Form 10-K

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended July 31, 2010

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from _____ to _____

Commission File Number 333-130295

WELLSTAR INTERNATIONAL, INC.

(Exact name of small business issuer as specified in its charter)

|

Nevada

|

|

20-1834908

|

|

(State or other jurisdiction of incorporation

or organization)

|

|

(IRS Employer Identification No.)

|

|

6911 Pilliod Road

Holland, Ohio

|

|

43528

|

|

419-865-0069

|

|

(Address of principal executive office)

|

|

(Postal Code)

|

|

(Issuer's telephone number)

|

|

|

|

|

|

|

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

o

No

x

Indicate by check by mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes

o

No

x

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

x

No

o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

x

No

o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer

o

Accelerated filer

o

Non-accelerated filer (Do not check if a smaller reporting company)

o

Smaller reporting company

x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

o

No

x

The aggregate market value of the voting stock held by non-affiliates as of November 10, 2010 was $ 1,474,265.

Number of outstanding shares of the registrant's par value $0.001 common stock as of November 10, 2010:

7,371,327,726

WELLSTAR INTERNATIONAL, INC.

FORM 10-K

For the Fiscal Year Ended July 31, 2010

|

|

|

|

|

Part I

|

Page

|

|

|

|

|

|

|

Item 1. Description of Business.

|

4

|

|

|

|

|

|

|

Item 1A. Risk Factors

|

14

|

|

|

|

|

|

|

Item 1B. Unresolved Staff Comments

|

14

|

|

|

|

|

|

|

Item 2. Description of Property.

|

14

|

|

|

|

|

|

|

Item 3. Legal Proceedings.

|

14

|

|

|

|

|

|

|

Item 4. (Removed and Reserved)

|

14

|

|

|

|

|

|

|

Part II

|

|

|

|

|

|

|

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases or Equity Securities.

|

14

|

|

|

|

|

|

|

Item 6. Selected Financial Data

|

17

|

|

|

|

|

|

|

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation.

|

17

|

|

|

|

|

|

|

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

|

25

|

|

|

|

|

|

|

Item 8. Financial Statements and Supplementary Data

|

F-

|

|

|

|

|

|

|

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure.

|

26

|

|

|

|

|

|

|

Item 9A. Controls and Procedures.

|

26

|

|

|

|

|

|

|

Item 9A(T). Controls and Procedures.

|

26

|

|

|

|

|

|

|

Item 9B. Other Information.

|

27

|

|

|

|

|

|

|

Part III

|

Page

|

|

|

|

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance.

|

28

|

|

|

|

|

|

|

Item 11. Executive Compensation.

|

30

|

|

|

|

|

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

31

|

|

|

|

|

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence.

|

32

|

|

|

|

|

|

|

Item 14. Principal Accountant Fees and Services.

|

33

|

|

|

|

|

|

|

Item 15 Exhibits, Financial Statement Schedules

|

33

|

|

|

|

|

|

|

Signatures.

|

34

|

|

|

|

|

|

|

Financial Statements

|

F-1

|

|

PART I

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K (including the section regarding Management's Discussion and Analysis of Financial Condition and Results of Operations) contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading "Risks Factors” that may be included in our reports from time to time, as well as those discussed elsewhere in this Annual Report on Form 10-K. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the Securities and Exchange Commission ("SEC"). We make available on our Web site under "Investor Relations/SEC Filings," free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-QSB, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such materials with or furnish them to the SEC. You can also read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

ITEM 1. DESCRIPTION OF BUSINESS

Corporate History

Wellstar International, Inc. ("Wellstar" or the "Company") was formed in the State of Nevada on December 5, 1997. Wellstar was a development stage company with no operating activities. On July 12, 2005, Wellstar entered into a share exchange agreement with Trillennium Medical Imaging, Inc. ("Trillennium" or "TMI"), a development stage company formed in June of 2005. As a result of the share exchange agreement, Trillennium became a subsidiary of Wellstar.

Wellstar International, Inc., through its Trillennium subsidiary, is dedicated to developing and licensing the use of advanced thermal imaging technology (TMI SYSTEM) in the consumer health care markets throughout the World.

Introduction

TMI is dedicated to placing cameras, for a monthly charge in hospitals, clinical and long care facilities throughout the United States. Management believes the Company’s current competitive advantage is derived from the state of the art technology of the camera and software it is utilizing, combined with an intimate knowledge and relationships in the markets. Although there is no guarantee that the Company will be successful in its plans to grow in these markets by expanding its imaging capabilities through the acquisition of new imaging technologies of which there is no guarantee.

The TMI Infrared Technology and software is approved by the FDA as an Adjunctive Diagnostic screening procedure for early breast cancer detection, differential diagnosis of pain dysfunctions, (such as Reflex Sympathetic Dystrophy, Neuromuscular Skeletal Syndromes and Neurological disorders), detection of pressure ulcers, deep tissue injuries, and bed sores, as well as orthopedic applications. This screening modality provides a differential diagnosis to justify additional screening procedures to ensure successful patient outcome assessment. Thermal Imaging is a low cost, non-contact, non-radioactive diagnostic screening procedure designed for clinical evaluation. In addition, thermal imaging provides an ability to track the progress of therapies being utilized in a low cost, non-invasive manner.

The TMI Infrared Technology fills a need that currently exists in diagnostic medicine today. Thermal imaging provides information that is specific to the physiological and functional activity in the body. This information becomes invaluable in that conventional diagnostic screening utilizes tests such as X-Ray, MRI and CT Scans. All aspects of these tests are concerned with the anatomical and structural problems of the body. Many problems arise from not combining both diagnostic modalities of structure and physiology, in that people are missed diagnosed and considered healthy and well when the physiological information provides an earlier outcome or risk assessment of future health predictors than the structural modalities.

Our marketing will be focused on university research centers, hospitals, multidisciplinary physician practices, pain centers, long term care facilities, home health care and rehabilitation centers support the need for this type of screening modality.

History and Future of Medical Infrared Applications

The detection and estimation or measurement of heat released by the body has been a cornerstone of medicine since its beginning. The earliest physicians knew the presence of excessive heat signaled illness. For centuries the measurement of heat, either present in or being released by the body, required contact. Temperature was physically felt and much later was measured with various devices such as the thermometer.

In the 1800’s Herschel demonstrated the presence of heat energy as an invisible wave, much like light. Heat could be reflected and refracted under the right conditions. Understanding of this heat energy wave would require years of investigation. Much later, as all with all scientific advances, these studies would provide more finite measurements of heat energy.

In the 1940’s, the electronic detector of infrared energy was developed for use in military applications. Night vision scopes were the first applications. The science of infrared detection owes its current development and sophistication to demands from military and industrial applications.

Medical use of infrared detection lagged behind military application due to government classification of the infrared detectors and technologies. Only when scientific advances are released from such government restrictions are they open to general use and applications. Once available, the scientific/medical application of the heat detector was made simultaneously by the British, the Canadians and Americans. These scientists and physicians used thermal imaging as a measurement of human physiology; the most common applications being the evaluation of cancerous tumors. The level of heat emitted was correlated to the presence and type of disease, as well as a prognostic indicator. Many tumors were hot, and the hotter the tumor the worse the outcome.

