TIDMLBE

RNS Number : 5405A

Longboat Energy PLC

26 September 2022

Longboat Energy plc

("Longboat Energy", the "Company" or "Longboat")

Interim Results to 30 June 2022

London, 26 September 2022 - Longboat Energy, the emerging

full-cycle E&P company, is pleased to announce its unaudited

interim results for the period to 30 June 2022.

Helge Hammer, Chief Executive Officer of Longboat Energy,

commented:

"Last week we announced our fourth discovery from eight wells

drilled over the past 15 months. This drill programme has not only

made us one of the most active companies in the Norwegian North Sea

but also one of the most successful in that period with discovery

rates well-ahead of the industry average.

"Of those eight wells, five have been drilled this year

delivering two of our most exciting discoveries to date in Oswig

and Kveikje. Kveikje has excellent quality reservoir in an

attractive location near infrastructure. The initial indications

from Oswig are very encouraging and we should have the results of

further testing in the next 6-8 weeks. Our discoveries to date, as

well as next year's Velocette exploration well, all have the

potential to create substantial value to shareholders."

Operational Highlights

Encouraging results from Longboat's initial eight wells exploration

-- drilling programme with success rates and finding costs better

than industry average

Two discoveries so far this year: Kveikje and Oswig

--

Kveikje discovery (Longboat 10%):

--

E xcellent reservoir qualities and attractive location

-- near infrastructure.

Preliminary estimates of recoverable resources in the excellent

-- quality injectite reservoir were 28 to 48 mmboe gross(1)

Focus on near-term monetization opportunities following

-- multiple enquiries

Oswig discovery (Longboat 20%).

--

Preliminary analysis of extensive wireline logs and core

-- data indicates strong correlation to nearby Tune field

and presence of gas-condensate

Preliminary in-place volumes (GIIP) estimated above pre-drill

-- expectations

Key uncertainty over recoverable resource range due to

-- challenges collecting downhole data from existing wellbore

Joint venture decision to sidetrack well and conduct drill-stem

-- test (DST) to establish reservoir productivity, detailed

fluid properties and recoverable resource range

Continued to pursue gas opportunities given its role in energy

-- security and contribution to the energy transition

Secured further bilateral transaction to acquire interests

-- in two further significant, near-term, low-risk gas exploration

wells on the NCS, Oswig and Velocette

Near-term focus on appraising and monetising existing key

-- discoveries and on building an attractive 3-5 well programme

for 2023.

Continued main focus on North Sea opportunities, but also

-- assessing wider opportunity set to leverage Longboat's

high-quality network, organisation and prior experience

set

Financial Summary

Cash reserves of GBP22.5 million (30 June 2021 GBP38.7 million)

--

Debt of GBP15.7 million to be repaid from the Norwegian Government's

-- tax rebate in November 2023

Loss for the period GBP1.7 million

--

This announcement does not contain

inside information

Enquiries:

Longboat Energy via FTI

Helge Hammer, Chief Executive Officer

Jon Cooper, Chief Financial Officer

Stifel (Nomad) Tel: +44 20 7710 7600

Callum Stewart

Jason Grossman

Simon Mensley

Ashton Clanfield

FTI Consulting (PR adviser) Tel: +44 20 3727 1000

Ben Brewerton

Rosie Corbett longboatenergy@fticonsulting.com

Notes :

1 ERC Equipoise estimates, 2C resources of 35 mmboe with 3C

potential of 60 mmboe using a conversion factor of 5,600

scf/stb

2 Under both existing and proposed Norwegian tax legislation,

the latter assuming that the Exploration Finance Facility is

amended as described in the interim report below

Standard

Estimates of reserves and resources have been prepared in

accordance with the June 2018 Petroleum Resources Management System

("PRMS") as the standard for classification and reporting with an

effective date of 31 December 2020.

Review by Qualified Person

The technical information in this release has been reviewed by

Hilde Salthe, Managing Director Norge, who is a qualified person

for the purposes of the AIM Guidance Note for Mining, Oil and Gas

Companies. Ms Salthe is a petroleum geologist with more than 20

years' experience in the oil and gas industry. Ms Salthe has a

Masters Degree from Faculty of Applied Earth Sciences at the

Norwegian University of Science and Technology in Trondheim

Glossary

Mmboe Millions of barrels of oil equivalent

NCS Norwegian Continental Shelf

scf Standard cubic feet

stb Stock tank barrel

LONGBOAT ENERGY PLC

STRATEGIC REPORT

FOR THE SIX MONTH PERIODED 30 JUNE 2022

CEO Introductory Statement

Well results and assets

In June of last year we announced that we had farmed-in to a

programme of seven exploration wells in Norway in three bilateral

transactions with Equinor, Spirit and Idemitsu. Three of the wells

were drilled in the second half of last year, which resulted in two

discoveries: Egyptian Vulture and Rødhette. In May this year the

Company farmed into two further exploration wells in a bilateral

transaction with OMV. Since the beginning of this year, five

exploration wells have been drilled resulting in a significant oil

discovery on the Kveikje prospect, unsuccessful wells in

Ginny-Hermine, Cambozola and Copernicus and, as recently announced,

a discovery on Oswig which is now being tested.

