false2024Q10001217234--12-31http://fasb.org/us-gaap/2023#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2023#PostemploymentRetirementBenefitsMemberxbrli:sharesiso4217:USDiso4217:USDxbrli:sharescdna:patientcdna:solutionxbrli:purecdna:intangibleAssetcdna:milestone_paymentcdna:complaintcdna:location00012172342024-01-012024-03-3100012172342024-05-0700012172342024-03-3100012172342023-12-310001217234us-gaap:ServiceMember2024-01-012024-03-310001217234us-gaap:ServiceMember2023-01-012023-03-310001217234us-gaap:ProductMember2024-01-012024-03-310001217234us-gaap:ProductMember2023-01-012023-03-310001217234cdna:PatientAndDigitalSolutionsMember2024-01-012024-03-310001217234cdna:PatientAndDigitalSolutionsMember2023-01-012023-03-3100012172342023-01-012023-03-310001217234us-gaap:CommonStockMember2023-12-310001217234us-gaap:AdditionalPaidInCapitalMember2023-12-310001217234us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001217234us-gaap:RetainedEarningsMember2023-12-310001217234us-gaap:CommonStockMember2024-01-012024-03-310001217234us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001217234us-gaap:RetainedEarningsMember2024-01-012024-03-310001217234us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001217234us-gaap:CommonStockMember2024-03-310001217234us-gaap:AdditionalPaidInCapitalMember2024-03-310001217234us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001217234us-gaap:RetainedEarningsMember2024-03-310001217234us-gaap:CommonStockMember2022-12-310001217234us-gaap:AdditionalPaidInCapitalMember2022-12-310001217234us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001217234us-gaap:RetainedEarningsMember2022-12-3100012172342022-12-310001217234us-gaap:CommonStockMember2023-01-012023-03-310001217234us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001217234us-gaap:RetainedEarningsMember2023-01-012023-03-310001217234us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001217234us-gaap:CommonStockMember2023-03-310001217234us-gaap:AdditionalPaidInCapitalMember2023-03-310001217234us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001217234us-gaap:RetainedEarningsMember2023-03-3100012172342023-03-310001217234cdna:AlloSureKidneyTestingServiceMember2024-01-012024-03-310001217234cdna:AlloMapHeartTestingServicesMember2024-01-012024-03-310001217234cdna:AlloSureHeartTestingServicesMember2024-01-012024-03-310001217234cdna:AlloSureLungTestingServicesMember2023-05-092023-05-090001217234cdna:HeartCareMember2023-04-012023-04-010001217234cdna:MiromatrixIncMember2021-05-012023-03-3100012172342018-01-310001217234cdna:XynManagementIncMember2024-01-012024-03-3100012172342023-05-1000012172342022-12-0300012172342022-12-082022-12-080001217234us-gaap:SalesRevenueNetMembercdna:MedicareMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001217234us-gaap:SalesRevenueNetMembercdna:MedicareMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-03-310001217234us-gaap:CreditConcentrationRiskMembercdna:MedicareMemberus-gaap:AccountsReceivableMember2024-01-012024-03-310001217234us-gaap:CreditConcentrationRiskMembercdna:MedicareMemberus-gaap:AccountsReceivableMember2023-01-012023-03-310001217234srt:MinimumMember2024-01-012024-03-310001217234srt:MaximumMember2024-01-012024-03-310001217234cdna:EmployeeAndNonEmployeeStockOptionsMember2024-01-012024-03-310001217234cdna:EmployeeAndNonEmployeeStockOptionsMember2023-01-012023-03-310001217234us-gaap:WarrantMember2024-01-012024-03-310001217234us-gaap:WarrantMember2023-01-012023-03-310001217234us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001217234us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001217234us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-03-310001217234us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2024-03-310001217234us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2024-03-310001217234us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-03-310001217234us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001217234us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-03-310001217234us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-03-310001217234us-gaap:FairValueMeasurementsRecurringMember2024-03-310001217234us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001217234us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-12-310001217234us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001217234us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001217234us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001217234us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001217234us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001217234us-gaap:FairValueMeasurementsRecurringMember2023-12-310001217234cdna:BusinessAcquisitionContingentConsiderationMember2024-01-012024-03-310001217234cdna:AssetAcquisitionContingentConsiderationMember2024-01-012024-03-3100012172342023-03-012023-03-310001217234cdna:MiromatrixIncMember2023-12-012023-12-310001217234cdna:MiromatrixIncMember2023-01-012023-12-310001217234cdna:MiromatrixIncMember2024-03-310001217234srt:MinimumMember2023-01-012023-12-310001217234srt:MaximumMember2023-01-012023-12-310001217234us-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-03-310001217234us-gaap:CorporateDebtSecuritiesMember2024-03-310001217234us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001217234us-gaap:CorporateDebtSecuritiesMember2023-12-310001217234cdna:HLADataSystemsMember2023-01-310001217234cdna:HLADataSystemsMember2023-01-012023-01-310001217234cdna:MediGOMember2023-07-310001217234us-gaap:CustomerRelationshipsMembercdna:HLADataSystemsMember2023-01-310001217234us-gaap:DevelopedTechnologyRightsMembercdna:HLADataSystemsMember2023-01-310001217234us-gaap:TrademarksMembercdna:HLADataSystemsMember2023-01-310001217234cdna:MeasurementInputRoyaltyRateMemberus-gaap:DevelopedTechnologyRightsMembercdna:HLADataSystemsMember2023-01-310001217234cdna:MeasurementInputRoyaltyRateMemberus-gaap:TrademarksMembercdna:HLADataSystemsMember2023-01-310001217234us-gaap:MeasurementInputDiscountRateMembercdna:HLADataSystemsMember2023-01-310001217