Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks.

You can find the Fund’s prospectus, statement of additional information and other information about the Fund online at https://www.arbitragefunds.com/ restricted/get/arbitrage_credit_opportunities_fund_info.html. You can also get this

information at no cost by calling the Fund at (800) 295-4485 or by sending an e-mail request to the SEC at publicinfo@sec.gov. The Fund’s prospectus and statement of additional information, both dated September 30, 2013, as

supplemented from time to time, are incorporated by reference into this Summary Prospectus.

|

|

|

|

|

|

|

THE ARBITRAGE CREDIT OPPORTUNITIES FUND

|

Investment Objective

The Fund seeks to provide current income and capital growth.

Fund Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on

Class A Shares if you and your family invest, or agree to invest in the future, at least $100,000 in the Fund.

Shareholder Fees

(fees paid

directly from your investment)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class R

Shares

|

|

Class I

Shares

|

|

Class C

Shares

|

|

Class A

Shares

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering

price)

|

|

|

|

None

|

|

|

|

|

None

|

|

|

|

|

None

|

|

|

|

|

3.25

|

%

|

|

Maximum Deferred Sales Charge (Load)

(as a percentage of original purchase

price)

|

|

|

|

None

|

|

|

|

|

None

|

|

|

|

|

1.00

|

%

(1)

|

|

|

|

None

|

(2)

|

|

Maximum Sales Charge (Load) Imposed on Reinvested Dividends

|

|

|

|

None

|

|

|

|

|

None

|

|

|

|

|

None

|

|

|

|

|

None

|

|

|

Redemption Fee (as a percentage of amount redeemed within 60 days of purchase)

|

|

|

|

2.00%

|

|

|

|

|

2.00%

|

|

|

|

|

None

|

|

|

|

|

2.00

|

%

(3)

|

|

Exchange Fee (as a percentage of amount exchanged within 30 days of purchase)

(7)

|

|

|

|

2.00%

|

|

|

|

|

2.00%

|

|

|

|

|

None

|

|

|

|

|

None

|

|

|

Annual Fund Operating Expenses

(expenses that you pay

each year as a percentage of the value of your investment)

|

|

|

|

|

Class R

Shares

|

|

Class I

Shares

|

|

Class C

Shares

|

|

Class A

Shares

|

|

Management Fees

|

|

|

|

1.00

|

%

|

|

|

|

1.00

|

%

|

|

|

|

1.00

|

%

|

|

|

|

1.00

|

%

|

|

Distribution and/or Service (12b-1) Fees

|

|

|

|

0.25

|

%

|

|

|

|

None

|

|

|

|

|

1.00

|

%

|

|

|

|

0.25

|

%

|

|

Other

Expenses

(4)

|

|

|

|

2.61

|

%

(8)

|

|

|

|

2.61

|

%

(8)

|

|

|

|

2.61

|

%

(8)

|

|

|

|

2.61

|

%

|

|

Dividend and Interest Expense on Short Positions

(5)

|

|

|

|

0.05

|

%

|

|

|

|

0.05

|

%

|

|

|

|

0.05

|

%

|

|

|

|

0.05

|

%

|

|

All Remaining Other Expenses

|

|

|

|

2.56

|

%

|

|

|

|

2.56

|

%

|

|

|

|

2.56

|

%

|

|

|

|

2.56

|

%

|

|

Total Annual Fund Operating Expenses

|

|

|

|

3.86

|

%

|

|

|

|

3.61

|

%

|

|

|

|

4.61

|

%

|

|

|

|

3.86

|

%

|

|

Fee Waiver

(6)

|

|

|

|

(2.31

|

)%

|

|

|

|

(2.31

|

)%

|

|

|

|

(2.31

|

)%

|

|

|

|

(2.31

|

)%

|

|

Total Annual Fund Operating Expenses After Fee

Waiver

(6)

|

|

|

|

1.55

|

%

|

|

|

|

1.30

|

%

|

|

|

|

2.30

|

%

|

|

|

|

1.55

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

This contingent deferred sales charge applies to Class C shares redeemed within 12 months of purchase.

