First Quarter 2014 Summary

- Acquired and fully integrated

specialty lender Infinity Franchise Holdings

- Net income of $2.6 million, or $0.15

per fully diluted share

- Net interest margin of

4.30%

- Total loans increased 7%

- Non-interest bearing deposits

increased 13%

- Nonperforming assets to total assets

at 0.20%

- Tangible book value per share

increased $0.18 to $9.26

Pacific Premier Bancorp, Inc. (NASDAQ: PPBI)(the “Company”), the

holding company of Pacific Premier Bank, reported net income for

the first quarter of 2014 of $2.6 million, or $0.15 per diluted

share, which included merger-related expenses of $626,000

associated with the acquisition of Infinity Franchise Holdings, LLC

(“Infinity Franchise Holdings”).

The Company’s acquisition of Infinity Franchise Holdings was

consummated on January 30, 2014. The value of the total

consideration paid for Infinity Franchise Holdings was $17.4

million, which was based upon their adjusted net asset value at the

closing date. The consideration consisted of 50% cash and 50% of

the Company’s common stock. As a result of the consummation of this

transaction, we acquired $80.2 million in total assets and $78.8

million of total loans outstanding.

For the fourth quarter of 2013, the Company recorded net income

of $4.2 million, or $0.24 per share on a diluted basis, which

included merger-related expenses of $203,000. For the first quarter

of 2013, the Company recorded net income of $2.0 million, or $0.13

per share on a diluted basis, which included merger-related

expenses of $1.7 million associated with the acquisition of First

Associations Bank (“First Associations”).

Excluding merger-related expenses, the Company reported adjusted

net income of $3.0 million, or $0.17 per share on a diluted basis,

for the first quarter of 2014, compared with $4.3 million, or $0.24

per share on a diluted basis, for the fourth quarter of 2013, and

$3.1 million, or $0.20 per share on a diluted basis, for the first

quarter of 2013.

For the three months ended March 31, 2014, the Company’s return

on average assets was 0.64%, compared with 1.05% for the three

months ended December 31, 2013, and 0.67% for the three months

ended March 31, 2013. For the three months ended March 31, 2014,

the Company’s return on average tangible common equity was 7.22%,

compared with 11.69% for the three months ended December 31, 2013,

and 6.06% for the three months ended March 31, 2013.

Steven R. Gardner, President and Chief Executive Officer of the

Company, commented on the results, “During the first quarter of

2014, we completed the integration and system conversion of

Infinity Franchise Holdings. The $78.8 million in loans added

through the acquisition provides us with attractive risk-adjusted

yields. As a result of the loans added from the acquisition and

$46.8 million in new business loan production, our C&I

portfolio increased to 21% of total loans outstanding at March 31,

2014, up from 15% at the end of the prior quarter.

“In the first quarter of 2014, our loan portfolio continued to

experience solid growth, with a 7% increase in total loans.

However, the portfolio was impacted by $78 million in loan payoffs,

which were concentrated in our CRE loan portfolio. With lenders

offering fixed rate pricing in the mid to high three percent range,

we were not willing to assume that level of interest rate risk to

retain the loans. Looking ahead, we anticipate increasing loan

production in the second quarter as our various business lines

continue to attract a variety of lending opportunities, which is

reflected in the growth of our pipeline to $247 million.

“We had a very productive quarter from a deposit gathering

perspective. We experienced significant core deposit inflows from

new commercial customers and our HOA line of business, which

contributed to a $46 million, or 12.6%, increase in our

non-interest bearing deposits during the first quarter of 2014. Our

robust deposit growth during the first quarter of 2014 further

contributed to our already strong liquidity position and further

enhanced our franchise.

“Our operating expenses during the first quarter of 2014 were

higher than our expected run-rate due to $626,000 in merger-related

expenses and $549,000 in expenses related to a change in our

payment processing system provider and an upgrade to our existing

core system. The switch to a new, more cost-effective and robust

payment and core system is expected to result in cost savings over

the coming years. Going forward, we expect to see lower levels of

operating expense which should result in an improvement in our

profitability as we move through 2014,” said Mr. Gardner.

Net Interest Income and Net Interest Margin

Net interest income totaled $16.6 million in the first quarter

of 2014, down $31,000 or 0.2% from the fourth quarter of 2013. The

decrease in net interest income primarily reflected a decrease in

the number of days in the quarter and a decrease in net interest

margin of 2 basis points to 4.30%, partially offset by an increase

in average interest-earning assets of $39.6 million. The decrease

in the net interest margin was impacted by a previously reported

$715,000 discount recognized from a loan payoff during the fourth

quarter of 2013 that equated to 18 basis points of net interest

margin benefit during that quarter. Excluding that recognized

discount, the net interest margin would have increased by an

adjusted 16 basis points reflecting an improved mix of higher

yielding loans, an increase in loan yield by an adjusted 13 basis

points and an increase in interest-earning assets, all of which is

primarily attributable to our acquisition of Infinity Franchise

Holdings. Partially offsetting these favorable items was an

increase in the cost of interest-bearing liabilities of 3 basis

points primarily related to the increase in interest-bearing

deposit costs of 2 basis points. The increase in average

interest-earning assets during the first quarter of 2014 was

primarily related to an increase in our average loan portfolio of

$71.2 million and average cash and cash equivalents of $7.7

million, partially offset by a decrease in investment securities of

$39.5 million.

