AEW UK REIT plc: Update Statement (1128855)

September 09 2020 - 2:00AM

UK Regulatory

AEW UK REIT plc (AEWU)

AEW UK REIT plc: Update Statement

09-Sep-2020 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

9 September 2020

AEW UK REIT Plc (the "Company")

Update statement

AEW UK REIT plc (LSE: AEWU) (the "Company"), which, as at 9 September 2020,

directly owns a diversified portfolio of 34 regional UK commercial property

assets, today provides an update in respect of recent activity.

Rent Collection

The Investment Manager has continued to maintain close contact with all

tenants over recent months in order to maximise collection. As at the date

of this announcement, the Company had collected the following rental

payments for the rental quarter commencing 24 June 2020, expressed as a

percentage of the quarter's total rental income:

Current Position As at 7 September 2020

Received 85%

Payments expected prior to quarter end 2%

87%

Payments expected under longer term 2%

payment plans

3%

Under Negotiation - pending the

agreement of potential asset management

transactions

91%

Outstanding 9%

Total 100%

In respect of the quarter commencing on the 25 March 2020, the Company

reports that 89% of rents have now been collected with a further 8% of

payments expected to be received over coming periods by way of agreed

payment plans which, once received, will total 97%.

It should be noted that this is an evolving picture with further payments

being received each day. In addition, amounts that remain outstanding are

being pursued by the Company and are subject to ongoing engagement between

the Manager and the tenant.

Asset Management Update

Since its last announcement in July, the Company has completed the following

asset management transactions:

Langthwaite Grange Industrial Estate, South Kirkby - During August, a lease

renewal was signed with the Company's third largest tenant, Ardagh Glass.

Rent payable under the new lease has been agreed 13% ahead of both

independent valuer's estimated levels and the previous level of passing

rent. The lease is for a five year term and the tenant will benefit from

four months' rent free and a tenant break option after three years.

Bessemer Road, Basingstoke - During July, the Company has completed a 5 year

lease renewal at its 58,000 sq ft industrial premises in Basingstoke. The

lease has been granted with no rent free incentive given to the tenant and

secures a rental income that is 6% ahead of independent valuer's estimated

levels. The tenant has the benefit of a break option in year 3.

Alex Short and Laura Elkin, Portfolio Managers, AEW UK REIT, commented:

"We are very encouraged by recent performance from AEWU's portfolio and rent

collection figures continue to improve in line with our expectations. We

have completed some major asset management initiatives since the start of

the year that have been accretive to both income and NAV, some examples of

these are listed above, and in the majority of our portfolio we are still

seeing opportunities to both lengthen and grow income streams. This positive

momentum, along with our healthy capitalisation, led our Board to support

the full payment of AEWU's target 2p per share per quarter dividend during

July and it is our hope that this positive momentum can be maintained going

forward."

Enquiries

AEW UK

Alex Short alex.short@eu.aew.com

+44(0) 20 7016 4848

Laura Elkin laura.elkin@eu.aew.com

+44(0) 20 7016 4869

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 7711 401 021

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 1392 477 500

TB Cardew aew@tbcardew.com

Ed Orlebar +44 (0) 7738 724 630

Lucas Bramwell +44 (0) 7939 694 437

Liberum Capital

Gillian Martin/Owen Matthews +44 (0) 20 3100 2000

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total return to

shareholders by investing predominantly in smaller commercial properties

(typically less than GBP15 million), on shorter occupational leases in strong

commercial locations across the United Kingdom. The Company was listed on

the Official List of the UK Listing Authority and admitted to trading on the

Main Market of the London Stock Exchange on 12 May 2015, raising GBP100.5m.

Since IPO it has raised a further GBP58m.

The Company is currently invested in office, retail, industrial and leisure

assets, with a focus on active asset management, repositioning the

properties and improving the quality of the income stream.

AEWU is currently paying an annualised dividend of 8p per share.

www.aewukreit.com [1] [2]

About AEW UK Investment Management LLP

AEW UK Investment Management LLP employs a well-resourced team comprising 26

individuals covering investment, asset management, operations and strategy.

It is part of AEW Group, one of the world's largest real estate managers,

with &euro71.2bn of assets under management as at 31 March 2020. AEW Group

comprises AEW SA and AEW Capital Management L.P., a U.S. registered

investment manager and their respective subsidiaries. In Europe, as at 31

March 2020, AEW Group managed &euro33.5bn of real estate assets on behalf of

a number of funds and separate accounts with over 420 staff located in 9

offices. The Investment Manager is a 50:50 joint venture between the

principals of the Investment Manager and AEW. In May 2019, AEW UK Investment

Management LLP was awarded Property Manager of the Year at the Pensions and

Investment Provider Awards.

www.aewuk.co.uk [3]

LEI: 21380073LDXHV2LP5K50

ISIN: GB00BWD24154

Category Code: MSCL

TIDM: AEWU

LEI Code: 21380073LDXHV2LP5K50

OAM Categories: 3.1. Additional regulated information required to be

disclosed under the laws of a Member State

Sequence No.: 83738

EQS News ID: 1128855

End of Announcement EQS News Service

1: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=c9b6404682d7efd026577394ecbedab5&application_id=1128855&site_id=vwd&application_name=news

2: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=9220892e63355ca6947a3a3423a3bac8&application_id=1128855&site_id=vwd&application_name=news

3: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=c3ab986d9b746ee23c3523d74649f8db&application_id=1128855&site_id=vwd&application_name=news

(END) Dow Jones Newswires

September 09, 2020 02:00 ET (06:00 GMT)

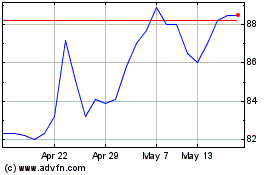

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From May 2024 to Jun 2024

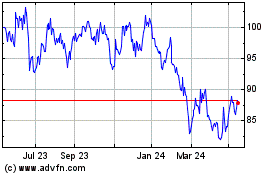

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jun 2023 to Jun 2024