TIDMHAT

RNS Number : 2267H

H&T Group PLC

16 August 2016

H&T Group plc

("H&T" or "the Group" or "the Company")

UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2016

H&T Group plc, which trades under the H&T Pawnbrokers

and est1897 brands, today announces its interim results for the six

months ended 30 June 2016.

John Nichols, chief executive, said: "This is a promising start

to the year in the face of challenging trading conditions, with a

strong operational performance aided by favourable market

conditions around the gold price.

We have reinvigorated and widened our product range to capture

the opportunities presented by the ongoing changes in the wider

market. The continued growth in our Personal Loans products and the

recent increases in gold price, if sustained, will benefit the

Group during the second half of the year."

KEY FINANCIAL RESULTS

-- Profit before tax up 42.3% to GBP3.7m (H1 2015: GBP2.6m)

-- Basic EPS of 7.99p (H1 2015: 5.53p)

-- Net debt reduced by 22.5% to GBP6.9m (30 June 2015: GBP8.9m)

-- Pledge book increased by 4.3% to GBP39.0m (30 June 2015: GBP37.4m)

-- Personal Loan book increased 85.3% to GBP6.3m (30 June 2015: GBP3.4m)

-- Pawn Service Charge down 1.4% at GBP14.1m (H1 2015: GBP14.3m)

-- Other Services income increased 68.8% to GBP2.7m (H1 2016: GBP1.6m)

-- Interim dividend of 3.9p (2015 interim: 3.5p)

OPERATIONAL HIGHLIGHTS

-- Launch of the new higher value, lower APR personal loan

product to customers with good history

-- Development of a new high-end operation on Old Bond Street, London

-- Creation of a retail merchandising team to support stock efficiency and sales

-- Enhancements to the field operations and leadership team to support new product development

Enquiries:

H&T Group plc

Tel: 0870 9022 600

John Nichols, chief executive

Steve Fenerty, finance director

Numis Securities (broker and nominated adviser)

Tel: 020 7260 1000

Mark Lander, corporate broking

Freddie Barnfield, nominated adviser

Haggie Partners (public relations)

Tel: 020 7562 4444

Damian Beeley

Brian Norris

INTERIM REPORT

Introduction

The trading environment remains challenging for the sector with

most large businesses reporting losses and being forced to

significantly restructure their operations. H&T had anticipated

many of these changes and had adjusted its business model and

investment approach accordingly. As a result, we have fared

relatively well over the last two years.

The Group has made good progress realigning the business to

capture the opportunities presented by the continuing changes in

the wider market. In particular the developments in the Personal

Loan and Buyback products support the core proposition of providing

easy access to cash and extend our reach into new customer

segments.

In the medium term we will develop these areas further by

integrating the online and offline services to provide a clear

proposition to the consumer irrespective of how they access our

services.

Financial performance

Profit before tax increased by 42.3% to GBP3.7m (H1 2015:

GBP2.6m) through a combination of strong operational performance

and a rising gold price.

Gross profit increased by GBP2.3m with the majority of the

growth from Personal Loans, Buyback and FX. The average sterling

gold price during H1 2016 was GBP852 (H1 2015: GBP791), an increase

of 7.7%; gross profits from Gold Purchasing and Pawnbroking Scrap

activities increased by GBP0.9m as a result.

Total direct and administration expenses increased 6.0% to

GBP21.2m (H1 2015: GBP20.0m) principally as a result of investment

in people and systems to support product development.

The Group's balance sheet is strong with net debt at GBP6.9m (30

June 2015: GBP8.9m) and a leverage ratio of 0.57x (30 June 2016:

0.87x), well within the covenant test of 3.0x. The Group refinanced

its existing facility on 12 February 2016 with Lloyds Bank plc; the

new facility has a termination date of 30 April 2020. The GBP4.8m

increase in net debt since year end is principally due to the

planned increase in the Personal Loans and inventory balances.

The Group has closed three stores in H1 2016 resulting in 186

trading stores at 30 June 2016. The Group continues to assess

underperforming stores and anticipates a small number of closures

in the second half.

