Q3 top and bottom line above high end of

guidance; Fiscal 2025 outlook increased

On track to deliver positive Free Cash Flow for

Q4

Enters new era as multi-product company with

the launch of AI Studio

Asana, Inc. (NYSE: ASAN)(LTSE: ASAN), a leading enterprise work

management platform, today reported financial results for its third

quarter fiscal 2025 ended October 31, 2024.

“The launch of AI Studio is the birth of a new category,

unlocking a massive Total Addressable Market (TAM) and growth

opportunity for the company,” said Dustin Moskovitz, co-founder and

chief executive officer of Asana. “While still early, we have seen

significant demand, with customers experiencing meaningful

productivity gains across their workflows. The productivity

benefits and early traction not only validate the market demand for

AI-powered work management solutions but also underscore Asana's

leadership position in this space.”

"We delivered a solid quarter with stabilizing revenue growth,

improving in-quarter net retention, and expansion with large

customers," said Sonalee Parekh, chief financial officer of Asana.

"As we execute our plan, we're demonstrating that growth and

profitability improvements can progress in parallel. With AI Studio

expanding our TAM and our commitment to driving productivity

benefits and efficiencies, we see significant potential for both

re-acceleration of growth and operating margin expansion."

Third Quarter Fiscal 2025 Financial Highlights

- Revenues: Revenues were $183.9 million, an increase of 10% year

over year.

- Operating Loss: GAAP operating loss was $60.2 million, or 33%

of revenues, compared to GAAP operating loss of $63.4 million, or

38% of revenues, in the third quarter of fiscal 2024. Non-GAAP

operating loss was $7.6 million, or 4% of revenues, compared to

non-GAAP operating loss of $9.8 million, or 6% of revenues, in the

third quarter of fiscal 2024.

- Net Loss: GAAP net loss was $57.3 million, compared to GAAP net

loss of $61.8 million in the third quarter of fiscal 2024. GAAP net

loss per share was $0.25, compared to GAAP net loss per share of

$0.28 in the third quarter of fiscal 2024. Non-GAAP net loss was

$4.8 million, compared to non-GAAP net loss of $8.2 million in the

third quarter of fiscal 2024. Non-GAAP net loss per share was

$0.02, compared to non-GAAP net loss per share of $0.04 in the

third quarter of fiscal 2024.

- Cash Flow: Cash flows from operating activities were negative

$14.9 million, compared to negative $8.2 million in the third

quarter of fiscal 2024. Free cash flow was negative $18.2 million,

compared to negative $11.5 million in the third quarter of fiscal

2024.

Business Highlights

- The number of Core customers, or customers spending $5,000 or

more on an annualized basis, grew to 23,609 in Q3, an increase of

11% year over year. Revenues from Core customers in Q3 grew 11%

year over year.

- The number of customers spending $100,000 or more on an

annualized basis in Q3 grew to 683, an increase of 18% year over

year.

- Overall dollar-based net retention rate in Q3 was 96%.

- Dollar-based net retention rate for Core customers in Q3 was

98%.

- Dollar-based net retention rate for customers spending $100,000

or more on an annualized basis in Q3 was 99%.

- Launched Asana AI Studio, a no-code builder that lets any team

design any workflow, embed AI agents without code, and deploy the

workflow directly where teams are already working in Asana.

- Appointed new Chief Financial Officer, Sonalee Parekh, along

with Josh Abdulla as Head of Customer Experience.

- Announced Asana’s commitment to pursuing FedRAMP (Federal Risk

and Authorization Management Program) authorization to serve the

complex needs of enterprises in regulated industries.

- Published our 2024 State of Work Innovation report, which

uncovers what’s holding organizations back – unpacking four hidden

"taxes" and how innovative companies can minimize them.

- Hosted Asana’s largest-ever Work Innovation Summit event in New

York City – diving into how Asana is shaping the new era of work

with partners, customers, thought leaders, and more.

- Celebrated first-ever Asana Work Innovation Award winners,

comprised of five customers who each combine creativity with

technology to craft solutions as imaginative as they are effective.

Winners included NCAA, Disney Theatrical Group, World Resources

Institute, Beauty Pie, and Children’s Health.

- Launched a partnership with Mastercard, offering Mastercard

Business cardholders a 20% rebate on an annual subscription to

first-time Asana customers.

