TIDMGBGR

GOLDBRIDGES GLOBAL RESOURCES PLC

Interim report - six months to 30 June 2016

GoldBridges Global Resources Plc ("GoldBridges" or the

"Company"), the gold mining and development company, announces its

unaudited results for the six months to 30 June 2016.

Highlights:

Underground development

-- Following the completion of the second decline to 310 metres above sea

level (masl), from the 250 (masl), further associated works to

enable

access to the ore bodies 3 to 8 and 10 have been advancing and

are

expected to be completed by the end of September;

-- The existing decline was taken from 250 metres (masl) to 200 metres

(masl), the ore in relation to ore body 11 has been prepared

during

this period for stoping;

-- Tailings dam 4 is in an advanced stage of completion, the expected

time line of completion is the end of September ;

-- Timing of capital requirements re-evaluated. Total external funding

requirement estimated to be unchanged at between US$8m to

US$18m, to

finalise the underground expansion;

-- The Company has acquired an Atlas Copco boomer drilling machine T1D

and 3 Sandvik UG trucks TH430 each one capable of carrying 30

tons.

-- Award of a six-year exploration contract in relation to Karasuyskoye

project in May 2016, enabling exploratory drilling to confirm

the gold

deposits. The data gathered will enable the appropriate reports

to be

prepared for submission to the authorities in order to obtain

a

sub-soil production contract.

Production

-- H1 2016 gold production from Sekisovskoye of 3,694 ounces (H1 2015:

8,823 ounces), expected reduction due to repositioning of mine

to

underground production;

-- Total ore processed in the plant 116,834 tons (H1 2015 296,959 tons);

-- Total underground ore processed 28,824 (H1 2015 60,586 tons);

-- Contribution of ore from the underground mine increased to 25% of

total ore mined (H1 2015: 17%);

-- Operating cost of sales have increased as expected to US$1,201 due to

the low level of production (H1 2015 US$682/oz).

Financial

-- Revenue for the period of US$6.8m (H1 2015: US$12.8m);

-- Gross profit of US$1.05m in H1 2016, compared to US$3.3m in H1 2015;

-- Significant reduction in administrative costs falling by 40% from the

equivalent period last year from US$4m to US$2.4m, due to

savings at

head office on consultants and employment costs at subsidiary

level;

-- Capital raising of US$12m during the period through the issue of

convertible bonds;

-- Capital expenditure (including payments in advance for fixed assets

and transfers from assets under construction) amounted to

US$4.7m,

Capital expenditure requirement for the underground expansion

for the

year ended December 2016 re-assessed and not expected to

exceed

US$6.7m in total.

Aidar Assaubayev, CEO of GoldBridges Global Resources Plc

commented:

The Board remains confident in delivering a highly profitable

project from the Sekisovskoye underground mine operation. We are

developing the mine in accordance with the previously approved plan

and focusing on the key priority tasks for reaching full capacity.

During the period we have completed the construction of a second

transport decline, acquired new equipment, substantially completed

the construction of a fourth tailings dam, and received a license

to explore Karasu - in the opinion of the Board a great advance in

the successful transition of the Company.

For further information please contact:

GoldBridges Global Resources Plc

Rajinder Basra +44 (0) 207 932 2456

Information on the Company

GoldBridges is a gold mining, exploration and development group

based in Kazakhstan. Whilst the Company was initially established

to exclusively develop and operate the Sekisovskoye gold and silver

mine in the East Kazakhstan Region, it is now actively targeting

additional gold mining opportunities in Kazakhstan. This includes

the adjacent prospective Karasuyskoye Ore Fields, on which

GoldBridges was recently awarded the tender to perform further

confirmatory testing in order to gain the sub-soil user

licence.

The Company holds a 100 per cent shareholding in DTOO

Gornorudnoe Predpriatie Sekisovskoye ("DGPS") which holds a subsoil

use contract in relation to the Sekisovskoye deposit, covering a

total area of 0.855km². The subsoil use contract for Sekisovskoye

is valid until 2020 and the Company currently intends to seek to

extend the contract in accordance with its terms. The Company also

holds a 100 per cent shareholding in Altai Ken-Bayitu LLP which

owns and operates the processing plant at the Sekisovskoye deposit.

