TIDMCRU

RNS Number : 8250I

Coral Products PLC

29 November 2018

CORAL PRODUCTS PLC

("Coral" or the "Group")

HALF YEARLY REPORT

Coral Products plc, a specialist in the design, manufacture and

supply of plastic products, is pleased to report its half yearly

report for the six months ended 31 October 2018.

Financial headlines Six months Six months

to to

31 October 31 October

2018 2017 % change

GBP13.08 GBP11.91

Group sales million million +9.8%

GBP4.04

Gross profit GBP5.04 million million +24.8%

Underlying operating margin* 38.5% 33.9% +13.5%

Underlying operating profit

(excluding finance expenses)* GBP1,009,000 GBP371,000 +172.0%

Reported profit/(loss) before

taxation GBP582,000 GBP (7,000) +8,414.3%

Underlying EBITDA* GBP1,747,000 GBP982,000 +77.9%

Underlying basic earnings

per share* 0.87p 0.23p +278.3%

Proposed interim dividend

per share 0.25p 0.0p

*The financial headlines disclosed as underlying represent the

reported metrics excluding separately disclosed items (being share

based payment charges, amortisation of intangible assets and other

one-off costs in each period).

Operational and financial highlights

- All metrics show substantial improvement.

- Strong net assets position has been maintained.

- Interim dividend of 0.25p proposed.

- Additional sales resource recruited at Interpack to support

growth aspirations in the business.

- Re-organisation and turn-around of the Haydock manufacturing

facility continued, with positive site profits in all of the six

months of this financial year.

- The commitment to the Group's 360-degree re-cycling supply

initiative has been realised by the purchase of a state-of-the-art

plastic recycling system. The system will be installed in December

2018 and commissioned in January 2019 with contribution expected

before the end of the current financial period.

- Capital investment programme continued across the Group with

investment in state-of-the-art injection moulding machines, blow

moulding capacity and extruding capability. This will reduce

operating costs, improve capacity and technical availability as

well as open up new areas of business.

- New chilled cooling water system installed in Haydock, saving

water and cost whilst eliminating future likely HSHE (health,

safety, hygiene and environmental) issues.

- New product development partnership with Rotite already

resulted in two new products being developed, with tools being

ordered for introduction during 2019/20. In addition, some current

products have benefited from design changes making for cost

savings. Our customers have shown high interest in these new and

improved products.

- Extension to the on-line tote supply gained for the rest of this financial period.

Commenting on today's results, Joe Grimmond, Coral's Chairman,

said:

"Trading in the first half of the current year shows a

substantial improvement of all our financial headlines.

We are delighted with the performance of the business in the

first half. The main feature of the results is the excellent

turnaround of Coral Products (Mouldings) into profit and we are

optimistic that this trend will continue. This improvement reflects

the huge amount of effort put in by the Coral team. We have

increased investment in business development, new products,

production capacity and employee capabilities. These investments

have strengthened our position in injection moulding, blow moulding

and plastic extrusion, whilst at the same time expanding the range

of plastic services we supply.

I am pleased to report that results to date are well ahead of

the same period last year and that, in spite of the prevailing

uncertainties of Brexit we remain confident of the Groups future

prospects."

Enquiries

Coral Products plc Tel: 01942 272

Joe Grimmond, Non-Executive Chairman 882

Mick Wood, CEO

Nominated Adviser

Cairn Financial Advisers LLP Tel: 020 7213

Tony Rawlinson / Liam Murray 0880

Broker

Daniel Stewart & Company Limited Tel: 020 7776

David Lawman 6550

Richard Potts

Capital Markets Consultants Limited Tel: 07515 587

Richard Pearson 184

Chairman's Statement

Results and Financial Position

Trading in the first half of the current year shows revenue and

gross profits both substantially ahead of the same period for last

year. Reported revenue increased to GBP13,077,000 (six months to 31

October 2017: GBP11,911,000).

As a result of the re-organisation and cost reduction action

taken in January 2018, gross margins have substantially increased

to 38.5% (2017: 33.9%) resulting in a gross profit of GBP5,039,000

(2017: GBP4,037,000) in the six months to 31 October 2018.

