UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x |

QUARTERLY REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

for the quarterly period ended

June 30, 2023 |

OR

| ¨ |

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

for the transition period from

to

|

Commission File Number: 001-34800

ECA MARCELLUS TRUST I

(Exact name of registrant as specified in its

charter)

| Delaware |

|

27-6522024 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

| |

|

|

| The

Bank of New York Mellon |

|

|

| Trust

Company, N.A., Trustee |

|

|

| Global

Corporate Trust |

|

|

| 601

Travis Street, 16th Floor |

|

|

| Houston,

Texas |

|

77002 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(512)

236-6555

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x

No ¨

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ¨ No ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer

¨ |

|

Accelerated

filer ¨ |

|

Non-accelerated

filer x |

Smaller

reporting company x |

Emerging

growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨

No x

As of August 14, 2023, 17,605,000 Common Units of Beneficial

Interest in ECA Marcellus Trust I were outstanding.

TABLE OF CONTENTS

References to the “Trust” in this document

refer to ECA Marcellus Trust I. As discussed in Part I, Item 2 – “Trustee’s Discussion and Analysis of Financial

Condition and Results of Operations – Overview,” in November 2017 Greylock Energy, LLC, and certain of its wholly owned

subsidiaries acquired substantially all of the gas production and midstream assets of Energy Corporation of America, including all of

the interests of Legacy ECA (as defined below) in certain natural gas properties that are subject to the royalty interests held by ECA

Marcellus Trust I (the “Acquisition”). References to “Greylock Energy” in this document refer to Greylock Energy,

LLC and certain of its wholly-owned subsidiaries, including Greylock Production, LLC (“Greylock Production”), which serves

as operator of the subject wells, and Greylock Midstream, LLC (“Greylock Midstream”), whose subsidiaries market and gather

certain of the gas. References to “Legacy ECA” in this document refer to Energy Corporation of America and its wholly-owned

subsidiaries, and, when discussing the conveyance documents, the Private Investors (as defined in “Glossary of Certain Terms”

in Appendix A), as such entities existed prior to the asset acquisition by Greylock Energy. References to the “Sponsor” in

this document refer to Legacy ECA for periods prior to the Acquisition, and to Greylock Energy for periods after the Acquisition.

PART I-FINANCIAL

INFORMATION

| Item 1. | Financial Statements. |

| ECA Marcellus Trust I |

| Statements of Assets, Liabilities, and Trust Corpus |

| |

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS: | |

| | | |

| | |

| Cash | |

$ | 2,012,062 | | |

$ | 2,169,420 | |

| Royalty income receivable | |

| 582,893 | | |

| 2,387,846 | |

| Royalty interest in gas properties | |

| 352,100,000 | | |

| 352,100,000 | |

| Accumulated amortization | |

| (340,083,458 | ) | |

| (339,477,839 | ) |

| Net royalty interest in gas properties | |

| 12,016,542 | | |

| 12,622,161 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 14,611,497 | | |

$ | 17,179,427 | |

| | |

| | | |

| | |

| LIABILITIES AND TRUST CORPUS: | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Distributions payable to unitholders | |

$ | 4,926 | | |

$ | 2,187,332 | |

| Trust corpus; 17,605,000 common units authorized, issued and outstanding | |

| 14,606,571 | | |

| 14,992,095 | |

| | |

| | | |

| | |

| Total Liabilities and Trust Corpus | |

$ | 14,611,497 | | |

$ | 17,179,427 | |

See notes to the unaudited financial statements.

| ECA Marcellus Trust I |

| Statements of Distributable Income |

| (Unaudited) |

| | |

| | |

| | |

| | |

| |

| | |

Six Months Ended | | |

Three Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Royalty income | |

$ | 1,748,436 | | |

$ | 5,559,807 | | |

$ | 582,893 | | |

$ | 3,458,976 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net proceeds to Trust | |

$ | 1,748,436 | | |

$ | 5,559,807 | | |

$ | 582,893 | | |

$ | 3,458,976 | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative expense | |

| (827,810 | ) | |

| (620,024 | ) | |

| (494,730 | ) | |

| (262,981 | ) |

| Interest income | |

| 57,099 | | |

| 1,876 | | |

| 27,592 | | |

| 1,817 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income available for distribution prior to cash reserves | |

$ | 977,725 | | |

$ | 4,941,659 | | |

$ | 115,755 | | |

$ | 3,197,812 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cash reserves withheld by Trustee | |

| (180,000 | ) | |

| (180,000 | ) | |

| (90,000 | ) | |

| (90,000 | ) |

| Interest withheld on cash reserves | |

| (37,643 | ) | |

| (1,028 | ) | |

| (20,829 | ) | |

| (995 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Distributable income available to unitholders | |

$ | 760,082 | | |

$ | 4,760,631 | | |

$ | 4,926 | | |

$ | 3,106,817 | |

| | |

| | | |

| | | |

| | | |

| | |

| Distributable income per common unit (17,605,000 units authorized and outstanding) | |

$ | 0.043 | | |

$ | 0.270 | | |

$ | 0.000 | | |

$ | 0.176 | |

See notes to the unaudited financial statements.

| ECA Marcellus Trust I |

| Statements of Trust Corpus |

| (Unaudited) |

| | |

| | |

| |

| | |

Three Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| Trust Corpus, Balance at April 1, | |

$ | 14,811,172 | | |

$ | 15,639,928 | |

| Cash reserves withheld, including interest | |

| 110,829 | | |

| 90,995 | |

| Distributable income | |

| 4,926 | | |

| 3,106,817 | |

| Distributions paid or payable to unitholders | |

| (6,785 | ) | |

| (3,107,873 | ) |

| Amortization of royalty interest in gas properties | |

| (313,572 | ) | |

| (334,418 | ) |

| Impairment of royalty interest in gas properties | |

| - | | |

| - | |

| | |

| | | |

| | |

| Trust Corpus, Balance at June 30, | |

$ | 14,606,571 | | |

$ | 15,395,449 | |

| | |

Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| Trust Corpus, Balance at January 1, | |

$ | 14,992,095 | | |

$ | 15,892,890 | |

| Cash reserves withheld, including interest | |

| 217,643 | | |

| 181,028 | |

| Distributable income | |

| 760,082 | | |

| 4,760,631 | |

| Distributions paid or payable to unitholders | |

| (757,630 | ) | |

| (4,765,471 | ) |

| Amortization of royalty interest in gas properties | |

| (605,619 | ) | |

| (673,630 | ) |

| Impairment of royalty interest in gas properties | |

| - | | |

| - | |

| | |

| | | |

| | |

| Trust Corpus, Balance at June 30, | |

$ | 14,606,571 | | |

$ | 15,395,449 | |

See notes to the unaudited financial statements.

