Executive Snapshot:

-- Continued strong financial results:

-- First quarter 2014 compared to 2013:

- Net income up 20.1%

- Diluted EPS up 19.6%

- Return on average assets (ROA) rose 13 basis points to

0.99%

- Return on average equity (ROE) rose 174 basis points to

12.09%

- Significant improvement in the efficiency ratio from 54.33% in

2013 to 51.28% in 2014

-- Continued expansion of customer base:

-- Focus on capitalizing on the opportunities presented by

expanded branch franchise

-- Deposits per branch grew from $28.0 million at year-end 2013

to $28.7 million at March 31, 2014

-- Average core deposits grew $90.7 million from Q1 2013 to Q1

2014

-- Loan portfolio reaches all-time high:

-- Average loans were up $233.5 million or 8.7% from Q1 2013 to

Q1 2014

-- Residential mortgage loans comprised $219.1 million of the

increase

-- At $2.94 billion, loans have reached an all-time high

-- Asset quality improvement:

-- Non-performing assets (NPAs) fell $5.8 million to $53.9

million at March 31, 2014 compared to $59.7 million at March 31,

2013

-- NPAs to total assets improved from 1.35% to 1.18% over the

last year

-- NCOs to average loans improved from 0.34% in Q1 2013 to 0.30%

in Q1 2014

TrustCo Announces First Quarter Earnings

Increase Of 20.1% Over Prior Year

TrustCo Bank Corp NY (TrustCo) (Nasdaq:TRST) today

announced that net income rose to $11.0 million in the quarter

ended March 31, 2014, up 20.1% from $9.2 million for the quarter

ended March 31, 2013.

Robert J. McCormick, President and Chief Executive Officer

noted, "Our results for the first quarter of 2014 continued our

progress in terms of solid bottom line growth and in positioning

our business for the future. In addition to the significant

increase in net income, we continued to add profitable customer

relationships on both the loan and deposit sides of the Bank. Our

highly liquid balance sheet continues to allow us to fund our loan

growth without having to overpay for deposits. The first quarter

was a strong start for TrustCo and we look forward to the remainder

of 2014 with optimism. We continue to take advantage of

opportunities as they are presented."

TrustCo saw continued strong loan growth in the first quarter of

2014. The gains were primarily funded by continued expansion of

retail deposits. Lower yielding investment securities declined

during the quarter, with most of the proceeds invested in short

term instruments as of quarter-end. The shift towards loans helped

offset part of the impact from continued low yields on cash and

securities, while this liquidity provides for opportunities when

interest rate conditions improve.

Mr. McCormick also noted, "We are encouraged by the continued

economic improvements where we operate, particularly Florida, and

believe that we are well positioned to capitalize on these changes.

Our long-term focus on traditional lending criteria and

conservative balance sheet management has enabled us to maintain a

strong balance sheet and continued profitability. As a result, we

have been able to focus on conducting business, which has

significantly enhanced our reputation and put us in a position to

take advantage of changes in market and competitive

conditions."

Return on average assets and return on average equity were 0.99%

and 12.09%, respectively for the first quarter of 2014, compared to

0.86% and 10.35% for the first quarter of 2013. Diluted earnings

per share were $0.116 for the first quarter of 2014, up 19.6% from

$0.097 for the first quarter of 2013.

On a year-over-year basis, average loans were up $233.5 million

or 8.7% in the first quarter of 2014, over the same period in 2013.

Average deposits were up $141.6 million for the first quarter of

2014 over the same period a year earlier. Customers continued to

move some funds into certificates with slightly longer maturities,

which may help TrustCo if rates rise, without having a material

impact on the current cost of funds. During this time period core

deposits rose $90.7 million. Core deposits typically represent

longer term customer relationships and are generally lower cost

than time deposits. Mr. McCormick noted that, "The year-over-year

growth of our loans and core deposit base reflect the long term

strategic focus of the Company.

"While some banks have backed away from branches, a customer

friendly branch franchise continues to be the key to our long term

plans. During 2013 we celebrated the ten year anniversary of our

expansion into Florida, while at the same time making significant

progress expanding loans and deposits throughout our branch

network. We expect that trend to continue as the new branches

continue to grow. At March 31, 2014, our average branch had $28.7

million of deposits, up $731 thousand compared to the prior year.

We also note we have always designed our branches to be smaller and

more cost effective than those built by many of our competitors. We

have utilized open floor plans that help maximize the value of our

branches. We remain mindful that fully achieving our goals for our

newer branches will take time and continued work. We believe our

success in growing customer relationships provides the basic

building blocks that will help drive profit growth for the coming

years."

Asset quality, reserve coverage of nonperforming loans (NPLs)

and net charge-offs all improved from March 31, 2013 to March 31,

2014. NPLs declined to $44.9 million at March 31, 2014, compared to

$49.9 million at March 31, 2013 and nonperforming assets (NPAs)

declined to $53.9 million from $59.7 million over the same period.

