Titan Pharmaceuticals Announces Third Quarter 2013 Financial

Results

Management Team to Host Conference Call November 15 at 1:00 p.m.

ET / 10:00 a.m. PT

SOUTH SAN FRANCISCO, CA--(Marketwired - Nov 14, 2013) - Titan

Pharmaceuticals, Inc. (OTCBB: TTNP) today reported financial

results for the third quarter ended September 30, 2013.

Net loss for the quarter ended September 30, 2013 was

approximately $1.1 million, or approximately $0.01 per share,

compared to a net loss of approximately $8.0 million, or

approximately $0.12 per share, for the comparable period in 2012.

License revenues of approximately $2.2 million for the three months

ended September 30, 2013 reflect the amortization of the upfront

license fee received from Braeburn in December 2012 for its license

agreement for the U.S. and Canadian rights to commercialize

Probuphine®, the company's investigational subdermal implant

designed to deliver continuous, blood levels of buprenorphine for

six months following a single treatment. Titan generated no grant

or royalty revenue during the three months ended September 30,

2013.

Total operating expenses for the third quarter ended September

30, 2013 were approximately $2.3 million, compared with

approximately $3.9 million for the comparable period in 2012, and

consisted largely of research and development (R&D) expenses of

approximately $1.7 million, compared to approximately $3.0 million

of R&D expenses for the comparable period in 2012. This

decrease in R&D costs was primarily associated with a decrease

in external R&D expenses related to the preparation and review

of the New Drug Application (NDA) for Probuphine by the U.S. Food

and Drug Administration (FDA). General and administrative (G&A)

expenses for the quarter were approximately $0.6 million, compared

to approximately $0.9 million for the comparable period in 2012.

The decrease in G&A expenses was primarily related to decreases

in non-cash stock compensation of approximately $0.2 million and

legal fees of approximately $0.1 million.

At September 30, 2013, Titan had approximately $9.0 million of

cash compared to approximately $18.1 million at December 31, 2012.

Titan believes that its working capital at September 30, 2013,

together with the $5.0 million in proceeds from the recently

announced sale of common stock to Braeburn, is sufficient to fund

its planned operations into January 2015.

Key recent updates include:

- On November 12, Titan announced a $5 million equity investment

by Braeburn Pharmaceuticals as well as adjusted terms to its

license agreement for the U.S. and Canadian commercialization

rights for Probuphine. Under the terms of the license agreement

amendment, there will be a reduction in the milestone payment upon

approval by the FDA of the Probuphine NDA from $45 million to $15

million, and an increase in the total amount of potential sales

milestones payments to Titan from $130 million to $165 million. The

sales threshold to achieve the highest royalty tier has been

lowered. Braeburn also agreed to assume responsibility for all

third-party expenses related to the Probuphine regulatory process.

The collaboration amendment also contains a provision entitling

Titan to receive a low single-digit royalty on sales by Braeburn of

other mid or long-term continuous delivery treatments for opioid

dependence, up to a maximum of $50 million. In addition, Titan has

the right to elect to participate in sales by Braeburn of other

products in the addiction market in exchange for a similar

reduction in Titan's royalties on Probuphine. The amendment will be

effective upon the closing of the sale of shares.

- In September, Titan announced that the FDA had granted its

request for a meeting to discuss Probuphine. The goal of this

meeting is to understand more fully the issues raised in the April

2013 Complete Response Letter (CRL) to the NDA for Probuphine for

the maintenance treatment of opioid dependence in adults, review

and discuss the available data from the Probuphine studies

conducted to date and gain further clarity regarding the regulatory

path forward for Probuphine. Comprehensive briefing materials

addressing the issues raised in the CRL have been submitted to the

FDA and the meeting is scheduled for November 19, 2013.

- In August, Titan announced the publication of data from

its positive confirmatory Phase 3 clinical trial of Probuphine

in the journal Addiction.

"As you know, the focus for the third quarter was on the

preparation of the briefing material for the upcoming FDA meeting

which was provided to the FDA in early October," said Sunil

Bhonsle, president of Titan Pharmaceuticals. "The goal of this FDA

meeting is to understand more fully the issues raised in the CRL,

review and discuss the information in the briefing book and gain

further clarity regarding the regulatory path forward. The

financial results for the quarter were as expected, and the

recently announced investment in Titan by Braeburn Pharmaceuticals

should help support our operations into the beginning of 2015."