Underlying EBITDA has improved substantially on last year at

GBP1,747,000 (2017: GBP982,000).

Underlying profits for operations increased to GBP1,009,000

(2017: 371,000), a significant improvement over the same period

last year.

Separately disclosed expenses of GBP222,000 (2017: GBP196,000)

comprised the amortisation of intangibles acquired on acquisition

and share based payment charges over employee options.

Finance costs were up from GBP182,000 to GBP205,000 in this

period due to the increased levels of borrowing needed to fund

capital expenditure.

Profit after tax after including all these items was GBP500,000

compared to a loss of GBP7,000 over the same period last year.

The balance sheet net asset position remains strong at

GBP13,749,000 (2017: GBP13,493,000). This represents a solid asset

platform for developing the business.

The Group's net debt has decreased to GBP6,868,000 (2017:

GBP7,110,000). The Group has undrawn bank facilities of GBP1.9

million which, together with its asset-based finance lines at 31

October 2018, enable it to invest internally or in further

acquisitions and businesses for growth which will then enable

better returns for our shareholders.

Operations

Tatra-Rotalac Ltd

New extrusion technology and capacity has been introduced

allowing both current products to be competitively produced and, as

importantly, giving the business a technology boost that allows

more technically advanced products to be made. A full business

overview has taken place and subsequent actions are being addressed

urgently to enable the business to realise its potential. The extra

costs we have incurred to boost future performance have impacted on

the current period resulting in a loss and we are below our budget

expectations but I am confident that the actions being taken will

support the business growth aspirations of the company via its

existing customer base and with the introduction of new customers

in light of the new technically advanced extrusion equipment now in

the operation.

Interpack Ltd

Sales, Gross and Net profit exceeded expectations and were well

ahead of the same period last year. New European suppliers have

been sourced to supplement the range of products offered for sale

whilst new capacity released by the introduction of new ice cream

tools at Coral Products (Mouldings) will give further growth

opportunities.

Global One-Pak Ltd

Sales, Gross profit and Net profit are substantially ahead of

expectations for the current financial period albeit below the same

period last year. New products using high levels of plastic

recyclate are being developed to supplement the current successful

portfolio. It is expected that the Global One-Pak's strong

financial performance will continue through the second half of this

financial period.

Coral Products (Mouldings) Ltd

We are delighted with the turnaround in Coral Products

(Mouldings) in the period. Sales, Gross and Net profit are

substantially ahead of the comparative previous year financial

period albeit below budget but as announced, with a healthy

pipeline in place we are optimistic about the overall performance

for the year.

The Operational & Sales turnaround actions taken over the

previous eleven months have been successful with the subsidiary

achieving a profit every month since January 2018. Improvement work

in logistics and material purchasing is now bearing fruit with all

actions completed in this area expected prior to the end of this

financial period.

Improving the machine capabilities of the subsidiary has meant

some capital expenditure has been incurred. The new injection

moulders and blow moulders have enabled the business to advance

technically whilst improving the manufacturing cost base.

A new recycling plant has been developed and purchased. This

plant will be installed in December 2018 with commissioning

expected to be completed by the end of January 2019. The interest

from our customer base in this plant, its capabilities and our

360-degree approach to recycling has been extremely encouraging.

Aimed, in the first instance, at the UK Council and local authority

recycling arms our novel approach has put Coral at the forefront of

the decision makers. Encouragingly the plant has received the first

batch of crates to be recycled from a local Council in anticipation

of the plant being operational. In addition, there are also local

agreements to take waste crates, caddies and bins at a further five

councils and this is expected to exponentially increase during the

coming months. This recycling plant is expected to be profit

enhancing during this current financial period.

Capital expenditure

Total capital expenditure in the first six months was GBP810,000

(2017: GBP1,277,000) of which GBP244,000 (2017: GBP201,000) was

spent at Tatra-Rotalac, Wythenshawe and the balance expended on the

continued improvements to the capabilities at Coral Mouldings,

Haydock which included two fully electric machines and three blow

moulding machines.

