UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

|

|

|

DINEWISE, INC.

|

|

(Name of Issuer)

|

|

|

|

Common Stock

|

|

(Title of Class of Securities)

|

|

|

|

David M. Kaye, Esq.

Kaye Cooper Fiore Kay & Rosenberg, LLP

30A Vreeland Road, Suite 230

Florham Park, New Jersey 07932

(973) 443-0600

|

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

|

|

|

|

November 19, 2010

|

|

(Date of Event which Requires Filing of this Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [_]

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

Page 2

SCHEDULE 13D

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

Convenient Gourmet Group, LP

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

|

|

(a) [_]

(b) [x]

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

11, 436,057

|

|

8

|

SHARED VOTING POWER

|

|

0

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

11,436,057

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

11,436,057

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

[_]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

35.32%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

PN

|

Page 3

SCHEDULE 13D

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

Atheneum Capital LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

|

|

(a) [_]

(b) [x]

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

Connecticut

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

0

|

|

8

|

SHARED VOTING POWER

|

|

11, 436,057

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

0

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

11, 436,057

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

11,436,057

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

[_]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

35.32%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

OO

|

Page 4

SCHEDULE 13D

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

Broad Street Ventures, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

|

|

(a) [_]

(b) [x]

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

Tennessee

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

0

|

|

8

|

SHARED VOTING POWER

|

|

11, 436,057

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

0

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

11, 436,057

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

11,436,057

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

[_]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

35.32%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

OO

|

Page 5

SCHEDULE 13D

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

Paramount Advisors, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

|

|

(a) [_]

(b) [x]

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

Florida

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

0

|

|

8

|

SHARED VOTING POWER

|

|

11, 436,057

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

0

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

11, 436,057

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

11,436,057

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

[_]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

35.32%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

OO

|

Page 6

SCHEDULE 13D

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

Richard Rankin

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

|

|

(a) [_]

(b) [x]

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

0

|

|

8

|

SHARED VOTING POWER

|

|

11, 436,057

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

0

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

11, 436,057

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

11,436,057

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

[_]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

35.32%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

IN

|

Page 7

SCHEDULE 13D

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

James H. Brennan, III

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

|

|

(a) [_]

(b) [x]

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

0

|

|

8

|

SHARED VOTING POWER

|

|

11, 436,057

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

0

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

11, 436,057

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

11,436,057

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

[_]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

35.32%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

IN

|

Page 8

SCHEDULE 13D

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

Hugh L. Clark, Jr.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

|

|

(a) [_]

(b) [x]

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

0

|

|

8

|

SHARED VOTING POWER

|

|

11, 436,057

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

0

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

11, 436,057

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

11,436,057

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

[_]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

35.32%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

IN

|

Page 9

Item 1.

Security and Issuer

The title and class of equity securities to which this Schedule 13D relates is Common Stock, par value $.01 per share (the “Common Stock”), of Dinewise, Inc., a Nevada corporation (the “Issuer”). The address of the principal executive offices of the Issuer is 500 Bi-Country Boulevard, Suite 400, Farmingdale, New York 11735.

Item 2.

Identity and Background

(a) - (c)

This statement is being filed jointly on behalf of the following persons (collectively, the “Reporting Persons”): (i) Convenient Gourmet Group, LP, a Delaware limited partnership (“Convenient Gourmet”), (ii) Atheneum Capital LLC, a Connecticut limited liability company (“Atheneum”), (iii) Broad Street Ventures, LLC, a Tennessee limited liability company (“Broad Street”), (iv) Paramount Advisors, LLC, a Florida limited liability company (“Paramount”), (v) Richard Rankin (“Rankin”), (vi) James H. Brennan III (“Brennan”), and (vii) Hugh L. Clark, Jr. (“Clark”).

The principal business address of Convenient Gourmet is 30A Vreeland Road, Suite 230, Florham Park, New Jersey 07932. The principal business address for each of the other Reporting Persons is as follows: (i) 535 Connecticut Avenue, 2

nd

floor, Norwalk, Connecticut 06854 for Atheneum and Rankin, (ii) 735 Broad Street, Suite 400, Chattanooga, Tennessee 37402 for Broad Street and Brennan, and (iii) 145 Middle Street, Suite 1131, Lake Mary, Florida 32746 for Paramount and Clark.

Convenient Gourmet is an entity which was formed to acquire, hold and dispose of securities in the Issuer and such other activities related or incidental to the foregoing. Atheneum, Broad Street and Paramount are the general partners of Convenient Gourmet. Each of Atheneum, Broad Street and Paramount is in the business of acquiring, holding and disposing of investments in various companies and providing advisory and other consulting services. Rankin is the Managing Member of Atheneum, Brennan is the Managing Member of Broad Street, and Clark is the Managing Member of Paramount.

(d)

During the last five years, none of the Reporting Persons has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e)

During the last five years, none of the Reporting Persons has been a party to any civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding of any violation with respect to such laws.

(f)

Rankin, Brennan and Clark are citizens of the United States.

Item 3.

Source and Amount of Funds or Other Considerations

The aggregate amount of funds used to purchase the 11,436,057 shares of Common Stock reported herein as being held by the Reporting Persons (the “Shares”) was $114,360.57 (the “Purchase Price”). The Purchase Price was funded with cash provided by Convenient Gourmet which Convenient Gourmet obtained from cash provided to it by its limited partners.

Item 4.

Purpose of Transaction

Pursuant to a Stock Purchase Agreement (the “Stock Purchase Agreement”)

dated as of November 17, 2010, by and between MacKay Shields, LLC, a Delaware limited liability company (the “Seller”), as investment adviser for certain clients (the “Seller Clients”), and Convenient Gourmet, Convenient Gourmet acquired from the Seller, and the Seller on behalf of the Seller Clients sold to Convenient Gourmet, the Shares for the Purchase Price which was paid by Convenient Gourmet to the Seller on November 19, 2010.

