Filed Pursuant to Rule 424(b)(4)

Registration No.

333–283821

PROSPECTUS

Up to 524,000 Shares of Common Stock

Issuable Upon Conversion of Series H Preferred

Stock

LogicMark, Inc.

This prospectus relates

to the offer and resale of up to an aggregate of 524,000 shares of common stock, par value $0.0001 per share (the “Common Stock”),

of LogicMark, Inc. (the “Company”, “LogicMark”, “we”, “us” or “our”), as follows:

524,000 shares (the “Series H Conversion Shares”) of Common Stock issuable upon conversion of the Company’s Series H

Convertible Non-Voting Preferred Stock, $0.0001 par value per share (the “Series H Preferred Stock”). On November 13,

2024, the Company entered into settlement and release agreements (the “Settlement Agreements”) with the current and former

holders (the “Holders” or “Selling Stockholders”) of its Series B Common Stock purchase warrants (the “Series

B Warrants”) exercisable for up to an aggregate of 386,800 shares of Common Stock issued, on August 5, 2024, pursuant to those certain

securities purchase agreements, dated August 2, 2024, by and between the Company and the Holders. Pursuant to the Settlement Agreements,

on November 13, 2024, all remaining Series B Warrants were exercised and the Holders waived and released the Company from certain claims

in connection with the exercise thereof and in exchange the Company agreed to issue to the Holders: (i) an aggregate of 1,000 shares of

Series H Preferred Stock, which will be convertible at the option of the Holder into shares of Common Stock at an initial conversion price

of $11.64, and (ii) an aggregate of 1,000 shares of a newly-designated series of preferred stock of the Company to be known as the Series

I Non-Convertible Voting Preferred Stock, $0.0001 par value per share (the “Series I Preferred Stock”, and together with the

Series H Preferred Stock, the “Preferred Stock”), each share of which will entitle the holder thereof to two (2) votes on

all matters submitted to a vote of the stockholders of the Company.

The shares of Series H Preferred Stock and the

Series H Conversion Shares are also referred to herein as the “Securities”. For additional information regarding the issuance

of the Securities, see “Settlement Agreements and Issuance of Preferred Stock” beginning on page 8.

This prospectus also covers any additional shares

of Common Stock that may become issuable upon any standard adjustment pursuant to the terms of the Certificate of Designation of Preferences,

Rights and Limitations of Series H Convertible Non-Voting Preferred Stock (the “Series H Certificate of Designation”) by reason

of stock splits, stock dividends and other events described therein.

The Series H Conversion Shares will be resold

from time to time by the Selling Stockholders listed in the section titled “Selling Stockholders” beginning on page 9.

The Selling Stockholders, or their respective transferees, pledgees,

donees or other successors-in-interest, may sell the Series H Conversion Shares through public or private transactions at prevailing market

prices, at prices related to prevailing market prices or at privately negotiated prices. The Selling Stockholders may sell any, all or

none of the Series H Conversion Shares offered by this prospectus, and we do not know when or in what amount the Selling Stockholders

may sell their Series H Conversion Shares hereunder following the effective date of this registration statement. We provide more information

about how Selling Stockholders may sell their Series H Conversion Shares in the section titled “Plan of Distribution” on page

17.

We are registering the Series H Conversion Shares

on behalf of the Selling Stockholders, to be offered and sold by them from time to time. We will not receive any proceeds from the sale

of our Common Stock by the Selling Stockholders in the offering described in this prospectus. We have agreed to bear all of the expenses

incurred in connection with the registration of the Series H Conversion Shares. The Selling Stockholders will pay or assume discounts,

commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale of the Series

H Conversion Shares.

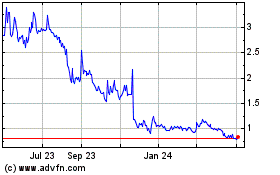

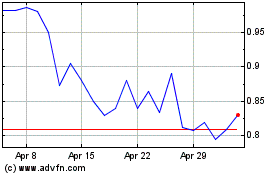

Our Common Stock is listed on the Nasdaq Capital

Market (“Nasdaq”) under the symbol “LGMK.” The last reported sales prices of our Common Stock on Nasdaq on December

26, 2024 was $1.68 per share.

Investing in our Common Stock involves a high

degree of risk. See “Risk Factors” beginning on page 5 and in the documents which are incorporated by reference herein

to read about factors you should consider before investing in our Common Stock.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is December 27,

2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus describes the general manner in

which the Selling Stockholders may offer from time to time up to 524,000 shares of Common Stock. You should rely only on the information

contained in this prospectus and the related exhibits, any prospectus supplement or amendment thereto and the documents incorporated by

reference, or to which we have referred you, before making your investment decision. Neither we nor the Selling Stockholders have authorized

anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely

on it. This prospectus, any prospectus supplement or amendments thereto do not constitute an offer to sell, or a solicitation of an offer

to purchase, the shares of Common Stock offered by this prospectus, any prospectus supplement or amendments thereto in any jurisdiction

to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should

not assume that the information contained in this prospectus, any prospectus supplement or amendments thereto, as well as information

we have previously filed with the U.S. Securities and Exchange Commission (the “SEC”), is accurate as of any date other than

the date on the front cover of the applicable document.

If necessary, the specific manner in which the

shares of Common Stock may be offered and sold will be described in a supplement to this prospectus, which supplement may also add, update

or change any of the information contained in this prospectus. To the extent there is a conflict between the information contained in

this prospectus and any prospectus supplement, you should rely on the information in such prospectus supplement, provided that if any

statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document

incorporated by reference in this prospectus or any prospectus supplement — the statement in the document having the later date

modifies or supersedes the earlier statement.

Neither the delivery of this prospectus nor any

distribution of shares of Common Stock pursuant to this prospectus shall, under any circumstances, create any implication that there has

been no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this

prospectus. Our business, financial condition, results of operations and prospects may have changed since such date.

When used herein, unless the context requires

otherwise, references to the “LogicMark,” “Company,” “we,” “our” and “us”

refer to LogicMark, Inc., a Nevada corporation with respect to the Company on or after June 1, 2023, and LogicMark, Inc., a Delaware corporation

with respect to the Company prior to June 1, 2023.

On November 18, 2024, we effected a one-for-twenty-five

reverse stock split (the “Common Stock Reverse Stock Split”) of all of our outstanding shares of Common Stock. Unless the

context expressly indicates otherwise, all references to share and per share amounts referred to herein reflect the amounts after giving

effect to the Common Stock Reverse Stock Split.

PROSPECTUS SUMMARY

This summary highlights selected information

contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing

in our Common Stock. You should carefully read this entire prospectus, and our other filings with the SEC, including the following sections,

which are either included herein and/or incorporated by reference herein, “Risk Factors,” “Special Note Regarding Forward-Looking

Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated

financial statements incorporated by reference herein before making a decision about whether to invest in our Common Stock. All references

to “we,” “us,” “our,” and the “Company” refer to LogicMark, Inc., unless we specifically

state otherwise or the context indicates otherwise.

Company Overview

LogicMark, Inc. provides personal emergency response

systems (“PERS”), health communications devices, and Internet of Things (“IoT”) technology that creates a connected

care platform. The Company’s devices provide people with the ability to receive care at home and age independently. The Company’s

PERS devices incorporate two-way voice communication technology directly in the medical alert pendant and provide life-saving technology

at a customer-friendly price point aimed at everyday consumers. These PERS technologies as well as other personal safety devices are sold

direct-to-consumer through the Company’s eCommerce website and Amazon.com, through dealers and resellers, as well as directly to

the United States Veterans Health Administration (the “VHA”). The Company was awarded a contract by the U.S. General Services

Administration (the “GSA”) that enables the Company to distribute its products to federal, state, and local governments (the

“GSA Agreement”).

