for the same period a year ago. The change in net

loss from the prior year is due primarily to the non-cash change in

the fair value of warrants and decreases in both research and

development and selling, general and administrative expenses.

Research and development expenses for the quarter ended March

31, 2014 were $3.3 million versus $5.5 million for the same period

a year ago. The decrease in expenses is due primarily to a

reduction in clinical trial expenses and the execution of a

corporate restructuring that substantially reduced headcount and

operating expenses.

General and administrative expenses for the quarter ended March

31, 2014 were $1.4 million compared to $1.6 million for the same

period a year ago. The decrease in expenses is due primarily to the

reduction of operating expenses resulting from the corporate

restructuring.

Other income (expense) for the quarter ended March 31, 2014 was

($1.4) million compared to $1.6 million for the same period a year

ago. The decrease in other income is due primarily to the non-cash

change in the fair value of warrants due to the increase in

Aastrom's stock price, the issuance of the August 2013 warrants,

the adjustment to the fair value due to the exercise of warrants in

March 2014, and the reduction in the time to maturity for the

warrants.

As of March 31, 2014, the company had $8.8 million in cash and

cash equivalents, compared to $8.1 million in cash and cash

equivalents at December 31, 2013, and approximately $8.7 million in

cash and cash equivalents as of April 30, 2014. For the quarter

ended March 31, 2014, cash used for operations was $4.7

million.

Recent Business Highlights

During and since the first quarter of 2014, the company has:

- entered into a definitive agreement to acquire Sanofi's Cell

Therapy and Regenerative Medicine (CTRM) business;

- entered into a $15 million equity commitment with Lincoln Park

Capital;

- continued site activation and enrollment of patients in the

Phase 2b ixCELL-DCM clinical trial of ixmyelocel-T for the

treatment of advanced heart failure due to ischemic dilated

cardiomyopathy (DCM);

- announced that the independent Data and Safety Monitoring Board

(DSMB) for the ixCELL-DCM clinical trial recommended continuing the

study without modification following an interim review of unblinded

safety data from the trial;

- conducted preliminary analysis of data from patients in the

REVIVE CLI study, which showed positive trends in amputation-free

survival and wound closure, consistent with previous results; the

company plans to maintain its current clinical development strategy

for ixmyelocel-T; and

- announced the appointment of Dr. Ross Tubo as chief scientific

officer and Dr. David Recker as chief medical officer of

Aastrom.

"The acquisition of Sanofi's CTRM business represents a unique

opportunity to strengthen our leadership position in the field of

regenerative medicine and accelerate our forward integration as we

develop ixmyelocel-T for the treatment of advanced heart failure

due to ischemic DCM and other severe conditions," said Nick

Colangelo, president and chief executive officer of Aastrom. "With

this acquisition and the recent actions we have taken to strengthen

our company, we are well-positioned to realize our clinical and

commercial goals. We look forward to building on Sanofi's record of

success in the autologous cell therapy field as we unite our

operations to maximize the potential of our combined commercial and

pipeline products to drive growth in the years ahead."

Conference Call Information

Aastrom's management will host a conference call to discuss

these results on Thursday, May 15, 2014 at 4:30 p.m. Eastern time.

Interested parties should call toll-free (877) 312-5881, or from

outside the U.S. (253) 237-1173, and use conference ID 44774762.

The call will be available live in the Investors section of

Aastrom's website at http://investors.aastrom.com/investors.cfm. A

replay of the call will be available until May 19, 2014 by calling

(855) 859-2056, or from outside the U.S. at (404) 537-3406 and

using conference ID 44774762. The webcast will also be available

after the live event at http://investors.aastrom.com/events.cfm

until May 15, 2015.

About Aastrom Biosciences

Aastrom Biosciences is the leader in developing

patient-specific, expanded multicellular therapies for use in the

treatment of patients with severe, chronic cardiovascular diseases.

The company's proprietary cell-processing technology enables the

manufacture of ixmyelocel-T, a patient-specific multicellular

therapy expanded from a patient's own bone marrow and delivered

directly to damaged tissues. Aastrom has advanced ixmyelocel-T into

late-stage clinical development, including a Phase 2b clinical

trial in patients with advanced heart failure due to ischemic

dilated cardiomyopathy. For more information, please visit

Aastrom's website at www.aastrom.com.