Dividends

It is the board's intention to pay an interim dividend of 0.25p

pence per share (2017: 0.00p). The ex-dividend date and the record

date for the interim dividend will be 14 February 2019 and 15

February 2019 respectively. The interim dividend will be paid on 28

March 2019. This continues to reflect our confidence in the

recovery path and improvement this will bring to our results.

Outlook

We are delighted with the performance of the business in the

first half. The main feature of the results is the excellent

turnaround of Coral Products (Mouldings) into profit and we are

optimistic that this trend will continue. This improvement reflects

the huge amount of effort put in by the Coral team. We have

increased investment in business development, new products,

production capacity and employee capabilities. These investments

have strengthened our position in injection moulding, blow moulding

and plastic extrusion, whilst at the same time expanding the range

of plastic services we supply.

Results to date in the current financial year have been

excellent. The return to profitability of Coral Products

(Mouldings) along with the continued financial performance of

Interpack and Global One-Pak has enabled the Group to return to

profitability. It is expected that actions currently underway will

bring Tatra-Rotalac back to profitability prior to the end of this

financial year.

The exciting new plastic recycling plant will give the business

an edge when operational with interest in it already evident by

both existing customers and prospective customers alike.

Brexit

As the current outcome of Brexit is still undecided the business

continues as normal with focus on operational cost control. This is

reflected in our significantly improved gross margin.

Discussions with customers and suppliers are on-going with

reference to holding finished goods and raw material supply.

Agreements for the months leading up to the 29(th) March have been

made with various major suppliers to the Group, and customers of

the Group, to mitigate any shortages that may or may not

happen.

We are confident that whilst the next 12 months will be

challenging, Coral will remain in a good position to deal with the

aftermath of Brexit.

Joe Grimmond

Non-Executive Chairman

29 November 2018

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months to 31 October 2018

Six months Six months

to to Year to

31 October 31 October 30 April

2018 2017 2018

Notes (unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Revenue 3 13,077 11,911 23,405

Cost of sales (8,038) (7,874) (15,302)

------------- ---------------- --------------

Gross profit 5,039 4,037 8,103

Operating costs

Distribution expenses (575) (546) (1,256)

Administrative expenses

before separately disclosed

items (3,455) (3,120) (5,968)

------------- ---------------- --------------

Underlying operating profit 1,009 371 879

Separately disclosed items:

-------------

Share based payment charge (78) (8) (50)

Amortisation of intangible

assets (144) (174) (348)

Compensation for loss of

office - (14) -

Reorganisation costs - - (481)

Impairment loss on trade

receivables - - (186)

------------- ---------------- --------------

(222) (196) (1,065)

Operating profit/(loss) 787 175 (186)

Finance expense (205) (182) (311)

------------- ---------------- --------------

Profit/(loss) before taxation 582 (7) (497)

Taxation 4 (82) - 127

------------- ---------------- --------------

Total comprehensive income/(loss) 500 (7) (370)

------------- ---------------- --------------

Earnings per ordinary share 5

Basic and diluted (pence) 0.61 0.00 (0.45)

Underlying basic (pence) 0.87 0.23 0.84

------------- ---------------- --------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 October 2018

31 October 31 October 30 April

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Non-current assets

Goodwill 5,495 5,495 5,495

Other intangible assets 1,546 1,864 1,690

Property, plant and equipment 9,314 9,111 9,299

Total non-current assets 16,355 16,470 16,484

------------- -------------- ---------------

Current assets

Inventories 3,278 3,162 2,864

Trade and other receivables 6,005 5,172 5,452

Cash and cash equivalents 727 464 471

Total current assets 10,010 8,798 8,787

------------- -------------- ---------------

Total assets 26,365 25,268 25,271

------------- -------------- ---------------

Current liabilities

Bank overdrafts and borrowings (4,518) (4,199) (5,939)

Trade and other payables (4,554) (3,657) (3,909)

Corporation tax (51) (82) -

Total current liabilities (9,123) (7,938) (9,848)

------------- -------------- ---------------

Non-current liabilities

Borrowings (3,077) (3,375) (1,843)

Deferred taxation liability (416) (462) (409)