These first infrared applications were both costly and cumbersome, therefore the infrared detection units were found mostly in research. Like all early electronics the infrared detection systems were physically large, costly to produce and challenging to operate. These restrictions meant exposure to general medicine use was limited.

Today, through the advances in all levels of science, and driven by military funding, infrared detection devices are state-of-the art electronics. Like all electronic components, the infrared detector has come down in cost, size and has significantly improved in general applicability.

The continued refinement of infrared systems, both in image acquisition and data collection, has brought the use of infrared energy analysis to a new level. Together with a better understanding of human and animal physiological thermoregulatory mechanisms, the use of infrared detection in health and illness provides a new mechanism for early disease detection.

Trillennium Medical Imaging recognized the medical need for cost-effective, non-contact physiological monitoring – and embraced the use of infrared imaging. Trillennium is dedicated to the advancement of infrared detection in medicine. Trillennium has forged relationships with well-known manufacturers of infrared detection systems, recognizable entities in multiple medical specialties, and highly skilled computer analysts – and together are developing state-of the art infrared imaging systems, as well as investigating new uses/applications in medicine.

The focus of medicine and health care today means technology must be “faster, better, and more cost-effective.” Trillennium Medical Imaging and its partners are working to make infrared detection systems the easiest to use, applicable in the every-day clinical setting and cost-effective in its application.

The use of infrared analysis has historically been limited in clinical application. With improved science comes improve equipment development and with computerization – the analytical evaluation of infrared information is moving to new levels. Today’s computerization of infrared systems is overcoming the limitations of the past applications. Trillennium Medical Imaging systems incorporate, not only objective temperature data analysis, but TMI has also taken data collection to a new level. Today, medical device development and use is based on evidence of efficacy. Application data collected from all TMI systems is compiled into a single database that will continue to provide the statistical analysis needed to demonstrate the efficacy of this technology in all current and future applications. TMI believes that it is currently the only company to incorporate this data collection component into their systems.

The first records of physical observation demonstrate that physiological temperature variations have signaled the presence of disease. Today the importance of this vital physical parameter is of no less significance. Together, scientific advancements and technological improvements will demonstrate that temperature shifts can signal the earliest stages of physiological change. Through non-contact temperature analysis, Trillennium Medical Imaging and partners will continue to demonstrate the efficacy of infrared analysis in disease detection and to drive the use of infrared analysis in new medical applications.

The Future of Disease Detection

Trillennium Medical Imaging sees the future of infrared imaging moving to critical positions in early phase disease detection and monitoring. Although currently not a diagnostic modality, infrared analysis still provides key information in health monitoring. Management believes Trillennium’s completed research project conducted at Duke University for early detection of tissue breakdown will provide the initial data demonstrating the TMI Systems ability to detect damage prior to visible evidence. We believe this capability – in a non-contact device – will save patients from potential disabling conditions, as well as generate a sizeable cost-savings in health care.

Markets

Skin Assessment

The early visualization of tissue damage that can lead to development of pressure ulcers and or deep tissue injury is paramount to the reduction of open sores and the deadly complications that accompany them. Currently, no method of detection is used that can identify tissue breakdown prior to the visible and palpable changes that take place.

Trillennium Medical Imaging began investigation of this health care issue shortly after the company was formed. The ability of infrared to detect blood flow changes is well documented and the key benefit of the technology. Association of blood flow changes to both pressure ulcers and deep tissue injury has been documented since the 1970’s when early imaging units were used to image suspicious damage. One of the original studies of pressure sores by thermal detection was conducted by Barton and Barton in 1973. Studying existing ulcers they determined the temperature variations present with their classification of ‘indolent’ and normal pressure sores. The category of indolent was associated with a longer healing time (approximately four months) and a temperature difference of 1°C or less. A classification of normal demonstrated a higher temperature differential of approximately 2.5ºC and healed more quickly than indolent sores and the patients generally displayed a better outcome. This ‘normal’ classification of ulcer was generally attributed to the ‘otherwise healthy person’ whose pressure sore was either post operative from extended times in one position or from incorrect use of a prosthetic device. This wound usually resolved in six weeks. This thermal evaluation has been substantiated by Hansen et al in a 1996 study.

The size, cost and availability of infrared was a limiting factor in its use for many years. The most cost effective detection was contact thermography, and the question was if the contact alone was increasing the possible artifact of damage. Electronic imaging provided the benefit of non-contact evaluation, but thermal artifact induced in uncontrolled environments was still a question.

Trillennium Medical Imaging began the process of incorporating computerized analysis of images to eliminate the subjective influence of previous infrared analysis. Changes introduced in the analytical phase reduced the influence of environmental shifts. This proprietary approach has been evaluated through a completed study at Duke University and the data / results will be released and published in the very near future.

Market Opportunities

Functional or physiological evaluation conducted with infrared imaging has applications in many areas of medicine. Initially, Trillennium Medical Imaging focused on three key markets with our current imaging system: Breast Health Monitoring, Pain Evaluation; and Sports Medicine applications. However, recent developments indicate significant economic gains can be realized with a revised plan.

Trillennium Medical has begun investigating the use of infrared detection in early stage pressure ulcer development. Trillennium is proposing a unique approach for early detection of tissue changes that will significantly impact the wound care market. TMI is in the initial phase for design and application of a new imaging device that incorporates software and data collection that is separate and apart from its current clinical markets.

While Trillennium Medical Imaging will continue to prove the viability of IR through its ongoing trials in existing markets (outlined under existing market profile), it is evident that a method of early detection of tissue changes related to pressure ulcers is not currently available.

Pressure ulcers have always been an area of concern for healthcare providers due to the degradation of the patient’s condition and the increased care required when pressure ulcers occur. Pressure ulcers are responsible for over 65,000 deaths per year in the United States alone. Aside from the human toll, the costs involved in treating this problem are enormous. Taking into consideration all direct, indirect and peripheral costs, it is conservatively estimated that currently over $25 billion is spent annually on wound care in the United States (Columbia Surgery, Department of Surgery, H. Brem, M.D., 2006).

New regulation recently imposed by the Center for Medicare and Medicaid will reshape the approach by all health care facilities and practitioners. In October 2008, reimbursement for the care of individuals incurring pressure ulcers during hospitalization (secondary diagnosis) will no longer be reimbursed. This edict from the government has been followed by third party payers. This loss of revenue can cripple many health care facilities if a procedure or validated system is not put in place.

Additionally, the potential of fines incurred for the occurrence of pressure ulcers in the long term care facilities will drive these markets with burden of proof.

We believe Trillennium Medical Imaging is ideally positioned to provide a cost-effective, non-contact method to identify the presence of early or existing tissue damage. The next step for TMI is to complete it’s original Beta Test and implement the system into a full scale usage environment for a period of 90 days to demonstrate the effectiveness in a hospital setting.

