TIDMICGT

ICG Enterprise Trust plc

Q1 Update for the three months ended 30 April 2022

28 June 2022

NAV per Share Total Return of 4.5% in the first quarter;

27.9% in the last twelve months

Highlights

-- NAV per Share of 1,761p (31 January 2022: 1,690p),

NAV per Share Total Return of 4.5% during the

quarter; 27.9% during the last twelve months

-- Portfolio Return on a Local Currency Basis during the

quarter of 2.0% (Sterling return: 5.2%); 30.2% during

the last twelve months. Portfolio valued at GBP1,244m

on 30 April 2022

-- Disciplined transaction activity: new Investments of

GBP59.1m and Realisation Proceeds of GBP48.8m during

the quarter, including 17 Full Exits executed at an

average of 23% Uplift to Carrying Value and 2.7x

Multiple to Cost

-- First quarter dividend of 7p per share; progressive

dividend policy maintained

-- Revolving Credit Facility increased to EUR240m in May,

and maturity extended to February 2026

-- Board strengthened further by the appointment of two

additional Non-Executive Directors

Oliver Gardey

Head of Private Equity Fund Investments, ICG

The 4.5% growth in ICGT's NAV per Share Total Return

in the first quarter reflects the resilience of our

Portfolio, which grew 2.0% during the quarter on a

local currency basis. Our Portfolio of private companies

continues to generate attractive shareholder returns

and, while realisation proceeds are lower than during

Q1 FY22, the 17 Full Exits from our Portfolio were

executed at attractive uplifts to carrying values.

We are currently in an unusual environment, which

is presenting attractive primary and secondary opportunities.

Furthermore, our Manager's expertise in structured

transactions with downside protection is generating

differentiated investment opportunities for ICG Enterprise

Trust. We were able to capitalise on these factors

during the quarter, making a number of primary commitments

to high-performing managers and sourcing attractive

secondary and direct investment opportunities. Discipline

is crucial, and we remain highly selective in our

investment process.

Looking ahead, we believe ICGT's focus on investing

in companies with defensive growth characteristics

through our actively managed portfolio positions us

well to generate long-term value. We are invested

in high quality companies that we expect to show resilient

operational and financial performance across economic

cycles, and our Portfolio offers diversified exposure

across vintages, sectors and countries.

PERFORMANCE OVERVIEW

Annualised

--------------------------

3 months 1 year 3 years 5 years 10 years

-------------------------------- -------- ------ ------- ------- --------

Performance to 30 April 2022

NAV per Share Total Return 4.5% 27.9% 20.3% 17.4% 13.8%

Share Price Total Return (6.7%) 5.2% 10.9% 11.5% 13.3%

FTSE All-Share Index Total

Return 1.1% 8.7% 4.5% 4.8% 7.2%

Three months to: 12 months to:

-------------------------- --------------------------

30 Apr. 2022 30 Apr. 2021 30 Apr. 2022 30 Apr. 2021

------------------- ------------ ------------ ------------ ------------

Portfolio Return on

a Local Currency

Basis 2.0% 3.4% 30.2% 37.0%

NAV per Share Total

Return 4.5% 1.6% 27.9% 29.8%

Realisation Proceeds GBP49m GBP100m GBP282m GBP208m

Total New Investment GBP59m GBP32m GBP331m GBP139m

ENQUIRIES

Investor / Analyst enquiries:

Oliver Gardey, Head of Private Equity Fund Investment, ICG: +44

(0) 20 3545 2000

Colm Walsh, Managing Director of Private Equity Fund

Investments, ICG

Chris Hunt, Head of Shareholder Relations, ICG

Livia Bridgman Baker, Shareholder Relations, ICG

Media enquiries:

Clare Glynn, Corporate Communications, ICG: +44 (0) 20 3545

1395

Website:

www.icg-enterprise.co.uk

Company timetable

Ex-dividend date: 7 July 2022

Record date: 8 July 2022

Payment of dividend: 22 July 2022

ABOUT ICG ENTERPRISE TRUST

ICG Enterprise Trust is a leading listed private equity investor

focused on creating long-term growth by delivering consistently

strong returns through selectively investing in profitable private

companies, primarily in Europe and the US.