------------- -------------- ---------------

Total non-current liabilities (3,493) (3,837) (2,252)

------------- -------------- ---------------

Total liabilities (12,616) (11,775) (12,100)

------------- -------------- ---------------

Total net assets 13,749 13,493 13,171

------------- -------------- ---------------

Equity

Share capital 826 826 826

Share premium 5,288 5,288 5,288

Other reserves 1,567 1,567 1,567

Retained earnings 6,068 5,812 5,490

------------- -------------- ---------------

Total equity 13,749 13,493 13,171

------------- -------------- ---------------

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

For the six months to 31 October 2018 (unaudited)

Share Share Other Retained Total

capital premium reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 May 2018 826 5,288 1,567 5,490 13,171

Total comprehensive

income - - - 500 500

Credit for share based

payment - - - 78 78

Dividend paid - - - - -

----- --------- ---------- ---------- --------

At 31 October 2018 826 5,288 1,567 6,068 13,749

----- --------- ---------- ---------- --------

For the six months to 31 October 2017 (unaudited)

Share Share Other Retained Total

capital premium reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 May 2017 826 5,288 1,567 6,116 13,797

Total comprehensive

income - - - (6) (6)

Credit for share based

payment - - - 8 8

Dividend paid - - (306) (306)

--------- ---------- ------------ ------------- ----------------

At 31 October 2017 826 5,288 1,567 5,812 13,493

--------- ---------- ------------ ------------- ----------------

For the year ended 30 April 2018 (audited)

Share Share Other Retained Total

capital premium reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 May 2017 826 5,288 1,567 6,116 13,797

Total comprehensive

loss - - - (370) (370)

Credit for share based

payment - - - 50 50

Dividend paid - - - (306) (306)

--------- --------- ---------- ---------- --------------

At 30 April 2018 826 5,288 1,567 5,490 13,171

--------- --------- ---------- ---------- --------------

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months to 31 October 2018

Six months Six months

to to Year to

31 October 31 October 30 April

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Cash flow from operating activities

Profit/(loss) for the period after

tax 500 39 (370)

Adjustments for:

Depreciation 738 611 1,212

Loss on disposal of fixed assets 3 - 17

Intangibles amortisation 144 174 348

Share based payment charge 78 8 50

Taxation charge 82 8 (127)

Interest payable 205 182 311

(Increase)/decrease in inventories (414) (279) 18

(Increase)/decrease in trade and

other receivables (553) 357 77

Increase/(decrease) in trade and

other payables 645 (803) (549)

UK corporation tax paid - - 46

Net cash generated/(used) from

operating activities 1,428 297 1,033

------------- ----------------------- ------------

Cash flow from investing activities

Proceeds from disposal of property,

plant and equipment - 13 (5)

Acquisition of property, plant

and equipment (180) (1,265) (907)

Net cash used in investing activities (180) (1,252) (912)

------------- ----------------------- ------------

Cash flow from financing activities

Proceeds of new asset finance - 1,291 500

Dividend paid - (306) (306)

Interest paid (205) (182) (311)

Repayments of bank borrowings (75) (65) (1,601)

Finance lease principal payments (539) (501) (899)

Repayment of bank term loans - (1,462) -

New bank loans raised - 1,743 1,743

Movements on invoice discounting

facility (173) 228 551

Net cash generated/(used) in financing

activities (992) 746 (323)

------------- ----------------------- ------------

Net increase/(decrease) in cash

and cash equivalents 256 (209) (202)

Cash and cash equivalents at the

start of the period 471 673 673

------------- ----------------------- ------------

Cash and cash equivalents at the

end of the period 727 464 471

------------- ----------------------- ------------

1. Basis of preparation

The financial information set out in this Interim Report does

not constitute statutory accounts as defined in Section 435 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 30 April 2018, prepared under IFRS, have been filed

with the Registrar of Companies.

The auditor's report on those financial statements was

unqualified and did not contain a statement under Section 498 (2)

or (3) of the Companies Act 2006.

The interim financial information has been prepared in

accordance with the recognition and measurement principles of

International Financial Reporting Standards (IFRS) and on the same

basis and using the same accounting policies as used in the

financial statements for the year ended 30 April 2018.

