WMS Industries Inc. (NYSE:WMS) today reported revenue of $159.1

million and net income of $9.3 million, or $0.17 per diluted share,

for the quarter ended September 30, 2012, compared to revenue of

$155.6 million and net income of $3.8 million, or $0.07 per diluted

share, in the September 2011 quarter. Net income and diluted

earnings per share in the September 2012 quarter reflect higher

year-over-year research and development expenses to support the

growth of interactive products and services as well as for the

ongoing development and commercialization of a greater number of

new participation and for-sale games and cabinets. Reflecting these

factors, research and development expenses increased $3.2 million

year over year and $3.3 million on a quarterly sequential basis.

Diluted earnings per share in the September 2011 quarter included

impairment and restructuring charges of $0.12 per share, primarily

for facilities closure and separation-related costs, and $0.05 per

share to write down receivables from certain customers in

Mexico.

Recent Highlights:

- Gaming operations revenues increased

both year over year and on a quarterly sequential basis primarily

reflecting growth in revenue from interactive products and services

and the third consecutive quarter of growth in the installed

participation base to 9,632 gaming machines, which led to the first

installed base increase over the prior-year quarter in the last

eight quarters, partially offset by lower gaming operations daily

revenue per unit.

- Product sales revenues rose modestly

reflecting sales of 693 new video lottery terminals (VLTs) for the

Canada and Illinois VLT markets. Product sales revenues also

include higher other product sales revenues including one-time

software revenues of a VLT game set and higher revenues from used

gaming machine sales, which more than offset the anticipated lower

industry-wide shipments for new casino openings and expansions and

a lower average selling price reflecting the higher mix of

lower-priced VLTs and the competitive marketplace.

- Gross profit increased $4.1 million

reflecting a 120 basis point improvement in gross profit margin due

to higher product sales margin and a greater mix of gaming

operations revenues. Product sales gross margin was 53.1%, a fiscal

first quarter record, reflecting the mix of business, ongoing

benefits from the Company’s continuous improvement and supply chain

management initiatives, and the VLT game set software, which more

than offset the impact of a lower average selling price and the

seasonally lower unit volumes for the September quarter that

typically impacts margin.

- Adjusted EBITDA increased 24% to $52.9

million as EBITDA margin improved 570 basis points (Adjusted EBITDA

is a non-GAAP financial metric, and a reconciliation to net income

is provided in a supplemental schedule near the end of this

release.)

- Cash flow provided by operating

activities for the quarter ended September 30, 2012, was $21.0

million, a year-over-year increase of 60% or $7.9 million.

- WMS was selected by the Manitoba

Lotteries Corporation to join two incumbent suppliers to replace

existing VLT units throughout the province. WMS was previously

selected by the Alberta Liquor and Gaming Commission to participate

in their VLT replacement initiative.

- During the quarter, Jackpot Party®

Social Casino was launched and became one of the five largest and

most popular social casinos on Facebook®, as measured by the number

of daily active users and monetization rates.

- In September, the Company’s

first-of-its-kind interactive, casino-branded Play4Fun™ Network

went live at a tribal casino in Iowa, enabling the casino’s players

to access multiple play-for-fun slot and casual games online, all

under the casino’s own brand association.

- At the Global Gaming Exposition (G2E®),

WMS showcased more than 100 new games, including 22 new games

leveraging the advanced capabilities of the next-generation

CPU-NXT®3 operating platform and 87 new games for WMS’ successful

CPU-NXT2 platform. Also on display were five distinct cabinet

configurations, including the revolutionary new Gamefield xD™

cabinet for participation games, the all-new My Poker® video poker

dedicated gaming machines and the next-generation Blade™ cabinet,

WMS’ latest upright cabinet, as well as the ever-popular

Bluebird®2e and Bluebird xD™ cabinets. WMS also featured the

Williams Interactive™ branded products and services for online

wagering and play-for-fun social, casual and mobile gaming

opportunities.

