TIDMGBGR

29 April 2016

GoldBridges Global Resources Plc

("GoldBridges" or the "Company")

Results for the year ended 31 December 2015

GoldBridges, the underground gold mining and development

company, is pleased to announce its 2015 results.

Highlights

Company Highlights

-- Detailed plans developed internally using advice from external

consultants leading to a revised approach to the development of

the

mine and a reduction in capex requirement. Expansion capex now

reduced

to an external funding requirement of US$20-US$30m, of which

US$10m

was raised in 2016.

-- Approximately 570m of development undertaken on second transportation

decline to date.

-- Transportation decline on track for completion by May 2016, allowing

an underground production run rate of 500,000 t/ year.

-- The Company is actively pursuing the balance of funds, the expected

requirement is in H2 2017.

Financial Highlights

-- 20,890 oz of gold sold (2014: 27,959oz), a reduction of 7,069oz.

-- Turnover decreased in the year to US$24m (2014: US$35.2m), principally

a reflection of the time and resources spent on the development

of the

underground workings.

-- Decrease in finished gold stockholding to 1,819oz (2014: 7,307oz), a

reflection of decreased production.

-- Average gold price achieved (including silver as a by-product),

US$1,151/oz, (2014: US$1,258/oz).

-- Adjusted EBITDA (Earnings before interest, tax, depreciation and

amortisation), of US$(2.3m) (2014: positive US$5.3m).

-- Loss of US$10.2m (2014: US$(0.25m)), and a total comprehensive loss to

include exchange differences of US$(40m) (2014: US$(9m)).

-- Equity raising of US$5.1m completed in April 2015.

-- Net asset value decreased as the Kazakh Tenge devalued against the US

dollar - however, no practical impact on the Company's

value.

Operational Highlights

-- Gold poured 15,534oz, (2014: 32,994oz) a 52.9% decrease year-on-year,

principally due to the winding down of the open pit and

development of

the underground.

-- Gold grade 1.12g/t, (2014: 1.81g/t). The reduction is a reflection of

the processing of the lower grade ore from the open pit and use

of low

grade ore stock piles, in order to maximise throughput while

the

underground developments continue.

-- Cash cost of production US$837/oz (2014: US$834/oz).

-- Gold recovery rate 76.04% (2014: 83.3%) was due to variable grade and

ore composition. Recovery is expected to increase again to over

80%

after plant improvements.

Aidar Assaubayev, CEO of GoldBridges, commented:

"While our gold production from Sekisovskoye fell year on year,

we regard 2015 as a successful year of transition for GoldBridges.

Our open pit mine wound down and is set to close, as planned, and

we are pleased to report that significant progress has been made in

developing our new underground mine. This operation will secure our

long term future and we expect our gold production to begin to

increase again in H2 2016. "

For further information please contact:

GoldBridges Global Resources Plc Louise Wrathall+44 (0) 207 932

2456

Cantor Fitzgerald Europe Stewart Dickson+44 (0) 207 894 7000

Information on the Company

GoldBridges is a gold mining, exploration and development group

based in Kazakhstan. Whilst the Company was initially established

to exclusively develop and operate the Sekisovskoye gold and silver

mine in the East Kazakhstan Region, it is now actively targeting

additional gold mining opportunities in Kazakhstan. This includes

the adjacent prospective Karasuyskoye Ore Fields, on which

GoldBridges was recently awarded the tender to perform further

confirmatory testing in order to gain the sub-soil user

licence.

The Company holds a 100 per cent shareholding in DTOO

Gornorudnoe Predpriatie Sekisovskoye ("DGPS") which holds a subsoil

use contract in relation to the Sekisovskoye deposit, covering a

total area of 0.855km². The subsoil use contract for Sekisovskoye

is valid until 2020 and the Company currently intends to seek to

extend the contract in accordance with its terms. The Company also

holds a 100 per cent shareholding in DTOO Altai Ken-Bayitu LLP

which owns and operates the processing plant at the Sekisovskoye

deposit. The Sekisovskoye deposit is located at the village of

Sekisovka, approximately 40km north of the town of Ust-Kamenogorsk,

the capital city of the East Kazakhstan Region.