Breast Health Monitoring

Current Testing/Screening Methods

The medically accepted tool (gold standard) for breast cancer screening is x-ray mammography. Mammography detects structural changes present in the breast tissue, indicating either the presence of dead cell structures (calcifications) or a shift in tissue density. Mammography was established as the test of choice following the Breast Cancer Detection Demonstration Project (BCDDP) study and as a result of the Health Insurance Plan (HIP) study of 1974.

According to the National Cancer Institute Fact Sheet on Mammography, “Several large studies conducted around the world show that breast cancer screening with mammograms reduces the number of deaths from breast cancer for women ages 40 to 69, especially those over age 50. Studies conducted to date have not shown a benefit from regular screening mammograms, or from a baseline screening mammogram (a mammogram used for comparison), in women under age 40.” Regardless, it is the only medically accepted screening test to-date.

With the evolution in technology, proposals have been made to implement other modalities in the screening process. Due to associated cost, and or sensitivity and specificity of the exams (Ultrasound/MRI/PET) recommendations for screening have not changed. These tests are used as ‘adjunctive’ or in addition to mammography following a positive or questionable test.

Limitations of Current Methods

Contact, compression, ionizing radiation, limited or no options for screening other than mammography (physician restricted access) and cost are some of the primary reasons women list for limited or non-participation in breast health evaluation.

Current statistics demonstrating the number of women who participate in mammography are not readily available. 2002 studies estimated approx 60% of women over the age of 40 participated in mammography within the year. Studies show that for the uninsured it (screening mammography) is a low priority procedure, because few programs exist to assist in the payment for or toward mammography for women less than 50 years of age as are for those who are older (Medicare).

Women reject or delay mammography for many reasons. Fear appears to be the primary factor. Fear of discomfort, fear of radiation and fear of finding cancer are only a few reasons that women site.

Many women falsely believe that if there is no known breast cancer within their family that there is no reason to be concerned. Few women know that approximately 75% of breast cancers found occur in women who have no known history.

Studies indicate that 40% or more of the population eligible for screening mammography do not participate in testing. Reasons listed are economic, cultural and perception of increased harm (radiation / compression) from the exam – whether real or imagined. These factors contribute to late-stage

Importance of Infrared Imaging for Breast Cancer

Management defines risk as the likelihood that harm will arise coupled with consequence. Medical assessment of ‘risk’ for developing breast cancer is linked with time/cost and effort to arrive at the benefit of risk assessment. Risk/benefit studies determine that screening for breast cancer should begin at 40 years of age. The cost of screening the female population younger than 40 years of age provides no reduction in life-years saved compared to costs incurred.

Although mammography screening is an effective tool for detecting the presence of breast cancer, it has inherent and well described limitations. In addition, mathematical models such as the Gail Model have been developed to predict

breast cancer

risk

, but such models are better at assessing population-based risk rather than individual risk.

Monitoring individuals with infrared imaging provides for improved individual assessment to determine the ‘at-risk’ person as indicated by physiology (versus mathematical), and therefore in a screening scenario, the ‘at-risk’ population.

Infrared imaging is a non-contact, non-invasive, non-ionizing imaging tool and poses no physical risk. It displays information regarding breast blood flow. Temperature assessment of breast tissue provides for a profile as it relates to homeostasis within the breast tissue. Any alterations are attributed to imbalance. The presence of structural changes or tissue is not visible on the infrared image. But neither is the vascular information displayed on the mammogram. Screening the breast with infrared provides the individual and practitioner with information not currently available as a screening modality. Other functional imaging is prohibited by availability and cost. (fMRI/ PET/f CT). Additionally other functional modalities are most often incorporated into structural exams such as computed tomography and MRI.

Infrared study parameters have been identified as consistent repeatable and independent markers that identify those patients at risk for breast disease. Ease of implementation (non-ionizing), low comparative cost and appeal to the general population (non-contact) make it an ideal test for screening in the younger patient (not a candidate for mammography), the woman with dense breasts or implants, those who have surgically altered breasts that add to mammography distortion (biopsies, lumpectomies, mastectomies) and those that refuse to participate in screening mammography. [START]

Market Opportunities

Breast Health Monitoring/Screening

Today the U.S population is roughly 300 million (projection based on 2000 Census Data) and of this 150 million individuals are female. According to the Census Bureau, currently the largest segments of females are 40-44 (11.35M), 35-39 (11.34M) and 45-49 (10.27M) years of age respectively. These are closely followed by the 30-34 (10.21M) and the 10-14 (10M) years of age.

These numbers become significant when we consider the disease of breast cancer. It is the second leading cause of cancer deaths in the female population. 1 in 8 women will be diagnosed with cancer of the breast during their lifetime.

The probability of breast cancer occurrence increases with age. Fifty percent of all breast cancers will occur in women under 61 -- the median age of occurrence. But roughly 1/3 of all breast cancers will occur in women under the age of 50 (20 to 50 years of age.) In the total population of breast cancers the largest percentage are found in women over 50 years of age. The average projected growth rate (disease development prior to detection) for breast cancer is approximately 8 to 10 years. For this reason, mammography is recommended as a screening procedure beginning at 40 years of age.

U.S Government statistics in 2005, show an estimated 2 million women diagnosed with or living with breast cancer. 2006 estimates projected 212,920 new cases of invasive breast cancer diagnosed, along with 61,980 new cases of non-invasive breast cancer. The current medical paradigm with breast imaging is demonstrated in the inability of mammography to reduce the mortality statistics of those women found with invasive breast lesions. Structural studies, and mammography in particular, are detecting the presence of tumors and tissue changes, but missing the functional or metabolic activity presented by the disease. Infrared has continued to demonstrate underlying metabolic changes present in tissue years in advance of mammography. Slow growing, metabolically inactive cancers such as those with low IR signals can easily be detected with mammography. The issue of early detection is key for the women with dense breasts, especially the younger woman who would be missed by never participating in mammography until a palpable lesion is found.

Sports Medicine

Sports medicine or sport medicine is an interdisciplinary subspecialty of medicine which deals with the treatment and preventive care of athletes, both amateur and professional. The team includes specialty physicians and surgeons, athletic trainers, physical therapists, coaches, other personnel, and, of course, the athlete.

There has been a tendency for many to assume that sport-related problems are by default musculoskeletal and that sports medicine is an orthopedic specialty. It is commonly understood that there is much more to sports medicine than just musculoskeletal diagnosis and treatment. Illness or injury in sport can be caused by many factors – from environmental to physiological and psychological. Consequently, sports medicine

can encompass an array of specialties, including cardiology, pulmonology, orthopedic surgery, exercise physiology, biomechanics, and traumatology.

The risk of injury in athletic practice will never be entirely eliminated, but modifications in training techniques, equipment, sports venues and rules, based on outcomes of meaningful research have shown that it can be lowered. For these reasons sports medicine will make its most significant future contributions in the area of prevention.

Market Opportunities

When all the inclusive markets are considered, the total revenue projections for the sports medicine market are vast but illusive. Costs are measured in billions of dollars when both treatment cost and indirect costs of loss (wage and productivity) are considered.

