TIDMAEWU

RNS Number : 5221G

AEW UK REIT PLC

16 November 2022

16 November 2022

AEW UK REIT PLC

Interim Report and Financial Statements

for the six months ended 30 September 2022

AEW UK REIT PLC ("AEW UK REIT" or the "Company"), which holds a

diversified portfolio of 35 commercial investment properties

throughout the UK, is pleased to publish its Interim Report and

Financial Statements for the six months ended 30 September

2022.

Mark Burton, Chairman of AEW UK REIT, commented : "We are

pleased with the robust performance of the Company during the

period, which reported NAV total return of 4.35%, achieved against

a backdrop of economic uncertainty. We believe that the Company is

defensively positioned given its focus on value and having

prudently fixed the cost of debt early in the period. The

Investment Manager's unconstrained sector approach and its active

management style also provide a strong basis for counter-cyclical

performance. Given the market volatility, the Company's high cash

weighting makes it very well-positioned to select assets from the

increased number of investment opportunities that are expected to

present in the near future which supports our focus of returning to

full investment and to full cover of the dividend over the medium

term."

Financial Highlights

-- Net Asset Value ('NAV') of GBP193.09 million and of 121.88

pence per share ('pps') as at 30 September 2022 (31 March

2022: GBP191.10 million and 120.63 pps).

-- NAV Total Return for the period of 4.35% (six months ended

30 September 2021: 14.99%).

-- Operating profit before fair value changes of GBP5.25

million for the period (six months ended 30 September

2021: GBP5.88 million).

-- Profit Before Tax ('PBT')* of GBP8.32 million and earnings

per share ('EPS') of 5.25 pps for the period (six months

ended 30 September 2021: GBP23.55 million and 14.86 pps).

PBT includes a GBP6.51 million loss arising from changes

to the fair values of investment properties in the period

(six months ended 30 September 2021: GBP16.60 million

gain). This change explains the significant reduction

in PBT for the period.

-- EPRA Earnings Per Share ('EPRA EPS') for the period of

2.58 pps (six months ended 30 September 2021: 3.45 pps).

-- Total dividends of 4.00 pps declared in relation to the

period (six months ended 30 September 2021: 4.00 pps).

-- Shareholder Total Return for the period of -18.53% (six

months ended 30 September 2021: 28.37%).

-- The price of the Company's Ordinary Shares on the London

Stock Exchange was 93.60 pps as at 30 September 2022 (31

March 2022: 119.80 pps).

-- The Company secured a new GBP60.00 million, five-year

term loan facility with AgFe, a leading independent asset

manager specialising in debt-based investments. The loan

is priced as a fixed rate loan with a total interest cost

of 2.959%.

-- As at 30 September 2022, the Company had a balance of

GBP60.00 million drawn down (31 March 2022: GBP54.00 million)

of its GBP60.00 million (31 March 2022: GBP60.00 million)

loan facility with AgFe and was geared to 31.07% of NAV

(31 March 2022: 28.26%). See note 14 in the full Half-Yearly

Report for further details.

-- The Company held cash balances totalling GBP38.91 million

as at 30 September 2022 (31 March 2022: GBP6.77 million).

Property Highlights

-- As at 30 September 2022, the Company's property portfolio

had a valuation of GBP214.25 million across 35 properties

(31 March 2022: GBP240.18 million across 36 properties)

as assessed by the valuer(1) and a historical cost of

GBP200.10 million (31 March 2022: GBP214.47 million).

-- The Company acquired two properties during the period

for a total purchase price of GBP7.30 million, excluding

acquisition costs (year ended 31 March 2022: four properties

for GBP38.23 million).

-- The Company made three disposals during the period for

gross sale proceeds of GBP40.01 million (year ended 31

March 2022: two properties for gross sale proceeds of

GBP16.71 million).

-- The portfolio had an EPRA vacancy rate** of 8.48% as at

30 September 2022 (31 March 2022: 10.69%).

-- Rental income generated during the period was GBP8.41

million (six months ended 30 September 2021: GBP7.87 million).

-- EPRA Net Initial Yield ('EPRA NIY')** of 7.04% as at 30

September 2022 (31 March 2022: 5.87%).

-- Weighted Average Unexpired Lease Term ('WAULT') of 3.58

years to break and 5.66 years to expiry (31 March 2022:

3.94 years to break and 5.87 years to expiry).

-- As at the date of this report, 92% of the rent due for

the September 2022 quarter had been collected, 97% for

the June 2022 quarter and 98% for the March 2022 quarter.

(* See KPIs in the full Half-Yearly Report for definition of

alternative performance measures. ** See glossary in the full

Half-Yearly Report for definition of alternative performance

measures. 1 The valuation figure is reconciled to the fair value

under IFRS in note 11 in the full Half-Yearly Report.)