“WMS’ progress with the commercialization of new innovative game

content and products is evident in both the year-over-year growth

of domestic replacement units shipped and solid demand in the

Canadian and Illinois VLT markets,” said Brian R. Gamache, Chairman

and Chief Executive Officer. “Following a period of transition and

re-focus on the development of products that address customers’

near-term needs, our newest for-sale and participation games

continue to re-establish WMS’ excellence in the creation of

differentiated content and games that deliver value to our

customers. Over the next three quarters, we will begin to

commercialize our latest games and platforms which were introduced

to broad acclaim at the recent Global Gaming Expo. We believe these

products are among the most exciting new games and cabinets we have

brought to market and expect them to provide casino operators with

new must-have products for their players.

“In addition, we are generating very exciting revenue growth

from our interactive products and services as we continue to invest

in attractive long-term growth opportunities,” continued Gamache.

“We are extremely pleased by the initial success we are achieving

in leveraging the value of our library of proven gaming content

into the interactive markets, including social, casual and mobile

entertainment. This success is reflected in the $9 million

year-over-year growth in revenue from interactive products and

services, and we anticipate a range of $35-to-$40 million in annual

revenue for fiscal 2013 from these revenue streams. While the costs

needed to build a sustainable foundation for interactive products

and services impact near-term operating profitability, we believe

this investment favorably positions WMS to participate in the

attractive, high-margin growth potential of these opportunities

that can lead to the creation of new value for our

shareholders.”

Gamache concluded, “With improved product sales ship share,

terrific titles and platforms for our gaming operations business

and momentum with our interactive products and services, we fully

expect to generate further progress across our worldwide business

in the coming quarters.”

Fiscal 2013 First Quarter Financial Review

The following table summarizes key components related to revenue

generation for the three months ended September 30, 2012, and 2011

(dollars in millions, except unit, per unit and per day data):

Three Months Ended September 30,

Increase/(Decrease) Product Sales Revenues:

2012 2011 Amount % New

gaming machine sales revenues $ 60.8 $ 64.9 $ (4.1 ) (6.3 ) Other

product sales revenues 27.2 22.2

5.0 22.5

Total product sales revenues $

88.0 $ 87.1 $ 0.9

1.0 Average sales price per new unit $ 16,033

$ 16,574 $ (541 ) (3.3 ) New unit shipments to the U.S. and Canada

2,453 2,530 (77 ) (3.0 ) New unit shipments to International

markets 1,338 1,388 (50 ) (3.6 )

Total new units on which revenue was recognized 3,791 3,918 (127 )

(3.2 ) Used unit shipments globally 1,660

2,472 (812 ) (32.8 )

Total unit shipments

globally 5,451 6,390

(939 ) (14.7 ) Conversion

kit sales globally 2,400 5,500 (3,100 ) (56.4 ) Gross profit

on product sales revenues (1) $ 46.7 $ 44.3 $ 2.4 5.4 Gross margin

on product sales revenues (1) 53.1 % 50.9 % 220bp 4.3

Gaming Operations Revenues: Participation revenues $ 57.0 $

63.3 $ (6.3 ) (10.0 ) Interactive products and services revenues

9.5 0.7 8.8 nm Other gaming operations revenues 4.6

4.5 0.1 2.2

Total gaming operations

revenues $ 71.1 $ 68.5

$ 2.6 3.8

Installed participation units at period

end, with lease payments based on:

Percentage of coin-in 3,633 3,616 17 0.5 Percentage of net win

2,857 2,952 (95 ) (3.2 ) Daily lease rate (2) 3,142

3,024 118 3.9

Total installed

participation units at period end 9,632

9,592 40 0.4

Average installed participation units 9,503 9,602 (99 ) (1.0

) Average revenue per day per participation unit $ 65.23 $ 71.70 $

(6.47 ) (9.0 ) Gross profit on gaming operations revenues

(1) $ 55.9 $ 54.2 $ 1.7 3.1 Gross margin on gaming operations

revenues (1) 78.6 % 79.1 % (50)bp (0.6 )

Total

revenues $ 159.1 $ 155.6

$ 3.5 2.2 Total gross profit

(1) $ 102.6 $ 98.5

$ 4.1 4.2 Total gross margin (1)

64.5 % 63.3 %

120bp 1.9

(1) As used herein, gross profit and gross margin do not include

depreciation, amortization and distribution expenses.