|

|

(2)

|

A deferred sales charge of up to 1.00% will be imposed on purchases of $500,000 or more of Class A shares purchased without a front-end

sales charge that are redeemed within 18 months of purchase.

|

|

(3)

|

The redemption fee does not apply to purchases of $500,000 or more of Class A shares, which are subject to a contingent deferred sales

charge.

|

|

(4)

|

Other Expenses for Class A shares are based on Class R expenses because the Class A shares have not been offered for a full year.

|

|

(5)

|

The Fund is obligated to pay any interest incurred or dividend declared during the period in which the Fund maintains a short position to the

lender from which the Fund borrowed the security and the Fund

|

PROSPECTUS

|

SEPTEMBER 30

.

2013

is obligated to record the payment of the accrued interest or dividend as an expense. These expenses are not fees charged to shareholders but are expenses paid by the Fund that are similar to

finance charges that the Fund incurs in borrowing transactions. The Fund may be subject to additional expenses related to short sales (for example, costs of borrowing and margin account maintenance costs).

|

(6)

|

The Fund has entered into an Expense Waiver and Reimbursement Agreement with the Fund’s investment adviser pursuant to which the adviser has

contractually agreed to limit the total annual operating expenses of the Fund, not including the effects of dividends or interest on short positions, acquired fund fees and expenses, taxes, or other extraordinary expenses so that they do not exceed

1.50% of the Fund’s average daily net assets allocable to the Class R shares, 1.25% of the Fund’s average daily net assets allocable to the Class I shares, 2.25% of the Fund’s average daily net assets allocable to the Class C shares,

and 1.50% of the Fund’s average daily net assets allocable to the Class A shares. The agreement remains in effect until August 31, 2015, and thereafter continues until either party terminates it upon not less than five days’

notice by sending a written notice to the other party. The adviser may recoup any waived amount from the Fund pursuant to the agreement, if such recoupment does not cause the Fund to exceed expense limitations in effect at the time the amounts were

waived and the recoupment is done within three years after the year in which the expense is waived.

|

|

(7)

|

Exchange

privileges do not apply to Class A or Class C shares until such shares have been held for at least 30 days.

|

|

(8)

|

The

operating expenses in this fee table do not correlate to the expense ratio in the financial highlights for the Class R, Class I and Class C shares, but rather reflect the Fund’s current (i) expense levels and (ii) expense limitation

agreement.

|

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in the Fund for the time periods indicated and

then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s expenses are equal to the Total Annual Fund Operating Expenses After Fee Waiver for the

first year and equal to the Total Annual Fund Operating Expenses for the remaining years. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

Class R Shares

|

|

$ 158

|

|

$ 736

|

|

$1,580

|

|

$3,776

|

|

Class I Shares

|

|

$ 132

|

|

$ 660

|

|

$1,458

|

|

$3,549

|

|

Class C Shares

|

|

$ 333

|

|

$ 959

|

|

$1,939

|

|

$4,420

|

|

Class A Shares

|

|

$ 404

|

|

$ 968

|

|

$1,791

|

|

$3,931

|

You would pay the following expenses if you did not redeem your shares:

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

Class R Shares

|

|

$ 158

|

|

$ 736

|

|

$1,580

|

|

$3,776

|

|

Class I Shares

|

|

$ 132

|

|

$ 660

|

|

$1,458

|

|

$3,549

|

|

Class C Shares

|

|

$ 233

|

|

$ 959

|

|

$1,939

|

|

$4,420

|

|

Class A Shares

|

|

$ 404

|

|

$ 968

|

|

$1,791

|

|

$3,931

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may

result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. Between October 1, 2012, the Fund’s

inception, and May 31, 2013, the Fund’s portfolio turnover rate was 92% of the average value of its portfolio.

|

|

|

|

|

|

|

3

|

|

|

|

|

|

|

|

THE ARBITRAGE CREDIT OPPORTUNITIES FUND

|

Principal Investment Strategies

The Fund invests primarily in a portfolio of debt securities including corporate bonds and debentures (including high yield bonds commonly known as “junk bonds”), bank loans, convertible and preferred

securities that the Fund’s investment adviser believes have debt-like characteristics, credit default swaps and other debt instruments and derivatives that the Fund’s investment adviser believes have debt-like characteristics. The Fund

invests in both domestic and foreign debt securities. The principal type of derivatives in which the Fund may invest are credit default swaps, interest rate swaps, total return swaps, futures and options.

