|

|

|

|

|

THE ADVISORS’ INNER CIRCLE FUND

|

|

CBRE CLARION

|

|

|

|

LONG/SHORT FUND

|

|

|

|

JANUARY 31, 2014

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

|

|

Value

|

|

|

EXCHANGE TRADED FUNDS — (10.4)%

|

|

|

|

|

|

|

|

|

|

CurrencyShares Australian Dollar Trust

|

|

|

(210,100

|

)

|

|

|

|

$

|

(18,415,265

|

)

|

|

CurrencyShares Japanese Yen Trust *

|

|

|

(97,334

|

)

|

|

|

|

|

(9,303,184

|

)

|

|

iShares Dow Jones U.S. Real Estate Index

|

|

|

(472,400

|

)

|

|

|

|

|

(30,824,100

|

)

|

|

iShares MSCI Hong Kong Index

|

|

|

(309,000

|

)

|

|

|

|

|

(5,908,080

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL EXCHANGE TRADED FUNDS

(Proceeds $64,099,819)

|

|

|

|

|

|

|

|

|

(64,450,629

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL SECURITIES SOLD SHORT — (47.1)%

(Proceeds $291,285,800) #

|

|

|

|

|

|

|

|

$

|

(291,629,903

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $618,972,633.

|

‡

|

Includes U.S. Real Estate Investment Trusts (“REIT”) and Real Estate Operating Companies (“REOC”) as well as entities similarly formed under the laws of

non-U.S. countries.

|

|

*

|

Non-income producing security.

|

|

(A)

|

All or a portion of this security has been committed as collateral for securities sold short as of January 31, 2014.

|

|

(B)

|

Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only

to dealers in that program or other “accredited investors.” These securities have been determined to be liquid under guidelines established by the Board of Trustees.

|

Cl — Class

As of January 31, 2014, all of the Fund’s investments and securities

sold short were considered Level 1 in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. Generally Accepted Accounting Principles.

For the period ended January 31, 2014, there were no transfers between levels and there were no Level 3 securities.

@ At January 31, 2014, the tax basis cost of the Fund’s investments was $736,791,424, and the unrealized appreciation and depreciation were $32,190,330 and $(17,661,323), respectively.

# At January 31, 2014, the tax basis proceeds of the Fund’s securities sold short were $291,285,800, and the unrealized

appreciation and depreciation were $7,628,926 and $(7,973,029), respectively.

For information on the Fund’s policy regarding

valuation of investments, fair value hierarchy levels and other significant accounting policies, please refer to Note 2 of the Fund’s most recent financial statements.

CCS-QH-001-0500

4

|

Item 2.

|

Controls and Procedures

|

(a) The

registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company

Act of 1940 (the “1940 Act”)) are effective, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934 as of a date

within 90 days of the filing date of this report.

(b) There were no significant changes in the registrant’s internal control over

financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the registrant’s last fiscal quarter that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control

over financial reporting.

(a) A separate certification

for the principal executive officer and the principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940, as amended (17 CFR 270.30a-2(a)), are filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

The Advisors’ Inner Circle Fund

|

|

|

|

|

|

|

By (Signature and Title)

|

|

|

|

|

|

/s/ Michael Beattie

|

|

|

|

|

|

|

|

Michael Beattie

|

|

|

|

|

|

|

|

President

|

Date: March 31, 2014

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in

the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

By (Signature and Title)

|

|

|

|

|

|

/s/ Michael Beattie

|

|

|

|

|

|

|

|

Michael Beattie

|

|

|

|

|

|

|

|

President

|

Date: March 31, 2014

|

|

|

|

|

|

|

|

|

By (Signature and Title)

|

|

|

|

|

|

/s/ Michael Lawson

|

|

|

|

|

|

|

|

Michael Lawson

|

|

|

|

|

|

|

|

Treasurer, Controller & CFO

|

Date: March 31, 2014

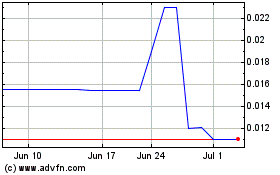

CirTran (PK) (USOTC:CIRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

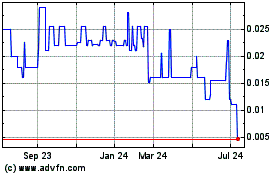

CirTran (PK) (USOTC:CIRX)

Historical Stock Chart

From Apr 2023 to Apr 2024