The Sekisovskoye deposit is located at the village of Sekisovka,

approximately 40km north of the town of Ust-Kamenogorsk, the

capital city of the East Kazakhstan Region. The current operation

is focused on mining the near-vertical deposits which extend to the

surface below the open pits which have been previously mined.

The Company intends that the Sekisovskoye deposit shall become a

selective-mining underground operation. As at 31 May 2014, the

Company's proven and probable reserves consisted of 2.3Moz of gold

and 3.0Moz of silver and the Company's measured, indicated and

inferred resources consisted of 5.1Moz of gold and 3.5Moz of

silver, in each case as classified in accordance with JORC.

In the year ended 31 December 2015, the Company's consolidated

revenue was US$24.05 million and its net assets US$38.4

million.

GOLDBRIDGES GLOBAL RESOURCES PLC

Chief Executive Review

H1 2016 Review

In order to understand the current position I will clarify the

progress and approach to date. The underground development has been

advancing with continuing capital and horizontal development. In

the current year progress has been made in two ways: firstly to

develop the second transport decline from 250 (masl) to the bottom

of the open pit at 310 (masl). Time and resources were diverted to

this project in priority to other works. This process has been

completed. Further associated works to enable access to the ore

bodies 3 to 8 and 10 have been advancing and are expected to be

completed by the end of September. Secondly, the new decline is

being taken from the 250 (masl) level to 200 (masl) level, to

access the ore bodies at that level. As you can appreciate there is

a lot of preparatory work to be undertaken, and we are pleased with

the work progress to date, there have not been any significant

problems.

Some development work was also undertaken in relation to ore

body 11 (serviced by the existing decline).

During this period ore body 5 (which is segregated into 3

sections), has been prepared for production, this is expected to be

on line towards the second half of H2 2016, this will coincide with

the access works being completed to the bottom of the open pit and

the second decline being fully operational.

At the same time, the other significant project in the period

has been the continuing work on tailings dam four, which is

required to take-up the tailings from the underground mine ore

processed once it is fully operational.

The plant was kept operational by a utilising a blend of low

grade, stock piled ore, the remnants of the open pit ore and

underground ore. The underground ore was a mixture of that produced

from ore body 11 and developmental ore, from ore bodies 8 and 10.

Currently recovery rate is below our targeted expectations but due

to improvements made in the last year we are targeting a recovery

rates in excess of 80% based on use of purely underground ore.

In relation to the capital requirement this was originally

estimated at approximately US$42m (excluding the contingency), of

which we have raised US$12m, of the balance it is expected that

US$12m will be funded by operational cash flows leaving a

requirement of approximately US$18m. This may be further reduced if

further costs savings can be made operationally or in purchasing

the required equipment. In the current period the Company acquired

the following equipment, as part of the underground development

expenditure, an Atlas Copco boomer drilling machine T1D and 3

Sandvik UG trucks TH430 each one capable of carrying 30 tons, a

significant upgrade to current capacity. A total budget was set for

this equipment of US$3.66m, the actual spend was US$2.5m, a

significant saving of 46%. The Company will maintain a keen eye for

purchasing good quality equipment at competitive prices were

possible.

Sufficient cash reserves are available in order to operate the

underground mine up to the point that it will be generating

projected operational revenues, It is not envisaged that any

further significant capital expenditure requirements are needed in

H2 2016.

During H1 2016, there has been a successful capital raising of

US$12m, through the issue of Convertible bonds, of this amount

US$10m was issued to African Resources the existing majority

shareholder and US$2m to other institutional investors. The

commitment of cash resources by the principal shareholder

demonstrates their belief, in relation to the future viability and

success of the project. The Company is also at this time continuing

to explore further financing options.

The Karasuyskoye operation is being progressed with a key

milestone being reached in May 2016 with the award of the sub-soil

contract. The award by Ministry of Investment and Development of

Kazakhstan of the contract which runs for six years, will allow the

Company to undertake exploration and validation activity in order

to submit detailed development plans to the relevant authorities to

obtain a sub-soil production contract. A detailed work program has

been agreed with the Kazakh authorities in order to meet the

detailed requirements to obtain the sub-soil production

contract.