Financial Outlook

For the fourth quarter of fiscal 2025, Asana expects:

- Revenues of $187.5 million to $188.5 million, representing year

over year growth of 10%.

- Non-GAAP operating loss of $6.5 million to $5.5 million, with

3% operating loss margin.

- Non-GAAP net loss per share of $0.02 to $0.01, assuming basic

and diluted weighted average shares outstanding of approximately

229 million.

For fiscal 2025, Asana expects:

- Revenues of $723.0 million to $724.0 million, representing year

over year growth of 11%.

- Non-GAAP operating loss of $46.0 million to $45.0 million, with

6% operating loss margin.

- Non-GAAP net loss per share of $0.15 to $0.14, assuming basic

and diluted weighted average shares outstanding of approximately

229 million.

These statements are forward-looking and actual results may

materially differ. Refer to the “Forward-Looking Statements”

section below for information on the factors that could cause

Asana’s actual results to materially differ from these

forward-looking statements.

A reconciliation of non-GAAP outlook measures to corresponding

GAAP measures is not available on a forward-looking basis without

unreasonable effort due to the uncertainty regarding, and the

potential variability of, many of these costs and expenses that may

be incurred in the future. Asana has provided a reconciliation of

GAAP to non-GAAP financial measures in the financial statement

tables for its third quarter fiscal year 2025 non-GAAP results

included in this press release.

Earnings Conference Call Information

Asana will hold a conference call and live webcast today to

discuss these results at 1:30 p.m. Pacific Time. A live webcast and

replay will be available on the Asana Investor Relations webpage

at: https://investors.asana.com.

Forward-Looking Statements

This press release contains “forward-looking” statements within

the meaning of the Private Securities Litigation Reform Act of 1995

that are based on management’s beliefs and assumptions and on

information currently available to management. Forward-looking

statements include, but are not limited to, statements about our

market opportunity, the potential and impact of AI, the expected

benefits of AI Studio, including our expectations regarding revenue

to be generated by AI Studio, our ability to execute on our current

strategies, our technology and brand position, expectations

regarding product launches, Asana’s outlook for the fiscal quarter

and the full fiscal year ending January 31, 2025, Asana’s outlook

for free cash flow, expected benefits of our offerings, and our

market position. Forward-looking statements generally relate to

future events or Asana’s future financial or operating performance.

Forward-looking statements include all statements that are not

historical facts and in some cases can be identified by terms such

as “anticipate,” “expect,” “intend,” “plan,” “believe,” “continue,”

“could,” “potential,” “may,” “will,” “goal,” or similar expressions

and the negatives of those terms. However, not all forward-looking

statements contain these identifying words. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors, including factors beyond Asana’s control, that may cause

Asana’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. These risks include, but are not limited to, risks and

uncertainties related to: Asana’s ability to achieve future growth

and sustain its growth rate, Asana’s ability to attract and retain

customers and increase sales to its customers, Asana’s ability to

develop and release new products and services and to scale its

platform, including the successful integration of AI, Asana’s

ability to increase adoption of its platform through Asana’s

self-service model, Asana’s ability to maintain and grow its

relationships with strategic partners, the highly competitive and

rapidly evolving market in which Asana participates, Asana’s

international expansion strategies, and broader macroeconomic

conditions. Further information on risks that could cause actual

results to differ materially from forecasted results are included

in Asana’s filings with the SEC, including Asana’s Annual Report on

Form 10-K for the year ended January 31, 2024 and subsequent

filings with the SEC. Any forward-looking statements contained in

this press release are based on assumptions that Asana believes to

be reasonable as of this date. Except as required by law, Asana

assumes no obligation to update these forward-looking statements,

or to update the reasons if actual results differ materially from

those anticipated in the forward-looking statements.

Use of Non-GAAP Financial Measures

To supplement Asana’s consolidated financial statements, which

are prepared and presented in accordance with GAAP, Asana utilizes

certain non-GAAP financial measures to assist in understanding and

evaluating its core operating performance. In this release, Asana’s

non-GAAP gross profit, gross margin, operating expenses, operating

expenses as a percentage of revenue, operating loss, operating

margin, net loss, net loss per share, and free cash flow are not

presented in accordance with GAAP and are not intended to be used

in lieu of GAAP presentations of results of operations. These

non-GAAP financial measures, which may be different from similarly

titled measures used by other companies, are presented to enhance

investors’ overall understanding of Asana’s financial performance

and should not be considered a substitute for, or superior to, the

financial information prepared and presented in accordance with

GAAP. Investors are encouraged to review the reconciliation of

these non-GAAP measures to their most directly comparable GAAP

financial measures which can be found in the accompanying financial

statements included with this press release.