Enquiries

AEW UK

L aura Elkin Laura.Elkin@eu.aew.com

Nicki Gladstone Nicki.Gladstone-ext@eu.aew.com

+44(0) 771 140 1021

Liberum Capital Darren.Vickers@liberum.com

Darren Vickers +44 (0)20 3100 2218

TB Cardew AEW@tbcardew.com

Ed Orlebar +44(0) 7738 724 630

Tania Wild +44(0) 7425 536 903

Chairman's Statement

Overview

The Company reported a resilient NAV total return of 4.35% for

the six-month period to 30 September 2022. Following a prolonged

period of strong capital performance up to the end of June 2022,

which saw the Company report a three-year annualised NAV total

return of 17.7%, the value of the Company's assets fell marginally

in the three months to September, reflecting broader pricing

pressure in the UK commercial property market. This has been seen

as a result of ongoing political and economic instability in the

UK, where a sustained period of high inflation has been exacerbated

by the sanctions-related energy crisis. With a backdrop of an

uncertain political outlook, this has seen costs of borrowing

increase rapidly since the start of 2022 and, after early valuation

declines in prime assets lower down the yield spectrum, is now

starting to impact across most asset classes.

As a result of this uncertainty, the shares of listed property

companies have sold off almost indiscriminately over the period.

The Company's own shares demonstrate this, having started the

six-month period to 30 September trading at a discount to NAV of

0.68% and finished the period trading at a discount of 23.2%. This

has led to a disappointing shareholder total return for the period

of -18.5%, albeit the Company trades at the narrowest discount of

its peer group in UK diversified REIT's. We hope that this, along

with the Company's track record of outperformance and its robust

positioning, will stand its shares in good stead once market

sentiment recovers.

Current consensus forecasts show an expectation for the Bank of

England base rate to peak at 4% in early 2023 and for it to remain

at that level for more than a year. The Company took the prudent

decision to complete a full refinancing of its loan in May 2022,

leaving it defensively positioned to weather the current period of

high interest rates. In May 2022, the Company was able to fix its

cost of debt at 2.959% for the next five years, protecting it from

the impact of rising interest rates on its cost of borrowing. There

is also significant headroom on both the loan-to-value and debt

yield covenants associated with the loan. Consequently, the outlook

for the Company, from a debt financing perspective, is robust. We

also believe that high yielding assets, such as those in the

Company's portfolio, will be more resilient over the long term to

the valuation impact of rising interest rates, albeit further

near-term value decline is expected. With higher "starting" yields,

the portfolio's current book values are closer to long term value

fundamentals such as vacant possession values, alternative use

values and replacement cost.

A particular performance highlight during the period was the

sale of Eastpoint Business Park, Oxford, which completed during

August 2022 for GBP29.0 million. The property was acquired in May

2015 for GBP8.2 million, providing a net initial yield of over 9%.

The asset sale was realised following the culmination of a

multi-year business plan, which included the signing of a 25-year

lease in 2018 with specialist healthcare provider, Genesis Care.

The lease provided for five-yearly compounded rental uplifts in

line with RPI, which increased the asset's value by GBP2.0m. As a

condition of this letting, the Investment Manager sought planning

consent for change of use away from the asset's existing office

use, setting a precedent for healthcare and life science use in the

location. Since the signing of the existing lease, investor demand

in the healthcare and life science sectors has increased

considerably and this is reflected in the sale price, which

crystallises significant profit. The asset delivered an IRR to the

Company in excess of 22% during its hold period, with the sale

price exceeding the valuation level immediately prior to the sale

by 16%.

Another key sale during the period was the Company's asset at

225 Bath Street, Glasgow, for GBP9.3 million. The sale realises a

long-term change of use strategy for the asset, for which contracts

had been exchanged with a subsidiary company of IQ Student

Accommodation in October 2020. Since that time, the purchaser

achieved detailed planning consent for the redevelopment of a

527-unit student accommodation scheme at the site and the

Investment Manager negotiated with tenants to bring the asset to

vacancy. As such, the sale of the asset led to a reduction in the

portfolio's vacancy level and will lead to a boost in earnings once

capital from the sale is reinvested. The sale demonstrates the

Investment Manager's ability to pursue an alternative use strategy

due to weakened occupier market conditions in this location.

Assisted by these notable sales, the Company's office assets saw

a total return of 24.0% during the period. The fact that these

returns were achieved during a period when wider office sector

performance was negative points to the effectiveness of the

Company's investment strategy to drive counter-cyclical returns

during periods of wider value decline due to its value investment

fundamentals and active management style. The Investment Manager

and the Board believe that the Company's ability to seek value

opportunities unconstrained by sector is key to the maximisation of

total return over the long term.

The sales of Glasgow and Oxford during the period also form an

important step towards the portfolio's planned return to full cover

of its dividend. Despite dividend cover since IPO being in excess

of 90%, earnings have been reduced in recent quarters, primarily as

a result of vacancy in these assets that was required in order to

maximise their sale values to alternative use developers. Together,

the assets had been producing an income yield of circa 1.0% and

therefore reinvested proceeds from the sales of assets producing

net initial yields between 6.75% and 10% will be significantly

accretive to the Company's earnings in future periods.