Differential diagnosis related to sports injuries is complicated by the fact that

soft tissue injuries are some of the most common and clinically challenging musculoskeletal disorders in patients presenting for treatment. Therefore, establishing clear-cut diagnostic and therapeutic objectives for these injuries is important. Current imaging methods of evaluation are structural. Flat plane x-ray, computed tomography (CT), ultrasound, and MRI are the most common examinations. This leaves the assessment of soft tissue injury to visual, palpable and indirect visualization via the structural image.

Complication of evaluation (structure vs. tissue) results in inappropriate or ill-timed care. Oversight of the magnitude of soft tissue injuries may result in a failure to expeditiously consider vascular injury or compartment syndrome and its resultant complications, including loss of a limb. Misdiagnosis or mismanagement of damage may lead to chronic problems with subsequent development of degenerative joint disease and/or loss of function, including but not limited to an inability to bear weight or ambulate.

Like all areas of pain, the number of those afflicted by joint and connective tissue disorders seems to be increasing rather than under control.

Statistics taken from the U.S. government website on arthritis provides the following numbers related to occurrence.An estimated 46 million adults in the United States reported being told by a doctor that they have some form of arthritis, rheumatoid arthritis, gout, lupus, or fibromyalgia. By 2030, an estimated 67 million of Americans aged 18 years or older are projected to have doctor-diagnosed arthritis. Arthritis & Rheumatism 2006;54(1):226-229 [Data Source: 2003 NHIS]

Importance of TMI Infrared Monitoring System

Until recently, sports medicine has been a little-explored market for infrared technology as an adjunctive to diagnostics. Infrared imaging provides an indirect measurement of skin blood flow and a temperature measurement of the physiological response controlled by the body’s autonomic nervous system. This information has broad application in the world of sports medicine. Infrared evaluation can provide a new dimension to diagnostic capabilities in an adjunctive capacity (physiology vs. anatomy). Some of these applications are: providing a monitor for hyperthermic and hypothermic responses associated with nerve irritation, acute injuries, swelling, inflammation, infection, and atrophy. Provide physicians and trainers with a visual and measurable reference for differential diagnosis, and a visual and objective reference relating to treatment efficacy.

TMI Solution in Sports Medicine Applications

TMI is currently involved in a pilot study with Duke University Sports Medicine evaluating infrared technology for spot-checking of core body temperatures of athletes in the field. The preliminary study of this non-invasive technology has demonstrated temperature readings that are directly correlated with the core body temperature in a small population. A more extensive study is being planned. The value will be an easy to use, non-invasive tool for monitoring heat exhaustion in athletics that can be easily used in the field. All levels and types of sports organizations (schools, teams and professionals) could all benefit from using this technology. TMI is working to develop a portable, cost-effective, handheld solution that will fit the need of this extensive market.

TMI is also exploring the use of this same assessment tool for immediate trauma evaluation on the field or in emergency rooms for monitoring deep tissue injury and assist with fast evaluation of potential compartment syndrome.

TMI Market Approach

With significant relationships in the medical industry, our initial marketing approach and main thrust will be to hospitals and long term care facilities for the early detection of pressure ulcers. The study at Duke Medical Center has been completed and was successful. The data and the publishing of the data will be released in the near future.

Rheumatology

For over forty years infrared measurement has been used in the evaluation of rheumatological disease. Initially identified and analyzed in the 1970’s by Abernathy, Ring, and many others, joint and connective tissue disorders were an undisputed area in which infrared detection provided a non-ionizing and non-contact method of detection.

Infrared evaluation provides both an indication of abnormal blood flow in the area of pain, and as a monitoring device for the efficacy of various therapies. Additionally infrared imaging is an ideal tool for evaluation of this peripheral blood flow and vasospastic disorders of peripheral digital vessels is often an indication of connective tissue disorders.

Research and Development

Equipment Development

We continue to interface with equipment manufacturers and medical device research and development firms to seek out state of the art thermal imaging technology. We have designed a new more effective camera and are working with a major manufacturer on initial prototypes to be delivered before year end of 2010.

In addition, we have created a Data Collection division. This will enable us in the future to keep data and compare results of images taken from all of our cameras. This will then lead to definitive conclusions for the medical community. Through a HIPPA-compliant database we plan to gather a statistically-verifiable data set from our patient population from all of our participating facilities. This information will be compared to currently known statistics and provide additional verification regarding the efficacy of infrared imaging in a variety of applications. The medical community requires "evidence" to back the use or implementation of all technologies. TMI expects that its thermal imaging operations will yield significant data. This will supply the data needed to support evidenced-based practice. This data can then be compared to the patient outcome-information held by each practitioner.

Future Market Research/Medical

Grafts and Flaps

The use of skin grafts and local flaps can help solve some difficult wound closure problems. Postoperative flap failure is a devastating complication that surgeons occasionally encounter when using plastic surgery techniques.

Intraoperative monitoring of flap perfusion has shown to prevent flap failure. Infrared imaging can be used to evaluate and monitor reperfusion, and is a fast, non-contact, reliable method.

Infrared can be used preoperatively to trace perforators in the skin to be excised for reconstruction, as well as postoperatively to monitor the rewarming following attachment.

Amputation

Infrared has proven to be valuable in the area of amputation of tissue as well. Evaluation of digits or limbs of persons undergoing amputation has improved the success by proving or disproving the viability of tissue present. In instances of lower limb amputation due to peripheral vascular disease, amputation can often be preformed below the knee, improving the rehabilitation and mobility of the patient and therefore quality of life issues. Selection of amputation level made on the basis of laboratory criteria using skin blood flow and infrared thermography data proves to be more successful.

Diabetic Neuropathy

Diabetic peripheral neuropathy (DPN) is a condition secondary to the disease and can result in ulceration. Of the diabetic population 0.6 % eventually require lower limb amputation. However of those with peripheral neuropathy roughly 40% require amputation of a toe, 12% a foot, and 47% The total annual cost of DPN and its complications in the U.S. was estimated to be between $4.6 and $13.7 billion. Up to 27% of the direct medical cost of diabetes

Dermatology

“The skin is the largest organ in the body, and it is therefore not surprising that cancer of the skin is the most common of all cancers. Basal cell carcinoma and squamous cell carcinoma make up the vast majority of cases. Melanoma is the least common but the most deadly skin cancer, accounting for only about 4% of all cases but 79% of skin cancer deaths. For 2002, the American Cancer Society estimates there will be 53,600 new cases of melanoma in the United States and 7,400 deaths from the disease. The United States has experienced a dramatic increase in the number of melanoma cases over the past few decades. According to the American Cancer Society, the incidence rate for melanoma (number of new cases of melanoma per 100,000 people each year) has more than doubled since 1973. The mortality rate for melanoma (number of deaths per 100,000 people each year) has increased at a much slower pace and has remained stable over the past 10 years. During this same time period, there has been a significant rise in overall five-year survival in patients with melanoma. This may be due to thinner depth of tumors at time of diagnosis and improved surgical techniques to treat the disease. “

The study of skin and skin lesions is an area of infrared that has waxed and waned since the early studies of thermography conducted in the 1980’s by the French. Evaluation of the thermal flare presented by the increased vascularity present in melanomas was thermally mapped prior to radiotherapy. Infrared mapping provided information that demonstrated that the underlying vascular bed related to the visible lesion was usually significantly larger than assumed, and if not included in the area of radiation, may remain as a pathway of metastasis.