In the Kveikje well (Longboat 10%), we encountered hydrocarbons

at all four targets levels. Preliminary estimates of recoverable

resources in the excellent quality injectitie reservoir were 28 to

48 mmboe gross. Kveikje is operated by Equinor and is located in an

area to the north of the giant Troll field with significant

infrastructure and multiple tie-back opportunities. Furthermore,

several third-party discoveries have been made close to Kveikje

during the last few years, such as Røver Nord, Toppand and Swicher,

which will allow for significant operational synergies and

economies of scale as the Kveikje development moves forward.

The Company's fourth transaction announced in May was to farm-in

to two further exploration wells on the Norwegian Continental

Shelf, Oswig and Velocette, which had been negotiated bilaterally

with OMV, the Austrian E&P company. The two wells are both

targeting material gas resources in close proximity to Norwegian

gas infrastructure. The first of these wells, Oswig, spud at the

start of August and, as announced last week, a decision has been

taken to drill a sidetrack well and perform a drill stem test.

Extensive coring and logging data have been successfully acquired

and the preliminary analysis of the data indicates excellent

correlation with the nearby Tune field; likely presence of gas and

condensate; and Gas In Place (GIIP) volumes in the Jurassic Tarbert

reservoir higher than pre-drill expectations .

Oswig (Longboat 20%) consists of a high pressure, high

temperature Jurassic rotated fault block nearby the Equinor

operated producing Tune and Oseberg fields. Oswig had a pre-drill

gross unrisked mean resource of 93 mmboe making it one of the

larger gas prospects being tested in Norway this year. Several

additional fault blocks have been identified on-block which could

contain further gross unrisked mean resources of 80 mmboe which

would be significantly derisked by a successful DST.

The Velocette prospect (Longboat 20%) is also operated by OMV

and comprises Cretaceous Nise turbidite sands in the Norwegian Sea.

This gas-condensate prospect is located within tie-back distance to

the Aasta Hansteen gas field and has been estimated by the operator

to contain gross unrisked mean resources of 130 mmboe (26mmboe net

to Longboat). Last week we announced that a rig contract had been

entered into for the Transocean Norge semi-sub with the well

expected to spud in Q3 next year.

In October last year, we announced the Egyptian Vulture

discovery (Longboat 15%) close to infrastructure on the Halten

Terrace in the Norwegian Sea. The discovery is visible on seismic

as a large amplitude anomaly which covers an area of more than 80

km(2) and therefore has significant volume potential. Detailed

technical studies are ongoing with particular focus on the seismic

interpretation and the reservoir quality and distribution as,

whilst expansive, it is a thin reservoir. The objectives are to

reduce the risk and increase the understanding of the discovery as

far as possible before making a final decision on a possible second

well on Egyptian Vulture. As part of this work, ERCE has provided

an independent assessment of the discovery in a Competent Person

Report commissioned by Longboat, which has confirmed the size of

the discovery at gross 4-68 mmboe.

Rødhette was discovered in October last year and is located

within tie-back distance to the Goliath field in the Barents Sea.

The discovery contains oil and gas resources between 9 and 12 mmboe

(gross), which is not commercial as a standalone development, but

could be tied-back for production as part of an area cluster

development. The way forward for the asset therefore depends on the

outcome of several third-party exploration wells, which are

scheduled for drilling in the area before the end of this year. On

the Ginny-Hermine, Cambozola and Copernicus licences work continues

to establish the remaining prospectivity on the licences.

Strategy and markets

Longboat's strategy remains unchanged: to create significant

value to shareholders by building a significant E&P business

through value accretive M&A transactions and with the

drill-bit.

In a situation where access to energy is becoming increasingly

important and particularly gas in North West Europe, Norway plays a

critical role as the country continues to offer attractive

opportunities for E&P companies. Exploration results in Norway

remain good and the country continues to offer high quality acreage

in regular licensing rounds. According to the latest Resource

Report by the Norwegian Petroleum Directorate, only half of total

estimated resources of 100 billion boe have so far been produced

and sold. Longboat, with its highly skilled G&G team and

extensive industry network, is uniquely positioned to benefit from

this continued opportunity as was recently demonstrated by the OMV

farm-in deal.

Norway also continues to offer an attractive regulatory

framework. A new Norwegian Petroleum Tax System has been

introduced, which Longboat views as generally positive for the

Company. The main elements of the new tax system are an unchanged

marginal rate at 78%, a move to immediate expensing of investments,

71.8% repayment of all losses in the following year (compared to

previously 72% of exploration losses only) with corporate tax at

6.2% carried forward against future profits. Longboat has worked

with its lending banks and has successfully amended the

'Exploration Finance Facility' (EFF) to fit the new tax regime and

will use its restructured EFF credit facilities to meet the working

capital requirement for future exploration expenditure. The size

and tenure of the facility remains the same as the original

facility, NOK600 million and is available for drawing until 31

December 2023.

As part of Longboat's sustainability strategy, the Company has

undertaken to be corporate 'Net Zero' on a Scope 1 and 2 basis by

2050. In this context, delivering exploration success with

significant gas prospects near existing infrastructure will be

crucial to reducing carbon intensity in order maximise the use of

existing facilities and pipelines. We aim to make an important

contribution to the energy transition and acknowledge the place

that hydrocarbon exploration and production will continue to have

in the global markets for the foreseeable future.

