Disposal

November 04 2011 - 7:00AM

UK Regulatory

TIDMLFI

4 November 2011

London Finance & Investment Group P.L.C.

("LFIG" or the "Company")

Proposed Disposal of Investment Property

The Company is pleased to announce that it has agreed, subject to Shareholder

approval, to dispose of the Company's property in Rutland Gate, Knightsbridge,

London (the `Property') for a cash consideration of GBP2.625million (the

"Disposal"). The purchaser, Rutland Property Holdings Limited, and the Company

have now exchanged contracts and therefore the Company will proceed towards

completion once Shareholder approval has been obtained.

As the Disposal represents more than 25% of the market capitalisation of the

Company, the Company is required by the Listing Rules to seek Shareholder

approval of the Disposal as a class 1 transaction. Such Shareholder approval

will be sought at a General Meeting to be held shortly; Notice of the General

Meeting will be contained in a Circular to Shareholders which is being drafted

and will be mailed to Shareholders once the Circular has been approved by the

relevant regulatory authorities.

Details of the Property

The Property was carried in the Company's books on 30 June 2011 at GBP367,000 but

was valued in July 2011 at GBP2,150,000 on an open market basis in accordance

with valuation standards issued by the Royal Institution of Chartered

Surveyors. An updated Property Valuation report will be included in the

Circular.

The Property is leased to Marshall Monteagle PLC, a company controlled by

trusts associated with Mr. D.C. Marshall and Mr. J.M. Robotham, Directors of

the Company. The Property has been let on the basis that the tenant meets all

costs related to the Property and pays a rent which up to 1 January 2009 was GBP

27,000 p.a., from 1 January 2009 to 30 September 2011 was GBP40,000 p.a. and from

1 October 2011 has been increased to GBP53,000. No costs relating to the Property

such as maintenance and repairs have been borne by the Company i.e. the rental

income is both the gross and net income from the Property. As a consequence of

the Disposal, rental income from the Property will decline by GBP53,000 in the

next 12 months. This would have been a return of 2.5% based on the July 2011

valuation of the Property.

If the sale proceeds are not re-invested, and the bulk of the proceeds are used

to repay all of the Company's borrowings, the Directors estimate that the

effect on earnings will be a reduction of approximately GBP15,000 per annum

assuming that interest earned on surplus cash deposits is 1% and base rates

remain at 0.5%. Each extra 1% that can be earned on the surplus cash deposits

will increase after tax earnings by approximately GBP3,000 per annum. If all the

Disposal proceeds are re-invested and achieve a similar yield (3.6% before tax)

to the Company's existing General investment portfolio, earnings will increase

by approximately GBP23,000 per annum. The actual effect on earnings will depend

on the extent and speed with which sale proceeds are re-invested.

Completion of the Disposal will provide the Company with:

* cash proceeds of approximately GBP2.35 million (net of transaction costs and

tax);

* a strengthened balance sheet reflecting the cash proceeds;

* reduced exposure to a single property which represented in excess of

one-fifth of the assets of the Company;

* an opportunity to redeploy capital in line with the investment policy of

the Company.

The Company will make a further announcement when the Circular has been posted

to Shareholders.

Enquiries:

London Finance & Investment Group P.L.C.

Lloyd Marshall

Tel: 020 7448 8950

Beaumont Cornish Limited, Sponsor

Roland Cornish

Tel: 0207 628 3396

END

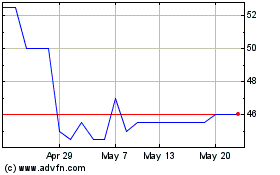

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From May 2024 to Jun 2024

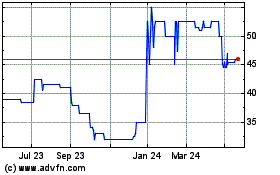

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jun 2023 to Jun 2024