NPLs were equal to 1.53% of total loans at March 31, 2014, compared

to 1.84% a year earlier. The coverage ratio, or allowance for loan

losses to NPLs, was 104.7% at March 31, 2014, compared to 95.6% at

March 31, 2013. Overall, virtually every asset quality indicator

improved during the first quarter of 2014 relative to the first

quarter of 2013. The ratio of reserves to total loans was 1.60% as

of March 31, 2014, compared to 1.76% at March 31, 2013. This

decline was due primarily to new loan growth over the last

year.

The net interest margin for the first quarter of 2014 was 3.13%,

compared to 3.15% in the fourth quarter of 2013. Included in first

quarter of 2014 results was a gain of $1.6 million on the

previously disclosed sale of the regional operations center in

Florida. First quarter results also reflect the impact of New York

State tax law changes which required a deferred tax asset

write-down of $200 thousand.

At March 31, 2014 the tangible equity ratio was 8.11% compared

to 7.99% at December 31, 2013 and 8.17% at March 31, 2013. Tangible

book value per share ended the first quarter at $3.93 compared to

$3.83 in the year-ago period.

TrustCo Bank Corp NY is a $4.6 billion savings and loan holding

company and through its subsidiary, Trustco Bank, operated 139

offices in New York, New Jersey, Vermont, Massachusetts, and

Florida at March 31, 2013.

In addition, the Bank's Financial Services Department offers a

full range of investment services, retirement planning and trust

and estate administration services. The common shares of TrustCo

are traded on the NASDAQ Global Select Market under the symbol

TRST.

A conference call to discuss first quarter 2014 results will be

held at 9:00 a.m. Eastern Time on April 22, 2014. Those wishing to

participate in the call may dial toll-free 1-888-317-6016.

International callers must dial 1-412-317-6016. A replay of the

call will be available thirty days by dialing 1-877-344-7529

(1-412-317-0088 for international callers), Conference Number

10043698. The call will also be audio webcast at:

https://services.choruscall.com/links/trst140422.html, and will be

available for one year.

Safe Harbor Statement

All statements in this news release that are not historical are

forward-looking statements within the meaning of the Securities

Exchange Act of 1934, as amended. The "forward-looking statements"

may include statements regarding future events or performance. Such

forward-looking statements are subject to factors that could cause

actual results to differ materially for TrustCo from those

discussed. TrustCo wishes to caution readers not to place undue

reliance on any such forward-looking statements, which speak only

as of the date made. The following important factors, among others,

in some cases have affected and in the future could affect

TrustCo's actual results and could cause TrustCo's actual financial

performance to differ materially from that expressed in any

forward-looking statement: our ability to continue to originate a

significant volume of one-to-four family mortgage loans in our

market areas; our ability to continue to maintain noninterest

expense and other overhead costs at reasonable levels relative to

income; the future earnings and capital levels of Trustco Bank and

the continued ability of Trustco Bank under regulatory rules to

distribute capital to TrustCo, which could affect our ability to

pay dividends; our ability to make accurate assumptions and

judgments regarding the credit risks associated with lending and

investing activities; the effect of changes in financial services

laws and regulations and the impact of other governmental

initiatives affecting the financial services industry; results of

examinations of Trustco Bank and TrustCo by our respective

regulators; the effects of, and changes in, trade, monetary and

fiscal policies and laws, including interest rate policies of the

Federal Reserve Board, inflation, interest rates, market and

monetary fluctuations; the perceived overall value of our products

and services by users, including in comparison to competitors'

products and services and the willingness of current and

prospective customers to substitute competitors' products and

services for our products and services; real estate and collateral

values; changes in accounting policies and practices, as may be

adopted by the bank regulatory agencies, the FASB or PCAOB; changes

in local market areas and general business and economic trends, as

well as changes in consumer spending and saving habits; our success

at managing the risks involved in the foregoing and managing our

business; and other risks and uncertainties under the heading "Risk

Factors" in our annual report on Form 10-K for the year ended

December 31, 2013, as amended, and, if any, in our subsequent

quarterly reports on Form 10-Q or other securities filings.