ECA MARCELLUS TRUST I

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

NOTE 1. Organization of the Trust

ECA Marcellus Trust I is a Delaware statutory trust

formed in March 2010 by Energy Corporation of America (“Legacy ECA”) to own royalty interests in 14 producing horizontal

natural gas wells producing from the Marcellus Shale formation, all of which are online and are located in Greene County, Pennsylvania

(the “Producing Wells”), and royalty interests in 52 horizontal natural gas development wells subsequently drilled to the

Marcellus Shale formation (the “PUD Wells”) within the “Area of Mutual Interest”, or “AMI”, comprising

approximately 9,300 acres held by Legacy ECA, of which it owned substantially all of the working interests, in Greene County, Pennsylvania.

The effective date of the Trust was April 1, 2010; consequently, the Trust received the proceeds of production attributable to the

PDP Royalty Interest (defined herein) from that date even though the PDP Royalty Interest was not conveyed to the Trust until the closing

of the initial public offering on July 7, 2010. The total number of units the Trust is authorized to issue is 17,605,000 units, all

of which are now common units. The royalty interests were conveyed from Legacy ECA’s working interest in the Producing Wells and

the PUD Wells limited to the Marcellus Shale formation (the “Underlying Properties”). In November 2017, Greylock Energy,

LLC and certain of its wholly owned subsidiaries (“Greylock Energy”), including Greylock Production, LLC (“Greylock

Production”), which serves as operator of the subject wells, and Greylock Midstream, LLC (“Greylock Midstream”), whose

subsidiaries market and gather certain of the gas, acquired substantially of the assets of Legacy ECA, as described in Note 4.

The royalty interest in the Producing Wells (the

“PDP Royalty Interest”) entitles the Trust to receive 90% of the proceeds (exclusive of any production or development costs

but after deducting post-production costs and any applicable taxes) from the sale of production of natural gas attributable to the Sponsor’s

initial interest in the Producing Wells. The royalty interest in the PUD Wells (the “PUD Royalty Interest” and collectively

with the PDP Royalty Interest, the “Royalty Interests”) entitles the Trust to receive 50% of the proceeds (exclusive of any

production or development costs but after deducting post-production costs and any applicable taxes) from the sale of production of natural

gas attributable to the Sponsor’s initial interest in the PUD Wells.

The Trust’s cash receipts in respect of the

Royalty Interests are determined after deducting post-production costs and any applicable taxes associated with the Perpetual Royalty

Interests. The Trust’s cash available for distribution is reduced by Trust administrative expenses. Post-production costs generally

consist of costs incurred to gather, compress, transport, process, treat, dehydrate and market the natural gas produced. Charges (the

“Post-Production Services Fee”) payable to the Sponsor for such post-production costs on the Greene County Gathering System

(“GCGS”) were limited to $0.52 per MMBtu gathered until Legacy ECA fulfilled its drilling obligation in 2011; since then the

Sponsor has been permitted to increase the Post-Production Services Fee to the extent necessary to recover certain capital expenditures

in the GCGS. Additionally, if electric compression is utilized in lieu of gas as fuel in the compression process, the Trust will be charged

for the electric usage as provided for in the Trust conveyance documents.

The trust agreement provides that the Trust will

terminate if gross proceeds to the Trust attributable to the Royalty Interests over any four consecutive quarters are less than $1.5 million.

If this early termination event occurs, the trust agreement will require the Trustee to sell the Royalty Interests, either by private

sale or public auction, subject to Greylock Energy's right of first refusal to purchase the Royalty Interests. After the sale of

all of the Royalty Interests, payment of all Trust liabilities and establishment of reasonable provisions for the payment of additional

anticipated or contingent Trust expenses or liabilities, the Trustee will distribute the net proceeds of the sale to the Trust unitholders.

The Trust makes quarterly cash distributions of

substantially all of its cash receipts, after deducting Trust administrative expenses, including the costs incurred as a result of being

a publicly traded entity, on or about the 60th day following the completion of each quarter. Unless sooner terminated, the

Trust will begin to liquidate on or about March 31, 2030 (the “Termination Date”) and will soon thereafter wind up its

affairs and terminate. At the termination of the Trust, 50% of each of the PDP Royalty Interest and the PUD Royalty Interest will revert

automatically to Greylock Production. The remaining 50% of each of the PDP Royalty Interest and the PUD Royalty Interest will be sold,

and the net proceeds will be distributed pro rata to the unitholders soon after the termination of the Trust. Greylock Production will

have a right of first refusal to purchase the remaining 50% of the Royalty Interests at the termination of the Trust.

The business and affairs of the Trust are administered

by The Bank of New York Mellon Trust Company, N.A., as Trustee. Although Greylock Production operates all of the Producing Wells and all

of the PUD Wells, Greylock Production has no ability to manage or influence the management of the Trust. Neither the Trust nor the Trustee

has any authority or responsibility for, or any involvement with or influence over, any aspect of the operations on or relating to the

properties to which the Royalty Interests relate.

NOTE 2. Basis of Presentation

The preparation of financial statements requires

the Trust to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period.

Without limiting the foregoing statement, the information furnished is based upon certain estimates of the revenues attributable to the

Trust from natural gas production for the three and six months ended June 30, 2023 and 2022 and is therefore subject to adjustment

in future periods to reflect actual production for the periods presented.

The information furnished reflects all normal and

recurring adjustments which are, in the opinion of the Trustee, necessary for a fair presentation of the results for the interim period

presented. The accompanying unaudited interim financial statements should be read in conjunction with the audited financial statements

and notes thereto included in the Trust’s Annual Report on Form 10-K for the year ended December 31, 2022. The December 31,

2022 condensed balance sheet data was derived from audited financial statements, but does not include all applicable financial statement

disclosures.

NOTE 3. Significant Accounting Policies

The accompanying unaudited financial information

has been prepared by the Trustee in accordance with the instructions to Form 10-Q. The financial statements of the Trust differ from

financial statements prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”)

because certain cash reserves may be established for contingencies, which would not be accrued in financial statements prepared in accordance

with GAAP. Amortization of the investment in overriding royalty interests calculated on a unit-of-production basis is charged directly

to Trust Corpus. This comprehensive basis of accounting other than GAAP corresponds to the accounting permitted for royalty trusts by

the U.S. Securities and Exchange Commission (“SEC”) as specified by Accounting Standard Codification (“ASC”) Topic

932, Extractive Activities—Oil and Gas: Financial Statements of Royalty Trusts. Income determined on the basis of GAAP would include

all expenses incurred for the period presented. However, the Trust serves as a pass-through entity, with expenses for depreciation, depletion,

and amortization, interest and income taxes being based on the status and elections of the Trust unitholders. General and administrative

expenses, production taxes or any other allowable costs are charged to the Trust only when cash has been paid for those expenses. In addition,

the Royalty Interests are not burdened by field and lease operating expenses. Thus, the statement shows distributable income, defined

as income of the Trust available for distribution to the Trust unitholders before application of those additional expenses, if any, for

depreciation, depletion, and amortization, interest and income taxes. The revenues are presented net of existing royalties and overriding

royalties and have been reduced by gathering/post-production expenses.

Cash:

Cash may include highly liquid instruments maturing

in three months or less from the date acquired.

Use of Estimates in the Preparation of Financial

Statements:

The preparation of financial statements requires

the Trust to make estimates and assumptions that affect the reported amounts of assets and liabilities and the reported amounts of revenues

and expenses during the reporting period. Actual results could differ from those estimates.