Net interest income for the first quarter of 2014 increased $3.7

million or 29.0%, compared to the first quarter of 2013. The

increase in net interest income was primarily related to an

increase in interest-earning assets of $436.1 million, primarily

related to the acquisition of First Associations and San Diego

Trust Bank in the first and second quarters of 2013, respectively,

and organic loan growth. The increase was partially offset by a

lower net interest margin, which decreased 32 basis points from the

first quarter of 2013 to the first quarter of 2014. The decrease in

the net interest margin was related to the rate on interest-earning

assets decreasing more rapidly than the cost of interest-bearing

liabilities. The decrease in interest-earning assets of 44 basis

points is mainly attributable to a higher mix of lower yielding

investment securities, which were acquired from First Associations

and San Diego Trust Bank, and a decrease in our weighted average

loan portfolio rate. The weighted average loan portfolio rate at

the end of the first quarter of 2014 was 5.0%, 30 basis points

lower than the weighted average loan portfolio rate at the end of

the first quarter of 2013 and primarily reflected lower rates on

loan originations during the period. Partially offsetting the lower

yield on average interest-earning assets was a decrease in deposit

costs of 13 basis points primarily resulting from an improved mix

of lower cost deposits acquired from First Associations and San

Diego Trust Bank and lower pricing on certificates of deposit.

Provision for Loan Losses

We recorded a $949,000 provision for loan losses during the

first quarter of 2014, up from $596,000 for the fourth quarter of

2013 and up from $296,000 for the first quarter of 2013. The

increase in the provision for loan losses in the first quarter of

2014 was attributable to both the changing profile of our loan

portfolio and the net charge-off of $464,000 of loans primarily

acquired from our FDIC acquisitions. Net loan charge-offs in the

first quarter of 2014 were up $74,000 from the fourth quarter of

2013, and $168,000 from the first quarter of 2013. Substantially

all of the charge-offs in the first quarter of 2014 were

attributable to loans that we acquired from our FDIC-assisted

transactions.

Noninterest income

Noninterest income for the first quarter of 2014 was $2.1

million, down $565,000 or 21.6% from the fourth quarter of 2013.

The decrease from the prior quarter was primarily related to the

following:

- A $753,000 decrease in gains on the

sale of loans. During the first quarter of 2014, we sold $4.7

million in Small Business Administration (“SBA”) loans at an

overall premium of 11% and $4.8 million in commercial non-owner

occupied and multi-family loans. That compares with sales of $10.9

million in SBA loans at a 10% overall premium, and $7.1 million in

commercial real estate loans in the fourth quarter of 2013.

- A $209,000 decrease in other income.

During the first quarter of 2014, we recorded a $180,000 market

value loss related to loans held for sale that were moved to loans

held for investment.

- A $109,000 decrease in net gains from

sale of investment securities.

Partially offsetting these decreases were higher loan servicing

fees of $545,000 primarily associated with the receipt of a

$500,000 fee related to the assumption of an existing loan.

Compared with the first quarter of 2013, noninterest income for

the first quarter of 2014 increased by $328,000 or 19.0%. The

increase was primarily related to higher loan servicing fees of

$530,000, primarily associated with the $500,000 fee related to the

assumption of an existing loan in the first quarter of 2014,

partially offset by lower net gains on sales of loans of $175,000

and other income of $146,000, primarily related to the $180,000

market value loss on loans held for sale.

Noninterest Expense

Noninterest expense totaled $13.5 million for the first quarter

of 2014, up $1.5 million or 12.8%, compared with the fourth quarter

of 2013. The increase was primarily related to the following:

- A $605,000 increase in compensation and

benefits costs, primarily related to increases in beginning of the

year employer payroll taxes, employee compensation and healthcare

cost;

- A $423,000 increase in merger-related

expenses associated with the acquisition of Infinity Franchise

Holdings;

- A $265,000 increase in data processing

and communications expense, primarily related to a $357,000 fee

paid to terminate services from our payment processing system

provider for a new, more cost effective provider;

- A $253,000 increase in legal, audit and

professional fees, primarily associated with $192,000 paid for

services related to the upgrade in our core operating system;

and

- A $115,000 increase in deposit

expenses, primarily related to increase in deposit transaction

accounts.

Partially offsetting these increases were decreases in marketing

expense of $135,000 and loan expenses of $111,000.

Compared to the first quarter of 2013, noninterest expense for

the first quarter of 2014 increased by $2.4 million or 21.1%. The

increase in expense primarily related to the acquisitions of First

Associations during the first quarter of 2013, San Diego Trust Bank

in the second quarter of 2013 and Infinity Franchise Holdings in

the first quarter of 2014, together with our organic growth. On a

year-over-year basis, compensation and benefits expense increased

$1.8 million, due to the addition of employees from the

acquisitions, as well as employees added in lending and credit

areas to increase our loan production of commercial and industrial

(“C&I”) loans, commercial real estate (“CRE”) loans, SBA loans,

homeowner association (“HOA”) loans, warehouse facilities and

construction loans. Additionally, on a year-over-year basis,

one-time merger-related expense declined by $1.1 million.

The Company’s efficiency ratio was 67.96%, 60.45% and 63.50% for

the quarters ended March 31, 2014, December 31, 2013 and March 31,

2013, respectively. The increase in first quarter efficiency ratio

was negatively impacted by combined costs associated with the

termination of our payment processing system provider and an

upgrade to our existing core system of $549,000 and a market value

loss recognized of $180,000 on loans held for sale recorded in our

noninterest income. These items were partially offset by the

positive impact from the $500,000 fee paid on the assumption an

existing loan.