The Company completed two purchases during the period. In June

2022, the Company acquired the 6.04 acre Railway Station Retail

Park in Dewsbury for a price of GBP4.7 million. The purchase price

reflects a low capital value of GBP82 psf and provides an

attractive net initial yield of 9.4%. The park is fully let and

located in an area of low supply with a low average passing rent of

GBP8.28 psf. The Investment Manager believes this provides strong

potential for rental growth. During August 2022, the Company

completed the purchase of a high yielding leisure asset in Glasgow

for a price of GBP2.6 million, reflecting a low capital value of

GBP99 per sq. ft. and a net initial yield of 7.4%. The site

contains a vacant plot of land which may be suitable for

redevelopment over the medium term, subject to planning.

We believe that balancing the Company's investment rate against

expected pipeline opportunities will be beneficial to our

shareholders' total return. The Company currently benefits from a

high cash weighting, leaving it advantageously positioned to select

assets from the increased number of investment opportunities that

are expected to present in the near future. The Investment Manager

is currently analysing a pipeline of investment opportunities,

including those assets that the Company had placed under

exclusivity over the summer, albeit these are being re-evaluated

against current pricing. The focus of the Company's investment

strategy remains to return to full investment and to full cover of

its dividend over the medium term.

Although the outlook from a capital markets perspective is one

of increased volatility, we are not, at this point, seeing this

reflected in the uptake by tenants of the portfolio's occupational

space. Active asset management is a key driver of value and income

resilience within AEWU and, during the period under review, the

Investment Manager agreed terms with several key tenants to take

space, the terms of which were agreed in line with the rental

estimates of our expert independent valuer, Knight Frank. Several

of these lettings have been in the portfolio's industrial assets,

including the letting in Rotherham to Senior Architectural Systems

Ltd which completed in September 2022. This letting will deliver a

rental income to the Company 49% ahead of the level paid by the

previous tenant and, in addition, income growth during the lease

term is ensured by inflation-linked reviews. This activity

highlights ongoing demand from industrial occupiers. AEWU's

industrial holdings show an average passing rent of GBP3.37 per sq.

ft. and are expected to continue to deliver growth over the long

term from this low starting point.

Other key lettings during the period took place at Arrow Point,

Shrewsbury, where a 10-year lease renewal was completed with

Charlie's Stores at a level 46% higher than ERV. At Queen Square,

Bristol, a renewal to Konica Minolta at GBP40 per sq. ft. set a new

high rental tone for the building.

Financial Results

Six months

Six months ended 30 Year ended

ended 30 September September 31 March

2022 2021 2022

Operating Profit before fair value

changes (GBP'000) 5,253 5,879 11,752

Operating Profit (GBP'000) 9,576 23,919 46,913

Profit before Tax (GBP'000) 8,322 23,547 46,695

Earnings Per Share (basic and

diluted) (pence)* 5.25 14.86 29.47

EPRA Earnings Per Share (basic

and diluted) (pence)* 2.58 3.45 6.79

Ongoing Charges (%) 1.33 1.31 1.35

Net Asset Value per share (pence) 121.88 110.01 120.63

EPRA (NTA) Net Asset Value per

share (pence) 121.88 109.94 120.10

* see note 9 of the Financial Statements for the corresponding

calculations. See the Investment Manager's Report for further

explanation of performance in the period.

Awards

I am delighted that the Company's market leading performance and

practices have been recognised in two awards gained during the

period. The Company has once again been awarded by EPRA, the

European Public Real Estate Association, a gold medal for its high

standard of financial reporting and a silver medal for standards of

sustainability reporting. Post period-end, the Company has won the

Citywire investment trust award in the 'UK Property' category, an

award given to the trust displaying the highest NAV returns over a

three-year period. AEWU won this award in both 2021 and 2020 so we

are very pleased to receive it for a third consecutive year. The

Company has also been nominated for 'Best REIT' at the AJ Bell

Shares Magazine awards, voted for by readers of the publication. We

are delighted that these awards and nominations recognise the hard

work and dedication that is put into running the Company by both my

colleagues on the Board and the Company's Investment Manager,

AEW.

Environmental, Social, Governance + Resilience ('ESG+R')

AEW, as Investment Manager of the Company, has committed to

abide by the UN Principles for Responsible Investment (PRI), where

these are consistent with operating guidelines, as outlined in its

Socially Responsible Investment Policy. As a result, during the

period, the Company and the Investment Manager has taken further

steps to integrate ESG+R considerations into its investment, asset

management and operations process. This has seen the continuous

development of a number of initiatives, including asset

sustainability action plans across all portfolio assets to inform

and drive ESG+R agendas, the re-assessment of EPC's to prepare for

upcoming regulation in relation to Minimum Energy Efficiency

Standards and the integration of increased ESG+R considerations

into the Company's investment process. As Investment Manager of the

Company, AEW will continue to refine and improve its ESG+R policy

in line with new legislation, such as the Task Force on

Climate-related Financial Disclosures ('TCFD') and in line with

industry best practices as they evolve.