During 2022, Longboat has also continued to pursue production

acquisition opportunities in the North Sea, which has not yet led

to any production transactions. In the M&A market there have

been multiple deals made involving production assets in the North

Sea this year, however the recent spike in commodity prices

following the Russian invasion of Ukraine has widened the gap

between buyer and seller expectations. Almost all of the production

transactions during the period have occurred in Norway, with the UK

continuing to suffer from negative investor sentiment associated

most recently with the 25% windfall levy imposed on UK producers in

response to high domestic energy prices. The majority of deals in

Norway continue to be struck by privately held companies. Longboat

continues to be active in this market but is not willing to

compromise on its requirement for transactions to be of high

quality and value accretive.

Bearing in mind that the North Sea M&A market for production

and development assets remains very competitive with a rather small

number of opportunities to review, to make full use of our highly

skilled team, the Company has recently also started to review

opportunities in a few carefully selected countries outside of the

North Sea. These are countries which offer attractive opportunities

in supportive regulatory regimes as we continue to pursue in

Norway.

Financial Results

The Company's gross cash position at 30 June 2022 was GBP22.5

million (30 June 2021: GBP38.7 million) with debt of GBP15.7million

(30 June 2021: nil) drawn under the EFF, resulting in a net cash

position of GBP6.8 million. EFF drawings in the period will be

repaid from the Norwegian Government's tax rebate, due in November

2023. The post-tax loss for the period was GBP1.7 million (30 June

2021: $0.9 million). During the period the Company had an active

drilling campaign which included spudding Ginny & Hermine,

Kveikje and Cambozola, spending GBP17.7 million on exploration

drilling costs and GBP13.5 million on exploration carry costs.

Operational performance has been good and the wells were drilled in

line with the budget. In the period to 30 June 2022 there were no

write offs of E&A costs despite drilling dry wells while

evaluation work to establish remaining prospectivity on the

licences is still ongoing. The carrying value of licences and

evaluation work will again be reviewed at the year end.

Administrative expenses in the period were GBP2.4 million (30

June 2021: 1.5 million). Wages and salaries in the period were

GBP1.2 million (30 June 2021: 0.4 million) reflecting increased

staffing costs post the farm-in deals.

Going concern

The Directors have completed the going concern assessment, including

a review of cash flow forecasts to December 2023, to assess whether

the Group is a going concern. Following the announcement of a

discovery at Oswig, the Oswig partnership has agreed to expand

the scope of appraisal work which will now include a side track

and drill stem test. This expanded work programme will require

additional funding under the base case towards the end of the

forecast period. Whilst the directors are confident that such

funding will be available if required there can be no guarantee

that this will be the case. These circumstances represent a material

uncertainty that may cast significant doubt on the Company's

ability to continue as a going concern. The financial statements

do not include any adjustments that would result from the going

concern basis of preparation being inappropriate.

Outlook

Our plan remains to build Longboat into a full-cycle E&P

company. The very high commodity prices are making the M&A

market challenging for both buyers and sellers, although more so

for buyers. That aside, Longboat remains well-placed to transact.

We have an experienced team with excellent relationships across the

industry and we believe there are now many excellent opportunities

for Longboat to pursue. However, patience will still be required

given the commodity price levels and the competitive landscape.

On behalf of the board

Helge Ansgar Hammer

Director

23 September 2022

LONGBOAT ENERGY PLC

DIRECTORS' RESPONSIBILITES STATEMENT

FOR THE SIX MONTH PERIODED 30 JUNE 2022

The directors are responsible for preparing the interim report in

accordance with applicable law and regulations.

The directors have elected to prepare the financial statements in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the United Kingdom. The directors must not approve

the financial statements unless they are satisfied that they give

a true and fair view of the state of affairs of the Group and of

the profit or loss of the Group for that period. The directors are

also required to prepare the financial statements in accordance

with the rules of the London Stock Exchange for companies trading

securities on AIM.

In preparing these financial statements, the directors are required

to:

* select suitable accounting policies and then apply

them consistently;

* make judgements and accounting estimates that are

reasonable and prudent;

* state whether they have been prepared in accordance

with IFRSs as adopted by the United Kingdom, subject

to any material departures disclosed and explained in

the financial statements; and

* prepare the financial statements on the going concern

basis unless it is inappropriate to presume that the

company will continue in business.

The directors are responsible for keeping adequate accounting records

that are sufficient to show and explain the company's transactions

and disclose with reasonable accuracy at any time the financial

position of the company. They are also responsible for safeguarding

the assets of the company and hence for taking reasonable steps

for the prevention and detection of fraud and other irregularities.

Website publication

The directors are responsible for ensuring the annual and interim

reports and financial statements are made available on a website.

Financial statements are published on the company's website in accordance

with legislation in the United Kingdom governing the preparation

and dissemination of financial statements, which may vary from legislation

in other jurisdictions. The maintenance and integrity of the company's

website is the responsibility of the directors. The directors' responsibility

also extends to the ongoing integrity of the financial statements

contained therein.