Dividend

The directors have approved an interim dividend of 3.9 pence

(2015 interim: 3.5 pence). This will be payable on 7 October 2016

to all shareholders on the register at the close of business on 9

September 2016.

REVIEW OF OPERATIONS

Pawnbroking

The pledge book increased to GBP39.0m (30 June 2015: GBP37.4m)

as a result of the development of a new distribution channel for

pawnbroking services and a slight increase in the aged pledge.

The Pawn Service Charge was GBP14.1m (H1 2015: GBP14.3m); the

interest component of the Pawn Service Charge was GBP14.1m (H1

2015: GBP14.2m) which more accurately reflects the underlying

performance of the pawnbroking segment than the total Pawn Service

Charge. The yield on the pledge book has marginally reduced due to

the changing business mix and the increase in aged pledge.

Development of the pawnbroking product remains extremely

challenging in this market. Over the last ten years a combination

of increased competition, a reduction of gold in circulation and

changing fashion have resulted in reducing numbers of customers

using the service. Recent market trends have stabilised as the

number of competitor stores reduces and gold purchasing activity

reduces.

The Group has invested heavily in its existing stores and people

to provide the highest standards of service to our customers. This

investment together with enhancements to asset valuations, the

Expert Eye central support and integration of our online and

offline services will ultimately support the development of our

pawnbroking product.

The expansion of the "we lend on anything" proposition continues

with the launch of our H&T Finance branded location on Old Bond

St, London. This provides a central London location to serve a more

affluent customer and enables access to product experts to assist

in valuation and disposition.

Pawnbroking scrap

Pawnbroking scrap produced gross profits of GBP0.6m (H1 2015:

GBP0.1m profit) for the half year, on sales of GBP4.9m (H1 2015:

GBP4.2m). This performance benefitted from the increased gold price

during H1 2016.

The impact of the EU referendum on the US$ exchange rate has

increased the sterling price of gold: the average for July 2016 was

GBP1,017 per troy oz vs a H1 2016 average of GBP852. This increase,

if sustained, will benefit the Group during H2 2016.

Retail

The Group regards the High Street retail offering as a core part

of its business. Pawnbroking and Gold Purchasing generate

significant amounts of saleable jewellery which must be sold. The

ability to retail items rather than scrap them provides a higher

return and reduces the Group's exposure to short term gold price

volatility.

Retail sales increased by 1.5% to GBP13.6m (H1 2015: GBP13.4m)

and gross profits were flat at GBP4.8m (H1 2015: GBP4.8m). During

the H1 2016 the Group closed one standalone Discount Secondhand

Jewellery store as we were unable to secure satisfactory lease

terms.

The Group has invested in a merchandising team to provide a more

focussed approach to sales and inventory management.

Gold Purchasing

Gold purchasing profits increased from GBP1.0m in H1 2015 to

GBP1.5m in H1 2016. The additional profit and margin was mainly the

result of the increasing gold price during H1 2016.

The impact of an increase in gold price to purchasing profits is

relatively short lived. There is a delay between purchasing gold in

store and realising the value through the market; if the gold price

increases during this period then margins are enhanced. As the gold

price stabilises, the rate that is paid for gold in store increases

and ultimately we return to normal margins.

Personal Loans

Personal Loans gross profits increased by 25.0% to GBP1.5m (H1

2015: GBP1.2m); the loan book net of provisions at 30 June 2016

increased 85.3% to GBP6.3m (30 June 2015: GBP3.4m).

The development of the Personal Loan product in-store and online

is a significant opportunity. H&T's Personal Loan allows for

loans of up to GBP2,500 over any term of up to three years based on

affordability. Approximately 80% of the loans issued by the Group

fell under the definition of High-Cost Short-Term Credit (HCSTC)

during H1 2016 and as such must comply with additional rules under

the Financial Conduct Authority (FCA) regulatory regime.

