- Record revenue for fiscal year 2013 – up 56 percent

year-over-year

- Bridgeport fuel cell park on schedule and producing power

- 59 megawatt South Korean fuel cell park completed on schedule

and operating

- Delivered first German-manufactured fuel cell power plant

FuelCell Energy, Inc. (Nasdaq:FCEL), a global leader in the design,

manufacture, operation and service of ultra-clean, efficient and

reliable fuel cell power plants, today reported results for its

fourth quarter and fiscal year ended October 31, 2013 along with an

update on key business highlights.

Financial Results

FuelCell Energy (the Company) reported total revenues for the

fourth quarter of 2013 of $55.2 million compared to $35.4 million

for the fourth quarter of 2012.

Product sales for the fourth quarter of 2013 totaled $36.2

million, comprising $23.4 million of power plant revenue and fuel

cell kit sales, and $12.8 million of power plant component sales

and installation services, including installation services for the

Bridgeport fuel cell park. For the comparable prior year period,

product sales totaled $29.1 million, including $24.0 million of

power plant revenues and fuel cell kit sales and $5.1 million of

power plant component sales and installation services.

Service and license revenues for the fourth quarter of 2013

totaled $15.4 million compared to $4.8 million for the comparable

prior year period. During the fourth quarter of 2013, the Company

entered into a previously announced revised Master Service

Agreement with POSCO Energy, its South Korean partner, whereby

POSCO assumes more responsibility for servicing installations in

Asia that utilize power plants manufactured by POSCO Energy. FCE

will perform engineering and support services for each unit in the

installed fleet and receive quarterly fees as well as a royalty on

each scheduled fuel cell module exchange built by POSCO Energy and

installed at any plant in Asia. Costs incurred under the Master

Service Agreement during the fourth quarter of fiscal year 2013 of

$10.1 million resulted in associated revenue recognized of $10.2

million. Such costs primarily related to the provision of fuel cell

stacks to POSCO upon execution of the agreement to service the

installations under the ongoing service contract. Quarterly service

revenue in 2014 is forecasted to be in a range of $4.0 million to

$6.0 million with quarterly fluctuations impacted by the timing of

scheduled fuel cell module exchanges. Customer acceptance of the

Bridgeport fuel cell park during the first quarter of fiscal 2014

is expected to trigger the start of the associated $69 million 15

year service contract, which would contribute to a quarterly

increase in service revenues in fiscal year 2014.

Advanced technologies contract revenue was $3.6 million for the

fourth quarter of 2013 compared to $1.6 million for the fourth

quarter of 2012. The increase is primarily a result of solid oxide

fuel cell commercialization programs, particularly the unmanned

aerial program with Boeing, which has been included in the

Company's financial results subsequent to the December 2012

acquisition of Versa Power Systems.

Backlog totaled $355.4 million at October 31, 2013 compared to

$318.9 million at October 31, 2012.

- Product sales backlog was $170.1 million at October 31, 2013

compared to $228.2 million at October 31, 2012. Product backlog in

megawatts (MW) totaled 107.3 MW at October 31, 2013 compared to

150.7 MW at October 31, 2012.

- Service backlog was $166.8 million at October 31, 2013 compared

to $78.5 million at October 31, 2012. The service contract for the

Bridgeport fuel cell park project accounted for a significant

portion of the year-over-year growth.

- Advanced technologies contracts backlog was $18.5 million at

October 31, 2013 compared to $12.2 million at October 31,

2012.

The fourth quarter 2013 gross profit of $2.6 million generated a

4.7 percent gross margin compared to a gross profit of $0.9 million

in the fourth quarter of 2012 and a gross margin of 2.5 percent.

The margin impact of the previously referenced revised master

service agreement with POSCO Energy and higher aftermarket costs

negatively impacted the gross margin in the quarter.

Loss from operations for the fourth quarter of 2013 was $7.0

million compared to $8.4 million for the fourth quarter of 2012.

Administrative and selling expenses decreased year-over-year as the

prior year period included business development expenses that were

non-recurring in the current year period. Research and development

expenses increased year-over-year resulting from initiatives to

continue to reduce the cost profile of large scale multi-megawatt

installations through consolidating certain aspects of the balance

of plant functions.