Income Tax

For the first quarter of 2014, our effective tax rate was 37.3%,

compared with a 37.1% for the fourth quarter of 2013 and 37.4% for

the first quarter of 2013.

Assets and Liabilities

At March 31, 2014, assets totaled $1.7 billion, up $31.1 million

or 1.8% from December 31, 2013, and up $338.6 million or 24.1% from

March 31, 2013. The increase in assets during the first quarter of

2014 was primarily related to the acquisition of Infinity Franchise

Holdings, which added assets at the acquisition date of $81.0

million and $5.5 million in goodwill, partially offset by a

decrease in investment securities available for sale of $53.9

million. The increase in assets from March 31, 2013 was primarily

related to the acquisition of San Diego Trust Bank, which added

assets at the acquisition date of $211.2 million, and Infinity

Franchise Holdings, as well as organic loan growth. In addition,

during the period, loans increased $379.9 million inclusive of

loans acquired; cash and cash equivalents increased $25.0 million

and goodwill from acquisitions increased $11.1 million. These

increases were partially offset by a decrease in investment

securities available for sale of $99.0 million.

Investment securities available for sale totaled $202.1 million

at March 31, 2014, down $53.9 million or 21.1% from December 31,

2013 and $99.0 million or 32.9% from March 31, 2013. The decrease

in securities available for sale during the first quarter of 2014

was primarily due to sales totaling $56.0 million and principal pay

downs of $6.2 million, partially offset by purchases of $5.5

million and increase in market value of $3.4 million. The decrease

in securities from March 31, 2013 was primarily related to sales of

$288.5 million and principal pay downs of $34.1 million, partially

offset by $124.8 million added from the acquisition of San Diego

Trust Bank and $106.8 million of investment security purchases. The

purchase of investment securities primarily related to investing

excess liquidity from our bank acquisitions, while the sales were

made to help fund loan production and to improve our

interest-earning asset mix by redeploying investment funds into

loans.

Net loans held for investment totaled $1.3 billion at March 31,

2014, an increase of $84.8 million or 6.9% from December 31, 2013,

and an increase of $382.9 million or 41.0% from March 31, 2013. The

increase in loan balances for the first quarter of 2014 was

primarily related to increases in C&I loans of $84.8 million,

primarily from the acquisition of Infinity Franchise Holdings,

construction loans of $16.8 million and commercial owner occupied

loans of $2.8 million, partially offset by decreases in

multi-family loans of $10.5 million, warehouse facilities loans of

$6.5 million and one-to-four family loans of $3.8 million. The

increase in loans from March 31, 2013 included $42.7 million in

loans from the San Diego Trust Bank acquisition, and was primarily

associated with increases in real estate loans of $244.1 million,

commercial and industrial loans of $131.3 million and commercial

owner occupied loans of $57.3 million, partially offset by a

decrease in warehouse facility loans of $57.9 million.

Loan activity during the first quarter of 2014 included loan

originations of $106.2 million, of which $69.5 million were funded

at origination, loans acquired from Infinity Franchise Holdings of

$78.8 million and loan purchases of $1.8 million, partially offset

by loan repayments of $77.6 million, an increase in undisbursed

loan funds of $17.7 million and loan sales of $9.5 million. During

the first quarter of 2014, our loan originations were diversified

across loan type and included $46.8 million in C&I loans which

contained $8.1 million in HOA loans and $6.8 million in franchise

business loans, $22.8 million in commercial non-owner occupied

loans, $20.4 million in construction loans, $7.6 million in

multifamily loans and $5.2 million in SBA loans. Loan originations

for the first quarter of 2014 had a weighted average rate of 4.98%,

compared to a weighted average rate of 4.92% in the previous

quarter. At March 31, 2014, our loan to deposit ratio was 92.4%,

down from 95.2% at December 31, 2013, but up from 79.8% at March

31, 2013.

March 31, 2014 deposits totaled $1.4 billion, up $128.9 million

or 9.9% from December 31, 2013 and up $249.5 million or 21.0% from

March 31, 2013. During the first quarter of 2014, we had deposit

increases in noninterest bearing checking of $46.1 million,

certificates of deposit of $41.0 million, money market of $25.7

million and checking of $16.4 million. Within the first quarter of

2014, transaction account increases of approximately $27 million to

$30 million were related to seasonal increases in existing HOA

management accounts attributed to annual billings and the receipt

of homeowner’s dues. The increase in deposits since March 31, 2013

was primarily related to the San Diego Trust Bank acquisition,

which added deposits of $183.9 million at a cost of 23 basis points

at the acquisition date, partially offset by declines in deposit

levels in the second through fourth quarters in 2013 of $63.3

million, mainly related to purposeful runoff of certificates of

deposit, and the deposit activity in first quarter of 2014.

The total end of period weighted average cost of deposits at

March 31, 2014 was 0.34%, up from 0.33% at December 31, 2013, but

down from 0.37% at March 31, 2013.

At March 31, 2014, total borrowings amounted to $105.8 million,

down $108.6 million or 50.6% from December 31, 2013, but up $51.3

million or 94.2% from March 31, 2013. The change in borrowings

primarily related to overnight FHLB advances used to supplement the

funding of loans as deposit levels fluctuate. Additionally, during

the first quarter of 2014, repurchase agreement debt related to our

HOA business decreased $1.6 million to $17.0 million. At March 31,

2014, total borrowings represented 6.1% of total assets and had an

end of period weighted average cost of 1.22%, compared with 12.5%

of total assets at a weighted average cost of 0.63% at December 31,

2013, and 3.9% of total assets at a weighted average cost of 2.29%

at March 31, 2013.