As a listed private equity investor, our purpose is to provide

shareholders with access to the attractive long-term returns

generated by investing in private companies, with the added benefit

of daily liquidity.

We invest in companies directly via co-investments and through

funds managed by ICG and other leading private equity managers who

focus on creating long-term value and building sustainable growth

through active management and strategic change.

We have a long track record of delivering strong returns through

a flexible mandate and highly selective approach that strikes the

right balance between concentration and diversification, risk and

reward.

NOTES

Included in this document are Alternative Performance Measures

("APMs"). APMs have been used if considered by the Board and the

Manager to be the most relevant basis for shareholders in assessing

the overall performance of the Company, and for comparing the

performance of the Company to its peers and its previously reported

results. The Glossary in the Company's H1 results includes further

details of APMs and reconciliations to International Financial

Reporting Standards ("IFRS") measures, where appropriate.

In the Manager's Review and Supplementary Information, all

performance figures are stated on a Total Return basis (i.e.,

including the effect of re-invested dividends). ICG Alternative

Investment Limited, a regulated subsidiary of Intermediate Capital

Group plc, acts as the Manager of the Company.

DISCLAIMER

This report may contain forward looking statements. These

statements have been made by the directors in good faith based on

the information available to them up to the time of their approval

of this report and should be treated with caution due to the

inherent uncertainties, including both economic and business risk

factors, underlying such forward-looking information. These written

materials are not an offer of securities for sale in the United

States. Securities may not be offered or sold in the United States

absent registration under the US Securities Act of 1933, as

amended, or an exemption therefrom. The issuer has not and does not

intend to register any securities under the US Securities Act of

1933, as amended, and does not intend to offer any securities to

the public in the United States. No money, securities or other

consideration from any person inside the United States is being

solicited and, if sent in response to the information contained in

these written materials, will not be accepted.

BUSINESS REVIEW

Portfolio Structure

We invest in businesses directly, through ICG managed funds, and

through third-party private equity managers. We believe that this

combination of investments results in a differentiated and balanced

portfolio construction, striking the right balance between

concentration and diversification, risk and reward.

ICGT's Portfolio composition as at 30 April 2022 is shown

below:

Investment category GBPm % of Portfolio

------------------------------------ ------- ---------------

ICG managed investments 358.7 28.8%

Third party Direct Investments 201.5 16.2%

Third party Secondary Investments 60.0 4.8%

------------------------------------ ------- ---------------

High Conviction Investments 620.2 49.9%

------------------------------------ ------- ---------------

Third Party Funds 623.5 50.1%

------------------------------------ ------- ---------------

Total 1,243.7 100.0%

------------------------------------ ------- ---------------

Portfolio performance

-- Portfolio valued at GBP1,244m on 30 April 2022

-- Portfolio Return on a Local Currency Basis of 2.0% during the quarter

-- High Conviction Investments (49.9% of the Portfolio) generated local

currency returns of 2.1% during the quarter and Third Party Funds (50.1%

of the Portfolio) generated local currency returns of 1.9%

Three months

Movement in the Portfolio to 30 April 2022 GBPm

----------------------------------------------------- ------------

Opening Portfolio 1,172.2

------------

Total New Investments 59.1

Total Proceeds (48.8)

------------

Net (proceeds)/investments 10.3

Valuation movement* 23.1

Currency movement 38.1

----------------------------------------------------- ------------

Closing Portfolio 1,243.7

% Portfolio growth (local currency) 2.0%

----------------------------------------------------- ------------

% currency movement 3.1%

------------

% Portfolio growth (Sterling) 5.2%

Effect of cash drag 0.1%

----------------------------------------------------- ------------

Expenses and other income (0.5)%

----------------------------------------------------- ------------

Co-investment Incentive Scheme Accrual (0.3)%

----------------------------------------------------- ------------

Impact of share buybacks and dividend reinvestment 0.0%

----------------------------------------------------- ------------

NAV per share Total Return 4.5%

----------------------------------------------------- ------------

* 83% of the Portfolio is valued using 30 March 2022 (or later)

valuations (Q1 22: 82%)