Revenue and Expenses:

The Trust serves as a pass-through entity, with

items of depletion, interest income and expense, and income tax attributes being based upon the status and election of the unitholders.

Thus, the Statements of Distributable Income show Income available for distribution before application of those unitholders’ additional

expenses, if any, for depletion, interest income and expense, and income taxes.

The Trust uses the accrual basis to recognize revenue,

with royalty income recorded as reserves are extracted from the Underlying Properties and sold. Expenses are recognized when paid.

Royalty Interest in Gas Properties:

The Royalty interest in gas properties is assessed

to determine whether the net capitalized cost is impaired, whenever events or changes in circumstances indicate that its carrying amount

may not be recoverable, pursuant to ASC Topic 360, Property, Plant and Equipment. The Trust determines whether an impairment charge is

necessary to its investment in the Royalty interest in gas properties if total capitalized costs, less accumulated amortization, exceed

undiscounted future net revenues attributable to proved gas reserves of the Underlying Properties. Determination as to whether and how

much an asset is impaired involves estimates of fair value, which is determined based on discounted cash flow techniques using assumptions

including projected revenues, future commodity prices, production costs, and market-specific average cost of capital. Estimates of undiscounted

future net revenues attributable to proved gas reserves utilize estimates of future pricing, which are generally developed based on NYMEX

forward pricing curves. If required, the Trust will recognize an impairment charge to the extent that the net capitalized costs exceed

the discounted fair value of the investment in net profits interests attributable to proved gas reserves of the Underlying Properties.

Any such impairment charge would not reduce Distributable Income, although it would reduce Trust Corpus. No impairment in the Underlying

Properties was recognized during 2022 or during the three and six months ended June 30, 2023. Significant dispositions or abandonment

of the Underlying Properties are charged to Royalty Interests and the Trust Corpus.

Amortization of the Royalty interest in gas properties

is calculated on a units-of-production basis, whereby the Trust’s cost basis in the properties is divided by Trust total proved

reserves to derive an amortization rate per reserve unit. Such amortization does not reduce Distributable Income, rather it is charged

directly to Trust Corpus. Revisions to estimated future units-of-production are treated on a prospective basis beginning on the date significant

revisions are known.

The conveyance of the Royalty Interest to the Trust

was accounted for as a purchase transaction. The $352,100,000 reflected in the Statements of Assets, Liabilities and Trust Corpus as Royalty

interests in gas properties represents 17,605,000 Trust units valued at $20.00 per unit. The carrying value of the Trust’s investment

in the Royalty Interests is not necessarily indicative of the fair value of such Royalty Interests.

NOTE

4. Reaffirmation Agreement

On November 29, 2017, Greylock Energy acquired

substantially all of the gas production and midstream assets of Legacy ECA, including Legacy ECA’s interests in certain natural

gas properties that are subject to royalty interests held by the Trust.

In

connection with the transaction, Greylock Production assumed all of Legacy ECA’s obligations under the Amended and Restated

Trust Agreement among the Trust, Legacy ECA and the Trustee (the “Trust Agreement”), and other instruments to which Legacy

ECA and the Trustee were parties, including (1) the Administrative Services Agreement by and among Legacy ECA, the Trust and the

Trustee dated July 7, 2010, and (2) a letter agreement between Legacy ECA and the Trustee regarding certain loans to be made

by Legacy ECA to the Trust as necessary to enable the Trust to pay its liabilities as they become due (the “Letter Agreement”).

In addition, Legacy ECA, Greylock Production, and the Trustee entered into a Reaffirmation and Amendment of Mortgage, Assignment of Leases,

Security Agreement, Fixture Filing and Financing Statement (the “Reaffirmation Agreement”), pursuant to which, among other

things, Greylock Production (1) reaffirmed the liens and the security interest granted pursuant to the existing mortgage securing

the interests in the subject properties, as well as the mortgage and the obligations of Legacy ECA under the mortgage, and (2) assumed

the obligations of Legacy ECA under the Letter Agreement. As of June 30, 2023, no amounts have been loaned to the Trust pursuant

to the Letter Agreement.

NOTE 5. Income Taxes

The Trust is a Delaware statutory trust, which

is taxed as a partnership for federal and state income taxes. Accordingly, no provision for federal or state income taxes has been made.

Uncertain tax positions are accounted for under ASC Topic 740, Income Taxes (“ASC 740”), which prescribes a recognition

threshold and measurement attribute for financial statement disclosure of tax positions taken or expected to be taken on a tax return.

Additionally, ASC 740 provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure,

and transition. The Trust has not identified any uncertain tax positions through the period ended June 30, 2023.

NOTE 6. Related Party Transactions

Trustee Administrative Fee:

Under the terms of the Trust Agreement, the Trustee

charges an annual administrative fee, subject to adjustment each year. The annual fee was $167,027 in 2022 and is $171,743 in 2023. The

Trust deducts these costs, as well as those to be paid to Greylock Production pursuant to the Administrative Services Agreement referred

to below, in the period paid.

Administrative Services Fee:

The Trust and Greylock Production are parties to

an Administrative Services Agreement that obligates the Trust to pay Greylock Production an administrative services fee for accounting,

bookkeeping and informational services to be performed by Greylock Production on behalf of the Trust relating to the Royalty Interests.

The annual fee of $60,000 is payable in equal quarterly installments. Under certain circumstances, Greylock Production and the Trustee

each may terminate the Administrative Services Agreement at any time following delivery of notice no less than 90 days prior to the date

of termination.

| Item 2. |

Trustee's Discussion and Analysis of Financial Condition and Results of Operations. |

References to the “Trust” in this document

refer to ECA Marcellus Trust I. As discussed in “Overview” below, Greylock Energy acquired substantially all of the assets

of Energy Corporation of America in November 2017. References to “Legacy ECA” in this document refer to Energy Corporation

of America and its wholly-owned subsidiaries and, when discussing the conveyance documents, the Private Investors, as such entities existed

prior to the asset acquisition by Greylock Energy. The following review of the Trust’s financial condition and results of operations

should be read in conjunction with the financial statements and notes thereto and the audited financial statements and notes thereto included

in the Trust’s Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Form 10-K”).

The Trust’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments

to those reports are available on the SEC’s website at www.sec.gov and at http://ect.q4web.com/home/default.aspx. Certain terms

used herein are defined in Appendix A. All information regarding operations has been provided to the Trustee by Greylock Energy.

Note Regarding Forward-Looking Statements

This report contains “forward-looking statements”

about Greylock Energy and the Trust and other matters discussed herein that are subject to risks and uncertainties. All statements other

than statements of historical fact included in this document, including, without limitation, statements under “Trustee’s Discussion

and Analysis of Financial Condition and Results of Operations” and “Risk Factors” regarding the financial position,

business strategy, production and reserve growth, development activities and costs and other plans and objectives for the future operations

of Greylock Energy and all matters relating to the Trust are forward-looking statements. Actual outcomes and results may differ materially

from those projected.