Asset Quality

At March 31, 2014, nonperforming assets totaled $3.4 million or

0.20% of total assets, essentially equal to the total and

percentage at December 31, 2013, but down from $4.7 million or

0.33% of total assets at March 31, 2013. During the first quarter

of 2014, nonperforming loans increased $423,000 to total $2.7

million and other real estate owned decreased $434,000, related to

the sale of a property, to $752,000.

At March 31, 2014, our allowance for loan losses was $8.7

million, up $485,000 from December 31, 2013 and $691,000 from March

31, 2013. At March 31, 2014, our allowance for loan losses as a

percent of nonaccrual loans was 324.8%, down from 364.3% at

December 31, 2013, but up from 257.7% at March 31, 2013. At March

31, 2014, the ratio of allowance for loan losses to total gross

loans was 0.66%, equal to the percentage at December 31, 2013, but

down from 0.85% at March 31, 2013. Including the loan fair market

value discounts recorded in connection with our acquisitions, the

allowance for loan losses to total gross loans ratio was 0.88% at

March 31, 2014, compared with 0.93% at December 31, 2013 and 1.33%

at March 31, 2013.

Capital Ratios

At March 31, 2014, our ratio of tangible common equity to total

assets was 9.30%, with a tangible book value of $9.26 per share and

a book value per share of $10.96.

At March 31, 2014, the Pacific Premier Bank exceeded all

regulatory capital requirements with a ratio for tier 1 leverage

capital of 10.26%, tier 1 risked-based capital of 12.06% and total

risk-based capital of 12.71%. These capital ratios exceeded the

“well capitalized” standards defined by the federal banking

regulators of 5.00% for tier 1 leverage capital, 6.00% for tier 1

risked-based capital and 10.00% for total risk-based capital. At

March 31, 2014, the Company had a ratio for tier 1 leverage capital

of 10.45%, tier 1 risked-based capital of 12.23% and total

risk-based capital of 12.88%.

Conference Call and Webcast

The Company will host a conference call at 9:00 a.m. PT / 12:00

p.m. ET on April 23, 2014 to discuss its financial results.

Analysts and investors may participate in the question-and-answer

session. The conference call will be webcast live on the Investor

Relations section of the Company’s website www.ppbi.com and an

archived version of the webcast will made be available in the same

location shortly after the live call has ended. The conference call

can be accessed by telephone at (866) 225-8754, conference ID

4678800 or “Pacific Premier Bancorp.” Additionally a telephone

replay will be made available through April 30, 2014 at (800)

406-7325, conference ID 4678800.

About Pacific Premier Bancorp, Inc.

Pacific Premier Bancorp, Inc. is the holding company for Pacific

Premier Bank, one of the largest community banks headquartered in

Southern California. Pacific Premier Bank is a business bank

primarily focused on serving small- and medium-sized businesses in

the counties of Los Angeles, Orange, Riverside, San Bernardino and

San Diego, California. Pacific Premier Bank offers a diverse range

of lending products including commercial, CRE, construction,

residential warehouse and SBA loans, as well as specialty banking

products for HOAs and franchise lending nationwide. Pacific Premier

Bank serves its customers through its 13 full-service depository

branches in Southern California located in the cities of Encinitas,

Huntington Beach, Irvine, Los Alamitos, Newport Beach, Palm Desert,

Palm Springs, San Bernardino, San Diego and Seal Beach.

FORWARD-LOOKING COMMENTS

The statements contained herein that are not historical facts

are forward-looking statements based on management’s current

expectations and beliefs concerning future developments and their

potential effects on the Company. Such statements involve inherent

risks and uncertainties, many of which are difficult to predict and

are generally beyond the control of the Company. There can be no

assurance that future developments affecting the Company will be

the same as those anticipated by management. The Company cautions

readers that a number of important factors could cause actual

results to differ materially from those expressed in, or implied or

projected by, such forward-looking statements. These risks and

uncertainties include, but are not limited to, the following: the

strength of the United States economy in general and the strength

of the local economies in which we conduct operations; the effects

of, and changes in, trade, monetary and fiscal policies and laws,

including interest rate policies of the Board of Governors of the

Federal Reserve System; inflation, interest rate, market and

monetary fluctuations; the timely development of competitive new

products and services and the acceptance of these products and

services by new and existing customers; the willingness of users to

substitute competitors’ products and services for the Company’s

products and services; the impact of changes in financial services

policies, laws and regulations (including the Dodd-Frank Wall

Street Reform and Consumer Protection Act) and of governmental

efforts to restructure the U.S. financial regulatory system;

technological changes; the effect of acquisitions that the Company

may make, if any, including, without limitation, the failure to

achieve the expected revenue growth and/or expense savings from its

acquisitions; changes in the level of the Company’s nonperforming

assets and charge-offs; oversupply of inventory and continued

deterioration in values of California real estate, both residential

and commercial; the effect of changes in accounting policies and

practices, as may be adopted from time-to-time by bank regulatory

agencies, the Securities and Exchange Commission (“SEC”), the

Public Company Accounting Oversight Board, the Financial Accounting

Standards Board or other accounting standards setters; possible

other-than-temporary impairment of securities held by us; changes

in consumer spending, borrowing and savings habits; the effects of

the Company’s lack of a diversified loan portfolio, including the

risks of geographic and industry concentrations; ability to attract

deposits and other sources of liquidity; changes in the financial

performance and/or condition of our borrowers; changes in the

competitive environment among financial and bank holding companies

and other financial service providers; unanticipated regulatory or

judicial proceedings; and the Company’s ability to manage the risks

involved in the foregoing. Additional factors that could cause

actual results to differ materially from those expressed in the

forward-looking statements are discussed in the 2013 Annual Report

on Form 10-K of Pacific Premier Bancorp, Inc. filed with the SEC

and available at the SEC’s Internet site (http://www.sec.gov).