The Interim Report has not been audited in accordance with the

International Standard on Review Engagement 2410 issued by the

Auditing Practices Board.

2. Significant accounting policies

The accounting policies applied by the Group in these condensed

consolidated interim financial statements are the same as those

applied by the Group in its consolidated financial statements for

the year ended 30 April 2018.

In respect of the new accounting standards, the Directors have

reviewed and adopted the requirements of IFRS 9 and IFRS 15, which

became effective for the year ended 30 April 2019. The Directors

are currently reviewing the impact of IFRS 16 which will become

effective for the year ended 30 April 2020. At this point it is not

practicable for the Directors to provide a reasonable estimate of

the effect of IFRS 16 as their detailed review of this standard is

ongoing.

3. Revenue

All production is based in the United Kingdom. The geographical

analysis of revenue is shown below:

Six months Six months

to to Year to

31 October 31 October 30 April

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

United Kingdom 12,283 10,764 21,068

Rest of Europe 710 967 1,326

Rest of the World 84 180 1,011

13,077 11,911 23,405

-------------- ------------- -----------

Turnover by business activity

Sale and manufacture of plastic

products 13,077 11,911 23,405

-------------- ------------- -----------

4. Taxation

The taxation charge for the six months to 31 October 2018 is

based on the effective taxation rate, which is estimated will apply

to earnings for the year ending 30 April 2019. The rate used is

below the applicable UK corporation tax rate of 19% due to the

utilisation of tax losses in the period.

5. Earnings per share

Basic and underlying earnings per ordinary share are calculated

using the weighted average number of ordinary shares in issue

during the financial period of 82,614,865 (31 October 2017:

82,614,865 and 30 April 2018: 82,614,865).

Year to

Six months Six months

to to 30 April

31 October 31 October

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP000 p GBP000 p GBP000 p

Basic and diluted earnings

per ordinary share

Profit/(loss) for the period

after tax 500 0.61 (7) 0.00 (370) (0.45)

-------- ----- -------- ----- ------- -------

Underlying earnings per ordinary

share

Underlying profit for the period

after tax 722 0.87 189 0.23 695 0.84

-------- ----- -------- ----- ------- -------

6. Movement in Net Debt

Net debt incorporates the Group's borrowings and bank overdrafts

less cash and cash equivalents. A reconciliation of the movement in

the net debt is shown below:

Six months Six months

to to

Year to

31 October 31 October 30 April

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Net increase/(decrease) in

cash and cash equivalents 256 (437) (753)

Decrease/(increase) in bank

and other loans 248 (212) (142)

Increase in finance leases (61) (851) (806)

Movement in net debt in the

financial period 443 (1,500) (1,701)

Net debt at beginning of period (7,311) (5,610) (5,610)

-------------- ------------- -----------

Net debt at end of period (6,868) (7,110) (7,311)

-------------- ------------- -----------

7. Forward looking statements

This announcement contains unaudited information and

forward-looking statements that are based on current expectations

or beliefs, as well as assumptions about future events. These

forward-looking statements can be identified by the fact that they

do not relate only to historical or current facts and undue

reliance should not be placed on any such statement because they

speak only as at the date of this document and are subject to known

and unknown risks and uncertainties and can be affected by other

factors that could cause actual results, and Corals plans and

objectives, to differ materially from those expressed or implied in

the forward-looking statements. Coral undertakes no obligation to

revise or update any forward-looking statement contained within

this announcement, regardless of whether those statements are

affected as a result of new information, future events or

otherwise, save as required by law and regulations.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (MAR).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFFDLFLTFIT

(END) Dow Jones Newswires

November 29, 2018 02:00 ET (07:00 GMT)

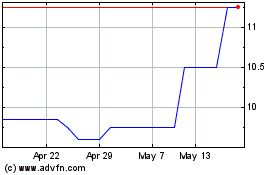

Coral Products (LSE:CRU)

Historical Stock Chart

From May 2024 to Jun 2024

Coral Products (LSE:CRU)

Historical Stock Chart

From Jun 2023 to Jun 2024