| TRUSTCO BANK

CORP NY |

|

|

|

| GLENVILLE,

NY |

|

|

|

| |

|

|

|

| FINANCIAL

HIGHLIGHTS |

|

|

|

| |

|

|

|

| (dollars in

thousands, except per share data) |

|

|

|

| (Unaudited) |

|

|

|

| |

Three Months

Ended |

| |

03/31/14 |

12/31/13 |

03/31/13 |

| Summary of operations |

|

|

|

| Net interest income (TE) |

$ 34,701 |

34,577 |

33,707 |

| Provision for loan losses |

1,500 |

1,500 |

2,000 |

| Net securities

transactions |

6 |

188 |

2 |

| Noninterest income, excluding

net securities transactions |

5,753 |

4,660 |

4,590 |

| Noninterest expense |

20,801 |

20,891 |

21,557 |

| Net income |

11,011 |

10,629 |

9,168 |

| |

|

|

|

| Per common share |

|

|

|

| Net income per share: |

|

|

|

| - Basic |

$ 0.116 |

0.113 |

0.097 |

| - Diluted |

0.116 |

0.112 |

0.097 |

| Cash dividends |

0.066 |

0.066 |

0.066 |

| Tangible Book value at period

end |

3.93 |

3.82 |

3.83 |

| Market price at period end |

7.04 |

7.18 |

5.58 |

| |

|

|

|

| At period end |

|

|

|

| Full time equivalent

employees |

709 |

708 |

761 |

| Full service banking

offices |

139 |

139 |

138 |

| |

|

|

|

| Performance ratios |

|

|

|

| Return on average assets |

0.99% |

0.94 |

0.86 |

| Return on average equity |

12.09 |

11.78 |

10.35 |

| Efficiency (1) |

51.28 |

52.15 |

54.33 |

| Net interest spread (TE) |

3.08 |

3.10 |

3.13 |

| Net interest margin (TE) |

3.13 |

3.15 |

3.19 |

| Dividend payout ratio |

56.36 |

58.44 |

67.33 |

| |

|

|

|

| Capital ratio at period end |

|

|

|

| Consolidated tangible equity to

tangible assets (2) |

8.11 |

7.99 |

8.17 |

| |

|

|

|

| Asset quality analysis at period end |

|

|

|

| Nonperforming loans to total

loans |

1.53 |

1.49 |

1.84 |

| Nonperforming assets to total

assets |

1.18 |

1.15 |

1.35 |

| Allowance for loan losses to

total loans |

1.60 |

1.64 |

1.76 |

| Coverage ratio (3) |

1.0x |

1.1 |

1.0 |

| |

|

|

|

| (1) Calculated

as noninterest expense (excluding ORE income/expense) divided by

taxable equivalent net interest income plus noninterest income

(excluding net securities transactions and the net gain on sale of

building). |

|

|

|

| (2) The tangible

equity ratio excludes $553,000 of intangibles from both equity and

assets. |

|

|

| (3) Calculated

as allowance for loan losses divided by total nonperforming

loans. |

|

|

|

| |

|

|

|

| TE = Taxable

equivalent. |

|

|

|

| |

|

|

|

|

|

| CONSOLIDATED

STATEMENTS OF INCOME |

|

|

|

|

|

| |

|

|

|

|

|

| (dollars in

thousands, except per share data) |

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

| |

Three

Months Ended |

|

| |

3/31/2014 |

12/31/2013 |

9/30/2013 |

6/30/2013 |

3/31/2013 |

| Interest and dividend income: |

|

|

|

|

|

| Interest and fees on loans |

$ 32,874 |

32,658 |

32,166 |

31,639 |

31,481 |

| Interest and dividends on securities

available for sale: |

|

|

|

|

|

| U. S. government sponsored

enterprises |

506 |

586 |

571 |

627 |

816 |

| State and political

subdivisions |

68 |

96 |

127 |

148 |

191 |

| Mortgage-backed securities and

collateralized mortgage obligations-residential |

3,078 |

3,027 |

2,888 |

2,701 |

2,769 |

| Corporate bonds |

59 |

138 |

223 |

233 |

218 |

| Small Business

Administration-guaranteed participation securities |

556 |

562 |

558 |

564 |

496 |

| Mortgage-backed securities and

collateralized mortgage obligations-commercial |

38 |

38 |

39 |

38 |

29 |

| Other securities |

4 |

4 |

5 |

3 |

5 |

| Total interest and dividends on

securities available for sale |

4,309 |

4,451 |