During 2018, AEW established sustainability targets across its

managed portfolio. The managed portfolio comprises service charged

assets and vacant accommodation, which are those assets at which

the Company has control over utilities. These targets include the

reduction of Scope 1 and 2 greenhouse gas emissions and waste

disposal. Since this time, overall energy usage has reduced by 15%,

emissions have been reduced by 19%, and waste transferred to

landfill has also been reduced to zero within the managed

portfolio. We would like to thank the Company's very committed

managing agents, Mapp, for their assistance in achieving these

improvements.

GRESB is a global real estate benchmark that assesses

Environmental, Social and Governance performance. AEWU achieved two

stars in its seventh submission year, improving on its 2021 score

to achieve an overall score of 67 out of 100 against a peer group

average of 65. Much of the GRESB score relates to data coverage and

due to the high percentage of assets in the AEWU portfolio with

tenant-procured utilities, the Company does not score as well as

peers with a smaller holding of single-let assets.

Succession Planning

Both Bim Sandhu and I have been Directors since the Company's

IPO in June 2015. In seeking to comply with best corporate

governance practice, we both intend to resign by 2024. In order to

stagger our departures, we have determined that Bim, who chairs the

Audit Committee, will resign at the AGM in September 2023 and I

will resign at the AGM in 2024. The Board has also determined that

our successors should have sufficient time to familiarise

themselves with the Company before they formally take over our

respective roles. With that in mind, in July 2022 the Board

appointed Trust Associates, a firm specialising in recruiting NEDs

for the investment trust sector, to produce a short list of eight

candidates who would be suitable for the role of Audit Chairman.

Four of the candidates were interviewed by the Board in October

2022 and were invited to a separate meeting with the Investment

Manager. Following this extensive search, I am delighted to welcome

to the Board Mark Kirkland, who was appointed as Non-Executive

Director and Audit Committee Chairman designate with effect from 9

November 2022 and will take over From Bim at the AGM in September

2023. Mark brings extensive corporate experience gained over 30

years, having held numerous senior roles in public and private

companies. Mark's initial career was in corporate finance,

predominately with UBS Limited. He has been CFO of numerous public

and private companies and latterly was CEO of Delin Property, a

pan-European logistics developer, investor and manager. He is

currently a NED and Audit Committee Chairman of Strix Group plc,

and an Advisor to DP World. We will begin the process of finding my

successor in mid-2023.

Outlook

The Board and Investment Manager believe that the Company is as

defensively positioned as possible against the current challenging

backdrop. Whilst further near-term value decline is expected, the

Company's fixed cost of debt and book values which are closer to

long term value fundamentals, such as alternative use values and

replacement cost, provide a robust outlook for the portfolio over

the long term. The portfolio's current high weighting to cash and

value investment style leave it well placed to benefit from

upcoming investment opportunities. The strategy's approach, being

unconstrained by sector, and its active management style of the

portfolio provide a strong basis for counter-cyclical performance.

In addition, we are seeing resilience in occupational demand from

the Company's tenants.

Investing the current capital available for deployment will be a

key focus of the Company's Investment Manager over the coming

months. The Investment Manager expects that value investment

opportunities will be increasing in number over this period across

all real estate sectors. Following full investment of capital

available for deployment, the Company's earnings are expected to

return to full cover of its 8p annual dividend, which has now been

paid for 28 consecutive quarters.

In the near term, the Board and Investment Manager will continue

to take a prudent approach towards the management of the Company,

given the ongoing economic uncertainty. Economic conditions will be

monitored closely and it is hoped that the UK's new Prime Minister,

Rishi Sunak, will be able to restore an element of stability to the

UK's financial markets.

Mark Burton

Chairman

15 November 2022

Investment Manager's Report

Economic Outlook

In common with most of Europe, the UK's macroeconomic outlook

has been impacted by the conflict in Ukraine. With winter

approaching, the sanctions-related energy crisis has pushed already

high inflation to a record new high of above 10% in October 2022.

This has put further pressure on the Bank of England to raise base

rates. However, the outlook for inflation has become more uncertain

following the fiscal U-turns announced by the new Chancellor in the

third week of October 2022. On the one hand, a much tighter fiscal

stance points to lower inflation in the medium-term. On the other,

the curtailment of the cap on energy bills could push inflation up

sharply in the spring of 2023. As of mid-October 2022, Oxford

Economics projects the Bank of England base rate to peak at 4% in

early 2023 and for it to remain at that level for more than a year.

As these government policies and rate hikes will impact on mortgage

interest rates, house prices and consumer spending, Oxford

Economics forecasts, as of mid-October 2022, that GDP growth will

be adjusted downward to 4.5% for the full year of 2022. More

importantly, they project a fall of 0.5% in 2023 before returning

to modest 1.8% growth in 2024. Investors and lenders will need to

adjust to the slower economic growth and increased costs of debt as

they might impact on both their acquisition or lending strategies

and any loans coming up for refinancing.