When used in this document, the words “believes,”

“expects,” “anticipates,” “intends” or similar expressions, are intended to identify such forward-looking

statements. Further, all statements regarding future circumstances or events are forward-looking statements. The following important factors,

in addition to those discussed elsewhere in this document, could affect the future results of the energy industry in general, and Greylock

Energy and the Trust in particular, and could cause those results to differ materially from those expressed in such forward-looking statements:

| • | risks incident to the operation of natural gas wells; |

| • | future production costs; |

| • | the effects of existing and future laws and regulatory actions; |

| • | the effects of changes in commodity prices; |

| • | conditions in the capital markets; |

| • | the occurrence or threat of epidemic or pandemic diseases, such as the COVID-19 pandemic, or any government response to such occurrence

or threat; |

| • | the armed conflict between Russia and Ukraine and the potential destabilizing effect such conflict may pose for global natural gas

markets; |

| • | competition in the energy industry; |

| • | the uncertainty of estimates of natural gas reserves and production; and |

| • | other risks described under the caption “Risk Factors” in Part I, Item 1A of the 2022 Form 10-K. |

This report describes other important factors that

could cause actual results to differ materially from expectations of Greylock Energy and the Trust. All subsequent written and oral forward-looking

statements attributable to Greylock Energy or the Trust or persons acting on behalf of Greylock Energy or the Trust are expressly qualified

in their entirety by such factors. The Trust assumes no obligation, and disclaims any duty, to update these forward-looking statements.

Overview

The

Trust is a statutory trust created under the Delaware Statutory Trust Act. The Bank of New York Mellon Trust Company, N.A. serves

as Trustee. The Trust does not conduct any operations or activities. The Trust’s purpose is, in general, to hold the Royalty Interests

(described below), to distribute to the Trust unitholders cash that the Trust receives in respect of the Royalty Interests after payment

of Trust expenses, and to perform certain administrative functions in respect of the Royalty Interests and the Trust units. The Trustee

has no authority or responsibility for, and no involvement with, any aspect of the oil and gas operations on the properties to which the

Royalty Interests relate. The Trust derives all or substantially all of its income and cash flows from the Royalty Interests. The

Trust is treated as a partnership for federal and state income tax purposes.

In

November 2017, Greylock Energy and certain of its wholly owned subsidiaries, including Greylock Production, LLC, which serves

as operator of the subject wells, and Greylock Midstream, LLC, whose subsidiaries market and gather certain of the gas, acquired substantially

all of the gas production and midstream assets of Legacy ECA, including all of Legacy ECA’s interests in certain natural gas properties

that are subject to royalty interests held by the Trust.

In

connection with the transaction, Greylock Production assumed all of Legacy ECA’s obligations under the Trust Agreement and

other instruments to which Legacy ECA and the Trustee were parties, including (1) the Administrative Services Agreement by and among

Legacy ECA, the Trust and the Trustee dated July 7, 2010, and (2) a letter agreement between Legacy ECA and the Trustee regarding

certain loans to be made by Legacy ECA to the Trust as necessary to enable the Trust to pay its liabilities as they become due (the “Letter

Agreement”). In addition, Legacy ECA, Greylock Production, and the Trustee entered into a Reaffirmation and Amendment of Mortgage,

Assignment of Leases, Security Agreement, Fixture Filing and Financing Statement (the “Reaffirmation Agreement”), pursuant

to which, among other things, Greylock Production (1) reaffirmed the liens and the security interest granted pursuant to the existing

mortgage securing the interests in the subject properties, as well as the mortgage and the obligations of Legacy ECA under the mortgage,

and (2) assumed the obligations of Legacy ECA under the Letter Agreement.

The

Royalty Interests were conveyed to the Trust from the working interest now held by Greylock Production in the Producing Wells and the

PUD Wells limited to the Underlying Properties. The PDP Royalty Interest entitles the Trust to receive 90% of the proceeds (exclusive

of any production or development costs but after deducting post-production costs and any applicable taxes) from the sale of production

of natural gas attributable to the Sponsor’s initial interest in the Producing Wells for a period of 20 years commencing

on April 1, 2010 and 45% thereafter. The PUD Royalty Interest entitles the Trust to receive 50% of the proceeds (exclusive of any

production or development costs but after deducting post-production costs and any applicable taxes) from the sale of production of natural

gas attributable to the Sponsor’s initial interest in the PUD Wells for a period of 20 years commencing on April 1, 2010

and 25% thereafter.

Legacy ECA was obligated

to drill all of the PUD Wells by March 31, 2014. As of November 30, 2011, Legacy ECA had fulfilled its drilling obligation to

the Trust by drilling 40 PUD Wells (52.06 Equivalent PUD Wells), calculated as provided in the Development Agreement. Consequently, no

additional wells will be drilled for the Trust. The Trust was not responsible for any costs related to the drilling of development wells

or any other development or operating costs. As of June 30, 2023, the Trust owns royalty interests in 14 Producing Wells and the

40 development wells (52.06 Equivalent PUD Wells) that are now completed and in production.

The

Trust’s cash receipts in respect of the Royalty Interests are determined after deducting post-production costs and any

applicable taxes associated with the Royalty Interests, and the Trust’s cash available for distribution is reduced by Trust

administrative expenses and any amounts reserved for administrative expenses. Post-production costs generally consist of

costs incurred to gather, compress, transport, process, treat, dehydrate and market the natural gas produced. Charges (the

“Post-Production Services Fee”) payable to Legacy ECA for such post-production

costs on the related GCGS were limited to $0.52 per MMBtu gathered until Legacy ECA fulfilled its drilling obligation in 2011; since

then the Sponsor has been permitted to increase the Post-Production Services Fee to the extent necessary to recover certain capital

expenditures in the GCGS.

Greylock Production has an agreement with Columbia

Gas Transmission, LLC (“Columbia”) to provide firm transportation downstream of the GCGS for 45,000 MMBtu per day (the

“Transportation Agreement”). The Transportation Agreement has been in effect since August 1, 2011 and provides for firm

transportation at Columbia’s filed tariff rate, which is currently $0.3154 per MMBtu at one hundred percent load factor. As amended

by Greylock Production and Columbia in September 2020, the Transportation Agreement will terminate on December 31, 2024.

Greylock Production and Columbia had an additional

agreement, as amended in September 2020, to provide firm transportation downstream of the GCGS for 52,550 MMBtu per day that will

utilize Columbia’s Mountaineer XPress Project (the “MXP Agreement”). This firm transportation arrangement went into

effect on January 18, 2019, and was at a fixed demand rate of $0.50 per MMBtu at one hundred percent load factor plus applicable

Columbia tariff surcharges until its termination on December 31, 2022.

Firm transportation utilized as to the Trust’s

interests is a chargeable post-production cost, and the Trust bears its proportionate share of such costs; however, the Trust was not

charged for the costs associated with modifying the firm transportation agreements with Columbia, including the difference between the

base negotiated rate and the increased negotiated rate in September 2020 and December 2021 under the MXP Agreement.