Net loss attributable to common shareholders for the fourth

quarter of 2013 totaled $10.5 million, or $0.06 per basic and

diluted share, or excluding the non-cash fair value adjustment of

$1.1 million required on the embedded derivatives in the

convertible notes, the adjusted net loss attributable to common

shareholders totaled $9.4 million or $0.05 per basic and diluted

share. For the comparable prior year period, net loss

attributable to common shareholders totaled $12.1 million or $0.07

per basic and diluted share or $8.1 million and $0.05 per basic and

diluted share on an adjusted basis.

Fiscal Year 2013

For the twelve months ended October 31, 2013, the Company

reported revenue of $187.7 million compared to $120.6 million for

the prior year period, an increase of 56 percent. Product

sales were $145.1 million compared to $95.0 million for the prior

year period. Service agreement and license revenues were $28.1

million compared to $18.1 million for the prior year

period. Advanced technologies contract revenues totaled $14.4

million, compared to $7.5 million for the prior year period.

For the twelve months ended October 31, 2013, gross profit was

$7.1 million compared to a gross profit of $0.4 million for the

twelve months ended October 31, 2012. The gross margin for

fiscal year 2013 was 3.8 percent.

Loss from operations for the twelve months ended October 31,

2013 was $29.8 million, compared to $32.1 million for the twelve

months ended October 31, 2012. The year-over-year change in

operating expenses includes increased business development

expenditures for the North American and European markets and the

consolidation of Versa Power Systems after its acquisition by the

Company, all of which contribute to future growth

opportunities. As a percentage of total revenues, total

operating expenses decreased from 27.0 percent for the twelve

months ended October 31, 2012 to 19.7 percent for the twelve months

ended October 31, 2013 reflecting the leverage of existing sales

and services infrastructure that supports higher revenue

levels.

Net loss attributable to common shareholders for the twelve

months ended October 31, 2013 was $37.6 million or $0.20 per basic

and diluted share, or excluding the non-cash fair value adjustment

required on the embedded derivatives in the convertible notes, the

adjusted net loss attributable to common shareholders totaled $36.2

million or $0.19 per basic and diluted share. For the

comparable prior year period, net loss attributable to common

shareholders totaled $38.7 million or $0.23 per basic and diluted

share or $34.6 million and $0.21 per basic and diluted share on an

adjusted basis.

Cash and cash equivalents and restricted cash

Cash and cash equivalents and restricted cash totaled $77.7

million at October 31, 2013. Net cash use for the fourth

quarter of 2013 was $13.7 million, including an $8.8 million

increase in accounts receivable. Accounts receivable includes

$20.4 million related to the Bridgeport fuel cell park project,

with collection expected during the first quarter of fiscal year

2014. Capital spending was $2.5 million and depreciation

expense was $1.1 million for the fourth quarter of 2013.

Business Highlights and Strategy

Execution

Market Update

"The size of our pipeline in both North America and Europe

continues to increase, but more importantly we have made

significant progress towards closure on a number of multi-megawatt

projects in the pipeline," said Chip Bottone, President and Chief

Executive Officer, FuelCell Energy, Inc. "We evaluate our

production levels weekly, coordinating closely with our order

closure expectations and the need to be able to execute on

multi-plant projects quickly, as we proved we can do by meeting the

production and installation schedule for the 15 megawatt Bridgeport

fuel cell park project."

Multiple utilities in four U.S. states have recently issued over

one gigawatt of renewable power requests for proposals (RFP's) that

all include fuel cells. The Company is actively bidding these

solicitations. Utility-scale adoption is accelerating in South

Korea with recent announcements by partner POSCO Energy including a

20 megawatt project and a 40 megawatt project. These recent

actions in North America and Asia illustrate both the market

potential as well as the growing awareness of the value of clean

distributed generation. In addition, the Company is

actively pursuing and developing opportunities through its business

partners.

"Based upon strong 2013 project development activity and

regulatory approvals, we anticipate closing over 30 megawatts of

new orders in North America in the first half of 2014. These,

combined with our backlog from POSCO and service commitments, will

consume all of our anticipated production in fiscal year 2014,"

continued Mr. Bottone.