(2) Includes only participation game theme units. Does not

include units with product sales game themes placed under

fixed-term, daily fee operating leases.

Product Sales Revenues

Total product sales revenues for the September 2012 quarter rose

1% over the year-ago period to $88.0 million. WMS shipped 2,453 new

gaming machines to customers in the U.S. and Canada, inclusive of

693 VLTs for Canada and the new Illinois VLT markets. Replacement

units shipped to U.S. and Canadian customers increased 8% over the

prior-year period to 1,726 gaming machines, while new gaming

machine sales for new casino openings and expansions totaled 727

units compared with approximately 900 units in the September 2011

quarter. WMS shipped 1,338 new units, or 35% of total global new

unit shipments, to international customers in the September 2012

quarter, compared to 1,388 new units, or 35% of global sales, in

the year-ago period. The average sales price for new units of

$16,033 rose modestly on a quarterly sequential basis but declined

approximately 3% year over year, reflecting the mix of the

lower-priced VLT units and a competitive marketplace.

Other product sales revenue increased 23% over the prior-year

period to $27.2 million, reflecting higher revenue from a smaller

number of used gaming machines at higher prices than the year-ago

period, and other revenues, including one-time VLT software game

set revenues, partially offset by lower conversion kit sales

revenue compared to the record level of a year ago.

Gaming Operations Revenues

Gaming operations revenues increased to $71.1 million in the

September 2012 quarter from $68.5 million in the year-ago period,

marking the first year-over-year increase in gaming operations

revenues in the last eight quarters. The quarter-end installed

participation base increased by 71 units on a quarterly sequential

basis to 9,632 gaming machines at September 30, 2012, and increased

40 units over the quarter end installed base a year-ago. The

average installed participation base for the September 2012 quarter

increased by 253 units on a quarterly sequential basis and was down

99 units compared to a year ago. Average revenue per day in the

quarter of $65.23 per unit declined 2% on a quarterly sequential

basis and was down from $71.70 in the September 2011 quarter.

Revenue from interactive products and services increased to $9.5

million from $0.7 million in the prior-year period, primarily

reflecting the successful July 2012 launch of Jackpot Party® Social

Casino on Facebook®, which currently ranks among the five most

popular social casinos on Facebook based on the number of daily

active users, coupled with organic growth in our UK-based B2C

online website and the addition of Phantom EFX retail sales and

Jadestone game server integration revenues.

Other gaming operations revenue increased $0.1 million on a

year-over-year basis to $4.6 million, primarily reflecting growth

in networked gaming products and services.

Total gross profit, excluding depreciation, amortization and

distribution expense as used herein, increased 4% to $102.6 million

from $98.5 million in the year-ago period. Total gross margin

improved to 64.5% compared to 63.3% a year ago. Product sales gross

margin rose 220 basis points to 53.1% in the September 2012 quarter

compared to 50.9% in the prior-year quarter. The year-over-year

increase reflects the benefits from our mix of business, ongoing

continuous improvement initiatives, strategic sourcing actions, and

a year-over-year improvement in gross margin on other product

revenues due to higher margin on used gaming machine sales and

high-margin VLT software game set revenues. Gaming operations gross

margin was 78.6% in the September 2012 quarter compared with 79.1%

in the prior year, reflecting the impact of higher jackpot expense

on wide-area progressive games, partially offset by the benefit of

increased revenues from high-margin interactive products and

services, and compares favorably to 77.4% in the June 2012

quarter.

The following table summarizes key components of operating

expenses and operating income for the three months ended September

30, 2012, and 2011 ($ in millions):

Three Months Ended September 30,

Increase/(Decrease) Operating Expenses: 2012

2011

Amount % Research and development

$ 27.6 $ 24.4 $ 3.2 13.1 As a percentage of revenues 17.4 % 15.7 %

170bp 10.8 Selling and administrative 34.4 38.3 (3.9 ) (10.2 ) As a

percentage of revenues 21.6 % 24.6 % (300)bp (12.2 ) Depreciation

and amortization 28.0 22.6 5.4 23.9 As a percentage of revenues

17.6 % 14.5 % 310bp 21.4 Impairment and restructuring charges — 9.7

(9.7 ) nm As a percentage of revenues — 6.2 %

(620)bp nm

Total operating expenses $ 90.0

$ 95.0 $ (5.0 )