H1 2016 Operational Overview

Sekisovskoye mining activity H1 2016 H1 2015

Total ore mined, open pit (t) 87,319 297,406

Total ore mined, underground (t) 28,824 60,586

Total ore milled (t) 116,834 296,959

Open pit gold grade (g/t) 0.87 1.20

Underground gold grade (g/t) 2.38 2.46

Average gold grade (g/t) 1.33 1.27

Average silver grade (g/t) 2.70 2.09

Gold recovery (%) 75.87 73.2

Gold produced (oz) 3,694 8,823

Silver produced (oz) 6,382 11,630

In relation to commentary on the actual production results for

H1 2016 as the plant was not operating at normal capacity or with a

normal feed stock, comparisons with prior periods and extrapolation

of trends from these results is difficult.

The gold recovery is increasing, however is below our targeted

expectations, and is expected to improve once one source of ore is

processed. While the underground gold grade was below that of 2015

H1 2016: 2.38g/t, (H1 2015: 2.46g/t), this still remains reflective

of developmental ore and will therefore vary in the near term.

GoldBridges remains confident that, once the underground mine is

fully developed and expanded, it can deliver ore to the

Sekisovskoye mill with an average gold grade well in excess of

those currently being achieved.

Underground expansion plans - moving forward

The plans in the near term are to finalise the ancillary works

to enable full access and finalise the works in relation to decline

2, to give access to ore bodies 3 to 8. At the same time

exploratory drilling will be undertaken from the 250 (masl), in

both directions for a distance of 50 metres in order to provide

information, to extract the maximum amount of high grade ore. This

is being undertaken by utilising the Company's Atlas Copco Diamec

rig, in addition a contractor is to be hired with another two rigs

in order to firstly increase the pace of development and secondly

in order to achieve a denser drilling matrix. The plan is to drill

approximately 4,500 linear metres by the end of the year using the

three rigs at the 250 (masl) - being 50 metres in both

directions.

At the same time the existing decline giving access to ore

bodies 9 and 11 will be taken from the current level of 250( masl)

to 200 ( masl) by the end of the year. Preparatory work will then

be done to bring these zones into production during 2017.

As previously reported the Company will utilise the long hole

open stoping method of mining, with paste back fill. As the Company

is currently obtaining the necessary permits in relation to the

construction of the paste plant, at present the mining methods used

are not the most efficient possible in terms of recovery, dilution

and costs. The Company are progressing plans in order to complete

the paste plant as a priority, and are planning to have it

operational in 2017.

We are carefully monitoring costs to ensure that cash

utilisation is in line with the revised budgets.

The Company is currently using a gold price of $1,100 per ounce

in its assumptions for the foreseeable future, and the underground

expansion will be based on this basis. At these prices the Company

is expected to achieve a high level of profitability and rate of

return on the investment. The current gold price is in the region

of US$1,300, with the possibility of a further upside to the

projections if the prices are maintained in to the future.

H1 2016 Financial Review

GoldBridges has reported a gross profit of US$1.0m for H1 2016,

against US$3.3m for H1 2015, with turnover of US$6.8m (H12015

US$12.8m). The figures reflect the time and resources diverted to

the preparation of the underground mine in order to commence

commercial production from the ore bodies 3,8, and 10.

Sekisovskoye produced 3,694 ounces of gold in H1 2016 (H1

2015:8,823 ounces). Gold sold during the period amounted to 5,513

ounces (H1 2015: 10,440 ounces) at an average price of US$1,235/oz

(H1 2014: US$1,231/oz). The average price of sales achieved

includes revenues generated from silver sales in the period, which

are treated as incidental to gold production.

The cash cost (cost of sales excluding depreciation and

provisions) for the period was US$1,201/oz (H1 2014: US$682/oz).

The increase in the cost of production is to expected given the low

level of production.