Healthcare

LogicMark builds technology to remotely check,

manage and monitor a loved one’s health and safety. The Company is focused on modernizing remote monitoring to help people stay

safe and live independently longer. We believe there are five trends driving the demand for better remote monitoring systems:

1. The “Silver Tsunami”.

With 11,000 Baby Boomers turning 65 in the U.S. every day, there will be more older adults than children under 18 for the first time

in the near future. With 72 million “Baby Boomers” in the United States, they are not only one of the largest generations,

but the wealthiest. Unlike generations before them, Baby Boomers are reliant and comfortable with technology. Most of them expect to

live independently at home.

2. Shift to At-Home Care.

As it stands, the current healthcare system is unprepared for the resource strain and is shifting much of the care elderly patients used

to receive at a hospital or medical facility to the patient’s home. The rise of digital communication to support remote care exploded

during the COVID-19 pandemic. The need for connected and remote monitoring devices is more necessary and in-demand than ever before.

3. Rise of Data and IoT.

Doctors and clinicians are asking patients to track more and more vital

signs. Whether it’s how they’re reacting to medication or tracking blood sugar, patients and their caregivers are participating

in their healthcare in unprecedented ways. Consumers are using data collected from connected devices like never before. This data can

be used to prevent health emergencies as technology companies use machine learning (ML) / artificial intelligence (“AI”) to

learn patient patterns and alert the patient and their care team of potential emergencies, leading to a switch to predicting potential

problems from reacting to current problems after they occur.

4. Lack of Healthcare

Workers. It’s estimated that 20% of healthcare workers quit during the COVID-19 pandemic. Many healthcare workers who were working

during the COVID-19 pandemic suffered from burnout, exhaustion and demoralization due to the COVID-19 pandemic. There were not enough

healthcare workers to support our entire population throughout the pandemic, let alone enough to support our elderly population. The responsibility

of taking care of elderly family members is increasingly falling on the family, and they need help.

5. Rise of the Care Economy.

The term “Care Economy” refers to the money people contribute to care for people until the end of their lives; the Care Economy

offsets the deficiencies within the healthcare system and the desire to age in place. There has been little innovation in the industry

because the majority of PERS are operated by home security companies. It is not their main line of business, and they have little expertise

in developing or launching machine-learning algorithms or artificial intelligence.

Together, we believe these trends have produced

a large and growing market opportunity for LogicMark. The Company enjoys a strong base of business with the VHA and plans to expand to

other government agencies after being awarded the five-year GSA Agreement in July 2021, which is renewable for up to 25 years.

The PERS Opportunity

PERS or personal emergency response services, also known as a medical

alert or medical alarm system, is designed to detect a threat that requires attention and then immediately contacts a trusted family member

and/or the emergency medical workforce. Unlike conventional alarm systems which consist of a transmitter and are activated in the case

of an emergency, PERS transmits signals to an alarm monitoring medical team, which then departs for the location where the alarm was activated.

These types of medical alarms are traditionally utilized by the disabled, elderly or those living alone.

The PERS market is generally divided into direct-to-consumer

and healthcare customer channels. With the advent of new technologies, demographic changes, and our five previously stated trends in healthcare,

an expanded opportunity exists for LogicMark to provide at-home and on-the-go health and safety solutions to both customer channels.

For LogicMark, growing the healthcare opportunity

relies on partnering with organizations such as government, Medicaid, hospitals, insurance companies, managed care organizations, affiliates

and dealers. Partners can provide leads at no cost for new and replacement customers, have significant buying power and can provide collaboration

on product research and development.

Our longstanding partnership with the VHA is a good example. LogicMark

has sold over 850,000 PERS devices since 2012, of which over 500,000 devices have been sold to the VHA. The signing of the GSA Agreement

in 2021 further strengthened our partnership with the government and expanded our ability to capture new sales. We envision a continued

focus on growing the healthcare channel during 2023 given lower acquisition costs and higher customer unit economics.

In addition to the healthcare channel, LogicMark

also expects to continue growth in sales volume through its direct-to-consumer channel. It is estimated that approximately 70% of PERS

customers fall into the direct-to-consumer category. Family members regularly conduct research and purchase PERS devices for their loved

ones through online websites. The Company expects traditionally higher customer acquisition costs to be balanced by higher sales growth

and lower sales cycles with an online DTC channel.

With the growth in IoT devices, data driven solutions

using AI and ML are helping guide the growth of the PERS industry. In both the healthcare and direct-to-consumer channels, product offerings

can include 24/7 emergency response, fall detection, location tracking and geo-fencing, activity monitoring, medication management, caregiver

and patient portals, concierge services, telehealth, vitals monitoring, and customer dashboards. These product offerings are primarily

delivered via mobile and home-base equipment. LogicMark will also continue to pursue research and development partnerships to grow our

product offerings.

Corporate Information

We were originally incorporated in the State of

Delaware on February 8, 2012. In 2016, we acquired LogicMark, LLC, which operated as a wholly-owned subsidiary of the Company until December

30, 2021, when it was merged into the Company (formerly known as Nxt-ID Inc.) along with the Company’s other subsidiary, 3D-ID,

LLC. Effective February 28, 2022, the Company changed its name from Nxt-ID, Inc. to LogicMark, Inc. The Company has realigned its business

strategy with that of its former LogicMark, LLC operating division, managing contract manufacturing and distribution of non-monitored

and monitored PERS sold through the VHA, direct-to-consumers, healthcare durable medical equipment dealers and distributors and monitored

security dealers and distributors.

On June 1, 2023, the Company was incorporated

in the State of Nevada by merging its predecessor entity with and into its wholly-owned subsidiary, LogicMark, Inc., a Nevada corporation,

pursuant to an agreement and plan of merger, dated as of June 1, 2023. Such Nevada entity survived and succeeded

to the assets, continued the business and assumed the rights and obligations of LogicMark, Inc., the Delaware corporation that existed

immediately prior to the effective date of such agreement.

Our principal executive office is located at 2801

Diode Lane, Louisville, KY 40299, and our telephone number is (502) 519-2419. Our website address is www.logicmark.com. The information

contained therein or connected thereto shall not be deemed to be incorporated into this prospectus. The information on our website is

not part of this prospectus.

Recent Developments

Reverse Stock Splits

On November 18, 2024, the Company, acting pursuant

to authority received at a special meeting of its stockholders on October 1, 2024, filed with the Secretary of State of the State of Nevada

(i) a certificate of change (the “Charter Amendment”) to its articles of incorporation, as amended (the “Articles of

Incorporation”), which effected the Common Stock Reverse Stock Split; and (ii) a certificate of amendment (the “Series C Certificate

of Amendment”) to its Certificate of Designations, Preferences and Rights of Series C Non-Convertible Voting Preferred Stock (“Series

C Certificate of Designations”), which effected a one-for-twenty-five reverse stock split (the “Series C Reverse Stock Split”

and together with the Common Stock Reverse Stock Split, the “Reverse Stock Splits”) of all of the Company’s outstanding

shares of Series C Non-Convertible Voting Preferred Stock, par value $0.001 per share (the “Series C Preferred Stock”), and

which proportionally increased the stated value of the Series C Preferred Stock from $200,000 per share to $2,000,000 per share. Pursuant

to each of the Charter Amendment and the Series C Certificate of Amendment, each of the Reverse Stock Splits became effective as of 5:00

p.m. Eastern Time on November 18, 2024. As a result of the Reverse Stock Splits, every twenty-five (25) shares of Common Stock were exchanged

for one (1) share of Common Stock and every twenty-five (25) shares of Series C Preferred Stock were exchanged for one (1) share of Series

C Preferred Stock. The Common Stock began trading on Nasdaq on a split-adjusted basis at the start of trading on November 19, 2024.