(5.3 ) Operating expenses as a percentage of

revenues 56.6 % 61.0 %

(440)bp (7.2 ) Operating income

$ 12.6 $ 3.5 $

9.1 260.0 Operating margin 7.9

% 2.2 % 570bp 259.1

Research and development expenses in the September 2012 quarter

increased $3.2 million on a year-over-year basis, and $3.3 million

on a quarterly sequential basis to $27.6 million. The increase

reflects incremental development costs to re-engineer and

re-purpose a portion of the Company’s library of slot gaming

content for distribution as interactive products and services,

coupled with a modest increase in spending for the Company’s

innovative new casino gaming products.

Selling and administrative expenses in the September 2012

quarter of $34.4 million were $3.9 million lower than the year-ago

period as the prior year included $4.3 million in bad debt expense

related to the write-down of Mexican customer receivables. Higher

marketing and incremental administrative expenses to support

interactive products and services were partially offset by ongoing

cost savings initiatives.

Depreciation and amortization expense was $28.0 million in the

September 2012 quarter compared with $22.6 million in the year-ago

quarter and $25.3 million in the June 2012 quarter. The increase

primarily reflects the Company’s investment in gaming operations

equipment over the last 12 months to upgrade and transition its

installed base of participation units, coupled with the additional

depreciation associated with the completion of a new facility plus

amortization of finite-lived intangible assets from our two

acquisitions in the June 2012 quarter.

Cash Flow and Balance Sheet

Cash flow provided by operating activities for the quarter ended

September 30, 2012, was $21.0 million, a year-over-year increase of

$7.9 million, or a 60% improvement over the prior year, reflecting

higher net income, depreciation and amortization and share-based

compensation, partially offset by lower other non-cash items. Total

receivables, net were $387.8 million at September 30, 2012,

compared with $334.6 million at September 30, 2011, which reflects

the use of the Company’s financial liquidity to support customers’

efforts to refresh their slot base during a period of constrained

capital for many casino operators. Total receivables, net were down

from $405.1 million at June 30, 2012, reflecting the lower seasonal

revenue on a quarterly sequential basis. Inventory was $52.5

million, or $11.9 million lower than at September 30, 2011,

primarily reflecting operational improvements and lower finished

goods inventory, and was slightly below the $53.3 million in

inventory at June 30, 2012. Total current liabilities at September

30, 2012, declined $40.5 million from June 30, 2012, due to lower

accounts payables and lower accrued liabilities reflecting the

timing of income tax payments.

Net cash used in investing activities was $48.7 million in the

September 2012 quarter compared to $42.7 million in the prior-year

quarter, reflecting a $3.5 million increase in capital deployed for

gaming operations equipment as we continued to upgrade our

installed base with newer gaming cabinets and operating systems,

and $4.4 million for higher property, plant and equipment

expenditures, primarily related to costs to complete two

significant projects during the quarter, all of which were

partially offset by a $1.9 million decrease in capital deployed to

acquire or license intangible and other non-current assets. With

two major property, plant and equipment projects now largely

complete and anticipated lower capital investment in gaming

operations assets, the Company expects an aggregate 20% decline in

annual capital spending on gaming operations equipment and

property, plant and equipment in fiscal 2013.

Net cash provided by financing activities was $20.6 million

compared to $8.2 million in the prior year primarily due to $22.5

million of lower stock repurchase activity compared with the

prior-year period, partially offset by $10.0 million of lower net

borrowings under the Company’s line of credit.

Adjusted EBITDA, a non-GAAP financial metric (see reconciliation

to net income schedule near the end of this release), increased 24%

to $52.9 million in the September 2012 quarter compared with $42.8

million in the prior-year period. The adjusted EBITDA margin for

the September 2012 quarter improved to 33.2% from 27.5% in the

year-ago period.

Total cash, cash equivalents and restricted cash was $69.1

million at September 30, 2012.