With the increase in melanoma occurrence, the use of infrared imaging in screening evaluations could add to number of cases found in the early stages. Additionally, the use to map the underlying vascularity could again aid in mapping the underlying angiogenic blood supply to the tumor.

Pharmaceuticals/Vaccines

The use of infrared detection for adverse reactions resulting from administration of drugs and vaccines is an area of potential investigation.

Trillennium Medical Imaging anticipates that investigation of adverse reactions with infrared imaging may provide a non-contact, cost-effective way to monitor for adverse reactions prior to their occurrence. Through is affiliation with Duke University, TMI plans to participate in research projects that are first isolating these drug-reaction potentials in mice. Participation in this and other research projects will require capital investment to provide various lens and other adaptations to the existing infrared imaging device, as well as the possible development of other specific IR optical imaging devices that could revolutionize this arena.

Trillennium, through its advisors and affiliates will continue to investigate areas of medical concern where infrared imaging will possibly benefit the survival-outcome, the cost-effective delivery of non-invasive diagnostic and adjunctive imaging, as well the return-on-investment from development of such products.

FDA Regulations

Changes in Approved Devices - The FD&C Act requires device manufacturers to obtain a new FDA 510(k) clearance when there is a substantial change or modification in the intended use of a legally marketed device or a change or modification, including product enhancements and, in some cases, manufacturing changes, to a legally marketed device that could significantly affect its safety or effectiveness. Supplements for approved PMA devices are required for device changes, including some manufacturing changes that affect safety or effectiveness. For devices marketed pursuant to 510(k) determinations of substantial equivalence, the manufacturer must obtain FDA clearance of a new 510(k) notification prior to marketing the modified device. For devices marketed with PMA, the manufacturer must obtain FDA approval of a supplement to the PMA prior to marketing the modified device.

Good Manufacturing Practices and Reporting. TMI does not manufacture the infrared cameras used in its thermal imaging system. Nevertheless, the FD&C Act requires device manufacturers to comply with Good Manufacturing Practices regulations. The regulations require that medical device manufacturers comply with various quality control requirements pertaining to design controls, purchasing contracts, organization and personnel, including device and manufacturing process design, buildings, environmental control, cleaning and sanitation; equipment and calibration of equipment; medical device components; manufacturing specifications and processes; reprocessing of devices; labeling and packaging; in-process and finished device inspection and acceptance; device failure investigations; and record keeping requirements including complaint files and device tracking. We are in compliance with the above requirements.

Current Regulatory Status- The FDA found that the cameras utilized in the TMI thermal imaging system are substantially equivalent to an existing legally marketed device, thus permitting them to be marketed as an adjunct (supplemental) screening/diagnostic device. The cameras utilized in our system first received 510(k) clearance in September 2001 and subsequently in March 2003. Together with our software we, are marketing the TMI thermal imaging system as an adjunct (supplemental) method for the diagnosis of breast cancer and other diseases affecting the perfusion or reperfusion of blood in tissue or organs in the foreign markets, and exclusively promoting the early detection of Pressure Ulcers in the US market.

Permits and Inspections

The manufacturer of the thermal imaging cameras utilized in the TMI thermal imaging system is subject to compliance with Good Manufacturing Practices under the FD&C Act, as described above. The manufacturer is subject to government inspection and failure to comply with all applicable standards can result in suspension or termination of its ability to manufacture cameras for use in our system. In that event we would be compelled to seek thermal imaging cameras from other manufacturers.

Users of the TMI thermal imaging system are required to utilize protocols for accurate thermal imaging such as the "Technical Protocols for High Resolution Infrared Imaging" approved by the ACCII 5-15-99. Failure to comply with these requirements can result in suspension or termination of the facilities' authority to utilize our thermal imaging system. In that event we would experience a disruption in revenue while we removed our equipment and sought to install it in another location.

ITEM 1A. RISK FACTORS

As a Smaller Reporting Company, the Company is not required to include the disclosure under this Item 1A. Risk Factors.

ITEM 1B. UNRESOLVED STAFF COMMENTS

As a Smaller Reporting Company, the Company is not required to include the disclosure under this Item 1B. Unresolved Staff Comments.

ITEM 2. PROPERTIES.

We maintain our principal office at 6911 Pilliod Road, Holland OH 43528. Our telephone number at that office is (419) 865-0069 and our facsimile number is (419) 867-0829. We currently occupy this facility on a month to month basis at a no cost arrangement with the building owner. The facilities are in good condition.

ITEM 3. LEGAL PROCEEDINGS.

From time to time, we may become involved in various lawsuits and legal proceedings, which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently only aware of the following legal proceedings or claims that we believe will not have, individually or in the aggregate, a material adverse affect on our business, financial condition or operating results.

On September 20, 2010, Micro Health Systems, Inc. (“Micro”), a dissolved Florida Corporation, filed a certified summons and complaint (the “Complaint”) with the Circuit Court of the 17

th

Judicial Circuit in Broward County, Florida, naming the Company as the sole Defendant. Micro alleges in the Complaint that on December 21, 2005, the Company executed and delivered a promissory note in the amount of $200,000 (the “Note”) to Micro. Further, Micro alleges that Micro has failed to make a payment on the Note and continues to owe the principal and interest. The Company intends to vigorously defend against the allegations stated in the Complaint

.

None of our directors, officers or affiliates are involved in a proceeding adverse to our business or have a material interest adverse to our business.

ITEM 4. (REMOVED AND RESERVED).

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

MARKET INFORMATION

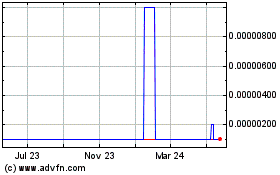

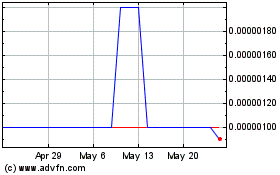

Our common stock is quoted on the OTC Bulletin Board under the symbol "WLSI".

For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. These prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2009

|

|

Fiscal 2010

|

|

|

|

High

|

Low

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

$0.004

|

$0.0038

|

|

$0.03

|

|

|

$0.01

|

|

|

Second Quarter

|

$0.0047

|

$0.001

|

|

$0.02

|

|

|

$0.0027

|

|

|

Third Quarter

|

$0.002

|

$0.0005

|

|

$

|

.0049

|

|

|

$

|

.0004

|

|

|

Fourth Quarter

|

$0.001

|

$0.001

|

|

$

|

.0013

|

|

|

$

|

.0001

|

|

Holders

As of November 10, 2009, there were approximately 7,371,327,726 shares of common stock outstanding.

As of November 10, 2010, there were approximately 94 active holders of our common stock. The number of record holders was determined from the records of our transfer agent and does not include beneficial owners of common stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies. The transfer agent of our common stock is Pacific Stock Transfer.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

|

●

|

we would not be able to pay our debts as they become due in the usual course of business; or

|

|

|

|

|

●

|

our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

|

We have not declared any dividends, and we do not plan to declare any dividends in the foreseeable future.