The Reverse Stock Splits did not affect the total number of shares

of capital stock, including the Common Stock and Series C Preferred Stock, that the Company is authorized to issue, which remain as set

forth pursuant to the Articles of Incorporation and the Series C Certificate of Designations, respectively. No fractional shares were

issued in connection with the Reverse Stock Splits, all of which shares of post-split Common Stock and Series C Preferred Stock were rounded

up to the nearest whole number of such shares.

THE OFFERING

This prospectus relates to the offer and resale

by the Selling Stockholders of up to 524,000 Series H Conversion Shares issuable upon the conversion of the Series H Preferred Stock.

All of the Series H Conversion Shares, if and when sold, will be sold by the Selling Stockholders. The Selling Stockholders may sell the

Series H Conversion Shares from time to time at prevailing market prices or at privately negotiated prices.

| Series H Conversion Shares offered by the Selling Stockholders: |

|

Up to 524,000 shares of Common Stock. |

| |

|

|

| Shares of Common Stock outstanding after completion of this offering (assuming full conversion of the Series H Preferred Stock): |

|

2,560,013 shares of Common Stock (1) |

| |

|

|

| Use of proceeds: |

|

We will not receive any of the proceeds from any sale of the Series H Conversion Shares by the Selling Stockholders. See “Use of Proceeds.” |

| |

|

|

| Risk factors: |

|

An investment in the shares of Common Stock offered under this prospectus is highly speculative and involves substantial risk. Please carefully consider the “Risk Factors” section on page 5 and other information in this prospectus for a discussion of risks. Additional risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business and operations. |

| |

|

|

| Nasdaq symbol: |

|

Our Common Stock is listed on Nasdaq under the symbol “LGMK”. |

| (1) | Shares of our Common Stock that will be outstanding after this offering

is based on 2,036,013 shares of Common Stock outstanding as of December 26, 2024, and excludes the following as of such date: (i) the

exercise of outstanding warrants to purchase up to an aggregate of 2,599,270 shares of Common Stock at a weighted average exercise price

of approximately $626.23 per share, (ii) the exercise of outstanding options granted to certain directors of the Company to purchase up

to an aggregate of 17,855 shares of Common Stock at a weighted average exercise price of $42.50 per share, and (iii) the conversion of

the 106,333 outstanding shares of Series F Convertible Preferred Stock, par value $0.0001 per share (the “Series F Preferred Stock”),

into up to 107 shares of Common Stock based on a conversion price equal to $3,000.00 per share. |

RISK FACTORS

Holding the shares of Common Stock offered

under this prospectus involves a high degree of risk. You should carefully consider and evaluate all of the information contained in this

prospectus, any prospectus supplement and in the documents that we incorporate by reference herein before you decide to invest in our

Common Stock. In particular, you should carefully consider and evaluate the risks and uncertainties described under the heading “Risk

Factors” in this prospectus, any prospectus supplement and our filings with the SEC, including our Annual Report on Form 10-K for

the fiscal year ended December 31, 2023 as well as of the documents incorporated by reference herein or therein. Investors are further

advised that the risks described below may not be the only risks we face. Additional risks that we do not yet know of, or that we currently

think are immaterial, may also negatively impact our business operations or financial results. Any of the risks and uncertainties set

forth in this prospectus and in the documents incorporated by reference herein, as updated by annual, quarterly and other reports and

documents that we file with the SEC and incorporate by reference into this prospectus, could materially and adversely affect our business,

results of operations and financial condition, which in turn could materially and adversely affect the value of our Common Stock.

Risks Related to the Resale of the Series H

Conversion Shares and Ownership of Our Common Stock

The Selling Stockholders may choose to sell

the Series H Conversion Shares at prices below the current market price.

The Selling Stockholders are not restricted as

to the prices at which they may sell or otherwise dispose of the Series H Conversion Shares covered by this prospectus. Sales or other

dispositions of the Series H Conversion Shares below the then-current market prices could adversely affect the market price of our Common

Stock.

A large number of shares of Common Stock

may be sold in the market following this offering and upon the SEC declaring this registration statement on Form S-3 effective, which

may significantly depress the market price of our Common Stock.

The Series H Conversion Shares sold in the offering

will be freely tradable without restriction or further registration under the Securities Act of 1933, as amended (the “Securities

Act”) upon the SEC declaring this registration statement on Form S-3 effective. As a result, a substantial number of shares of our

Common Stock may be sold in the public market following this offering and upon the SEC declaring this Registration Statement effective.

If there are significantly more shares of Common

Stock offered for sale than buyers are willing to purchase, then the market price of our Common Stock may decline to a market price at

which buyers are willing to purchase the offered Common Stock and sellers remain willing to sell our Common Stock. Sales of a substantial

number of Series H Conversion Shares in the public market following the completion of this offering, or the perception that such sales

might occur, could depress the market price of our Common Stock and could impair our ability to raise capital through the sale of our

additional equity securities.

You may experience future dilution as a

result of the issuance of the Series H Conversion Shares, future equity offerings by us and other issuances of our Common Stock or other

securities. In addition, the issuance of the Series H Conversion Shares and future equity offerings and other issuances of our Common

Stock or other securities may adversely affect our Common Stock price.

In order to raise additional capital, we may in

the future offer additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock at prices

that may not be the same as the price per share as prior issuances of Common Stock. We may not be able to sell shares or other securities

in any other offering at a price per share that is equal to or greater than the price per share previously paid by investors, and investors

purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which

we sell additional shares of our Common Stock or securities convertible into Common Stock in future transactions may be higher or lower

than the prices per share for previous issuances of Common Stock or securities convertible into Common Stock paid by certain investors.

You will incur dilution upon exercise of any outstanding stock options or warrants or upon the issuance of shares of Common Stock in accordance

with our equity incentive plans. In addition, the issuance of the Series H Conversion Shares and any future sales of a substantial number

of shares of our Common Stock in the public market, or the perception that such sales may occur, could adversely affect the price of our

Common Stock. We cannot predict the effect, if any, that market sales of those shares of Common Stock or the availability of such shares

for sale will have on the market price of our Common Stock.

Neither we nor the Selling Stockholders

have authorized any other party to provide you with information concerning us or this offering.