The company is in transition moving from open pit production to

underground development of the mine. The operations are expected to

be fully underground from H2 2016 onwards.

As at 31 May 2014, the Company's proven and probable reserves

consisted of 2.3Moz of gold and 3.0Moz of silver, and the Company's

measured, indicated and inferred resources consisted of 5.1Moz of

gold and 3.5Moz of silver, in each case as classified in accordance

with JORC.

In the year ended 31 December 2015, the Company's consolidated

revenue was US$24million and its EBITDA was US$(2.3) million.

Chairman's Statement

During the year, we continued with the move from the open pit

gold mine at Sekisovskoye to a solely underground operation, and

this process is to be completed in the near term. Mid-year, we

announced our decision to access our substantial gold reserves by

developing a decline underground, rather than by sinking a shaft as

described in the Venmyn Deloitte CPR that we released in November

2014.

In that report, the overall capital expenditure (capex) outlay

was estimated to be US$130m for the shaft based solution. Based on

our current plans, the overall capex requirement to achieve

100,000oz of production in three years is now only estimated to be

US$42m, of which only US$20-US$30m needs to be externally funded.

US$10m of this total has already been successfully raised.

As previously announced, GoldBridges has already commenced

development of the new transportation decline, improving access to

its significant deeper gold reserves. Development of the decline is

well underway.

Construction of the portal in the open pit, which is in the

process of being closed, has already commenced. As part of the

preparation of the underground mine for more extensive mining in

2016, the company is in the process of sourcing the capital

equipment required from various providers. It will include the

purchase of larger 30 tonne underground trucks, a load-haul-dumper

and associated equipment. A drilling rig is already commissioned

for underground works. On completion of the second decline

development, the company will have the capacity to significantly

increase gold production from Sekisovskoye. This is expected to

have a marked effect on production in H2 2016.

Unsurprisingly, our gold production fell from 32,994oz in 2014

to 15,534oz in 2015 as the open pit part of Sekisovskoye wound down

and is expected to close.

In April 2015, we announced a successful capital raising of

GBP3.4m (US$5.1m), through the placing of 123m new shares at a

price of 2.8p/share, and we thank our existing and new shareholders

for their support and belief in our business. The net proceeds of

this placing have been used to fund working capital and the

expansion of our underground mine.

In terms of the gold market, we have witnessed another

challenging year as the gold price fell by around US$200/oz during

the course of 2015, putting more pressure on higher cost producers.

Currently the gold price is in the range of US$1,200-1,250oz.

Fortunately for Kazakh mine operators, our local currency, the

Tenge, fell from around 182KZT to 339KZT to the US dollar in 2015

and has further weakened to current levels of about 340KZT to the

US dollar. This devaluation was due to the National Bank of

Kazakhstan taking the decision to allow the currency to float. This

was as a result of weakening currencies of some of Kazakhstan's key

trading partners, such as China and Russia, and the National Bank

of Kazakhstan will now target inflation rate control rather than

its currency valuation. Given that a significant portion of our

operating costs are Tenge denominated, while the sales of gold are

linked to US dollar prices, this has aided us in lowering costs in

US dollar terms.

With recent currency based developments in mind, we continue to

believe that we are located in the right country in terms of our

gold operations, and will continue to focus on Kazakhstan and other

neighbouring Central Asia countries for our business development

going forwards. Kazakhstan is immensely resource rich, has a

motivated and able mining workforce, and is becoming even more cost

effective. Changes to mining code are underway with the overarching

aim to attract more direct foreign investment in the country. All

in all, we continue to see a strong natural resources long term

future in Kazakhstan, notwithstanding near term difficulties faced

by weaker commodity prices.

Finally, may I thank all our employees and our Management team

for their hard work and also thank our shareholders for their

continued support.