The Company specifically disclaims any obligation to update any

factors or to publicly announce the result of revisions to any of

the forward-looking statements included herein to reflect future

events or developments.

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (dollars in

thousands, except share data)

March 31, December 31, September 30,

June 30, March 31, ASSETS 2014

2013 2013 2013 2013 (Unaudited)

(Audited) (Unaudited) (Unaudited) (Unaudited) Cash and due from

banks $ 124,143 $ 126,787 $ 61,393 $ 103,946 $ 99,431 Federal funds

sold 276 26 26 26

27 Cash and cash equivalents 124,419 126,813

61,419 103,972 99,458 Investment securities available for sale

202,142 256,089 282,846 313,047 301,160 FHLB/Federal Reserve

Bank/TIB stock, at cost 14,104 15,450 10,827 11,917 10,974 Loans

held for sale, net - 3,147 3,176 3,617 3,643 Loans held for

investment 1,325,372 1,240,123 1,138,969 1,055,430 941,828

Allowance for loan losses (8,685 ) (8,200 )

(7,994 ) (7,994 ) (7,994 ) Loans held for investment,

net 1,316,687 1,231,923 1,130,975 1,047,436 933,834 Accrued

interest receivable 5,865 6,254 5,629 5,766 4,898 Other real estate

owned 752 1,186 1,186 1,186 1,561 Premises and equipment 9,643

9,864 9,829 9,997 8,862 Deferred income taxes 9,180 8,477 9,029

8,644 2,646 Bank owned life insurance 26,240 24,051 23,862 23,674

17,701 Intangible assets 6,374 6,628 6,881 7,135 4,463 Goodwill

22,950 17,428 17,428 18,234 11,854 Other assets 6,926

6,877 5,933 3,833

5,601 TOTAL ASSETS $ 1,745,282 $ 1,714,187 $

1,569,020 $ 1,558,458 $ 1,406,655

LIABILITIES AND STOCKHOLDERS’ EQUITY LIABILITIES: Deposit

accounts: Noninterest bearing $ 412,871 $ 366,755 $ 363,606 $

345,063 $ 316,536 Interest bearing 1,022,332

939,531 920,528 969,126

869,183 Total deposits 1,435,203 1,306,286 1,284,134

1,314,189 1,185,719 FHLB advances and other borrowings 95,506

204,091 86,474 48,082 44,191 Subordinated debentures 10,310 10,310

10,310 10,310 10,310 Accrued expenses and other liabilities

15,403 18,274 16,948

17,066 8,846 TOTAL LIABILITIES

1,556,422 1,538,961 1,397,866

1,389,647 1,249,066 STOCKHOLDERS’

EQUITY: Common stock, $.01 par value; 25,000,000 shares authorized;

shares issued and outstanding of 17,224,977, 16,656,279,

16,641,991, 16,635,786 and 15,437,531 at March 31, 2014, December

31, 2013, September 30, 2013, June 30, 2013 and March 31, 2013,

respectively 172 166 166 166 154 Additional paid-in capital 152,325

143,322 143,014 142,759 128,075 Retained earnings 37,447 34,815

30,611 27,545 27,794 Accumulated other comprehensive income (loss),

net of tax (benefit) of ($757), ($2,152), ($1,843), ($1,160) and

$1,095 at March 31, 2014, December 31, 2013, September 30, 2013,

June 30, 2013 and March 31, 2013, respectively (1,084 )

(3,077 ) (2,637 ) (1,659 ) 1,566

TOTAL STOCKHOLDERS’ EQUITY 188,860 175,226

171,154 168,811 157,589

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $ 1,745,282

$ 1,714,187 $ 1,569,020 $ 1,558,458 $

1,406,655

PACIFIC PREMIER BANCORP, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS

(dollars in thousands, except per share data)

Three Months Ended March 31, December

31, March 31, 2014 2013 2013

INTEREST INCOME

(Unaudited)

(Unaudited)

(Unaudited)