Operations update

"We began 2013 with North American production levels at an

annual run-rate of 56 megawatts, smoothly increased the production

rate to 70 megawatts during the year, and expanded total capacity

by about 11 percent through process improvements to 100 megawatts

annually," said Tony Rauseo, Chief Operating Officer, FuelCell

Energy, Inc. "We are prepared to increase production levels

further as demand supports."

The Company maintained an annual production run-rate at the

Torrington, Connecticut production facility of approximately 70

megawatts during the fourth quarter of 2013, producing 17.5 MW of

cell components for fuel cell kits and fuel cell power plants.

The construction of the Bridgeport fuel cell park is on schedule

and is currently undergoing final commissioning. All five fuel

cell plants are producing power and power production from the

organic rankine cycle turbine is expected within days. Final

acceptance is expected by the end of December 2013, as

scheduled. The associated service contract, valued at

approximately $69 million over the 15 year project life, begins at

customer acceptance.

All 21 DFC3000® power plants are installed at the Gyeonggi Green

Energy fuel cell park in Hwasung City, South Korea. The

project is on schedule and delivering power to the electric grid

and steam to a district heating system. POSCO Energy

constructed the fuel cell park in only twelve months demonstrating

the ability to add a significant level of renewable power near

where the power is used in a very short period of time. The

facility is a global showcase for distributed baseload electric

grid support from ultra-clean fuel cell power plants and a model

for other regions of the world.

The first German built fuel cell power plant was completed by

FuelCell Energy Solutions, GmbH (FCES) and delivered to the future

Federal Ministry of Education and Research office complex in

Berlin, Germany during the fourth quarter. FCES is managing

the installation of the power plant and commissioning is expected

in mid-2014 once construction of the office complex nears

completion. FCES is the sales, manufacturing and service

business for the European Served Area for FuelCell Energy,

Inc.

Advanced Technology update

The Company continues working towards commercialization of its

solid oxide fuel cell (SOFC) technology and distributed hydrogen

generation capabilities, utilizing global partners to build

critical mass and to develop technology platforms suitable for

markets around the world. During the fourth quarter of 2013,

the Company entered into the following:

- $6.4 million agreement with the U.S. Department of Energy (DOE)

to demonstrate a sub-megawatt SOFC plant configured for combined

heat & power (CHP) output that is connected to the electric

grid.

- A multi-phase two year agreement to supply a demonstration

solid-state electrochemical hydrogen separation (EHS) unit to a

global chemical company for high efficiency separation of hydrogen

from natural gas. Under the first phase, valued at

approximately $1.1 million, the Company will deliver a remotely

monitored CE-compliant EHS system. Successful completion of

the first phase is expected to lead to subsequent funding to

increase the size and scale of the system for the targeted

industrial market. The technology provides a unique way to

separate hydrogen from clean natural gas or renewable biogas in a

process with relatively low energy consumption and without the need

for pressurization or moving parts, leading to lower operating

costs than current hydrogen separation technologies. Cost

effective distributed hydrogen generation has attractive market

potential.

- The build phase of a DOE supported project to convert renewable

biogas from agricultural waste into power utilizing a FuelCell

Energy manufactured SOFC power plant at a dairy farm in

California. The Sacramento Municipal Utility District (SMUD)

will facilitate the installation and operation of the SOFC power

system.

Cautionary Language

This news release contains forward-looking statements within the

meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including, without limitation,

statements with respect to the Company's anticipated financial

results and statements regarding the Company's plans and

expectations regarding the continuing development,

commercialization and financing of its fuel cell technology and

business plans. All forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ

materially from those projected. Factors that could cause such a

difference include, without limitation, changes to projected

deliveries and order flow, changes to production rate and product

costs, general risks associated with product development,

manufacturing, changes in the regulatory environment, customer

strategies, unanticipated manufacturing issues that impact power

plant performance, changes in critical accounting policies,

potential volatility of energy prices, rapid technological change,

competition, and the Company's ability to achieve its sales plans

and cost reduction targets, as well as other risks set forth in the

Company's filings with the Securities and Exchange Commission. The

forward-looking statements contained herein speak only as of the

date of this press release. The Company expressly disclaims any

obligation or undertaking to release publicly any updates or

revisions to any such statement to reflect any change in the

Company's expectations or any change in events, conditions or

circumstances on which any such statement is based.