Kanat Assaubayev

Chairman

Chief Executive Officer and Operational Review

Overview

(MORE TO FOLLOW) Dow Jones Newswires

April 29, 2016 11:22 ET (15:22 GMT)

During 2015, our operational performance at Sekisovskoye was

affected by the winding down of our open pit operations and the

management and team re-focusing on developing the decline to access

our higher grade underground reserves. This necessitated the

closure of operations for 2 months at the ore mining facility. This

was required in order to make modifications and upgrades to

transition to the underground operation. Our reduced gold

production together with the lower global price of gold has led

inevitably to a decrease in revenue, however we have maintained

tight control of costs, which will have a positive impact as the

Company revenue increases in the medium term. Management has taken

the opportunity to review the assets and operations and made

impairments as necessary.

Expansionary capex significantly reduced

Many of our achievements during 2015 were focussed on the

continued development of our underground mine. As previously

discussed, during 2015 we made the decision to develop a decline

underground rather than to sink a shaft to access our higher grade

gold reserves at depth. To that end, we re-developed our

underground mining access approach and, in early 2016, reported

that we had finalised our new capital expenditure budget. In order

to expand and further develop our underground mine, expand our

processing plant and to produce 100,000oz of gold annually, we will

need to spend US$42m excluding contingency.

This is a marked decrease on the US$130m estimated in our 2014

Venmyn Deloitte competent person's report, which assumed we would

sink a shaft to access our reserves.

Of the US$42m expansionary capital expenditure required,

GoldBridges only requires external financing of between US$20m and

US$30m, as the remainder is expected to be generated from

operational cash flows.

Our supportive shareholder, African Resources, which is

indirectly owned by members of the Assaubayev family, has agreed to

finance the development of the underground mine if other sources of

funding are unsuitable. To that end, in February 2016, African

Resources bought US$10m of five year, 10% coupon convertible bonds

that can be redeemed at over 3p/share, a significant premium to the

current share price. This demonstrates the family's continued

support.

Projected capital expenditure, underground operation (US$m)

Total 2016 2017 2018 2019 2020

Development capex 46.0 14.6 16.2 10.2 2.5 2.5

Prospecting drilling 4.0 0.9 - 0.1 1.5 1.5

Underground development 4.4 0.8 1.1 0.6 0.9 1.0

Infrastructure 1.3 1.3 - - - -

Ore handling facilities 20.6 10.4 7.6 2.6 - -

Process plant expansion and 12.0 - 6.0 6.0 - -

paste plant construction

Contingency 3.7 1.2 1.5 0.9 0.1 -

Underground mine development

In terms of decline development, significant progress was made

in 2015 and early 2016. To date, a total of approximately 570m of

development work has been undertaken on the new transportation

decline. Also, construction of the portal has already commenced,

with completion expected in May 2016.

By completing the initial development works of the new decline

in May 2016, the Company expects to reduce the current haulage

distance from 3km to 1.2km and to increase the ore throughput

capacity to 45,000 tonnes per month. This should enable the company

to mine at an annualised run rate of 500,000 tonnes per year from

May 2016.

Work undertaken by Mining Plus

In H2 2015, Mining Plus, the international mine consultancy

group, was retained by GoldBridges to undertake studies on the

underground mining plans and to assist it in transitioning its

Sekisovskoye mine into a large underground gold operation with

100,000oz annual output.

Mining Plus has expertise in geological modelling and

geotechnical aspects for hard rock underground mines, combined with

underground mine planning experience, particularly using decline

haulage. It has offices in Australia, Canada and Peru and provides

mining expertise from the conceptual stage of projects, through to

feasibility study work, project delivery, commissioning, and mine

closure.

Under the scope of this assignment, Mining Plus re-modelled the

Sekisovskoye drilling data and reviewed all mining methods that

could potentially be applicable to the underground mine development

at Sekisovskoye. The studies had important findings. Firstly,

Mining Plus identified that, while several mining methods are

applicable at Sekisovskoye, the most efficient methods in terms of

mining recovery, dilution and costs are long hole open stoping

methods with either paste fill or with cemented aggregate fill.

Both mining methods provide high selectivity and sequencing

flexibility, giving GoldBridges the opportunity to extract higher

grade ore earlier in the schedule. Secondly, the Mining Plus work

identified the opportunity to increase the overall head grade of

the ore mined by selectively mining the deposit, giving the Company

increased flexibility.