Administrative costs were reviewed at both head office and at

subsidiary level with savings being made by the reduction of

professional costs at head office and significant savings being

made in relation to wages and salaries at subsidiary level.

Capital expenditure totalled US$4.7m in H1 2016 (H1 2015:

US$4.1m). The main item of capital expenditures were the costs

associated with the tailings dam, drilling equipment and

trucks.

As of 30 June 2016, the Company had cash of US$4.9m. During the

period the Company has repaid two tranches of debt in relation to

the EBRD loan, an amount of US$5.0m remains outstanding. This

amount is repayable over 6 quarterly instalments. The Company has

sufficient cash resources to operate at the current time and, it is

expected more significant revenues are to be generated from

production towards the end of H2 2016. In addition to the monies

raised in H1 2016, the Company received a short term loan from

Amrita Investments Limited (a company associated with the major

shareholder) of US$1m, to further aid cash requirements.

Aidar Assaubayev

Chief Executive Officer

31 August 2016

GOLDBRIDGES GLOBAL RESOURCES PLC

Consolidated income statement

Six months ended Six monthsended Year ended31

30 June 2016 30 June2015 December2015

(unaudited) (unaudited) (audited)

Note US$'000 US$'000 US$'000

Revenue 6,811 12,846 24,054

Cost of sales (5,758) (9,534) (19,763)

Gross profit 1,053 3,312 4,291

Administrative (2,390) (4,094) (9,762)

expenses

Impairments - 737 674

reversed

Operating loss (1,337) (45) (4,797)

Finance income - - -

Foreign (883) (173) (5,718)

exchange

loss

Finance Expense (323) (244) (1,235)

Loss before (2,543) (462) (11,750)

taxation

Taxation (8) 35 1,532

Loss attributable

to (2.551) (427) (10,218)

equity

shareholders

Loss per

ordinary

share

Basic & diluted 2 (0.1c) (0.02c) (0.4c)

(US cent)

GOLDBRIDGES GLOBAL RESOURCES PLC

Consolidated statement of comprehensive income

Six months ended Six monthsended Year ended31

30 June 2016 30 June2015 December2015

(unaudited) (unaudited) (audited)

(unaudited)

US$'000 US$'000 US$'000

Loss)for the period/year (2,551) (427) (10,218)

Currency translation

differences arising 141 (931) (34,577)

on translations of

foreign operations

items which will or may

be reclassified

to profit or loss

Currency translation - - 4,574

differences

arising on translation

of foreign operations

relating to taxation

Total comprehensive loss

for the period/year (2,410) (1,358) (40,221)

attributable to equity

shareholders

GOLDBRIDGES GLOBAL RESOURCES PLC

Consolidated statement of financial position

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2016 2015 2015

Notes (unaudited) (unaudited) (audited)

US$'000 US$'000 US$'000

Non-current assets

Intangible asset 3 9,632 18,530 9,887

Property, plant 4 36,688 63,154 35,134

and equipment

Inventories 499 - 604

Other receivables 2,237 1,336 1,337

Deferred tax asset 5,145 2,360 5,145

Restricted cash 137 249 137

54,338 85,629 52,244

Current assets

Inventories 1,790 11,590 3,223

Trade and other 2,649 9,783 2,649

receivables

Cash and cash 4,863 2,307 1,084

equivalents

9,302 23,680 6,956

Total assets 63,640 109,309 59,200

Current liabilities

Current tax payable - (463) (191)

Trade and other (5,049) (14,635) (9,298)

payables

Other financial (332) (326) (297)

liabilities

Provisions (218) (378) (247)

Borrowings (6,107) (3,333) (6,676)

(11,706) (19,135) (16,709)

Net (2,404) 4,545 (9,753)

current

(liabilities)/assets

Non-current liabilities

Other financial (396) (438) (537)

liabilities

Provisions (3,530) (7,472) (3,553)

Borrowings (12,017) (5,000) -

(15,943) (12,910) (4,090)

Total liabilities (27,649) (32,045) (20,799)

Net assets 35,991 77,264 38,401

Equity

Called-up share capital 5 3,886 3,886 3,886

Share premium 141,918 141,918 141,918

Merger reserve (282) (282) (282)