LONGBOAT ENERGY PLC

INDEPENT REVIEW REPORT

FOR THE SIX MONTH PERIODED 30 JUNE 2022

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2022 is not prepared, in all material respects, in accordance

with the London Stock Exchange AIM Rules for Companies.

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2022 which comprises the consolidated

statement of comprehensive income, consolidated statement of

financial position, consolidated statement of changes in equity,

consolidated statement of cash flows and notes to the consolidated

interim financial information.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

a form consistent with that which will be adopted in the Company's

annual accounts having regard to the accounting standards

applicable to such annual accounts.

Material uncertainty related to going concern

We draw attention to note 1.2 to the condensed set of financial

statements which indicates that additional funding will be required

to meet the Group's commitments and obligations as they fall due.

These events or conditions, along with other matters as set out in

note 1.2, indicates that a material uncertainty exists which may

cast significant doubt over the Company and Group's ability to

continue as a going concern. Our conclusion is not modified in

respect of this matter.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with

the London Stock Exchange AIM Rules for Companies which require

that the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the Company's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including the Material Uncertainty Related to Going

Concern, are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange AIM Rules for Companies for no

other purpose. No person is entitled to rely on this report unless

such a person is a person entitled to rely upon this report by

virtue of and for the purpose of our terms of engagement or has

been expressly authorised to do so by our prior written consent.

Save as above, we do not accept responsibility for this report to

any other person or for any other purpose and we hereby expressly

disclaim any and all such liability.

BDO LLP

Chartered Accountants

London

23 September 2022

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

LONGBOAT ENERGY PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTH PERIODED 30 JUNE 2022

6 months 6 months

ended 30 ended to Year

June 30 June to 31 December

2022 2021 2021

unaudited unaudited audited

Notes GBP GBP GBP

Administrative expenses (2,399,804) (1,513,958) (4,720,133)

Exploration and evaluation

refund/(expense) 309,337 - (6,399,134)

Operating loss 6 (2,090,467) (1,513,958) (11,119,267)

Investment revenues 5 - 3,963 11,412

Finance costs (405,878) - (484,527)

Loss before taxation (2,496,345) (1,509,995) (11,592,382)

Income tax credit 8 851,981 645,117 6,911,762

Loss for the period (1,644,364) (864,878) (4,680,620)

Items that may be reclassified to profit

or loss

Currency translation differences (23,989) (11,731) 580,447

Total items that may be reclassified

to profit or loss (23,989) (11,731) 580,447

Total comprehensive loss (1,668,353) (876,609) (4,100,173)

Loss per share 10

Basic and diluted (2.90) (7.70) (12.97)

Loss per share is expressed in pence per share.

The income statement has been prepared on the basis that all operations

are continuing operations.

LONGBOAT ENERGY PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

FOR THE SIX MONTH PERIODED 30 JUNE 2022

30 June 30 June 31 December

2022 2021 2021

unaudited unaudited audited

Notes GBP GBP GBP

Non-current assets

Exploration and evaluation

assets 11 55,191,851 - 23,988,754

Property, plant and

equipment 11 74,817 25,685 29,600

Right of use assets 11 498,806 - 560,709

Non-current tax receivable 14 20,960,554 - -

76,726,028 25,685 24,579,063

Current assets

Inventories 9 104,502 - 92,798

Trade and other receivables 12 991,174 1,368,540 1,136,081

Current tax recoverable 14 - 1,089,367 8,149,906

Cash and cash equivalents 22,492,722 38,729,643 26,282,067

23,588,398 41,187,550 35,660,852

Total assets 100,314,426 41,213,235 60,239,915

Current liabilities

Trade and other payables 16 8,668,246 1,707,404 4,772,167

Lease liabilities 13 119,219 - 96,172

8,787,465 1,707,404 4,868,339

Net current assets 14,800,933 39,480,146 30,792,513

Non-current liabilities

Lease liabilities 13 422,822 - 486,630

Deferred tax liabilities 17 41,146,691 372,709 18,766,424

Bank loans and borrowings 15,328,609 - -

372,709

56,898,122 372,709 19,253,054

Total liabilities 65,685,587 2,080,113 24,121,393

Net assets 34,628,839 39,133,122 36,118,522

Equity GBP GBP GBP

Called up share capital 15 5,666,665 5,666,665 5,666,665

Share premium account 35,570,411 35,570,411 35,570,411

Own shares 450,000 450,000 450,000

Currency translation

reserve 557,007 (11,183) 580,996

Share based payment reserve 532,220 144,587 353,550

Retained earnings (8,147,464) (2,687,358) (6,503,100)

Total equity 34,628,839 39,133,122 36,118,522

Total equity and liabilities 100,314,426 41,213,235 60,239,915

The financial statements were approved by the board of directors

and authorised for issue on 23 September 2022 and are signed on its

behalf by:

Helge Ansgar Hammer

Director

Company Registration No. 12020297

LONGBOAT ENERGY PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIODED 30 JUNE 2022

Share Share Currency Share

capital premium translation based payment Own Retained

capital account reserve reserve shares earnings Total

GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January 2021 1,000,000 7,808,660 549 97,763 450,000 (1,822,480) 7,534,492