These findings mean that GoldBridges could further reduce its

cash cost of operation at full production, as it has the option of

mining fewer tonnes at a higher grade. This could enhance the value

of the project, over and above the US$226m that was estimated by

Venmyn Deloitte in November 2014 using a gold price of US$1,100/oz

and a 9.3% discount rate.

Sekisovskoye gold mine - Our operational track record

The operational performance of the Company's Sekisovskoye gold

mine during 2015, against the prior year, is provided below. The

key operational statistics of the mine operation are as

follows:

2015 2014

Ore mined T 339,111 570,991

Gold grade g/t 1.06 1.26

Silver grade g/t 2.03 1.89

Contained gold oz. 11,595 23,050

Contained silver oz. 22,139 34,620

2015 2014

Ore mined T 79,276 82,045

Gold grade g/t 2.55 2.96

Silver grade g/t 3.7 4.05

Contained gold oz. 6,492 7,807

Contained silver oz. 9,441 10,680

Mining processing

2015 2014

Crushing T 570,949 726,427

Milling T 566,664 728,620

Gold grade g/t 1.12 1.71

Silver grade g/t 2.25 2.37

Gold recovery % 76.04 83.3

Silver recovery % 64.91 74.4

Contained gold oz. 20,428 39,798

Contained silver oz. 40,994 55,603

Gold poured oz. 15,534 32,994

Silver poured oz. 26,608 41,390

Total gold production for 2015 was 15,534oz. This is a 53%

reduction on the 2014 gold output of 32,994oz. This result reflects

the winding down and closure of the open pit mine at Sekisovskoye,

while the Company's efforts were focused on increasing its

underground development in order to increase underground gold

production for the future.

In total, 566,664 tonnes of ore were milled (2014: 728,620

tonnes), of which 79,276 tonnes or 14% were mined from the

underground operation. This compares to 82,045 tonnes or 11% in

2014.

The average gold grade of ore milled during 2015 was 1.12g/t

(2014: 1.81g/t), and comprised ore mined at an average grade of

1.06g/t from the open pit mine and 2.55g/t from the underground

mine. Open pit gold grades were lower than the 1.26g/t achieved in

2014 due to the exhaustion of the open pit economic reserves. Gold

grades are expected to increase in 2016 and onwards as the

production from Sekisovskoye is solely from the higher grade

reserves of the underground mine.

At 76.04% and 64.91% respectively, both gold and silver

recoveries were lower than 2014. This was related to lower

recoveries experienced predominantly in H1 2015 as a result of

variable grade and ore composition and also reflected plant

improvement works undertaken during the period.

As the proportions of sulphidic minerals in the ore and the

amount of gold in fine grains increases during underground mining,

the characteristics of the free gold generally improve, and some

changes were made to the ore process in the plant to reflect this.

The work was largely related to introducing a fuller gravity

circuit into the operational process. This processing route

consists of jigs, washers and centrifugal concentrators and

refining this part of the process allows the plant to recover the

finer grained gold particles from this circuit. This material is

then processed in line with the Company's standard processing

procedure. Additionally, the technology will enable the Company to

reduce its consumption of key reagents, in particular cyanide and

calcium hypochlorite. Gold and silver recoveries are projected to

be at around 84% for the life of the operation.

Financial performance review 2015

The transition to a fully operational underground mine has been

delayed from that previously anticipated as a number of development

and mining options were assessed by management to ascertain the

optimal approach in terms of efficiency and cost. During the period

under review, the underground ore was mixed with lower grade open

pit ore and stockpiled ore. This blending of the ore led in part to

a lower recovery. In the future, as the mine moves to the

processing of only higher grade underground ore, this is not

anticipated to be an issue. This combined with interruptions to

processing due to the plant upgrade led to a lower production

achievement in 2015. As the underground mine becomes operational in

H2 2016 at its enhanced capability level, with the new mining

equipment the production is expected to be back on track and begin

to increase.

(MORE TO FOLLOW) Dow Jones Newswires

April 29, 2016 11:22 ET (15:22 GMT)

The other principal impact on the results for the year arises

due to the devaluation of the Kazakh Tenge against the US Dollar.

