The ETF industry has been growing for more than two decades, as

exchange traded products have cracked the investing space wide

open. With nearly $3 trillion in total global assets, it is clear

that these vehicles are here to stay. To better educate our

audience, we offer 101 ETF fun facts that many investors probably

are not aware of. To share a fun fact, simply click the “Tweet

this!” caption next to the phrase.

1. If investors took the $158 billion out of SPY (0.0945%

ER) and put it into VOO (0.05%), they’d save $70 million

annually in management fees (Tweet this!). 2. During an average

trading day, about 5,000 shares of SPY trade hands each second

(Tweet this!). 3.

For a

brief time in

2011, GLD was the largest US ETF

by assets. GLD now has $34 billion, compared to $162 billion

for SPY (Tweet this!). 4. There are 3 ETFs that

have positive returns in each of the last 6 years: iShares 1-3

Year Credit Bond (CSJ), Barclays Short Term Municipal Bond ETF

(SHM), and Vanguard Short Term Bond ETF (BSV) (Tweet this!). 5. The

best performing ETF in 2008 was UltraShort Semiconductors (SSG),

which gained 111% (Tweet this!). 6. The biggest one day gain for

the Daily Gold Miners Bear 3x (DUST) is 29%, on April 15, 2013. The

biggest 1-day loss was 27%, on September 18 of that year (Tweet

this!).

7. In August 2011, TVIX had two

separate sessions where it was up at least 40% (August 4 and August

18) (Tweet this!). 8. QQQ owns about 10 million shares of AAPL, or

about 0.1% of the total outstanding (Tweet this!). 9. In 2008,

investors could purchase the Metabolic-Endocrine Disorders ETF

(HHM), Dermatology & Wound Care ETF (HRW) and

Autoimmune-Inflammation ETF (HHA). Seriously (Tweet this!). 10. The

smallest country, in terms of GDP, with a dedicated US-listed

ETF is Vietnam (Tweet this!). 11. The largest country, in

terms of GDP, without a dedicated US-listed ETF is Saudi

Arabia (19th largest economy) (Tweet this!). 12. The smallest

country, in terms of population, with a dedicated US-listed ETF is

New Zealand (ENZL, 4.5 million people) (Tweet this!). 13. The

largest country, in terms of population, without a

dedicated US-listed ETF is Pakistan (6th largest

population with 186 million people) (Tweet this!). 14. Since

launching in 1993, SPY has had 2,857 “up” sessions, 2,423 “down”

sessions and 65 unchanged sessions (Tweet this!). 15. The largest

holding of the Belgium ETF (EWK) is Anheuser-Busch Inbev, at 22% of

assets. In 2013, InBev generated 89% of its EBITDA from North,

Latin, and South America (Tweet this!). 16. Since it launched in

January 2009, the VIX ETN (VXX) has lost 99.3% of its value (Tweet

this!). 17. Since 2010, more than 250 ETFs have closed (Tweet

this!). 18. Since launching in 1993, SPY is up approximately 527%

(Tweet this!). 19. In the 5 years after March 6, 2009, the Daily

Technology Bull 3x (TECL) was up 3,237%. A $10,000 investment would

have turned into about $334,000 (Tweet this!). 20. There are about

177 stocks that are in both the S&P 500 Value (IVE) and Growth

(IVW) ETFs (Tweet this!). 21. SPY, RSP, and RWL all hold the exact

same 500 stocks. In 2013, they were up 32.3%, 35.5%, and 37.9%,

respectively (Tweet this!). 22. Taiwan has a higher per capita GDP

than Portugal and higher literacy rate than Spain. It is one of the

largest allocations in emerging market ETFs: about 14% of VWO and

12% of EEM (Tweet this!). 23. South Korea represents 15% of EEM and

0% of VWO (Tweet this!). 24. The average holding period for SPY is

about a week (Tweet this!). 25. The average holding period for the

S&P 500 VIX Short Term Futures ETN (VXX) is about 4.5 hours

(Tweet this!). 26. The average holding period for the 2050 Target

Retirement Date ETF (TZY) is about 3 weeks (Tweet this!).

27. GLD and IAU are taxed as collectibles,

at a rate of 28% (Tweet this!). 28. There are more than 370 ETFs

that can be traded commission free (Tweet this!). 29. The

largest non-precious metals, non-oil/gas single commodity ETF is

CORN, with $125 million in assets (Tweet this!). 30. Williams

Sonoma (WSM), Tempur Sealy (TPX), Bet Bath & Beyond (BBBY),

Whirlpool (WHR), and Home Depot (HD) are components of the

Homebuilders ETF (XHB) (Tweet this!). 31. About 45% of the

Vanguard Small Cap ETF (VB) is in mid cap stocks (according to the

Morningstar classification) (Tweet this!). 32. The Vanguard

Dividend Appreciation ETF (VIG) has a 30-Day SEC yield of 2.1%,

compared to 2.0% for the S&P 500 ETF (VOO) (Tweet this!). 33.