We have never declared or paid any cash dividends on our common stock. We do not anticipate paying any cash dividends to stockholders in the foreseeable future. In addition, any future determination to pay cash dividends will be at the discretion of the Board of Directors and will be dependent upon our financial condition, results of operations, capital requirements, and such other factors as the Board of Directors deem relevant.

Recent Sales of Unregistered Securities

Convertible Debenture Financing

On May 15, 2009, the Company entered into a Securities Purchase Agreement with AJW Partners, LLC ("Partners"), AJW Partners II, LLC ("Partners II "), AJW Master Fund, Ltd. ("Master"), AJW Master Fund II, Ltd. ("Master II") and New Millennium Capital Partners, II, LLC ("Millennium" and collectively with Partners, Partners II, Master and Maser II, the “Purchasers”) for the sale of 13% secured convertible notes in an aggregate principal amount of up to $79,500 (the "Notes"). The Purchasers closed on $22,000 in Notes on May 18, 2009.

The Notes bear interest at the rate of 13% per annum. Interest is payable monthly, unless the Company's common stock is greater than $0.045 per share for each trading day of a month, in which event no interest is payable during such month. Any interest not paid when due shall bear interest of 15% per annum from the date due until the same is paid. The Notes mature three years from the date of issuance, and are convertible into common stock, at the Purchasers' option, at the lesser of (i) $0.12 or (ii) a 75% discount to the average of the three lowest trading prices of the common stock during the 20 trading day period prior to conversion. The Notes contain a call option whereby, if the Company's stock price is below $0.045, the Company may prepay the outstanding principal amount of the Notes, subject to the conditions set forth in the call option. The Notes also contain a partial call option whereby, if the Company's stock price is below $0.045, the Company may prepay a portion of the outstanding principal amount of the Note, subject to the conditions set forth in the partial call option.

The full principal amount of Notes are due upon a default under the terms of the secured convertible notes. In addition, the Company granted the Purchasers a security interest in substantially all of the Company's assets and intellectual property. The Company is required to file a registration statement with the Securities and Exchange Commission upon demand, which will include the common stock underlying the Notes.

The conversion price of the Notes may be adjusted in certain circumstances such as if the Company pays a stock dividend, subdivides or combines outstanding shares of common stock into a greater or lesser number of shares, or takes such other action as would otherwise result in dilution of the selling stockholder's position.

The Purchasers have agreed to restrict their ability to convert their Notes and receive shares of common stock such that the number of shares of common stock held by them in the aggregate and their affiliates after such conversion or exercise does not exceed 4.99% of the then issued and outstanding shares of common stock.

Series A Preferred Stock

On May 20, 2009, the Company entered into a conversion agreement with John Antonio (“Antonio”) and Kenneth McCoppen (“McCoppen”), both executive officers and directors of the Company, pursuant to which the Company agreed to convert $30,000 in outstanding wages owed to each McCoppen and Antonio into a total of 60,000 shares of Series A Preferred Stock.

The above transactions were approved by the Board of Directors of the Company. The Series A Preferred Stock does not pay dividends but each holder of Series A Preferred Stock shall be entitled to 100 votes for each share of common stock that the Series A Preferred Stock shall be convertible into. The Series A Preferred Stock has a conversion price of $0.0014 (the “Conversion Price”) and a stated value of $1.00 (the “Stated Value”). Each share of Series A Preferred Stock is convertible, at the option of the holder, into such number of shares of common stock of the Company as determined by dividing the Stated Value by the Conversion Price. The Series A Preferred Stock has no liquidation preference.

Series B Preferred Stock

On October 1, 2009, the Company entered into a conversion agreement with John Antonio (“Antonio”) and Kenneth McCoppen (“McCoppen”), both executive officers and directors of the Company, pursuant to which the Company agreed to convert $50,000 in outstanding wages owed to each McCoppen and Antonio into a total of 100,000 shares of Series B Preferred Stock.

The above transactions were approved by the Board of Directors of the Company. The Series B Preferred Stock does not pay dividends but each holder of Series B Preferred Stock shall be entitled to 100 votes for each share of common stock that the Series B Preferred Stock shall be convertible into. The Series B Preferred Stock has a conversion price of $0.001 (the “Conversion Price”) and a stated value of $1.00 (the “Stated Value”). Each share of Series B Preferred Stock is convertible, at the option of the holder, into such number of shares of common stock of the Company as determined by dividing the Stated Value by the Conversion Price. The Series B Preferred Stock has no liquidation preference.

JMJ Financing

On May 22, 2009, the Company issued a Convertible Promissory Note to JMJ Financial (“JMJ”) in aggregate principal amounts of $575,000 (the “Initial JMJ Note”). In consideration for Wellstar’s issuing of the Initial JMJ Note, JMJ issued Wellstar a Secured and Collateralized Promissory Note in the principle amount of $500,000 (the “Initial Wellstar Note”).

In addition, on August 19, 2009 Wellstar issued a Convertible Promissory Note to JMJ in aggregate principal amounts of $1,150,000 (the “Second JMJ Note” and together with the Initial JMJ Note, the “JMJ Notes”). In consideration for Wellstar’s issuing of the Second JMJ Note, JMJ issued Wellstar a Secured and Collateralized Promissory Note in the principle amounts of $1,000,000 (the “Second Wellstar Note” and together with the Initial Wellstar Note, the “Wellstar Notes”).

The JMJ Notes bear interest at 12%, mature three years from the date of issuance, and are convertible into our common stock, at JMJ’s option, at a conversion price, equal to 70% of the lowest trade for our common stock during the 20 trading days prior to the conversion. Prior to the conversion of the JMJ Notes, JMJ must make a payment to Wellstar reducing the amount owed to Wellstar under the Wellstar Notes. As of November 10, 2010, the lowest trade for our common stock during the 20 trading days as reported on the Over-The-Counter Bulletin Board was $.0001 and, therefore, the conversion price for the JMJ Notes was $.00007. Based on this conversion price, the JMJ Notes in the aggregate amount of $1,725,000, excluding interest, are convertible into 24.6 billion shares of our common stock.

JMJ has agreed to restrict their ability to convert the JMJ Notes and receive shares of common stock such that the number of shares of common stock held by them in the aggregate and their affiliates after such conversion or exercise does not exceed 4.99% of the then issued and outstanding shares of common stock.

The Wellstar Notes bear interest at the rate of 13.8% per annum and mature three years from the date of issuance. No interest or principal payments are required until the maturity date, but both principal and interest may be prepaid prior to Maturity Date. The Wellstar Notes are secured by units of STIC AIM Liquidity Portfolio Select Investment Select Investment Fund (the “JMJ Collateral”). On each of the Wellstar Notes, JMJ has agreed to pay down the principal of the Wellstar Notes commencing 210 days after the original issuance of the Wellstar Notes, However, JMJ may adjust the payment schedule within its sole discretion. In the event that JMJ defaults on the Wellstar Notes, Wellstar may take possession of the JMJ Collateral.