About FuelCell Energy

Direct FuelCell® power plants are generating ultra-clean,

efficient and reliable power at more than 50 locations

worldwide. With more than 300 megawatts of power generation

capacity installed or in backlog, FuelCell Energy is a global

leader in providing ultra-clean baseload distributed generation to

utilities, industrial operations, universities, municipal water

treatment facilities, government installations and other customers

around the world. The Company's power plants have generated

more than two billion kilowatt hours of ultra-clean power

using a variety of fuels including renewable biogas from wastewater

treatment and food processing, as well as clean natural

gas. For more information, please visit

www.fuelcellenergy.com

See us on YouTube

Direct FuelCell, DFC, DFC/T, DFC-H2 and FuelCell Energy, Inc.

are all registered trademarks of FuelCell Energy, Inc.

DFC-ERG is a registered trademark jointly owned by Enbridge,

Inc. and FuelCell Energy, Inc.

Conference Call Information

FuelCell Energy management will host a conference call with

investors beginning at 10:00 a.m. Eastern Time on December 17, 2013

to discuss the fourth quarter and full year 2013 results. An

accompanying slide presentation for the earnings call will be

available

at http://fcel.client.shareholder.com/events.cfm immediately

prior to the call.

Participants can access the live call via webcast on the Company

website or by telephone as follows:

- The live webcast of this call will be available on the Company

website at www.fuelcellenergy.com. To listen to the call,

select 'Investors' on the home page, then click on 'events &

presentations' and then click on 'Listen to the webcast'

- Alternatively, participants in the U.S. or Canada can dial

877-303-7005

- Outside the U.S. and Canada, please call 678-809-1045

- The passcode is 'FuelCell Energy'

The webcast of the conference call will be available on the

Company's Investors' page at

www.fuelcellenergy.com. Alternatively, the replay of the

conference call will be available approximately two hours after the

conclusion of the call until midnight Eastern Time on December 20,

2013:

- From the U.S. and Canada please dial 855-859-2056

- Outside the U.S. or Canada please call 404-537-3406

- Enter confirmation code 17928256

| FUELCELL ENERGY,

INC. |

| Consolidated Balance

Sheets |

| (Unaudited) |

| (Amounts in thousands,

except share and per share amounts) |

| |

| |

October 31, |

October 31, |

| |

2013 |

2012 |

| ASSETS |

|

|

| Current assets: |

|

|

| Cash and cash equivalents -

unrestricted |

$ 67,696 |

$ 46,879 |

| Restricted cash and cash equivalents –

short-term |

5,053 |

5,335 |

| License fee receivable |

-- |

10,000 |

| Accounts receivable, net |

49,116 |

25,984 |

| Inventories, net |

56,185 |

47,701 |

| Other current assets |

11,279 |

4,727 |

| Total current assets |

189,329 |

140,626 |

| |

|

|

| Restricted cash and cash equivalents –

long-term |

4,950 |

5,300 |

| Property, plant and equipment, net |

24,225 |

23,258 |

| Goodwill |

4,075 |

-- |

| Intangible assets |

9,592 |

-- |

| Investment in and loans to affiliate |

-- |

6,115 |

| Other assets, net |

5,465 |

16,186 |

| Total assets |

$ 237,636 |

$ 191,485 |

| |

|

|

| LIABILITIES AND

EQUITY |

|

|

| Current liabilities: |

|

|

| Current portion of long-term debt |

$ 6,931 |

$ 5,161 |

| Accounts payable |

24,535 |

12,254 |

| Accounts payable due to affiliate |

-- |

203 |

| Accrued liabilities |

21,912 |

20,265 |

| Deferred revenue |

51,857 |

45,939 |

| Preferred stock obligation of

subsidiary |

1,028 |

1,075 |

| Total current liabilities |

106,263 |

84,897 |

| |

|

|

| Long-term deferred revenue |

18,763 |

15,533 |

| Long-term preferred stock obligation of

subsidiary |

13,270 |

13,095 |

| Long-term debt and other liabilities |

52,675 |

3,975 |

| Total liabilities |

190,971 |

117,500 |

| Redeemable preferred stock (liquidation

preference of $64,020 at October 31, 2013 and October 31,

2012) |

59,857 |

59,857 |

| Total (Deficit) Equity: |

|

|

| Shareholders' (deficit) equity |

|

|

| Common stock ($.0001 par value;

