Definitive Materials Filed by Investment Companies. (497)

February 14 2014 - 4:37PM

Edgar (US Regulatory)

CRM Mutual Fund Trust

(the “Trust”)

CRM Small Cap Value Fund

CRM Small/Mid Cap Value Fund

CRM Mid Cap Value Fund

CRM Large Cap Opportunity Fund

CRM All Cap Value Fund

CRM Global Opportunity Fund

CRM International Opportunity Fund

(each a “Fund” and together, the “Funds”)

Institutional and Investor Shares

Supplement Dated February 14, 2014

to the Prospectus and Statement of Additional Information

Dated October 28, 2013, as supplemented on December 17, 2013

Capitalized terms used without definition below have the meanings given to them in the Prospectus and Statement of Additional Information.

This document should be read together with the Prospectus and Statement of Additional Information.

The following information

supplements the Prospectus and Statement of Additional Information for each of the CRM Funds and supersedes any contrary information:

PORTFOLIO MANAGERS

Ronald McGlynn, Chairman and Jay Abramson, CEO & CIO are responsible for the overall management of the CRM Funds. The investment research

team for all of the CRM Funds consists of 16 individuals, with an average of 16 years investment and financial experience. The portfolio managers who have responsibility for the day-to-day management of each Fund are set forth below.

|

|

|

|

|

|

|

CRM Small Cap

Value Fund

|

|

CRM Small/Mid Cap

Value Fund

|

|

CRM Mid Cap

Value Fund

|

|

Michael J. Caputo

|

|

Jay B. Abramson

|

|

Jay B. Abramson

|

|

Brian M. Harvey, CFA

|

|

Jonathan Ruch

|

|

Thad Pollock

|

|

|

|

|

|

|

|

|

|

CRM Large Cap

Opportunity Fund

|

|

CRM All Cap

Value Fund

|

|

CRM Global

Opportunity Fund

|

|

CRM International

Opportunity Fund

|

|

Jay B. Abramson

|

|

Jay B. Abramson

|

|

Jay B. Abramson

|

|

Andrey A. Belov, Ph.D.

|

|

Robert Maina

|

|

Michael J. Caputo

|

|

Andrey A. Belov, Ph.D.

|

|

Sackett S. Cook

|

|

|

|

Jeffrey B. Reich, MD

|

|

|

|

|

Please consult the CRM Funds Prospectus for additional information regarding the CRM Funds’ portfolio

managers, including their business experience for at least the past five years. The CRM Funds SAI provides additional information about compensation of the portfolio managers listed above, the other funds, pooled investment vehicles and accounts

they manage, and their ownership of securities of the Funds.

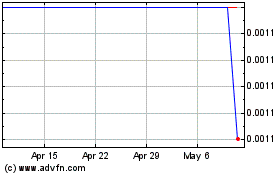

3Power Energy (CE) (USOTC:PSPW)

Historical Stock Chart

From Mar 2024 to Apr 2024

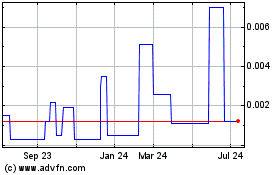

3Power Energy (CE) (USOTC:PSPW)

Historical Stock Chart

From Apr 2023 to Apr 2024