In order to meet its investment objective, the Fund invests primarily in debt securities whose returns the adviser believes will be more correlated

with the outcome of specific catalysts or events rather than overall market direction. These catalysts and events include reorganizations, restructurings, recapitalizations, debt maturities, refinancings, mergers, acquisitions, regulatory changes

and other special situations. The Fund also uses a relative value approach and expresses positive views on specific issuers by taking long positions in cash bonds and/or derivatives and negative views on specific issuers by taking short positions in

cash bonds and/or derivatives. The Fund uses fundamental research to identify mispricings or inefficiencies in these situations and assess their potential impact on security prices.

The Fund may engage in short-term trading strategies, and may, without limitation, engage in short sales and invest in derivatives. The principal

short-term trading strategies may at times include convertible arbitrage, merger arbitrage, and capital structure arbitrage, which are discussed below. The Fund will seek to mitigate the risk of volatility (the appreciation or depreciation of the

value of a security over a short period of time) and duration (interest rate changes impacting the value of fixed income securities with longer effective maturities more than those with shorter effective maturities) by taking long and short

positions, based on individual credit evaluations that are designed to protect against short-term fluctuations in the value of securities, as well as by investing in derivatives that are designed to protect against the decline in value of fixed

income securities resulting from interest rate changes, including credit default swaps, interest rate swaps, total return swaps, futures and options to hedge the portfolio’s interest rate risk and credit risk. The Fund may purchase or sell

short equity securities or derivatives as part of a hedging strategy or hold equity positions or other assets that the Fund receives as part of a reorganization process.

The Fund is not limited with respect to its portfolio maturity or duration. The Fund may invest in debt securities without regard to their credit ratings, including securities that are non-investment grade, and in

debt securities with a wide variety of terms applicable to principal repayment, interest rates and other features. Terms that vary from security to security include: optional and mandatory prepayment provisions, fixed, variable, semi-variable, and

resettable interest rates and conversion options, as well as various combinations of these terms.

Convertible Arbitrage:

Convertible arbitrage is a specialized strategy that seeks to profit from mispricings between a firm’s

convertible securities and its underlying equity. The most common convertible arbitrage approach, and the strategy the Fund generally uses when it believes that the common stock is overvalued in relation to the convertible securities, matches a long

position in the debt securities, preferred stocks and other securities convertible into common stock with a short position in the underlying common stock. The Fund seeks to purchase such convertible securities at discounts to their expected future

values and sell short shares of the underlying common stock in order to mitigate equity market movements. As stock prices rise and the convertible security becomes more equity sensitive, the Fund will sell short additional common shares in order to

maintain the relationship between the convertible and the underlying common stock. As stock prices fall, the Fund will typically buy back a portion of shares which it had sold short. Positions are typically designed to earn income from coupon or

dividend payments, and from the short sale of common stock.

PROSPECTUS

|

SEPTEMBER 30

.

2013

Merger Arbitrage:

Merger arbitrage is a highly specialized investment approach designed to profit from the successful completion of mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations and other corporate reorganizations. The most common

merger arbitrage activity, and the approach the Fund generally uses, involves purchasing debt securities of an announced acquisition target company at a discount to their expected value upon completion of the acquisition. The Fund may engage in

selling securities short when the terms of a proposed acquisition call for the exchange of common stock and/or other securities. In such a case, the securities of the company to be acquired may be purchased and, at approximately the same time, an

equivalent amount of the acquiring company’s common stock and/or other securities may be sold short.

Capital Structure Arbitrage:

Capital structure arbitrage seeks to profit from relative pricing discrepancies between related debt and/or

equity securities. For example, when the Fund believes that unsecured securities are overvalued in relation to senior secured securities, the Fund may purchase a senior secured security of an issuer and sell short an unsecured security of the same

issuer. In this example the trade would be profitable if credit quality spreads widened or if the issuer went bankrupt and the recovery rate for the senior debt was higher than anticipated. It is expected that, over time, the relative mispricing of

the securities will disappear, at which point the position will be liquidated.