On July 31, 2020 Columbia submitted an application

to the Federal Energy Regulatory Commission (“FERC”) to increase certain tariff rates effective February 1, 2021. The

FERC issued an Order Accepting and Suspending Filing, Subject to Refund on August 31, 2021. As proposed, this tariff filing would

have increased the tariff rate from $0.23/MMBtu to $0.41/MMBtu on the applicable contracts. The tariff filing was protested at the FERC,

and on February 25, 2022, the FERC approved the Stipulation and Agreement of Settlement and Motion for Shortened Comment Period submitted

by Columbia, which resolved all remaining issues set for hearing in the consolidated proceedings and adjusted the tariff rate to $0.3154/MMBtu

effective December 1, 2021, requiring Columbia to issue a refund on the difference between the initial increased rate and the final

rate. Greylock Production received the refund from Columbia in April 2022 and distributed a refund of $102,075 to the Trust, which

was reflected in Royalty Income during the year ended December 31, 2022.

Generally, the percentage

of production proceeds to be received by the Trust with respect to a well equals the product of (i) the percentage of proceeds to

which the Trust is entitled under the terms of the conveyances (90% for the Producing Wells and 50% for the PUD Wells) multiplied by (ii) Greylock

Production’s net revenue interest in the well. Greylock Production on average owns an 81.53% net revenue interest in the Producing

Wells. Therefore, the Trust is entitled to receive on average 73.37% of the proceeds of production from the Producing Wells. With respect

to the PUD Wells, the conveyance related to the PUD Royalty Interest provides that the proceeds from the PUD Wells will be calculated

on the basis that the underlying PUD Wells are burdened only by interests that in total would not exceed 12.5% of the revenues from such

properties, regardless of whether the royalty interest owners are actually entitled to a greater percentage of revenues from such properties.

As an example, assuming Greylock Production owns a 100% working interest in a PUD Well, the applicable net revenue interest is calculated

by multiplying Greylock Production’s percentage working interest in the 100% working interest well by the unburdened interest percentage

(87.5%), and such well would have a minimum 87.5% net revenue interest. Accordingly, the Trust is entitled to a minimum of 43.75% of the

production proceeds from the well provided in this example. To the extent Greylock Production’s working interest in a PUD Well is

less than 100%, the Trust’s share of proceeds would be proportionately reduced.

The Trust makes quarterly

cash distributions of substantially all of its cash receipts, after deducting Trust administrative expenses and costs and reserves therefor,

on or about the 60th day following the completion of each quarter. Unless sooner terminated, the Trust will begin to liquidate

in March 2030 and will soon thereafter wind up its affairs and terminate.

The amount of Trust revenues and cash distributions

to Trust unitholders depends on, among other things:

| • | natural gas prices received; |

| • | the volume and Btu rating of natural gas produced and sold; |

| • | post-production costs and any applicable taxes; and |

| • | administrative expenses of the Trust including expenses incurred as a result of being a publicly traded entity and any changes in

amounts reserved for such expenses. |

The markets for natural gas are volatile, as demonstrated by significant

price swings experienced during 2020 and 2021 attributable primarily to the economic effects of the COVID-19 pandemic, followed by the

gradual return of demand for natural gas as economies reopened. COVID-19 and the responses by federal, state and local governmental authorities

to the pandemic also resulted in significant business and operational disruptions, including business closures, supply chain disruptions,

travel restrictions, stay-at-home orders and limitations on the availability of workforces. Meanwhile, the outbreak of armed conflict

between Russia and Ukraine in February 2022 and the subsequent sanctions imposed on Russia and other actions have created significant

market uncertainties, including uncertainties around potential supply disruption for oil and natural gas, which has further enhanced the

volatility in natural gas prices since early 2022. The extent and duration of the military action, sanctions and resulting market disruptions

could be significant, including significant volatility in commodity prices, supply of energy resources, instability in financial markets,

supply chain interruptions, political and social instability, changes in consumer or purchaser preferences as well as increases in cyberattacks

and espionage, each of which could have a substantial impact on the global economy and consequently the Trust’s business for an

unknown period of time. Although these events are not currently expected to have a material impact on the Trust’s business, cash

flows, liquidity or financial condition, neither Greylock nor the Trustee can predict the progress or outcome of the military conflict

in Ukraine, as the conflict, and any resulting government reactions, are evolving and beyond the control of Greylock or the Trust. Although

the inflation rate has declined from the higher levels experienced in 2022 and early 2023, the resulting increases in interest rates since

the first quarter of 2022 and the prospect of a possible recession in the near future also could have a negative effect on the demand

for natural gas. Given the dynamic nature of these events, neither Greylock Energy nor the Trust can reasonably estimate the period of

time that these market conditions will persist. As a result, prices for natural gas, and therefore the Trust’s quarterly cash distributions,

might not be maintained for any significant period of time. Low natural gas prices will reduce revenues to the Trust, which will reduce

the amount of cash available for distribution to unitholders and in certain periods could result in no distributions to unitholders. For

example, there were no distributions to unitholders for the quarters ended March 31, 2020, June 30, 2020, or September 30,

2020 as Trust expenses exceeded net revenues to the Trust.

The effective date of the Trust was April 1,

2010, meaning the Trust has received the proceeds of production attributable to the PDP Royalty Interest from that date even though the

PDP Royalty Interest was not conveyed to the Trust until July 7, 2010. The amount of the quarterly distributions fluctuates from

quarter to quarter, depending on the proceeds received by the Trust, among other factors. There is no minimum required distribution.

Pursuant to Section 1446 of the Internal Revenue

Code of 1986 (the “IRC”), withholding tax on income effectively connected to a United States trade or business allocated to

non-U.S. persons (“ECI”) should be made at the highest marginal rate. Under IRC Section 1441, withholding tax on fixed,

determinable, annual, periodic income from United States sources allocated to non-U.S. persons should be made at a 30% rate unless the

rate is reduced by treaty. Nominees and brokers should withhold at the highest marginal rate on the distribution made to non-U.S. persons.

The Tax Cuts and Jobs Act (the “TCJA”) enacted in December 2017 treats a non-U.S. holder’s gain on the sale of

Trust units as ECI to the extent such holder would have had ECI if the Trust had sold all of its assets at fair market value on the date

of the sale of such Trust units. The TCJA also requires a transferee of units to withhold 10% of the amount realized on the sale of exchange

of units (generally, the purchase price) unless the transferor certifies that it is not a nonresident alien individual or foreign corporation

or another exception is available. Pursuant to final Treasury Regulations issued on October 7, 2020, this withholding obligation

applies to transfers of units in publicly traded partnerships such as the Trust (which is classified as a partnership for federal and

state income tax purposes) occurring on or after January 1, 2022.

Results of Trust Operations

For the Three Months Ended June 30, 2023 compared to the Three

Months Ended June 30, 2022

Distributable income for the three months ended

June 30, 2023 decreased to $4,926 from $3.1 million for the three months ended June 30, 2022. Compared to the quarter ended

June 30, 2022, royalty income decreased by $3.0 million while general and administrative expenses increased by $0.2 million.

