TIDMICGT

ICG Enterprise Trust plc

2 February 2023

Q3 Update for the three months ended 31 October 2022

NAV per Share Total Return +3.6% in the third quarter; +19.9%

LTM

Highlights

-- NAV per Share of 1,918p (31 July 2022: 1,852p); NAV

per Share Total Return of 3.6% for the quarter and

19.9% for the last twelve months ('LTM')

-- Portfolio Return on a Local Currency Basis of 0.2%

for the quarter and 13.8% on an LTM basis

-- New Investments of GBP59.9m, including 3 Direct

Investments

-- Realisation Proceeds of GBP62.6m during the quarter,

including 11 Full Exits executed at a 33.0% weighted

average Uplift to Carrying Value

-- Third quarter dividend of 7p per share, taking total

dividends for the period to 21p (Q3 FY22: 18p);

reiterated intention to declare total dividend for

FY23 of at least 30p per share

-- Long-term share buyback programme initiated in

October, with GBP0.3m being invested in share

buybacks during the quarter and total repurchases

under the program of GBP2.1m up to and including 31

January 2023

-- Revised management fee agreement and cost-sharing,

effective from 1 February 2023

Oliver Gardey

Head of Private Equity Fund Investments, ICG

ICG Enterprise Trust extended its track record of

delivering resilient growth during the period, generating

NAV per Share Total Return of 3.6% in the third quarter,

bringing our five-year annualised NAV per Share Total

Return to 17.6%.

Our Portfolio generated local currency returns of

0.2% in the third quarter, and 13.8% on an LTM basis.

Importantly, we continued to realise assets at a premium,

with 11 full exits completed during the third quarter

at an average Uplift to Carrying Value of 33%. We

believe these uplifts underline the quality and value

of our Portfolio. We are also encouraged to see this

momentum continuing post-period end.

ICG and our third-party managers have continued to

source attractive opportunities, whilst our strong

capitalisation is enabling us to invest for the future.

Our investment strategy, centred on 'defensive growth',

is underpinned by a disciplined approach to capital

allocation, seeking to enable ICG Enterprise Trust

shareholders to benefit from both income and capital

appreciation over the long term.

PERFORMANCE OVERVIEW

Annualised

------------ -------- -------- --------- ---------------------------------

Performance

to 31

October

2022 3 months 9 months 1 year 3 years 5 years 10 years

------------ -------- -------- --------- --------- --------- ---------

Portfolio

Return on a

Local

Currency

Basis 0.2% 7.9% 13.8% 22.2% 20.2% 14.4%

NAV per

Share Total

Return 3.6% 14.8% 19.9% 21.0% 17.6% 14.6%

Share Price

Total

Return (13.9)% (15.2)% (18.1)% 4.9% 6.3% 11.7%

FTSE

All-Share

Index Total

Return (4.6)% (4.7)% (2.8)% 2.3% 2.4% 6.2%

Three months to: Nine months to: 12 months to:

------------ ------------------ -------------------- ----------------------

Portfolio 31 Oct. 31 Oct. 31 Oct. 31 Oct. 31 Oct. 31 Oct.

activity 2022 2021 2022 2021 2022 2021

------------ -------- -------- --------- --------- --------- -----------

Realisation GBP62.6m GBP90.0m GBP169.4m GBP265.3m GBP237.7m GBP308.3m

Proceeds

Total New GBP59.9m GBP75.2m GBP203.6m GBP208.5m GBP298.8m GBP265.7m

Investments

ENQUIRIES

Investors and analysts:

Oliver Gardey, Head of Private Equity Fund Investments, ICG: +44

(0) 20 3545 2000

Colm Walsh, Managing Director, Private Equity Fund Investments,

ICG

Chris Hunt, Shareholder Relations, ICG

Livia Bridgman Baker, Shareholder Relations, ICG

Media:

Clare Glynn, Corporate Communications, ICG: +44 (0) 20 3545

1395

Website:

www.icg-enterprise.co.uk

EVENTS

A presentation for investors and analysts will be held at 10:30

GMT today. A link for the presentation can be found on the Results

& Reports page

https://www.globenewswire.com/Tracker?data=SrDC1aQFAwpRjopRmpj6LZ-GDy4HafQ9dv8k3ehY_N5zMmeGiUxCObTolOFerCck99PFdUPmOwEVC5REFxPvFNx0XgDojylNnc6HkRiTQ-KPjkw1UCbXVwrCkXAI1GRCjALLhzm8Xy4s3SL26-nZ6Ev3uZNgYIjb7dDfHIkjVy8=

of the Company website. A recording of the presentation will be

made available on the Company website after the event.

