UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) May 15, 2013

RECEIVABLE ACQUISITION & MANAGEMENT CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

DELAWARE

(State or Other Jurisdiction of Incorporation)

| | |

| 001-09370 | 13-3186327 |

| (Commission File Number) | (IRS Employer Identification No.) |

60 E. 42nd Street, 46th Floor

New York, NY 10165

(Address of Principal Executive Offices) (Zip Code)

(212) 796-4097

(Registrant's Telephone Number, Including Area Code)

2 Executive Drive, Suite 630

Fort Lee, NJ 07024

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c))

ITEM 2.01 COMPLETION OF MERGER

On March 29, 2013, Receivable Acquisition & Management Corporation, a Delaware corporation (the “Company”), Cornerstone Program Advisors LLC, a Delaware limited liability company (“Cornerstone”) and Sustainable Energy Industries, Inc. a Delaware corporation (“Sustainable”), entered into a definitive merger agreement (the “Agreement”), hereby incorporated by reference from a Form 8-K filed on April 4, 2013. The merger was completed on May 15, 2013. Pursuant to the terms of the Agreement, two wholly-owned subsidiaries of the Company were separately merged into Sustainable and Cornerstone, with Sustainable and Cornerstone surviving as individual subsidiaries of the Company (the “Merger”). In connection with the Merger, the Company entered into a voluntary share exchange transaction (the “Exchange”) whereby the Company acquired all of the issued and outstanding membership units of Cornerstone and the issued and outstanding shares of Sustainable in exchange for the issuance to the members of Cornerstone (the “Cornerstone Members”) and issuance to the shareholders of Sustainable (the “Sustainable Shareholders”) an aggregate of approximately 176,400,000 shares of Common Stock of the Company. Cornerstone is an energy infrastructure project management company focused on healthcare and higher learning institutions. Sustainable is focused on the alternative energy business, with emphasis on “green” engine technology it has licensed. The Company intends to change its name to Cornerstone Sustainable Energy, Inc. at such time as audited financial statements for Cornerstone are filed under an amendment to this Form 8-K and following shareholder approval.

In accordance with the terms of the Agreement, at the Closing of the Exchange (the “Closing”), the Company shall have no outstanding assets except $50,000 in cash and a certain default judgment awarded to the Company in The Matter of Receivable Acquisition & Management Corp. vs. Airbak Technologies, LLC & Phillip Troy Christy, individually and as a member of Airbak Technologies, LLC (Civil No. 11-4330 (FSH) (PS) in the U.S. District Court of New Jersey, in the amount of $299,000 plus post-judgment interest and no outstanding liabilities. Of that amount, $100,000 is attributable to Mr. Ramesh Arora and that amount will have to be paid out to him upon recovery on the judgment. Immediately prior to Closing, the Company’s officers resigned, and immediately thereafter the Company will be managed by Cornerstone’s and Sustainable’s current management. Prior to the Closing there were approximately 19,600,000 shares of common stock issued and outstanding and there are currently approximately 196 million shares issued and outstanding.

ITEM 3.02 UNREGISTERED SALE OF EQUITY SECURITIES

Pursuant to the Merger described in 2.01 above, the Company issued approximately 176,400,000 shares of common stock to the Cornerstone and Sustainable shareholders (the “Shares”).

2

The Shares have a par value of $.001 per share. No discounts or commissions were paid and no underwriters or placement agents were involved in the issuance of the Shares.

All of the Shares described above were exempt from registration pursuant to the exemption set forth in Section 4(a)(2) of the Securities Act of 1933, and Rule 506 of Regulation D promulgated thereunder, as amended as not involving any public offering.

ITEM 5.02 RESIGNATIONS OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS, APPOINTMENT OF CERTAIN OFFICERS; COMPENSATION ARRANGEMENT OF CERTAIN OFFICERS

Gobin Sahney and Steven Lowe both resigned as directors of Company on May 15, 2013 in connection with and as a result of the Merger.

Max Khan resigned as Chief Executive Officer, President and Chief Financial Officer of the Company on May 15, 2013, however, remained a director.

