New Zealand Energy Production and Operational Update

January 06 2014 - 6:00AM

Marketwired Canada

New Zealand Energy Corp. (TSX VENTURE:NZ)(OTCQX:NZERF) today provided an update

on its production and operational activities. The Company is currently producing

approximately 236 barrels ("bbl") per day of light, high-quality oil (average

daily production net to NZEC during December 2013) from eight wells in the

Taranaki Basin of New Zealand's North Island, with the expectation that three

more wells will contribute to production by the end of Q1-2014.

HIGHLIGHTS

TWN Reactivated Wells (NZEC 50% interest)

-- Six wells reactivated and producing oil from Tikorangi Formation using

installed gas lift

-- Total production (100% basis) during December 2013: 9,332 bbl oil, 16.2

million cubic feet ("mmcf") natural gas(1)

-- Total production net to NZEC during December 2013: 4,666 bbl oil

-- Average daily production (100% basis) during December 2013: 302 bbl oil,

0.52 mmcf natural gas,1 average water cut 74%

-- Average daily production net to NZEC during December 2013: 151 bbl oil

TWN Recompleted Well (NZEC 50% interest)

-- Existing Tikorangi Waihapa-2 well recompleted uphole to access bypassed

production in Mt. Messenger Formation

-- Perforated two zones, well flowed from natural reservoir pressure for

three short flow tests

-- A further flow test planned for early January, followed by shut-in for

pressure build-up

-- Commercial production expected in early February

-- Recompletion activities on a second well expected to commence by mid-

January

Eltham Permit Wells (NZEC 100% interest)

-- Average daily production during December 2013: 85 bbl/d from Copper

Moki-1 and Copper Moki-2 wells

-- Copper Moki-3 shut-in during December, workover activities underway to

resume production in January

-- Waitapu-2 well expected to resume production in January

New Zealand Energy Corp., through its subsidiaries (collectively "NZEC" or the

"Company"), holds a 50% interest in the TWN Licenses, with L&M Energy and its

related entities (collectively "L&M") holding the other 50%. NZEC and L&M

acquired the TWN Licenses on October 28, 2013 and formed the TWN Joint

Arrangement ("TWN JA"), with NZEC as the operator, to explore and develop the

TWN Licenses and operate the Waihapa Production Station and associated

infrastructure.

TWN Licenses - Tikorangi Formation Production and Development Plan

During November 2013 the TWN JA reactivated oil and gas production from six

wells that had been drilled to the Tikorangi Formation by previous operators.

Well head metering was installed at each well to monitor flow rates on a

well-by-well basis. A number of wells flowed from natural pressure for two to

three weeks, and all six wells are now being produced using an existing gas lift

system. The TWN JA is monitoring production data to identify the most efficient

method to optimize oil production from each well, which may include installation

of high-volume electric submersible pumps ("ESPs") or other methods of

artificial lift.

NZEC believes the Tikorangi Formation underlying the TWN Licenses holds

significant production potential. Current development plans for the Tikorangi

Formation on the TWN Licenses include drilling two new Tikorangi wells on the

Waihapa License in 2014.(2) In addition, the TWN JA has identified production

potential from additional existing wells in other areas of the TWN Licenses, and

from additional drilling opportunities identified on 3D seismic.

TWN Licenses - Mt. Messenger Formation Production and Development Plan

In December 2013, the TWN JA recompleted the Waihapa-2 well to access bypassed

pay with production potential in the Mt. Messenger Formation. Waihapa-2 had been

drilled by a previous operator through the Mt. Messenger Formation to the

Tikorangi, and produced 4.8 million bbl of oil from the Tikorangi Formation. The

TWN JA used a service rig to perforate two intervals in the Mt. Messenger

Formation. The well flowed from natural reservoir pressure for three short

tests. Following a further flow test in early January, the well will be shut-in

for pressure build-up, with commercial production expected in early February.

A number of additional existing wells on the TWN Licenses have uphole completion

potential in the Mt. Messenger Formation. Recompletion of these wells is

significantly less expensive and faster than drilling new wells, and economic

discoveries could be tied in to the Waihapa Production Station using existing

oil and gas gathering pipelines. The TWN JA plans to commence uphole completion

of the Waihapa-1 well in mid-January.2

Exploration and development plans for the Mt. Messenger Formation on the TWN

Licenses in 2014 include drilling three new Mt. Messenger wells (in addition to

the uphole completions referred to above).2 The TWN JA will prioritize

exploration targets that can be accessed from existing drill pads that are tied

in or in close proximity to the Waihapa Production Station infrastructure.