You should carefully evaluate all of the information

in this prospectus and the registration statement of which this prospectus forms a part, including the documents incorporated by reference

herein. We may receive media coverage regarding our Company, including coverage that is not directly attributable to statements made by

our officers, that incorrectly reports on statements made by our officers or employees, or that is misleading as a result of omitting

information provided by us, our officers or employees. Neither we nor the Selling Stockholders have authorized any other party to provide

you with information concerning us or this offering of Series H Conversion Shares, and such recipients should not rely on this information.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement

and the documents we incorporate by reference herein or therein contain forward-looking statements within the meaning of Section 21(E)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities Act. These forward-looking

statements include, without limitation: statements regarding proposed new products or services; statements concerning litigation or other

matters; statements concerning projections, predictions, expectations, estimates or forecasts for our business, financial and operating

results and future economic performance; statements of our management’s goals and objectives; statements concerning our competitive

environment, availability of resources and regulation; trends affecting our financial condition, results of operations or future prospects;

our financing plans or growth strategies; and other similar expressions concerning matters that are not historical facts. Words such as

“may”, “will”, “should”, “could”, “would”, “predicts”, “potential”,

“continue”, “expects”, “anticipates”, “future”, “intends”, “plans”,

“believes” and “estimates,” and variations of such terms or similar expressions, are intended to identify such

forward-looking statements.

Forward-looking statements should not be read

as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by which, that performance

or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or our

management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could

cause actual performance or results to differ materially from what is expressed in or suggested by the forward-looking statements.

Forward-looking statements speak only as of the

date they are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking

statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except

to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn

that we will make additional updates with respect to those or other forward-looking statements. You should review our subsequent reports

filed with the SEC described in the sections of this prospectus entitled “Where You Can Find More Information” and “Incorporation

of Documents by Reference,” all of which are accessible on the SEC’s website at www.sec.gov.

INDUSTRY AND MARKET DATA

Unless otherwise indicated, information contained

in this prospectus concerning our industry and the market in which we operate, including our market position, market opportunity and market

size, is based on information from various sources, on assumptions that we have made based on such data and other similar sources and

on our knowledge of the markets for our products. These data sources involve a number of assumptions and limitations, and you are cautioned

not to give undue weight to such estimates.

We have not independently verified any third-party

information. While we believe the market position, market opportunity and market size information included in this prospectus is generally

reliable, such information is inherently imprecise. In addition, projections, assumptions and estimates of our future performance and

the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety

of factors, including those described in the section titled “Risk Factors” and elsewhere in this prospectus. These and other

factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

SETTLEMENT AGREEMENTS AND ISSUANCE OF PREFERRED

STOCK

On November 13, 2024, the Company entered into

Settlement Agreements with the Selling Stockholders. In connection with the Settlement Agreements, on November 13, 2024, the Company filed

with the Secretary of State of the State of Nevada (the “Nevada Secretary of State”): (i) a Series H Certificate of Designation

to designate 1,000 shares of the Company’s authorized and unissued preferred stock as Series H Preferred Stock; and (ii) a Certificate

of Designation of Preferences, Rights and Limitations of Series I Non-Convertible Voting Preferred Stock (the “Series I Certificate

of Designation”) to designate 1,000 shares of the Company’s authorized and unissued preferred stock as Series I Preferred

Stock. Each of the Series H Certificate of Designation and the Series I Certificate of Designation became effective upon its filing with

the Nevada Secretary of State, and establishes the rights, preferences, privileges, qualifications, restrictions, and limitations relating

to the applicable Preferred Stock.

Pursuant to the Settlement Agreements, in consideration for the Selling

Stockholders’ agreement to exercise any outstanding Series B Warrants on or before the date of the issuance of the Preferred Stock

and waive any and all claims or demands that the Selling Stockholders may receive upon exercise of the Series B Warrants pursuant to Sections

2.3 and 3.8 of the Series B Warrants on or after the effective time of the Company’s then next reverse stock split of its outstanding

Common Stock a number of shares of Common Stock in excess of four (4) times the number of shares of Common Stock that was initially issuable

upon exercise of the Series B Warrants as of the date of their issuance, the Company issued to the Selling Stockholders, on November 14,

2024, (i) an aggregate of 1,000 shares of Series H Preferred Stock, which are convertible at the option of the holder thereof into Series

H Conversion Shares at an initial conversion price of $11.64, and (ii) an aggregate of 1,000 shares of Series I Preferred Stock, each

share of which entitles the holder thereof to two (2) votes on all matters submitted to a vote of the stockholders of the Company. The

Series I Preferred Stock will be automatically redeemed for no consideration upon the redemption, conversion or sale of shares of Series

H Preferred Stock on a one for one basis. The shares of Series H Preferred Stock have a stated value of $1,000.

Pursuant to Section 6(c) of the Series H Certificate

of Designation, following the Common Stock Reverse Stock Split, the conversion price of the Series H Preferred Stock was reset at $1.91

per share. The Series H Conversion Shares are subject to a 4.99%/9.99% beneficial ownership limitation. In an event of liquidation, each

holder of Series H Preferred Stock is entitled to the greater of (a) the aggregate stated value of the shares of Series H Preferred Stock,

and (b) the amount the holder’s shares of Series H Preferred Stock would be entitled to receive if their shares of Series H Preferred

Stock were fully converted.

Also pursuant to the Settlement Agreements, on the issuance date of

the Preferred Stock, the Company entered into registration rights agreements with the Selling Stockholders (pursuant to which the Company

agreed to register the resale of the Series H Conversion Shares). The Company is required to prepare and file the resale registration

statement with the SEC no later than the 30th calendar day following the issuance of the Preferred Stock and to use its best efforts to

have such registration statement declared effective within 60 calendar days after such date, subject to certain exceptions. In order to

satisfy such obligations, the Company is filing the registration statement of which this prospectus forms a part to register for resale

all of the Series H Conversion Shares issuable upon conversion of the Series H Preferred Stock issued to the Selling Stockholders.

SELLING STOCKHOLDERS

The shares of Common Stock being offered by the

Selling Stockholders consist of the Series H Conversion Shares issuable upon conversion of Series H Preferred Stock. For additional information

regarding the issuance of these securities, see “Settlement Agreements and Issuance of Preferred Stock” beginning on page

8 of this prospectus. We are registering the Series H Conversion Shares in order to permit the Selling Stockholders to offer such shares

of Common Stock for resale from time to time. Except for the Settlement Agreements described in the section entitled “Settlement

Agreements and Issuance of Preferred Stock”, and as disclosed in this section under “Material Relationships with Selling Stockholders,”

the Selling Stockholders have not had any material relationship with us or our affiliates within the past three years.

The following table sets forth certain information with respect to

each Selling Stockholder, including (i) the shares of Common Stock beneficially owned by the Selling Stockholder prior to this offering,

(ii) the number of Series H Conversion Shares being offered by the Selling Stockholder pursuant to this prospectus and (iii) the Selling

Stockholders’ beneficial and percentage ownership of our outstanding shares of Common Stock after completion of this offering. The

registration of the Series H Conversion Shares issuable to the Selling Stockholders upon conversion of the Series H Preferred Stock does

not necessarily mean that the Selling Stockholders will sell all or any of such Series H Conversion Shares, but the number of shares of

Common Stock and percentages set forth in the final two columns below assume that all Series H Conversion Shares being offered by the

Selling Stockholders are sold. The final two columns also assume, as of December 26, 2024, the full conversion of the Series H Preferred

Stock, without regard to any limitations on conversion. See “Plan of Distribution.”

