CIC Reports Fiscal 2013 Results

March 31 2014 - 9:23AM

Communication Intelligence Corporation ("CIC") (OTCQB:CICI), a

leading supplier of electronic signature and business document work

flow solutions, today reported total revenue of $1,418,000 for the

year ended December 31, 2013, a decrease of $960,000, or 40%,

compared to total revenue of $2,378,000 for the prior year.

"We completed a challenging 2013, in which we invested heavily

in new technology," said Philip Sassower, chairman and chief

executive officer for CIC. "Our new software platform enables

bi-directional on-premise and Cloud server migration. It supports

both enterprise-wide and workflow-specific solutions, and can be

quickly and efficiently deployed. This development effort

represented a necessary and major step forward in terms of rapid

enterprise integration and deployment for electronic signature, as

well as the scalability needed for managing tens of millions of

simple-to-complex transactions within a single enterprise. The new

SignatureOne® Enterprise was released near the end of the year and

supported the higher revenue run rate achieved in the last three

months of the year. With our product transition now complete, the

successful completion of our recently announced funding round and a

strong pipeline of opportunities, we remain highly confident in

CIC's ability to resume its earlier growth trend."

For the year ended December 31, 2013, operating expenses were

$5,715,000, an increase of $283,000, or 5%, compared to operating

expenses of $5,432,000 in the prior year. This increase was

primarily due to higher stock option expenses and outsourced

engineering services, offset by lower commissions and professional

services.

For the year ended December 31, 2013, the net loss attributable

to common stockholders was $8,099,000, an increase of $1,355,000,

or 20%, compared to a net loss attributable to common stockholders

of $6,744,000 in the prior year. This increase was primarily due to

the $1,243,000 increase in loss from operations from 2012 to 2013,

resulting from lower revenue and an increase in certain non-cash

charges related to our funding activities, including net charges of

$227,000 related to certain warrant issuances and a $67,000 loss on

extinguishment of debt. This was offset by a decrease of $324,000

in charges associated with preferred stock beneficial conversion

features and dividends and a gain of $108,000 on derivative

liability.

Additional financial information regarding CIC's operating

results for the year ended December 31, 2013, will be available in

the Company's Annual Report on Form 10-K that will be filed with

the Securities and Exchange Commission and available at

www.sec.gov.

About CIC

CIC is a leading supplier of electronic signature products and

business document workflow solutions. CIC enables companies to

achieve truly paperless workflow in their electronic business

processes by providing multiple signature and digital transaction

management technologies across virtually all applications. CIC's

solutions are available both on-premise and in the Cloud as a

service, and afford "straight-through-processing," which can

increase customer revenue by enhancing user experience and can also

reduce costs through paperless and virtually error-free electronic

transactions that can be completed significantly quicker than

paper-based procedures. CIC is headquartered in Silicon Valley. For

more information, please visit our website at http://www.cic.com.

CIC's logo is a trademark of CIC.

Forward Looking Statements

Certain statements contained in this press release, including

without limitation, statements containing the words "believes",

"anticipates", "hopes", "intends", "expects", and other words of

similar import, constitute "forward looking" statements within the

meaning of the Private Litigation Reform Act of 1995. Such

statements involve known and unknown risks, uncertainties and other

factors, which may cause actual events to differ materially from

expectations. Such factors include the following (1) technological,

engineering, quality control or other circumstances which could

delay the sale or shipment of products containing the Company's

technology; (2) economic, business, market and competitive

conditions in the software industry and technological innovations

which could affect customer purchases of the Company's solutions;

(3) the Company's inability to protect its trade secrets or other

proprietary rights, operate without infringing upon the proprietary

rights of others or prevent others from infringing on the

proprietary rights of the Company; and (4) general economic and

business conditions and the availability of sufficient

financing.

CONTACT: CIC

Investor Relations & Media Inquiries:

Andrea Goren

+1.650.802.7723

agoren@cic.com

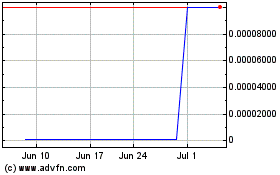

iSign Solutions (CE) (USOTC:ISGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

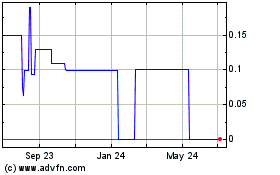

iSign Solutions (CE) (USOTC:ISGN)

Historical Stock Chart

From Apr 2023 to Apr 2024