275,000,000 shares authorized; 196,310,402 and 185,856,123 shares

issued and outstanding at October 31, 2013 and October 31,

2012, respectively) |

20 |

18 |

| Additional paid-in capital |

758,656 |

751,256 |

| Accumulated deficit |

(771,189) |

(736,831) |

| Accumulated other

comprehensive income |

101 |

66 |

| Treasury stock, Common, at cost (5,679

shares at October 31, 2013 and October 31, 2012) |

(53) |

(53) |

| Deferred compensation |

53 |

53 |

| Total shareholders' (deficit)

equity |

(12,412) |

14,509 |

| Noncontrolling interest in subsidiaries |

(780) |

(381) |

| Total (deficit) equity |

(13,192) |

14,128 |

| Total liabilities and (deficit)

equity |

$ 237,636 |

$ 191,485 |

| |

| FUELCELL ENERGY,

INC. |

| Consolidated Statements

of Operations |

| (unaudited) |

| (Amounts in thousands,

except share and per share amounts) |

| |

| |

Three Months

Ended |

| |

October

31, |

| |

2013 |

2012 |

| Revenues: |

|

|

| Product sales |

$ 36,190 |

$ 29,068 |

| Service agreements and license

revenues |

15,358 |

4,785 |

| Advanced technologies contract

revenues |

3,609 |

1,567 |

| Total revenues |

55,157 |

35,420 |

| |

|

|

| Costs of revenues: |

|

|

| Cost of product sales |

33,039 |

29,944 |

| Cost of service agreements and license

revenues |

15,867 |

2,915 |

| Cost of advanced technologies contract

revenues |

3,654 |

1,683 |

| Total cost of revenues |

52,560 |

34,542 |

| |

|

|

| Gross profit |

2,597 |

878 |

| |

|

|

| Operating expenses: |

|

|

| Administrative and selling expenses |

5,147 |

5,874 |

| Research and development expenses |

4,402 |

3,422 |

| Total operating expenses |

9,549 |

9,296 |

| |

|

|

| Loss from operations |

(6,952) |

(8,418) |

| |

|

|

| Interest expense |

(1,755) |

(555) |

| Loss from equity investment |

-- |

(91) |

| License fee and royalty income |

-- |

341 |

| Impairment of equity investment |

-- |

(3,602) |

| Other income (expense), net |

(941) |

806 |

| |

|

|

| Loss before provision for income taxes |

(9,648) |

(11,519) |

| |

|

|

| Provision for income taxes |

(349) |

-- |

| |

|

|

| Net loss |

(9,997) |

(11,519) |

| |

|

|

| Net loss attributable to noncontrolling

interest |

297 |

181 |

| |

|

|

| Net loss attributable to FuelCell Energy,

Inc. |

(9,700) |

(11,338) |

| |

|

|

| Preferred stock dividends |

(800) |

(800) |

| |

|

|

| Net loss to common shareholders |

$ (10,500) |

$ (12,138) |

| |

|

|

| Loss per share basic and diluted |

|

|

| Basic |

$ (0.06) |

$ (0.07) |

| Diluted |

$ (0.06) |

$ (0.07) |

| |

|

|

| Weighted average shares outstanding |

|

|

| Basic |

187,918,612 |

185,905,702 |

| Diluted |

187,918,612 |

185,905,702 |

| |

| FUELCELL ENERGY,

INC. |

| Consolidated Statements

of Operations |

| (unaudited) |

| (Amounts in thousands,

except share and per share amounts) |

| |

| |

Twelve Months

Ended |

| |

October

31, |

| |

2013 |

2012 |

| Revenues: |

|

|

| Product sales |

$ 145,071 |

$ 94,950 |

| Service agreements and license

revenues |

28,141 |

18,183 |