The table is based on information supplied to us by the Selling Stockholders,

with beneficial ownership and percentage ownership determined in accordance with the rules and regulations of the SEC, and includes voting

or investment power with respect to shares of Common Stock. This information does not necessarily indicate beneficial ownership for any

other purpose. In computing the number of shares of Common Stock beneficially owned by a Selling Stockholder and the percentage ownership

of that Selling Stockholder, shares of Common Stock subject to securities held by that Selling Stockholder that are exercisable for or

convertible into shares of Common Stock within 60 days after December 26, 2024, are deemed outstanding. Such shares of Common Stock, however,

are not deemed outstanding for the purposes of computing the percentage ownership of any other stockholder.

| | |

Number of

Shares of

Common

Stock

Beneficially

Owned

Prior to

Offering (1) | | |

Maximum

Number of

Series

H

Conversion

Shares

to be Sold

Pursuant

to this

Prospectus (2) | | |

Number of

Shares of

Common

Stock

Beneficially

Owned

After

Offering (1)(3) | | |

Percentage

Beneficially

Owned

After

Offering (1)(3) | |

| Altium Growth Fund, LP (4) | |

| 106,933 | | |

| 131,000 | | |

| 127,744 | | |

| 4.99 | % |

| Entities affiliated with Anson Investments Master Fund LP (5) | |

| 106,933 | | |

| 131,000 | | |

| 127,744 | | |

| 4.99 | % |

| Hudson Bay Master Fund Ltd. (6) | |

| 106,933 | | |

| 131,000 | | |

| 127,744 | | |

| 4.99 | % |

| Sabby Volatility Warrant Fund, LLC (7) | |

| 106,933 | | |

| 131,000 | | |

| 127,744 | | |

| 4.99 | % |

| TOTAL | |

| 427,732 | | |

| 524,000 | | |

| 510,976 | | |

| 19.96 | % |

|

(1) |

The number of shares owned and the percentage of beneficial ownership prior to and after this offering set forth in these columns are based on 2,036,013 shares of Common Stock outstanding on December 26, 2024. Conversions of the Series H Preferred Stock and exercises of other securities held by the Selling Stockholders are subject to certain beneficial ownership limitations, which provide that a holder of the Series H Preferred Stock will not have the right to conversion of any portion of such Series H Preferred Stock if such holder, together with such holder’s affiliates, would beneficially own in excess of 4.99% or 9.99%, as applicable, of the number of shares of Common Stock outstanding immediately after giving effect to such conversion, provided that upon at least 61 days’ prior notice to the Company, a holder may increase or decrease such limitation up to a maximum of 9.99% of the number of shares of Common Stock outstanding (each such limitation, a “Beneficial Ownership Limitation”). As a result, the number of shares of Common Stock reflected in these columns as beneficially owned by each Selling Stockholder includes (a) any outstanding shares of Common Stock held by such Selling Stockholder, and (b) if any, the number of Series H Conversion Shares offered hereby and any other securities convertible into or exercisable for shares of Common Stock that may be held by such Selling Stockholder, in each case which such Selling Stockholder has the right to acquire as of December 26, 2024 and without such holder or any of such holder’s affiliates beneficially owning more than 4.99% or 9.99%, as applicable, of the number of outstanding shares of Common Stock as of December 26, 2024. |

| (2) | Represents

all Series H Conversion Shares offered hereby upon full conversion of the Series H Preferred Stock owned by the Selling Stockholders,

without regard to the Beneficial Ownership Limitations that apply thereto. |

| (3) | The number of shares owned and the percentage of beneficial ownership after this

offering set forth in these columns assumes full conversion of the Series H Preferred Stock for an aggregate of 524,000 Series H Conversion

Shares offered hereby and the subsequent sale of all such Series H Conversion Shares. |

|

(4) |

Shares of Common Stock beneficially owned prior

to the offering include 633,911 shares of Common Stock issuable upon exercise of the Series A Warrants (as defined below), of which 526,978

shares are not currently exercisable due to a 4.99% Beneficial Ownership Limitation, and does not include 125,000 Series H Conversion

Shares upon conversion of the Series H Preferred Stock, none of which are currently exercisable due to a 4.99% Beneficial Ownership Limitation.

Altium Capital Management, LP, the investment

manager of Altium Growth Fund, LP, has voting and investment power over these securities. Jacob Gottlieb is the managing member of Altium

Capital Growth GP, LLC, which is the general partner of Altium Growth Fund, LP. Each of Altium Growth Fund, LP and Jacob Gottlieb disclaims

beneficial ownership over these securities. The principal address of Altium Capital Management, LP is 152 West 57th Street, 20th Floor,

New York, NY 10019. |

|

(5) |

Shares of Common Stock beneficially owned prior

to the offering include (i) 8,988 shares of Common Stock issuable upon exercise of certain common stock purchase warrants, and (ii) 633,911

shares of Common Stock issuable upon exercise of the Series A Warrants, of which 535,966 are not currently exercisable due to a 4.99%

Beneficial Ownership Limitation, and does not include 125,000 Series H Conversion Shares upon conversion of the Series H Preferred Stock,

none of which are currently exercisable due to a 4.99% Beneficial Ownership Limitation.

The securities are directly held by (i) Anson

East Master Fund LP (“Anson East”) and (ii) Anson Investments Master Fund LP (“Anson Investments”, and, collectively

with Anson East, the “Anson Master Funds”). Anson Advisors Inc and Anson Funds Management LP, the Co-Investment Advisers of

the Anson Master Funds, hold voting and dispositive power over the shares of Common Stock held by the Anson Master Funds. Tony Moore is

the managing member of Anson Management GP LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo

are directors of Anson Advisors Inc. Mr. Moore, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these shares of Common

Stock except to the extent of their pecuniary interest therein. The principal business address of the Anson Master Funds is Maples Corporate

Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. |

|

(6) |

Shares of Common Stock beneficially owned prior to the offering include (i) 1,255 shares of Common Stock issuable upon exercise of certain common stock purchase warrants, and (ii) 607,335 shares of Common Stock issuable upon exercise of the Series A Warrants, of which 501,657 are not currently exercisable due to a 4.99% Beneficial Ownership Limitation, and does not include 125,000 Series H Conversion Shares upon conversion of the Series H Preferred Stock, none of which are currently exercisable due to a 4.99% Beneficial Ownership Limitation. |

The securities are directly held by Hudson

Bay Master Fund Ltd, a Cayman Islands exempted company (“Hudson Bay”). Hudson Bay Capital Management LP, the investment manager

of Hudson Bay, has sole voting and dispositive control of the shares reported herein. Sander Gerber is the managing member of Hudson Bay

Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Hudson Bay and Sander Gerber disclaims beneficial

ownership of the shares reported herein. The address of Hudson Bay is c/o Hudson Bay Capital Management LP, 290 Harbor Drive, 3rd Floor,

Stamford, CT, 06902.

|

(7) |

Shares of Common Stock beneficially owned prior to the offering include 581,436 shares of Common Stock issuable upon exercise of the Series A Warrants (as defined below), of which 474,503 shares are not currently exercisable due to a 4.99% Beneficial Ownership Limitation, and does not include 125,000 Series H Conversion Shares upon conversion of the Series H Preferred Stock, none of which are currently exercisable due to a 4.99% Beneficial Ownership Limitation. |

The securities are directly held by

Sabby Volatility Warrant Master Fund, Ltd. (“Sabby”). Sabby Management, LLC is the investment manager of Sabby and shares

voting and investment power with respect to these shares in this capacity. As manager of Sabby Management, LLC, Hal Mintz also shares

voting and investment power on behalf of Sabby. Each of Sabby Management, LLC and Hal Mintz disclaims beneficial ownership over the securities

listed except to the extent of their pecuniary interest therein. The address of Sabby is Captiva (Cayman) Ltd, Governors Square, Bldg

4, 2nd Floor, 23 Lime Tree Bay Avenue, P.O. Box 32315, Grand Cayman KY1-1209, Cayman Islands.