4,411 |

4,314 |

4,524 |

| |

|

|

|

|

|

| Interest on held to maturity

securities: |

|

|

|

|

|

| Mortgage-backed securities and

collateralized mortgage obligations-residential |

625 |

649 |

686 |

716 |

789 |

| Corporate bonds |

154 |

153 |

154 |

214 |

312 |

| Total interest on held to

maturity securities |

779 |

802 |

840 |

930 |

1,101 |

| |

|

|

|

|

|

| Federal Reserve Bank and

Federal Home Loan Bank stock |

133 |

129 |

121 |

121 |

119 |

| |

|

|

|

|

|

| Interest on federal funds sold and other

short-term investments |

351 |

324 |

344 |

327 |

245 |

| Total interest income |

38,446 |

38,364 |

37,882 |

37,331 |

37,470 |

| |

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

| Interest on

deposits: |

|

|

|

|

|

| Interest-bearing checking |

84 |

83 |

84 |

82 |

80 |

| Savings |

763 |

790 |

798 |

829 |

916 |

| Money market deposit

accounts |

599 |

611 |

590 |

630 |

685 |

| Time deposits |

1,951 |

1,982 |

1,937 |

1,883 |

1,820 |

| Interest on short-term

borrowings |

393 |

382 |

370 |

367 |

364 |

| Total interest expense |

3,790 |

3,848 |

3,779 |

3,791 |

3,865 |

| |

|

|

|

|

|

| Net interest income |

34,656 |

34,516 |

34,103 |

33,540 |

33,605 |

| |

|

|

|

|

|

| Provision for loan losses |

1,500 |

1,500 |

1,500 |

2,000 |

2,000 |

| Net interest income after provision for loan

losses |

33,156 |

33,016 |

32,603 |

31,540 |

31,605 |

| |

|

|

|

|

|

| Noninterest income: |

|

|

|

|

|

| Trustco Financial Services

income |

1,510 |

1,276 |

1,317 |

1,287 |

1,421 |

| Fees for services to

customers |

2,521 |

2,917 |

2,903 |

2,968 |

2,887 |

| Net gain on securities

transactions |

6 |

188 |

-- |

1,432 |

2 |

| Other |

1,722 |

467 |

194 |

229 |

282 |

| Total noninterest income |

5,759 |

4,848 |

4,414 |

5,916 |

4,592 |

| |

|

|

|

|

|

| Noninterest expenses: |

|

|

|

|

|

| Salaries and employee

benefits |

7,592 |

8,664 |

7,935 |

7,647 |

8,178 |

| Net occupancy expense |

4,259 |

4,226 |

3,911 |

3,910 |

4,053 |

| Equipment expense |

1,752 |

1,514 |

1,567 |

1,582 |

1,718 |

| Professional services |

1,286 |

1,409 |

1,255 |

1,565 |

1,420 |

| Outsourced services |

1,325 |

1,075 |

1,350 |

1,350 |

1,350 |

| Advertising expense |

599 |

835 |

548 |

714 |

730 |

| FDIC and other insurance |

904 |

952 |

1,009 |

1,004 |

1,010 |

| Other real estate expense,

net |

855 |

430 |

946 |

1,473 |

749 |

| Other |

2,229 |

1,786 |

2,167 |

2,624 |

2,349 |

| Total noninterest expenses |

20,801 |

20,891 |

20,688 |

21,869 |

21,557 |

| |

|

|

|

|

|

| Income before taxes |

18,114 |

16,973 |

16,329 |

15,587 |

14,640 |

| Income taxes |

7,103 |

6,344 |

6,077 |

5,824 |

5,472 |

| |

|

|

|

|

|

| Net income |

$ 11,011 |

10,629 |

10,252 |

9,763 |

9,168 |

| Net income per Common Share: |

|

|

|

|

|

| - Basic |

$ 0.116 |

0.113 |

0.109 |

0.104 |

0.097 |

| |

|

|

|

|

|

| - Diluted |

0.116 |

0.112 |

0.109 |

0.104 |

0.097 |

| |

|

|

|

|

|

| Average basic shares (thousands) |

94,452 |

94,347 |

94,228 |

94,204 |

94,068 |

| Average diluted shares (thousands) |

94,581 |

94,472 |

94,275 |

94,211 |

94,073 |

| |

|

|

|

|

|

| Note: Taxable equivalent net interest

income |

$ 34,701 |

34,577 |

34,180 |

33,630 |

33,707 |

| |

|

|

|

|

|

| CONSOLIDATED

STATEMENTS OF FINANCIAL CONDITION |

|

|

|

|

|

| |

|

|

|

|

|

| (dollars in

thousands) |

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

| |

|

|

|

|

|

| |

3/31/2014 |

12/31/2013 |

9/30/2013 |

6/30/2013 |

3/31/2013 |