234cdna:MediGOMember2023-07-012023-07-310001217234us-gaap:CustomerRelationshipsMembercdna:MediGOMember2023-07-310001217234us-gaap:DevelopedTechnologyRightsMembercdna:MediGOMember2023-07-310001217234us-gaap:TrademarksMembercdna:MediGOMember2023-07-310001217234cdna:MeasurementInputRoyaltyRateMemberus-gaap:DevelopedTechnologyRightsMembercdna:MediGOMember2023-07-310001217234cdna:MeasurementInputRoyaltyRateMemberus-gaap:TrademarksMembercdna:MediGOMember2023-07-310001217234us-gaap:MeasurementInputDiscountRateMembercdna:MediGOMember2023-07-310001217234us-gaap:MeasurementInputDiscountRateMembercdna:MediGOMember2023-01-012023-01-310001217234cdna:HLADataSystemsAndMediGOMember2023-07-012023-07-310001217234cdna:HLADataSystemsAndMediGOMember2023-07-3100012172342023-08-092023-08-090001217234cdna:AcquiredAndDevelopedTechnologyMember2024-03-310001217234us-gaap:CustomerRelationshipsMember2024-03-310001217234cdna:CommercializationRightsMember2024-03-310001217234us-gaap:TrademarksAndTradeNamesMember2024-03-310001217234cdna:AcquiredInProcessTechnologyMember2024-03-310001217234us-gaap:LicensingAgreementsMember2024-03-310001217234cdna:AcquiredAndDevelopedTechnologyMember2023-12-310001217234us-gaap:CustomerRelationshipsMember2023-12-310001217234cdna:CommercializationRightsMember2023-12-310001217234us-gaap:TrademarksAndTradeNamesMember2023-12-310001217234cdna:AcquiredInProcessTechnologyMember2023-12-310001217234us-gaap:LicensingAgreementsMember2023-12-310001217234cdna:CostOfTestingMember2024-01-012024-03-310001217234cdna:CostOfTestingMember2023-01-012023-03-310001217234cdna:CostOfProductMember2024-01-012024-03-310001217234cdna:CostOfProductMember2023-01-012023-03-310001217234cdna:CostOfPatientAndDigitalSolutionsMember2024-01-012024-03-310001217234cdna:CostOfPatientAndDigitalSolutionsMember2023-01-012023-03-310001217234us-gaap:SellingAndMarketingExpenseMember2024-01-012024-03-310001217234us-gaap:SellingAndMarketingExpenseMember2023-01-012023-03-310001217234cdna:CostOfTestingMember2024-03-310001217234cdna:CostOfProductMember2024-03-310001217234cdna:CostOfPatientAndDigitalSolutionsMember2024-03-310001217234us-gaap:SellingAndMarketingExpenseMember2024-03-310001217234cdna:StanfordLicenseRoyaltyCommitmentMember2014-06-012014-06-300001217234cdna:StanfordLicenseRoyaltyCommitmentMember2023-12-012023-12-310001217234cdna:StanfordLicenseRoyaltyCommitmentMember2024-03-310001217234cdna:IBoxLicenseAndCollaborationAgreementMember2023-07-012023-07-310001217234cdna:CAREDXINCVsNateraIncMember2022-03-072022-03-140001217234cdna:CompensatoryDamagesMembercdna:CAREDXINCVsNateraIncMember2022-03-072022-03-140001217234cdna:PunitiveDamagesMembercdna:CAREDXINCVsNateraIncMember2022-03-072022-03-140001217234cdna:CAREDXINCVsNateraIncMember2022-05-132022-05-130001217234cdna:CAREDXINCVsNateraIncMember2024-01-262024-01-260001217234cdna:CAREDXINCVsNateraIncMember2023-12-310001217234cdna:CAREDXINCVsNateraIncMember2024-03-3100012172342022-12-012022-12-310001217234us-gaap:RestrictedStockUnitsRSUMember2023-12-310001217234us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001217234us-gaap:RestrictedStockUnitsRSUMember2024-03-310001217234us-gaap:PerformanceSharesMember2024-01-012024-03-310001217234us-gaap:PerformanceSharesMember2024-03-310001217234us-gaap:PerformanceSharesMember2023-03-310001217234us-gaap:PerformanceSharesMember2023-01-012023-03-310001217234us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001217234us-gaap:EmployeeStockOptionMember2024-03-310001217234cdna:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2024-03-310001217234cdna:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2024-01-012024-03-310001217234cdna:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2024-01-022024-01-020001217234us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001217234us-gaap:EmployeeStockMember2024-01-012024-03-310001217234us-gaap:EmployeeStockMember2023-01-012023-03-310001217234us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001217234us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001217234us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-310001217234us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310001217234us-gaap:ServiceMembercountry:US2024-01-012024-03-310001217234us-gaap:ServiceMembercountry:US2023-01-012023-03-310001217234cdna:RestOfTheWorldMemberus-gaap:ServiceMember2024-01-012024-03-310001217234cdna:RestOfTheWorldMemberus-gaap:ServiceMember2023-01-012023-03-310001217234us-gaap:ProductMembercountry:US2024-01-012024-03-310001217234us-gaap:ProductMembercountry:US2023-01-012023-03-310001217234us-gaap:ProductMembersrt:EuropeMember2024-01-012024-03-310001217234us-gaap:ProductMembersrt:EuropeMember2023-01-012023-03-310001217234us-gaap:ProductMembercdna:RestOfTheWorldMember2024-01-012024-03-310001217234us-gaap:ProductMembercdna:RestOfTheWorldMember2023-01-012023-03-310001217234cdna:PatientAndDigitalSolutionsMembercountry:US2024-01-012024-03-310001217234cdna:PatientAndDigitalSolutionsMembercountry:US2023-01-012023-03-310001217234srt:EuropeMembercdna:PatientAndDigitalSolutionsMember2024-01-012024-03-310001217234srt:EuropeMembercdna:PatientAndDigitalSolutionsMember2023-01-012023-03-310001217234cdna:RestOfTheWorldMembercdna:PatientAndDigitalSolutionsMember2024-01-012024-03-310001217234cdna:RestOfTheWorldMembercdna:PatientAndDigitalSolutionsMember2023-01-012023-03-310001217234country:US2024-01-012024-03-310001217234country:US2023-01-012023-03-310001217234srt:EuropeMember2024-01-012024-03-310001217234srt:EuropeMember2023-01-012023-03-310001217234cdna:RestOfTheWorldMember2024-01-012024-03-310001217234cdna:RestOfTheWorldMember2023-01-012023-03-310001217234country:US2024-03-310001217234country:US2023-12-310001217234srt:EuropeMember2024-03-310001217234srt:EuropeMember2023-12-310001217234cdna:RestOfTheWorldMember2024-03-310001217234cdna:RestOfTheWorldMember2023-12-310001217234country:AU2023-01-012023-01-310001217234us-gaap:EmployeeSeveranceMember2023-10-012023-12-310001217234us-gaap:EmployeeSeveranceMember2024-01-012024-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 10-Q