Asana is presenting these non-GAAP financial measures because it

believes that these non-GAAP financial measures provide useful

information about its financial performance, enhance the overall

understanding of Asana’s past performance and future prospects,

facilitate period-to-period comparisons of operations against other

companies in Asana’s industry, and allow for greater transparency

with respect to important metrics used by Asana’s management for

financial and operational decision-making.

Asana believes excluding the following items from its non-GAAP

financial measures is useful to investors and others in assessing

Asana’s operating performance due to the following factors:

- Stock-based compensation expenses. Although stock-based

compensation is an important aspect of the compensation of our

employees and executives, management believes it is useful to

exclude stock-based compensation expenses to better understand the

long-term performance of Asana’s core business and to facilitate

comparison of its results to those of peer companies.

- Employer payroll tax associated with RSUs. The amount of

employer payroll tax-related items on employee stock transactions

is dependent on Asana’s stock price and other factors that are

beyond its control and that do not correlate to the operation of

the business.

- Non-cash and non-recurring expenses. Non-cash expenses include

charges for impairment of long-lived assets. Non-recurring expenses

include costs related to restructuring. Asana believes the

exclusion of certain non-cash and non-recurring items provides

useful supplemental information to investors and facilitates the

analysis of its operating results and comparison of operating

results across reporting periods.

There are a number of limitations related to the use of non-GAAP

financial measures as compared to GAAP financial measures,

including that the non-GAAP financial measures exclude stock-based

compensation expense, which has been, and will continue to be for

the foreseeable future, a significant recurring expense in Asana’s

business and an important part of its compensation strategy.

In addition to the non-GAAP financial measures outlined above,

Asana also uses the non-GAAP financial measure of free cash flow,

which is defined as net cash from operating activities less cash

used for purchases of property and equipment and capitalized

internal-use software costs, plus non-recurring expenditures such

as costs related to restructuring. Asana believes free cash flow is

an important liquidity measure of the cash that is available, after

capital expenditures and operational expenses, for investment in

its business and to make acquisitions. Asana believes that free

cash flow is useful to investors as a liquidity measure because it

measures Asana’s ability to generate or use cash. There are a

number of limitations related to the use of free cash flow as

compared to net cash from operating activities, including that free

cash flow excludes capital expenditures, the benefits of which are

realized in periods subsequent to those when expenditures are

made.

Definitions of Business Metrics

Customers spending $5,000 or more on an annualized basis, or

Core customers

We define customers spending $5,000 or more, which we also refer

to as Core customers, as those organizations on a paid subscription

plan that had $5,000 or more in annualized GAAP revenues in a given

quarter, inclusive of discounts.

Customers spending $100,000 or more on an annualized basis

We define customers spending $100,000 or more as those

organizations on a paid subscription plan that had $100,000 or more

in annualized GAAP revenues in a given quarter, inclusive of

discounts.

Dollar-based net retention rate

Asana’s reported dollar-based net retention rate equals the

simple arithmetic average of its quarterly dollar-based net

retention rate for the four quarters ending with the most recent

fiscal quarter. Asana calculates its dollar-based net retention

rate by comparing its revenues from the same set of customers in a

given quarter, relative to the comparable prior-year period. To

calculate Asana’s dollar-based net retention rate for a given

quarter, Asana starts with the revenues in that quarter from

customers that generated revenues in the same quarter of the prior

year. Asana then divides that amount by the revenues attributable

to that same group of customers in the prior-year quarter. Current

period revenues include any upsells and are net of contraction or

attrition over the trailing 12 months, but exclude revenues from

new customers in the current period. Asana expects its dollar-based

net retention rate to fluctuate in future periods due to a number

of factors, including the expected growth of its revenue base, the

level of penetration within its customer base, its ability to

retain its customers, and the macroeconomic environment.