New investment

-- GBP59.1m of Total New Investment in the quarter; 52.8% (GBP31.2m)

invested into High Conviction Investments with the remaining 47.2%

(GBP27.9m) being drawdowns on a range of Commitments to Third Party Funds

-- Within our High Conviction Investments, we made a new co-investment of

GBP12.8m alongside our Manager and deployed GBP16.7m in drawdowns to

ICG-managed funds (principally LP Secondaries I and ICG Europe Fund

VIII). The detail of the co-investment made during the period is set out

below:

Company Manager Company sector Description Investment

------- ------- ----------------- ----------------------------- ----------

Newton ICG Business Services Provider of management GBP12.8m

consulting services

------- ------- ----------------- ----------------------------- ----------

-- The balance of GBP1.7m of High Conviction Investments made during the

quarter comprises co-investments alongside third-party managers and

drawdowns on commitments acquired through secondary transactions

New commitments

-- During the period we made a total of GBP119.0m of new fund Commitments,

of which GBP45.5m was to the ICG-managed LP Secondaries Fund I,

supporting our strategic target to increase our exposure to the secondary

market

-- The breakdown of new Commitments was as follows:

Fund Manager Focus ICG Enterprise Trust

Commitment during the

period

--------------------- ---------- -------------------- ---------------------

ICG LP Secondaries ICG Secondary portfolio $60.0m (GBP45.5m)

Fund I of mid-market and

large buyouts

--------------------- ---------- -------------------- ---------------------

PAI Europe VIII PAI Mid-market and large EUR25.0m (GBP20.9m)

buyouts

--------------------- ---------- -------------------- ---------------------

Advent X Advent Large buyouts EUR20.0m (GBP16.8m)

--------------------- ---------- -------------------- ---------------------

Gridiron V Gridiron Mid-market buyouts $20.0m (GBP15.0m)

--------------------- ---------- -------------------- ---------------------

Permira VIII Permira Large buyouts EUR15.0m (GBP12.6m)

--------------------- ---------- -------------------- ---------------------

Hg Genesis X Hg Capital Mid-market buyouts EUR5.0m (GBP4.2m)

--------------------- ---------- -------------------- ---------------------

Hg Saturn III Hg Capital Mid-market and large $5.0m (GBP4.0m)

buyouts

--------------------- ---------- -------------------- ---------------------

Realisation activity

-- Realisation proceeds of GBP48.8m received during the quarter, of which

GBP37.9m was generated from 17 Full Exits executed at an average of 23%

Uplift to Carrying Value and 2.7x Multiple to Cost

Quoted Companies

-- We do not invest directly in publicly quoted companies, but gain listed

investment exposure when IPOs are used to exit an investment. Public

market valuations are typically more volatile than those observed in

private markets

-- At 30 April 2022, quoted companies representing 9.2% of the Portfolio

were valued by reference to the latest market price (31 January 2022;

10.3%)

-- Only one quoted investment individually accounted for 0.5% or more of the

Portfolio value:

Company Ticker % value of Portfolio

----- ----------------------------------- ------- --------------------

1 Chewy (part of PetSmart holding)(1) CHWY-US 3.5%

----- ----------------------------------- ------- --------------------

Other 5.7%

----- ----------------------------------- ------- --------------------

Total 9.2%

----- ----------------------------------- ------- --------------------

(1) % value of Portfolio includes entire holding of

PetSmart and Chewy. Majority of value is within Chewy

Balance sheet and financing

-- Total liquidity of GBP166.4m, comprising GBP15.4m cash and GBP151.0m

undrawn bank facility

GBPm

---------------------------------------------------- ------

Cash at 31 January 2022 41.3

Realisation Proceeds 48.8

Third Party Fund drawdowns (27.9)

