Host Hotels & Resorts Acquires 1 Hotel Nashville and Embassy Suites by Hilton Nashville Downtown

May 01 2024 - 4:30PM

Host Hotels & Resorts, Inc. (NASDAQ: HST) (the “Company”), the

nation’s largest lodging real estate investment trust, today

announced that it has acquired the fee simple interest in a

two-hotel complex comprising the 215-room 1 Hotel Nashville and the

506-room Embassy Suites by Hilton Nashville Downtown (together, the

“Property”) for approximately $530 million in cash. The acquisition

price represents a 12.6x EBITDA multiple or a cap rate of

approximately 7.4% on the Property’s 2024 estimated results1.

The Property is expected to be among Host’s top-25 assets based

on estimated full year 2024 results, with expected combined RevPAR

of $275, Total RevPAR of $435, and EBITDA per key of $58,5502,

further improving the quality of the Company’s portfolio.

James F. Risoleo, President and Chief Executive Officer, said,

“We are excited to add the 1 Hotel Nashville and Embassy Suites by

Hilton Nashville Downtown to our portfolio and establish a presence

in one of the country’s most exciting cities. The newly built

Property has a prime location in Nashville, a top performing

market, which had an impressive RevPAR CAGR of 7.7% from 2000 to

2023, even while absorbing new supply. A major leisure destination,

and the #2 ranked convention destination in the United States,

Nashville also has a recently expanded airport and a new stadium

that is expected to attract more entertainment and sporting events.

With meaningful in-place cash flow, multiple demand generators, and

no expected near-term capital expenditure requirements, we expect

the Property will generate outsized growth as it stabilizes,

enhancing the quality of our portfolio and driving additional value

creation for our stockholders.”

The newly built, LEED Silver® Property opened in 2022 and is

located two blocks from numerous live music and entertainment

venues in Nashville’s famed Lower Broadway entertainment district.

The Property stands directly across from the Music City Convention

Center (the “MCCC”), adjacent to the Bridgestone arena, home of the

NHL Nashville Predators, and within a 10-minute drive of Nissan

Stadium, the Country Music Hall of Fame Museum, Vanderbilt

University, Tennessee State University and Centennial Park. The

MCCC has continued to set record attendance numbers by attracting

larger events, and it has promising definite bookings in future

years. The new Nissan Stadium, home of the NFL Tennessee Titans, is

also expected to generate increased demand as the stadium’s dome

will allow for year-round activation beginning with the 2027

season. In addition, the Nashville International Airport is the

fastest growing airport in the United States with current passenger

traffic 33% above 2019. The recent $1.5 billion airport expansion

added six international gates and eight satellite gates, and

another $1.5 billion expansion is already underway, with completion

expected in 2028.

The Property has a combined 721 oversized rooms that average

approximately 500 square feet with a 75% suite mix. It offers seven

separate food & beverage outlets, including Harriet’s Rooftop,

which provides guests with exclusive views of Music City’s skyline

in an elevated nightlife setting. Among other amenities, the

Property has a Bamford Wellness spa with six treatment rooms, two

fitness centers, a yoga studio, and 33,000 square feet of shared

meeting space, including a 9,400 square foot ballroom and 9,300

square feet of pre-function space.

Supply growth is expected to continue in Nashville with most

projects in the planning stages and in the select service chain

scale. Host believes the Property is differentiated from the future

supply as a result of its central location and diversified product

offerings that provide distinct value propositions to customers.

The Company expects the Property to stabilize between approximately

10-12x EBITDA3 in the 2026-2028 timeframe.

ABOUT HOST HOTELS & RESORTS

Host Hotels & Resorts, Inc. is an S&P 500 company and is

the largest lodging real estate investment trust and one of the

largest owners of luxury and upper-upscale hotels. The Company

currently owns 74 properties in the United States and five

properties internationally totaling approximately 42,700 rooms. The

Company also holds non-controlling interests in seven domestic and

one international joint ventures.