* All of the above offerings and sales were deemed to be exempt under Rule 506 of Regulation D and/or Section 4(2) of the Securities Act of 1933, as amended. No advertising or general solicitation was employed in offering the securities. The offerings and sales were made to a limited number of persons, all of whom were accredited investors, business associates of the Company or executive officers of the Company, and transfer was restricted by the Company in accordance with the requirements of the Securities Act of 1933. In addition to representations by the above-referenced persons, we have made independent determinations that all of the above-referenced persons were accredited or sophisticated investors, and that they were capable of analyzing the merits and risks of their investment, and that they understood the speculative nature of their investment. Furthermore, all of the above-referenced persons were provided with access to our Securities and Exchange Commission filings.

ITEM 6. SELECTED FINANCIAL DATA

As a Smaller Reporting Company, the Company is not required to include the disclosure under this Item 6. Selected Financial Data.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULT OF OPERATIONS.

The following information should be read in conjunction with the consolidated financial statements and the notes thereto contained elsewhere in this report. The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" for forward-looking statements. Information in this Item 6, "Management's Discussion and Analysis or Plan of Operation," and elsewhere in this 10-K that does not consist of historical facts, are "forward-looking statements." Statements accompanied or qualified by, or containing words such as "may," "will," "should," "believes," "expects," "intends," "plans," "projects," "estimates," "predicts," "potential," "outlook," "forecast," "anticipates," "presume," and "assume" constitute forward-looking statements, and as such, are not a guarantee of future performance. The statements involve factors, risks and uncertainties including those discussed in the “Risk Factors” section contained elsewhere in this report, the impact or occurrence of which can cause actual results to differ materially from the expected results described in such statements. Risks and uncertainties can include, among others, fluctuations in general business cycles and changing economic conditions; changing product demand and industry capacity; increased competition and pricing pressures; advances in technology that can reduce the demand for the Company's products, as well as other factors, many or all of which may be beyond the Company's control. Consequently, investors should not place undue reliance on forward-looking statements as predictive of future results. The Company disclaims any obligation to update the forward-looking statements in this report.

Plan of Operation and Financing Needs

We are seeking financing in different amounts and up to 12 million dollars. Currently the company has exhausted its funding from it’s past agreements with JMJ Financial and is actively trying to secure financing to continue operations. If the company is successful in securing financing the company will continue to develop its camera and complete the Beta Test that is currently in operation in a Long Term Care Facility.

We presently do not have any available credit, bank financing or other external sources of liquidity. Due to our brief history and historical operating losses, our operations have not been a source of liquidity. We will need to obtain additional capital in order to expand operations and become profitable. In order to obtain capital, we may need to sell additional shares of our common stock or borrow funds from private lenders. There can be no assurance that we will be successful in obtaining additional funding.

We will still need additional capital in order to continue operations until we are able to achieve positive operating cash flow. Additional capital is being sought, but we cannot guarantee that we will be able to obtain such investments. This money would be used for the roll out of our TMI System to the long term care market and for the development and production of a new camera that will save the company money as well as be more effective in its diagnosis..

Financing transactions may include the issuance of equity or debt securities, obtaining credit facilities, or other financing mechanisms. However, the trading price of our common stock and a downturn in the North American stock and debt markets could make it more difficult to obtain financing through the issuance of equity or debt securities. Even if we are able to raise the funds required, it is possible that we could incur unexpected costs and expenses, fail to collect significant amounts owed to us, or experience unexpected cash requirements that would force us to seek alternative financing. Furthermore, if we issue additional equity or debt securities, stockholders may experience additional dilution or the new equity securities may have rights, preferences or privileges senior to those of existing holders of our common stock. If additional financing is not available or is not available on acceptable terms, we will have to curtail our operations.

If We Are Unable to Obtain Additional Funding, Our Business Operations Will be Harmed. In Addition, Section 4e of the October 2005 Securities Purchase Agreements Contains Certain Restrictions and Limitations on Our Ability to Seek Additional Financing. If We Do Obtain Additional Financing, Our Then Existing Shareholders Will Suffer Substantial Dilution.

Results of Operations

Year Ended July 31, 2010 compared to Year Ended July 31, 2009 (all references are to the Year Ended July 31)

Revenue: We did not have revenue during the years ended July 31, 2010 and 2009.

Cost of Sales and Gross Profit: There was no Cost of Sales for the years ended July 31, 2010 and 2009 as we did not generate revenue during these periods.

Operating, Selling, General and Administrative Expenses: Operating, selling, general and administrative expenses decreased by $368,977, or 17% in the 2010 fiscal year to $1,794,696 from $2,163,673 in 2009. This decrease reflects decreases in stockholder relations expenses by $377,550. In addition, salaries decreased by $206,200 from $735,500 to $529,300, rentals decreased by $53,152 from $55,391 to $2,239, and insurance decreased by $32,931 from $85,436 to $52,506for the same period in 2009.

Loss from Operations: Loss from operations for the 2010 fiscal year was $1,794,696, a decrease of $368,977 or 17% from the loss from operations in 2009 of $2,163,673 as a result of the aforementioned decrease in operating, sales and administrative expenses.

Other Income and Expense: Total other expenses of $1,313,772 in the 2010 fiscal year represent a decrease of $38,355,076 from the expense of $39,668,848 in 2009 as a result of a decreased expense from derivative instrument expense for the period related to a decrease in derivative instrument liabilities caused by lower stock prices.

Net Income: Net loss of $3,108,468 for the 2010 fiscal year was $38,724,053 less than the net loss of $41,832,521 for the same period in 2009 due to the lesser amount of derivative instrument expense.

Liquidity and Capital Resources

It is Managements opinion that the current financial position of the company is in dire straits and the Company will need to obtain additional funding to continue operations. The Company expects that it will be able to continue operating through January 2011. If the Company does not obtain financing at this time, it will be required to cease operations.

As of July 31, 2010, we had a working capital deficit of approximately $37,109,113, and a cash overdraft of $6,103. We do not have the funds necessary to maintain our operations for the coming fiscal year, and will need to raise additional funding.

The liquidity impact of our outstanding debt is as follows:

Our unsecured demand note with Michael Sweeney (the "Sweeney Note"), in the principal amount of $150,000, matured on August 1, 2006 and remains outstanding. In addition to the outstanding principal, we also owe accrued interest in the amount of $45,625. We are in default pursuant to the terms of the Sweeney Note and we have not received a notice of default from Mr. Sweeney, nor has Mr. Sweeney indicated to the Company that he intends to place the Company in default under the note.

Our unsecured demand note with Micro Health Systems (the "MHS Note"), dated December 21, 2005 in the principal amount of $200,000, with interest at 8% per annum, has two maturity dates: at the 180th day and the 365th day following issuance. A payment of $100,000.00 is due at each maturity date. We did not make the first or second payment. There is an acceleration provision in the MHS Note stipulating that the entire $200,000.00 was due upon non-payment of the first $100,000. The interest rate then goes to the highest rate allowed by Florida law. We received a notice of default from MHS on November 28, 2006 and a complaint was filed on September 2, 2010 in which MHS demands for judgment for damages. The MHS Note is secured by a pledge of 1.5 million shares of the Company's treasury stock.