----------- ----------- ------------ -------------- -------- ----------- -----------

Period ended

30 June 2021

Loss for the

period - - - - - (864,878) (864,878)

Other

comprehensive

loss for the

period - - (11,731) - - - (11,731)

Total

comprehensive

loss for the

period - - (11,731) - - (864,878) (876,609)

Issue of share

capital 4,666,665 30,333,334 - - - - 34,999,999

Share issue

costs - (2,571,584) (2,571,584)

Credit to

equity for

equity

settled

share-based

payments - - - 46,824 - - 46,824

Balance at 30

June 2021 5,666,665 35,570,411 (11,182) 144,587 450,000 (2,687,358) 39,133,122

----------- ----------- ------------ -------------- -------- ----------- -----------

Period ended

31 December

2021

Loss for the

period - - - - - (3,815,742) (3,815,742)

Other

comprehensive

income for

the period - - 592,178 - - - 592,178

Total

comprehensive

income for

the period - - 592,178 - - (3,815,742) (3,223,564)

Credit to

equity for

equity

settled

share-based

payments - - - 208,963 - - 208,963

----------- ----------- ------------ -------------- -------- ----------- -----------

Balance at 31

December 2021 5,666,665 35,570,411 580,996 353,550 450,000 (6,503,100) 36,118,522

=========== =========== ============ ============== ======== =========== ===========

Balance at 1 January 2022 5,666,665 35,570,411 580,996 353,550 450,000 (6,503,100) 36,118,522

Period ended 30 June 2022

Loss for the period - - - - - (1,644,364) (1,644,364)

Other comprehensive losses - (23,989) - - - (23,989)

Credit to equity for equity

settled

share-based payments - - - 178,670 - - 178,670

----------- ---------- -------- ------- ------- ----------- -----------

5,666,665 35,570,411 557,007 532,220 450,000 (8,147,464) 34,628,839

=========== ========== ======== ======= ======= =========== ===========

LONGBOAT ENERGY PLC

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR THE SIX MONTH PERIODED 30 JUNE 2022

30 30 31 December

June June 2021

2022 2021

unaudited unaudited audited

Notes GBP GBP GBP

Cash flows from operating

activities

Cash absorbed by operations 19 (3,412,843) (919,329) (4,197,318)

Tax refunded - 705,850 1,429,635

Net cash (outflow) from operating

activities (3,412,843) (213,479) (2,767,683)

------------- ----------- -------------

Investing activities

Purchase of property, plant

and equipment (55,547) (17,331) (25,769)

Tax refund relating to investing

activity 10,552,543 - 17,173,053

Purchase of exploration and

evaluation assets (26,330,050) (477,015) (26,513,457)

Interest received 5 - 3,963 11,412

Net cash used in investing

activities (15,833,054) (490,383) (9,354,761)

------------- ----------- -------------

Financing activities

Issue of ordinary shares - 32,428,415 32,428,416

Loan 15,716,675 - -

Interest paid (180,898) - (484,527)

Loan facility fees (224,980) - (604,085)

Net cash generated from financing

activities 15,310,797 32,428,415 31,339,804

------------- ----------- -------------

Net (decrease)/increase in cash

and cash equivalents (3,935,100) 31,724,553 19,217,360

------------- ----------- -------------

Cash and cash equivalents

at beginning of period 26,282,067 7,016,199 7,016,199

Effect of foreign exchange

rates 145,755 (11,733) 48,508

Cash and cash equivalents at end

of period 22,492,722 38,729,019 26,282,067

------------- ----------- -------------

Relating to:

Bank balances and short term

deposits 22,492,722 38,729,643 26,282,067

Bank overdrafts and credit - (624) -

cards

LONGBOAT ENERGY PLC

NOTES TO THE FINANCIAL STATEMENTS

FOR THE SIX MONTH PERIODED 30 JUNE 2022

1 Accounting policies

Company information

Longboat Energy plc is a public company limited by shares incorporated

in England and Wales. The registered office is 5th Floor One

New Change, London, EC4M 9AF. The Company's principal activities

and nature of its operations are disclosed in the directors'

report.

1.1 Accounting convention

The consolidated interim financial statements have been prepared

in accordance with International Financial Reporting Standards

(IFRS) as adopted for use in the United Kingdom.

The same accounting policies, presentation and methods of computation

are followed in the interim consolidated financial information

as were applied in the Group's latest annual audited financial

statements except for those that relate to new standards and

interpretations effective for the first time for periods beginning

on (or after) 1 January 2021 and will be adopted in the 2022

annual financial statements.

This interim financial information does not constitute statutory

accounts within the meaning of section 434 and of the Companies

Act 2006. The information for the year ended 31 December 2021

included in this report was derived from the statutory accounts

for that year, which were prepared in accordance with International

Financial Reporting Standards ('IFRSs') as adopted for use in

the United Kingdom, a copy of which has been delivered to the

Registrar of Companies. The report of the auditors on those accounts

was unqualified and did not contain a statement under 498(2)

498(3) of the Companies Act 2006. The ISRE 2410 review conclusion

on the consolidated interim financial statements as of and for

the six-month period ended 30 June 2021 included a material uncertainty

in respect of going concern paragraph.