The largest holding of the Spain ETF (EWP) is Banco Santander. In

2013, Santander generated about 7% of its profit from Spain (23%

from Brazil, and 10% from the U.S.) (Tweet this!). 34. Since its

launch in March 2012, the PIMCO Total Return ETF (BOND, +12.1%) has

outperformed its mutual fund counterpart (PTTRX, +6.3%) (Tweet

this!). 35. Since December ’98 launch: XLE +366%, XLB

+207%, XLY +202%, XLV +186%, XLI +181%, XLU

+122%, XLP +115%, XLK +30%, XLF +27% (Tweet this!).

36. The “deepest” equity ETF is Vanguard’s Total International

Stock ETF (VXUS) with about 5,500 components (Tweet this!). 37. The

Harvard Endowment lists 18 ETFs among its holdings in regulatory

filings, including GLD, MDY, HYG, EWM, and EWY (Tweet this!). 38.

About 850 ETFs, or 55% of total, have less than $100 million in

assets. Of those, 335 ETFs have less than $10 million in assets

(Tweet this!). 39. The ticker symbol ETF is associated with the

Aberdeen Emerging Markets Smaller Company Opportunities Fund (Tweet

this!). 40. The most profitable ETF is EEM, which generates about

$195 million in annual management fees (Tweet this!). 41. Lehman

Brothers launched 3 ETNs in 2008, 7 months before they went

bankrupt (Tweet this!). 42. In a 2012 study, 42.5% of advisors said

they don’t use ETFs simply because they don’t know enough about

them (Tweet this!). 43. Since 2008, RSP has outperformed SPY in

every year except for 2011 (Tweet this!). 44. On 5/6/2010 (the

Flash Crash), SPY had a range of $105 to $117 (Tweet this!). 45.

ETFs make up about 13% of total equity market daily trading volume

(Tweet this!). 46. The total assets under management for Currency

ETFs is around $3.87 billion, which is quite paltry compared to the

size of the FOREX market, which trades $4 trillion daily (Tweet

this!). 47. WisdomTree’s CEO, Jonathan Steinberg, is married to

FOX’s financial journalist Maria Bartiromo (Tweet this!). 48.

WisdomTree is the only “pure-play” ETF issuer that is publicly

traded under the ticker WETF (Tweet this!). 49. The most expensive

ETF per-share is BXUC at $269.95 (Tweet this!). 50. The cheapest

ETF per-share is CVOL at $2.67 (Tweet this!). 51. The smallest ETF

in terms of AUM is DFVL at $466,300 (Tweet this!). 52. One of the

secrets to Vanguard’s ultra-low expense fees is that shareholders

receive 100% of revenues from their securities-lending business

after other fees are paid out (Tweet this!). 53. SPY is structured

as a UIT, not an ETF (Tweet this!). 54. iShares issues the most

ETFs on the market with 305 total funds (Tweet this!). 55. Only

ETFs that invest in futures contracts will issue K-1s (Tweet

this!). 56. QQQ used to have the ticker QQQQ (Tweet this!). 57.

Just 65 out of 545 ETFs had a positive return in 2008 (Tweet

this!).

58. UUP has not had a positive annual

return since 2008, once QE began (Tweet this!). 59. The most ETFs

launched in one year was 310 in 2011 (Tweet this!). 60. It would

take the assets of the 9 largest ETFs to equal the market cap of

AAPL (Tweet this!). 61. ETFs can split and reverse split their

shares in the same manner as stocks (Tweet this!). 62. IVV invests

in the S&P 500, but unlike SPY, reinvests its dividends in

itself before paying them out (Tweet this!). 63. Soybeans and and

Wheat are tracked exclusively by one ETF each: SOYB and WEAT (Tweet

this!). 64. ETNs will never incur tracking error, but they are at

the credit risk of their issuer (Tweet this!). 65. It took over two

years from the time of SPY’s launch for a second ETF to hit the

market (Tweet this!). 66. Globally, there are over 5,000 ETPs from

over 200 providers across 59 exchanges (Tweet this!). 67. The

global ETF market totals over $2.9 trillion in AUM; U.S.-listed

securities make up over 70% of that figure (Tweet this!).

68. The most ETFs closed in one year was 102 in 2012 (Tweet

this!). 69. Ray Dalio’s prolific hedge fund, Bridgewater, manages

$150 billion for clients worldwide; by comparison, the largest

hedge fund ETF, the IQ Hedge Multi-Strategy Tracker (QAI), manages

under $700 million (Tweet this!). 70. Of the 1,586 ETPs currently

on the market, passive-based funds account for 95% of the products;

there are only 79 actively-managed ETFs in total (Tweet this!). 71.