Share Repurchase Program Update

During the three months ended September 30, 2012, the Company

purchased 317,347 shares of its common stock for total

consideration of $5.0 million. Approximately $143 million remains

available pursuant to WMS’ share repurchase authorization. At

September 30, 2012, WMS had 54.6 million shares outstanding and 5.1

million shares in the Company’s treasury.

Fiscal Year 2013 Outlook

The Company continues to expect annual revenue growth to

reflect: 1) modest growth in product sales ship share in the U.S.

and Canada and in the installed participation base reflecting the

favorable customer response to the Company’s latest innovative new

gaming content, platforms and cabinets; 2) higher VLT demand from

Canadian and Illinois VLT operators that will offset lower domestic

new casino and expansion unit demand, albeit at lower average

selling prices as VLT’s typically are lower in price than gaming

machines sold to new casino openings and expansions; 3) ongoing

revenue growth from interactive products and services; and 4) an

increased contribution from the ongoing commercialization of the

Company’s networked gaming system and portal game applications.

Revenues are expected to grow modestly from the September 2012

quarter to the December 2012 quarter and slightly exceed those

reported in the December 2011 quarter. However, lower-margin VLTs

are expected to exceed 25% of new units sold resulting in product

sales margin declining to a range of 48%-to-49% and operating

income is expected to be slightly lower than the September 2012

quarter, reflecting an incremental increase in costs to support

interactive products and services. WMS anticipates revenue growth

will accelerate in the second half of fiscal 2013 with the launch

of new cabinets, new games with more diversified math models, an

increase in the revenue per day from its gaming operations

business, and increased revenues from interactive products and

services.

WMS expects spending on R&D initiatives will increase on a

quarterly sequential basis and that on an annual basis these

expenses are anticipated to approximate 15%-to-16% of total fiscal

2013 revenues. WMS also expects selling and administrative expenses

will increase on a quarterly sequential basis, reflecting the

marketing and administrative needs to support growth in the

Company’s interactive products and services initiatives. In total,

the increase in development, marketing, depreciation and

amortization and administrative costs to grow the Company’s

interactive products and services is expected to total

approximately $30-to-$35 million in fiscal 2013.

The Company routinely reviews its guidance and may update it

from time to time based on changes in the market and its

operations.

WMS Industries is hosting a conference call and webcast at 4:30

PM ET today, Thursday, November 1, 2012. The conference call

numbers are 212/231-2905 or 415/226-5355. To access the live call

on the Internet, log on to www.wms.com (select “Investor

Relations”). Following its completion, a replay of the call can be

accessed for thirty days on the Internet via www.wms.com.

About WMS

WMS serves the gaming industry worldwide by designing,

manufacturing and marketing games, video and mechanical

reel-spinning gaming machines, video lottery terminals and in

gaming operations, which consists of the placement of leased

participation gaming machines in legal gaming venues. The Company

also develops and markets digital gaming content, products,

services and end-to-end solutions that address global online

wagering and play-for-fun social, casual and mobile gaming

opportunities. WMS is proactively addressing the next stage of

casino gaming floor evolution with its WAGE-NET networked gaming

solution, a suite of systems technologies and applications designed

to increase customers’ revenue generating capabilities and

operational efficiency. More information on WMS can be found at

www.wms.com or visit the Company on Facebook®, Twitter® or

YouTube®.

G2E is a registered trademark of the American Gaming Association

and Reed Elsevier Inc. Used with permission.

This press release contains forward-looking statements

concerning our future business performance, strategy, outlook,

plans, products and liquidity, including, but not limited to, the

statements set forth under the caption “Fiscal Year 2013 Outlook.”