The financial statements are prepared in sterling, which is the

functional currency of the company. Monetary amounts in these

financial statements are rounded to the nearest GBP.

The financial statements have been prepared under the historical

cost convention.

The Group interim financial statements consolidate the financial

statements of the parent company and its subsidiary undertakings

drawn up to 30 June 2022.

1 Accounting policies

1.2 Going concern

The Directors have completed the going concern assessment, including

a review of cash flow forecasts to December 2023, to assess whether

the Group is a going concern. Following the announcement of a

discovery at Oswig, the Oswig partnership has agreed to expand

the scope of appraisal work which will now include a side track

and drill stem test. This expanded work programme will require

additional funding under the base case towards the end of the

forecast period. Whilst the directors are confident that such

funding will be available if required there can be no guarantee

that this will be the case. These circumstances represent a material

uncertainty that may cast significant doubt on the Company's

ability to continue as a going concern. The financial statements

do not include any adjustments that would result from the going

concern basis of preparation being inappropriate.

2 Adoption of new and revised standards and changes in accounting

policies

The accounting policies adopted in the preparation of the consolidated

financial statements are consistent with those followed in the

preparation of the Group's annual consolidated financial statements

for the year ended 31 December 2021, except for the adoption of

new standards effective as of 1 January 2022. The Group has not

early adopted any standard, interpretation or amendment that has

been issued but is not yet effective.

Several amendments and interpretations apply for the first time

in 2022, but do not have an impact on the interim financial statements

of the Group.

3 Critical accounting estimates and judgements

In the application of the Group's accounting policies, the directors

are required to make judgements, estimates and assumptions about

the carrying amount of assets and liabilities that are not readily

apparent from other sources. The estimates and associated assumptions

are based on historical experience and other factors that are

considered to be relevant. Actual results may differ from these

estimates.

The estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimate is revised, if the revision affects

only that period, or in the period of the revision and future

periods if the revision affects both current and future periods.

Exploration and evaluation assets

Judgement is required to determine whether impairment indicators

exist in respect of the Group's exploration assets recognised

in the statement of financial position. The Group has to take

into consideration whether the assets have suffered any impairment,

taking into consideration the results of the drilling to date,

and the likelihood of reserves being found. The Group relies

upon information from third parties to take these decisions,

and can be subject to change if future information becomes available.

Share based payments

Estimation was required in determining inputs to the share-based

payment calculations including share price volatility as detailed

in the annual accounts for the year to 31 December 2021.

Under the Founder Incentive Plan, judgment was required in determining

the point at which the Company and recipients had a shared mutual

understanding of the terms of the awards. Whilst the awards were

legally granted in July 2020, the Board consider that the IPO

Admission Document provided such a shared mutual understanding

given the detailed disclosure of the terms of the scheme.

Under the Long-Term Incentive Plan, judgement was required in

determining the fair value of the shares awarded. The Board has

taken advice from external parties and has determined the fair

value per share.

4 Employees

The average monthly number of persons (including directors) employed

by the Group during the period was:

Six month Six month

period ended period ended Year ended

30 June 30 June 31 Dec

2022 2021 2021

Number Number Number

Executive Directors 5 2 3

Non-Executive Directors 4 4 4

Staff 10 2 4

Total 19 8 11

Their aggregate remuneration comprised:

Six month Six month

period ended period ended Year ended

30 June 30 June 31 Dec

2022 2021 2021

GBP GBP GBP

Wages and salaries 1,181,256 391,440 1,703,062

Share based payment 178,678 46,824 255,737

Social security costs 233,973 51,753 245,771

Pension costs 137,454 25,510 133,047

Foreign currency gains - - (33,844)

1,731,361 515,527 2,303,773

5 Investment Income

Six month Six month

period ended period ended Year ended

30 June 30 June to 31 Dec

2022 2021 2021

GBP GBP GBP

Interest income

Bank deposits - 3,963 11,412

Total interest income for financial assets that are not held at

fair value through profit or loss is GBPNil (2021: GBP3,963).

6 Operating Loss

Six month Six month

period ended period ended Year ended

30 June 30 June 31 Dec

2022 2021 2021

GBP GBP GBP

Operating loss for the period is stated

after charging/(crediting):

Exchange losses (355,013) 47,249 151,369

Fees payable to the company's auditor

for the audit of the company's financial

statements - - 36,190

Depreciation of property, plant and

equipment 67,400 3,483 30,057

Share-based payments 178,670 46,824 255,787

7 Auditor's remuneration

Six month Six month

period ended period ended Year ended

30 June 30 June 31 Dec

2022 2021 2021

Fees payable to the company's auditor GBP GBP GBP

and associates:

For audit services

Audit of the financial statements

of the company - - 32,000

Audit of the financial statements

of the company's subsidiaries - - 4,190

- - 36,190

For non-audit services

Interim review 23,000 16,000 16,000

Other services - 110,000 110,000

Total non-audit fees 23,000 126,000 126,000

During the period the auditor provided non-audit services of GBP23,000

for their role in review of the interim accounts. There were GBP126,000

non-audit services provided in the six months to 30 June 2021 and

in the year to 31 December 2021, they provided additional services

for the audit of the interim financial statements and performed

work in relation to the readmission to AIM.

