Gaelic Resources PLC - Interim Results

October 19 1999 - 12:47PM

UK Regulatory

RNS No 3055q

GAELIC RESOURCES PLC

19 October 1999

INTERIM REPORT 1999

It was announced on 27 August, 1999 that Gaelic Resources plc ("Gaelic") and

Desire Petroleum plc ("Desire") had agreed the terms of a proposed merger

between the two groups. In my letter to you of 11 September, 1999 contained

in the document entitled "Recommended merger of Desire Petroleum plc and

Gaelic Resources Public Limited Company", and in other sections of that

document, the rationale for the merger was given. This rationale has not

changed.

It was announced on 5 October, 1999 that as at 3.00 p.m. on 4 October, 1999,

the first closing date of the merger offer, that Desire had received valid

acceptances for 54.56% of the issued share capital of Gaelic and 67.44% of the

Gaelic warrants and that the offer had been extended to 3.00 p.m. on 25

October, 1999.

I, and the other independent directors (that is the directors of Gaelic other

than Dr. Colin Phipps), continue to unanimously recommend that Gaelic

Shareholders and Gaelic Warrantholders accept the merger offer and encourage

you to post your acceptance forms if you have not already done so.

Gaelic is currently involved in the appraisal of the gas discovery made in

exploration well, Aljubarrota No. 2, which was drilled in the Lusitanian Basin

in Portugal between December 1998 and March 1999. Completion of the merger

between Gaelic and Desire will mean that Gaelic Shareholders will have a

majority position in the merged group, which will maintain its existing

interest in Portugal, have cash to pursue the Portuguese appraisal programme

and also have the potential of the exploration acreage offshore the Falkland

Islands currently held by Desire.

IAN FORREST

Chairman

19 October, 1999

UNAUDITED CONSOLIDATED PROFIT AND LOSS ACCOUNT

for the six months ended 30 June, 1999

6 mths to 6 mths to

30/6/99 30/6/98

IR# IR#

Turnover - -

Cost of Sales - -

-------------------------

Gross Profit - -

-------------------------

Administration expenses (179,652) (158,683)

Amortisation of Goodwill (122,802) (122,806)

-------------------------

Operating Loss - Continuing Operations (302,454) (281,489)

Interest Receivable & Similar Income 12,461 39,973

Interest Payable & Similar Charges (788) (1,355)

Foreign Exchange gains - net 25,399 25,375

-------------------------

Loss on ordinary activities before taxation (265,382) 217,496)

Tax on Ordinary Activities (1,301) (21)

-------------------------

Loss for the financial period (266,683) (217,517)

-------------------------

Loss per Ordinary Share IR(0.03)p IR(0.03)p

=========================

Copies of this report are being sent to shareholders and are available to the

public at the Company's registered office: 103 Rathfarnham Wood, Rathfarnham,

Dublin 14.

For further information please contact:

Pat Mahony

Gaelic Resources plc

Tel: 353 1 494 7630

END

IR QKFFFKBKXFKL

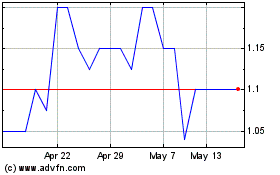

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Jul 2024 to Aug 2024

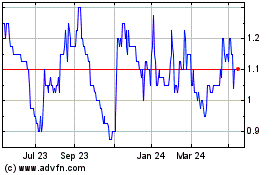

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Aug 2023 to Aug 2024