The Group has positioned the Personal Loan product to be cheaper

and more flexible than most comparable loans in the market and has

applied robust affordability assessments including a manual review

of each loan application. The Group intends to reduce the

proportion of HCSTC loans over time as we expand our lower APR,

longer term loans for our customers. During H1 2016 the Group lent

GBP1.0m through its larger loan product to existing customers with

good repayment history.

The increase in Personal Loans has been delivered principally

through operational improvements in store, the store loan book

represents approximately 95% of the total Personal Loans book.

Online presents a significant opportunity for the Group: during H2

2016 we will complete the implementation of new underwriting

systems to support the expansion of this segment.

Other Services

Other Services revenues increased 68.8% to GBP2.7m (H1 2016:

GBP1.6m). Foreign Exchange, Buyback and Western Union have

collectively contributed GBP2.3m in H1 2016 (H1 2015: GBP1.0m) and

brought a significant number of new customers to H&T. FX and

Buyback delivered the majority of the growth with an increase in

gross profits of GBP0.8m and GBP0.4m respectively.

FX is a simple transactional product based around sales of

retail foreign currency on the high street. Our experience

demonstrates that there are low barriers to entry and customers

show a willingness to shop around for the best rates. We believe

that further expansion in this product is possible through keen

pricing and increasing awareness. The larger providers typically

charge a significantly higher margin than H&T while also

capturing the vast majority of the market. As we become established

in the market we believe that more customers will seek us out.

During H1 2016 sales of FX increased by 60.4% and purchases more

than doubled delivering transactional profits of GBP1.2m (H1 2015:

GBP0.7m). Exchange rate gains during H1 2016 were GBP0.1m (H1 2015:

GBP0.2m loss), the Group introduced hedging of the foreign currency

balances in June 2016 to manage this exposure. The recent weakness

of sterling and travellers' concerns about safety may result in

slower growth in the short term.

Our Buyback offering supports the "we buy anything" proposition

by expanding the range of assets we accept into high end consumer

electronics. Demographically the Buyback customer base is younger

and more likely to be male than a pawnbroking customer. Changing

fashion also means that younger customers are more likely to own a

high end phone than a piece of quality jewellery. The Buyback

product allows us to address this changing market.

Buyback gross profit doubled to GBP0.8m (H1 2015: GBP0.4m), the

value of goods purchased using the Buyback service increased 72.0%

to GBP4.3m (H1 2015: GBP2.5m).

REGULATION

The Financial Conduct Authority

The regulation of Consumer Credit moved from the Office of Fair

Trading (OFT) to the Financial Conduct Authority (FCA) on 1 April

2014. The Group obtained authorisation from the FCA on 11 February

2016 and we welcome the higher standards that this change will

bring to our sector.

High-cost short-term cost cap

On 1 January 2015 the FCA implemented its cap on the interest

rate and charges that apply to High-Cost Short-Term Credit (HCSTC).

The FCA has stated that it will review the price cap during the

first half of 2017.

The vast majority of H&T Personal Loans are well within the

current cap; we therefore believe that this review will have a

limited impact on our product.

THE MARKET

The market is now characterised by store closures and trading

losses, with few exceptions. H&T had planned for many of the

changes experienced by the market, particularly around HCSTC and

the risk of a reducing gold price. We have stabilised the business,

strengthened the balance sheet and reinvigorated and widened our

product range.

There will be more store closures among our competitors and

further regulatory pressure on the market, only those businesses

with the right products and capabilities to address the market will

prosper.

STRATEGY AND OUTLOOK

The demand for small-sum, short-term cash loans remains strong.

By increasing the range of assets the Group accepts, by expanding

Personal Loans and expanding our online services we will be ideally

positioned to grow as the market adjusts in the future.

Current trading is in line with management's expectations. The

recent increases in gold price, if sustained, will benefit the

Group in the remainder of the year.