The Aastrom Biosciences, Inc. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=3663

This document contains forward-looking statements, including,

without limitation, statements concerning clinical trial plans and

progress, objectives and expectations, clinical activity timing,

intended product development, anticipated milestones, potential

advantages of our product candidates and the timing and ability of

Aastrom to close the acquisition of Sanofi's Cell Therapy and

Regenerative Medicine business pursuant to Aastrom's Asset Purchase

Agreement with Sanofi, all of which involve certain risks and

uncertainties. These statements are often, but are not always, made

through the use of words or phrases such as "anticipates,"

"intends," "estimates," "plans," "expects," "we believe," "we

intend," and similar words or phrases, or future or conditional

verbs such as "will," "would," "should," "potential," "could,"

"may," or similar expressions. Actual results may differ

significantly from the expectations contained in the

forward-looking statements. Among the factors that may result in

differences are the inherent uncertainties associated with the

closing of the acquisition of Sanofi's Cell Therapy and

Regenerative Medicine business, clinical trial and product

development activities, regulatory approval requirements,

competitive developments, and the availability of resources and the

allocation of resources among different potential uses. These and

other significant factors are discussed in greater detail in

Aastrom's Annual Report on Form 10-K for the year ended December

31, 2013, filed with the Securities and Exchange Commission ("SEC")

on March 13, 2014, Quarterly Reports on Form 10-Q and other filings

with the SEC. These forward-looking statements reflect management's

current views and Aastrom does not undertake to update any of these

forward-looking statements to reflect a change in its views or

events or circumstances that occur after the date of this release

except as required by law.

| |

|

|

| |

|

|

| AASTROM BIOSCIENCES,

INC. |

| (in thousands, except

per share amounts) |

| |

|

|

| CONDENSED CONSOLIDATED

BALANCE SHEETS (Unaudited) |

| |

|

|

| |

December 31,

2013 |

March 31, 2014 |

| ASSETS |

|

|

| Cash |

$8,059 |

$8,836 |

| Other current assets |

417 |

400 |

| Property and equipment,

net |

739 |

642 |

| Total assets |

$9,215 |

$9,878 |

| |

|

|

| LIABILITIES AND SHAREHOLDERS'

EQUITY |

|

|

| Warrant liabilities |

$2,019 |

$3,226 |

| Other current

liabilities |

3,296 |

2,881 |

| Current portion of long-term

debt |

6 |

2 |

| Shareholders' equity |

3,894 |

3,769 |

| Total liabilities and

shareholders' equity |

$9,215 |

$9,878 |

| |

|

|

| |

|

|

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (Unaudited) |

| |

|

|

| |

Quarter Ended

March 31, |

| |

2013

|

2014 |

| |

|

|

| REVENUES |

$ 8 |

$ -- |

| |

|

|

| COSTS AND EXPENSES |

|

|

| Cost of product sales and

rentals |

2 |

-- |

| Research and development |

5,538 |

3,271 |

| Selling, general and

administrative |

1,633 |

1,374 |

| |

|

|

| Total costs and

expenses |

7,173 |

4,645 |

| |

|

|

| LOSS FROM OPERATIONS |

(7,165) |

(4,645) |

| |

|

|

| OTHER INCOME (EXPENSE) |

|

|

| (Increase) decrease in fair

value of warrants |

1,619 |

(1,352) |

| Other income, net |

2 |

2 |

| Total other income

(expense) |

1,621 |

(1,350) |

| |

|

|

| NET LOSS |

$ (5,544) |

$ (5,995) |

| |

|

|

| NET LOSS PER SHARE ATTRIBUTABLE TO

COMMON SHAREHOLDERS (Basic and Diluted) |

$ (3.00) |

$ (1.26) |

| |

|

|

| Weighted average number of common shares

outstanding (Basic and Diluted) |

2,243 |

5,868 |

CONTACT: Media contact:

David Salisbury

Berry & Company

dsalisbury@berrypr.com

(212) 253-8881

Investor contact:

Chad Rubin

The Trout Group

crubin@troutgroup.com

(646) 378-2947

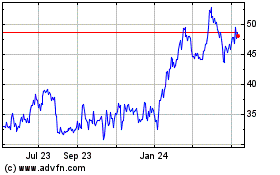

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024