Liquidmetal® Technologies, Inc. (OTCQB: LQMT), the

leading developer of amorphous alloys and composites, reported

results for the quarter ended March 31, 2014.

Q1 2014 Operational Highlights

During the first quarter, the Company completed another

milestone on the path toward commercialization of its technology

with the announcement of its first commercially available

non-beryllium alloy and the hiring of a World-Wide VP of Sales and

Support.

- We announced the availability of

beryllium-free LM105 from our alloy partner, Materion Brush

Inc.

- We hired Paul Hauck, as our World-Wide

VP of Sales and Support. Mr. Hauck is a 30-year veteran of the

Metal Injection Molding (MIM) industry, which we view as a

complementary technology to Liquidmetal.

Management Commentary

“Our activities during the first quarter are not only important

milestones, but set the stage for a much more aggressive sales and

marketing campaign, which we see as an important next step,” said

Tom Steipp, President and CEO. “We have ordered a newly produced

Engel metal molding machine for delivery in the second quarter of

2014, which will be showcased in our new Technology Development

Center in Rancho Santa Margarita, California. Further, we are

excited about the addition of Paul Hauck to the team, where he will

be instrumental in leading our sales and marketing efforts.”

Q1 2014 Financial Summary

In Q1 2014, the company generated revenues of $160 thousand as

it continued to focus on the development of prototype parts for its

customers and partnering with licensees on the development of the

Company’s technology and production processes.

Selling, marketing, general and administrative expense was $1.9

million compared to $1.3 million in Q1 2013. The increase was

primarily due to additional legal cost incurred during Q1 2014

related to our on-going arbitration with our contract manufacturer,

Visser Precision Cast.

Research and development expense was $334,000 compared to

$236,000 in Q1 2013.

Cash totaled $7.0 million at March 31, 2014, as compared to $2.1

million at December 31, 2013.

Conference Call

The Company’s management will hold a conference call later today

(May 8, 2014) to discuss these results. The Company’s President and

CEO Tom Steipp, CFO Tony Chung, and VP of Sales Paul Hauck will

host the call starting at 4:30 p.m. Eastern time. A question and

answer session will follow management’s presentation.

Date: Thursday, May 8, 2014Time: 4:30 p.m. Eastern time (1:30

p.m. Pacific time)Dial-In Number: 1-800-455-2263International:

1-719-325-2484Conference ID: 2887500

The conference call will be broadcast simultaneously and

available for replay via the investor section of the Company's

website at www.liquidmetal.com.

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization.

A replay of the call will be available after 7:30 p.m. Eastern

time on the same day through May 15th, 2014.

Toll-Free Replay Number: 1-888-203-1112International Replay

Number: 1-719-457-0820Replay PIN Number: 2887500

About Liquidmetal Technologies

Rancho Santa Margarita, California-based Liquidmetal

Technologies, Inc. is the leading developer of bulk alloys and

composites that utilize the performance advantages offered by

amorphous alloy technology. Amorphous alloys are unique materials

that are distinguished by their ability to retain a random

structure when they solidify, in contrast to the crystalline atomic

structure that forms in ordinary metals and alloys. Liquidmetal

Technologies is the first company to produce amorphous alloys in

commercially viable bulk form, enabling significant improvements in

products across a wide array of industries. For more information,

go to www.liquidmetal.com.

Forward-Looking Statement

This press release contains "forward-looking statements,"

including but not limited to statements regarding the advantages of

Liquidmetal's amorphous alloy technology, scheduled manufacturing

of customer parts and other statements associated with

Liquidmetal's technology and operations. These statements are based

on current expectations of future events. If underlying assumptions

prove inaccurate or unknown risks or uncertainties materialize,

actual results could vary materially from Liquidmetal's

expectations and projections. Risks and uncertainties include,

among other things; customer adoption of Liquidmetal's technologies

and successful integration of those technologies into customer

products; potential difficulties or delays in manufacturing

products incorporating Liquidmetal's technologies; Liquidmetal's

ability to fund its current and anticipated operations; the ability

of third party suppliers and manufacturers to meet customer product

requirements; general industry conditions; general economic

conditions; and governmental laws and regulations affecting

Liquidmetal's operations. Additional information concerning these

and other risk factors can be found in Liquidmetal's public

periodic filings with the U.S. Securities and Exchange Commission,

including the discussion under the heading "Risk Factors" in

Liquidmetal's 2013 Annual Report on Form 10-K.