Forward-looking statements may be typically identified by such

words as “may,” “will,” “should,” “expect,” “anticipate,” “plan,”

“likely,” “believe,” “estimate,” “project,” and “intend,” among

others. These forward-looking statements are subject to risks and

uncertainties that could cause our actual results to differ

materially from the expectations expressed in the forward-looking

statements. Although we believe that the expectations reflected in

our forward-looking statements are reasonable, any or all of our

forward-looking statements may prove to be incorrect. Consequently,

no forward-looking statements may be guaranteed. We undertake no

obligation to update such forward looking statements, all of which

are made only as of this date, November 1, 2012. Factors that could

cause our actual results to differ from expectations include (1)

delay or refusal by regulators to approve our new gaming platforms,

cabinet designs, game themes and related hardware and software; (2)

changes in regulations or regulatory interpretations that may

adversely affect existing product placements or future placements;

(3) an inability to introduce in a timely manner new games and

gaming machines that achieve and maintain market acceptance; (4) a

decrease in the desire of casino customers to upgrade gaming

machines or allot floor space to leased or participation games,

resulting in reduced demand for our products; (5) a reduction in

capital spending or interruption in payments by casino customers

associated with business weakness or economic uncertainty that

adversely affects our customers' ability to make purchases or pay;

(6) a greater-than-expected demand for operating leases by

customers over outright product sales or sales financing leases

that shift revenue recognition from a single period to the term of

such operating leases; (7) future costs to restructure our business

and other charges that may be higher than currently estimated,

including additional charges related to actions at a later time not

presently contemplated; (8) ability to realize in full, or part,

the anticipated savings and expense reductions from restructuring

and lower staffing; (9) adverse affects on product development,

innovation and the ability to retain and attract key personnel

following the restructuring and reorganization actions taken in

fiscal 2011 and 2012; (10) a reduction in play levels of our

participation games by casino patrons, whether due to economic

conditions or increased placements of competitive product; (11)

inability of suppliers of key components to timely meet our

requirements to fulfill customer orders; (12) increased pricing or

promotional competitive activity that adversely affects our average

selling price or product revenues; (13) a failure to obtain and

maintain our gaming licenses and regulatory approvals; (14) failure

of customers or players to adapt to the new technologies that we

introduce in new product concepts; (15) a software anomaly or

fraudulent manipulation of our gaming machines and software; (16) a

failure to obtain the right to use or an inability to adapt to

rapid development of new technologies; (17) an infringement claim

seeking to restrict our use of material technologies; (18) risks of

doing business in international markets, including political and

economic instability, terrorist activity, changes in importation

and repatriation regulations such as currently experienced in

Argentina, and foreign currency fluctuations; and (19) the

unfavorable outcome of any legal proceedings in which we may be

involved from time to time. These factors and other factors that

could cause actual results to differ from expectations are more

fully described under “Item 1. Business”, “Item 1A. Risk Factors”

and “Legal Proceedings” in our Annual Report on Form 10-K for the

year ended June 30, 2012, and our more recent reports filed with

the U.S. Securities and Exchange Commission.

WMS INDUSTRIES INC. CONDENSED CONSOLIDATED STATEMENTS OF

INCOME (in millions of U.S. dollars and millions of shares,

except per share amounts) (unaudited)

Three Months EndedSeptember

30,

REVENUES: 2012 2011 Product

sales $ 88.0 $ 87.1 Gaming operations 71.1

68.5

Total revenues 159.1 155.6

COSTS AND EXPENSES: Cost of product sales (1) 41.3 42.8 Cost

of gaming operations (1) 15.2 14.3 Research and development 27.6

24.4 Selling and administrative 34.4 38.3 Depreciation and

amortization (1) 28.0 22.6 Impairment and restructuring charges

— 9.7

Total costs and expenses

146.5 152.1

OPERATING INCOME 12.6 3.5 Interest expense

(0.7 ) (0.4 ) Interest income and other income and expense, net

2.4 2.7 Income before income taxes 14.3

5.8 Provision for income taxes 5.0 2.0

NET INCOME $ 9.3 $ 3.8

Earnings per share:

Basic

$ 0.17 $ 0.07

Diluted

$ 0.17 $ 0.07

Weighted-average common shares: Basic common stock

outstanding

54.5 56.2

Diluted common stock and common stock equivalents

54.7 56.6

1) Cost of product sales and cost of

gaming operations exclude the following amounts ofdepreciation and

amortization, which are included in the depreciation and

amortization line item:

Cost of product sales $ 2.0 $ 1.4 Cost of gaming operations

$ 17.6 $ 14.1

CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (in millions of U.S. dollars)