High Conviction Investments (31.2)

Shareholder returns (4.1)

FX and other (11.3)

---------------------------------------------------- ------

Cash at 30 April 2022 15.4

---------------------------------------------------- ------

Available undrawn debt facilities 151.0

---------------------------------------------------- ------

Cash and undrawn debt facilities (total available

liquidity) 166.4

---------------------------------------------------- ------

-- Portfolio represented 103.1% of net assets

GBPm % of net assets

-------------------------- ------- ---------------

Total Portfolio 1,243.7 103.1%

Cash 15.4 1.3.%

Net current liabilities (52.6) (4.4%)

-------------------------- ------- ---------------

Net assets 1,206.5 100%

-------------------------- ------- ---------------

-- Undrawn commitments of GBP491.9m, of which 19.1% (GBP93.9m) were to funds

outside of their investment period

DIVID

-- Maintaining a progressive dividend policy

-- First quarter dividend of 7p per share

-- In the absence of any unforeseen circumstances, it is the Board's current

intention to declare total dividends of at least 30p per share for the

financial year ended 31 January 2023. This would represent an increase of

3p (11.1%) per share compared to the financial year ended 31 January 2022

ACTIVITY SINCE THE QUARTER (TO 31 MAY 2022)

-- Total Proceeds of GBP45.0m

-- New investments of GBP4.8m, 14.6% into High Conviction Investments

-- Post period-end, we increased the size of our Revolving Credit Facility

("RCF") to EUR240m (from EUR200m previously), in keeping with the

Company's higher net asset value. In addition, the maturity of the RCF

was also extended by one year to February 2026. The other key terms

remain unchanged. The RCF is available for general corporate purposes,

including short-term financing of investments such as the Drawdown on

Commitments to funds

BOARD CHANGES

-- Adiba Ighodaro and Janine Nicholls have been appointed as Non-Executive

Directors of the Company, and will join the Board on 1 July 2022

-- Sandra Pajarola has retired from the Board, effective 28 June 2022,

having served as a Non-Executive Director of the Company for nine years

ICG Private Equity Fund Investments Team

28 June 2022

SUPPLEMENTARY INFORMATION

Top 30 companies

The table below presents the 30 companies in which ICG

Enterprise Trust had the largest investments by value at 30 April

2022.

Year of Value as a %

Company Manager investment Country of Portfolio

----------------------------------------------------------- ----------- ----------- -------- -------------

1 PetSmart+

United

Retailer of pet products and services BC Partners 2015 States 3.5%

2 Minimax+

Supplier of fire protection systems and services ICG 2018 Germany 2.7%

3 IRI+

Provider of mission-critical data and predictive analytics New United

to consumer goods manufacturers Mountain 2018 States 2.6%

4 Yudo+

Designer and manufacturer of hot runner systems ICG 2017 / 2018 South Korea 2.1%

5 Leaf Home Solutions

United

Provider of home maintenance services Gridiron 2016 States 1.9%

6 DOC Generici+

Manufacturer of generic pharmaceutical products ICG 2019 Italy 1.6%

7 Endeavor Schools+

Leeds United

Provider of private schooling Equity 2018 States 1.6%

8 Froneri+

United

Manufacturer and distributor of ice cream products PAI 2013 / 2019 Kingdom 1.5%

9 Visma+

Provider of business management software and outsourcing Hg Capital

services / ICG 2017 / 2020 Norway 1.3%

10 AML RightSource+

Provider of compliance and regulatory services and United

solutions Gridiron 2020 States 1.2%

11 DomusVI+

Operator of retirement homes ICG 2017 / 2021 France 1.2%

12 David Lloyd Leisure+

United

Operator of premium health clubs TDR 2013 / 2020 Kingdom 1.2%

13 DigiCert+

United

Provider of enterprise internet security solutions ICG 2021 States 1.2%

14 Newton+

United

Provider of management consulting services ICG 2021 / 2022 Kingdom 1.2%

15 Ambassador Theatre Group+

ICG / United

Operator of theatres and ticketing platforms Providence 2021 Kingdom 1.1%

Year of Value as a %

Company Manager investment Country of Portfolio

------------------------------------------------------- ----------------- ----------- ------------ -------------