Eltham Permit Production and Development Plans

NZEC's Copper Moki-1 and Copper Moki-2 wells produced a total of 2,633 bbl of

oil during December 2013, with average daily production of 85 bbl/day (100% net

to NZEC). NZEC will commence workover activities on the Copper Moki-3 well in

mid-January to clean out sand around the well bore and replace the pump, with

the objective of recommencing production in January.

NZEC completed installation of artificial lift on the Waitapu-2 well in

December, but has encountered problems with the down hole pump. Servicing of the

pump will commence this week to allow Waitapu-2 to recommence production.

(1) Gas produced from the reactivated Tikorangi wells has been used as fuel for

the compressor at the Waihapa Production Station. There were no gas sales

through December.

(2) Development and operating costs are to be funded initially by existing

working capital and cash flows from production. However, in order to carry out

all of the planned development activities, the Company is considering a number

of options to increase its financial capacity. These options include increasing

cash flow from oil production, additional joint arrangements, commercial

arrangements or other financing alternatives.

On behalf of the Board of Directors

John Proust, Chief Executive Officer & Director

About New Zealand Energy Corp.

NZEC is an oil and natural gas company engaged in the production, development

and exploration of petroleum and natural gas assets in New Zealand. NZEC's

property portfolio collectively covers approximately 1.97 million acres of

conventional and unconventional prospects in the Taranaki Basin and East Coast

Basin of New Zealand's North Island. The Company's management team has extensive

experience exploring and developing oil and natural gas fields in New Zealand

and Canada, and takes a multi-disciplinary approach to value creation with a

track record of successful discoveries. NZEC plans to add shareholder value by

executing a technically disciplined exploration and development program focused

on the onshore and offshore oil and natural gas resources in the politically and

fiscally stable country of New Zealand. NZEC is listed on the TSX Venture

Exchange under the symbol NZ and on the OTCQX International under the symbol

NZERF. More information is available at www.newzealandenergy.com or by emailing

info@newzealandenergy.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

This document contains certain forward-looking information and forward-looking

statements within the meaning of applicable securities legislation (collectively

"forward-looking statements"). The use of the word "will", "planned",

"expected", "may include", "expectation", "will be", "plans", "could be",

"objective" and similar expressions are intended to identify forward-looking

statements. These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements including, without

limitation, the speculative nature of exploration, appraisal and development of

oil and natural gas properties; uncertainties associated with estimating oil and

natural gas reserves and resources; uncertainties in both daily and long-term

production rates and resulting cash flow; volatility in market prices for oil

and natural gas; changes in the cost of operations, including costs of

extracting and delivering oil and natural gas to market, that affect potential

profitability of oil and natural gas exploration and production; the need to

obtain various approvals before exploring and producing oil and natural gas

resources; exploration hazards and risks inherent in oil and natural gas

exploration; operating hazards and risks inherent in oil and natural gas

operations; market conditions that prevent the Company from raising the funds

necessary for exploration and development on acceptable terms or at all; global

financial market events that cause significant volatility in commodity prices;

unexpected costs or liabilities for environmental matters; competition for,

among other things, capital, acquisitions of resources, skilled personnel, and

access to equipment and services required for exploration, development and

production; changes in exchange rates, laws of New Zealand or laws of Canada

affecting foreign trade, taxation and investment; failure to realize the

anticipated benefits of acquisitions; and other factors as disclosed in

documents released by NZEC as part of its continuous disclosure obligations.

Such forward-looking statements should not be unduly relied upon. The Company

believes the expectations reflected in those forward-looking statements are

reasonable, but no assurance can be given that these expectations will prove to

be correct. Actual results could differ materially from those anticipated in

these forward-looking statements. The forward-looking statements contained in

the document are expressly qualified by this cautionary statement. These

statements speak only as of the date of this document and the Company does not

undertake to update any forward-looking statements that are contained in this

document, except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

New Zealand Energy Corp.

John Proust

Chief Executive Officer & Director

North American toll-free: 1-855-630-8997

info@newzealandenergy.com

New Zealand Energy Corp

Bruce McIntyre

Acting General Manager Exploration & Director

North American toll-free: 1-855-630-8997

info@newzealandenergy.com

New Zealand Energy Corp

Rhylin Bailie

Vice President Communications & Investor Relations

North American toll-free: 1-855-630-8997

info@newzealandenergy.com

www.newzealandenergy.com

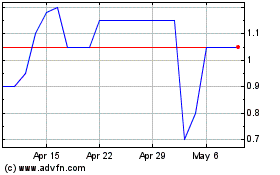

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

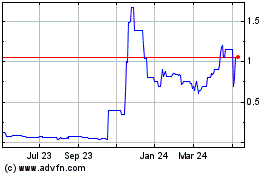

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Apr 2023 to Apr 2024