Currency translation (47,276) (18,345) (47,417)

reserve

Accumulated loss (62,255) (49,913) (59,704)

Total equity 35,991 77,264 38,401

The financial information was approved and authorised for issue

by the Board of Directors on 31 August 2016 and was signed on its

behalf by:

Aidar Assaubayev

Chief Executive Officer

GOLDBRIDGES GLOBAL RESOURCES PLC

Consolidated statement of changes of equity

For the six months

ended 30 June 2016

Share capital Share premium Merger reserve Currency translation Accumulated losses Total

reserve

Unaudited US$'000 US$'000 US'000 US$'000 US$'000 US$'000

At 1 January 2016 3,886 141,918 (282) (47,417) (59,704) 38,401

Loss for the period - - - - (2,551) (2,551)

Exchange differences - - - 141 - 141

on translating

foreign operations

Total comprehensive loss - - - 141 (2551) (2,410)

for the period

At 30 June 2016 3,886 141,918 (282) (47,276) (62,255) 35,991

For the six months

ended 30 June 2015

Share capital Share premium Merger reserve Currency translation reserve Accumulated losses Total

Unaudited US$'000 US$'000 US'000 US$'000 US$'000 US$'000

At 1 January 2015 3,702 137,234 (282) (17,414) (49,486) 73,754

Loss for the period - - - - (427) (427)

Exchange differences - - - (931) - (931)

on translating

foreign operations

Total comprehensive loss - - - (931) (427) (1,358)

for the period

Shares issued 184 4,968 - - - 5,152

Issue costs - (284) - - - (284)

At 30 June 2015 3,886 141,918 (282) (18,345) (49,913) 77,264

For the year ended

31 December 2015

Share capital Share premium Merger reserve Currency translation reserve Accumulated losses Total

Audited $'000 $'000 $'000 $'000 $'000 $'000

At 1 January 2015 3,702 137,234 (282) (17,414) (49,486) 73,754

Loss for the year - - - - (10,218) (10,218)

Other comprehensive loss - - - (30,003) - (30,003)

Total comprehensive - - - (30,003) (10,218) (40,221)

loss for the year

Shares issued 184 4,968 - - - 5,152

Issue costs - (284) - - - (284

At 31 December 2015 3,886 141,918 (282) (47,417) (59,704) 38,401

GOLDBRIDGES GLOBAL RESOURCES PLC

Consolidated cash flow statement

Six months ended Six months ended Year ended

30 June 2016 30June 2015 31December

2015

(unaudited) unaudited (audited)

Note US$'000 US$'000 US$'000

Net 8 (3,496) 1,867 8,183

cash

(outflow)/inflow

from

operating

activities

Investing

activities

Purchase of (2,574) (4,123) (9,639)

property,

plant

and equipment

Advances (900) - -

paid for

equipment

Restricted cash - 5 -

Net cash used

in investing (3,474) (4,118) (9,639)

activities

Financing

activities

Proceeds - 5,152 5,152

on issue

of shares

Issue costs - (284) (284)

Loans received 13,000 - -

Loans repaid (1,667) (1,667) -

Interest paid (584) (327) (3,990)

Net cash flow

from 10,749 2,874 878

financing

activities

Increase/(Decrease)

in cash 3,779 623 (578)

and

cash equivalents

Foreign currency

translation - - (22)

Cash and cash

equivalents

at 1,084 1,684 1,684

the beginning

of the year

Cash and cash

equivalents 4,863 2,307 1,084

at end of

the year

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information

Basis of preparation

General

GoldBridges Global Resources Plc is registered and domiciled in

England and Wales.

The interim financial results for the period ended 30 June 2016

are unaudited. The financial information contained within this

report does not constitute statutory accounts as defined by Section

434(3) of the Companies Act 2006.

This interim financial information of the Company and its

subsidiaries ("the Group") for the six months ended 30 June 2016

has been prepared on a basis consistent with the accounting

policies set out in the Group's consolidated annual financial

statements for the year ended 31 December 2015. It has not been

audited, does not include all of the information required for full

annual financial statements, and should be read in conjunction with

the Group's consolidated annual financial statements for the year

ended 31 December 2015. The 2015 annual report and accounts, as

filed with the Registrar of Companies, received an unqualified

opinion from the auditors.