Loans $ 16,585 $ 16,303 $ 13,396 Investment securities and other

interest-earning assets 1,437 1,670 839

Total interest income 18,022 17,973 14,235

INTEREST EXPENSE Deposits 1,069 968 1,019 FHLB

advances and other borrowings 243 262 240 Subordinated debentures

75 77 77 Total interest expense

1,387 1,307 1,336 NET INTEREST INCOME BEFORE

PROVISION FOR LOAN LOSSES 16,635 16,666 12,899 PROVISION FOR LOAN

LOSSES 949 596 296 NET INTEREST INCOME

AFTER PROVISION FOR LOAN LOSSES 15,686 16,070

12,603

NONINTEREST INCOME Loan servicing fees 856 311

326 Deposit fees 454 491 440 Net gain from sales of loans 548 1,301

723 Net gain from sales of investment securities 62 171 -

Other-than-temporary impairment recovery (loss) on investment

securities, net 13 15 (30 ) Gain on FDIC transaction - - - Other

income 119 328 265 Total noninterest

income 2,052 2,617 1,724

NONINTEREST

EXPENSE Compensation and benefits 6,891 6,286 5,097 Premises

and occupancy 1,588 1,575 1,293 Data processing and communications

1,131 866 635 Other real estate owned operations, net 13 8 37 FDIC

insurance premiums 237 212 140 Legal, audit and professional

expense 593 340 595 Marketing expense 176 311 206 Office and

postage expense 369 353 263 Loan expense 184 295 248 Deposit

expense 761 646 160 Merger related expense 626 203 1,745 Other

expense 972 914 760 Total noninterest

expense 13,541 12,009 11,179 NET INCOME

BEFORE INCOME TAX 4,197 6,678 3,148 INCOME TAX 1,565

2,474 1,176 NET INCOME $ 2,632 $ 4,204 $ 1,972

EARNINGS PER SHARE Basic $ 0.15 $ 0.26 $ 0.14 Diluted

$ 0.15 $ 0.24 $ 0.13

WEIGHTED AVERAGE SHARES

OUTSTANDING Basic 17,041,594 16,648,676 14,355,407 Diluted

17,376,001 17,486,083 15,117,216

PACIFIC PREMIER

BANCORP, INC. AND SUBSIDIARIES STATISTICAL INFORMATION

(dollars in thousands)

Three Months

Ended March 31, December 31, March 31,

2014 2013 2013 Profitability

and Productivity Net interest margin 4.30 % 4.32 % 4.62

% Noninterest expense to average total assets 3.27 2.99 3.82

Efficiency ratio (1) 67.96 60.45 63.50 Return on average assets

0.64 1.05 0.67 Return on average equity 5.77 9.69 5.65

Asset and liability activity Loans originated

and purchased $ 186,853 $ 201,633 $ 116,258 Repayments (77,555 )

(69,389 ) (45,244 ) Loans sold (9,508 ) (17,995 ) (5,048 ) Increase

(decrease) in loans, net 81,617 100,919 (40,417 ) Increase in

assets 31,095 145,167 232,863 Increase in deposits 128,917 22,152

280,951 Increase (decrease) in borrowings (108,585 ) 117,617

(71,309 ) (1) Represents the ratio of noninterest expense

less other real estate owned operations, core deposit intangible

amortization and non-recurring merger related expense to the sum of

net interest income before provision for loan losses and total

noninterest income less gains/(loss) on sale of securities,

other-than-temporary impairment recovery (loss) on investment

securities, and gain on FDIC-assisted transactions.

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES

STATISTICAL INFORMATION

Average Balance

Sheet Three Months Ended Three Months Ended

Three Months Ended March 31, 2014 December 31,

2013 March 31, 2013 Average Average

Average Average Average Average

Balance Interest Yield/Cost

Balance Interest Yield/Cost

Balance Interest Yield/Cost Assets

(dollars in thousands) Interest-earning assets: Cash and cash

equivalents $ 70,341 $ 27 0.16 % $ 62,647 $ 24 0.15 % $ 69,143 $ 37

0.22 % Federal funds sold 192 - - 26 - - 27 - - Investment

securities 243,847 1,410 2.31 283,334 1,646 2.32 134,895 802 2.38

Loans receivable, net (1) 1,254,407 16,585 5.36

1,183,209 16,303 5.47 928,577

13,396 5.85 Total interest-earning assets 1,568,787

18,022 4.65 % 1,529,216 17,973 4.67 % 1,132,642 14,235 5.09 %

Noninterest-earning assets 87,095 78,684

38,911 Total assets $ 1,655,882 $ 1,607,900 $ 1,171,553

Liabilities and Equity Interest-bearing deposits: Interest

checking $ 137,658 $ 38 0.11 % $ 119,092 $ 41 0.14 % $ 34,761 $ 8

0.09 % Money market 435,188 314 0.29 428,363 307 0.28 263,923 175

0.27 Savings 75,904 28 0.15 76,980 28 0.14 80,954 35 0.18 Time

329,026 689 0.85 294,292 592

0.80 350,304 801 0.93 Total

interest-bearing deposits 977,776 1,069 0.44 918,727 968 0.42

729,942 1,019 0.57 FHLB advances and other borrowings 85,019 243

1.16 122,786 262 0.85 44,769 240 2.17 Subordinated debentures

10,310 75 2.95 10,310 77 2.96

10,310 77 3.03 Total borrowings

95,329 318 1.35 133,096 339 1.01

55,079 317 2.33 Total interest-bearing

liabilities 1,073,105 1,387 0.52 % 1,051,823 1,307 0.49 % 785,021

1,336 0.69 % Noninterest-bearing deposits 389,513 364,735 237,081

Other liabilities 10,951 17,887 9,766 Total

liabilities 1,473,569 1,434,445 1,031,868 Stockholders' equity

182,313 173,455 139,685 Total liabilities and

equity $ 1,655,882 $ 1,607,900 $ 1,171,553 Net interest income $

16,635 $ 16,666 $ 12,899 Net interest rate spread (2) 4.13 % 4.18 %

4.40 % Net interest margin (3) 4.30 % 4.32 % 4.62 % Ratio of

interest-earning assets to interest-bearing liabilities 146.19 %

145.39 % 144.28 % (1) Average balance includes

loans held for sale and nonperforming loans and is net of deferred

loan origination fees, unamortized discounts and premiums, and

allowance for loan losses. (2) Represents the difference between

the yield on interest-earning assets and the cost of

interest-bearing liabilities. (3) Represents net interest income

divided by average interest-earning assets.