There are 140 Inverse ETFs for Bearish traders – 49 are -1x Short,

55 are -2x Short, and 36 are -3x Short (Tweet this!). 72. The

average expense ratio for actively-managed ETFs is right around

0.79%; the average for passive ETFs is 0.57% (Tweet this!). 73. Of

the 1,586 ETPs currently on the market, roughly one-third of all

funds are focused on U.S. equities (Tweet this!). 74. Of the 1,000

Equity ETFs on the market, only 116 of them, or just over 10%, are

focused exclusively on small caps (Tweet this!). 75. Of the 1,586

ETPs currently on the market, only 119, or just over 10%, have at

least a 10-year track record (Tweet this!). 76. Between its first

full year of trading in 1994, and 2013, SPY has turned in 16

positive annual performances and lost ground in four years (Tweet

this!). 77. SPY has gained as much as 19.4% and lost as much as

19.8% over the course of 5 trading sessions (Tweet this!). 78.

Between its first full year of trading in 2005, and 2013, GLD has

endured only a single negative annual return and it was in 2013

(Tweet this!). 79. The product of each ETF’s asset and expense

ratio is about $5 billion (in other words, total industry revenue)

(Tweet this!).

80. In 2013, the PowerShares Golden Dragon

China ETF (PGJ) was up about 60%. FXI, the largest China ETF, was

down 2% that year (Tweet this!). 81. The entire holdings of GLD

(worth about $34 billion) would fit in a 4x4x4 box (Tweet this!).

82. EEH once went 49 consecutive sessions without trading a share

(December 2012 to February 2013) (Tweet this!). 83. The ETF with

the largest allocation to FB is SOCL, at about 12% of assets (Tweet

this!). 84. About 56% of the holdings of FXI, the largest China

ETF, are banks (Tweet this!). 85. Other terms abbreviated ETF

include Early Termination Fees, Employee Trust Funds, and Escape

the Fate (Tweet this!). 86. In 2013, hedged Japan (DXJ) was up

about 41%. Unhedged (EWJ) was up 26% (Tweet this!). 87. Goldman’s

Emerging Markets Mutual Fund (GEMCX) charges a 2.47% ER. Since May

2005, it’s lagged VWO (0.15%) by 40% (Tweet this!). 88. Ben Stein

has publicly touted ETFs as some of his favorite investment tools

(Tweet this!). 89. Europe’s ETF industry makes up roughly 18% of

global ETF assets (Tweet this!). 90. The “father of ETFs,” Nathan

“Nate” Most, was 73 when he conceived of exchange-traded funds. He

began his career trading safflower seeds and coconut oil futures

(Tweet this!). 91. In 1993, when SPY made its debut, Ben Bernanke

was a Princeton professor, Steve Jobs was working at NeXT, George

Soros had just broken the pound, and Mark Zuckerburg was in 3rd

grade (Tweet this!). 92. For a brief period of time, investors

could buy a Texas (TXF) and Oklahoma (OOK) ETF. Though the funds

closed, investors can still invest in Nashville (NASH) (Tweet

this!). 93. Believe it or not, investors used to have several

“religiously-driven” ETF options. The lineup included Catholic,

Lutheran, Methodist, Christian, and Baptist Value ETFs (Tweet

this!). 94. The ETF with the highest expense ratio is the Sugar

Fund (CANE) at 2.32% (Tweet this!). 95. The ETF with the cheapest

expense ratio is the Treasury Floating Rate Bond ETF (TFLO) – it

charges 0% (Tweet this!). 96. Of all the ETFdb equity types,

investors can find the most options in Energy ETFs (there are 66 of

them) (Tweet this!). 97. There are over 120 2x leveraged ETFs, and

nearly 85 3x ETFs (Tweet this!). 98. From 2009 to 2010, the S&P

500 VIX Futures ETN (VXX) was the worst performing ETF in every

quarter except for two (Tweet this!). 99. The most heavily traded

Currency ETF is the DB USD Index Bullish ETF (UUP). It also happens

to be the largest currency ETF with over $670 M in AUM (Tweet

this!). 100. When the PIMCO Total Return ETF (BOND) launched in

2012, it amassed more than $3.8 billion during the year. In 2013,

the fund saw net outflows of over $112 million (Tweet this!). 101.

Every time an advisor converts from a pricey mutual fund to an ETF,

a puppy gets to play with a tennis ball (Tweet this!).

[For more ETF analysis, make sure to sign up for our free

ETF newsletter]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

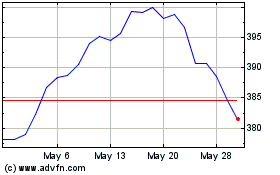

SPDR DJ Industrial Avera... (AMEX:DIA)

Historical Stock Chart

From Apr 2024 to May 2024

SPDR DJ Industrial Avera... (AMEX:DIA)

Historical Stock Chart

From May 2023 to May 2024