Financial Results

The Company's NAV as at 30 September 2022 was GBP193.09 million

or 121.88 pps (31 March 2022: GBP191.10 million or 120.63 pps).

This represents an increase of 1.25 pps or 1.04% over the six-month

period.

EPRA EPS for the period was 2.58 pence which, based on dividends

paid of 4.00 pps, reflects a dividend cover of 64.50%. The decrease

in dividend cover compared to the prior six-month period has

largely arisen due to the Company completing a number of key sales,

leaving it with a high cash weighting and a resulting loss of

rental income in the short term. Earnings have been further

depressed by one-off costs associated with refurbishment works

being undertaken at Queen Square, Bristol and Mangham Road,

Rotherham, which will both be accretive to the Company's earnings

in the medium to long term. A high cash weighting leaves the

Company advantageously positioned to select assets from the

increased number of investment opportunities that are expected to

present in the near term. The focus of the Company's investment

strategy remains to return to full investment and full dividend

cover. Income across the tenancy profile has remained intact.

Collection rates have reached 99% for both the March and June 2022

quarters respectively, with further payments expected to be

received under longer-term payment plans. Of the outstanding

arrears, the Company has made a GBP0.59 million expected credit

loss provision, given the deteriorating economic outlook. The

Company will continue to pursue all outstanding arrears.

Financing

During the period, the decision was taken to complete the

refinancing of the portfolio, as announced in May 2022. The Company

has secured a new GBP60.00 million, five-year term loan facility

with AgFe, a leading independent asset manager specialising in

debt-based investments. The loan is priced as a fixed rate loan

with a total interest cost of 2.959%. The existing RBSi loan

facility, which was priced at a floating rate according to SONIA,

was due to mature in October 2023 and has been repaid in full by

the new loan facility. Simultaneous to the funding, the Company's

interest rate cap was sold for proceeds of GBP743,000. In the

current inflationary environment, the Company considered it prudent

to fix the loan and interest, rather than run the risk of further

interest rate rises nearer renewal. The Company intends to utilise

borrowings to enhance returns over the next five years.

As at 30 September 2022, the Company has a GBP60.00 million loan

Facility with AgFe, in place until May 2027, the details of which

are presented below

30 September 2022 31 March 2022

------------------ -----------------

Facility GBP60.00 million GBP60.00 million

Drawn GBP60.00 million GBP54.00 million

Gearing (Loan to NAV) 31.07% 28.26%

Interest rate 2.959% fixed 2.20% variable

(SONIA +1.4%)

Notional Value of Loan Balance

Hedged N/A 95%

Property Portfolio

During the period, the Company completed three disposals, being:

Eastpoint Business Park, Oxford, for a price of GBP29.00 million;

Bath Street, Glasgow, for a price of GBP9.30 million; and Moorside

Road, Swinton, for a price of GBP1.71 million. The Company made two

acquisitions during the period, being: Dewsbury Railway Station

Retail Park, which was acquired in June 2022 for GBP4.70 million,

and JD Gyms, Glasgow, which was purchased in August 2022 for a

price of GBP2.60 million.

The following tables illustrate the composition of the portfolio

in relation to its properties, tenants and income streams:

Summary by Sector as at 30 September 2022

Gross Gross Like- Like-

passing passing for-like for-like

Number Vacancy WAULT rental rental Rental rental rental

of Valuation Area by ERV to income income ERV ERV income growth* growth*

Sector assets (GBPm) (sq ft) (%) break (GBPm) (GBPpsf) (GBPm) (GBPpsf) (GBPm) (GBPm) %

(years)

Industrial 18 113.32 2,340,264 9.52 3.76 7.89 3.37 9.32 3.98 3.72 0.09 2.51

Retail

warehouses 4 39.70 425,337 7.10 3.09 3.37 7.92 3.96 9.30 1.73 (0.14) (20.59)

Standard

retail 6 24.70 237,792 4.88 3.37 2.57 10.81 2.33 9.78 1.36 (0.03) (2.16)

Alternatives 4 19.78 178,165 0.00 7.05 2.01 11.30 1.85 10.38 0.90 (0.04) (5.19)

Office 3 16.75 91,903 21.16 2.28 1.17 12.72 1.56 17.01 0.70 (0.10) (14.93)

-------- ----------- ---------- --------- --------- --------- ---------- -------- ---------- -------- ---------- ----------

Portfolio 35 214.25 3,273,461 8.48 3.58 17.01 5.20 19.02 5.81 8.41 (0.22) (3.10)

-------- ----------- ---------- --------- --------- --------- ---------- -------- ---------- -------- ---------- ----------

Summary by Geographical Area as at 30 September 2022

Gross Gross Like- Like-

passing passing for-like for-like

Number Vacancy WAULT rental rental Rental rental rental

Geographical of Valuation Area by ERV to income income ERV ERV income growth* growth*

