AEW UK REIT PLC AEW UK REIT sells Nottingham office for £3.65m (4779K)

April 11 2018 - 2:00AM

UK Regulatory

TIDMAEWU

RNS Number : 4779K

AEW UK REIT PLC

11 April 2018

AEW UK REIT plc sells Nottingham office block for GBP3.65m

AEW UK REIT plc ("the Company"), which directly owns a

diversified portfolio of regional UK commercial property assets, is

pleased to announce the sale of the office accommodation at Pearl

Assurance House, Nottingham for GBP3.65m.

The sale comprises the first to the ninth floors, a ground floor

reception and car parking spaces, providing a total area of 41,262

sq ft, and reflecting a net initial yield (NIY) of 6.9%.

Pearl Assurance House was purchased by the Company in May 2016

for GBP8.15m. The Company will retain the ground floor

accommodation in this busy city centre location, totalling 28,432

sq ft, let to national retail operators including Costa Coffee,

Poundland and Lakeland. The retained element will provide the

Company with an ongoing yield of 9.5% based on its component value

of GBP5.26m.

Alex Short, Portfolio Manager, AEW UK REIT, commented: "Having

completed numerous asset management initiatives within this

property, including the completion of lease renewals across three

floors and gaining consent for residential development across the

upper floors, we believe that this is the right time to sell the

office component of the asset having maximised its value in the

short term. We are pleased to retain the ground floor, which

provides an attractive yield for the Company in a major city centre

location."

ENDS

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total

return to shareholders by investing predominantly in smaller

commercial properties (typically less than GBP10 million), on

shorter occupational leases in strong commercial locations across

the United Kingdom. The Company was listed on the Official List of

the UK Listing Authority and admitted to trading on the Main Market

of the London Stock Exchange on 12 May 2015, raising GBP100.5m.

Since IPO it has raised a further GBP51m.

The Company is currently invested in office, retail, industrial

and leisure assets, with a focus on active asset management,

repositioning the properties and improving the quality of the

income stream.

AEWU is currently paying an annualised dividend of 8p per

share.

www.aewukreit.com

About AEW UK Investment Management LLP

The Investment Manager AEW UK Investment Management LLP is a

50:50 joint venture between the principals of the Investment

Manager and AEW. It employs a well-resourced team comprising 25

individuals covering investment, asset management, operations and

strategy. It is part of AEW Group, one of the world's largest real

estate managers, with EUR58.5 billion of assets under management as

at 31 December 2017. AEW Group comprises AEW SA and AEW Capital

Management L.P., a U.S. registered investment manager and their

respective subsidiaries. In Europe, as at 31 December 2017, AEW

Group managed EUR28.4 billion in value in properties of all types

located in 15 countries, with close to 600 staff.

Enquiries:

AEW UK

Alex Short alex.short@eu.aew.com

+44(0) 207 016 4880

Laura Elkin laura.elkin@eu.aew.com

+44(0) 207 016 4869

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 771 140 1021

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 207 954 9547

Media Enquiries

TB Cardew (Financial PR aew@tbcardew.com

advisor) +44(0) 7738 724 630

Ed Orlebar +44(0) 7789 998 020

Tom Allison +44(0) 7789 374 663

Lucy Featherstone

About AEW Europe

AEW is one of the world's largest real estate asset managers,

with EUR58.5bn of assets under management as at 31 December 2017.

AEW has close to 600 employees, with its main offices located in

Boston, London, Paris and Hong Kong and offers a wide range of real

estate investment products including comingled funds, separate

accounts and securities mandates across the full spectrum of

investment strategies. AEW represents the real estate asset

management platform of Natixis Investment Managers, one of the

largest asset managers in the world.

As at 31 December 2017, AEW managed EUR28.4bn of real estate

assets in Europe on behalf of a number of funds and separate

accounts. AEW has close to 400 employees based in 10 offices across

Europe and has a long track record of successfully implementing

core, value-add and opportunistic investment strategies on behalf

of its clients. In the last five years, AEW has invested and

divested a total volume of over EUR17.5bn of real estate across

European markets.

www.aeweurope.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISURUVRWAASAAR

(END) Dow Jones Newswires

April 11, 2018 02:00 ET (06:00 GMT)

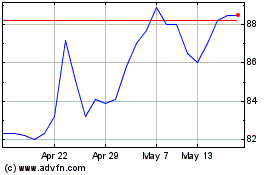

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From May 2024 to Jun 2024

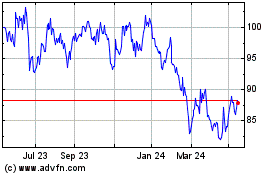

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jun 2023 to Jun 2024