| ASSETS: |

|

|

|

|

|

| |

|

|

|

|

|

| Cash and due from banks |

$ 46,127 |

46,453 |

45,088 |

40,580 |

39,512 |

| Federal funds sold and other short term

investments |

687,003 |

536,591 |

510,561 |

588,252 |

405,262 |

| Total cash and cash

equivalents |

733,130 |

583,044 |

555,649 |

628,832 |

444,774 |

| |

|

|

|

|

|

| Securities available for sale: |

|

|

|

|

|

| U. S. government sponsored

enterprises |

92,708 |

198,829 |

193,614 |

188,133 |

263,165 |

| States and political

subdivisions |

4,968 |

7,758 |

11,199 |

12,159 |

15,265 |

| Mortgage-backed securities and

collateralized mortgage obligations-residential |

524,197 |

532,449 |

534,301 |

504,793 |

612,555 |

| Corporate bonds |

6,402 |

10,471 |

53,094 |

53,053 |

59,239 |

| Small Business

Administration-guaranteed participation securities |

101,821 |

103,029 |

104,863 |

108,665 |

115,464 |

| Mortgage-backed securities and

collateralized mortgage obligations-commercial |

10,543 |

10,558 |

10,715 |

10,725 |

11,136 |

| Other securities |

653 |

660 |

660 |

660 |

660 |

| Total securities available for

sale |

741,292 |

863,754 |

908,446 |

878,188 |

1,077,484 |

| |

|

|

|

|

|

| Held to maturity securities: |

|

|

|

|

|

| Mortgage-backed securities and

collateralized mortgage obligations-residential |

72,188 |

76,270 |

81,337 |

88,852 |

98,038 |

| Corporate bonds |

9,948 |

9,945 |

9,941 |

9,937 |

19,935 |

| Total held to maturity

securities |

82,136 |

86,215 |

91,278 |

98,789 |

117,973 |

| |

|

|

|

|

|

| Federal Reserve Bank and Federal Home Loan

Bank stock |

10,500 |

10,500 |

10,500 |

10,500 |

9,632 |

| |

|

|

|

|

|

| Loans: |

|

|

|

|

|

| Commercial |

220,443 |

223,481 |

212,833 |

216,977 |

212,637 |

| Residential mortgage loans |

2,374,874 |

2,338,944 |

2,279,064 |

2,205,334 |

2,154,188 |

| Home equity line of credit |

339,971 |

340,489 |

337,178 |

334,571 |

332,111 |

| Installment loans |

5,714 |

5,895 |

5,894 |

5,544 |

4,831 |

| Loans, net of deferred fees and costs |

2,941,002 |

2,908,809 |

2,834,969 |

2,762,426 |

2,703,767 |

| Less: |

|

|

|

|

|

| Allowance for loan losses |

47,035 |

47,714 |

47,722 |

47,589 |

47,658 |

| Net loans |

2,893,967 |

2,861,095 |

2,787,247 |

2,714,837 |

2,656,109 |

| |

|

|

|

|

|

| Bank premises and equipment, net |

35,267 |

34,414 |

34,559 |

38,301 |

35,787 |

| Other assets |

82,445 |

82,430 |

71,728 |

73,757 |

69,998 |

| |

|

|

|

|

|

| Total assets |

$ 4,578,737 |

4,521,452 |

4,459,407 |

4,443,204 |

4,411,757 |

| |

|

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

| Deposits: |

|

|

|

|

|

| Demand |

$ 327,779 |

318,456 |

314,660 |

314,985 |

298,243 |

| Interest-bearing checking |

628,752 |

611,127 |

591,590 |

591,844 |

579,077 |

| Savings accounts |

1,236,331 |

1,218,038 |

1,221,791 |

1,228,281 |

1,213,226 |

| Money market deposit

accounts |

648,244 |

648,402 |

650,688 |

634,804 |

656,577 |

| Certificates of deposit (in

denominations of $100,000 or more) |

432,168 |

419,301 |

405,575 |

397,707 |

384,559 |

| Other time accounts |

713,944 |

711,747 |

710,064 |

725,255 |

725,998 |

| Total deposits |

3,987,218 |

3,927,071 |

3,894,368 |

3,892,876 |

3,857,680 |

| |

|

|

|

|

|

| Short-term borrowings |

195,411 |

204,162 |

185,226 |

176,325 |

171,019 |

| Accrued expenses and other liabilities |

24,329 |

28,406 |

25,425 |

25,380 |

22,169 |

| |

|

|

|

|

|

| Total liabilities |

4,206,958 |

4,159,639 |

4,105,019 |

4,094,581 |

4,050,868 |

| |

|

|

|

|

|

| SHAREHOLDERS'