Interim Condensed Financial Statements

Unaudited statement of comprehensive income

For the 6 months ended 30 June 2016

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

Note Total Total Total

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue 2 42,385 40,848 89,355

Cost of sales (17,192) (17,922) (41,782)

________ ________ ________

Gross profit 2 25,193 22,926 47,573

Other direct expenses (15,841) (15,802) (32,079)

Administrative expenses (5,398) (4,167) (7,976)

________ ________ ________

Operating profit 3 3,954 2,957 7,518

Investment revenues - 1 1

Finance costs 5 (208) (334) (679)

________ ________ ________

Profit before taxation 3,746 2,624 6,840

Tax on profit 6 (857) (626) (1,462)

________ ________ ________

Total comprehensive income

for the period 2,889 1,998 5,378

________ ________ ________

Pence Pence Pence

Earnings per ordinary

share - basic 7 7.99 5.53 14.88

Earnings per ordinary

share - diluted 7 7.97 5.52 14.86

All results derive from continuing operations.

Unaudited condensed consolidated statement of changes in

equity

For the 6 months ended 30 June 2016

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

Note 2016 2015 2015

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Opening total equity 94,060 90,863 90,863

Total comprehensive income

for the period 2,889 1,998 5,378

Share option credit taken

directly to equity 16 70 104

Dividends paid 9 (1,666) (996) (2,285)

Closing total equity 95,299 91,935 94,060

Unaudited condensed consolidated balance sheet

At 30 June 2016

At 30 June At 30 June At 31 December

2016 2015 2015

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 17,692 17,707 17,707

Other intangible assets 619 893 752

Property, plant and

equipment 7,365 9,059 8,138

Deferred tax assets 542 528 542

26,218 28,187 27,139

Current assets

Inventories 29,043 31,595 24,802

Trade and other receivables 53,889 48,187 50,893

Other current assets 834 493 646

Cash and cash equivalents 14,118 7,929 10,923

97,884 88,204 87,264

Total assets 124,102 116,391 114,403

Current liabilities

Trade and other payables (6,081) (5,825) (5,482)

Current tax liabilities (718) (602) (645)

Borrowings 4 - (1,755) -

(6,799) (8,182) (6,127)

Net current assets 91,085 80,022 81,137

Non-current liabilities

Borrowings 4 (20,667) (14,835) (12,911)

Provisions (1,337) (1,439) (1,305)

(22,004) (16,274) (14,216)

Total liabilities (28,803) (24,456) (20,343)

Net assets 95,299 91,935 94,060

EQUITY

Share capital 8 1,843 1,843 1,843

Share premium account 25,409 25,409 25,409

Employee Benefit Trust

share reserve (35) (35) (35)

Retained earnings 68,082 64,718 66,843

Total equity attributable

to equity holders of

the parent 95,299 91,935 94,060

Unaudited condensed consolidated cash flow statement

For the 6 months ended 30 June 2016

6 months 6 months 12 months

Note ended ended ended

30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Profit for the period 2,889 1,998 5,378

Adjustments for:

Investment revenues - (1) (1)

Finance costs 208 334 679

Movement in provisions 32 (51) (216)

Income tax expense 857 626 1,462

Depreciation of property,

plant and equipment 1,419 1,454 2,897

Amortisation of intangible

assets 133 163 321

Share based payment expense 16 70 104

Loss on disposal of fixed

assets 172 16 75

Operating cash inflows before

movements in working capital 5,726 4,609 10,699

(Increase)/decrease in inventories (4,241) (2,324) 4,469

Increase in other current

assets (188) (264) (417)

(Increase)/decrease in receivables (3,036) 1,236 (1,367)

Increase/(decrease) in payables 340 (222) (507)

Cash (used in)/generated

from operations (1,399) 3,035 12,877

Income taxes paid (785) (352) (1,160)

Debt restructuring cost (326) - -

Interest paid (138) (222) (508)

Net cash (used in)/generated

from operating activities (2,648) 2,461 11,209

Investing activities

Interest received - 1 1

Purchases of property, plant

and equipment (572) (540) (1,207)

Proceeds on disposal of property,

plant and equipment 81 - -

Acquisition of trade and assets

of business - - (120)

Net cash used in investing activities (491) (539) (1,326)

Financing activities

Dividends paid 9 (1,666) (996) (2,285)

Net increase /(decrease) in borrowings 8,000 (1,247) (3,000)

Decrease in Bank overdraft - - (1,925)