Material Relationships with Selling Stockholders

No material relationships exist between any of the Selling

Stockholders and us, nor have any such material relationships existed within the past three years, except, in either case, as identified

below or otherwise disclosed herein.

January 2023 Offering

On January 25, 2023, the Company closed a firm

commitment registered public offering (the “January 2023 Offering”) pursuant to which the Company issued to certain holders

of Common Stock, including two of the Selling Stockholders, Anson Investments and Hudson Bay (i) 21,170 shares of Common Stock and common

stock purchase warrants (exercisable for 31,755 shares of Common Stock at a purchase price of $63.00 per share), subject to certain adjustments,

(ii) pre-funded common stock purchase warrants which were exercised for 6,880 shares of Common Stock at a purchase price of $0.50 per

share, subject to certain adjustments, (iii) warrants to purchase up to an aggregate of 10,320 shares of Common Stock at $63.00 per share

and (iv) additional warrants to purchase up to 2,446 shares of Common Stock at $63.00 per share, which additional warrants were issued

upon the partial exercise by the underwriters of their over-allotment option, pursuant to an underwriting agreement, dated as of January

23, 2023 between the Company and Maxim Group LLC, as representative of the underwriters. The January 2023 Offering resulted in gross proceeds

to the Company of approximately $5.2 million, before deducting underwriting discounts and commissions of 7% of the gross proceeds (3.5%

of the gross proceeds in the case of certain identified investors) and estimated January Offering expenses.

November 2023 Warrant Inducement Transactions

On November 21, 2023, the Company entered into

warrant inducement agreements (the “2021 Inducement Agreements”) with certain holders of the Company’s Series A Common

Stock purchase warrants (the “Series A Warrants”) issued pursuant to a firm commitment public offering by the Company that

closed on September 15, 2021 (the “Existing September 2021 Warrants”) and the Series B Warrants (together with the Series

A Warrants, the “Warrants”) were issued pursuant to warrant inducement agreements (the “2023 Inducement Agreements”

and together with the 2021 Inducement Agreements, the “Inducement Agreements”) with certain holders of the Company’s

common stock purchase warrants issued pursuant to a firm commitment public offering by the Company that closed on January 25, 2023 (the

“Existing January 2023 Warrants” and together with the Existing September 2021 Warrants, the “Existing Warrants”).

The holders participating in the Inducement Agreements included two of the Selling Stockholders, Anson Investments and Hudson Bay. Pursuant

to the Inducement Agreements, the Company induced such warrant holders to exercise for cash their Existing Warrants to purchase up to

approximately 36,363 shares of Common Stock, at a lower exercise price of (x) $50.00 per share for the Existing September 2021 Warrants

and (y) $50.00 per one and one-half share for the Existing January 2023 Warrants, during the period from the date of the Inducement Agreements

until December 20, 2023. Additionally, the Company agreed to issue to such holders new (A) Series A Warrants to purchase a number of shares

of Common Stock issuable upon the exercise of Series A Warrants (the “Series A Warrant Shares”) equal to 200% of the number

of shares of Common Stock issued upon exercise of the Existing September 2021 Warrants to holders of Existing September 2021 Warrants,

at an exercise price of $50.00 per Series A Warrant Share, and (B) Series B Warrants to purchase a number of shares of Common Stock issuable

upon the exercise of Series B Warrants (the “Series B Warrant Shares”) equal to 200% of the number of shares of Common Stock

issued upon exercise of the Existing January 2023 Warrants to holders of Existing January 2023 Warrants, at an exercise price of $50.00

per one and one-half Series B Warrant Share.

August 2024 Public Offering

On August 5, 2024 (the “August 2024 Offering Closing Date”),

the Company, in connection with a best efforts public offering (the “August 2024 Offering”), sold to certain purchasers (x)

units of the Company (the “Units”) at an offering price of $11.64 per Unit, consisting of (i) 57,997 shares of the Company’s

Common Stock, and (ii) the Company’s Series A warrants to purchase Common Stock, exercisable for up to 57,997 shares of Common Stock

at an exercise price of $11.64 per share (the “August Series A Warrants”), and (iii) the Company’s Series B warrants

to purchase Common Stock at an exercise price of $11.64 per share, exercisable for up to 57,996 shares of Common Stock (the “August

Series B Warrants”); and (y) pre-funded units of the Company (the “Pre-Funded Units”) at an offering price $0.47 per

Pre-Funded Unit, consisting of (i) pre-funded common stock purchase warrants exercisable for up to 328,804 shares of Common Stock

at $0.03 per share, (the “August Pre-Funded Warrants”), (ii) August Series A Warrants exercisable for up to 9,670,000 shares

of Common Stock and (iii) August Series B Warrants exercisable for up to 9,670,000 shares of Common Stock, pursuant to the Company’s

Form S-1 registration statement, as amended (File No. 333-279133), declared effective by the SEC on August 1, 2024 and securities purchase

agreements, dated August 2, 2024, between the Company and each of the purchasers signatory thereto, which included each of the Selling

Stockholders. The August Series B Warrants can be exercised on an alternate cashless basis which would result in holders receiving four

(4) times the number of common stock if such election is made. On the August 2024 Offering Closing Date, the Company received gross proceeds

of approximately $4.5 million, before deducting placement agent commissions and estimated August 2024 Offering expenses. The Company

has begun to use the net proceeds from the August 2024 Offering for continued new product development, working capital and other general

corporate purposes.

In addition, as of September 30, 2024, the Selling Stockholders exercised

their August Pre-Funded Warrants for an aggregate of 328,804 shares of Common Stock. As of September 30, 2024, the exercise price of the

August Series A Warrants were subject to a one-time reset adjustment, which resulted in a new exercise price of $3.98 per warrant share.

USE OF PROCEEDS

The Selling Stockholders will receive all of the

proceeds from the sale of the Series H Conversion Shares under this prospectus and we will not receive any of such proceeds. The Selling

Stockholders will pay any agent’s commissions and expenses they incur for brokerage, accounting, tax or legal services or any other

expenses that they incur in disposing of the shares of Common Stock. We will bear all other costs, fees and expenses incurred in effecting

the registration of the shares of Common Stock covered by this prospectus and any prospectus supplement. These may include, without limitation,

all registration and filing fees, SEC filing fees and expenses of compliance with state securities or “blue sky” laws. We

cannot predict when or if the Series H Preferred Stock will be converted, and it is possible that the Series H Preferred Stock may never

be converted.

See “Plan of Distribution” elsewhere

in this prospectus for more information.

DESCRIPTION

OF SECURITIES THAT THE SELLING STOCKHOLDERS ARE OFFERING

The Selling Stockholders are offering for resale up to an

aggregate of 524,000 shares of Common Stock issuable upon full conversion of the Series H Preferred Stock. The following description of

our Common Stock, Series H Preferred Stock, certain provisions of our Articles of Incorporation, the Company’s Bylaws (the “Bylaws”),

the Series H Certificate of Designation and Nevada law are summaries. You should also refer to our Articles of Incorporation and our Bylaws,

which are listed as exhibits to the registration statement of which this prospectus is part. For a further description of the Series H

Preferred Stock, see the section entitled “Settlement Agreements and Issuance of Preferred Stock.” For a complete description

of the terms and conditions of the Settlement Agreements and the Series H Preferred Stock, please refer to our Quarterly Report on Form

10-Q for the period ended September 30, 2024, filed with the SEC on November 14, 2024 the forms of the Settlement Agreements and the Series

H Certificate of Designation filed as exhibits thereto.

