ITT Educational Beats Earnings & Rev Est. - Analyst Blog

April 26 2013 - 7:50AM

Zacks

ITT Educational Services Inc.' (ESI) earnings

of $1.33 per share in the first quarter of 2013 surpassed the Zacks

Consensus Estimate of $1.28 by 3.9%. However, earnings

declined 44.1% from the year-ago earnings of $2.38 per share. The

double-digit decline in revenues took a toll on the bottom

line.

Quarterly revenues totaled $287.7 million, down 15.8% from the

prior-year quarter due to weak enrollments. However, total revenue

surpassed the Zacks Consensus Estimate of $276 million by 4.2%.

ITT Educational reported total enrollment of 61,039 students for

first quarter of 2013, down 14.2% year over year. New enrollments

also witnessed a drop of 3.6% to 17,412 students in the quarter due

to the weak performance of criminal justice, electronics and

network administration programs. The company’s revenue per student

increased 1.0% from the prior-year quarter to $4,712.

During the quarter, student persistence rates declined 90 basis

points (bps) to 71.5% due to a 17.8% dip in the number of

continuing students. Student persistence rate is calculated by

dividing the number of continuing students in any academic term by

total student enrollment in the immediately preceding academic

term.

The company reported operating earnings of $52.7 million in the

first quarter of 2013, down 47.6% from the prior-year quarter due

to a weak top line and higher bad debt expenses. Operating margin

dipped 1,110 bps to 18.3%.

Cost of educational services in first quarter of 2013 came in at

$125.2 million, down 7.2% year over year, owing to decline in

compensation costs and course supplies expenses due to reduced

student enrollment. However, as a percentage of revenues, cost of

educational services increased 400 bps to 43.5% owing to a decline

in revenues, rise in bad debt expenses and media advertising cost,

partially offset by a decline in compensation expenses and other

scholarship related expenditure.

Student services and administrative (SSA) expenses remained flat

at $106.3 million in the first quarter of 2013. However, as a

percentage of revenues, SSA expenses increased 580 bps to 36.9%

owing to lower revenues and higher bad debt expenses.

Fiscal 2013 Outlook

For 2013, the company maintained its prior guidance. Earnings per

share are expected in the range of $3.50 – $4.00. The company

expects new student enrollment growth in the range of (5.0%) – 5%.

Revenue per student in 2013 is expected to decline in the range of

(6.0%) to (4.0%). The company intends to introduce new associate

degree programs in software development technology, industrial

engineering technology, medical assistance and administration at

some of the campuses in the Jun and Sept 2013 academic session.

The company expects earnings before interest, taxes,

depreciation and amortization (EBITDA) to range between $165

million to $190 million in fiscal 2013.

ITT Educational Services carries a Zacks Rank #4 (Sell).

Interestingly another education company, Apollo Group,

Inc. (APOL) surpassed the top- and bottom-line estimates

when it reported its results for the second quarter of fiscal 2013

on Mar 25. We believe that Apollo may have beaten the top- and

bottom-line estimates on the back of cost savings resulting from

its restructuring efforts.

Education stocks such as New Oriental Education &

Technology Group (EDU) and Xueda Education

Group (XUE) are currently performing well and are worth

considering. Xueda Education Group carries a Zacks Rank #1 (Strong

Buy), whereas New Oriental Education & Technology Group holds a

Zacks Rank #2 (Buy).

APOLLO GROUP (APOL): Free Stock Analysis Report

NEW ORIENTAL ED (EDU): Free Stock Analysis Report

ITT EDUCATIONAL (ESI): Free Stock Analysis Report

XUEDA EDUC-ADR (XUE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

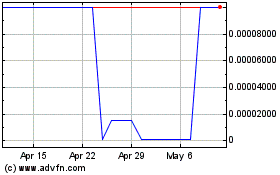

ITT Educational Services (CE) (USOTC:ESINQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

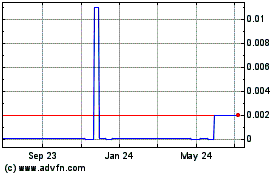

ITT Educational Services (CE) (USOTC:ESINQ)

Historical Stock Chart

From Apr 2023 to Apr 2024