Thomas Telegades, age 57, was appointed Chief Executive Officer of the Company on May 15, 2013. Since September 2006, Thomas has served as the managing member of Cornerstone Program Advisors LLC, an energy infrastructure project management company focused on healthcare and higher learning institutions, which became a subsidiary of the Company as a result of the Merger. Mr. Telegades has an MBA from Fairleigh Dickinson University and has a BAS from Florida Atlantic University.

Peter Fazio, age 60, was appointed Chief Operating Officer of the Company on May 15, 2013. Since June 2008, Peter has served as Chief Executive Officer of Sustainable Energy Industries Inc., and its predecessor Sustainable Energy Industries, LLC an alternative energy business, with emphasis on “green” engine technology, which became a subsidiary of the Company as a result of the Merger. From February 2009 until February 2011, Peter was Vice President of New Construction for Schlesinger/Siemens. Peter has more than twenty-five (25) years of experience in sales, management, employee relations, cost control and project management, and will continue in these roles with the Company.

Thomas Telegades and Peter Fazio were both elected as directors of the Company on May 15, 2013 pursuant to the Agreement.

The Company entered into a consulting agreement with Thomas Telegades under which Thomas shall serve on a full-time basis as Chief Executive Officer for a three year term beginning on May 15, 2013. Thomas shall be paid an annual compensation of $150,000 for his services. The consulting agreement includes non-competition and non-solicitation provisions which expire the latter of three years from May 15, 2013, or one year following his termination or voluntary resignation.

3

The Company entered into a consulting agreement with Peter Fazio, under which Peter shall serve on a full-time basis as Chief Operating Officer of the Company for a three year term beginning on May 15, 2013. Peter shall be paid annual compensation of $150,000 for his services. The consulting agreement includes non-competition and non-solicitation provisions which expire the latter of three years from May 15, 2013, or one year following his termination or voluntary resignation.

ITEM 9.01

FINANCIAL STATEMENTS AND EXHIBITS

(a)

Financial Statements of Business Acquired.

In accordance with Item 9.01(a)(4) of Form 8-K, the Company will file the financial statements of Sustainable and Cornerstone, the businesses acquired, as required by Item 9.01(a)(1) within seventy-one days after the due date of May 21, 2013, for this Report concerning the closing of the transaction on May 15, 2013.

(b)

Pro Forma Financial Information.

In accordance with Item 9.01(b)(2) of Form 8-K, the Company will file the pro forma financial information required by Item 9.01(b)(1) within seventy-one days after the due date of May 21, 2013, for this Report concerning the closing of the transaction on May 15. 2013.

(d)

Exhibits.

Exhibit Number

Description

2.01

Merger Agreement dated March 29, 2013 by and among the Company, Cornerstone Program Advisors LLC and Sustainable Energy Industries, Inc. (1)

2.02

Agreement and Plan of Merger by and between, Sustainable Acquisition Corp. and Sustainable Energy Industries, Inc.

2.03

Agreement and Plan on Merger between Cornerstone Acquisition Corp. and Cornerstone Program Advisors, LLC.

10.1

Consulting Agreement Dated as of May 15, 2013 by and between the Company and Tom Telegades.

10.2

Consulting Agreement Dated as of May 15, 2013 by and between the Company and Peter Fazio.

_____________________

(1)

Incorporated by reference for the Company’s Form 8-K for March 29, 2013 filed with the SEC on April 4, 2013.

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| Date: May 21, 2013 | RECEIVABLE ACQUISITION & MANAGEMENT CORPORATION |

| | |

| | |

| | By: /s/ Thomas Telegades |

| | Name: Thomas Telegades |

| | Title: Chief Executive Officer |

5

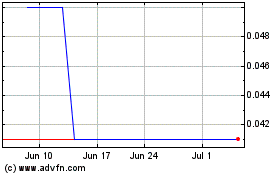

PwrCor (PK) (USOTC:PWCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

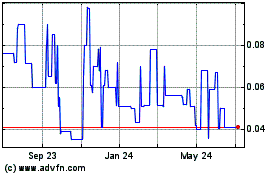

PwrCor (PK) (USOTC:PWCO)

Historical Stock Chart

From Apr 2023 to Apr 2024