Astrotech Reports Fourth Quarter and Fiscal Year 2013 Financial Results

October 15 2013 - 7:00AM

- EBITDA income of $2.6 million for the quarter ended

June 30, 2013 and $1.6 million for the year ended June 30,

2013

- GAAP results: net income of $2.2 million (attributable

to Astrotech Corporation), or $0.11 per diluted share for the

quarter ended June 30, 2013 and net loss of $0.2 million

(attributable to Astrotech Corporation), or $(0.01) per diluted

share, for the year ended June 30, 2013

- Astrotech Space Operations ("ASO"), the Company's core

business, supported the processing of eight missions during fiscal

year ended June 30, 2013

- 1st Detect was

granted one patent and filed eleven patent applications. The

Company now has two patents granted, sixteen additional patent

applications pending and a number of patent opportunities in the

draft or research stage.

Astrotech Corporation (Nasdaq:ASTC), a leading provider of

commercial aerospace services and products, today announced

financial results for its fourth quarter and fiscal year ended June

30, 2013.

"Our long held strategy to fully support our ASO subsidiary, by

meeting the needs of our customers with state-of-the-art

facilities, continues to perform as expected. We are also growing

ASTC value by investing in our Spacetech initiatives by partnering

with key industry participants to develop compelling solutions that

address imminent and compelling economic needs," said Thomas B.

Pickens III, Chairman and CEO of Astrotech Corporation. "We are

also very proud to announce the completion of our new development

facility in Webster, TX, where 1st Detect is ramping up its

manufacturing capabilities in anticipation of maturing joint

development partnerships. We are educating a number of high value

markets with the opportunity to sell solutions that meet the

general needs of quantitative analysis on the factory floor."

"Our fourth quarter performance has been exceptional, and we are

proud to release the best earnings report in over three years,"

said Carlisle Kirkpatrick, CFO of Astrotech Corporation. "During

the quarter, Astrotech Space Operations processed two very

important U.S. government missions and we are nearly complete on

our multi-year Ground Support Equipment contract. Our backlog

remains strong and we are encouraged by the diversity we are seeing

in new programs now under contract. This diversity allows the

Company to enhance its portfolio of future repeat customers. Our

financial performance has been remarkable both this quarter and for

the year just ending. EBITDA for the year was a very strong $1.6

million, achieved primarily through consistent delivery of high

value payload services and cost controls within our SG&A

functions.

"It is important to also note that we have successfully

concluded our negotiations with the lender under our financing

facilities and we are pleased to report a mutual resolution that

enables Astrotech to continue building its businesses while

satisfying our obligations with the lender."

Fourth Quarter Results

The Company posted fourth quarter fiscal year 2013 net income of

$2.2 million, or $0.11 per diluted share on revenue of $9.2 million

compared with a fourth quarter fiscal year 2012 net loss of $1.3

million, or $(0.07) per diluted share on revenue of $7.6

million.

Fiscal Year Results

The Company posted fiscal year 2013 net loss of $0.2 million, or

$(0.01) per diluted share on revenue of $24.0 million compared with

fiscal year 2012 net loss of $2.7 million, or $(0.15) per diluted

share on revenue of $26.1 million.

Update of Ongoing Operations

The Company's 18-month rolling backlog, which includes

contractual backlog, scheduled but uncommitted missions, and the

design and fabrication of GSE, is $25.5 million at June 30, 2013.

The 18-month rolling backlog for ASO consists of pre-launch

satellite processing services, which include hardware launch

preparation, advance planning, use of unique satellite preparation

facilities and spacecraft checkout, encapsulation, fueling and

transport, and design and fabrication of equipment and hardware for

space launch activities at our Titusville, Florida and VAFB

locations.

Financial Position and Liquidity

Working capital was $4.3 million as of June 30, 2013, which

included $5.1 million in cash and cash equivalents and $5.3 million

of accounts receivable.

About Astrotech Corporation

Astrotech is one of the first space commerce companies and

remains a strong entrepreneurial force in the aerospace industry.

We are leaders in identifying, developing and marketing space

technology for commercial use. Our ASO business unit serves our

government and commercial satellite and spacecraft customers with

pre-launch services on the eastern and western range. 1st Detect

Corporation is developing what we believe is a breakthrough

miniature mass spectrometer, while Astrogenetix, Inc. is a

biotechnology company utilizing microgravity as a research platform

for drug discovery and development.