Company timetable

Ex-dividend date: 16 February 2023

Record date: 17 February 2023

Payment of dividend: 3 March 2023

ABOUT ICG ENTERPRISE TRUST

ICG Enterprise Trust is a leading listed private equity investor

focused on creating long-term growth by delivering consistently

strong returns through selectively investing in profitable,

cash-generative private companies, primarily in Europe and the US,

while offering the added benefit to shareholders of daily

liquidity.

We invest in companies directly as well as through funds managed

by ICG and other leading private equity managers who focus on

creating long-term value and building sustainable growth through

active management and strategic change.

We have a long track record of delivering strong returns through

a flexible mandate and highly selective approach that strikes the

right balance between concentration and diversification, risk and

reward.

NOTES

Included in this document are Alternative Performance Measures

("APMs"). APMs have been used if considered by the Board and the

Manager to be the most relevant basis for shareholders in assessing

the overall performance of the Company, and for comparing the

performance of the Company to its peers and its previously reported

results. The Glossary in the Company's H1 results includes further

details of APMs and reconciliations to International Financial

Reporting Standards ("IFRS") measures, where appropriate.

In the Business Review and Supplementary Information, all

performance figures are stated on a Total Return basis (i.e.,

including the effect of re-invested dividends). ICG Alternative

Investment Limited, a regulated subsidiary of Intermediate Capital

Group plc, acts as the Manager of the Company.

DISCLAIMER

This report may contain forward looking statements. These

statements have been made by the directors in good faith based on

the information available to them up to the time of their approval

of this report and should be treated with caution due to the

inherent uncertainties, including both economic and business risk

factors, underlying such forward-looking information. These written

materials are not an offer of securities for sale in the United

States. Securities may not be offered or sold in the United States

absent registration under the US Securities Act of 1933, as

amended, or an exemption therefrom. The issuer has not and does not

intend to register any securities under the US Securities Act of

1933, as amended, and does not intend to offer any securities to

the public in the United States. No money, securities or other

consideration from any person inside the United States is being

solicited and, if sent in response to the information contained in

these written materials, will not be accepted.

BUSINESS REVIEW

Portfolio composition

We take an active approach to portfolio construction, with a

flexible mandate that enables us to deploy capital into primary,

secondary and direct investment opportunities. Our portfolio

composition as at 31 October 2022 is shown below:

31 October 2022 31 October 2022

Investment category GBPm % of Portfolio

-------------------- --------------- ---------------

Primary 749.7 53.3%

-------------------- --------------- ---------------

Secondary 266.6 18.9%

-------------------- --------------- ---------------

Direct 391.6 27.8%

-------------------- --------------- ---------------

Total 1,407.9 100.0%

-------------------- --------------- ---------------

We invest in funds managed by ICG and other leading private

equity managers who focus on creating long-term value and building

sustainable growth through active management and strategic change.

Investments managed by ICG account for 30.3% of the Portfolio as at

31 October 2022.

Our primary investments provide a diversified base to our

Portfolio, and through our direct and secondary investments we seek

to proactively increase our exposure to companies that particularly

align to our investment strategy.

31 October 2022 31 October 2022

Investment category GBPm % of Portfolio

------------------------------------------------------- --------------- ---------------

ICG managed investments(1) 426.5 30.3%

Third party Direct Investments 238.4 16.9%

Third party Secondary Investments 66.5 4.7%

------------------------------------------------------- --------------- ---------------

High Conviction Investments 731.4 51.9%

------------------------------------------------------- --------------- ---------------

Third Party Funds 676.5 48.1%

------------------------------------------------------- --------------- ---------------

Total 1,407.9 100.0%

------------------------------------------------------- --------------- ---------------

(1) ICG managed investments include Primary, Secondary

and Direct Investments

Geographically we focus on the developed markets of North

America and Europe, including the UK, which have deep and mature

private equity markets supported by a robust corporate governance

framework. The geographic profile of the Portfolio is shown

below:

31 October 2022 31 October 2022

Geography(1) GBPm % of Portfolio

----------------- ------------------ -----------------

North America 640.6 45.5%

----------------- ------------------ -----------------

Europe 430.8 30.6%

----------------- ------------------ -----------------

UK 242.2 17.2%

----------------- ------------------ -----------------

Other 94.3 6.7%

----------------- ------------------ -----------------

Total 1,407.9 100%

----------------- ------------------ -----------------

(1) Calculated by reference to the location of the

headquarters of the underlying Portfolio companies

on a value-weighted basis

Portfolio performance

-- Portfolio valued at GBP1,407.9m on 31 October 2022, with 87.2% of the

Portfolio having a Valuation Date of 30 September 2022 or later (October

2021: 88.9%)