"The board is pleased with the progress made by Titan and

Braeburn in preparation for the upcoming meeting with the FDA,"

said Marc Rubin, M.D., executive chairman of Titan Pharmaceuticals.

"Given the generally uncertain nature of the regulatory process

with respect to timing and outcome, the board felt it was prudent

to raise additional capital, and is very pleased with the at market

transaction without warrants concluded with Braeburn this week.

Braeburn's investment in Titan strengthens our partnership and

brings the companies in alignment to continue advancing the

Probuphine program toward our ultimate goal -- to make Probuphine

available to those clinicians, patients and families that need

it."

About Opioid Dependence According to recent estimates, there are

2.2 million people with opioid dependence in the U.S. Approximately

20 percent of this population is addicted to illicit opioids, such

as heroin, and the other 80 percent to prescription opioids, such

as oxycodone, hydrocodone, methadone, hydromorphone and codeine.

Before the year 2000, medication-assisted therapies for opioid

dependence had been sanctioned to a limited number of facilities in

the U.S. The Drug Addiction Treatment Act of 2000 (DATA 2000)

allowed medical office-based treatment of opioid dependence and

greatly expanded patient access to medication-assisted treatments.

As a result, an estimated 1.2 million people in the U.S. sought

treatment for opioid dependence in 2011.

About Probuphine Probuphine is an investigational subdermal

implant designed to deliver continuous, around the clock blood

levels of buprenorphine for six months following a single

treatment, and to simplify patient compliance and retention.

Buprenorphine, an approved agent for the treatment of opioid

dependence, is currently available in the form of daily dosed

sublingual tablets and film formulations, with reported 2012 sales

of $1.5 billion in the United States.

Probuphine was developed using ProNeura™, Titan's continuous

drug delivery system that consists of a small, solid implant made

from a mixture of ethylene-vinyl acetate (EVA) and a drug

substance. The resulting construct is a solid matrix that is placed

subdermally, normally in the upper arm in a simple office

procedure, and removed in a similar manner at the end of the

treatment period. The drug substance is released slowly and

continuously through the process of dissolution resulting in a

steady rate of release.

The efficacy and safety of Probuphine has been studied in

several clinical trials, including a 163-patient,

placebo-controlled study over a 24-week period (published in the

Journal of the American Medical Association (JAMA)), and a

confirmatory study of 287 patients (published in the journal

Addiction).

Conference Call Titan management will host a live conference

call at 1 p.m. ET / 10 a.m. PT on Friday, November 15, 2013 to

provide the Company's financial results as of September 30, 2013.

Participating on the call will be Mr. Bhonsle, Dr. Rubin, Brian

Crowley, vice president of finance and Katherine Glassman-Beebe,

Ph.D. executive vice president and chief development officer.

The live webcast of the call may be accessed by visiting the

Titan website at www.titanpharm.com. The call can also be accessed

by dialing 888-504-7963,

participant code: 9627990 five minutes prior to the start time. A

replay of the call will be available on the Company website

approximately two hours after completion of the call and will be

archived for two weeks.

About Titan Pharmaceuticals For information concerning Titan

Pharmaceuticals, Inc., please visit the Company's website at

www.titanpharm.com.

The press release may contain "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such statements

include, but are not limited to, any statements relating to our

product development programs and any other statements that are not

historical facts. Such statements involve risks and uncertainties

that could negatively affect our business, operating results,

financial condition and stock price. Factors that could cause

actual results to differ materially from management's current

expectations include those risks and uncertainties relating to the

regulatory approval process, the development, testing, production

and marketing of our drug candidates, patent and intellectual

property matters and strategic agreements and relationships. We

expressly disclaim any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in our expectations or any

changes in events, conditions or circumstances on which any such

statement is based, except as required by law.