Royalty income decreased to $0.6 million for the

three months ended June 30, 2023 from $3.5 million for the three months ended June 30, 2022, a decrease of $2.9 million. This

decrease was due to a decrease in the average sales price between periods and a decrease in production.

The average price realized for the three months

ended June 30, 2023 decreased $4.81 per Mcf to $1.02 per Mcf as compared to $5.83 per Mcf for the three months ended June 30,

2022. The decrease in the average sales price realized for natural gas production was due to a lower average sales price offset partially

from a decrease in other post-production costs during the period. The average sales price, before post-production costs, decreased from

$6.62 per Mcf for the three months ended June 30, 2022 to $1.63 per Mcf for the three months ended June 30, 2023. The decrease

in price was the result of a decrease in the weighted average monthly closing NYMEX price for the current period to $2.10 per MMBtu

compared to the weighted average monthly closing NYMEX price of $7.12 per MMBtu for the three months ended June 30, 2022. The average

Basis per MMBtu realized for the three months ended June 30, 2023 decreased $0.19 per Mcf to minus $0.52 per Mcf as compared to minus

$0.71 per Mcf for the three months ended June 30, 2022.

Post-production costs consist of a post-production

services fee together with a charge for electricity used in lieu of gas for compression on the gathering system and firm transportation

charges on interstate gas pipelines. Overall, average post-production costs decreased to $0.61 per Mcf in the current period compared

to $0.78 per Mcf, net of the Columbia FERC tariff settlement described in “—Overview”, for the three-month

period ended June 30, 2022, primarily due to a decrease in firm transportation cost.

Production decreased 3.4% from 593 MMcf for the

three months ended June 30, 2022 to 573 MMcf for the three months ended June 30, 2023 due to normal production declines.

General and administrative

expenses paid by the Trust were $0.5 million for the three-month period ended June 30, 2023 compared to $0.3 million for the three-month

period ended June 30, 2022, an increase of $0.2 million. This increase primarily resulted from higher professional services expenses

due to the timing of payments. Cash reserves of $0.1 million were withheld for each of the three-month periods ended June 30, 2023

and June 30, 2022.

For the Six Months Ended June 30, 2023 compared to the Six

Months Ended June 30, 2022

Distributable income for the six months ended June 30,

2023 decreased to $0.8 million from $4.8 million for the six months ended June 30, 2022. Compared to the six months ended June 30,

2022, royalty income decreased by $3.8 million while general and administrative expenses increased by $0.2 million.

Royalty income for the six months ended June 30,

2023 decreased to $1.7 million from $5.6 million for the six months ended June 30, 2022, a decrease of $3.8 million. This decrease

was due to a decrease in the average sales price between periods and a decrease in production.

The average price realized for the six months ended

June 30, 2023 decreased $3.07 per Mcf to $1.58 per Mcf as compared to $4.65 per Mcf for the six months ended June 30, 2022.

The decrease in the average sales price realized for natural gas production was due to a lower average sales price partially offset by

a decrease in other post-production costs during the period. The average sales price, before post-production costs, decreased from $5.50

per Mcf for the six months ended June 30, 2022 to $2.18 per Mcf for the six months ended June 30, 2023. The decrease in price

was the result of a decrease in the weighted average monthly closing NYMEX price for the current period to $2.74 per MMBtu compared

to the weighted average monthly closing NYMEX price of $6.01 per MMBtu for the six months ended June 30, 2022. The average Basis

per MMBtu realized for the six months ended June 30, 2023 decreased $0.05 per Mcf to minus $0.63 per Mcf as compared to minus $0.68

per Mcf for the six months ended June 30, 2022.

Post-production costs consist of a post-production

services fee together with a charge for electricity used in lieu of gas for compression on the gathering system and firm transportation

charges on interstate gas pipelines. Overall, average post-production costs decreased to $0.60 per Mcf in the current period compared

to $0.84 per Mcf, net of the Columbia FERC tariff settlement described in “—Overview”, for the six-month period

ended June 30, 2022, primarily due to a decrease in firm transportation cost.

Production decreased 7.4% from 1,195 MMcf for the

six months ended June 30, 2022 to 1,106 MMcf for the six months ended June 30, 2023 due to normal production declines.

General and administrative

expenses paid by the Trust were $0.8 million for the six-month period ended June 30, 2023 compared to $0.6 million for the six-month

period ended June 30, 2022, an increase of $0.2 million. This increase primarily resulted from higher professional services expenses

due to the timing of payments. Cash reserves of $0.2 million were withheld for each of the six month periods ended June 30, 2023

and June 30, 2022.

Liquidity and Capital Resources

The Trust has no source of liquidity or capital

resources other than net cash flows from the Royalty Interests. Other than Trust administrative expenses, including, if applicable, expense

reimbursements to Greylock Production and any reserves established by the Trustee for future liabilities, the Trust’s only use of

cash is for distributions to Trust unitholders. Administrative expenses include payments to the Trustee and the Delaware Trustee as well

as a quarterly fee of $15,000 to Greylock Production pursuant to the Administrative Services Agreement. Each quarter, the Trustee determines

the amount of funds available for distribution. Available funds are the excess cash, if any, received by the Trust from the Royalty Interests

and other sources (such as interest earned on any amounts reserved by the Trustee) that quarter, over the Trust’s expenses for that

quarter. Available funds are reduced by any cash the Trustee determines to hold as a reserve against future expenses or liabilities. The

Trustee, on behalf of the Trust, may borrow funds required to pay expenses or liabilities if the Trustee determines that the cash on hand

and the cash to be received are insufficient to cover the Trust’s expenses or liabilities. If the Trustee borrows funds, the Trust

unitholders will not receive distributions until the borrowed funds are repaid.

Since

the first quarter of 2019, the Trustee has been gradually building a cash reserve for the payment of future expenses and liabilities of

the Trust to approximately $1.8 million by withholding cash reserve amounts from each quarterly distribution equal to the greater

of $90,000 or 10% of the amount distributable to unitholders. In November 2021,

the Trustee notified the Sponsor that the Trustee had determined to increase the targeted cash reserve to approximately $3.8 million.

The Trustee achieved its initial target of $1.8 million in the quarter ended December 31, 2022 and currently plans to withhold

$90,000 per quarter until a total of approximately $3.8 million in cash reserves is withheld. For

the quarter ended June 30, 2023, the Trustee withheld $90,000 from the funds otherwise available for distribution and withheld a

minimal amount of interest earned on the cash reserve balance. As of June 30, 2023, the Trustee has withheld from the funds otherwise

available for distribution a total amount of approximately $2.0 million plus a minimal amount of interest toward the building of the $3.8

million cash reserve. These withholdings are in addition to the existing cash reserve of $0.5 million, which is determined prior

to the payments of quarterly expenses. The Trustee may increase or decrease the targeted amount at any time, and may increase or decrease

the rate at which it is withholding funds to build the cash reserve at any time, without advance notice to the unitholders.