The impact in the year has been on the asset values in the

subsidiaries, in order to reflect the devaluation of the currency.

In the accounts of the companies in Kazakhstan, it has been

necessary to revalue the assets using the much lower value of the

Tenge against the Dollar. This is no way reflects the commercial

value of the Company, as the revenue generating ability of the

assets is unchanged. Indeed, there is a positive impact as the

earnings are generated in US Dollars with a significant proportion

of the cost base payable in Tenge.

The Company has reported a net loss of US$10.2m (2014: US$0.3m),

with a gross profit of US$4.3m (2014: US$7.2m) and an operating

loss of US$4.8m (2013: US$0.8m).

During 2015, Sekisovskoye poured 15,534oz of gold (2014:

32,994oz). A total of 20,890oz (2014: 27,959oz) were sold in 2015

at an average price of US$1,157/oz (2014: US$1,258/oz). Revenue

totalled US$24.m (2014: US$35.2m) and was lower than 2014 due

principally to reduced gold sales as the Company focused its

efforts on developing the underground mine. The principal purchaser

of the gold dore was the Kazakhstan government, as last year.

The total cash cost of sales, which includes administrative

costs but excludes depreciation and provisions, amounted to

US$1,263/oz, (2014: US$1,084/oz). The production cash cost amounts

to US$837/oz (2014: US$834/oz). This is based on the cost of sales

excluding depreciation and administrative expenses, and exceptional

items. The earnings before interest, tax and depreciation,

(EBITDA), excluding exceptionals, amounted to negative US$2.3m

(2014: US$5.3m). Due to this transition and low level of production

in the current year, the results are not regarded as typical of the

operation.

Depreciation is US$4.2m (2014: US$5.4m). Amortisation is

US$852,000 (2014: US$1.3m) and this relates to amortising the value

of Karasuyskoye data purchased in 2013. This charge will be

reviewed on successful receipt of the sub-soil user contract. The

Company is currently in the final committee stages and the licence

is expected to be awarded in 2016.

The Company has reported net cash inflow from operating

activities of US$7.8m. This was higher than the US$5.6m reported in

2014 due principally to recoveries in relation to VAT and Akmola

receivable in the year.

Purchase of property plant and equipment of US$8.8m (2014:

US$2.6m) reflects the Company's increased capital spend on the

migration of operations from open-pit to a solely underground

mine.

Cash at year-end was US$1.1m. Cash at 31 December 2014 was

US$1.7m. During the year, the Company placed shares, raising equity

amounting to US$5.1m and this was largely spent on capex in the

year.

The Company's principal debts are that owed to The European Bank

for Reconstruction (EBRD), and the convertible loan note recently

issued in 2016. The EBRD loan is set to be paid over twelve equal

quarterly instalments. The repayments commenced in January 2015. At

the current time there are seven instalments remaining amounting to

US$5.8m. In relation to the convertible bond, this is not expected

to impact the cash flow until maturity, at which point it could be

converted into shares.

The consolidated net assets of the Company are US$38.4m (2014:

US$73.8m) and the decrease arises principally from the devaluation

of the functional currency in Kazakhstan, the Tenge, against the US

dollar. This resulted in the assets in Kazakhstan being devalued in

terms of dollars.

Consolidated statement of profit or loss

Year ended 31 December 2015

Notes 2015 2014

US$000 US$000

Revenue 3 24,054 35,177

Costs of sales (19,763) (27,969)

Gross profit 4,291 7,208

Other operating income - 1,141

Administrative expenses (9,762) (8,233)

Tailing dam leak - 330

Listing expenses - (702)

Impairments - (1,214)

Impairment reserved 674 2,227

Operation Profit (4,797) 757

Finance income - 7

Foreign exchange loss (5,718) (1,418)

Finance expense (1,235) (331)

Loss profit before taxation (11,750) (985)

Taxation credit 1,532 730

Loss attributable to equity (10,218) (255)

holders of the parent

Profit per ordinary share

Basic & Diluted 4 (0.4c) (0.01c)

Consolidated statement of profit or loss and other comprehensive

income

Year ended 31 December 2015

2015 2014

US$000 US$000

Loss for the year (10,218) (255)