16 Curium Pharma+

Supplier of nuclear medicine diagnostic pharmaceuticals ICG 2020 United Kingdom 1.1%

17 Ivanti

Provider of IT management solutions Charlesbank / ICG 2021 United States 1.1%

18 PSB Academy+

Provider of private tertiary education ICG 2018 Singapore 1.0%

19 Planet Payment+

Provider of integrated payments services focused on

hospitality and luxury retail Advent / Eurazeo 2021 Ireland 1.0%

20 Class Valuation+

Provider of residential mortgage appraisal management

services Gridiron 2021 United States 0.8%

21 European Camping Group+

Operator of premium campsites and holiday parks PAI 2021 France 0.8%

22 Precisely

Provider of enterprise software ICG 2021 United States 0.8%

23 MoMo Online Mobile Services

Operator of remittance and payment services via mobile

e-wallet ICG 2019 Vietnam 0.7%

24 Brooks Automation+

Provider of semiconductor manufacturing solutions Thomas H. Lee 2021 / 2022 United States 0.7%

25 Davies Group+

Specialty business process outsourcing service provider BC Partners 2021 United Kingdom 0.7%

26 RegEd+

Provider of SaaS-based governance, risk and compliance

enterprise software solutions Gryphon 2018 / 2019 United States 0.7%

27 Crucial Learning+

Provider of corporate training courses focused on

communication skills and leadership development Leeds Equity 2019 United States 0.6%

28 Travel Nurse Across America

Provider of travel nurse staffing services Gridiron 2016 United States 0.6%

29 AMEOS Group+

Operator of private hospitals ICG 2021 Switzerland 0.6%

30 nGAGE

Provider of recruitment services Graphite 2014 United Kingdom 0.5%

------------------------------------------------------- ----------------- ---------------- -------------

Total of the 30 largest underlying investments 38.0%

----------------------------------------------------------------------------------------------------- -------------

+ All or part of this investment is held directly as a

Co-investment or other Direct Investment

30 largest fund investments

The table below presents the 30 largest funds by value at 30

April 2022. The valuations are net of underlying managers' fees and

Carried Interest.