__________________________________________________

(Mark One) | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-36536

__________________________________________________

CAREDX, INC.

(Exact name of registrant as specified in its charter)

__________________________________________________ | | | | | | | | |

| Delaware | | 94-3316839 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

8000 Marina Boulevard, 4th Floor

Brisbane, California 94005

(Address of principal executive offices and zip code)

(415) 287-2300

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

__________________________________________________

Securities registered pursuant to Section 12(b) of the Act | | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

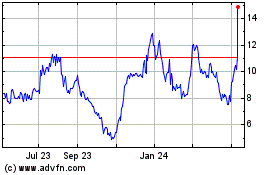

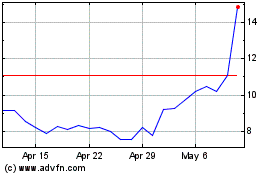

| Common Stock, par value $0.001 per share | CDNA | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☒ |

| | | | |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | |

| Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

There were 52,083,792 shares of the registrant’s Common Stock issued and outstanding as of May 7, 2024.

CareDx, Inc.

PART I. FINANCIAL INFORMATION

ITEM 1. UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CareDx, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands, except share data) | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 93,299 | | | $ | 82,197 | |

| Marketable securities | 122,622 | | | 153,221 | |

| Accounts receivable | 60,149 | | | 51,061 | |

| Inventory | 20,130 | | | 19,471 | |

| Prepaid and other current assets | 6,895 | | | 7,763 | |

| Total current assets | 303,095 | | | 313,713 | |

| Property and equipment, net | 34,411 | | | 35,246 | |

| Operating leases right-of-use assets | 28,591 | | | 29,891 | |

| Intangible assets, net | 43,330 | | | 45,701 | |

| Goodwill | 40,336 | | | 40,336 | |

| Restricted cash | 583 | | | 586 | |

| Other assets | 2,060 | | | 1,353 | |

| Total assets | $ | 452,406 | | | $ | 466,826 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 9,976 | | | $ | 12,872 | |

| Accrued compensation | 14,565 | | | 19,703 | |

| Accrued and other liabilities | 45,670 | | | 45,497 | |

| | | |

| Total current liabilities | 70,211 | | | 78,072 | |

| Deferred tax liability | 43 | | | 136 | |

| | | |

| Deferred payments for intangible assets | 1,348 | | | 2,461 | |

| Operating lease liability, less current portion | 26,893 | | | 28,278 | |

| Other liabilities | 97,686 | | | 96,551 | |

| Total liabilities | 196,181 | | | 205,498 | |

| Commitments and contingencies (Note 9) | | | |

| Stockholders’ equity: | | | |

Preferred stock: $0.001 par value; 10,000,000 shares authorized at March 31, 2024 and December 31, 2023; no shares issued and outstanding at March 31, 2024 and December 31, 2023 | — | | | — | |

Common stock: $0.001 par value; 100,000,000 shares authorized at March 31, 2024 and December 31, 2023; 51,782,612 and 51,503,377 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | 49 | | | 49 | |

| Additional paid-in capital | 959,734 | | | 946,511 | |

| Accumulated other comprehensive loss | (8,108) | | | (6,963) | |

| Accumulated deficit | (695,450) | | | (678,269) | |

| Total stockholders’ equity | 256,225 | | | 261,328 | |

| Total liabilities and stockholders’ equity | $ | 452,406 | | | $ | 466,826 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CareDx, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Revenue: | | | | | | | |

| Testing services revenue | $ | 53,837 | | | $ | 61,784 | | | | | |

| Product revenue | 8,594 | | | 6,861 | | | | | |

| Patient and digital solutions revenue | 9,618 | | | 8,617 | | | | | |

| Total revenue | 72,049 | | | 77,262 | | | | | |

| Operating expenses: | | | | | | | |

| Cost of testing services | 13,632 | | | 15,296 | | | | | |

| Cost of product | 5,344 | | | 4,066 | | | | | |

| Cost of patient and digital solutions | 6,958 | | | 6,604 | | | | | |

| Research and development | 18,711 | | | 24,357 | | | | | |

| Sales and marketing | 19,830 | | | 23,231 | | | | | |

| General and administrative | 26,911 | | | 28,032 | | | | | |

| | | | | | | |

| Total operating expenses | 91,386 | | | 101,586 | | | | | |

| Loss from operations | (19,337) | | | (24,324) | | | | | |

Other income: | | | | | | | |

| Interest income, net | 2,885 | | | 2,666 | | | | | |

| Change in estimated fair value of common stock warrant liability | — | | | 7 | | | | | |

Other expense, net | (290) | | | (1,974) | | | | | |

| Total other income | 2,595 | | | 699 | | | | | |

| Loss before income taxes | (16,742) | | | (23,625) | | | | | |

| Income tax benefit (expense) | 83 | | | (124) | | | | | |

| Net loss | $ | (16,659) | | | $ | (23,749) | | | | | |

| Net loss per share (Note 3): | | | | | | | |

| Basic | $ | (0.32) | | | $ | (0.44) | | | | | |

| Diluted | $ | (0.32) | | | $ | (0.44) | | | | | |

| Weighted-average shares used to compute net loss per share: | | | | | | | |

| Basic | 51,692,358 | | | 53,643,216 | | | | | |

| Diluted | 51,692,358 | | | 53,643,216 | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CareDx, Inc.

Condensed Consolidated Statements of Comprehensive Loss

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Net loss | $ | (16,659) | | | $ | (23,749) | | | | | |

Other comprehensive (loss) gain: | | | | | | | |

Foreign currency translation adjustment, net of tax | (1,145) | | | 64 | | | | | |

Comprehensive loss | $ | (17,804) | | | $ | (23,685) | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CareDx, Inc.

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

(In thousands, except share data) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated

Other

Comprehensive

Loss | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | |

| Balance at December 31, 2023 | 51,503,377 | | | $ | 49 | | | $ | 946,511 | | | $ | (6,963) | | | $ | (678,269) | | | $ | 261,328 | |

| | | | | | | | | | | |

| Issuance of common stock under employee stock purchase plan | 73,759 | | | — | | | 532 | | | — | | | — | | | 532 | |

| Repurchase and retirement of common stock | (55,500) | | | — | | | — | | | — | | | (522) | | | (522) | |

| RSU settlements, net of shares withheld | 252,662 | | | — | | | (668) | | | — | | | — | | | (668) | |

| Issuance of common stock for services | 6,813 | | | — | | | 56 | | | — | | | — | | | 56 | |

| Issuance of common stock for cash upon exercise of stock options | 1,501 | | | — | | | 8 | | | — | | | — | | | 8 | |

| | | | | | | | | | | |

| Employee stock-based compensation expense | — | | | — | | | 13,295 | | | — | | | — | | | 13,295 | |

Foreign currency translation adjustment, net of tax | — | | | — | | | — | | | (1,145) | | | — | | | (1,145) | |

| Net loss | — | | | — | | | — | | | — | | | (16,659) | | | (16,659) | |

| Balance at March 31, 2024 | 51,782,612 | | | $ | 49 | | | $ | 959,734 | | | $ | (8,108) | | | $ | (695,450) | | | $ | 256,225 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CareDx, Inc.

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

(In thousands, except share data) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated

Other

Comprehensive

Loss | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | |

| Balance at December 31, 2022 | 53,533,250 | | | $ | 52 | | | $ | 898,806 | | | $ | (7,503) | | | $ | (460,444) | | | $ | 430,911 | |

| Issuance of common stock under employee stock purchase plan | 47,025 | | | — | | | 456 | | | — | | | — | | | 456 | |

Repurchase and retirement of common stock | (59,472) | | | — | | | — | | | — | | | (690) | | | (690) | |

| RSU settlements, net of shares withheld | 123,910 | | | — | | | (785) | | | — | | | — | | | (785) | |

| Issuance of common stock for services | 7,649 | | | — | | | 93 | | | — | | | — | | | 93 | |

| Issuance of common stock for cash upon exercise of stock options | 820 | | | — | | | 2 | | | — | | | — | | | 2 | |

| | | | | | | | | | | |

| Employee stock-based compensation expense | — | | | — | | | 13,719 | | | — | | | — | | | 13,719 | |

Foreign currency translation adjustment, net of tax | — | | | — | | | — | | | 64 | | | — | | | 64 | |

| Net loss | — | | | — | | | — | | | — | | | (23,749) | | | (23,749) | |

Balance at March 31, 2023 | 53,653,182 | | | $ | 52 | | | $ | 912,291 | | | $ | (7,439) | | | $ | (484,883) | | | $ | 420,021 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CareDx, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In thousands) | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Operating activities: | | | |

| Net loss | $ | (16,659) | | | $ | (23,749) | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Stock-based compensation | 13,344 | | | 13,754 | |

| Revaluation of common stock warrant liability to estimated fair value | — | | | (7) | |

| Depreciation and amortization | 3,821 | | | 3,427 | |

| Asset impairments and write-downs | — | | | 1,000 | |

| Amortization of right-of-use assets | 1,402 | | | 1,337 | |

| Unrealized loss on long-term marketable equity securities | — | | | 905 | |

| Revaluation of contingent consideration to estimated fair value | 319 | | | 364 | |

| | | |

| | | |

| Amortization of premium and accretion of discount on short-term marketable securities, net | 1,451 | | | (773) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (9,199) | | | 7,664 | |