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES

STATISTICAL INFORMATION (dollars in thousands)

March 31, December 31,

September 30, June 30, March 31, 2014

2013 2013 2013 2013

Loan Portfolio Business loans: Commercial and

industrial $ 271,877 $ 187,035 $ 173,720 $ 146,240 $ 140,592

Commercial owner occupied (1) 223,848 221,089 222,162 201,802

166,571 SBA 11,045 10,659 6,455 5,820 5,116 Warehouse facilities

81,033 87,517 49,104 135,317 138,935 Real estate loans: Commercial

non-owner occupied 333,490 333,544 304,979 295,767 256,015

Multi-family 223,200 233,689 218,929 172,797 139,100 One-to-four

family (2) 141,469 145,235 152,667 84,672 87,109 Construction

29,857 13,040 2,835 2,135 - Land 6,170 7,605 7,371 10,438 7,863

Other loans 3,480 3,839 3,793

4,969 4,690 Total gross loans

(3) 1,325,469 1,243,252 1,142,015 1,059,957 945,991 Less loans held

for sale, net - (3,147 ) (3,176 )

(3,617 ) (3,643 ) Total gross loans held for

investment 1,325,469 1,240,105 1,138,839 1,056,340 942,348 Less:

Deferred loan origination costs/(fees) and

premiums/(discounts)

(97 ) 18 130 (910 ) (520 ) Allowance for loan losses (8,685

) (8,200 ) (7,994 ) (7,994 ) (7,994 )

Loans held for investment, net $ 1,316,687 $ 1,231,923

$ 1,130,975 $ 1,047,436 $ 933,834

Asset Quality Nonaccrual loans $ 2,674 $

2,251 $ 1,153 $ 2,032 $ 3,102 Other real estate owned 752

1,186 1,186 1,186

1,561 Nonperforming assets $ 3,426 $ 3,437

$ 2,339 $ 3,218 $ 4,663 Allowance for

loan losses 8,685 8,200 7,994 7,994 7,994 Allowance for loan losses

as a percent of total nonperforming loans 324.79 % 364.28 % 693.32

% 393.41 % 257.70 % Nonperforming loans as a percent of gross loans

0.20 0.18 0.10 0.19 0.33 Nonperforming assets as a percent of total

assets 0.20 0.20 0.15 0.21 0.33 Net loan charge-offs for the

quarter ended $ 464 $ 390 $ 646 $ 322 $ 296 Net loan charge-offs

for quarter to average total loans, net 0.15 % 0.13 % 0.25 % 0.13 %

0.13 % Allowance for loan losses to gross loans 0.66 0.66 0.70 0.75

0.85

Delinquent Loans: 30 - 59 days $ 118 $ 969

$ 724 $ 669 $ 58 60 - 89 days 32 - 214 580 1,077 90+ days (4)

1,427 1,143 111

1,073 1,881 Total delinquency $ 1,577 $

2,112 $ 1,049 $ 2,322 $ 3,016

Delinquency as a % of total gross loans 0.12 % 0.17 % 0.09 % 0.22 %

0.32 % (1) Majority secured by real estate. (2) Includes

second trust deeds. (3) Total gross loans for March 31, 2014 are

net of the unaccreted mark-to-market discounts on Canyon National

loans of $1.8 million, on Palm Desert National loans of $2.2

million, and on San Diego Trust loans of $115,000 and of the

mark-to-market premium on First Associations loans of $53,000. (4)

All 90 day or greater delinquencies are on nonaccrual status and

reported as part of nonperforming assets.

PACIFIC

PREMIER BANCORP, INC. AND SUBSIDIARIES STATISTICAL

INFORMATION (dollars in thousands, except per share data)

March 31,

December 31, September 30, June 30, March

31, 2014 2013 2013 2013 2013

Deposit

Accounts

Noninterest-bearing $ 412,871 $ 366,755 $ 363,606 $ 345,063 $

316,536 Interest-bearing: Checking 137,285 120,886 106,740 124,790

115,541 Money market 453,261 427,577 446,885 425,884 323,709

Savings 76,087 76,412 80,867 81,277 80,578 Time 355,699

314,656 286,036 337,175

349,355 Total interest-bearing

1,022,332 939,531 920,528

969,126 869,183 Total deposits $ 1,435,203

$ 1,306,286 $ 1,284,134 $ 1,314,189 $

1,185,719

Pacific Premier

Bank Capital Ratios

Tier 1 leverage ratio 10.26 % 10.03 % 10.02 % 10.97 % 12.55 % Tier

1 risk-based capital ratio 12.06 % 12.34 % 13.28 % 13.34 % 14.43 %

Total risk-based capital ratio 12.71 % 12.97 % 13.96 % 14.07 %

15.23 %

Pacific Premier

Bancorp, Inc. Capital Ratios

Tier 1 leverage ratio 10.45 % 10.29 % 10.19 % 11.15 % 12.84 % Tier

1 risk-based capital ratio 12.23 % 12.54 % 13.48 % 13.54 % 14.61 %

Total risk-based capital ratio 12.88 % 13.17 % 14.16 % 14.27 %

15.40 % Tangible common equity ratio (1) 9.30 % 8.94 % 9.51 % 9.36

% 10.16 %

Share

Data

Book value per share $ 10.96 $ 10.52 $ 10.28 $ 10.15 $ 10.21

Tangible book value per share (1) 9.26 9.08 8.82 8.62 9.15 Closing

stock price 16.14 15.74 13.42 12.22 13.15 (1) A

reconciliation of the non-GAAP measures of tangible common equity

and tangible book value per share to the GAAP measures of common

stockholders' equity and book value per share is set forth below.