EQUITY: |

|

|

|

|

|

| Capital stock |

98,927 |

98,927 |

98,912 |

98,912 |

98,912 |

| Surplus |

172,964 |

173,144 |

173,408 |

173,897 |

174,386 |

| Undivided profits |

152,237 |

147,432 |

143,015 |

138,953 |

135,373 |

| Accumulated other comprehensive income

(loss), net of tax |

(9,452) |

(13,803) |

(15,923) |

(16,831) |

(169) |

| Treasury stock at cost |

(42,897) |

(43,887) |

(45,024) |

(46,308) |

(47,613) |

| |

|

|

|

|

|

| Total shareholders' equity |

371,779 |

361,813 |

354,388 |

348,623 |

360,889 |

| |

|

|

|

|

|

| Total liabilities and

shareholders' equity |

$ 4,578,737 |

4,521,452 |

4,459,407 |

4,443,204 |

4,411,757 |

| |

|

|

|

|

|

| Outstanding shares (thousands) |

94,564 |

94,463 |

94,334 |

94,204 |

94,071 |

| |

|

|

|

|

|

| NONPERFORMING

ASSETS |

|

|

|

|

|

| |

|

|

|

|

|

| (dollars in

thousands) |

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

| |

|

|

|

|

|

| Nonperforming

Assets |

|

|

|

|

|

| |

03/31/14 |

12/31/13 |

09/30/13 |

06/30/13 |

03/31/13 |

| New York and other

states* |

|

|

|

|

|

| Loans in nonaccrual status: |

|

|

|

|

|

| Commercial |

$ 4,853 |

6,952 |

5,436 |

5,891 |

5,978 |

| Real estate mortgage - 1 to 4

family |

34,597 |

31,045 |

30,643 |

30,736 |

34,027 |

| Installment |

103 |

93 |

71 |

36 |

35 |

| Total non-accrual loans |

39,553 |

38,090 |

36,150 |

36,663 |

40,040 |

| Other nonperforming real estate mortgages - 1

to 4 family |

162 |

166 |

170 |

174 |

225 |

| Total nonperforming loans |

39,715 |

38,256 |

36,320 |

36,837 |

40,265 |

| Other real estate owned |

4,707 |

3,348 |

3,011 |

3,918 |

4,461 |

| Total nonperforming assets |

$ 44,422 |

41,604 |

39,331 |

40,755 |

44,726 |

| |

|

|

|

|

|

| Florida |

|

|

|

|

|

| Loans in nonaccrual status: |

|

|

|

|

|

| Commercial |

$ 517 |

-- |

-- |

583 |

2,595 |

| Real estate mortgage - 1 to 4

family |

4,668 |

5,137 |

5,406 |

6,022 |

7,013 |

| Installment |

7 |

-- |

-- |

-- |

1 |

| Total non-accrual loans |

5,192 |

5,137 |

5,406 |

6,605 |

9,609 |

| Other nonperforming real estate mortgages - 1

to 4 family |

-- |

-- |

-- |

-- |

-- |

| Total nonperforming loans |

5,192 |

5,137 |

5,406 |

6,605 |

9,609 |

| Other real estate owned |

4,300 |

5,381 |

6,816 |

6,427 |

5,406 |

| Total nonperforming assets |

$ 9,492 |

10,518 |

12,222 |

13,032 |

15,015 |

| |

|

|

|

|

|

| Total |

|

|

|

|

|

| Loans in nonaccrual status: |

|

|

|

|

|

| Commercial |

$ 5,370 |

6,952 |

5,436 |

6,474 |

8,573 |

| Real estate mortgage - 1 to 4

family |

39,265 |

36,182 |

36,049 |

36,758 |

41,040 |

| Installment |

110 |

93 |

71 |

36 |

36 |

| Total non-accrual loans |

44,745 |

43,227 |

41,556 |

43,268 |

49,649 |

| Other nonperforming real estate mortgages - 1

to 4 family |

162 |

166 |

170 |

174 |

225 |

| Total nonperforming loans |

44,907 |

43,393 |

41,726 |

43,442 |

49,874 |

| Other real estate owned |

9,007 |

8,729 |

9,827 |

10,345 |

9,867 |

| Total nonperforming assets |

$ 53,914 |

52,122 |

51,553 |

53,787 |

59,741 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Quarterly Net

Chargeoffs |

|

|

|

|

|

| |

03/31/14 |

12/31/13 |

09/30/13 |

06/30/13 |

03/31/13 |

| New York and other

states* |

|

|

|

|

|

| Commercial |

$ 242 |

176 |

585 |

49 |

248 |

| Real estate mortgage - 1 to 4 family |

851 |

1,194 |

1,215 |

1,885 |

1,563 |

| Installment |

44 |

(2) |

25 |

13 |

15 |

| Total net chargeoffs |

$ 1,137 |

1,368 |

1,825 |

1,947 |

1,826 |

| |

|

|

|

|

|

| Florida |

|

|

|

|

|

| Commercial |

$ 612 |

(1) |

(502) |

(1) |

99 |

| Real estate mortgage - 1 to 4 family |

428 |

138 |

41 |

123 |

344 |

| Installment |

2 |

3 |

3 |

-- |

-- |

| Total net chargeoffs |

$ 1,042 |

140 |

(458) |

122 |

443 |

| |

|

|

|

|

|

| Total |

|

|

|

|

|

| Commercial |

$ 854 |

175 |

83 |

48 |

347 |

| Real estate mortgage - 1 to 4 family |

1,279 |

1,332 |

1,256 |

2,008 |

1,907 |

| Installment |

46 |

1 |

28 |

13 |

15 |

| Total net chargeoffs |

$ 2,179 |

1,508 |

1,367 |

2,069 |

2,269 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Asset Quality Ratios |

|

|

|

|

|

| |

03/31/14 |

12/31/13 |

09/30/13 |

06/30/13 |

03/31/13 |

| |

|

|

|

|

|

| Total nonperforming loans(1) |

$ 44,907 |

43,393 |

41,726 |

43,442 |

49,874 |

| Total nonperforming assets(1) |

53,914 |

52,122 |

51,553 |

53,787 |

59,741 |

| Total net chargeoffs(2) |

2,179 |

1,508 |

1,367 |

2,069 |

2,269 |

| |

|

|

|

|

|

| Allowance for loan losses(1) |

47,035 |

47,714 |

47,722 |

47,589 |

47,658 |

| |

|

|

|

|

|

| Nonperforming loans to total loans |

1.53% |

1.49% |

1.47% |

1.57% |

1.84% |

| Nonperforming assets to total assets |

1.18% |

1.15% |

1.16% |

1.21% |

1.35% |

| Allowance for loan losses to total loans |

1.60% |

1.64% |

1.68% |

1.72% |

1.76% |

| Coverage ratio(1) |

104.7% |

110.0% |

114.4% |

109.5% |

95.6% |

| Annualized net chargeoffs to average

loans(2) |

0.30% |

0.21% |

0.20% |

0.29% |

0.34% |

| Allowance for loan losses to annualized net

chargeoffs(2) |

5.4x |

7.9x |

8.7x |

6.0x |

5.3x |

| |

|

|

|

|

|

| * Includes New York,

New Jersey, Vermont and Massachusetts. |

|

|

|

|

|

| (1) At

period-end |

|

|

|

|

|

| (2) For the

period ended |

|

|

|

|

|

| |

| DISTRIBUTION

OF ASSETS, LIABILITIES AND SHAREHOLDERS' EQUITY- |

| INTEREST

RATES AND INTEREST DIFFERENTIAL |

| |

|

|

|

|

|

|

| (dollars in thousands) |

Three months ended |

Three months ended |

| (Unaudited) |

March 31, 2014 |

March 31, 2013 |

| |

Average Balance |

Interest |

Average Rate |

Average Balance |

Interest |

Average Rate |

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Securities available for sale: |