| Inventory | (1,274) | | | 1,217 | |

| Prepaid and other assets | 108 | | | 1,515 | |

| Operating leases liabilities, net | (1,372) | | | (1,333) | |

| Accounts payable | (2,897) | | | 2,590 | |

| Accrued compensation | (4,820) | | | (4,888) | |

| Accrued and other liabilities | 557 | | | (2,352) | |

| Change in deferred taxes | (93) | | | — | |

Net cash (used in) provided by operating activities | (15,312) | | | 671 | |

| Investing activities: | | | |

Acquisitions of business, net of cash acquired | — | | | (4,562) | |

| | | |

| Purchases of short-term marketable securities | (57,746) | | | (86,310) | |

| Maturities of short-term marketable securities | 86,893 | | | 78,972 | |

| Purchase of corporate equity securities | — | | | (100) | |

| Additions of capital expenditures | (1,487) | | | (2,771) | |

Net cash provided by (used in) investing activities | 27,660 | | | (14,771) | |

| Financing activities: | | | |

| | | |

| | | |

| | | |

| Proceeds from issuance of common stock under employee stock purchase plan | 532 | | | 456 | |

| Taxes paid related to net share settlement of restricted stock units | (668) | | | (656) | |

| | | |

| Proceeds from exercise of stock options | 8 | | | 2 | |

| | | |

| Payment of contingent consideration | (625) | | | (250) | |

| Repurchase and retirement of common stock | (522) | | | (690) | |

| Net cash used in financing activities | (1,275) | | | (1,138) | |

| Effect of exchange rate changes on cash and cash equivalents | 26 | | | (25) | |

Net increase (decrease) in cash, cash equivalents and restricted cash | 11,099 | | | (15,263) | |

Cash, cash equivalents and restricted cash at beginning of period | 82,783 | | | 90,443 | |

Cash, cash equivalents and restricted cash at end of period | $ | 93,882 | | | $ | 75,180 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CareDx, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

1. ORGANIZATION AND DESCRIPTION OF BUSINESS

CareDx, Inc. (“CareDx” or the “Company”), together with its subsidiaries, is a leading precision medicine company focused on the discovery, development and commercialization of clinically differentiated, high-value diagnostic solutions for transplant patients and caregivers. The Company’s headquarters are in Brisbane, California. The primary operations are in Brisbane, California; Omaha, Nebraska; Fremantle, Australia; and Stockholm, Sweden.

The Company’s commercially available testing services consist of AlloSure® Kidney, a donor-derived cell-free DNA (“dd-cfDNA”) solution for kidney transplant patients, AlloMap® Heart, a gene expression solution for heart transplant patients, AlloSure® Heart, a dd-cfDNA solution for heart transplant patients, and AlloSure® Lung, a dd-cfDNA solution for lung transplant patients. The Company has initiated several clinical studies to generate data on its existing and planned future testing services. In April 2020, the Company announced its first biopharma research partnership for AlloCell, a surveillance solution that monitors the level of engraftment and persistence of allogeneic cells for patients who have received cell therapy transplants. The Company also offers high-quality products that increase the chance of successful transplants by facilitating a better match between a donor and a recipient of stem cells and organs. The Company also provides digital solutions to transplant centers following the acquisitions of Ottr Complete Transplant Management (“Ottr”) and XynManagement, Inc. (“XynManagement”), as well as the acquisitions of TransChart LLC (“TransChart”), MedActionPlan.com, LLC (“MedActionPlan”) and The Transplant Pharmacy, LLC (“TTP”) in 2021, HLA Data Systems, LLC (“HLA Data Systems”) in January 2023 and MediGO, Inc. (“MediGO”) in July 2023.

Testing Services

AlloSure Kidney has been a covered service for Medicare beneficiaries since October 2017 through a Local Coverage Determination (“LCD”), first issued by Palmetto MolDX (“MolDX”), which was formed to identify and establish coverage and reimbursement for molecular diagnostics tests, and then adopted by Noridian Healthcare Solutions, the Company’s Medicare Administrative Contractor (“Noridian”). The Medicare reimbursement rate for AlloSure Kidney is currently $2,841.

AlloMap Heart has been a covered service for Medicare beneficiaries since January 2006. The Medicare reimbursement rate for AlloMap Heart is currently $3,240. In October 2020, the Company received a final MolDX Medicare coverage decision for AlloSure Heart. In November 2020, Noridian issued a parallel coverage policy granting coverage for AlloSure Heart when used in conjunction with AlloMap Heart, which became effective in December 2020. In 2021, Palmetto and Noridian issued coverage policies written by MolDX to replace the former product-specific policies. The foundational LCD is titled “MolDX: Molecular Testing for Solid Organ Allograft Rejection” and the associated LCD numbers are L38568 (MolDX) and L38629 (Noridian). The Medicare reimbursement rate for AlloSure Heart is currently $2,753. Effective May 9, 2023, AlloSure Lung is covered for Medicare beneficiaries through the same MolDX LCD (Noridian L38629). The Medicare reimbursement rate for AlloSure Lung is $2,753. Effective April 1, 2023, HeartCare, a multimodality testing service that includes both AlloMap Heart and AlloSure Heart provided in a single patient encounter for heart transplant surveillance, is covered, subject to certain limitations, for Medicare beneficiaries through the same MolDX LCD (Noridian L38629). The Medicare reimbursement rate for HeartCare is $5,993.

AlloSure Kidney has received positive coverage decisions from several commercial payers, and is reimbursed by other private payers on a case-by-case basis. AlloMap Heart has also received positive coverage decisions for reimbursement from many of the largest U.S. private payers.

In May 2021 and March 2023, the Company purchased a minority investment of common stock in the biotechnology company Miromatrix Medical, Inc. (“Miromatrix”) for an aggregate amount of $5.1 million, and the investment is marked to market. Miromatrix works to eliminate the need for an organ transplant waiting list through the development of implantable engineered biological organs. In December 2023, Miromatrix was acquired by United Therapeutics Corporation.

Clinical Studies

In January 2018, the Company initiated the Kidney Allograft Outcomes AlloSure Kidney Registry study (“K-OAR”) to develop additional data on the clinical utility of AlloSure Kidney for surveillance of kidney transplant recipients. K-OAR is a multicenter, non-blinded, prospective observational cohort study which has enrolled more than 1,900 renal transplant patients who will receive AlloSure Kidney long-term surveillance.

In September 2018, the Company initiated the Surveillance HeartCare™ Outcomes Registry (“SHORE”). SHORE is a prospective, multi-center, observational registry of patients receiving HeartCare for surveillance. HeartCare combines the gene expression profiling technology of AlloMap Heart with the dd-cfDNA analysis of AlloSure® Heart in one surveillance solution.

In September 2019, the Company announced the commencement of the Outcomes of KidneyCare on Renal Allografts (“OKRA”) study, which is an extension of K-OAR. OKRA is a prospective, multi-center, observational, registry of patients receiving KidneyCare for surveillance. KidneyCare combines the dd-cfDNA analysis of AlloSure Kidney with the gene expression profiling technology of AlloMap Kidney and the predictive artificial intelligence technology of iBox for a multimodality surveillance solution. The Company has not yet made any applications to private payers for reimbursement coverage of AlloMap Kidney or KidneyCare.