8 Income tax credit

Six month Six month

period ended period ended Year ended

30 June 30 June 31 Dec

2022 2021 2021

GBP GBP GBP

Current tax

UK corporation tax on profits for

the current period - - -

Foreign taxes and reliefs (23,788,541) (1,017,401) (25,971,588)

------------- ------------- ------------

(23,788,541) (1,017,401) (25,971,588)

============= ============= ============

Deferred tax

Origination and reversal of temporary

differences 22,936,560 372,284 19,059,826

========== ========= ===========

Total tax (credit) (851,981) (645,117) (6,911,762)

========== ========= ===========

No deferred tax asset has been recognised in the UK because there

is uncertainty of the timing of suitable future profits against

which they can be recovered. The Company has losses carried forward

of GBP2,028,262 (June 2021: GBP2,003,236). A deferred tax liability

has been recognised relating to Norway, further details of which

can be found in Note 17.

Longboat Energy Norge AS received a tax refund under the temporary

tax measures introduced in Norway for the tax year 2020 & 2021.

9 Inventories

30 June 30 June 31 Dec

2022 2021 2021

GBP GBP GBP

Materials and supplies 104,502 - 92,798

---------- ---------- ------

Closing inventories are equal to their net realisable

value

10 Loss per share 30 June 30 June 31 Dec

2022 2021 2021

GBP GBP GBP

Weighted average number of ordinary

shares for basic loss per share 56,666,666 11,229,050 36,082,191

Losses

Continuing operations

Loss for the period from continued

operations (1,644,364) (864,878) (4,680,620)

------------- ----------- -------------

Loss for basic and diluted loss

per share being net losses attributable

to equity shareholders of the company

for continued operations (1,644,364) (864,878) (4,680,620)

============= =========== =============

Basic and diluted loss per share

(pence per share) (2.90) (7.70) (12.97)

============= =========== =============

Basic earnings per share is calculated by dividing the earnings attributable

to ordinary shareholders by the weighted average number of shares

outstanding during the period.

Diluted earnings per share is calculated using the weighted average

number of shares adjusted to assume to conversion of all dilutive

potential ordinary shares. 2,281,661 (2021: 2,281,661) of share options

are not included because they are anti-dilutive, due to the loss.

11 Non-current assets

Exploration Computers

and Right Fixtures

evaluation of Use and

assets Asset Fittings

GBP GBP GBP GBP

Cost

At 1 January 2021 - - - 14,605

Additions - - - 17,331

------------ -------- ----------- ---------

At 30 June 2021 - - - 31,936

Additions 29,716,850 580,044 3,340 20,538

Disposals - - - (15,322)

Foreign currency adjustments - - - (119)

At 31 December 2021 29,716,850 580,044 3,340 37,033

Additions 30,893,760 - 41,979 13,234

Foreign currency adjustments - (4,499) -

------------ -------- ----------- ---------

At 30 June 2022 60,610,610 575,545 45,319 50,267

Accumulated depreciation and

impairment

At 1 January 2021 - - - 2,807

Charge for the Six Month Period - - - 3,483

Foreign currency adjustments - - - (39)

------------ -------- ----------- ---------

At 30 June 2021 - - 6,251

Charge for the Six Month Period - 20,015 167 6,392

Foreign currency adjustments (671,038) (680) - 13

Exploration write off 6,399,134 - - (2,050)

At 31 December 2021 5,728,096 19,335 167 10,606

Exploration write off reversal (309,337) - - -

Charge for the Six Month Period 57,404 2,705 7,291

At 30 June 2022 5,418,759 76,739 2,872 17,897

Carrying amount

At 30 June 2022 55,191,851 498,806 42,447 32,370

============ ======== =========== =========

At 30 June 2021 - - - 25,685

============ ======== =========== =========

At 31 December 2021 23,988,754 560,709 3,173 26,427

============ ======== =========== =========

The exploration write off in the first half of 2021 relates to

the Mugnetind licence. The exploration refund in the Consolidated

statement of comprehensive income in 2022 relates to the

reimbursements of previously billed costs from the Operator,

effectively reducing the overall write off on Mugnetind.

12 Trade and other receivables

30 June 30 June 31 Dec

2022 2021 2021

GBP GBP GBP

Trade receivables 177,245 - 22,662

VAT recoverable 184,855 144,305 81,737

Prepayments and other receivables 629,074 1,224,235 1,031,682

991,174 1,368,540 1,136,081

======= ========= =========

13 Lease liabilities

The Group has lease contracts for buildings used in its operations.

The Group's obligations under its leases are secured by the lessor's

title to the leased assets.