Principal Risks

As with all mutual funds, investing in the Fund entails risks that could cause the Fund and you to lose money. The principal risks of investing in

the Fund are as follows:

Credit Risk:

Credit risk refers to the possibility that the issuer of the security will not be able to make interest or principal payments when due. The Fund may invest in convertible and non convertible debt securities,

including high yield debt securities, also known as “junk bonds.” Investments in junk bonds are subject to greater credit risks than securities with credit ratings above investment grade and have a greater risk of default than investment

grade debt securities. Junk bonds are less sensitive to interest rate changes than higher credit quality instruments and generally are more sensitive to adverse economic changes or individual corporate developments.

Interest Rate Risks:

The market value of debt securities and preferred securities is affected by changes in prevailing interest rates and the credit quality of the issuer. When interest rates fall or the perceived credit quality of the issuer improves, the market value

of the respective debt securities and preferred securities usually increases. Conversely, when interest rates rise or the perceived credit quality of the issuer declines, the market value of the respective debt securities and preferred securities

usually declines.

Market Risk:

Market risk is the possibility that securities prices will fluctuate over time. This fluctuation includes both increases and decreases in security prices. The Fund is subject to market risk. The value of the

Fund’s investments, and the net asset value of the Fund, will fluctuate. Investors could lose money due to this price fluctuation.

Merger Arbitrage

Risks:

The principal risk associated with the Fund’s merger arbitrage investment strategy is that the proposed reorganizations in which the Fund invests may be renegotiated or terminated,

in which case the Fund may realize losses.

Convertible Security

Risks:

Convertible securities generally offer lower interest or dividend yields than non convertible securities of similar quality. Because convertible securities are higher in the firm’s

capital structure than equity, convertible securities are generally not as risky as the equity securities of the same issuer. However, convertible securities may gain or lose value due to changes in interest rates and other general economic

conditions, industry fundamentals, market sentiment and changes in the issuer’s operating results, financial statements and credit ratings.

|

|

|

|

|

|

|

5

|

|

|

|

|

|

|

|

THE ARBITRAGE CREDIT OPPORTUNITIES FUND

|

Small and Medium Sized

Company Risks

: The Fund invests in small and medium sized companies, which may have more limited liquidity and greater price volatility than larger, more established companies. Small companies

may have limited product lines, markets or financial resources and their management may be dependent on a limited number of key individuals.

Credit Default Swap Risks

: Credit default swaps increase credit risk when the Fund is

the seller and increase counterparty risk when the Fund is the buyer. Credit default swaps may be illiquid and may be difficult to trade or value, especially in the event of market disruptions. Credit default swap transactions in which the Fund is

the seller may require the Fund to liquidate securities when it may not be advantageous to do so in order to satisfy its obligations or to meet segregation requirements. The swap market could be disrupted or limited as a result of recent

legislation, and these changes could adversely affect the Fund.

Interest Rate Swap

Risks

: The risk of interest rate swaps includes changes in market conditions that may affect the value of the contract or the cash flows, and the possible inability of the counterparty to

fulfill its obligations under the agreement. Certain interest rate swap arrangements also may involve the risk that they do not fully offset adverse changes in interest rates. Interest rate swaps may in some cases be illiquid and may be difficult to

trade or value, especially in the event of market disruptions. Under certain market conditions, the investment performance of the Fund may be less favorable than it would have been if the Fund had not used the swap agreement.

Total Return Swap

Risks:

In a standard “swap” transaction, two parties agree to exchange the returns (or differentials in rates of return) earned or realized on particular predetermined investments or

instruments. Certain categories of swap agreements often have terms of greater than seven days and may be considered illiquid. Moreover, the Fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of the

default or bankruptcy of a swap agreement counterparty. The swaps market is subject to extensive regulation under the Dodd-Frank Wall Street Reform and Consumer Protection Act and certain Securities and Exchange Commission and Commodity Futures

Trading Commission rules promulgated thereunder. It is possible that developments in the swaps market, including new and additional government regulation, could result in higher Fund costs and expenses and could adversely affect the Fund’s

ability, among other things, to terminate existing swap agreements or to realize amounts to be received under such agreements.