| Advanced technologies contract

revenues |

14,446 |

7,470 |

| Total revenues |

187,658 |

120,603 |

| |

|

|

| Costs of revenues: |

|

|

| Cost of product sales |

136,989 |

93,876 |

| Cost of service agreements and license

revenues |

29,683 |

19,045 |

| Cost of research and development

contracts |

13,864 |

7,237 |

| Total cost of revenues |

180,536 |

120,158 |

| |

|

|

| Gross profit |

7,122 |

445 |

| |

|

|

| Operating expenses: |

|

|

| Administrative and selling expenses |

21,218 |

18,220 |

| Research and development expenses |

15,717 |

14,354 |

| Total operating expenses |

36,935 |

32,574 |

| |

|

|

| Loss from operations |

(29,813) |

(32,129) |

| |

|

|

| Interest expense |

(3,973) |

(2,304) |

| Income (loss) from equity investment |

46 |

(645) |

| License fee and royalty income |

-- |

1,599 |

| Impairment of equity investment |

-- |

(3,602) |

| Other income (expense), net |

(1,208) |

1,244 |

| |

|

|

| Loss before provision for income taxes |

(34,948) |

(35,837) |

| |

|

|

| Provision for income taxes |

(371) |

(69) |

| |

|

|

| Net loss |

(35,319) |

(35,906) |

| |

|

|

| Net loss attributable to noncontrolling

interest |

961 |

411 |

| |

|

|

| Net loss attributable to FuelCell Energy,

Inc. |

(34,358) |

(35,495) |

| |

|

|

| Preferred stock dividends |

(3,200) |

(3,201) |

| |

|

|

| Net loss to common shareholders |

$ (37,558) |

$ (38,696) |

| |

|

|

| Net loss per share to common

shareholders |

|

|

| Basic |

$ (0.20) |

$ (0.23) |

| Diluted |

$ (0.20) |

$ (0.23) |

| |

|

|

| Weighted average shares outstanding |

|

|

| Basic |

186,525,001 |

165,471,261 |

| Diluted |

186,525,001 |

165,471,261 |

| |

| FUELCELL ENERGY,

INC. |

| Reconciliation of GAAP

to Non-GAAP Consolidated Statements of Operations |

|

(Unaudited) |

| (Amounts in thousands,

except share and per share amounts) |

| |

| |

Three Months

Ended October 31, |

| |

2013 |

2012 |

| |

GAAP As Reported |

Non-GAAP Adjustments |

|

Non-GAAP As Adjusted |

GAAP As Reported |

Non-GAAP Adjustments |

|

Non-GAAP As Adjusted |

| Cost of product sales |

$ 33,039 |

$ -- |

|

$ 33,039 |

$ 29,944 |

$ (462) |

(3) |

$ 29,482 |

| Gross profit |

$ 2,597 |

$ -- |

|

$ 2,597 |

$ 878 |

$ 462 |

|

$ 1,340 |

| Loss from operations |

$ (6,952) |

$ -- |

|

$ (6,952) |

$ (8,418) |

$ 462 |

|

$ (7,956) |

| Loss before provision for income taxes |

$ (9,648) |

$ 1,091 |

(1) |

$ (8,557) |

$ (11,519) |

$ 4,064 |

(2)(3) |

$ (7,455) |

| Net loss |

$ (9,997) |

$ 1,091 |

|

$ (8,906) |

$ (11,519) |

$ 4,064 |

|

$ (7,455) |

| Net loss to common shareholders |

$ (10,500) |

$ 1,091 |

|

$ (9,409) |

$ (12,138) |

$ 4,064 |

|

$ (8,074) |

| |

|

|

|

|

|

|

|

|

| Net loss per share to common

shareholders |

|

|

|

|

|

|

|

|

| Basic |

$ (0.06) |

$ 0.01 |

|

$ (0.05) |

$ (0.07) |

$ 0.02 |

|

$ (0.05) |

|

| Diluted |

$ (0.06) |

$ 0.01 |

|

$ (0.05) |

$ (0.07) |

$ 0.02 |

|

$ (0.05) |

|

| |

|

|

| |

|

|

| |

Twelve Months

Ended October 31, |

|

| |

2013 |

2012 |

|

| |