PACIFIC PREMIER BANCORP, INC. AND

SUBSIDIARIESSTATISTICAL INFORMATION(dollars in

thousands, except per share data)

GAAP Reconciliations

For periods presented below, adjusted net income and adjusted

diluted earnings per share are non-GAAP financial measures derived

from GAAP-based amounts. We calculate these figures by excluding

merger related expenses in period results. Management believes that

the exclusion of such items from these financial measures provides

useful information to an understanding of the operating results of

our core business. However, these non-GAAP financial measures are

supplemental and are not a substitute for an analysis based on GAAP

measures. As other companies may use different calculations for

these adjusted measures, this presentation may not be comparable to

other similarly titled adjusted measures reported by other

companies.

March 31, December 31,

March 31, 2014 2013 2013 Net

income $ 2,632 $ 4,204 $ 1,972 Plus merger related expenses, net of

tax 393 128 1,093

Adjusted net income $

3,025 $ 4,332 $ 3,065 Diluted earnings per share $ 0.15 $

0.24 $ 0.13 Plus merger related expenses, net of tax 0.02

0.00 0.07

Adjusted diluted earnings per share

$ 0.17 $ 0.24 $ 0.20

For periods presented below, adjusted net income and adjusted

average tangible common equity are non-GAAP financial measures

derived from GAAP-based amounts. We calculate these figures by

adjusting net income for the effect of CDI amortization and exclude

the average CDI and average goodwill from the average stockholders’

equity during the period. Management believes that the exclusion of

such items from these financial measures provides useful

information to an understanding of the operating results of our

core business. However, these non-GAAP financial measures are

supplemental and are not a substitute for an analysis based on GAAP

measures. As other companies may use different calculations for

these adjusted measures, this presentation may not be comparable to

other similarly titled adjusted measures reported by other

companies.

March 31, December 31,

March 31, 2014 2013 2013 Net

income $ 2,632 $ 4,204 $ 1,972 Less: Tax effected CDI amortization

159 159 58

Adjusted

net income $ 2,791 $ 4,363 $ 2,030

Average stockholders' equity $ 182,313 $ 173,455 $ 139,685 Less:

Average core deposit intangible 6,501 6,755 2,923 Less: Average

goodwill 21,109 17,428 2,107

Average tangible common equity $ 154,703 $

149,272 $ 134,655

Return on average

tangible common equity 7.22 % 11.69 % 6.03 %

Tangible common equity to tangible assets (the "tangible common

equity ratio") and tangible book value per share are non-GAAP

financial measures derived from GAAP-based amounts. We calculate

the tangible common equity ratio by excluding the balance of

intangible assets from common stockholders’ equity and dividing by

tangible assets. We calculate tangible book value per share by

dividing tangible common equity by common shares outstanding, as

compared to book value per share, which we calculate by dividing

common stockholders’ equity by shares outstanding. We believe that

this information is consistent with the treatment by bank

regulatory agencies, which exclude intangible assets from the

calculation of risk-based capital ratios. Accordingly, we believe

that these non-GAAP financial measures provide information that is

important to investors and that is useful in understanding our

capital position and ratios. However, these non-GAAP financial

measures are supplemental and are not a substitute for an analysis

based on GAAP measures. As other companies may use different

calculations for these measures, this presentation may not be

comparable to other similarly titled measures reported by other

companies.

March 31, December 31,

September 30, June 30, March 31,

2014 2013 2013 2013 2013

Total stockholders' equity $ 188,860 $ 175,226 $ 171,154 $ 168,811

$ 157,589 Less: Intangible assets (29,324 ) (24,056 )

(24,309 ) (25,369 ) (16,317 )

Tangible

common equity $ 159,536 $ 151,170 $ 146,845

$ 143,442 $ 141,272 Book value per

share $ 10.96 $ 10.52 $ 10.28 $ 10.15 $ 10.21 Less: Intangible book

value per share (1.70 ) (1.44 ) (1.46 )

(1.53 ) (1.06 )

Tangible book value per share $ 9.26

$ 9.08 $ 8.82 $ 8.62 $ 9.15

Total assets $ 1,745,282 $ 1,714,187 $ 1,569,020 $ 1,558,458

$ 1,406,655 Less: Intangible assets (29,324 ) (24,056

) (24,309 ) (25,369 ) (16,317 )

Tangible

assets $ 1,715,958 $ 1,690,131 $ 1,544,711

$ 1,533,089 $ 1,390,338

Tangible common

equity ratio 9.30 % 8.94 % 9.51 % 9.36 % 10.16 %

Pacific Premier Bancorp, Inc.Steve

GardnerPresident/CEO949-864-8000orKent J. SmithExecutive Vice

President/CFO949-864-8000

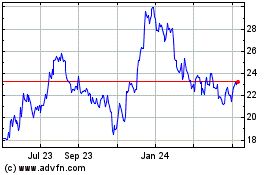

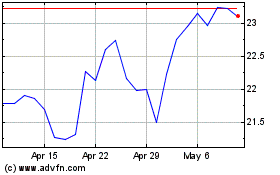

Pacific Premier Bancorp (NASDAQ:PPBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pacific Premier Bancorp (NASDAQ:PPBI)

Historical Stock Chart

From Apr 2023 to Apr 2024