Futures Risks:

The Fund’s use of futures contracts involves risks different from, or possibly greater than, the risks associated

with investing directly in securities and other traditional investments. These risks include (i) leverage risk; (ii) correlation or tracking risk; and (iii) liquidity risk. Because futures require only a small initial investment in

the form of a deposit or margin, they involve a high degree of leverage. Accordingly, the fluctuation of the value of futures in relation to the underlying assets upon which they are based is magnified. Thus, the Fund may experience losses that

exceed losses experienced by funds that do not use futures contracts. There may be imperfect correlation, or even no correlation, between price movements of a futures contract and price movements of investments for which futures are used as a

substitute, or which futures are intended to hedge. Lack of correlation (or tracking) may be due to factors unrelated to the value of the investments being hedged, such as speculative or other pressures on the markets in which these instruments are

traded. Consequently, the effectiveness of futures as a security substitute or as a hedging vehicle will depend, in part, on the degree of correlation between price movements in the futures and price movements in underlying securities. While futures

contracts are generally liquid instruments, under certain market conditions they may become illiquid. Futures exchanges may impose daily or intra-day price change limits and/or limit the volume of trading. Additionally, government regulation may

further reduce liquidity through similar trading restrictions. As a result, the Fund may be unable to close out its futures contracts at a time which is advantageous. The successful use of futures depends upon a variety of factors, particularly the

ability of the adviser to predict movements of the underlying securities markets, which requires different skills than predicting changes in the prices of individual securities. There can be no assurance that any particular futures strategy adopted

will succeed.

PROSPECTUS

|

SEPTEMBER 30

.

2013

Option Risks:

Option

transactions in which the Fund may engage involve the specific risks described below:

|

|

•

|

|

the writer of an option may be assigned an exercise at any time during the option period;

|

|

|

•

|

|

disruptions in the markets for underlying instruments could result in losses for options investors;

|

|

|

•

|

|

imperfect or no correlation between the option and the securities being hedged;

|

|

|

•

|

|

the insolvency of a broker could present risks for the broker’s customers; and

|

|

|

•

|

|

market imposed restrictions may prohibit the exercise of certain options.

|

In addition, the option activities of the Fund may affect its portfolio turnover rate and the amount of brokerage commissions paid by the Fund.

High Portfolio Turnover Risks:

The Fund’s investment strategies may result in high portfolio turnover rates. This may increase the Fund’s brokerage commission costs, which would reduce performance. Rapid portfolio turnover also

exposes shareholders to a higher current realization of short-term gains which could cause you to pay higher taxes.

Short Sale Risks:

The Fund will suffer a loss if it sells a security short and the value of the security rises rather than falls. It is

possible that the Fund’s long positions will decline in value at the same time that the value of its short positions increase, thereby increasing potential losses to the Fund. Short sales expose the Fund to the risk that it will be required to

buy the security sold short (also known as “covering” the short position) at a time when the security has appreciated in value, thus resulting in a loss to the Fund. The Fund’s investment performance will also suffer if it is required

to close out a short position earlier than it had intended. In addition, the Fund may be subject to expenses related to short sales that are not typically associated with investing in securities directly, such as costs of borrowing. These expenses

may negatively impact the performance of the Fund. Short positions introduce more risk to the Fund than long positions (purchases) because the maximum sustainable loss on a security purchased (held long) is limited to the amount paid for the

security plus the transaction costs, whereas there is no maximum attainable price of the shorted security. Therefore, in theory, securities sold short have unlimited risk.