The financial information is presented in US Dollars and has

been prepared under the historical cost convention.

The same accounting policies, presentation and method of

computation are followed in this consolidated financial information

as were applied in the Group's latest annual financial statements

except that in the current financial year, the Group has adopted a

number of revised Standards and Interpretations. However, none of

these have had a material impact on the Group.

In addition, the IASB has issued a number of IFRS and IFRIC

amendments or interpretations since the last annual report was

published. It is not expected that any of these will have a

material impact on the Group.

Going concern

The current cash position is sufficient to cover ongoing

operating and administrative expenditure for the next 12

months.

During the period the Company secured an additional US$12m

(gross), from the issue of convertible bonds. The Directors

consider this together with income from the Group's producing

assets to be sufficient to cover the expenses of running the

Group's business for the foreseeable future.

In terms of financing the underground development, the Company

is in detailed discussions with various other parties regarding

potential financing for completion of the expansion, and is keen to

continue these discussions. However, with African Resources'

commitment to fund some or all of the underground expansion project

capital expenditure, the Company is continuing its underground

expansion activities and is confident in project development.

The Company has therefore adopted the going concern basis in the

preparation of these financial statements.

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information (continued)

Directors Responsibility Statement and Report on Principal Risks

and Uncertainties

Responsibility statement

The Board confirms to the best of their knowledge:

The condensed set of financial statements have been prepared in

accordance with IAS 35 Interim Financial Reporting as adopted by

the EU;

The interim management report includes a fair review of the

information required by:

DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the condensed

set of financial statements; and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

DTR 4.2.8R of the Disclosures and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

the period; and any changes in the related party transactions

described in the last annual report that could do so.

The Company's management has analysed the risks and

uncertainties and has in place control systems that monitor daily

the performance of the business via key performance indicators.

Certain factors are beyond the control of the Company such as the

fluctuations in the price of gold and possible political upheaval.

However, the Company is aware of these factors and tries to

mitigate these as far as possible. In relation to the gold price

the Company is pushing to achieve a lower cost base in order to

minimise possible downward pressure of gold prices on

profitability. In addition, it maintains close relationships with

the Kazakhstan authorities in order to minimize bureaucratic delays

and problems.

Risks and uncertainties identified by the Company are set out on

page 8 and 9 of the 2015 Annual Report and Accounts and are

reviewed on an ongoing basis. There have been no significant

changes in the first half of 2016 to the principal risks and

uncertainties as set out in the 2015 Annual Report and Accounts and

these are as follows:

-- Fiscal changes in Kazakhstan

-- Not being awarded the subsoil production mining licence for

Karasuyskoye

-- No access to capital / funding for Sekisovskoye or Karasuyskoye

-- Commodity price risk

-- Currency risk

-- Changes to mining code in Kazakhstan

-- Reliance on operating in one country

-- Reliant on one operating mine

-- Cost (capex and operating cost) inflation

-- Technical difficulties associated with developing the underground mine

at Sekisovskoye

-- Technical difficulties associated with increasing the Sekisovskoye

processing plant

-- Exploration work being underwhelming at Karasuyskoye

-- Failure to achieve production estimates

-- Russian political issues

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information (continued)

2. Loss per ordinary share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period. The

weighted average number of ordinary shares and retained loss for

the financial period for calculating the basic loss per share for

the period are as follows:

Six months ended Six monthsended Year ended31

30 June 2016 30June 2015 December2015

(unaudited) (unaudited) (audited)

The basic weighted

average 2,334,342,130 2,261,225,463 2,298,284,596

number of ordinary

shares in issue

during

the period

The loss for

the period (2,551) (427) (10,218)

attributable

to

equity shareholders

(US$'000s)

3. Intangible assets

US$'000

Cost

1 January 2015 20,736

Currency translation adjustment (429)

30 June 2015 20,307

Currency translation adjustment (9,168)