Net cash generated from/(used

in) financing activities 6,334 (2,243) (7,210)

Net increase/(decrease) in cash

and cash equivalents 3,195 (321) 2,673

Cash and cash equivalents at

beginning of period 10,923 8,250 8,250

Cash and cash equivalents at

end of period 14,118 7,929 10,923

Unaudited notes to the condensed interim financial

statements

For the 6 months ended 30 June 2016

Note 1 Basis of preparation

The interim financial statements of the Group for the six months

ended 30 June 2016, which are unaudited, have been prepared in

accordance with the International Financial Reporting Standards

('IFRS') accounting policies adopted by the Group and set out in

the annual report and accounts for the year ended 31 December 2015.

The Group does not anticipate any change in these accounting

policies for the year ended 31 December 2016. As permitted, this

interim report has been prepared in accordance with the AIM rules

and not in accordance with IAS 34 "Interim financial reporting".

While the financial figures included in this preliminary interim

earnings announcement have been computed in accordance with IFRSs

applicable to interim periods, this announcement does not contain

sufficient information to constitute an interim financial report as

that term is defined in IFRSs.

The financial information contained in the interim report also

does not constitute statutory accounts for the purposes of section

434 of the Companies Act 2006. The financial information for the

year ended 31 December 2015 is based on the statutory accounts for

the year ended 31 December 2015. The auditors reported on those

accounts: their report was unqualified, did not draw attention to

any matters by way of emphasis and did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

After conducting a further review of the Group's forecasts of

earnings and cash over the next twelve months and after making

appropriate enquiries as considered necessary, the directors have a

reasonable expectation that the Company and Group have adequate

resources to continue in operational existence for the foreseeable

future. Accordingly, they continue to adopt the going concern basis

in preparing the half yearly condensed financial statements.

Note 2 Segmental Reporting

Consolidated

for the

6 months

ended

30 June

Gold Pawnbroking Personal Other 2016

2016 Pawnbroking Purchasing Retail Scrap Loans Services Unaudited

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

sales 14,130 5,599 13,555 4,898 1,481 2,722 42,385

Total revenue 14,130 5,599 13,555 4,898 1,481 2,722 42,385

Segment result

- gross profit 14,130 1,471 4,820 569 1,481 2,722 25,193

Other direct expenses (15,841)

Administrative expenses (5,398)

Operating profit 3,954

Investment revenues -

Finance costs (208)

------------

Profit before taxation 3,746

Tax charge on profit (857)

------------

Profit for the financial

year and total comprehensive

income 2,889

============

Consolidated

for the

6 months

ended

30 June

Gold Pawnbroking Personal Other 2015

2015 Pawnbroking Purchasing Retail Scrap Loans Services Unaudited

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

sales 14,283 6,279 13,364 4,196 1,158 1,568 40,848

Total revenue 14,283 6,279 13,364 4,196 1,158 1,568 40,848

Segment result

- gross profit 14,283 1,047 4,797 73 1,158 1,568 22,926

Other direct expenses (15,802)

Administrative expenses (4,167)

Operating profit 2,957

Investment revenues 1

Finance costs (334)

------------

Profit before taxation 2,624

Tax charge on profit (626)

------------

Profit for the financial

year and total comprehensive

income 1,998

============

Note 2 Segmental Reporting (continued)

Consolidated

For the

year

ended

Gold Pawnbroking Personal Other 2015

2015 Pawnbroking Purchasing Retail Scrap Loans Services Audited

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

sales 28,437 15,260 29,543 9,718 2,389 4,008 89,355

Total revenue 28,437 15,260 29,543 9,718 2,389 4,008 89,355

Segment result

- gross profit 28,437 2,297 10,326 116 2,389 4,008 47,573

Other direct expenses (32,079)

Administrative expenses (7,976)

Operating profit 7,518

Investment revenues 1

Finance costs (679)

------------

Profit before taxation 6,840

Tax charge on profit (1,462)

------------

Profit for the financial

year and total comprehensive

income 5,378

============

Note 3 Operating profit and EBITDA

EBITDA

The Board considers EBITDA as a key measure of the Group's

financial performance.