| |

|

| |

|

| TITAN PHARMACEUTICALS, INC. |

|

| CONDENSED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME (LOSS) |

|

| (in thousands, except per share amount) |

|

| (unaudited) |

|

| |

|

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2013 |

|

|

2012 |

|

|

2013 |

|

|

2012 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

License revenue |

|

$ |

2,198 |

|

|

$ |

- |

|

|

$ |

8,146 |

|

|

$ |

- |

|

| |

Royalty revenue |

|

|

- |

|

|

|

1,228 |

|

|

|

1,424 |

|

|

|

3,816 |

|

| |

Grant revenue |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

42 |

|

| |

|

Total revenue |

|

|

2,198 |

|

|

|

1,228 |

|

|

|

9,570 |

|

|

|

3,858 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Research and development |

|

|

1,679 |

|

|

|

2,995 |

|

|

|

7,380 |

|

|

|

8,037 |

|

| |

General and administrative |

|

|

647 |

|

|

|

890 |

|

|

|

2,439 |

|

|

|

3,750 |

|

| |

|

Total operating expense |

|

|

2,326 |

|

|

|

3,885 |

|

|

|

9,819 |

|

|

|

11,787 |

|

| Loss from operations |

|

|

(128 |

) |

|

|

(2,657 |

) |

|

|

(249 |

) |

|

|

(7,929 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Other income (expense), net |

|

|

(1,017 |

) |

|

|

(5,356 |

) |

|

|

10,169 |

|

|

|

(6,972 |

) |

| Net income (loss) and comprehensive income (loss) |

|

$ |

(1,145 |

) |

|

$ |

(8,013 |

) |

|

$ |

9,920 |

|

|

$ |

(14,901 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income (loss) per share |

|

$ |

(0.01 |

) |

|

$ |

(0.12 |

) |

|

$ |

0.12 |

|

|

$ |

(0.23 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income (loss) per share |

|

$ |

- |

|

|

$ |

(0.07 |

) |

|

$ |

0.11 |

|

|

$ |

(0.19 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares used in computing basic net

income (loss) per share |

|

|

82,544 |

|

|

|

66,839 |

|

|

|

81,125 |

|

|

|

63,748 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares used in computing diluted net

income (loss) per share |

|

|

82,544 |

|

|

|

66,839 |

|

|

|

81,832 |

|

|

|

70,189 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| CONDENSED BALANCE SHEETS |

|

| (in thousands) |

|

| (unaudited) |

|

| |

|

|

|

|

|

| |

|

September 30, |

|

December 31, |

|

| |

|

2013 |

|

2012 |

|

| |

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

| |

Cash |

|

$ |

8,998 |

|

$ |

18,102 |

|

| |

Receivables |

|

|

4,590 |

|

|

4,646 |

|

| |

Prepaid expenses and other current assets |

|

|

262 |

|

|

687 |

|

| |

|

Total current assets |

|

|

13,850 |

|

|

23,435 |

|

| |

Furniture and equipment, net |

|

|

1,670 |

|

|

1,392 |

|

| |

|

$ |

15,520 |

|

$ |

24,827 |

|

| Liabilities and Stockholders' Equity (Deficit) |

|

|

|

|

|

|

|

| |

Current liabilities |

|

$ |

12,250 |

|

$ |

21,393 |

|

| |

Warrant liabilities |

|

|

2,248 |

|

|

8,240 |

|

| |

Royalty liability |

|

|

- |

|

|

8,962 |

|

| |

Long-term debt |

|

|

- |

|

|

9,360 |

|

| |

Stockholders' equity (deficit) |

|

|

1,022 |

|

|

(23,128 |

) |

| |

|

$ |

15,520 |

|

$ |

24,827 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

CONTACT: Titan Pharmaceuticals, Inc. Sunil Bhonsle 650-244-4990

President Pure Communications Susan Heins 864-286-9597

sjheins@purecommunicationsinc.com

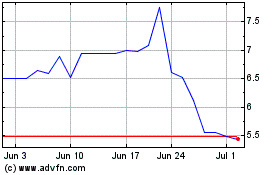

Titan Pharmaceuticals (NASDAQ:TTNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Titan Pharmaceuticals (NASDAQ:TTNP)

Historical Stock Chart

From Apr 2023 to Apr 2024