To obtain funding for our ongoing operations, we entered into a Securities Purchase Agreement with four accredited investors - AJW Partners, LLC, AJW Qualified Partners, LLC, AJW Offshore, Ltd. and New Millennium Partners II, LLC on October 31, 2005 for the sale of (i) $3,000,000 in secured convertible notes and (ii) warrants to buy 5,000,000 shares of our common stock. The gross financing proceeds were paid to the Company in three separate tranches of $1,000,000 each. The first tranche of the financing, in the amount of $1,000,000, was received by the Company upon closing. The second tranche was received on January 20, 2006. The third tranche was received as follows:

$500,000 in July 2006 and $500,000 in August 2006.

The secured convertible notes issued pursuant to our October 2005 through June 2008 Securities Purchase Agreements bear interest originally at 8% but increasing to 13% effective September 8, 2009, mature three years from the date of issuance, and are convertible into our common stock, at the selling stockholders' option, at the lower of (i) $0.12 or (ii) generally a 75% discount to the average of the three lowest intraday trading prices for the common stock on a principal market for the 20 trading days before but not including the conversion date. As of July 28, 2010, the average of the three lowest intraday trading prices for our common stock during the preceding 20 trading days as reported on the Over-The-Counter Bulletin Board was $ .0001 and, therefore, the conversion price for the secured convertible notes was $ .000025. Based on this conversion price, the $4,798,835 outstanding principal amount of the secured convertible notes, excluding interest, were convertible into approximately 191,953,400,000 shares of our common stock. The stock purchase warrants have an exercise price of $0.0001 and $0.50 per share. If the lender converts, the Company will issue the appropriate number of shares and will not be required to use cash to liquidate the debt. Additionally, the Company will receive cash proceeds in the amount of $3,055,000 if the lender exercises the warrants. If the lender converts, the Company will issue the appropriate number of shares and will not be required to use the cash to liquidate the debt.

The registration statement we filed to register the shares underlying the convertible notes and warrants was declared effective by the Securities & Exchange Commission on August 4, 2006 (File No. 333-130295).

To obtain additional funding for our ongoing operations, we entered into a loan agreement with JMJ Financial a loan in the principal sum of $ 575,000 and $ 1,000,000, of which $ 75,000 and $150,000 is a loan acquisition cost. The note provides for a one time 12% interest charge on the principal sum. The convertible note is convertible into our common stock, at the selling stockholders' option, at 70% of the average of the three lowest intraday trading prices for the common stock on a principal market for the 20 trading days before but not including the conversion date. As of July 31, 2010 the principal balance of the loan is $ 1,551,219.

On May 15, 2009, the Company entered into a Securities Purchase Agreement with AJW Partners, LLC ("Partners"), AJW Partners II, LLC ("Partners II "), AJW Master Fund, Ltd. ("Master"), AJW Master Fund II, Ltd. ("Master II") and New Millennium Capital Partners, II, LLC ("Millennium" and collectively with Partners, Partners II, Master and Maser II, the “Purchasers”) for the sale of 13% secured convertible notes in an aggregate principal amount of up to $79,500 (the "Notes"). The Purchasers closed on $22,000 in Notes on May 18, 2009.

The Notes bear interest at the rate of 13% per annum. Interest is payable monthly, unless the Company's common stock is greater than $0.045 per share for each trading day of a month, in which event no interest is payable during such month. Any interest not paid when due shall bear interest of 15% per annum from the date due until the same is paid. The Notes mature three years from the date of issuance, and are convertible into common stock, at the Purchasers' option, at the lesser of (i) $0.12 or (ii) a 75% discount to the average of the three lowest trading prices of the common stock during the 20 trading day period prior to conversion. The Notes contain a call option whereby, if the Company's stock price is below $0.045, the Company may prepay the outstanding principal amount of the Notes, subject to the conditions set forth in the call option. The Notes also contain a partial call option whereby, if the Company's stock price is below $0.045, the Company may prepay a portion of the outstanding principal amount of the Note, subject to the conditions set forth in the partial call option.

The full principal amount of Notes are due upon a default under the terms of the secured convertible notes. In addition, the Company granted the Purchasers a security interest in substantially all of the Company's assets and intellectual property. The Company is required to file a registration statement with the Securities and Exchange Commission upon demand, which will include the common stock underlying the Notes.

The conversion price of the Notes may be adjusted in certain circumstances such as if the Company pays a stock dividend, subdivides or combines outstanding shares of common stock into a greater or lesser number of shares, or takes such other action as would otherwise result in dilution of the selling stockholder's position.

The Purchasers have agreed to restrict their ability to convert their Notes and receive shares of common stock such that the number of shares of common stock held by them in the aggregate and their affiliates after such conversion or exercise does not exceed 4.99% of the then issued and outstanding shares of common stock.

JMJ Financing

On May 22, 2009, the Company issued a Convertible Promissory Note to JMJ Financial (“JMJ”) in aggregate principal amounts of $575,000 (the “Initial JMJ Note”). In consideration for Wellstar’s issuing of the Initial JMJ Note, JMJ issued Wellstar a Secured and Collateralized Promissory Note in the principle amount of $500,000 (the “Initial Wellstar Note”).

In addition, on August 19, 2009 Wellstar issued a Convertible Promissory Note to JMJ in aggregate principal amounts of $1,150,000 (the “Second JMJ Note” and together with the Initial JMJ Note, the “JMJ Notes”). In consideration for Wellstar’s issuing of the Second JMJ Note, JMJ issued Wellstar a Secured and Collateralized Promissory Note in the principle amouns of $1,000,000 (the “Second Wellstar Note” and together with the Initial Wellstar Note, the “Wellstar Notes”).

The JMJ Notes bear interest at 12%, mature three years from the date of issuance, and are convertible into our common stock, at JMJ’s option, at a conversion price, equal to 70% of the lowest trade for our common stock during the 20 trading days prior to the conversion. Prior to the conversion of the JMJ Notes, JMJ must make a payment to Wellstar reducing the amount owed to Wellstar under the Wellstar Notes. As of October 8, 2010, the lowest trade for our common stock during the 20 trading days as reported on the Over-The-Counter Bulletin Board was $.0001 and, therefore, the conversion price for the JMJ Notes was $.00007. Based on this conversion price, the JMJ Notes in the aggregate amount of $1,551,219, excluding interest, are convertible into 22.16 billion shares of our common stock.

JMJ has agreed to restrict their ability to convert the JMJ Notes and receive shares of common stock such that the number of shares of common stock held by them in the aggregate and their affiliates after such conversion or exercise does not exceed 4.99% of the then issued and outstanding shares of common stock.

The Wellstar Notes bear interest at the rate of 13.8% per annum and mature three years from the date of issuance. No interest or principal payments are required until the maturity date, but both principal and interest may be prepaid prior to Maturity Date. The Wellstar Notes are secured by units of STIC AIM Liquidity Portfolio Select Investment Select Investment Fund (the “JMJ Collateral”). On each of the Wellstar Notes, JMJ has agreed to pay down the principal of the Wellstar Notes commencing 210 days after the original issuance of the Wellstar Notes, However, JMJ may adjust the payment schedule within its sole discretion. In the event that JMJ defaults on the Wellstar Notes, Wellstar may take possession of the JMJ Collateral.