Hain Celestial Q2 Earnings Rise Y/Y, Ests Lag - Analyst Blog

February 05 2014 - 9:40AM

Zacks

Yesterday, The Hain

Celestial Group, Inc. (HAIN) posted improved financial

results on a year-over-year basis for second-quarter fiscal 2014,

with both the top and bottom lines registering double digit growth.

Despite that, the share price of this natural food and personal

care products retailer fell approximately 7.9% in yesterday’s

after-hour trading session as its top and bottom lines both fell

short of the Zacks Consensus Estimate. Moreover, investors remain

concerned about the company’s margins that were hit hard by

increased input costs.

The company’s adjusted earnings of

87 cents from continuing operations for the quarter registered a

rise of 17.6% from the year-ago quarter figure of 74 cents. The

year-over-year growth came primarily on the back of a rise in sales

and leveraged selling, general and administrative (SG&A)

expenses. However, quarterly earnings missed the Zacks Consensus

Estimate by a penny. On a reported basis, the company’s earnings

came in at 84 cents per share, up 25.4% from the year-ago quarter

figure of 67 cents.

Management stated that a healthy

industry trend, consumer demand and new products facilitated the

company to post the strong quarterly sales of $534.9 million, up

17.5% from the prior-year quarter. However, the reported figure

came below the Zacks Consensus Estimate of $544.0 million.

Net sales in the United States

increased 16.9% year over year to $327.7 million in the quarter,

while net sales in the United Kingdom increased 21.5% to $146.1

million. Operations in the Rest of World segment witnessed a 11.6%

increase in net sales to $61.1 million.

The company witnessed strong

performance across all of its brands with 19 brands registering

double-digit year-over-year growth while 5 brands registered

mid-to-high single-digit growth. Hain Celestial’s top line recorded

robust contribution from Spectrum, MaraNatha, The Greek Gods,

Garden of Eatin’, Arrowhead Mills, Celestial Seasonings, Jason,

Alba Botanica, Linda McCartney, Cully & Sully, Danival and

Europe's Best brands. The company also experienced solid sales

across new brands acquired after first-quarter fiscal 2013

including Hartley's, Robertson's, Sun-Pat, Frank Cooper's, Gale's

and BluePrint and Ella’s Kitchen.

Adjusted gross profit rose 11.1%

year over year to $145.3 million in the quarter. However, as a

percentage of sales, it contracted 150 basis points (bps) to 27.2%

due to increased commodity costs, unfavorable product mix and

negative impact from change in recording trade spending.

Adjusted operating income rose

21.5% to $66.9 million in the quarter. Moreover, adjusted operating

margin expanded approximately 40 bps to 12.5% primarily driven by

leveraged SG&A expenses which more than offset the negative

impact of lower gross margin.

Other Financial

Details

The company ended the quarter with

cash and cash equivalents of $67.5 million, long-term debt

excluding current maturities of $627.5 million and shareholders’

equity of $1,351.1 million, reflecting a debt-to-capitalization of

31.7%. Cash flow from operating activities in the first six

months of fiscal 2014 was $52.7 million.

Outlook

We believe that the company will

sustain the strong momentum across entire business segments and

will be favorably poised to capitalize on the growing global demand

for organic products.

Alongside, buoyed by improved

quarterly results and taking into account the recent acquisition of

Tilda Limited, a renowned name in Basmati rice, Hain Celestial

raised its top and bottom-line outlook for fiscal 2014. The company

now anticipates sales to come in the range of $2,115 – $$2,145

million, up from the previously forecasted range of $2,025 – $2,050

million, marking a year-over-year increase of 22% to 24%. Earnings

per share are now expected to come between $3.07 and $3.15 against

the earlier projection of $2.95 to $3.05. The Zacks Consensus

Estimate for the fiscal year stands at $3.10 per share.

Other Stocks to

Consider

Currently, Hain Celestial carries a

Zacks Rank #2 (Buy). Some other stocks that look promising in the

food industry include ConAgra Foods, Inc.

(CAG), Green Mountain Coffee Roasters, Inc.

(GMCR) and J&J Snack Foods Corp. (JJSF). All

of these carry the same Zacks Rank as Hain Celestial.

CONAGRA FOODS (CAG): Free Stock Analysis Report

GREEN MTN COFFE (GMCR): Free Stock Analysis Report

HAIN CELESTIAL (HAIN): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

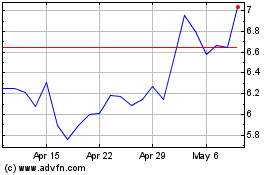

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

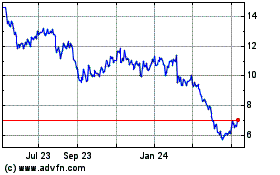

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Apr 2023 to Apr 2024