-- The Portfolio Return on a Local Currency Basis of 0.2% during the quarter

represents modest declines within our Primary funds of (0.5)%; an

increase of 0.3% within Secondaries; and an increase of 1.7% within

Direct investments

-- Due to the geographic diversification of our Portfolio, the reported

value is impacted by changes in foreign exchange rates. During the third

quarter, the Portfolio increased by GBP53.6m (4.0%) due to FX movements,

driven primarily by US Dollar strengthening against Sterling. The

Portfolio return on a reported currency basis was therefore 4.2% during

the period

Movement in the Portfolio Three months to

GBPm 31 October 2022

--------------------------------------------------- ----------------

Opening Portfolio 1,353.7

----------------

Total New Investments 59.9

Total Proceeds (62.6)

----------------

Net (proceeds)/investments (2.7)

Valuation movement 3.3

Currency movement 53.6

--------------------------------------------------- ----------------

Closing Portfolio 1,407.9

--------------------------------------------------- ----------------

% Portfolio growth (local currency) 0.2%

% currency movement 4.0%

--------------------------------------------------- ----------------

% Portfolio growth (Sterling) 4.2%

Impact of (net cash)/net debt 0.3%

Expenses and other income (0.5)%

Co-investment Incentive Scheme Accrual (0.4)%

Impact of share buybacks and dividend reinvestment -

--------------------------------------------------- ----------------

NAV per Share Total Return 3.6%

--------------------------------------------------- ----------------

Realisation activity

-- Total Realisation proceeds of GBP62.6m during the third quarter

-- 11 Full Exits completed in the quarter, at a weighted average Uplift to

Carrying Value of 33.0% and 1.8x Multiple to Cost

Investment activity

-- Total New Investment of GBP59.9m in the third quarter. New investment by

category was as follows:

GBPm % of total

---------- ---- ----------

Primary 33.9 56.6%

---------- ---- ----------

Secondary - -

---------- ---- ----------

Direct 26.0 43.4%

---------- ---- ----------

Total 59.9 100.0%

---------- ---- ----------

-- Total New Investment in the third quarter included three new direct

investments for a combined total of GBP25.9m, as outlined below:

Company Manager Company sector Description Investment value

--------------- -------- ---------------- --------------- ----------------

ECA Group ICG Industrials Provider of GBP13.0m

autonomous

systems and

navigation

solutions

--------------- -------- ---------------- --------------- ----------------

KronosNet ICG Business Provider of GBP8.8m

Services business

process

outsourcing

services

--------------- -------- ---------------- --------------- ----------------

Vistage Gridiron Business Provider of GBP4.1m

Worldwide Services executive

advisory

services

--------------- -------- ---------------- --------------- ----------------

New Commitments

-- We made one new fund Commitment of GBP17.2m during the third quarter:

Fund Manager Focus Commitment

value

------------------- ------------- ------------- -----------------

Leonard Green IX(1) Leonard Green Large buyouts $20.0m (GBP17.2m)

------------------- ------------- ------------- -----------------

(1) Represents a new manager relationship during the

period

Quoted Companies

-- We do not actively invest in publicly quoted companies but gain listed

investment exposure when IPOs are used as a route to exit an investment.

In these cases, exit timing typically lies with the third party manager

alongside whom we are invested

-- At 31 October 2022, quoted companies representing 8.0% of the Portfolio

were valued by reference to the latest market price (31 July 2022; 8.8%)

-- Only one quoted investment individually accounted for 0.5% or more of the

Portfolio value:

Company Ticker % of Portfolio value

----- ----------------------------------- ------- --------------------

1 Chewy (part of PetSmart holding)(1) CHWY-US 3.5%

----- ----------------------------------- ------- --------------------

Other 4.5%

----- ----------------------------------- ------- --------------------

Total 8.0%

----- ----------------------------------- ------- --------------------

(1) % value of Portfolio includes entire holding of

PetSmart and Chewy. Majority of value is within Chewy

Balance sheet and financing

-- Total available liquidity of GBP174.2m, comprising GBP22.7m cash and

GBP151.5m undrawn bank facility

GBPm

-------------------------------------------------- ------

Cash at 31 July 2022 12.7

Realisation Proceeds 62.6

New investments (59.9)