|

|

|

|

|

|

| U. S. government sponsored enterprises |

$ 169,355 |

506 |

1.19 % |

$ 270,953 |

816 |

1.20 % |

| Mortgage backed securities and collateralized

mortgage obligations-residential |

545,823 |

3,078 |

2.26 |

557,408 |

2,769 |

1.99 |

| State and political subdivisions |

6,133 |

105 |

6.85 |

18,556 |

285 |

6.15 |

| Corporate bonds |

8,548 |

59 |

2.78 |

47,358 |

218 |

1.84 |

| Small Business Administration-guaranteed

participation securities |

110,098 |

556 |

2.02 |

99,683 |

496 |

1.99 |

| Mortgage backed securities and collateralized

mortgage obligations-commercial |

10,939 |

38 |

1.39 |

8,378 |

29 |

1.38 |

| Other |

660 |

4 |

2.42 |

660 |

5 |

3.03 |

| |

|

|

|

|

|

|

| Total securities available for

sale |

851,556 |

4,346 |

2.04 |

1,002,996 |

4,618 |

1.84 |

| |

|

|

|

|

|

|

| Federal funds sold and other short-term

Investments |

575,352 |

351 |

0.25 |

405,953 |

245 |

0.24 |

| |

|

|

|

|

|

|

| Held to maturity securities: |

|

|

|

|

|

|

| Corporate bonds |

9,947 |

154 |

6.18 |

22,271 |

312 |

5.61 |

| Mortgage backed securities and collateralized

mortgage obligations-residential |

74,324 |

625 |

3.36 |

103,607 |

789 |

3.05 |

| |

|

|

|

|

|

|

| Total held to maturity

securities |

84,271 |

779 |

3.70 |

125,878 |

1,101 |

3.50 |

| |

|

|

|

|

|

|

| Federal Reserve Bank and Federal Home Loan

Bank stock |

10,500 |

133 |

5.07 |

9,632 |

119 |

4.94 |

| |

|

|

|

|

|

|

| Commercial loans |

222,332 |

2,797 |

5.03 |

216,210 |

2,847 |

5.27 |

| Residential mortgage loans |

2,355,125 |

26,982 |

4.60 |

2,136,067 |

25,684 |

4.83 |

| Home equity lines of credit |

340,681 |

2,936 |

3.49 |

333,434 |

2,800 |

3.41 |

| Installment loans |

5,596 |

167 |

12.11 |

4,528 |

158 |

14.20 |

| |

|

|

|

|

|

|

| Loans, net of unearned income |

2,923,734 |

32,882 |

4.52 |

2,690,239 |

31,489 |

4.70 |

| |

|

|

|

|

|

|

| Total interest earning

assets |

4,445,413 |

38,491 |

3.48 |

4,234,698 |

37,572 |

3.56 |

| |

|

|

|

|

|

|

| Allowance for loan losses |

(48,219) |

|

|

(48,458) |

|

|

| Cash & non-interest earning assets |

130,091 |

|

|

152,902 |

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Total assets |

$ 4,527,285 |

|

|

$ 4,339,142 |

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Liabilities and

shareholders' equity |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

| Interest bearing checking accounts |

$ 605,741 |

84 |

0.06 % |

$ 552,575 |

80 |

0.06 % |

| Money market accounts |

646,601 |

599 |

0.38 |

659,172 |

685 |

0.42 |

| Savings |

1,225,364 |

763 |

0.25 |

1,203,580 |

916 |

0.31 |

| Time deposits |

1,139,811 |

1,951 |

0.69 |

1,088,877 |

1,820 |

0.68 |

| |

|

|

|

|

|

|

| Total interest bearing

deposits |

3,617,517 |

3,397 |

0.38 |

3,504,204 |

3,501 |

0.41 |

| Short-term borrowings |

202,175 |

393 |

0.79 |

168,059 |

364 |

0.88 |

| |

|

|

|

|

|

|

| Total interest bearing

liabilities |

3,819,692 |

3,790 |

0.40 |

3,672,263 |

3,865 |

0.43 |

| |

|

|

|

|

|

|

| Demand deposits |

316,009 |

|

|

287,700 |

|

|

| Other liabilities |

22,311 |

|

|

20,003 |

|

|

| Shareholders' equity |

369,273 |

|

|

359,176 |

|

|

| |

|

|

|

|

|

|

| Total liabilities and shareholders'