Area assets (GBPm) (sq ft) (%) break (GBPm) (GBPpsf) (GBPm) (GBPpsf) (GBPm) (GBPm) %

(years)

West Midlands 5 42.22 598,405 8.40 3.76 3.52 5.88 4.09 6.84 1.87 (0.11) (11.70)

Yorkshire and

Humberside 8 42.17 931,941 3.23 2.87 3.26 3.50 3.90 4.19 1.26 (0.01) (0.89)

South West 5 40.23 517,232 15.62 3.04 2.83 5.48 3.58 6.92 1.47 (0.05) (3.29)

Eastern 5 24.82 344,339 0.76 1.84 2.11 6.14 2.20 6.38 1.02 0.07 7.37

Wales 3 22.48 415,607 27.55 10.48 1.28 3.07 1.84 4.43 0.78 (0.04) (5.88)

North West 3 16.18 277,347 0.00 2.36 1.44 5.19 1.30 4.71 0.67 (0.03) (4.55)

Rest of London 1 9.90 71,720 0.00 9.15 0.98 13.61 0.75 10.45 0.47 (0.03) (6.00)

South East 3 9.70 62,760 7.84 3.07 0.98 15.62 0.77 12.20 0.64 (0.01) (1.92)

East Midlands 1 3.95 28,219 0.00 4.17 0.41 14.56 0.38 13.38 0.20 (0.01) (3.29)

Scotland 1 2.60 26,341 0.00 5.43 0.20 7.71 0.21 7.97 0.03 - -

-------- ----------- ---------- --------- --------- --------- ---------- -------- ---------- -------- ---------- ----------

Portfolio 35 214.25 3,273,461 8.48 3.58 17.01 5.20 19.02 5.81 8.41 (0.22) (3.10)

-------- ----------- ---------- --------- --------- --------- ---------- -------- ---------- -------- ---------- ----------

*like-for-like rental growth is for the six months ended 30

September 2022.

Source: Knight Frank/AEW, 30 September 2022.

Individual Property Classifications

Market Value

Property Sector Region Range(GBPm)

-------------------- ------------------ ------------------------- ---------------

1 Central Six Retail

Park, Coventry Retail warehouses West Midlands 15.0-20.0

2 Gresford Industrial

Estate, Wrexham Industrial Wales 10.0-15.0

3 40 Queen Square,

Bristol Offices South West 10.0-15.0

4 15-33 Union Street,

Bristol Standard retail South West 10.0-15.0

5 Lockwood Court,

Leeds Industrial Yorkshire and Humberside 10.0-15.0

6 London East Leisure

Park, Dagenham Other Rest of London 7.5 -10.0

7 Arrow Point Retail

Park, Shrewsbury Retail warehouses West Midlands 7.5-10.0

8 Apollo Business

Park, Basildon Industrial Eastern 7.5-10.0

9 Storey's Bar Road,

Peterborough Industrial Eastern 7.5-10.0

10 Units 1001-1004

Sarus Court Industrial North West 7.5-10.0

The Company's top ten properties listed above comprise 50.0% of

the total value of the portfolio.

Market

Value

Range

Property Sector Region (GBPm)

--- ------------------------- ------------------ ------------------------- --------

11 Westlands Distribution Industrial South West 5.0-7.5

Park, Weston Super

Mare

12 Euroway Trading Industrial Yorkshire and Humberside 5.0-7.5

Estate, Bradford

13 Barnstaple Retail Retail warehouses South West 5.0-7.5

Park, Barnstaple

14 Brockhurst Crescent, Industrial West Midlands 5.0-7.5

Walsall

15 Diamond Business Industrial Yorkshire and Humberside 5.0-7.5

Park, Wakefield

16 Deeside Industrial Industrial Wales 5.0-7.5

Park, Deeside

17 Walkers Lane, St, Industrial North West 5.0-7.5

Helens

18 Mangham Road, Rotherham Industrial Yorkshire and Humberside 5.0-7.5

19 710 Brightside Lane, Industrial Yorkshire and Humberside <5.0

Sheffield

20 The Railway Centre, Retail warehouses Yorkshire and Humberside <5.0

Dewsbury

21 Oak Park, Droitwich Industrial West Midlands <5.0

22 Pipps Hall Industrial Industrial Eastern <5.0

Estate, Basildon

23 Pearl House, Nottingham Standard retail East Midlands <5.0

24 Odeon Cinema, Southend Other Eastern <5.0

25 PRZYM Other Wales <5.0

26 Eagle Road, Redditch lndustrial West Midlands <5.0

27 Cedar House, Gloucester Offices South West <5.0

28 69-75 Above Bar Standard retail South East <5.0

Street, Southampton

29 Commercial Road, Standard retail South East <5.0

Portsmouth

30 Bridge House, Bradford, Industrial Yorkshire and Humberside <5.0

31 Clarke Road, Milton Industrial South East <5.0

Keynes

32 Pricebusters Building, Standard retail North West <5.0

Blackpool

33 JD Gyms, Glasgow Other Scotland <5.0

34 Vantage Point, Hemel Offices Eastern <5.0

Hempstead

35 11/15 Fargate, Sheffield Standard retail Yorkshire and Humberside <5.0

Sector and Geographical Allocation by Market Value as at 30

September 2022

Sector Allocation

Sector %

------------------- ---

Standard retail 11

Retail warehouses 19

Offices 8

Industrial 53

Other 9

Geographical Allocation

Location %

-------------------------- ---

Rest of London 5

South East 4

South West 19

Eastern 12

West Midlands 20

East Midlands 2

North West 7

Yorkshire and Humberside 20

Wales 10

Scotland 1

Source: Knight Frank valuation report as at 30 September

2022.