GAAP As Reported |

Non-GAAP Adjustments |

|

Non-GAAP As Adjusted |

GAAP As Reported |

Non-GAAP Adjustments |

|

Non-GAAP

As Adjusted |

|

| Cost of product sales |

$ 136,989 |

$ -- |

|

$ 136,989 |

$ 93,876 |

$ (462) |

(3) |

$ 93,414 |

|

| Gross profit |

$ 7,122 |

$ -- |

|

$ 7,122 |

$ 445 |

$ 462 |

|

$ 907 |

|

| Loss from operations |

$ (29,813) |

$ -- |

|

$ (29,813) |

$ (32,129) |

$ 462 |

|

$ (31,667) |

|

| Loss before provision for income taxes |

$ (34,948) |

$ 1,383 |

(1) |

$ (33,565) |

$ (35,837) |

$ 4,064 |

(2)(3) |

$ (31,773) |

|

| Net loss |

$ (35,319) |

$ 1,383 |

|

$ (33,936) |

$ (35,906) |

$ 4,064 |

|

$ (31,842) |

|

| Net loss to common shareholders |

$ (37,558) |

$ 1,383 |

|

$ (36,175) |

$ (38,696) |

$ 4,064 |

|

$ (34,632) |

|

| |

|

|

|

|

|

|

|

|

|

| Net loss per share to common

shareholders |

|

|

|

|

|

|

|

|

|

| Basic |

$ (0.20) |

$ 0.01 |

|

$ (0.19) |

$ (0.23) |

$ 0.02 |

|

$ (0.21) |

|

| Diluted |

$ (0.20) |

$ 0.01 |

|

$ (0.19) |

$ (0.23) |

$ 0.02 |

|

$ (0.21) |

|

Notes to Reconciliation of GAAP to

Non-GAAP Consolidated Statements of Operations For

the Three and Twelve Months Ended October 31, 2013 and

2012

Results of Operations are presented in accordance with

accounting principles generally accepted in the United States

("GAAP"). Management also uses non-GAAP measures which

exclude non-recurring items in order to measure operating periodic

performance. We have added this information because we believe

it helps in understanding the results of our operations on a

comparative basis. This adjusted information supplements and

is not intended to replace performance measures required by U.S.

GAAP disclosure.

Notes to the reconciliation of GAAP to non-GAAP Consolidated

Statements of Operations information are as follows:

(1) Adjustment for the three and twelve months ended

October 31, 2013 for the impact from the fair value adjustment

required on the embedded derivatives in the Senior Unsecured

Convertible notes in accordance with Accounting Standards

Codification (ASC) 815 – Derivatives and Hedging.

(2) Adjustment for the three and twelve months ended

October 31, 2012 represents a non-recurring impairment of the

equity investment in Versa Power Systems.

(3) In the second quarter of 2011, the Company committed to a

repair and upgrade program to fix a performance shortfall for a

select group of 1.2 MW fuel cell modules produced between 2007 and

early 2009. The estimate for the repair and upgrade program

was revised in the fourth quarter of 2012 to adjust for the cost of

modules which were expected to be deployed as field replacements

when needed. This resulted in a charge to cost of goods sold

in the fourth quarter of 2012 of $0.5 million.

CONTACT: FuelCell Energy, Inc.

Kurt Goddard, Vice President Investor Relations

203-830-7494

ir@fce.com

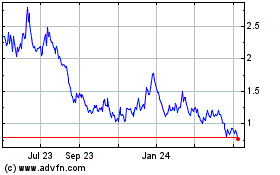

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Apr 2024 to May 2024

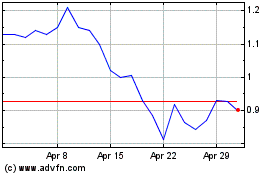

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From May 2023 to May 2024