31 December 2015 11,139

Currency translation adjustment 28

30 June 2016 11,167

Accumulated amortisation

1 January 2015 1,296

Charge for the period 526

Currency translation adjustment (45)

30 June 2015 1,777

Charge for the period 326

Currency translation adjustment (851)

31 December 2015 1,252

Charge for the period 273

Currency translation adjustment 13

30 June 2016 1,538

Net book values

30 June 2015 18,530

31 December 2015 9,887

30 June 2016 9,629

The intangible assets relate to the historic geological

information pertaining to the Karasuyskoye Ore Fields. The Ore

Fields are located in close proximity to the current open pit and

underground mining operations of Sekisovskoye.

In May 2016 the Company was awarded subsoil user rights to

Karasuyskoye by the Ministry of Investments and Development in

Kazakhstan. The subsoil user rights allows the Company to perform

further exploration work in order to complete a wok program which

will need to be submitted to the authorities for approval. The work

program is currently being finalised for submission to the

appropriate authorities.

The intangible asset is to be reclassified as exploration and

evaluation expenditure.

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information (continued)

4. Property, plant and equipment

Mining Freehold Plant, Assets under Total

properties land and Equipment construction

and leases buildings fixtures

and

US$000 fittings US$000 US$000

US$000 US$000

Cost

1 January 16,541 15,434 26,893 29,414 88,282

2015

Additions 119 616 1,964 1,869 4,568

Disposals - - (4) (25) (29)

Transfers - 255 64 (319) -

Currency (172) (324) (536) 273 (759)

translation

adjustment

30 June 16,488 15,981 28,381 31,212 92,062

2015

Additions - 594 92 4,582 5,268

Additions (15) - (182) - (197)

reclassified

Disposals (863) - (292) - (1.155)

Disposals 4 4

reclassified

Transfers - (255) (64) 319 -

Currency (7,220) (7,240) (12,461) (16,698) (43,619)

translation

adjustment

31 December 8,390 9,080 15,474 19,419 52,363

2015

Additions - - 1,947 888 2,835

Disposals - - (138) - (138)

Transfers - - - - -

Currency 9 16 26 32 83

translation

adjustment

30 June 8,399 9,096 17,309 20,339 55,143

2016

Accumulated

depreciation

1 January 3,432 6,046 17,566 - 27,044

2015

Charge for 200 671 1,613 - 2,484

the period

Disposals - - 2 - 2

Transfers - - 15 - 15

Currency (71) (131) (453) - (637)

translation

adjustment

30 June 3,561 6,586 18,761 - 28,908

2015

Charge for 225 465 1,050 - 1,740

the period

Disposals - - (98) - (98)

Currency (1,665) (3,062) (8,594) - (13,321)

translation

adjustment

31 December 2,121 3,989 11,119 - 17,229

2015

Charge for 43 355 890 - 1,288

the period

Disposals - - (113) - (113)

Transfers - - - - -

Currency 4 15 32 - 51

translation

adjustment

30 June 2,168 4,359 11,928 - 18,455

2016

Net Book

Values

1 January 13,109 9,388 9,327 29,414 61,238

2015

30 June 12,927 9,395 9,620 31,212 63,154

2015

31 December 6,269 5,091 4,355 19,419 35,134

2015

30 June 6,231 4,737 5,381 20,339 36,688

2016

The additions in the period principally relate the continuing

works associated with the underground mine in relation to

development of the declines, ventilation shafts and other

associated works.

5. Share capital

Number US$000

1 January 2015 2,211,342,130 3,702

Issued during the year

Share placement 123,000,000 184

31 December 2015 & 2,334,342,130 3,886

30 June 2016

6. Reserves

A description and purpose of reserves is given below:

Reserve Description and purpose

Share capital Amount of the contributions

made by shareholders

in return for the issue of shares.

Share premium Amount subscribed for share capital

in excess of nominal value.

Merger Reserve Reserve created on application of merger

accounting under a previous GAAP.

Currency translation reserve Gains/losses arising on re-translating

the net assets

of overseas operations into US Dollars.

Accumulated losses Cumulative net gains and

losses recognised in the

consolidate statement

of financial position.