About Asana

Asana, a leading enterprise work management platform, is where

work connects to goals. Over 150,000 customers like Amazon,

Accenture, and Suzuki rely on Asana to manage and automate

everything from goal setting and tracking to capacity planning to

product launches. To learn more, visit www.asana.com.

Disclosure of Material Information

Asana announces material information to its investors using SEC

filings, press releases, public conference calls, and on its

investor relations page of Asana’s website at

https://investors.asana.com. Asana uses these channels, as well as

social media, including its X (formerly Twitter) account (@asana),

its blog (blog.asana.com), its LinkedIn page

(www.linkedin.com/company/asana), its Instagram account (@asana),

its Facebook page (www.facebook.com/asana/), Threads profiles

(@asana and @moskov) and TikTok account (@asana), to communicate

with investors and the public about Asana, its products and

services and other matters. Therefore, Asana encourages investors,

the media and others interested in Asana to review the information

it makes public in these locations, as such information could be

deemed to be material information.

ASANA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

(unaudited)

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Revenues

$

183,882

$

166,503

$

535,542

$

481,369

Cost of revenues(1)

19,798

16,053

57,589

47,132

Gross profit

164,084

150,450

477,953

434,237

Operating expenses:

Research and development(1)

83,286

81,028

257,228

241,715

Sales and marketing(1)

104,708

98,349

317,689

288,034

General and administrative(1)

36,270

34,494

106,182

106,537

Total operating expenses

224,264

213,871

681,099

636,286

Loss from operations

(60,180

)

(63,421

)

(203,146

)

(202,049

)

Interest income and other income

(expense), net

4,949

3,479

16,069

13,310

Interest expense

(934

)

(1,012

)

(2,831

)

(2,947

)

Loss before provision for income taxes

(56,165

)

(60,954

)

(189,908

)

(191,686

)

Provision for income taxes

1,161

796

3,329

2,946

Net loss

$

(57,326

)

$

(61,750

)

$

(193,237

)

$

(194,632

)

Net loss per share:

Basic and diluted

$

(0.25

)

$

(0.28

)

$

(0.84

)

$

(0.89

)

Weighted-average shares used in

calculating net loss per share:

Basic and diluted

229,624

221,776

228,830

219,094

_______________

(1) Amounts include stock-based

compensation expense as follows:

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Cost of revenues

$

354

$

413

$

1,030

$

1,177

Research and development

28,087

29,384

88,872

83,928

Sales and marketing

15,837

15,584

48,334

43,438

General and administrative

7,677

7,485

22,466

22,026

Total stock-based compensation expense

$

51,955

$

52,866

$

160,702

$

150,569

ASANA, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(unaudited)

October 31, 2024

January 31, 2024

Assets

Current assets

Cash and cash equivalents

$

196,772

$

236,663

Marketable securities

258,541

282,801

Restricted cash

316

—

Accounts receivable, net

66,892

88,327

Prepaid expenses and other current

assets

48,837

51,925

Total current assets

571,358

659,716

Property and equipment, net

96,627

96,543

Operating lease right-of-use assets

177,626

181,731

Other assets

28,545

23,970

Total assets

$

874,156

$

961,960

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

12,606

$

6,907

Accrued expenses and other current

liabilities

69,307

75,821

Deferred revenue, current

279,560

265,306

Operating lease liabilities, current

21,556

19,179

Total current liabilities

383,029

367,213

Term loan, net

39,904

43,618

Deferred revenue, noncurrent

2,581

5,916

Operating lease liabilities,

noncurrent

207,527

215,084

Other liabilities

1,845

3,733

Total liabilities

634,886

635,564

Stockholders' equity

Common stock

2

2

Additional paid-in capital

2,002,764

1,821,216

Accumulated other comprehensive loss

(983

)

(236

)

Accumulated deficit

(1,762,513

)

(1,494,586

)

Total stockholders’ equity

239,270

326,396

Total liabilities and stockholders’

equity

$

874,156

$

961,960

ASANA, INC.