Payments to the Trust in respect of the Royalty

Interests are based on the complex provisions of the various conveyances held by the Trust, copies of which are filed as exhibits to the

2022 Form 10-K, and reference is hereby made to the text of the conveyances for the actual calculations of amounts due to the Trust.

The Trust does not have any transactions, arrangements

or other relationships with unconsolidated entities or persons that could materially affect the Trust’s liquidity or the availability

of capital resources.

Critical Accounting Policies and Estimates

The

financial statements of the Trust differ from financial statements prepared in accordance with generally accepted accounting principles

in the United States of America (“GAAP”) because, among other differences, certain cash reserves may be established for contingencies,

which would not be accrued in financial statements prepared in accordance with GAAP. Amortization of the investment in overriding royalty

interests calculated on a unit-of-production basis is charged directly to Trust Corpus. This comprehensive basis of accounting other than

GAAP corresponds to the accounting permitted for royalty trusts by the SEC as specified by ASC Topic 932 Extractive Activities—Oil

and Gas: Financial Statements of Royalty Trusts.

Income determined on the basis of GAAP would include

all expenses incurred for the period presented. However, the Trust serves as a pass-through entity, with expenses for depreciation, depletion,

and amortization, interest and income taxes being based on the status and elections of the Trust unitholders. General and administrative

expenses, production taxes or any other allowable costs are charged to the Trust only when cash has been paid for those expenses. In addition,

the Royalty Interests are not burdened by field and lease operating expenses. Thus, the statement shows distributable income, defined

as income of the Trust available for distribution to the Trust unitholders before application of those unitholders’ additional expenses,

if any, for depreciation, depletion, and amortization, interest and income taxes. The revenues are reflected net of existing royalties

and overriding royalties and have been reduced by gathering/post-production expenses.

Revenue and Expenses:

The Trust serves as a pass-through entity, with

items of depletion, interest income and expense, and income tax attributes being based upon the status and election of the unitholders.

Thus, the Statements of Distributable Income show income available for distribution before application of those unitholders’ additional

expenses, if any, for depletion, interest income and expense, and income taxes.

The Trust uses the accrual basis to recognize revenue,

with royalty income recorded as reserves are extracted from the Underlying Properties and sold. Expenses are recognized when paid.

Royalty Interest in Gas Properties:

The

Royalty interest in gas properties is assessed to determine whether the net capitalized cost is impaired, whenever events or changes in

circumstances indicate that its carrying amount may not be recoverable, pursuant to ASC Topic 360, Property, Plant and Equipment.

The Trust determines whether an impairment charge is necessary to its investment in the Royalty interest in gas properties if total capitalized

costs, less accumulated amortization, exceed undiscounted future net revenues attributable to proved gas reserves of the Underlying Properties.

Determination as to whether and how much an asset is impaired involves estimates of fair value, which is determined based on discounted

cash flow techniques using assumptions including projected revenues, future commodity prices, production costs, and market-specific average

cost of capital. Estimates of undiscounted future net revenues attributable to proved gas reserves utilize estimates of future pricing,

which are generally developed based upon NYMEX forward pricing curves. If required, the Trust will recognize an impairment charge to the

extent that the net capitalized costs exceed the discounted fair value of the investment in net profits interests attributable to proved

gas reserves of the Underlying Properties. Any such impairment charge would not reduce Distributable Income, although it would reduce

Trust Corpus. No impairment in the Underlying Properties was recognized during the quarter ended June 30, 2023. Significant dispositions

or abandonment of the Underlying Properties are charged to Royalty Interests and the Trust Corpus.

Amortization of the Royalty interest in gas properties

is calculated on a units-of-production basis, whereby the Trust’s cost basis in the properties is divided by Trust total proved

reserves to derive an amortization rate per reserve unit. Such amortization does not reduce Distributable Income, rather it is charged

directly to Trust Corpus. Revisions to estimated future units-of-production are treated on a prospective basis beginning on the date significant

revisions are known.

The conveyance of the Royalty Interests to the

Trust was accounted for as a purchase transaction. The $352,100,000 reflected in the Statements of Assets, Liabilities and Trust Corpus

as Royalty interest in gas properties represents 17,605,000 Trust units valued at $20.00 per unit. The carrying value of the Trust’s

investment in the Royalty Interests is not necessarily indicative of the fair value of such Royalty Interests.

| Item 3. | Quantitative and Qualitative Disclosures about Market

Risk. |

As a “smaller reporting company” as

defined in Item 10 of Regulation S-K, the Trust is not required to provide information required by this Item.

| Item 4. | Controls and Procedures. |

Evaluation

of Disclosure Controls and Procedures. The Trustee maintains disclosure controls and procedures designed to ensure that information

required to be disclosed by the Trust in the reports that it files or submits under the Securities Exchange Act of 1934, as amended (the

“Act”), is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and

forms promulgated by the SEC. Disclosure controls and procedures include controls and procedures designed to ensure that information required

to be disclosed by the Trust in the reports that it files or submits under the Act is accumulated and communicated by Greylock Production

to The Bank of New York Mellon Trust Company, N.A., as Trustee of the Trust, and its employees who participate in the preparation of the

Trust’s periodic reports as appropriate to allow timely decisions regarding required disclosure.

As of the end of the period covered by this report,

the Trustee carried out an evaluation of the Trustee’s disclosure controls and procedures. Sarah Newell, as Trust Officer of the

Trustee, has concluded that the disclosure controls and procedures of the Trust are effective.

Certain

characteristics of the Trust may limit the effectiveness of the disclosure controls and procedures established by the Trustee.

The limitations include the facts that:

| • | Greylock Production and its consolidated subsidiaries manage virtually all of the information relating to the Trust, including all

information regarding (i) historical operating data, production volumes, the number of producing wells and acreage, the marketing

and sale of production, operating and capital expenditures, environmental matters and other potential expenses and liabilities, and the

effects of regulatory matters and changes, (ii) plans for future operating and capital expenditures and (iii) geological data

relating to reserves, and the Trustee necessarily relies on Greylock Production for all such information; and |

| • | The Trustee necessarily relies upon the independent reserve engineer as an expert with respect to the annual reserve report, which

includes projected production, operating expenses and capital expenses. |

Other

than reviewing the financial and other information provided to the Trust by Greylock Production and the independent reserve engineer,

the Trustee has made no independent or direct verification of this financial or other information.

The Trustee does not intend to expand its responsibilities

beyond those permitted or required by the Trust Agreement and those required under applicable law.

The

Trustee does not expect that the Trustee’s disclosure controls and procedures or the Trustee’s internal control over financial

reporting will prevent all errors or all fraud. Further, the design of disclosure controls and procedures and internal control

over financial reporting must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative

to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that

all control issues and instances of fraud, if any, have been detected.

Changes

in Internal Control over Financial Reporting. During the quarter ended June 30, 2023, there was no change in the Trustee’s

internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Trustee’s

internal control over financial reporting relating to the Trust. The Trustee notes for purposes of clarification that it has no authority

over, and makes no statement concerning, the internal control over financial reporting of Greylock Energy.

PART II-OTHER INFORMATION

Risk factors relating to the Trust are contained

in Item 1A of the 2022 Form 10-K. No material changes to such risk factors have occurred since the filing of such report.