Liquidmetal Technologies Balance Sheet

March 31, December 31,

2014 2013

(Unaudited) (Audited)

ASSETS

Current assets: Cash $ 6,954 $ 2,062 Trade accounts

receivable, net of allowance for doubtful accounts 106 215 Prepaid

expenses and other current assets 260 412

Total current assets $ 7,320 $ 2,689 Property and

equipment, net 224 249 Patents and trademarks, net 738 764 Other

assets 380 401

Total assets $

8,662 $ 4,103

LIABILITIES AND

STOCKHOLDERS' DEFICIT

Current liabilities: Accounts payable 472 361 Accrued

liabilities 449 710 Convertible notes, net of debt discount - -

Embedded conversion feature liabilities on convertible notes

- -

Total current liabilities $ 921 $

1,071 Long-term liabilities: Warrant liabilities 6,647 4,921

Other long-term liabilities 856 856

Total liabilities $ 8,424 $ 6,848 Stockholders'

equity (deficit): Convertible, redeemable Preferred Stock, $0.001

par value; 10,000,000 shares authorized; 0 shares issued and

outstanding at March 31, 2014 and December 31, 2013. - - Common

stock, $0.001 par value; 700,000,000 shares authorized at March 31,

2014 and December 31, 2013; 406,005,498 and 375,707,190 shares

issued and outstanding at March 31, 2014 and December 31, 2013,

respectively 406 376 Warrants 18,179 18,179 Additional paid-in

capital 189,697 182,832 Accumulated deficit (207,999 ) (204,090 )

Non-controlling interest in subsidiary (45 ) (42 )

Total stockholders' equity (deficit) 238 (2,745 )

Total liabilities and stockholders' equity (deficit)

$ 8,662 $ 4,103 Working Capital (Deficit):

6,399 1,618 - -

Liquidmetal

Technologies Statement of Income

For the Three Months Ended March

31,

2014

2013 Revenue Products $ 156 $ 117

Licensing and royalties 4 5

Total

revenue 160 122 Cost of sales 140

82

Gross profit 20 40 Operating expenses

Selling, marketing, general and administrative 1,851 1,314 Research

and development 334 236

Total

operating expenses 2,185 1,550

Operating loss (2,165 ) (1,510 ) Change in value of

warrants, gain (loss) (1,726 ) 510 Change in value of embedded

conversion feature liabilities, gain - 1,678 Debt discount

amortization expense (21 ) (4,034 ) Interest expense - (141 )

Interest income - 3

Net

loss (3,912 ) (3,494 ) Net loss attributable to

non-controlling interest 3 -

Net

loss and comprehensive loss attributable to Liquidmetal

Technologies shareholders $ (3,909 ) $ (3,494 )

Net loss per common share attributable to Liquidmetal

Technologies shareholders, basic and diluted $ (0.01 ) $

(0.01 )

Number of weighted average shares - basic and

diluted 387,601,876 282,675,201

Liquidmetal Technologies, Inc.Otis BuchananMedia

Relations949-635-2120otis.buchanan@liquidmetal.com

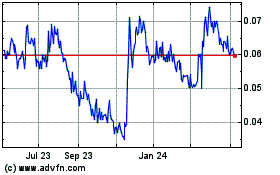

Liquidmetal Technologies (QB) (USOTC:LQMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

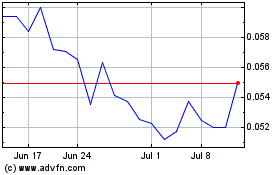

Liquidmetal Technologies (QB) (USOTC:LQMT)

Historical Stock Chart

From Apr 2023 to Apr 2024