SUMMARY OF CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Cash flows from operating

activities

Net loss

$

(57,326

)

$

(61,750

)

$

(193,237

)

$

(194,632

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Allowance for expected credit losses

653

683

1,025

2,072

Depreciation and amortization

4,437

3,531

12,730

10,407

Amortization of deferred contract

acquisition costs

6,696

5,668

19,189

15,971

Stock-based compensation expense

51,955

52,866

160,702

150,569

Net accretion of discount on marketable

securities

(1,090

)

(636

)

(4,646

)

(1,568

)

Non-cash lease expense

4,640

3,954

13,528

13,998

Impairment of long-lived assets

—

—

—

5,009

Amortization of discount on revolving

credit facility and term loan issuance costs

30

31

91

91

Changes in operating assets and

liabilities:

Accounts receivable

(2,304

)

(2,407

)

20,610

12,251

Prepaid expenses and other current

assets

(2,254

)

(4,707

)

(15,852

)

(13,764

)

Other assets

(1,513

)

(606

)

(4,594

)

742

Accounts payable

(1,759

)

6,857

4,610

3,612

Accrued expenses and other liabilities

(5,035

)

(2,668

)

(11,408

)

(16,885

)

Deferred revenue

(7,050

)

(5,693

)

10,920

21,843

Operating lease liabilities

(4,970

)

(3,356

)

(14,598

)

(12,310

)

Net cash used in operating activities

(14,890

)

(8,233

)

(930

)

(2,594

)

Cash flows from investing

activities

Purchases of marketable securities

(59,502

)

(145,018

)

(166,628

)

(284,312

)

Sales of marketable securities

—

12

—

12

Maturities of marketable securities

104,309

7,500

195,605

25,641

Purchases of property and equipment

(1,372

)

(1,255

)

(4,064

)

(7,221

)

Capitalized internal-use software

costs

(1,919

)

(1,977

)

(4,702

)

(4,325

)

Net cash provided by (used in) investing

activities

41,516

(140,738

)

20,211

(270,205

)

Cash flows from financing

activities

Repayment of term loan

(625

)

(625

)

(1,875

)

(2,500

)

Repurchases of common stock

(54,847

)

—

(73,869

)

—

Proceeds from exercise of stock

options

1,755

783

3,884

3,856

Proceeds from employee stock purchase

plan

4,799

6,511

13,665

15,069

Taxes paid related to net share settlement

of equity awards

(1

)

—

(5

)

(7

)

Net cash provided by (used in) financing

activities

(48,919

)

6,669

(58,200

)

16,418

Effect of foreign exchange rates on cash,

cash equivalents, and restricted cash

(474

)

(3,081

)

(656

)

(1,868

)

Net decrease in cash, cash equivalents,

and restricted cash

(22,767

)

(145,383

)

(39,575

)

(258,249

)

Cash, cash equivalents, and restricted

cash

Beginning of period

219,855

413,697

236,663

526,563

End of period

$

197,088

$

268,314

$

197,088

$

268,314

ASANA, INC.

Reconciliation of GAAP to

Non-GAAP Data

(in thousands, except

percentages)

(unaudited)

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Reconciliation of gross profit and

gross margin

GAAP gross profit

$

164,084

$

150,450

$

477,953

$

434,237

Plus: stock-based compensation and related

employer payroll tax associated with RSUs

361

418

1,052

1,209

Non-GAAP gross profit

$

164,445

$

150,868

$

479,005

$

435,446

GAAP gross margin

89.2

%

90.4

%

89.2

%

90.2

%

Non-GAAP adjustments

0.2

%

0.2

%

0.2

%

0.3

%

Non-GAAP gross margin

89.4

%

90.6

%

89.4

%

90.5

%

Reconciliation of operating

expenses

GAAP research and development

$

83,286

$

81,028

$

257,228

$

241,715

Less: stock-based compensation and related

employer payroll tax associated with RSUs

(28,419

)

(29,788

)

(90,897

)

(86,416

)

Non-GAAP research and development

$

54,867

$

51,240

$

166,331

$

155,299

GAAP research and development as

percentage of revenue

45.3

%

48.7

%

48.0

%

50.2

%

Non-GAAP research and development as

percentage of revenue

29.8

%

30.8

%

31.1

%

32.3

%

GAAP sales and marketing

$

104,708

$

98,349

$

317,689

$

288,034

Less: stock-based compensation and related

employer payroll tax associated with RSUs

(16,001

)

(15,745

)

(49,234

)

(44,438

)