The shares were acquired for investment purposes only. As an investor in the Issuer, the Reporting Persons may engage in communications with one or more stockholders and/or one or more members of the Issuer’s Board of Directors and management regarding the Issuer, its operations and its prospects.

In the ordinary course, the Reporting Persons intends to review its investment in the Issuer from time to time. Although it is not the Reporting Person’s present intention, the Reporting Person may decide at any time in

Page 10

the future to increase or decrease the size of its investment in the Issuer, depending upon the price and availability of the securities of the Issuer, subsequent developments affecting the Issuer, the Issuer’s business and prospects, other investment and business opportunities available to the Reporting Persons, general stock market and economic conditions, tax considerations and other factors deemed relevant. The Reporting Persons have no present plans or proposals that relate to or would result in: (a) the acquisition of additional securities of the Issuer or the disposition of securities of the Issuer; (b) an extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (c) a sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries; (d) a change in the present Board of Directors or management of the Issuer; (e) any material change in the present capitalization or dividend policy of the Issuer; (f) any other material change in the Issuer’s business or corporate structure; (g) changes in the Issuer’s charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person; (h) causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association; (i) causing a class of equity securities of the Issuer to become eligible for termination of registration pursuant to Section 12(g)(4) of the Exchange Act; or (j) any action similar to any of those enumerated above. However, the Reporting Persons reserve the right to change its plans and intentions at any time in the future, as its deems appropriate. Notwithstanding the foregoing, the Reporting Persons and the Issuer have had and may have further discussions with respect to transactions to enhance the Issuer’s business and the Reporting Persons may in the future make proposals to the Issuer’s management and Board of Directors for their consideration.

Item 5.

Interest in Securities of the Issuer

The Reporting Persons currently beneficially own 11,436,057 shares of Common Stock of the Issuer, or 35.32% of the Common Stock believed to be outstanding. Convenient Gourmet directly holds such shares over which Atheneum, Broad Street and Paramount, as general partners, share dispositive and voting power. By reason of Rankin being the Managing Member of Atheneum, Brennan being the Managing Member of Broad Street, and Clark being the Managing Member of Paramount, each is deemed to beneficially own such shares.

Each of the Reporting Persons disclaims beneficial ownership of the shares of Common Stock referred to herein that such Reporting Person does not hold directly except, with respect to Convenient Gourmet, to the extent of such Reporting Person’s actual ownership interest in Convenient Gourmet.

Except as set out above, none of the Reporting Persons has effected any other transaction in any securities of the Issuer in the past sixty days.

Item 6.

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

None.

Item 7.

Material to Be Filed as Exhibits

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

99.1

|

|

Joint Filing Agreement *

|

|

|

|

|

|

99.2

|

|

Stock Purchase Agreement dated as of November 17, 2010 by and between MacKay Shields, LLC and Convenient Gourmet Group, LP

|

|

|

|

|

|

|

|

|

* Included herein following the signature page.

Page 11

SIGNATURE

After reasonable inquiry and to the best of its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: December 2, 2010

CONVENIENT GOURMET GROUP, LP

By: Broad Street Ventures, LLC, a general partner

By:

/s/ James H. Brennan, III

Name:

James H. Brennan, III

Title:

Manager

ATHENEUM CAPITAL LLC

By:

/

s/ Richard Rankin

Name:

Richard Rankin

Title:

Manager

BROAD STREET VENTURES, LLC

By:

/s/ James H. Brennan, III

Name:

James H. Brennan, III

Title:

Manager

PARAMOUNT ADVISORS, LLC

By:

/s/ Hugh L. Clark, Jr.

Name:

Hugh L. Clark, Jr.

Title:

Manager

/s/ Richard Rankin

RICHARD RANKIN

/s/ James H. Brennan, III

JAMES H. BRENNAN, III

/s/ Hugh L. Clark, Jr.

HUGH L. CLARK, JR.

EX-99.1

SCHEDULE 13D JOINT FILING AGREEMENT

In accordance with the requirements of Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended, and subject to the limitations set forth therein, the parties set forth below agree to jointly file the Schedule 13D to which this joint filing agreement is attached, and have duly executed this joint filing agreement as of the date set forth below.

Dated:

December 2, 2010

CONVENIENT GOURMET GROUP, LP

By: Broad Street Ventures, LLC, a general partner

By:

/s/ James H. Brennan, III

Name:

James H. Brennan, III

Title:

Manager

ATHENEUM CAPITAL LLC

By:

/

s/ Richard Rankin

Name:

Richard Rankin

Title:

Manager

BROAD STREET VENTURES, LLC

By:

/s/ James H. Brennan, III

Name:

James H. Brennan, III

Title:

Manager

PARAMOUNT ADVISORS, LLC

By:

/s/ Hugh L. Clark, Jr.

Name:

Hugh L. Clark, Jr.

Title:

Manager

/s/ Richard Rankin

RICHARD RANKIN

/s/ James H. Brennan, III

JAMES H. BRENNAN, III

/s/ Hugh L. Clark, Jr.

HUGH L. CLARK, JR.

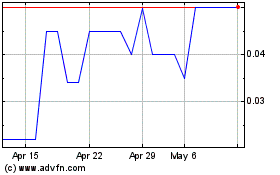

Dinewise (PK) (USOTC:DWIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dinewise (PK) (USOTC:DWIS)

Historical Stock Chart

From Apr 2023 to Apr 2024