GOLDBRIDGES GLOBAL RESOURCES PLC

Notes to the consolidated financial information (continued)

7. Related party transactions

Remuneration of key management personnel

The remuneration of the Directors, who are the key management

personnel of the Group, is set out below in aggregate for each of

the categories specified in IAS 24 - "Related Party

Disclosures".

Six months ended Six monthsended Year toDecember2015

30 June 2016 30June 2015

US$ US$ US$

Short term 185,543 229.668 522,084

employee

benefits

Other - - -

185,543 229,668 522,084

Social security 13,610 7,142 30,392

costs

199,153 236,810 552,476

During the period the company entered into the following

transactions with companies in which the Assaubayev family have a

controlling interest:

-- A short term loan was made by Amrita Investments Limited to the

Company of US$1m, this amount is still outstanding as at 30 June

2016.

-- An amount of US$6,000 was incurred in purchasing consumables with Asia

Mining Group, (H1 2015 US$795,000).

-- An amount of US$179,000 was incurred in rental costs during the

period, (H1 2015: US$253,000)

An amount of US$687,000 (H1 2015 US$2.6m) is outstanding and is

included within trade payables.

The transactions incurred by the Company were on normal

commercial terms.

8. Notes to the cash flow statement

Net Six months Six Year

cash (outflow)/inflow ended 30 June 2016 monthsended ended

from (unaudited) 30 31December2015(audited)US

operating activities US$000's June2015(unaudited)US$000's $000's

Loss before taxation (2,543) (45) (11,750)

Adjusted for

Finance expense 323 (245) 1,235

Depreciation of tangible 1,228 2,510 4,224

fixed assets

Amortisation of 273 517 852

intangibles

Change in provisions - (737) (2,618)

Decrease/(increase) 1.523 (708) 5,042

in inventories

Decrease in trade 52 2,432 5,338

receivables

Decrease in other (177) - (272)

financial

liabilities

(Decrease)/increase (4,884) (1,441) 363

in trade

and other payables

Loss/(profit) 25 (94) 236

on disposal

of property, plant and

equipment

Foreign currency 883 (357) 5,718

translation

Cash (outflow)inflow (3,297) 1,832 8,368

from operations

Income taxes paid (199) 35 (185)

(3,496) 1,867 8,183

9. Events after the balance sheet date

There were no significant post balance sheet events to

report.

This report will be available on our website at

www.goldbridgesplc.com

GOLDBRIDGES GLOBAL RESOURCES PLC

Company information

Directors Kanat Assaubayev Chairman

Aidar Assaubayev Chief executive officer

Sanzhar Assaubayev Executive director

Ashar Qureshi Non-executive director

Neil Herbert Non-executive director

Alain Balian Non-executive director

Secretary Rajinder Basra

Registered office Company number : 05048549

and number 28 Eccleston Square

London

SW1V 1NZ

Telephone: +44

208 932 2455

Company website

www.goldbridgesplc.com

Kazakhstan office 10 Novostroyevskaya

Sekisovskoye Village

Kazakhstan

Telephone: +7 (0)

72331 27927

Fax: +7 (0) 72331 27933

Auditor BDO LLP,

55 Baker Street,

London W1U 7EU

Registrars Neville Registrars

18 Laurel Lane

Halesowen

West Midlands B63 3DA

Telephone: +44 (0)

121 585 1131

Bankers NatWest Bank plc

London City Commercial

Business Centre

7th Floor, 280 Bishopsgate

London

EC2M 4RB

LTG Bank AG

Herrengasse 12

FL-9490, Vaduz

Principal of Liechtenstein

View source version on businesswire.com:

http://www.businesswire.com/news/home/20160831006275/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

September 01, 2016 02:00 ET (06:00 GMT)

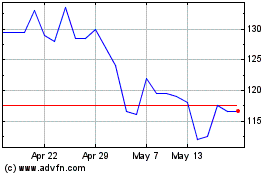

Altyngold (LSE:ALTN)

Historical Stock Chart

From May 2024 to Jun 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jun 2023 to Jun 2024