Adjustment for: restructuring (costs)

benefit

—

—

—

173

Non-GAAP sales and marketing

$

88,707

$

82,604

$

268,455

$

243,769

GAAP sales and marketing as percentage of

revenue

56.9

%

59.1

%

59.3

%

59.8

%

Non-GAAP sales and marketing as percentage

of revenue

48.2

%

49.6

%

50.1

%

50.6

%

GAAP general and administrative

$

36,270

$

34,494

$

106,182

$

106,537

Less: stock-based compensation and related

employer payroll tax associated with RSUs

(7,768

)

(7,621

)

(22,904

)

(22,636

)

Less: impairment of long-lived assets

—

—

—

(5,009

)

Adjustment for: restructuring (costs)

benefit

—

—

—

(26

)

Non-GAAP general and administrative

$

28,502

$

26,873

$

83,278

$

78,866

GAAP general and administrative as

percentage of revenue

19.7

%

20.7

%

19.8

%

22.1

%

Non-GAAP general and administrative as

percentage of revenue

15.5

%

16.1

%

15.6

%

16.4

%

Reconciliation of operating loss and

operating margin

GAAP loss from operations

$

(60,180

)

$

(63,421

)

$

(203,146

)

$

(202,049

)

Plus: stock-based compensation and related

employer payroll tax associated with RSUs

52,549

53,572

164,087

154,699

Plus: impairment of long-lived assets

—

—

—

5,009

Adjustment for: restructuring costs

(benefit)

—

—

—

(147

)

Non-GAAP loss from operations

$

(7,631

)

$

(9,849

)

$

(39,059

)

$

(42,488

)

GAAP operating margin

(32.7

)%

(38.1

)%

(37.9

)%

(42.0

)%

Non-GAAP adjustments

28.6

%

32.2

%

30.6

%

33.2

%

Non-GAAP operating margin

(4.1

)%

(5.9

)%

(7.3

)%

(8.8

)%

ASANA, INC.

Reconciliation of GAAP to

Non-GAAP Data

(in thousands, except

percentages and per share data)

(unaudited)

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Reconciliation of net loss

GAAP net loss

$

(57,326

)

$

(61,750

)

$

(193,237

)

$

(194,632

)

Plus: stock-based compensation and related

employer payroll tax associated with RSUs

52,549

53,572

164,087

154,699

Plus: impairment of long-lived assets

—

—

—

5,009

Adjustment for: restructuring costs

(benefit)

—

—

—

(147

)

Non-GAAP net loss

$

(4,777

)

$

(8,178

)

$

(29,150

)

$

(35,071

)

Reconciliation of net loss per

share

GAAP net loss per share, basic

$

(0.25

)

$

(0.28

)

$

(0.84

)

$

(0.89

)

Non-GAAP adjustments to net loss

0.23

0.24

0.71

0.73

Non-GAAP net loss per share, basic

$

(0.02

)

$

(0.04

)

$

(0.13

)

$

(0.16

)

Weighted-average shares used in GAAP and

non-GAAP per share calculation, basic and diluted

229,624

221,776

228,830

219,094

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Computation of free cash flow

Net cash provided by (used in) investing

activities

$

41,516

$

(140,738

)

$

20,211

$

(270,205

)

Net cash provided by (used in) financing

activities

$

(48,919

)

$

6,669

$

(58,200

)

$

16,418

Net cash used in operating activities

$

(14,890

)

$

(8,233

)

$

(930

)

$

(2,594

)

Less: purchases of property and

equipment

(1,372

)

(1,255

)

(4,064

)

(7,221

)

Less: capitalized internal-use software

costs

(1,919

)

(1,977

)

(4,702

)

(4,325

)

Plus: restructuring costs paid

—

—

—

707

Free cash flow

$

(18,181

)

$

(11,465

)

$

(9,696

)

$

(13,433

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241204897438/en/

Catherine Buan Asana Investor Relations ir@asana.com

Frances Ward Asana Communications press@asana.com

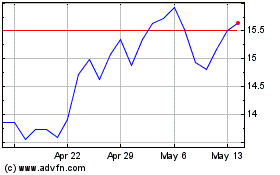

Asana (NYSE:ASAN)

Historical Stock Chart

From Jan 2025 to Feb 2025

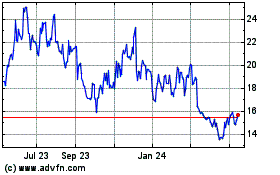

Asana (NYSE:ASAN)

Historical Stock Chart

From Feb 2024 to Feb 2025