General

The Company is authorized to issue 110,000,000 shares of its capital

stock consisting of (a) 100,000,000 shares of Common Stock and (b) 10,000,000 shares of “blank check” preferred stock, par

value $0.0001 per share, (i) 2,000 shares of which are designated as Series C Preferred Stock, 1 share of which is outstanding; (ii) 1,333,333

shares of which are designated as Series F Preferred Stock, 106,333 shares of which are outstanding; (iii) 1,000,000 shares of which are

designated as Series G Non-Convertible Voting Preferred Stock, par value $0.0001 per share, none of which are currently outstanding, (iv)

1,000 shares of Series H Preferred Stock, all of which are currently outstanding, and (v) 1,000 shares of Series I Preferred Stock. All

of which are currently outstanding.

As of December 26, 2024, 2,036,013 shares of our Common Stock were

issued and outstanding, held by 88 stockholders of record (which do not include shares of Common Stock held in street name), which number

excludes the following as of such date: (i) the exercise of outstanding warrants to purchase up to an aggregate of 2,599,270 shares of

Common Stock with an approximate weighted average exercise price and remaining life in years of $626.23 and 3.18, respectively, and (ii)

the exercise of outstanding options to purchase up to an aggregate of 19,050 shares of Common Stock at a weighted average exercise price

of $73.62 per share. In addition, as of December 26, 2024, 1 share of our Series C Preferred Stock was issued and outstanding, held by

one stockholder of record, 106,333 shares of Series F Preferred Stock were issued and outstanding, held by one stockholder of record,

1,000 shares of Series H Preferred Stock were issued and outstanding, held by four holders of record, and 1,000 shares of Series I Preferred

Stock were issued and outstanding, held by four holders of record. The Series C Preferred Stock ranks senior to the Common Stock, the

Series F Preferred Stock and the Series H Preferred Stock with respect to dividends and redemption rights and rights upon liquidation,

dissolution or winding up of the Company. The Series F Preferred Stock ranks senior to the Common Stock and the Series H Preferred Stock

with respect to dividends and redemption rights and rights upon liquidation, dissolution or winding up of the Company. The Series H Preferred

Stock ranks junior to the Series C Preferred Stock and Series F Preferred Stock but ranks senior to Common Stock and the Series I

Preferred Stock with respect to dividends and redemption rights and rights upon liquidation, dissolution or winding up of the Company.

The Series I Preferred Stock ranks junior to the Series C Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock

and the Series H Preferred Stock with respect to the rights upon liquidation, dissolution or winding up of the Company.

Common

Stock

Each

share of Common Stock entitles the holder to one vote, either in person or by proxy, at meetings of stockholders. Generally, all matters

to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes

entitled to be cast by all shares of common stock that are present in person or represented by proxy. Our Articles of Incorporation do

not provide for cumulative voting in the election of directors.

Holders

of Common Stock are entitled to receive ratably such dividends, if any, as may be declared by the Company’s Board of Directors

(the “Board”) out of funds legally available. We have not paid any dividends since our inception, and we presently anticipate

that all earnings, if any, will be retained for development of our business. Any future disposition of dividends will be at the discretion

of our Board and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements,

and other factors.

Holders

of our Common Stock have no preemptive rights or other subscription rights, conversion rights, registration rights, redemption or sinking

fund provisions by virtue of only holding such shares. Upon our liquidation, dissolution or winding up, the holders of our Common Stock

will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our

debts and other liabilities.

Series

H Preferred Stock

Stated

Value. Each share of Series H Preferred Stock has a stated value of $1,000.

Voting.

Holders of the shares of Series H Preferred Stock are not entitled to vote on matters on which the holders of shares of Common Stock

are entitled to vote until and unless such holder has converted such shares of Series H Preferred Stock into Series H Conversion Shares.

Notwithstanding the foregoing, so long as any shares of Series H Preferred Stock are outstanding, the Company cannot, without the affirmative

vote of the holders of a majority of the then-outstanding shares of Series H Preferred Stock, (a) alter or change adversely the powers,

preferences or rights given to the Series H Preferred Stock or alter or amend the Series H Certificate of Designation, (b) amend the

Articles of Incorporation or any other charter documents of the Company in any manner that adversely affects any rights of the Holders

or (c) enter into any agreement with respect to any of the foregoing.

Ranking.

The Series H Preferred Stock, with respect to the preferences as to dividends, distributions and payments upon the liquidation, dissolution

and winding up of the Company, are junior in rank only to the Company’s Series F Preferred Stock, the Series C Preferred Stock,

and any capital stock a majority of holders of the Series H Preferred Stock consent to the creation of.

Conversion.

At any time from and after the first date of issuance of any Series

H Preferred Stock, a holder of Series H Preferred Stock may convert all, or any part, of the outstanding Series H Preferred Stock, at

any time at such holder’s option, into Series H Conversion Shares at an initial conversion price of $11.64, which is subject to

proportional adjustment upon the occurrence of any stock split, stock dividend, stock combination and/or similar transactions. Subject

to the rules and regulations of Nasdaq, the Company has the right to, at any time, with the written consent of a majority of the holders

of outstanding Series H Preferred Stock, lower the conversion price to any amount. In addition, the conversion price of the Series H Preferred

Stock reset on the fifth trading day following the effective date of the Company’s next reverse stock split of its outstanding Common

Stock to the greater of (i) the lowest volume weighted average price of the Common Stock on the Nasdaq Stock Market LLC during the five

trading days immediately preceding the reset date and (ii) a floor price of $0.1785. Following the Common Stock Reverse Stock Split, the

conversion price of the Series H Preferred Stock was reset at $1.91 per share.

Each

holder of Series H Preferred Stock is prohibited from converting their shares of Series H Preferred Stock if, after giving effect to

the issuance of such Series H Conversion Shares, such holder together with its affiliates would beneficially own more than 4.99% of the

outstanding Common Stock. A holder of Series H Preferred Stock may increase such Beneficial Ownership Limitation to 9.99% upon notice

to the Company.

Pro

Rata Distributions. During such time as the Series H Preferred Stock is outstanding, if the Company declares or makes any dividend

or other distribution of its assets (or rights to acquire its assets) to holders of shares of Common Stock, by way of return of capital

or otherwise (including, without limitation, any distribution of cash, stock or other securities, property or options by way of a dividend,

spin off, reclassification, corporate rearrangement, scheme of arrangement or other similar transaction), other than dividends or issuances

of rights pursuant to the Company’s existing rights agreement to holders of Common Stock or Common Stock Equivalents (a “Distribution”),

at any time after the issuance of the Series H Preferred Stock, then, in each such case, the holder will be entitled to participate in

such Distribution to the same extent that the holder would have participated therein if the holder had held the number of shares of Common

Stock acquirable upon complete conversion of the Series H Preferred Stock (without regard to any limitations on conversion hereof, including

without limitation, the beneficial ownership limitation) immediately before the date of which a record is taken for such Distribution,

or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the participation

in such Distribution (provided, however, to the extent that the holder’s right to participate in any such Distribution would result

in the holder exceeding such limitation, then the holder will not be entitled to participate in such Distribution to such extent (or

in the beneficial ownership of any shares of Common Stock as a result of such Distribution to such extent) and the portion of such Distribution

shall be held in abeyance for the benefit of the holder until such time, if ever, as its right thereto would not result in the holder

exceeding the beneficial ownership limitation).

Redemption.

The shares Series H Preferred Stock are not redeemable.