Top Ten Tenants

% of

Portfolio

Passing Total

Rental Contracted

Income Rental

Tenant Sector Property (GBP'000) Income

--------------------- ----------- ------------------------------ ----------- ------------

Plastipak UK Gresford Industrial

1 Ltd Industrial Estate, Wrexham 975 5.7

2 Wyndeham Group Industrial Wyndeham, Peterborough 644 3.8

Mecca Bingo London East Leisure

3 Ltd Leisure Park, Dagenham 625 3.7

Harrogate Spring

4 Water Limited Industrial Lockwood Court, Leeds 603 3.5

5 Odeon Cinemas Leisure Odeon Cinema, Southend-on-Sea 535 3.1

Wilko Retail 15-33 Union Street,

6 Limited Retail Bristol 481 2.8

Advanced Supply

Chain (BFD) Euroway Trading Estate,

7 Ltd Industrial Bradford 467 2.7

8 Poundland Limited Retail Pearl House, Nottingham 414 2.4

Senior Architectural

9 Systems Ltd Industrial Mangham Road, Rotherham 410 2.4

Kvernerland Walkers Lane, St.

10 Group UK Limited Industrial Helens 389 2.3

The Company's top ten tenants, listed above, represent 32.6% of

the total passing rental income of the portfolio.

Source: Knight Frank valuation report as at 30 September

2022.

Asset Management

The Company completed the following material asset management

transactions during the period:

Acquisitions - The Railway Centre, Dewsbury, was acquired in

June 2022 for GBP4.70 million and is a 6.04-acre railway station

retail park, occupying a prominent location on the edge of the town

centre within an established retail and leisure area. The asset

provides an attractive net initial yield of 9.4%. The second

acquisition, JD Gyms, Glasgow, is a high yielding leisure asset,

providing a NIY of 7.4% and a low capital value of GBP99 per sq.

ft. Both of these assets provide strong and stable income streams

from their tenancy profiles.

Disposals - Sales of Moorside Road, Swinton for GBP1.71 million;

Eastpoint Business Park, Oxford, for GBP29.00 million; and Bath

Street, Glasgow, for GBP9.30 million. The Swinton and Oxford sales

prices produced IRRs in excess of 13% and 22%, respectively. The

sale of Glasgow realised a long-term change of use strategy where

full vacant possession of the building was achieved. Following its

sale, the occupancy rate for the remaining portfolio increased by

circa 4%, all else being equal. Reinvestment of the sales proceeds

is expected to provide a significant boost to the Company's

earnings, due to both higher levels of anticipated income and lower

running costs.

Arrow Point, Shrewsbury - During May 2022, the Company completed

the renewal of Charlie's Stores' lease on a straight 10-year term

at a rent of GBP385,000 per annum reflecting GBP11 psf, versus an

ERV of GBP7.50 psf. Charlie's Stores is the scheme's anchor tenant,

so this is an important letting for the property. Only nine months'

rent-free incentive was given.

40 Queen Square, Bristol - The Company completed an agreement

for lease with existing tenant

Konica Minolta Marketing Services Ltd on the third floor. The

tenant will enter into a new ten-year lease with a five-year tenant

break option at a rent of GBP218,840 per annum, reflecting a new

high rental tone for the building of GBP40 per sq. ft. The letting

is subject to landlord refurbishment works including roof, lift and

reception upgrades at a cost of GBP1.07 million plus 11 months'

rent-free incentive. Landlord works commenced during the period and

are due to complete before the end of the year.

Commercial Road, Portsmouth - During May 2022 the Company

completed a new 15-year lease to Kokoro UK Limited, a

Japanese-Korean restaurant. The agreed rent is GBP52,500 per annum

versus an ERV of GBP45,750 per annum. The tenant has the benefit of

a 12-month rent free period and a tenant only break option at the

end of the tenth year.

Diamond Business Park, Wakefield - During June 2022, the Company

completed a new letting of Units 8 and 9 to Wow Interiors, an

existing tenant on the estate already occupying Unit 7. Wow have

taken a new six-year lease with a tenant break option at the end of

the third year. The commencing rent of GBP3 psf will increase to

GBP3.50 psf in years 2 and 3, and subsequently GBP3.75 psf from

year 4 onwards. In doing so, the Company has also completed a lease

re-gear on Unit 7, removing Wow's 2022 tenant break option and

agreeing a three-year reversionary lease with a tenant break option

mirroring Units 8 and 9.