In December 2021, the Company initiated the ALAMO study. ALAMO is a multicenter observational study and focuses on surveillance in lung transplant recipients within the first post-transplant year. Beyond demonstrating the clinical validity of AlloSure in detecting Acute Lung Allograft Dysfunction, a composite outcome of acute rejection and clinically meaningful infections, the study explores its clinical utility by capturing clinician decision-making processes to further demonstrate the practical clinical application of AlloSure. In addition, the study will collect samples to enable development of AlloMap Lung.

Products

The Company’s suite of AlloSeq products are commercial next generation sequencing (“NGS”)-based kitted solutions. These products include: AlloSeq™ Tx, a high-resolution Human Leukocyte Antigen (“HLA”) typing solution, AlloSeq™ cfDNA, a surveillance solution designed to measure dd-cfDNA in blood to detect active rejection in transplant recipients, and AlloSeq™ HCT, a solution for chimerism testing for stem cell transplant recipients.

The Company’s other HLA typing products include: Olerup SSP®, based on the sequence specific primer (“SSP”) technology; and QTYPE®, which uses real-time polymerase chain reaction (“PCR”) methodology, to perform HLA typing.

In March 2021, the Company acquired certain assets of BFS Molecular S.R.L. (“BFS Molecular”), a software company focused on NGS-based patient testing solutions. BFS Molecular brings extensive software and algorithm development capabilities for NGS transplant surveillance products.

Patient and Digital Solutions

Following the acquisitions of both Ottr and XynManagement, the Company is a leading provider of transplant patient management software (“Ottr software”), as well as of transplant quality tracking and waitlist management solutions. Ottr software provides comprehensive solutions for transplant patient management and enables integration with electronic medical record (“EMR”) systems providing patient surveillance management tools and outcomes data to transplant centers. XynManagement provides two unique solutions, XynQAPI software (“XynQAPI”) and XynCare. XynQAPI simplifies transplant quality tracking and Scientific Registry of Transplant Recipients reporting. XynCare includes a team of transplant assistants who maintain regular contact with patients on the waitlist to help prepare for their transplant and maintain eligibility.

In September 2020, the Company launched AlloCare, a mobile app that provides a patient-centric resource for transplant recipients to manage medication adherence, coordinate with Patient Care Managers for AlloSure scheduling and measure health metrics.

In January 2021, the Company acquired TransChart. TransChart provides EMR software to hospitals throughout the U.S. to care for patients who have or may need an organ transplant. As part of the Company’s acquisition of TransChart in January 2021, the Company acquired TxAccess, a cloud-based service that allows nephrologists and dialysis centers to electronically submit referrals to transplant programs and closely follow and assist patients through the transplant waitlist process and, ultimately, through transplantation.

In June 2021, the Company acquired the Transplant Hero patient application. The application helps patients manage their medications through alarms and interactive logging of medication events.

Also in June 2021, the Company entered into a strategic agreement with OrganX, which was amended in April 2022, to develop clinical decision support tools across the transplant patient journey. Together, the Company and OrganX will develop advanced analytics that integrate AlloSure with large transplant databases to provide clinical data solutions. This partnership delivers the next level of innovation by incorporating a variety of clinical inputs to create a universal composite scoring system. The Company has agreed to potential future milestone payments.

In November 2021, the Company acquired MedActionPlan, a New Jersey-based provider of medication safety, medication adherence and patient education. MedActionPlan is a leader in patient medication management for transplant patients and beyond.

In December 2021, the Company acquired TTP, a transplant-focused pharmacy located in Mississippi. TTP provides individualized transplant pharmacy services for patients at multiple transplant centers located throughout the U.S.

In January 2023, the Company acquired HLA Data Systems, a Texas-based company that provides software and interoperability solutions for the histocompatibility and immunogenetics community. HLA Data Systems is a leader in the laboratory information management industry for human leukocyte antigen laboratories.

In July 2023, the Company acquired MediGO, an organ transplant supply chain and logistics company. MediGO provides access to donated organs by digitally transforming donation and transplantation workflows to increase organ utilization.

Liquidity and Capital Resources

The Company has incurred significant losses and negative cash flows from operations since its inception and had an accumulated deficit of $695.5 million at March 31, 2024. As of March 31, 2024, the Company had cash, cash equivalents and marketable securities of $215.9 million and no debt outstanding.

Shelf Registration Statement

On May 10, 2023, the Company filed a universal shelf registration statement (File No. 333-271814) (the “Registration Statement”), and thereafter filed post-effective amendments thereto and expects to file another post-effective amendment thereto on or about May 9, 2024. Upon its effectiveness, the Company can sell from time to time up to $250.0 million of shares of its common stock, preferred stock, debt securities, warrants, units or rights comprised of any combination of these securities, for the Company’s own account in one or more offerings under the Registration Statement. The terms of any offering under the Registration Statement will be established at the time of such offering and will be described in a prospectus supplement to the Registration Statement filed with the Securities and Exchange Commission (the “SEC”) prior to the completion of any such offering.

Stock Repurchase Program

On December 3, 2022, the Company’s Board of Directors approved a stock repurchase program (the “Repurchase Program”), whereby the Company may purchase up to $50 million of shares of its common stock over a period of up to two years, commencing on December 8, 2022. The Repurchase Program may be carried out at the discretion of a committee of the Company’s Board of Directors through open market purchases, one or more Rule 10b5-1 trading plans and block trades and in privately negotiated transactions. During the three months ended March 31, 2024, the Company purchased an aggregate of 55,500 shares of its common stock, under the Repurchase Program for an aggregate purchase price of $0.5 million. As of March 31, 2024, $21.4 million remained available for future share repurchases under the Repurchase Program.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The significant accounting policies and estimates used in the preparation of the unaudited condensed consolidated financial statements are described in the Company’s audited consolidated financial statements as of and for the year ended December 31, 2023, and the notes thereto, which are included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 28, 2024.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States (“U.S. GAAP”), and follow the requirements of the SEC for interim reporting. As permitted under those rules, certain notes and other financial information that are normally required by U.S. GAAP can be condensed or omitted. These unaudited condensed consolidated financial statements have been prepared on the same basis as the Company’s annual consolidated financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments that are necessary for a fair statement of the Company’s financial information. The condensed consolidated balance sheet as of December 31, 2023 has been derived from audited consolidated financial statements as of that date but does not include all of the financial information required by U.S. GAAP for complete financial statements. Operating results for the three months ended March 31, 2024 are not necessarily indicative of the results that may be expected for the year ending December 31, 2024.

Use of Estimates

The preparation of unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities and the reported amounts of revenues and expenses in the unaudited condensed consolidated financial statements and accompanying notes. On an ongoing basis, management evaluates its estimates, including those related to transaction price estimates used for testing services revenue; standalone fair value of patient and digital solutions revenue performance obligations; accrued expenses for clinical studies; inventory valuation; the fair value of assets and liabilities acquired in a business combination or an asset acquisition (including identifiable intangible assets acquired); the fair value of contingent

consideration recorded in connection with a business combination or an asset acquisition; the grant date fair value assumptions used to estimate stock-based compensation expense; income taxes; impairment of long-lived assets and indefinite-lived assets (including goodwill); and legal contingencies. Actual results could differ from those estimates.

Concentrations of Credit Risk and Other Risks and Uncertainties

For the three months ended March 31, 2024 and 2023, approximately 33% and 42%, respectively, of total revenue was derived from Medicare.