Liquidation.

In the event of any liquidation, dissolution or winding up of the Company, the Series H Preferred Stock holders are entitled to the greater

of (a) the aggregate stated value of the shares of Series H Preferred Stock and (b) such amount the holders of shares of Series H Preferred

Stock would be entitled to receive if their shares of Series H Preferred Stock were fully converted.

Anti-Takeover

Provisions

Some

features of the Nevada Revised Statutes (“NRS”), which are further described below, may have the effect of deterring third

parties from making takeover bids for control of us or may be used to hinder or delay a takeover bid. This would decrease the chance

that our stockholders would realize a premium over market price for their shares of Common Stock as a result of a takeover bid.

Acquisition

of Controlling Interest

The

NRS contain provisions governing acquisition of a controlling interest of a Nevada corporation. These provisions provide generally that

any person or entity that acquires a certain percentage of the outstanding voting shares of a Nevada corporation may be denied voting

rights with respect to the acquired shares, unless certain criteria are satisfied. On November 1, 2024, the Company entered into a rights

agreement with Nevada Agency and Transfer Company (the “Rights Agreement”). Pursuant to the Rights Agreement, in the event

that a person or entity or group thereof becomes the Beneficial Owner (as defined in the Rights Agreement) of at least fifteen percent

(15%) of the outstanding shares of Common Stock (an “Acquiring Person”), each holder of Common Stock as of the close of business

on November 1, 2024 (the “Record Date”) will be entitled to receive a dividend of one right for each share of Common Stock

owned by such holder (each, a “Right”), with each Right exercisable for one one-hundredth of a share of the Company’s

Series G Non-Convertible Voting Preferred Stock, at a price of $0.05 per one-hundredth of a share (the “Purchase Price”),

subject to adjustment as set forth in the Rights Agreement.

Combination

with Interested Stockholder

The

NRS contain provisions governing combinations of a Nevada corporation that has 200 or more stockholders of record with an “interested

stockholder.” These provisions only apply to a Nevada corporation that, at the time the potential acquirer became an interested

stockholder, has a class or series of voting shares listed on a national securities exchange, or has a class or series of voting shares

traded in an “organized market” and satisfies certain specified public float and stockholder levels. As we do not now meet

those requirements, we do not believe that these provisions are currently applicable to us. However, to the extent they become applicable

to us in the future, they may have the effect of delaying or making it more difficult to affect a change in control of the Company in

the future.

A

corporation affected by these provisions may not engage in a combination within two years after the interested stockholder acquires his,

her or its shares unless the combination or purchase is approved by the board of directors before the interested stockholder acquired

such shares. Generally, if approval is not obtained, then after the expiration of the two-year period, the business combination may be

consummated with the approval of the board of directors before the person became an interested stockholder or a majority of the voting

power held by disinterested stockholders, or if the consideration to be received per share by disinterested stockholders is at least

equal to the highest of:

| ● | the

highest price per share paid by the interested stockholder within the three years immediately

preceding the date of the announcement of the combination or within three years immediately

before, or in, the transaction in which he, she or it became an interested stockholder, whichever

is higher; |

| ● | the

market value per share on the date of announcement of the combination or the date the person

became an interested stockholder, whichever is higher; or |

| ● | if

higher for the holders of preferred stock, the highest liquidation value of the preferred

stock, if any. |

Generally,

these provisions define an interested stockholder as a person who is the beneficial owner, directly or indirectly of 10% or more of the

voting power of the outstanding voting shares of a corporation, and define combination to include any merger or consolidation with an

interested stockholder, or any sale, lease, exchange, mortgage, pledge, transfer or other disposition, in one transaction or a series

of transactions with an interested stockholder of assets of the corporation:

| |

● |

having

an aggregate market value equal to 5% or more of the aggregate market value of the assets of the corporation; |

| |

● |

having

an aggregate market value equal to 5% or more of the aggregate market value of all outstanding shares of the corporation; or |

| |

● |

representing

10% or more of the earning power or net income of the corporation. |

Anti-Takeover

Effects of Certain Provisions of our Bylaws

Our

Bylaws provide that directors may be removed by the stockholders with or without cause upon the vote of a plurality of the votes cast

at a meeting of stockholders. Furthermore, the authorized number of directors may be changed only by resolution of the Board, and vacancies

may only be filled by a majority vote of the directors, although such majority is less than a quorum, or by a plurality of the votes

cast at a meeting of stockholders. Except as otherwise provided in the Bylaws and the Articles of Incorporation any vacancies or newly

created directorships on the Board resulting from any increase in the authorized number of directors elected by all of the stockholders

having the right to vote as a single class may be filled by a majority of the directors then in office, although less than a quorum.

Our

Bylaws also provide that only a director, chief executive officer, chief financial officer, president, vice president or corporate secretary

may call a special meeting of stockholders.

The

combination of these provisions makes it more difficult for our existing stockholders to replace our Board as well as for another party

to obtain control of us by replacing our Board. Since our Board has the power to retain and discharge our officers, these provisions

could also make it more difficult for existing stockholders or another party to effect a change in management. In addition, the authorization

of undesignated preferred stock makes it possible for our Board to issue preferred stock with voting or other rights or preferences that

could impede the success of any attempt to change our control.

These

provisions are intended to enhance the likelihood of continued stability in the composition of our Board and its policies and to discourage

coercive takeover practices and inadequate takeover bids. These provisions are also designed to reduce our vulnerability to hostile takeovers

and to discourage certain tactics that may be used in proxy fights. However, such provisions could have the effect of discouraging others

from making tender offers for our shares and may have the effect of delaying changes in our control or management. As a consequence,

these provisions may also inhibit fluctuations in the market price of our Common Stock that could result from actual or rumored takeover

attempts. We believe that the benefits of these provisions, including increased protection of our potential ability to negotiate with

the proponent of an unfriendly or unsolicited proposal to acquire or restructure our Company, outweigh the disadvantages of discouraging

takeover proposals, because negotiation of takeover proposals could result in an improvement of their terms.

Registration

Rights

Pursuant to each of the Settlement Agreements, the Company was obligated

to file a registration statement on Form S-3 with the SEC covering the resale of the Series H Conversion Shares issuable upon conversion

of the Series H Preferred Stock and to ensure such registration statement is declared effective. In order to satisfy such obligations,

the Company is filing the registration statement of which this prospectus forms a part to register for resale all of the Series H Conversion

Shares issuable upon conversion of the Series H Preferred Stock issued to the Selling Stockholders pursuant to the Settlement Agreements.

Transfer

Agent and Registrar

The

transfer agent and registrar for our Common Stock is Nevada Agency and Transfer Company, which is located at 50 West Liberty Street,

Suite 880, Reno, NV 89501 and its telephone number is (775) 322-5623.

Nasdaq

Listing

Our

Common Stock is listed on Nasdaq under the symbol “LGMK.”

PLAN

OF DISTRIBUTION

Each

Selling Stockholder of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any

or all of their securities covered hereby on the principal trading market or any other stock exchange, market or trading facility on

which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may

use any one or more of the following methods when selling securities:

| |

● |

ordinary brokerage transactions

and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block trades in which the

broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate

the transaction; |

| |

|

|

| |

● |

purchases by a broker-dealer

as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an exchange distribution

in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately negotiated transactions; |

| |

|

|

| |

● |

settlement of short sales; |

| |

|

|

| |

● |

in transactions through

broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security; |

| |

|

|

| |

● |

through the writing or