(unaudited) Three Months Ended September

30, 2012 2011 Net income $ 9.3 $

3.8 Foreign currency translation adjustment, net of taxes

2.9 (3.1 )

Total comprehensive income $

12.2 $ 0.7 WMS INDUSTRIES

INC. CONDENSED CONSOLIDATED BALANCE SHEETS (in

millions of U.S. dollars and millions of shares)

September 30, June 30, ASSETS 2012

2012 CURRENT ASSETS: (unaudited) (audited) Cash and

cash equivalents $ 54.9 $ 62.3 Restricted cash and cash equivalents

14.2 13.8

Total cash, cash

equivalents and restricted cash 69.1 76.1

Accounts and notes receivable, net of allowances of $7.2 and $6.9,

respectively 284.4 282.8 Inventories 52.5 53.3 Other current assets

48.3 40.1

Total current assets

454.3 452.3 NON-CURRENT ASSETS:

Long-term notes receivable, net 103.4 122.3

Gaming operations equipment, net of

accumulated depreciation and amortization of $237.7 and $227.1,

respectively

125.7 115.7

Property, plant and equipment, net of

accumulated depreciation and amortization of $150.6 and $142.0,

respectively

232.7 226.7 Intangible assets, net 176.9 178.9 Deferred income tax

assets 40.0 39.3 Other assets, net 18.7 18.9

Total non-current assets 697.4

701.8 TOTAL ASSETS $

1,151.7 $ 1,154.1

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES: Accounts payable $ 66.9 $ 84.8

Accrued compensation and related benefits 8.8 9.5 Other accrued

liabilities 54.6 76.5

Total current

liabilities 130.3 170.8 NON-CURRENT

LIABILITIES: Long-term debt 85.0 60.0

Deferred income tax liabilities

22.7 22.7 Other non-current liabilities 25.0

23.3

Total non-current liabilities 132.7

106.0 Commitments, contingencies and indemnifications — —

STOCKHOLDERS’ EQUITY: Preferred stock (5.0 shares

authorized, none issued) — — Common stock (200.0 shares authorized

and 59.7 shares issued) 29.8 29.8 Additional paid-in capital 444.0

443.5 Treasury stock, at cost (5.1 and 4.9 shares, respectively)

(145.4 ) (144.1 ) Retained earnings 564.2 554.9 Accumulated other

comprehensive income (loss) (3.9 ) (6.8 )

Total

stockholders’ equity 888.7

877.3 TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY $ 1,151.7 $ 1,154.1

WMS INDUSTRIES INC. CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (in millions of U.S. dollars)

(unaudited) Three Months Ended September

30, 2012 2011 CASH FLOWS FROM OPERATING

ACTIVITIES Net income $ 9.3 $ 3.8

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation 23.0 19.3 Amortization of intangible and other

non-current assets 9.0 6.6 Share-based compensation 4.4 2.6 Other

non-cash items 1.5 8.1 Deferred income tax benefit (0.7 ) (0.9 )

Change in operating assets and liabilities (25.5 )

(26.4 )

Net cash provided by operating activities 21.0 13.1

CASH FLOWS FROM INVESTING ACTIVITIES Additions to

gaming operations equipment (25.6 ) (22.1 ) Additions to property,

plant and equipment (20.3 ) (15.9 ) Payments to acquire or license

intangible and other non-current assets (2.8 ) (4.7 )

Net cash used in investing activities (48.7 ) (42.7 )

CASH FLOWS FROM FINANCING ACTIVITIES Borrowings under

revolving credit facility make this first line 38.0 35.0 Repayments

of borrowings under revolving credit facility make this first line

(13.0 ) — Purchases of treasury stock (5.0 ) (27.5 ) Cash received

from exercise of stock options and employee stock purchase plan

0.6 0.7

Net cash provided by

financing activities 20.6 8.2

Effect of exchange rates on

cash and cash equivalents (0.3 ) (1.0 )

DECREASE IN CASH AND CASH EQUIVALENTS (7.4 ) (22.4 )

CASH

AND CASH EQUIVALENTS, beginning of period 62.3

90.7

CASH AND CASH EQUIVALENTS, end of period

$ 54.9 $ 68.3

WMS INDUSTRIES INC.