As of March 31, 2024 and December 31, 2023, approximately 37% and 36%, respectively, of accounts receivable was due from Medicare. No other payer or customer represented more than 10% of accounts receivable at either March 31, 2024 or December 31, 2023.

Marketable Securities

The Company considers all highly liquid investments in securities with a maturity of greater than three months at the time of purchase to be marketable securities. As of March 31, 2024, the Company’s short-term marketable securities consisted of corporate debt securities with maturities of greater than three months but less than twelve months at the time of purchase, which were classified as current assets on the condensed consolidated balance sheet.

The Company classifies its short-term marketable securities as held-to-maturity at the time of purchase and reevaluates such designation at each balance sheet date. The Company has the positive intent and ability to hold these marketable securities to maturity. Short-term marketable securities are carried at amortized cost and are adjusted for amortization of premiums and accretion of discounts to maturity, which is included in interest income, net, on the condensed consolidated statements of operations. Realized gains and losses and declines in value judged to be other-than-temporary, if any, on short-term marketable securities are included in interest income, net. The cost of securities sold is determined using specific identification.

The Company records its long-term marketable equity securities at fair market value. Unrealized gains and losses from the remeasurement of the long-term marketable equity securities to fair value are included in other expense, net, on the condensed consolidated statements of operations.

Leases

The Company determines if an arrangement is or contains a lease at contract inception. A right-of-use (“ROU”) asset, representing the underlying asset during the lease term, and a lease liability, representing the payment obligation arising from the lease, are recognized on the condensed consolidated balance sheet at lease commencement based on the present value of the payment obligation. For operating leases, expense is recognized on a straight-line basis over the lease term. For finance leases, interest expense on the lease liability is recognized using the effective interest method and amortization of the ROU asset is recognized on a straight-line basis over the shorter of the estimated useful life of the asset or the lease term. The Company also has lease arrangements with lease and non-lease components. The Company elected the practical expedient not to separate non-lease components from lease components for the Company’s facility leases. The Company also elected to apply the short-term lease measurement and recognition exemption in which ROU assets and lease liabilities are not recognized for leases with an initial term of 12 months or less.

The present value of lease payments is determined by using the interest rate implicit in the lease, if that rate is readily determinable; otherwise, the Company uses its incremental borrowing rate. The incremental borrowing rate is determined by using the rate of interest that the Company would pay to borrow on a collateralized basis an amount equal to the lease payments for a similar term and in a similar economic environment.

As of March 31, 2024, the Company’s leases had remaining terms of 0.17 years to 8.84 years, some of which include options to extend the lease term.

Revenue

The Company recognizes revenue from testing services, product sales and patient and digital solutions revenue in the amount that reflects the consideration that it expects to be entitled in exchange for goods or services as it transfers control to its customers. Revenue is recorded considering a five-step revenue recognition model that includes identifying the contract with a customer, identifying the performance obligations in the contract, determining the transaction price, allocating the transaction price to the performance obligations and recognizing revenue when, or as, an entity satisfies a performance obligation.

Testing Services Revenue

AlloSure Kidney, AlloMap Heart, AlloSure Heart and AlloSure Lung patient tests are ordered by healthcare providers. The Company receives a test requisition form with payer information along with a collected patient blood sample. The Company considers the patient to be its customer and the test requisition form to be the contract. Testing services are performed in the Company’s laboratory. Testing services represent one performance obligation in a contract and which is satisfied at the point in time when results of the test are provided to the healthcare provider.

The healthcare providers that order the tests and on whose behalf the Company provides testing services are generally not responsible for the payment of these services. The first and second revenue recognition criteria are satisfied when the Company receives a test requisition form with payer information from the healthcare provider. Generally, the Company bills third-party payers upon delivery of an AlloSure Kidney, AlloMap Heart, AlloSure Heart or AlloSure Lung test result to the healthcare provider. Amounts received may vary amongst payers based on coverage practices and policies of the payer. The Company has used the portfolio approach under ASC Topic 606, Revenue from Contracts with Customers, to identify financial classes of payers. Revenue recognized for Medicare and other contracted payers is based on the agreed current reimbursement rate per test, adjusted for historical collection trends where applicable. The Company estimates revenue for non-contracted payers and self-payers using transaction prices determined for each financial class of payers using history of reimbursements. This includes analysis of an average reimbursement per test and a percentage of tests reimbursed. These estimates require significant judgment.

The Company monitors revenue estimates at each reporting period based on actual cash collections in order to assess whether a revision to the estimate is required. Changes in transaction price estimates are updated quarterly based on actual cash collected or changes made to contracted rates.

In March and May 2023, MolDX issued a new billing article related to the LCD entitled Molecular Testing for Solid Organ Allograft Rejection. The billing article issued in May 2023 (the “Revised Billing Article”) and together with the billing article issued in March 2023 (the “Billing Articles”) impacted Medicare coverage for AlloSure Kidney, AlloSure Heart, AlloMap Heart and AlloSure Lung, and required certain companies, including the Company, to implement new processes to address the requirements related to Medicare claim submissions. Noridian adopted the Revised Billing Article on August 17, 2023, with a retroactive effective date of March 31, 2023.

On August 10, 2023, MolDX and Noridian released a draft proposed revision to the LCD (DL38568, Palmetto; DL38629, Noridian) that, if adopted, would revise the existing foundational LCD, MolDX: Molecular Testing for Solid Organ Allograft Rejection (L38568 and L38629). On August 14, 2023, MolDX released a draft billing article (DA58019) to accompany the proposed draft LCD, which generally reflected the changes in coverage included in the Revised Billing Article. The comment period end date for this proposed LCD was September 23, 2023. The Company presented at public meetings regarding the proposed draft LCD held on September 18, 2023 and September 20, 2023, with MolDX and Noridian, respectively. The Company also submitted written comments on the proposed draft LCD.

On February 29, 2024, MolDX and Noridian released a revised version of the Revised Billing Article.

Product Revenue

Product revenue is recognized from the sale of products to end-users, distributors and strategic partners when all revenue recognition criteria are satisfied. The Company generally has a contract or a purchase order from a customer with the specified required terms of order, including the number of products ordered. Transaction prices are determinable and products are delivered and the risk of loss is passed to the customer upon either shipping or delivery, as per the terms of the agreement.

Patient and Digital Solutions Revenue

Patient and digital solutions revenue is mainly derived from a combination of software as a service (“SaaS”) and perpetual software license agreements entered into with various transplant centers, which are the Company’s customers for this class of revenue. The main performance obligations in connection with the Company’s SaaS and perpetual software license agreements are the following: (i) implementation services and delivery of the perpetual software license, which are considered a single performance obligation, and (ii) post contract support. The Company allocates the transaction price to each performance obligation based on relative stand-alone selling prices of each distinct performance obligation. Digital revenue in connection with perpetual software license agreements is recognized over time based on the Company’s satisfaction of each distinct performance obligation in each agreement.

Perpetual software license agreements typically require advance payments from customers upon the achievement of certain milestones. The Company records deferred revenue in relation to these agreements when cash payments are received or invoices are issued in advance of the Company’s performance, and generally recognizes revenue over the contractual term, as performance obligations are fulfilled.