Shareholder returns (0.3)

FX and other(1) 7.6

-------------------------------------------------- ------

Cash at 31 October 2022 22.7

-------------------------------------------------- ------

Available undrawn debt facilities 151.5

-------------------------------------------------- ------

Cash and undrawn debt facilities (total available

liquidity) 174.2

-------------------------------------------------- ------

(1) FX and other includes a GBP13.1m drawing from

existing debt facilities, partially offset by FX and

other expenses paid out

-- At 31 October 2022 the Portfolio represented 107.2% of net assets and the

Company had net debt of GBP32.7m

GBPm % of net assets

----------------------------------------- ------- ---------------

Total Portfolio 1,407.9 107.2%

Cash 22.7 1.7%

Drawn debt (55.4) (4.2)%

Co-investment Incentive Scheme Accrual (59.8) (4.6)%

Other net current liabilities (2.0) (0.1)%

----------------------------------------- ------- ---------------

Net assets 1,313.4 100.0%

----------------------------------------- ------- ---------------

-- Undrawn commitments of GBP528.5m, of which 18.8% (GBP99.1m) were to funds

outside of their investment period

Dividend and share buyback

-- Progressive dividend policy maintained: third quarter dividend of 7p per

share, bringing total dividends for the financial year-to-date to 21p

-- In the absence of any unforeseen circumstances, it is the Board's current

intention to declare total dividends of at least 30p per share for the

financial year ended 31 January 2023. This would represent an increase of

3p (11.1%) per share compared to the financial year ended 31 January 2022

-- Long-term share buyback program initiated in October 2022, with 30,000

shares repurchased during the third quarter for a total consideration of

GBP0.3m at an estimated weighted-average discount of 45.9% to last

reported NAV per Share

-- In aggregate, GBP2.1m invested in share buybacks since the program was

initiated, up to and including 31 January 2023, with a total of 191,480

shares having been repurchased at an estimated weighted-average discount

of 40.0% to the last reported NAV per Share

Changes to management fees and costs

-- The ICG Enterprise Trust Board and the Manager have agreed a revised

management fee rate, effective from 1 February 2023

-- While the management fee arrangement will remain unchanged, a tiered cap

as a proportion of NAV has been introduced at the following thresholds:

ICG Enterprise Trust NAV Management Fee Cap

------------------------- ------------------

< GBP1.5bn 1.25%

------------------------- ------------------

>= GBP1.5bn <= GBP2.0bn 1.10%

------------------------- ------------------

> GBP2.0bn 1.00%

------------------------- ------------------

-- The Board believes that this arrangement fairly compensates the Manager,

and ensures that ICG Enterprise Trust shareholders benefit from the

economies of scale generated from growth in the Company's NAV

-- The management fees for the twelve months to Q3 FY23 were 1.34% of NAV.

As an illustration, had the revised agreement been in place during this

period, management fees would have been capped at 1.25%. This would have

reduced the management fee by approximately 6% (approximately GBP1.1m)

-- The Manager has also agreed to absorb a number of ongoing costs

previously paid for by ICG Enterprise Trust, in particular a material

share of Sales and Marketing costs. The Board estimates that these are

equivalent to approximately 25-30% of the General Expenses (which exclude

management fees and finance costs) that would have been paid by ICG

Enterprise Trust prior to this agreement being reached

Notable activity since the period end(1)

-- One new Primary Commitment of GBP12.5m

-- New investments of GBP44.5m

-- Total Proceeds of GBP46.3m

ICG Private Equity Fund Investments Team

2 February 2023

SUPPLEMENTARY INFORMATION

Top 30 companies

The table below presents the 30 companies in which ICG

Enterprise Trust had the largest investments by value at 31 October

2022.

% of

Year of Portfolio

Company Manager investment Country value

----------------------------------------------------------- ------------ ----------- ------------ ---------

1 PetSmart

Retailer of pet products and services BC Partners 2015 United States 3.5%

2 Endeavor Schools

Provider of paid private schooling Leeds Equity 2018 United States 2.8%

3 Minimax

Supplier of fire protection systems and services ICG 2018 Germany 2.7%

4 Leaf Home Solutions

Provider of home maintenance services Gridiron 2016 United States 1.9%

5 Froneri

Manufacturer and distributor of ice cream products PAI 2013 / 2019 United Kingdom 1.8%