Outstanding

Year of Country/ commitment

Fund commitment region Value GBPm GBPm

--------------- -------------- -------------- ---------- ------------

ICG Ludgate

1 Hill I

Secondary Europe/North

portfolio 2021 America 43.1 13.8

ICG Strategic

Equity Fund

2 III

Secondary fund

restructurings 2018 Global 37.5 11.0

Graphite

Capital

3 Partners VIII

Mid-market

buyouts 2013 UK 36.6 4.4

4 ICG Europe VII

Mezzanine and

equity in

mid-market

buyouts 2018 Europe 34.8 10.1

Gridiron

Capital Fund

5 III

Mid-market

buyouts 2016 North America 31.4 4.3

CVC European

Equity Partners

6 VII

Europe/North

Large buyouts 2017 America 27.3 2.1

CVC European

Equity Partners

7 VI

Europe/North

Large buyouts 2013 America 25.2 2.1

Thomas H Lee

Equity Fund

8 VIII

Mid-market and

large buyouts 2017 North America 21.3 3.6

Sixth Cinven

9 Fund

Large buyouts 2016 Europe 20.5 1.3

ICG LP

Secondaries

10 Fund I

Secondary Europe/North

portfolio 2023 America 19.3 13.2

BC European

11 Capital IX

Mid-market and Europe/North

large buyouts 2011 America 19.1 0.7

PAI Strategic

12 Partnerships

Mid-market and

large buyouts 2019 Europe 18.8 0.6

New Mountain

13 Partners V

Mid-market

buyouts 2017 North America 18.1 1.0

14 Advent IX

Europe/North

Large buyouts 2019 America 17.2 3.8

15 Permira V

Europe/North

Large buyouts 2013 America 17.0 0.4

16 Oak Hill V

Mid-market

buyouts 2019 North America 17.0 1.8

Gridiron

Capital Fund

17 IV

Mid-market

buyouts 2019 North America 17.0 2.8

BC European

18 Capital X

Large buyouts 2016 Europe 16.9 2.5

Outstanding

Year of Country/ commitment

Fund commitment region Value GBPm GBPm

--------------- ------------ ------------- ---------- ---------------

19 Resolute IV

Mid-market

buyouts 2018 North America 16.4 1.7

Advent Global

Private Equity

20 VIII

Europe/North

Large buyouts 2016 America 16.4 0.0

ICG Strategic

21 Equity Fund IV

Secondary fund

restructurings 2021 Global 16.2 18.6

22 TDR Capital III

Mid-market and

large buyouts 2013 Europe 15.3 1.6

23 PAI Europe VI

Mid-market and

large buyouts 2013 Europe 15.2 1.3

24 Gryphon V

Mid-market

buyouts 2019 North America 14.0 1.9

ICG Augusta

Partners

25 Co-Investor

Secondary fund

restructurings 2018 Global 13.8 18.9

ICG Ludgate

26 Hill II

Secondary

portfolio 2022 North America 13.3 5.7

27 PAI Europe VII

Mid-market and

large buyouts 2017 Europe 13.3 10.3

Resolute II

Continuation

28 Fund

Secondary fund

restructurings 2018 North America 12.8 2.2

29 AEA VII

Mid-market

buyouts 2019 North America 12.2 4.1

Leeds Equity

30 Partners VI

Mid-market

buyouts 2017 North America 11.8 1.0

Total of the largest 30 fund investments 608.8 146.6

Percentage of total investment Portfolio 49.0%

-------------------------------------------- ---------- ---------------

Portfolio at 30 April 2022

All data is presented on a look-through basis to the investment

portfolio held by the Company, consistent with the commentary in

previous annual and interim reports

Portfolio by calendar year of

investment % of value of underlying investments

-------------------------------------- ------------------------------------

2022 3.7%

2021 25.5%

2020 11.8%

2019 15.5%

2018 17.2%

2017 9.1%

2016 5.4%

2015 5.0%

2014 and older 6.8%

-------------------------------------- ------------------------------------

Total 100.0%

-------------------------------------- ------------------------------------

Portfolio by sector % of value of underlying investments

---------------------------- ------------------------------------

TMT 24.1%

Consumer goods and services 19.5%

Healthcare 15.9%

Business services 12.3%

Industrials 8.4%

Financials 5.5%

Education 5.4%

Leisure 4.2%

Other 4.7%

---------------------------- ------------------------------------

Total 100.0%

---------------------------- ------------------------------------

% of value of

Portfolio by geographic distribution based on location underlying

of company headquarters investments

------------------------------------------------------- ---------------------

North America 42.3%

Europe 30.6%

Other 27.1%

Total 100.0%

------------------------------------------------------- -------------------

(END) Dow Jones Newswires

June 28, 2022 09:30 ET (13:30 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

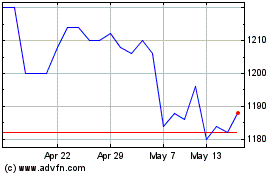

Icg Enterprise (LSE:ICGT)

Historical Stock Chart

From May 2024 to Jun 2024

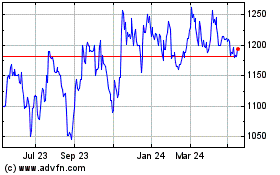

Icg Enterprise (LSE:ICGT)

Historical Stock Chart

From Jun 2023 to Jun 2024