TIDMROQ

RNS Number : 9449V

Roquefort Investments PLC

16 December 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE

REPUBLIC OF SOUTH AFRICA, ANY MEMBER STATE OF THE EEA (OTHER THAN

THE UNITED KINGDOM) OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT

JURISDICTION.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

DOES NOT CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION,

RECOMMENDATION, OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR,

OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES IN ANY

JURISDICTION.

16 December 2021

Roquefort Investments plc

("Roquefort Investments" or the "Company")

Publication of Prospectus

Roquefort Investments (LSE:ROQ), the London listed investment

company established to acquire businesses focused on early-stage

opportunities in the medical biotechnology sector , is pleased to

announce that, further to the conditional share sale and purchase

agreement (the "Acquisition Agreement") with Provelmare Holding

S.A. as announced on 18 November 2021, the Company has today

published its Prospectus in relation to the proposed acquisition of

Lyramid Pty Limited ("Lyramid"), the conditional placing for new

Ordinary Shares to raise gross proceeds of GBP3 million (the

"Placing") and the issue of Consideration Shares (as described

below).

As announced on 18 November 2021 the Company entered into the

Acquisition Agreement pursuant to which Roquefort Investments

agreed to acquire the entire issued share capital of Lyramid for an

initial consideration of a cash payment of GBP500,000 and the issue

of 5,000,000 new ordinary shares ("Consideration Shares") (the

"Acquisition"). The Acquisition is conditional, inter alia, on

Admission (as described below) and a successful Placing.

The net proceeds of the Placing after expenses are estimated at

GBP2,563,492 (the "Net Placing Proceeds"). The Net Placing

Proceeds, together with existing cash, are intended to be used to

fund the cash component of the consideration for the Acquisition,

pre-clinical drug development and working capital.

The Prospectus and an electronic copy of the Prospectus has been

made available on the Company's website ( www.roquefortinvest.com )

The Prospectus will also be available for inspection at the

National Storage Mechanism website: (

https://data.fca.org.uk/#/nsm/nationalstoragemechanism ).

The Company also confirms that it has today allotted the

5,000,000 Initial Consideration Shares and the 30,000,000 Placing

Shares ("New Ordinary Shares"), conditionally on the re-admission

of the Existing Ordinary Shares and the admission of the New

Ordinary Shares to the Official List by way of a Standard Listing

and to trading on the London Stock Exchange's Main Market for

listed securities ("Admission") at the issue price of GBP0.10 per

New Ordinary Share.

Applications are being made to the FCA and to the London Stock

Exchange for the re-admission of the Existing Ordinary Shares and

for admission of the New Ordinary Shares to the Official List by

way of a Standard Listing and to trading on the London Stock

Exchange's Main Market for listed securities.

It is expected that Admission will become effective at or around

8.00 a.m. on 21 December 2021 and that dealings in the New Ordinary

Shares will commence at that time and that trading in the Existing

Ordinary Shares will resume at that time.

The New Ordinary Shares will, when issued, be credited as fully

paid and will rank pari passu in all respects with the Existing

Ordinary Shares of the Company and will on issue be free of all

claims, liens, charges, encumbrances and equities.

The Company confirms that with effect from Admission, the

Company's issued share capital will comprise 71,900,000 ordinary

shares of GBP0.01 each, with each share carrying the right to one

vote. The Company does not hold any ordinary shares in

treasury.

The above figure of 71,900,000 may be used by shareholders as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or of a change to

their interest in the Company under the FCA's Disclosure and

Transparency Rules.

Terms used in this announcement shall, unless the context

otherwise requires, be as defined in the announcement published by

the Company on 18 November 2021 in relation to the Acquisition of

Lyramid and the Placing .

Expected Timetable of Principal Events

Publication of the Prospectus 16 December 2021

Completion of Acquisition 21 December 2021

Issue of New Ordinary Shares 21 December 2021

Admission and commencement of dealings 8.00 a.m. on 21 December

2021

Ordinary Shares to be issued in uncertificated form credited

to stock accounts in CREST 21 December 2021

Ordinary Share certificates (for Placing Shares) despatched

in week commencing 3 January 2022

All times are London times unless stated otherwise

Stephen West, Executive Chairman, commented:

"We're delighted to issue shareholders with the Prospectus in

relation to the proposed acquisition of Lyramid. This is a

transformative transaction for Roquefort Investments and one which

sets the Company on an exciting journey as Lyramid continues to

progress its pre-clinical drug development programme around

Midkine-based therapeutics.

We thank shareholders for their support through the process, as

demonstrated by the strong demand for the recent Placing, and we

look forward to the recommencement of trading next week."

Enquiries:

Roquefort Investments plc

+44 (0)20 3290

Stephen West (Chairman) 9339

Buchanan (Public Relations)

Ben Romney / Jamie Hooper

+44 (0)20 7466

Optiva Securities Limited (Broker) 5000

+44 (0)20 3411

Christian Dennis 1881

For further information, please visit www.roquefortinvest.com

and @roquefortinvest on Twitter.

LEI: 254900P4SISIWOR9RH34

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended ("MAR"). Upon the publication of

this announcement via Regulatory Information Service, this inside

information is now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PDIQQLFFFLLLFBF

(END) Dow Jones Newswires

December 16, 2021 11:24 ET (16:24 GMT)

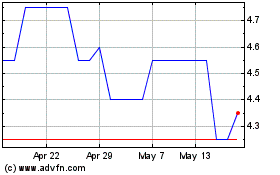

Roquefort Therapeutics (LSE:ROQ)

Historical Stock Chart

From May 2024 to Jun 2024

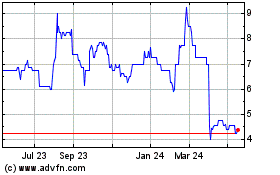

Roquefort Therapeutics (LSE:ROQ)

Historical Stock Chart

From Jun 2023 to Jun 2024