Set out below are the carrying amounts of right of use assets recognised

and the movements during the period:

30 June 30 June 31 Dec

2022 2021 2021

GBP GBP GBP

Opening balance 582,802 - -

Additions - - 585,706

Repayments (43,694) -

Interest 8,131 - 2,758

Foreign exchange (5,198) - (5,662)

Closing balance 542,041 - 582,802

-

Within 1 year 119,219 - 96,172

In two to five years 422,822 - 486,630

-------- ------- --------

542,041 - 582,802

======== ======= ========

Maturity analysis -

Within one year 115,109 - 111,799

In two to five years 383,697 - 514,273

-

Total undiscounted liabilities 498,806 - 626,072

Future finance charges and other adjustments 43,235 - (43,270)

-------- ------- --------

Lease liabilities in the financial

statements 542,041 - 582,802

======== ======= ========

14 Current and non-current tax receivable

30 June 30 June 31 Dec

2022 2021 2021

GBP GBP GBP

Current tax receivable - 1,089,367 8,149,906

Non-current tax receivable 20,960,554 - -

---------- --------- ---------

20,960,554 1,089,367 8,149,906

========== ========= =========

15 Share Capital

GBP

Balance at 1 January 2021 1,000,000

Additions 4,666,665

-----------

Balance at 30 June and 31 December 2021 5,666,665

-----------

Balance at 30 June 2022 5,666,665

===========

16 Trade and other payables

30 June 30 June 31 Dec

2022 2021 2021

GBP GBP GBP

Trade payables 3,568,526 823,780 580,084

Accruals 4,757,033 830,971 2,753,202

Social security and other taxation 336,911 48,946 239,922

Other payables 5,776 3,707 1,198,959

---------- ---------- -------------

8,668,246 1,707,404 4,772,167

========== ========== =============

17 Deferred taxation

The following are the major deferred tax liabilities and assets

recognised by the company and movements thereon during the current

and prior reporting period.

ACAs Total

GBP GBP

Deferred tax balance at 1 January 2021 431 431

Deferred tax movements in prior year

Differences in tax basis for depreciation in

Norway 372,278 372,278

---------- ----------

Deferred tax liability at 30 June 2021 372,709 372,709

========== ==========

Deferred tax movements

Foreign exchange (293,832) (293,832)

Differences in tax basis for depreciation in

Norway 18,687,547 18,687,547

Deferred tax liability at 31 December 2021 18,766,424 18,766,424

========== ==========

Deferred tax movements

Differences in tax basis for depreciation in

Norway 22,380,267 22,380,267

Deferred tax liability at 30 June 2022 41,146,691 41,146,691

========== ==========

Deferred tax assets and liabilities are offset in the financial

statements only where the company has a legally enforceable right

to do so. In Norway, deferred tax assets and liabilities occur

mainly because of prepayment of Exploration spend. Exploration

spend is fully tax refundable when incurred.

18 Related party transactions

Remuneration of key management personnel

Members of the Board of Directors are deemed to be key management

personnel. Key management personnel compensation for the financial

period is the same as the Director remuneration which is disclosed

in the Annual Report and accounts.

Other information

Directors' and PDMR interests in the shares of the Company in

the period, including family interests, were as follows:

Ordinary shares

Helge Hammer 837,023

Jonathan Cooper 333,432

Graham Stewart 350,000

Jorunn Saetre 51,667

Nick Ingrassia 179,023

Julian Riddick (PDMR) 272,648

Hilde Sathe 11,805

In addition, the following conditional awards have been made

to the Executive Directors and Company Secretary under the prior

period FIP which are expressed as a percentage of the total maximum

potential award, being 10% of the Company's issued share capital:

Founder Percentage Maximum percentage

entitlement entitlement of Maximum percentage

of Initial growth in value of issued share

Award pool from IPO capital

% % %

Helge Hammer 23.50% 3.53% 2.35%

Graham Stewart 19.75% 2.96% 1.98%

Jonathan Cooper 19.13% 2.87% 1.91%

Julian Riddick 18.50% 2.78% 1.85%

The Group does not have one controlling party.

19 Cash used by operations

30 June 30 June 31 Dec

2022 2021 2021

GBP GBP GBP

Loss for the six month period

after tax (1,644,363) (864,878) (4,680,620)

Adjustments for:

Net taxation (credited) (851,980) (645,117) (6,911,763)

Exploration write offs (309,338) - 6,399,134

Release of prepaid bank fees - - 103,517

Investment income - (3,963) -

Interest payable 180,898 - 484,527

Interest receivable - - (11,412)

Non-utilisation fees 224,980 - -

Time writing adjustments - - (448,071)

Depreciation of property, plant

& equipment 68,523 3,483 27,982

Equity settled share-based payment

expense 178,678 46,824 255,736

Movements in working capital:

Increase in inventories (11,704) - (92,798)

(Increase)/decrease in trade

and other receivables (221,922) (815,712) 104,906

(Decrease)/increase in trade

and other payables (1,026,618) 1,360,034 571,544

Cash (absorbed by) operations (3,412,846) (919,329) (4,197,318)

20 Events after the reporting date

On 15 September 2022, the Company announced that the Copernicus

well was dry.

On 23 September 2022, the Company announced that a side track

and drill stem test would be performed on the Oswig well.

21 Other information

A copy of this interim report and financial statements is available

on the Company's website www.longboatenergy.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFEIAIIEFIF

(END) Dow Jones Newswires

September 26, 2022 02:01 ET (06:01 GMT)

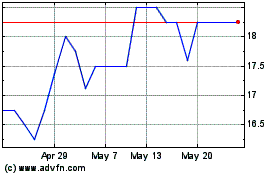

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024