equity |

$ 4,527,285 |

|

|

$ 4,339,142 |

|

|

| |

|

|

|

|

|

|

| Net interest income , tax equivalent |

|

34,701 |

|

|

33,707 |

|

| |

|

|

|

|

|

|

| Net interest spread |

|

|

3.08 % |

|

|

3.13 % |

| |

|

|

|

|

|

|

| Net interest margin (net interest income to

total interest earning assets) |

|

|

3.13 % |

|

|

3.19 % |

| |

|

|

|

|

|

|

| Tax equivalent adjustment |

|

(45) |

|

|

(102) |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Net interest income |

|

34,656 |

|

|

33,605 |

|

Non-GAAP Financial Measures Reconciliation

Tangible book value per share and tangible equity as a

percentage of tangible assets at period end are non-GAAP financial

measures derived from GAAP-based amounts. We calculate tangible

equity and tangible assets by excluding the balance of intangible

assets from shareholders' equity and total assets, respectively. We

calculate tangible book value per share by dividing tangible equity

by common shares outstanding, as compared to book value per common

share, which we calculate by dividing shareholders' equity by

common shares outstanding. We calculate tangible equity as a

percentage of tangible assets at period end by dividing tangible

equity by tangible assets at period end. We believe that this is

consistent with the treatment by bank regulatory agencies, which

exclude intangible assets from the calculation of risk-based

capital ratios.

The efficiency ratio is a non-GAAP measure of expense control

relative to recurring revenue. We calculate the efficiency

ratio by dividing total noninterest expenses as determined under

GAAP, but excluding other real estate expense, net, which we refer

to below as recurring expense, by net interest income (fully

taxable equivalent) and total noninterest income as determined

under GAAP, but excluding net gains on securities from this

calculation, which we refer to below as recurring revenue. We

believe that this provides one reasonable measure of core expenses

relative to core revenue.

We believe that these non-GAAP financial measures provide

information that is important to investors and that is useful in

understanding our financial position, results and ratios. Our

management internally assesses our performance based, in part, on

these measures. However, these non-GAAP financial measures are

supplemental and are not a substitute for an analysis based on GAAP

measures. As other companies may use different calculations for

these measures, this presentation may not be comparable to other

similarly titled measures reported by other companies. A

reconciliation of the non-GAAP measures of tangible common equity,

tangible book value per share and efficiency ratio to the

underlying GAAP numbers is set forth below.

| NON-GAAP

FINANCIAL MEASURES RECONCILIATION |

|

|

|

| |

|

|

|

| (dollars in

thousands, except per share amounts) |

|

|

|

| (Unaudited) |

|

|

|

| |

03/31/14 |

12/31/13 |

03/31/13 |

| Tangible Book Value Per

Share |

|

|

|

| |

|

|

|

| Equity |

$ 371,779 |

361,813 |

360,889 |

| Less: Intangible assets |

553 |

553 |

553 |

| Tangible equity |

371,226 |

361,260 |

360,336 |

| |

|

|

|

| Shares outstanding |

94,564 |

94,463 |

94,071 |

| Tangible book value per share |

3.93 |

3.82 |

3.83 |

| Book value per share |

3.93 |

3.83 |

3.84 |

| |

|

|

|

| Tangible Equity to Tangible

Assets |

|

|

|

| Total Assets |

4,578,737 |

4,521,452 |

4,411,757 |

| Less: Intangible assets |

553 |

553 |

553 |

| Tangible assets |

4,578,184 |

4,520,899 |

4,411,204 |

| |

|

|

|

| Tangible Equity to Tangible Assets |

8.11% |

7.99% |

8.17% |

| Equity to Assets |

8.12% |

8.00% |

8.18% |

| |

|

|

|

| |

3 Months

Ended |

| Efficiency Ratio |

03/31/14 |

12/31/13 |

03/31/13 |

| |

|

|

|

| Net interest income (fully taxable

equivalent) |

$ 34,701 |

34,577 |

33,707 |

| Non-interest income |

5,759 |

4,848 |

4,592 |

| Less: Net gain on sale of building |

1,556 |

-- |

-- |

| Less: Net gain on securities |

6 |

188 |

2 |

| Recurring revenue |

38,898 |

39,237 |

38,297 |

| |

|

|

|

| Total Noninterest expense |

20,801 |

20,891 |

21,557 |

| Less: Other real estate expense,

net |

855 |

430 |

749 |

| Recurring expense |

19,946 |

20,461 |

20,808 |

| |

|

|

|

| Efficiency Ratio |

51.28% |

52.15% |

54.33% |

CONTACT: Kevin T. Timmons

Vice President/Treasurer

(518) 381-3607

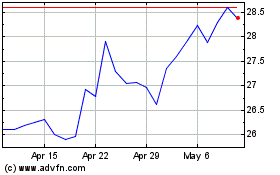

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Mar 2024 to Apr 2024

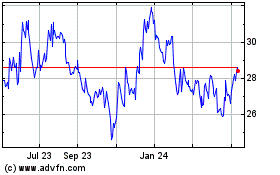

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Apr 2023 to Apr 2024