FORWARD LOOKING STATEMENTS

Note: This press release contains forward-looking statements

within the meaning of federal securities regulations. These

forward-looking statements are identified by their use of terms and

phrases such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “should,” “plan,” “predict,” “project,”

“will,” “continue” and other similar terms and phrases, including

references to assumptions and forecasts of future results.

Forward-looking statements are not guarantees of future performance

and involve known and unknown risks, uncertainties and other

factors which may cause the actual results to differ materially

from those anticipated at the time the forward-looking statements

are made. These risks include, but are not limited to: general

economic uncertainty in Nashville and the possibility that

future growth in this market will not meet current expectations;

other factors such as natural disasters and weather that will

affect occupancy rates at the property and the demand for hotel

products and services; the impact of economic and geopolitical

developments on lodging demand and the Nashville market in

particular; volatility in global financial and credit markets;

operating risks associated with the hotel business; risks and

limitations in our operating flexibility associated with the level

of our indebtedness and our ability to meet covenants in our debt

agreements; risks that hotel supply in the Nashville market will

increase greater than expected or will have a larger impact on

occupancy at the property then currently forecasted; risks

associated with our relationships with property managers and joint

venture partners; our ability to maintain our properties in a

first-class manner, including meeting capital expenditure

requirements; the effects of hotel renovations on our hotel

occupancy and financial results; our ability to compete effectively

in areas such as access, location, quality of accommodations and

room rate structures; risks that the acquisitions of the property

and any new developments at the property may not perform in

accordance with our expectations; and other risks and uncertainties

associated with our business described in the Company’s annual

report on Form 10-K, quarterly reports on Form 10-Q and current

reports on Form 8-K filed with the SEC. Although the Company

believes the expectations reflected in such forward-looking

statements are based upon reasonable assumptions, it can give no

assurance that the expectations will be attained or that any

deviation will not be material. All information in this release is

as of the date of this release and the Company undertakes no

obligation to update any forward-looking statement to conform the

statement to actual results or changes in the Company’s

expectations.

|

|

|

|

SOURAV GHOSHChief Financial Officer(240)

744-5267 |

JAIME MARCUSInvestor Relations(240)

744-5117ir@hosthotels.com |

|

|

|

_________________________________

1 Consistent with industry practice, Host calculates the EBITDA

multiple as the ratio of the purchase price to the property’s

EBITDA and the capitalization rate as the ratio of property’s net

operating income to its purchase price. EBITDA and net operating

income are non-GAAP measures. The comparable GAAP metric to EBITDA

multiple is the ratio of the purchase price to net income. The

ratio of the purchase price to 2024 net income is 23x based on

expected net income of $23 million. The comparable GAAP metric to

capitalization rate utilizing 2024 estimated net income is the

ratio of net income to the purchase price, which is 4.4%. The

difference between estimated 2024 net income and EBITDA is

depreciation expense of $19 million. The difference between EBITDA

and net operating income is $3 million for the annual contractual

reserve requirements for renewal and replacement expenditures for

2024.

2 The comparable GAAP metric to EBITDA per key is net income per

key, which is $32,500 based on 2024 forecast net income of $23

million.

3 The ratio of the purchase price to stabilized net income is

19x based on forecast stabilized net income of $28 million. The

difference between stabilized net income and EBITDA is depreciation

expense of $19 million. Stabilized results are illustrative only.

Our ability to achieve the 2026-2028 stabilized results is subject

to various uncertainties and actual results may be materially

different.

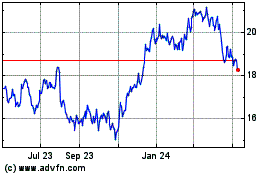

Host Hotels and Resorts (NASDAQ:HST)

Historical Stock Chart

From Dec 2024 to Jan 2025

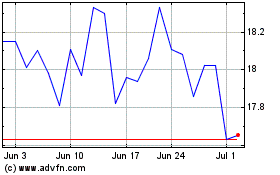

Host Hotels and Resorts (NASDAQ:HST)

Historical Stock Chart

From Jan 2024 to Jan 2025