In addition, the Company derives patient and digital solutions revenue from software subscriptions and medication sales. The Company generally bills software subscription fees in advance. Revenue from software subscriptions is deferred and recognized ratably over the subscription term. The medication sales revenue is recognized based on the negotiated contract price with the governmental, commercial and non-commercial payers with any applicable patient co-pay. The Company recognizes revenue from medication sales when prescriptions are delivered.

Recent Accounting Pronouncements

There were no recently adopted accounting standards which would have a material effect on the Company’s condensed consolidated financial statements and accompanying disclosures, and no recently issued accounting standards that are expected to have a material impact on the Company’s condensed consolidated financial statements and accompanying disclosures.

Effective in Future Periods

In November 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which requires enhanced disclosure of significant segment expenses. All current annual disclosures about a reportable segment’s profit or loss and assets will also be required in interim periods. The new guidance also requires disclosure of the title and position of the Chief Operating Decision Maker (“CODM”) and explanation of how the CODM uses the reported measure(s) of segment profit or loss in assessing segment performance and deciding how to allocate resources. The amendments set forth in this ASU are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. The amendments should be applied retrospectively to all prior periods presented in the financial statements. This ASU will be effective for the Company’s annual disclosures in fiscal year 2024 and interim-period disclosures in fiscal year 2025. We are currently evaluating the potential effect that the updated standard will have on our financial statement disclosures.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 340): Improvements to Income Tax Disclosures, which requires annual disclosures in the rate reconciliation table to be presented using both percentages and reporting currency amounts, and this table must include disclosure of specific categories. Additional information will also be required for reconciling items that meet a quantitative threshold. The new guidance also requires enhanced disclosures of income taxes paid, including the amount of income taxes paid disaggregated by federal, state and foreign taxes and the amount of income taxes paid disaggregated by individual jurisdictions that exceed a quantitative threshold. The amendments should be applied on a prospective basis, but retrospective application is permitted. The amendments set forth in this ASU are effective for annual periods beginning after December 15, 2024 for public entities. This guidance will be effective for the Company’s annual disclosures in fiscal year 2025. We are currently evaluating the potential effect that the updated standard will have on our financial statement disclosures.

3. NET LOSS PER SHARE

Basic and diluted net loss per share have been computed by dividing the net loss by the weighted-average number of common shares outstanding during the period, without consideration of common share equivalents as their effect would have been antidilutive.

The following tables set forth the computation of the Company’s basic and diluted net loss per share (in thousands, except shares and per share data): | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Numerator: | | | | | | | |

| Net loss used to compute basic and diluted net loss per share | $ | (16,659) | | | $ | (23,749) | | | | | |

| Denominator: | | | | | | | |

Weighted-average shares used to compute basic and diluted net loss per share | 51,692,358 | | | 53,643,216 | | | | | |

| Net loss per share: | | | | | | | |

| Basic and diluted | $ | (0.32) | | | $ | (0.44) | | | | | |

The following potentially dilutive securities have been excluded from diluted net loss per share as of March 31, 2024 and 2023 because their effect would be antidilutive: | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Shares of common stock subject to outstanding options | 2,974,042 | | | 3,248,696 | |

| Shares of common stock subject to outstanding common stock warrants | — | | | 3,132 | |

| | | |

| Restricted stock units | 7,244,901 | | | 4,096,014 | |

| Total common stock equivalents | 10,218,943 | | | 7,347,842 | |

4. FAIR VALUE MEASUREMENTS

The Company records its financial assets and liabilities at fair value. The carrying amounts of certain financial instruments of the Company, including cash and cash equivalents, prepaid expenses and other current assets, accounts payable and accrued liabilities, approximate fair value due to their relatively short maturities. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the reporting date. The accounting guidance establishes a three-tiered hierarchy, which prioritizes the inputs used in the valuation methodologies in measuring fair value as follows:

•Level 1: Inputs that include quoted prices in active markets for identical assets and liabilities.

•Level 2: Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities, quoted prices in markets that are not active or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

•Level 3: Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

The following table sets forth the Company’s financial assets and liabilities, measured at fair value on a recurring basis, as of March 31, 2024 and December 31, 2023 (in thousands): | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2024 |

| Fair Value Measured Using | | |

| (Level 1) | | (Level 2) | | (Level 3) | | Total Balance |

| Assets | | | | | | | |

| Cash equivalents: | | | | | | | |

| Money market funds | $ | 73,155 | | | $ | — | | | $ | — | | | $ | 73,155 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total | $ | 73,155 | | | $ | — | | | $ | — | | | $ | 73,155 | |

| Liabilities | | | | | | | |

| Short-term liabilities: | | | | | | | |

| Contingent consideration | $ | — | | | $ | — | | | $ | 6,050 | | | $ | 6,050 | |

| Long-term liabilities: | | | | | | | |

| Contingent consideration | — | | | — | | | 1,348 | | | 1,348 | |

| | | | | | | |

| Total | $ | — | | | $ | — | | | $ | 7,398 | | | $ | 7,398 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 |

| | Fair Value Measured Using | | |

| | (Level 1) | | (Level 2) | | (Level 3) | | Total Balance |

| Assets | | | | | | | |

| Cash equivalents: | | | | | | | |

| Money market funds | $ | 60,525 | | | $ | — | | | $ | — | | | $ | 60,525 | |

| | | | | | | |

| | | | | | | |

| Total | $ | 60,525 | | | $ | — | | | $ | — | | | $ | 60,525 | |

| Liabilities | | | | | | | |

| Short-term liabilities: | | | | | | | |

| Contingent consideration | $ | — | | | $ | — | | | $ | 5,469 | | | $ | 5,469 | |

| Long-term liabilities: | | | | | | | |

| Contingent consideration | — | | | — | | | 2,461 | | | 2,461 | |

| | | | | | | |

| Total | $ | — | | | $ | — | | | $ | 7,930 | | | $ | 7,930 | |

The following table presents the issuances, exercises, changes in fair value and reclassifications of the Company’s Level 3 financial instruments that are measured at fair value on a recurring basis (in thousands): | | | | | |

| | (Level 3) |

Contingent Consideration | |

Balance as of December 31, 2023 | $ | 7,930 | |

| |

| |

| |

Change in estimated fair value of contingent consideration on business combination | 319 | |

Change in estimated fair value of contingent consideration on asset acquisition | (226) | |

| |

| Payments related to contingent consideration | (625) | |

Balance as of March 31, 2024 | $ | 7,398 | |

During March 2023, the Company wrote off $1.0 million of its investment in convertible preferred shares of Cibiltech SAS (“Cibiltech”), which was carried at cost. Cibiltech’s operations have been liquidated. The fair value of this investment was based on Level 3 inputs.

In July 2023, the Company entered into a Securities Holders’ Agreement (the “Agreement”) with a private entity based in France. The private entity was established to continue Cibiltech's activity, which consists of designing, developing, publishing, promoting, distributing, and marketing of software related to predictive solutions, monitoring and/or remote monitoring in the field of human organ allotransplantation, allografting, and chronic organ diseases. The private entity retained all assets of Cibiltech, including its licenses. Pursuant to the Agreement, the Company agreed to invest a certain amount in the private entity, in order to continue the commercialization of the iBox technology. The Company's investment is in the form of ordinary and Class B shares carried at cost. This investment is not considered material to the Company's condensed consolidated financial statements.

In December 2023, Miromatrix was acquired by United Therapeutics Corporation. The Company tendered and sold all of its shares of Miromatrix to United Therapeutics Corporation in the transaction for $2.5 million. The Company recognized a $1.5 million gain from the disposal in Miromatrix and recorded as other income (expense), net at December 31, 2023. There was no outstanding investment with Miromatrix as of March 31, 2024.