EBITDA is defined as Earnings Before Interest, Taxation,

Depreciation and Amortisation. It is calculated by adding back

depreciation and amortisation to the operating profit as

follows:

6 months ended 30 June 2016 6 months 6 months 12 months

Unaudited ended ended ended

30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

Total Total Total

GBP'000 GBP'000 GBP'000

Operating profit 3,954 2,957 7,518

Depreciation and amortisation 1,552 1,617 3,218

EBITDA 5,506 4,574 10,736

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2016

Note 4 Borrowings

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Secured borrowing at amortised

cost

Short term portion of bank

loan - 1,755 -

Amount due for settlement within

one year - 1,755 -

========= ========= ============

Long term portion of bank loan 21,000 15,000 13,000

Unamortised issue costs (333) (165) (89)

--------- --------- ------------

Amount due for settlement after

more than one year 20,667 14,835 12,911

========= ========= ============

Note 5 Finance costs

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Interest payable on bank loans

and overdraft 126 258 524

Other interest - - 2

Amortisation of debt issue

costs 82 76 153

Total finance costs 208 334 679

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2016

Note 6 Tax on profit

The taxation charge for the 6 months ended 30 June 2016 has been

calculated by reference to the expected effective corporation tax

and deferred tax rates for the full financial year to end on 31

December 2016. The underlying effective full year tax charge is

estimated to be 20% (six months ended 30 June 2015: 20.3%).

Note 7 Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to equity shareholders by the weighted

average number of ordinary shares in issue during the period.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. With respect to the Group these

represent share options granted to employees where the exercise

price is less than the average market price of the Company's

ordinary shares during the period.

Reconciliations of the earnings per ordinary share and weighted

average number of shares used in the calculations are set out

below:

Unaudited Unaudited Audited

6 months ended 6 months ended 12 months ended

30 June 2016 30 June 2015 31 December 2015

Earnings Weighted Per-share Earnings Weighted Per-share Earnings Weighted Per-share

GBP'000 average amount GBP'000 average amount GBP'000 average amount

number pence number pence number pence

of shares of shares of shares

Earnings

per share

-

basic 2,889 36,154,799 7.99 1,998 36,154,799 5.53 5,378 36,154,799 14.88

Effect of

dilutive

securities

Options - 74,159 (0.02) - 29,533 (0.01) - 34,805 (0.02)

Earnings

per share

diluted 2,889 36,228,958 7.97 1,998 36,184,332 5.52 5,378 36,189,604 14.86

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2016

Note 8 Share capital

At At At

30 June 30 June 31 December

2016 2015 2015

Unaudited Unaudited Audited

Allotted, called up

and fully paid

(Ordinary Shares of

GBP0.05 each)

GBP'000 Sterling 1,843 1,843 1,843

Number 36,856,264 36,856,264 36,856,264

Note 9 Dividends

On 11 August 2016, the directors approved a 3.9 pence interim

dividend (30 June 2015: 3.5 pence) which equates to a dividend

payment of GBP1,440,000 (30 June 2015: GBP1,290,000). The dividend

will be paid on 7 October 2016 to shareholders on the share

register at the close of business on 9 September 2016 and has not

been provided for in the 2016 interim results. The shares will be

marked ex-dividend on 8 September 2016.

On 28 April 2016, the shareholders approved the payment of a 4.5

pence final dividend for 2015 which equates to a dividend payment

of GBP1,666,000 (2014: GBP996,000). The dividend was paid on 6 June

2016.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGUWGRUPQGQA

(END) Dow Jones Newswires

August 16, 2016 02:00 ET (06:00 GMT)

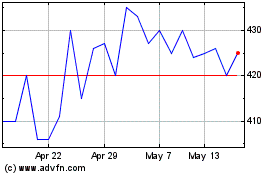

H&t (LSE:HAT)

Historical Stock Chart

From May 2024 to Jun 2024

H&t (LSE:HAT)

Historical Stock Chart

From Jun 2023 to Jun 2024