Currency translation differences arising (34,577) (9,310)

on translations of foreign

operations items that may be reclassified

to profit or loss

Currency translation differences 4,574 737

arising on translation

of foreign operations relating to taxation

Total comprehensive loss attributable (40,221) (8,828)

to equity holders of the parent

Consolidated statement of financial position

Year ended 31 December 2015

2015 2014

Company number 5048549 Notes US$000 US$000

Non-current assets

Intangible assets 5 9,887 19,440

Property, plant and equipment 6 35,134 61,238

Inventory 604 -

Trade and other receivables 1,337 2,553

Deferred tax asset 5,145 2,407

Restricted cash 137 260

52,244 85,898

Current assets

Inventories 3,223 10,882

Trade and other receivables 2,649 10,260

Cash and cash equivalents 1,084 1,684

6,956 22,826

Total assets 59,200 108,724

Current Liabilities

Trade and other payables (9,298) (15,725)

Other financial liabilities (297) (326)

Current tax payable (191) (475)

Provisions (247) (335)

Borrowings (6,676) (3,333)

(16,709) (20,194)

Net current assets/(liabilities) (9,753) 2,632

Non-current liabilities

Other financial liabilities (537) (709)

Provisions (3,553) (7,400)

Borrowings - (6,667)

(4,090) (14,776)

Total liabilities (20,799) (34,970)

Net assets 38,401 73,754

Equity

Called-up share capital 3,886 3,702

Share premium 141,918 137,234

Merger reserve (282) (282)

Currency translation reserve (47,417) (17,414)

Accumulated losses (59,704) (49,486)

Total equity 38,401 73,754

Consolidated statement of changes in equity

Year ended 31 December 2015

Notes Share Capital Share Premium Merger Currency Accumulat-ed Total US$000

US$000 US$000 Reserve Translation Losses

US$000 reserve US$000

US$000

1 2,635 115,594 (282) (8,841) (49,231) 59,875

January

2014

Loss for - - - - (255) (255)

the year - - - (8,573) - (8,573)

Other

comprehensive

loss

Total - - - (8,573) (255) (8,828)

comprehensive

loss

Shares 1,067 22,095 - - - 23,162

issued

on - (455) - - - (455)

conversion

of loan

notes

Issue

costs

31 3,702 137,234 (282) (17,414) (49,486) 73,754

December

2014

Loss for - - - - (10,218) (10,218)

the year - - - (30,003) - (30,003)

Other

comprehensive

loss

Total - - - (30,003) (10,218) (40,221)

comprehensive

loss

Share 184 4,968 - - - 5,152

issued - (284) - - - (284)

Issued

costs

31 3,886 141,918 (282) (47,417) (59,704) 38,401

December

2015

Consolidated statement of changes in cashflows

(MORE TO FOLLOW) Dow Jones Newswires

April 29, 2016 11:22 ET (15:22 GMT)

Year ended 31 December 2015

2015 2014

US$000 US$000

Net cash inflow from operating activities 8,183 5,601

Investing activities - 7

Interest received (9,639) (25,989)

Purchase of property, plant and equipment - (6)

Restricted cash - (651)

Payment of costs associated with provisions

Net cash used in investing activities (9,639) (26,639)

Financing activities

Proceeds on issue of shares 5,152 23,162

Issue costs (284) (455)

Loan from related party - (1,043)

Interest paid (3,990) (750)

Net cash used in investing activities 878 20,914

Decrease in cash and cash equivalents (578) (124)

Foreign currency translation (22) (259)

Cash and cash equivalents at beginning of the year 1,684 2,067

Cash and cash equivalents at the end of the year 1,084 1,684

Notes

1.General information

GoldBridges Global Resources Plc (the "Company") is a Company

incorporated in England and Wales under the Companies Act 2006.

The financial information set out above for the years ended 31

December 2015 and 31 December 2014 does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006, but

is derived from those accounts. Whilst the financial information

included in this announcement has been compiled in accordance with

International Financial Reporting Standards ("IFRS") (as adopted by

the European Union), this announcement itself does not contain

sufficient financial information to comply with IFRS. A copy of the

statutory accounts for 2014 has been delivered to the Registrar of

Companies and those for 2015 will be submitted for approval by

shareholders at the Annual General Meeting. The full audited

financial statements for the years end 31 December 2015 and 31

December 2014 do comply with IFRS.