The exhibits below are filed or furnished herewith

or incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

ECA MARCELLUS TRUST I |

| |

|

| |

By: |

THE BANK OF

NEW YORK MELLON TRUST COMPANY, N.A., trustee |

| |

|

|

| |

|

|

| |

|

By: |

/s/

SARAH NEWELL |

| |

|

|

Sarah Newell |

| |

|

|

Vice President |

Date: August 14, 2023

The registrant, ECA Marcellus Trust I, has no principal executive officer,

principal financial officer, board of directors or persons performing similar functions. Accordingly, no additional signatures are available,

and none have been provided. In signing the report above, the Trustee does not imply that it has performed any such function or that such

function exists pursuant to the terms of the Trust agreement under which it serves.

APPENDIX A

GLOSSARY OF CERTAIN TERMS

The following are definitions of certain significant

terms used in this report. Other terms are defined in the text of this report.

AMI

- The area of mutual interest, or AMI, consisted of the Marcellus Shale formation in approximately 121 square miles of property

located in Greene County, Pennsylvania in which Legacy ECA had leased approximately 9,300 acres and owned substantially all of the

working interests at the date of formation of the Trust. Legacy ECA was obligated to drill the 52 development wells from drill sites on

approximately 9,300 leased acres in the AMI. Until Legacy ECA satisfied its drilling obligation on November 30, 2011, it was not

permitted to drill and complete any well in the Marcellus Shale formation within the AMI for its own account.

Basis

- The difference between the spot or cash price and the futures price of the same or related commodity. For natural gas, basis equals

the local cash market price minus the price of the nearby NYMEX natural gas futures contract.

Completion

- (or its derivatives) means that the well has been perforated, stimulated, tested and permanent equipment for the production of natural

gas has been installed.

Development

Agreement - An agreement under which Legacy ECA was obligated to drill all of the PUD Wells no later than March 31, 2014.

In order to secure the estimated amount of the drilling costs for the Trust’s interests in the PUD Wells, Legacy ECA granted to

the Trust a lien on Legacy ECA’s interest in the Marcellus Shale formation in the AMI, excluding the Producing Wells and any other

wells which were producing and not subject to the Royalty Interests.

Equivalent

PUD Well - is defined as a well that is drilled horizontally in the Marcellus formation for a lateral distance of 2,500 feet

measured from the midpoint of the curve to the end of the lateral multiplied by the working interest held by Legacy ECA. Wells with

a horizontal lateral less than 2,500 feet count as fractional wells in proportion to the total lateral length divided by 2,500 feet.

Wells with a horizontal lateral greater than 2,500 feet (subject to a maximum of 3,500 feet) count as fractional wells in proportion to

the total lateral length divided by 2,500 feet.

Gas

- means natural gas and all other gaseous hydrocarbons, excluding condensate, butane, and other liquid and liquefiable components that

are actually removed from the Gas stream by separation, processing or other means.

MMBtu

- One million British Thermal Units.

Mcf

- One thousand cubic feet of natural gas.

MMcf

- One million cubic feet of natural gas.

Perpetual

Royalty Interests—a term that collectively references the Perpetual PDP Royalty Interests and the Perpetual PUD Royalty

Interests.

Private

Investors - the persons described as the “Private Investors”

in the Prospectus.

Prospectus

- the prospectus dated July 1, 2010 and filed on July 1, 2020 with the SEC pursuant to Rule 424(b) under the Securities

Act of 1933, as amended, relating to the initial public offering of the Trust units.

SEC

- means the United States Securities and Exchange Commission.

Subject

Gas - means Gas from the Marcellus Shale formation from any Producing Well or PUD Well.

Working

Interest - The right granted to the lessee of a property to explore for and to produce and own oil, gas, or other minerals.

The working interest owners bear the exploration, development and operating costs on either a cash, penalty or carried basis.

EXHIBIT 31

CERTIFICATION

I, Sarah Newell, certify that:

| 1. | I have reviewed this quarterly report on Form 10-Q of ECA Marcellus Trust I, for which The Bank of New York Mellon Trust Company,

N.A., acts as Trustee; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period

covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, distributable income and changes in Trust corpus of the registrant as of, and for, the periods presented

in this report; |

| 4. | I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and

15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)), or for

causing such controls and procedures to be established and maintained, for the registrant and I have: |

a) Designed such disclosure controls and procedures, or caused

such disclosure controls and procedures to be designed under my supervision, to ensure that material information relating to the registrant,

including its consolidated subsidiaries, is made known to me by others within those entities, particularly during the period in which

this report is being prepared; and

b) Designed such internal control over financial reporting,

or caused such internal control over financial reporting to be designed under my supervision, to provide reasonable assurance regarding

the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the basis

of accounting described in Note 3 in Item 1 of Part I; and

c) Evaluated the effectiveness of the registrant's disclosure

controls and procedures and presented in this report my conclusions about the effectiveness of the disclosure controls and procedures,

as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the registrant's

internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal

quarter in the case of an annual report) that has materially affected or is reasonably likely to materially affect the registrant's internal

control over financial reporting; and

| 5. | I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant's auditors: |

a) All significant deficiencies and material weaknesses in

the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's

ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves any

persons who have a significant role in the registrant's internal control over financial reporting.

In giving the foregoing certifications in paragraphs 4 and 5, I

have relied to the extent I consider reasonable on information provided to me by Greylock Energy, LLC.

| Date: August 14, 2023 |

|

/s/ SARAH NEWELL |

| |

|

Sarah Newell |

| |

|

Vice President and Trust Officer |

| |

|

The Bank of New York Mellon Trust Company, N.A. |

EXHIBIT 32

August 14, 2023

Via EDGAR

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

Ladies and Gentlemen:

In connection with the Quarterly Report of ECA

Marcellus Trust I (the "Trust") on Form 10-Q for the quarterly period ended June 30, 2023 as filed with the Securities

and Exchange Commission on the date hereof (the "Report"), the undersigned, not in its individual capacity but solely as the

Trustee of the Trust, certifies pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002,

that to its knowledge:

| (1) | The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as

amended; and |

| (2) | The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations

of the Trust. |

The above certification is furnished solely pursuant

to Section 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350) and is not being filed as part of the Report or as a separate disclosure

document.

| |

|

The Bank of New York Mellon Trust Company, |

| |

|

N.A., Trustee for ECA Marcellus Trust I |

| |

|

|

| |

|

|

|

By: |

/s/ SARAH NEWELL |

| |

|

Sarah Newell |

| |

|

Vice President and Trust Officer |

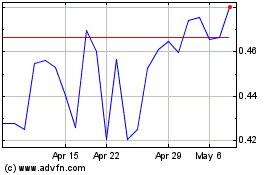

ECA Marcellus Trust I (PK) (USOTC:ECTM)

Historical Stock Chart

From Oct 2024 to Nov 2024

ECA Marcellus Trust I (PK) (USOTC:ECTM)

Historical Stock Chart

From Nov 2023 to Nov 2024