Supplemental Data – Earnings per Share (in millions of

U.S. dollars and millions of shares, except per share amounts)

(unaudited) Three Months Ended September

30, 2012 2011 Net income $ 9.3 $

3.8 Basic weighted average common shares outstanding 54.5

56.2 Dilutive effect of stock options 0.1 0.3 Dilutive effect of

restricted common stock and warrants 0.1 0.1

Diluted weighted average common stock and

common stock equivalents

54.7 56.6 Basic earnings per share of common

stock $ 0.17 $ 0.07 Diluted earnings per share of common stock and

common stock equivalents $ 0.17 $ 0.07

Supplemental Data

– Reconciliation of Net Income to Adjusted EBITDA (in

millions of U.S. dollars) (unaudited)

Three Months EndedSeptember

30,

2012 2011 Net income $ 9.3

$ 3.8 Net income $ 9.3 $ 3.8 Depreciation 23.0

19.3 Amortization of intangible and other non-current assets 9.0

6.6 Provision for income taxes 5.0 2.0 Interest expense 0.7 0.4

Share-based compensation 4.4 2.6 Other non-cash items 1.5

8.1

Adjusted EBITDA $ 52.9 $

42.8

Adjusted EBITDA margin 33.2 % 27.5

%

Adjusted EBITDA (earnings before interest, taxes, depreciation,

amortization, share-based compensation and other non-cash items,

including non-cash impairment and restructuring charges) and

adjusted EBITDA margin are supplemental non-GAAP financial metrics

used by our management and commonly used by industry analysts to

evaluate our financial performance. Adjusted EBITDA and adjusted

EBITDA margin provide additional useful information to investors

regarding our ability to service debt and are commonly used

financial analysis metrics for measuring and comparing gaming

companies in areas of liquidity, operating performance, valuation

and leverage. Adjusted EBITDA and adjusted EBITDA margin should not

be construed as an alternative to operating income (as an indicator

of our operating performance) or net cash provided by operating

activities (as a measure of liquidity) as determined in accordance

with U.S. generally accepted accounting principles. All companies

do not calculate adjusted EBITDA and adjusted EBITDA margin in

necessarily the same manner, and WMS’ presentation may not be

comparable to those presented by other companies.

WMS INDUSTRIES INC. Supplemental Data – Items Impacting

Comparability: Charges (in millions of U.S. dollars, except

per share amounts) (unaudited)

Three Months EndedSeptember 30,

2012

Three Months EndedSeptember 30,

2011

DESCRIPTION OF

CHARGES

Pre-taxamounts

Perdilutedshare

Pre-taxamounts

Perdilutedshare

IMPAIRMENT AND RESTRUCTURING CHARGES Non-cash Charges

Impairment of property, plant and equipment — — $ 0.6 $ 0.01

Cash Charges Restructuring charges — — 9.1

0.11

Total Impairment and Restructuring Charges — —

9.7 0.12 OTHER CHARGES

Non-cash charges to write-down Mexican

customer receivables (recorded in selling and administrative

expenses)

— — 4.3 0.05

TOTAL IMPAIRMENT, RESTRUCTURING AND

OTHER CHARGES

— —

$ 14.0 $ 0.17

We did not record any impairment, restructuring or other charges

in the three months ended September 30, 2012.

The three month period ended September 30, 2011, includes $14.0

million of pre-tax charges, or $0.17 per diluted share, which

includes $9.7 million pre-tax, or $0.12 per diluted share, of

impairment and restructuring charges, including $5.9 million

pre-tax of separation-related costs and $3.8 million pre-tax of

costs related to the decision to close two facilities; and $4.3

million pre-tax, or $0.05 per diluted share, of non-cash charges to

write-down receivables following government enforcement actions at

certain casinos in Mexico.

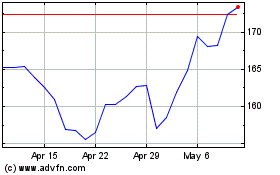

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

From Apr 2024 to May 2024

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

From May 2023 to May 2024