2.Going concern

The Company is in the advances stages of its plans to move

production from the open pit to the underground operations at

Sekisovskoye. It is expected that the underground mine will be

producing at significantly higher levels from May 2016 onwards, and

will increase again once further development of the decline is

completed. The funding for the initial stage has been obtained from

the corporate bond issued in February 2016. The external debt in

the Company (other than the corporate bond), consists of US$6.7m

payable to EBRD. This amount is repayable by eight equal quarterly

payments of US$833,000 each. As at the date of this report, there

are seven instalments remaining. However, as the Company has

breached certain covenants in relation to the borrowing, the full

amount of the loan is shown as falling due within one year.

The company raised funding of US$10m in February 2016 via a

corporate bond to its parent company, African Resources Limited.

This provided additional working capital to the Company, and also

provides the further capital required to progress the underground

project development. The Company is actively pursuing further

funding to raise the balance of the funds needed to complete the

planned full scale development of the underground mine and the

Directors are confident that further funding can be obtained in the

timescales required to meet the future developmental requirements

of the Company. Should the funding be delayed, or additional

funding is required to cover any unforeseen production shortfalls

and additional working capital requirements arising from the move

to the underground operations or in the event that the EBRD loan is

requested for repayment earlier than scheduled, the parent company

has confirmed its intention to provide further funding to enable

the Company to continue its planned operations for at least twelve

months from the date of approval of the financial statements.

On this basis, the Directors have therefore concluded that is

appropriate to prepare the financial statements on a going concern

basis.

3.Revenue

An analysis of the Company's revenues is as follows:

2015 2014

$000 $000

Sale of gold and silver 24,054 35,177

Included in revenues from sale of gold and silver are revenues

of US$24,017,000 (2014: US$34,049,000) which arose from sales to

the Company's only customer the state refinery Tau-Ken Altyn LLP,

which is located in Astana, Kazakhstan.

4.Loss per ordinary share

The calculation of basic and diluted earnings per share from

continuing operations is based upon the retained loss from

continuing operations for the financial year of US$10.2m (2014:

loss of US$225,000).

The weighted average number of ordinary shares for calculating

the basic loss in 2015 and 2014 is shown below. There were no

potential ordinary shares outstanding at the reporting date (2014:

Nil) and as such basic and diluted earnings are the same.

2015 2014

Basic and diluted 2,298,284,596 2,115,470,650

5.Intangible assets

Total

US$000

Cost 27,500

1 January 2014 (2,532)

Adjustments* (4,232)

Translation difference

31 December 2014 & 1 January 2015 20,736

Translation difference (9,597)

31 December 2015 11,139

Amortisation 343

1 January 2014 1,023

Charge for the year (70)

Adjustments*

31 December 2014 & 1 January 2015 1,296

Charge for the year 852

Translation difference (896)

31 December 2015 1,252

Net book value

1 January 2014 27,157

31 December 2014 19,440

31 December 2015 9,887

*The adjustment relates to the recovery of VAT reclaimable on

the purchase price of the geological data

The intangible assets relate to the historic geological

information pertaining to the Karasuyskoye ore fields. The ore

fields are located in close proximity to the current open pit and

underground mining operations of Sekisovskoye. The Company is in

the advanced stages of obtaining the sub-soil user licence from the

authorities and it is expected to be received in May 2016.

Management have taken a view that a 20 year write off is

appropriate being the expected life of the sub-soil user license.

In assessing the carrying value, Management have made a number of

estimates in determining the level of mineral resources and

interpreting the geological data. There are numerous uncertainties

inherent in estimating mineral resources, and assumptions that were

valid at the time of estimation may change when new information

becomes available. These include assumptions as to grade estimates,

cut-off grades and other factors that will affect commercial

viability of the deposits such as recovery rates, commodity prices,

exchange rates, production costs, capital costs, processing and

reclamation costs and discount rates. The actual volume of ore

extracted and any changes in these assumptions could affect

prospective amortisation rates and carrying values of intangible

assets.