Foreign Securities Risks:

The securities of foreign issuers may be less liquid and more

volatile than securities of comparable U.S. issuers. The costs associated with securities transactions are often higher in foreign countries than in the United States. The U.S. dollar value of foreign securities traded in foreign currencies (and any

dividends and interest earned) held by the Fund or by mutual funds in which the Fund invests may be affected favorably or unfavorably by changes in foreign currency exchange rates. An increase in the U.S. dollar relative to these other currencies

will adversely affect the Fund. Additionally, investments in foreign securities, even those publicly traded in the United States, may involve risks which are in addition to those inherent in U.S. investments. Foreign companies may not be subject to

the same regulatory requirements of U.S. companies, and as a consequence, there may be less publicly available information about such companies. Also, foreign companies may not be subject to uniform accounting, auditing, and financial reporting

standards and requirements comparable to those applicable to U.S. companies. Foreign governments and foreign economies often are less stable than the U.S. Government and the U.S. economy.

Tax Risks:

The U.S.

income tax rules may be uncertain when applied to specific arbitrage transactions, including identifying deferred losses from wash sales or realized gains from constructive sales, among other issues. Such uncertainty may cause the Fund to be exposed

to unexpected tax liability or loss of pass through tax status.

Performance Information

Performance information for the Fund will be provided once it has annual returns for a full calendar year. Please remember that the Fund’s past

performance (before and after taxes) is not necessarily an indication

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

|

THE ARBITRAGE CREDIT OPPORTUNITIES FUND

|

of its future performance. It may perform better or worse in the future. Updated information on

the Fund’s performance can be obtained by visiting www.arbitragefunds.com.

Investment Adviser

Water Island Capital, LLC is the investment adviser to the Fund.

Portfolio Managers

Gregory Loprete, Portfolio Manager of the Fund, has been a portfolio

manager of the Fund since its inception. James Powers, Portfolio Manager of the Fund, has been a portfolio manager of the Fund since its inception.

Purchase and Sale of Fund Shares

Minimum Investment Amounts Class R Shares

– The minimum initial investment for all types of accounts is $2,000. There is no minimum

for subsequent investments other than investments through the Fund’s Automatic Investment Plan, which has a $100 minimum for investments.

Minimum Investment Amounts Class I Shares

– The minimum initial investment for all

types of accounts is $100,000. There is no minimum for subsequent investments other than investments through the Fund’s Automatic Investment Plan, which has a $100 minimum for investments.

You may conduct transactions by mail (Regular Mail to The Arbitrage Funds, c/o DST Systems, Inc., P.O. Box 219842, Kansas City, Missouri

64121-9842, or Express/Overnight Mail to The Arbitrage Funds, c/o DST Systems, Inc., 430 West 7th Street, Kansas City, Missouri 64105), or by telephone at (800) 295-4485. Transactions will only occur on days the New York Stock Exchange (NYSE)

is open. Investors who wish to purchase, exchange or redeem Class R or Class I shares through a broker-dealer should contact the broker-dealer regarding the hours during which orders to purchase, exchange or sell shares of the Fund may be placed.

The Fund’s transfer agent is open from 9:00 a.m. to 5:00 p.m. Eastern Time for purchase, exchange or redemption orders.

Minimum Investment Amounts Class C and Class A Shares

– The minimum initial investment for all types of accounts is $2,000.

There is no minimum for subsequent investments in Class C or Class A shares.

Purchases, exchanges and redemptions of Class C and

Class A shares can be made only through institutional channels, such as financial intermediaries and retirement platforms, which have established an agreement with the Fund’s distributor. Financial intermediaries may charge additional fees

for their services. You should contact your financial intermediary or refer to your plan documents for information on how to invest in the Fund. Requests must be received in good order by the Fund or its agent (financial intermediary or plan

sponsor, if applicable) prior to the close of the regular trading session of the NYSE in order to receive that day’s net asset value.

Tax

Information

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are

investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, in which case such distributions may be taxable at a later date.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through

a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the

broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

PROSPECTUS

|

SEPTEMBER 30

.

2013

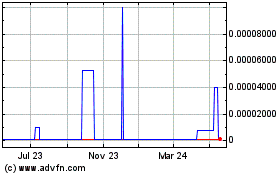

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

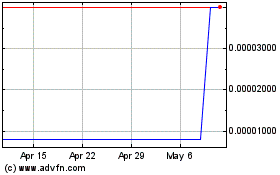

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024