This press release contains forward-looking statements that are

made pursuant to the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks, trends, and uncertainties that

could cause actual results to be materially different from the

forward-looking statement. These factors include, but are not

limited to, continued government support and funding for key space

programs, the ability to expand ASO, the availability of capital

for reinvestment in growth initiatives, product performance and

market acceptance of products and services, as well as other risk

factors and business considerations described in the Company's

Securities and Exchange Commission filings including the annual

report on Form 10-K. Any forward-looking statements in this

document should be evaluated in light of these important risk

factors. The Company assumes no obligation to update these

forward-looking statements.

| |

| |

| ASTROTECH CORPORATION

AND SUBSIDIARIES |

| Condensed Consolidated

Statements of Operations |

| (In thousands, except per share

data) |

| |

| |

Three Months

Ended June 30, |

Twelve Months

Ended June 30, |

| |

2013 |

2012 |

2013 |

2012 |

| Revenue |

$ 9,180 |

$ 7,609 |

$ 23,995 |

$ 26,138 |

| Cost of revenue |

5,102 |

5,986 |

15,684 |

18,790 |

| Gross profit |

4,078 |

1,623 |

8,311 |

7,348 |

| Operating expenses: |

|

|

|

|

| Selling, general and

administrative |

1,449 |

1,616 |

6,790 |

7,067 |

| Research and development |

586 |

592 |

2,080 |

2,571 |

| Total operating expenses |

2,035 |

2,208 |

8,870 |

9,638 |

| Income (loss) from

operations |

2,043 |

(585) |

(559) |

(2,290) |

| Interest and other expense,

net |

(44) |

(824) |

(164) |

(1,026) |

| Income (loss) before income

taxes |

1,999 |

(1,409) |

(723) |

(3,316) |

| Income tax benefit

(expense) |

— |

— |

— |

(17) |

| Net income (loss) |

1,999 |

(1,409) |

(723) |

(3,333) |

| Less: Net loss attributable to

noncontrolling interest* |

(156) |

(134) |

(538) |

(620) |

| Net income (loss) attributable

to Astrotech Corporation |

$ 2,155 |

$ (1,275) |

$ (185) |

$ (2,713) |

| |

|

|

|

|

| Net income (loss) per share attributable

to Astrotech Corporation, basic and diluted |

$ 0.11 |

$ (0.07) |

$ (0.01) |

$ (0.15) |

| |

|

* Noncontrolling interest resulted from grants of restricted

stock in 1st Detect and Astrogenetix to certain employees, officers

and directors. Please refer to the June 30, 2013 10-K filed

with the Securities and Exchange Commission for further

detail. |

| |

| |

| ASTROTECH CORPORATION

AND SUBSIDIARIES |

| Condensed Consolidated

Balance Sheets |

| (In

thousands) |

| |

| |

June

30, |

| |

2013 |

2012 |

| Assets |

|

|

| Cash and cash equivalents |

$ 5,096 |

$ 10,177 |

| Accounts receivable, net of

allowance |

5,317 |

1,926 |

| Prepaid expenses and other

current assets |

503 |

592 |

| Total current assets |

10,916 |

12,695 |

| Property, plant, and equipment,

net |

37,035 |

37,270 |

| Long-term note receivable, net

of reserve |

— |

— |

| Other assets, net |

51 |

84 |

| Total assets |

$ 48,002 |

$ 50,049 |

| |

|

|

| Liabilities and stockholders'

equity |

|

|

| Current liabilities |

$ 6,609 |

$ 7,875 |

| Long-term liabilities |

5,913 |

6,042 |

| Stockholders' equity |

35,480 |

36,132 |

| Total liabilities and stockholders'

equity |

$ 48,002 |

$ 50,049 |

| |

| |

| ASTROTECH CORPORATION

AND SUBSIDIARIES |

| Unaudited

Reconciliation of Non-GAAP Measures |

| Earnings Before

Interest, Taxes, Depreciation and Amortization |

| (In

thousands) |

| |

| |

Three Months

Ended June 30, |

Twelve Months Ended June

30, |

| |

2013 |

2012 |

2013 |

2012 |

| EBITDA |

$ 2,623 |

$ (829) |

$ 1,642 |

$ (589) |

| Depreciation &

amortization |

563 |

514 |

2,115 |

2,456 |

| Interest expense |

61 |

66 |

250 |

271 |

| Income tax expense |

— |

— |

— |

17 |

| Net income (loss) |

1,999 |

(1,409) |

(723) |

(3,333) |

| Net loss attributable to

noncontrolling interest |

(156) |

(134) |

(538) |

(620) |

| Net income (loss) attributable

to Astrotech Corporation |

$ 2,155 |

$ (1,275) |

$ (185) |

$ (2,713) |

EBITDA (earnings before interest, taxes, depreciation and

amortization) is a non-U.S. GAAP financial measure. We included

information concerning EBITDA because we use such information when

evaluating operating earnings (loss) to better evaluate the

underlying performance of the Company. EBITDA does not represent,

and should not be considered an alternative to, net income (loss),

operating earnings (loss), or cash flow from operations as those

terms are defined by U.S. GAAP and does not necessarily indicate

whether cash flows will be sufficient to fund cash needs. While

EBITDA is frequently used as measures of operations and the ability

to meet debt service requirements by other companies, our use of

this financial measure is not necessarily comparable to such other

similarly titled captions of other companies.

CONTACT: Carlisle Kirkpatrick

Chief Financial Officer

Astrotech Corporation

512.485.9530

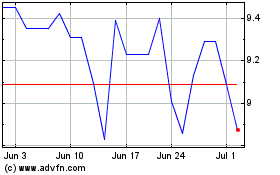

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Apr 2023 to Apr 2024