6 Yudo

Designer and manufacturer of hot runner systems ICG 2017 / 2018 South Korea 1.8%

7 DOC Generici

Manufacturer of generic pharmaceutical products ICG 2019 Italy 1.7%

8 Precisely

Provider of enterprise software Clearlake 2021 / 2022 United States 1.4%

9 AML RightSource

Provider of compliance and regulatory services and

solutions Gridiron 2020 United States 1.3%

10 Ambassador Theatre Group

ICG /

Operator of theatres and ticketing platforms Providence 2021 United Kingdom 1.3%

11 Curium Pharma

Supplier of nuclear medicine diagnostic pharmaceuticals ICG 2020 United Kingdom 1.2%

12 DigiCert

Provider of enterprise internet security solutions ICG 2021 United States 1.2%

13 IRI/NPD

Provider of mission-critical data and predictive analytics

to consumer goods manufacturers New Mountain 2022 United States 1.2%

14 DomusVi

Operator of retirement homes ICG 2017 / 2021 France 1.2%

15 David Lloyd Leisure

Operator of premium health clubs TDR 2013 / 2020 United Kingdom 1.2%

16 European Camping Group

Operator of premium campsites and holiday parks PAI 2021 France 1.1%

17 Newton

Provider of management consulting services ICG 2021 / 2022 United Kingdom 1.1%

18 Ivanti

Charlesbank

Provider of IT management solutions / ICG 2021 United States 1.1%

19 Visma

Provider of business management software and outsourcing Hg Capital /

services ICG 2017 / 2020 Norway 1.0%

20 PSB Academy

Provider of private tertiary education ICG 2018 Singapore 1.0%

21 Crucial Learning

Provider of corporate training courses focused on

communication skills and leadership development Leeds Equity 2019 United States 1.0%

22 Planet Payment

Provider of integrated payments services focused on Advent /

hospitality and luxury retail Eurazeo 2021 Ireland 0.9%

23 Brooks Automation

Thomas H.

Provider of semiconductor manufacturing solutions Lee 2021 / 2022 United States 0.9%

24 ECA Group

Provider of autonomous systems for the aerospace and

maritime sectors ICG 2022 France 0.9%

25 Class Valuation

Provider of residential mortgage appraisal management

services Gridiron 2021 United States 0.8%

26 Davies Group

Provider of specialty business process outsourcing

services BC Partners 2021 United Kingdom 0.8%

27 RegEd

Provider of SaaS-based governance, risk and compliance

enterprise software solutions Gryphon 2018 / 2019 United States 0.7%

28 MoMo Online Mobile Services

Operator of remittance and payment services via

mobile e-wallet ICG 2019 Vietnam 0.6%

29 AMEOS Group

Operator of private hospitals ICG 2021 Switzerland 0.6%

30 KronosNet

Provider of tech-enabled customer engagement and business

solutions ICG 2022 Spain 0.6%

Total of the 30 largest underlying investments 39.3%

---------------------------------------------------------------------------------------------------- ---------

Portfolio at 31 October 2022

All data is presented on a look-through basis to the investment

portfolio held by the Company, consistent with the commentary in

previous annual and interim reports

Portfolio by calendar year of

investment % of value of underlying investments

-------------------------------------- ------------------------------------

2022 17.4%

2021 25.3%

2020 10.2%

2019 13.7%

2018 12.4%

2017 6.5%

2016 4.4%

2015 4.3%

2014 and older 5.8%

-------------------------------------- ------------------------------------

Total 100.0%

-------------------------------------- ------------------------------------

Portfolio by sector % of value of underlying investments

---------------------------- ------------------------------------

TMT 23.0%

Consumer goods and services 20.1%

Healthcare 14.5%

Business services 11.8%

Industrials 8.8%

Financials 7.3%

Education 6.9%

Leisure 3.8%

Other 3.8%

---------------------------- ------------------------------------

Total 100.0%

---------------------------- ------------------------------------

(1) Unless otherwise stated, values in this section refer to the

period up to 31 December 2022

(END) Dow Jones Newswires

February 02, 2023 02:00 ET (07:00 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

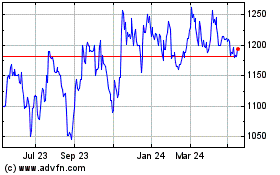

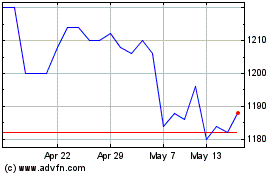

Icg Enterprise (LSE:ICGT)

Historical Stock Chart

From May 2024 to Jun 2024

Icg Enterprise (LSE:ICGT)

Historical Stock Chart

From Jun 2023 to Jun 2024