Mangham Road, Rotherham - The Company has completed a new

ten-year ex-Act lease to Senior Architectural Systems Ltd at a rent

of GBP410,000 per annum, reflecting a rent of GBP5 per sq. ft. This

shows a significant uplift to the rent paid by previous tenant,

Hydro Components, at GBP275,000 per annum. The lease provides for

five-yearly rent reviews to the higher of open market rent or RPI,

with collar and cap at 2% & 4% per annum, respectively. There

was no rent-free incentive granted to the tenant, however the

landlord undertook works to upgrade the building at a cost of

GBP964,700. These works were completed during the period and are

expected to improve the asset's energy efficiency. The tenant

benefits from a break option at the end of year five.

Bank Hay Street, Blackpool - Repair works at the property which

commenced in 2020 have now reached practical completion. The total

cost of these works amounted to circa GBP2.40 million, of which

approximately GBP800,000 is expected to be recovered from tenants.

The recoverable elements of this expenditure have been raised

within the service charge budget and all tenants are up to date

with payments.

Vacancy - The portfolio's overall vacancy level is 8.48%.

Environmental, Social and Governance ('ESG') Update

The Company has maintained its two stars Global Real Estate

Sustainability Benchmark ('GRESB') rating for 2022 and improved its

score to 67 (GRESB Peer Group Average 65). A large portion of the

GRESB score relates to performance data coverage where, due to the

high percentage of single-let assets with tenant procured

utilities, the Company does not score as well as Funds with a

smaller holding of single-let assets and a higher proportion of

multi-let assets where the owner is responsible for the utilities

and can therefore gather the relevant data.

We continue to implement our plan to improve overall data

coverage and data collection for all utilities through increased

tenant engagement at our single-let assets and by installing

automated meter readers ('AMR') across the portfolio. So far, we

are in the process of installing AMRs in all of our multi-let

properties. We are also in discussions with the tenants of our top

10 single-let FRI assets (in terms of floor area) regarding the

installation of AMR.

We endeavour, where the opportunity presents itself through a

lease event, to include green clauses in leases, covenanting

landlord and tenant to collaborate over the environmental

performance of the property. Green clauses seek to improve data

coverage by ensuring tenants provide regular and appropriate

utility consumption data.

We continue to assess and strengthen our reporting and alignment

against the Framework set out by the TCFD, with further disclosure

to be provided in the 2023 annual report and accounts. We are

pleased to report that the Company has maintained its EPRA Silver

rating for sBPR for ESG disclosure and transparency.

We have an Asset Sustainability Action Plan ('ASAP') initiative,

tracking ESG initiatives across the portfolio on an asset-by-asset

basis for targeted/relevant and specific implementation of ESG

improvements. In doing so, all managed assets and units have

recently been contracted to High Quality Green Tariffs, ensuring

that electricity supply is from renewable sources. All void/vacant

unit supplies have also been transferred to High Quality Green

Tariffs.

All managed assets will be moved to 'Green Gas' supplies in

2022.

We are underway with implementing a number of initiatives across

our portfolio, including a new landscaping/biodiversity programme

at our retail warehouse in Barnstaple, replacing the existing

plants and shrubs with a greater diversity of appropriate species

which in turn will attract a wider variety of insects and wildlife

to the property.

Lease Expiry Profile

Approximately GBP2.91 million of the Company's current

contracted income stream is subject to an expiry or break within

the 12-month period commencing 1 October 2022. 26.68% (GBP776,757)

of this income is in the industrial sector, where we anticipate

strong occupier demand, low incentives and reversionary rents.

Regarding the remainder, we will proactively manage, looking to

unlock capital upside, whether that be through lease

regears/renewals, or through refurbishment/capex projects and new

lettings.

Source: Knight Frank valuation report as at 30 September

2022.

AEW UK Investment Management LLP

15 November 2022

AEW UK REIT PLC's interim report and financial statements for

the period ended 30 September 2022 will be

available today on www .aewukreit.com.

It will also be submitted shortly in full unedited text to the

Financial Conduct Authority's National Storage Mechanism and will

be available for inspection at

data.fca.org.uk/#/nsm/nationalstoragemechanism in accordance with

DTR 6.3.5(1A) of the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules.

LEI: 21380073LDXHV2LP5K50

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLTLRLELIF

(END) Dow Jones Newswires

November 16, 2022 02:00 ET (07:00 GMT)

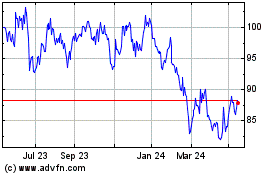

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From May 2024 to Jun 2024

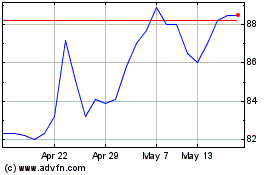

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jun 2023 to Jun 2024