Mining Freehold, Equipment Plant, Assets under

properties land and fixtures and machinery construction Total

and leases buildings fittings and US$000 US$000

US$000 US$000 US$000 vehicles

US$000

Cost 10,682 16,494 15,927 8,132 20,933 72,168

1 131 58 5,312 1,302 22,040 28,843

January - (563) (1,017) - (131) (1,711)

2014 7,211 2,028 1,400 (339) (10,300) -

Additions (1483) (2,583) (2,770) (1,054) (3,128) (11,018)

Disposals

Transfers

Currency

translation

adjustment

31 16,541 15,434 18,852 8,041 29,414 88,282

December 104 1,210 1,782 92 6,451 9,639

2014 (863) - (288) (8) (21) (1,180)

& - - - - - -

1 (7,392) (7,564) (9,245) (3,752) (16,425) (44,378)

January

2015

Additions

Disposals

Transfers

Currency

translation

adjustment

31 8,390 9,080 11,101 4,373 19,419 52,363

December

2015

Accumulated

depreciation 3,552 5,501 12,174 5,075 - 26,302

1 432 1,478 2,575 865 - 5,350

January - (60) (988) 574 - (474)

2014 (552) (873) (993) (1,716) - (4,134)

Charge

for

the

year

Disposals

Currency

translation

adjustment

31 3,432 6,046 12,768 4,798 - 27,044

December 425 1,136 1,840 823 - 4,224

2014 - - - (81) - (81)

& (1,736) (3,193) (6,550) (2,479) - (13,958)

1

January

2015

Charge

for

the

year

Disposals

Currency

translation

adjustment

31 2,121 3,989 8,058 3,061 - 17,229

December

2015

Net

(MORE TO FOLLOW) Dow Jones Newswires

April 29, 2016 11:22 ET (15:22 GMT)

book 7,130 10,993 3,753 3,057 20,933 45,866

value

1

January

2014

31 13,109 9,388 6,084 3,243 29,414 61,238

December

2014

31 6,269 5,091 3,043 1,312 19,419 35,134

December

2015

6.Property, plant and equipment

Capitalised costs of mining property and leases are amortised

over the life of the licence from commencement of production on a

unit of production basis. This basis uses the ratio of production

in the period compared to the mineral reserves at the end of the

period plus production in the period Mineral reserves estimates are

based on a number of underlying assumptions which are inherently

uncertain. Mineral reserves estimates take into consideration

estimates by independent geological consultants. However, the

amount of mineral that will ultimately be recovered cannot be known

until the end of the life of the mine. Any changes in reserve

estimates are, for amortisation purposes, treated on a prospective

basis. The recovery of the capitalised cost of the Company's

property, plant and equipment is dependent on the development of

the underground mine. Included within mining properties is an

amount of US$Nil relating to interest that has been capitalised

(2014: US$750,000, 2013: US$744,000)

Under the terms of the loan agreement with the European Bank for

Reconstruction and Development (EBRD), the Company and its

subsidiaries has pledged certain assets as security for the loan

that was entered into.

The Directors are required to consider whether the non-current

assets comprising, mineral properties leases, plant and equipment

have suffered any impairment. The recoverable amount is determined

based on value in use calculations. The use of this method requires

the estimation of future cash flows and the choice of a discount

rate in order to calculate the present value of the cash flows. The

Directors have concluded that no adjustment is required for

impairment.

7.Availability of accounts

The audited Annual Report and Financial Statements for the 12

months ended 31 December 2015 and notice of AGM will shortly be

sent to shareholders and published at: www.goldbridgesplc.com

View source version on businesswire.com:

http://www.businesswire.com/news/home/20160429005815/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

April 29, 2016 11:22 ET (15:22 GMT)

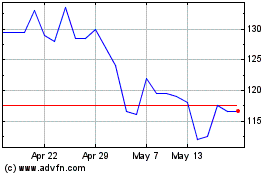

Altyngold (LSE:ALTN)

Historical Stock Chart

From May 2024 to Jun 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jun 2023 to Jun 2024