In determining fair value, the Company uses various valuation approaches within the fair value measurement framework. The valuation methodologies used for the Company’s instruments measured at fair value and their classification in the valuation hierarchy are summarized below:

•Money market funds – Investments in money market funds are classified within Level 1. Money market funds are valued at the closing price reported by the fund sponsor from an actively traded exchange. At March 31, 2024 and December 31, 2023, money market funds were included as cash and cash equivalents in the condensed consolidated balance sheets.

•Contingent consideration – Contingent consideration is classified within Level 3. Contingent consideration relates to asset acquisitions and business combinations. The Company recorded the estimate of the fair value of the contingent consideration based on its evaluation of the probability of the achievement of the contractual conditions that would result in the payment of the contingent consideration. Contingent consideration was estimated using the fair value of the milestones to be paid if the contingency is met based on management’s

estimate of the probability of success and projected revenues for revenue-based considerations at discounted rates ranging from 7% and 12% at March 31, 2024 and from 6% and 12% at December 31, 2023. The significant input in the Level 3 measurement that is not supported by market activity is the Company’s probability assessment of the achievement of the milestones. The value of the liability is subsequently remeasured to fair value at each reporting date, and the change in estimated fair value is recorded as income or expense within operating expenses in the condensed consolidated statements of operations until the milestones are paid, expire or are no longer achievable. Increases or decreases in the estimation of the probability percentage results in a directionally similar impact to the fair value measurement of the contingent consideration liability. The carrying amount of the contingent consideration liability represents its fair value.

5. CASH AND MARKETABLE SECURITIES

Cash, Cash Equivalents and Restricted Cash

A reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets to the amount reported within the condensed consolidated statements of cash flows is shown in the table below (in thousands): | | | | | | | | | | | |

| March 31, 2024 | | March 31, 2023 |

| Cash and cash equivalents | $ | 93,299 | | | $ | 74,660 | |

| Restricted cash | 583 | | | 520 | |

Total cash, cash equivalents and restricted cash at the end of the period | $ | 93,882 | | | $ | 75,180 | |

Marketable Securities

All short-term marketable securities were considered held-to-maturity at March 31, 2024. At March 31, 2024, some of the Company’s short-term marketable securities were in an unrealized loss position. The Company determined that it had the positive intent and ability to hold until maturity all short-term marketable securities that have been in a continuous loss position. The Company assesses whether the decline in value of short-term marketable securities is temporary or other-than-temporary. In making its assessment, the Company evaluates the current market and interest rate environment as well as specific issuer information. There was no recognition of any other-than-temporary impairment at March 31, 2024. All short-term marketable securities with unrealized losses as of the balance sheet date have been in a loss position for less than twelve months. Contractual maturities of the short-term marketable securities were within one year or less.

The long-term marketable equity securities were recorded at fair market value with changes in the fair value recognized in earnings at March 31, 2024 and December 31, 2023. The long-term marketable debt securities were considered available-for-sale at March 31, 2024 and December 31, 2023. The contractual maturity of the long-term marketable debt securities are less than three years.

The amortized cost, gross unrealized holding gains and fair value of the Company’s marketable securities by major security type at each balance sheet date are summarized in the tables below (in thousands):

| | | | | | | | | | | | | | | | | |

| March 31, 2024 |

| Amortized Cost | | Unrealized Holding Gains, Net | | Fair Value |

| Short-term marketable securities: | | | | | |

| U.S. agency securities | $ | 79,603 | | | $ | 640 | | | $ | 80,243 | |

| Corporate debt securities | 43,019 | | | 587 | | | 43,606 | |

| Total short-term marketable securities | $ | 122,622 | | | $ | 1,227 | | | $ | 123,849 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| December 31, 2023 |

| Amortized Cost | | Unrealized Holding Gains, Net | | Fair Value |

| Short-term marketable securities: | | | | | |

| U.S. agency securities | $ | 80,468 | | | $ | 2,038 | | | $ | 82,506 | |

| Corporate debt securities | 72,753 | | | 711 | | | 73,464 | |

| Total short-term marketable securities | $ | 153,221 | | | $ | 2,749 | | | $ | 155,970 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

6. BUSINESS COMBINATIONS AND ASSET ACQUISITION

Business Combinations

HLA Data Systems

In January 2023, the Company acquired HLA Data Systems, a Texas-based company that provides software and interoperability solutions for the histocompatibility and immunogenetics community. The Company acquired HLA Data Systems with a combination of cash consideration paid upfront and contingent consideration with a fair value of $1.3 million.

The Company accounted for the transaction as a business combination using the acquisition method of accounting. Acquisition-related costs of $0.4 million associated with the acquisition were expensed as incurred, and classified as part of general and administrative expenses in the condensed consolidated statement of operations.

Goodwill of $2.1 million arising from the acquisition primarily consists of synergies from integrating HLA Data Systems’ technology with the current testing and digital solutions offered by the Company. The acquisition of HLA Data Systems will provide a robust and comprehensive Laboratory Information Management System and support the laboratory workflows. None of the goodwill is expected to be deductible for income tax purposes. All of the goodwill has been assigned to the Company’s existing operating segment.

The following table summarizes the fair values of the intangible assets acquired as of the acquisition date ($ in thousands):

| | | | | | | | | | | |

| Estimated Fair Value | | Estimated Useful Lives (Years) |

| Customer relationships | $ | 3,010 | | | 13 |

| Developed technology | 770 | | | 11 |

| Trademarks | 320 | | | 17 |

| Total | $ | 4,100 | | | |

Customer relationships acquired by the Company represent the fair value of future projected revenue that is expected to be derived from sales of HLA Data Systems’ products to existing customers. The customer relationships’ fair value has been estimated utilizing a multi-period excess earnings method under the income approach, which reflects the present value of the projected cash flows that are expected to be generated by the customer relationships, less charges representing the contribution of other assets to those cash flows that use projected cash flows with and without the intangible asset in place. The economic useful life was determined based on the distribution of the present value of the cash flows attributable to the intangible asset.

The acquired developed technology represents the fair value of HLA Data Systems’ proprietary software. The trademark acquired consists primarily of the HLA Data Systems brand and markings. The fair value of both the developed technology and the trademark were determined using the relief-from-royalty method under the income approach. This method considers the value of the asset to be the value of the royalty payments from which the Company is relieved due to its ownership of the asset. The royalty rates of 10% and 2% were used to estimate the fair value of the developed technology and the trademark, respectively.

A discount rate of 24% was utilized in estimating the fair value of these three intangible assets.

The pro forma impact of the HLA Data Systems acquisition is not material, and the results of operations of the acquisition has been included in the Company’s condensed consolidated statements of operations from the acquisition date.

MediGO

In July 2023, the Company acquired MediGO, an organ transplant supply chain and logistics company. MediGO provides access to donated organs by digitally transforming donation and transplantation workflows to increase organ utilization. The Company acquired MediGO with a combination of cash consideration paid upfront and contingent consideration with a fair value of $0.3 million.

The Company accounted for the transaction as a business combination using the acquisition method of accounting. Acquisition-related costs of $0.3 million associated with the acquisition were expensed as incurred, and classified as part of general and administrative expenses in the condensed consolidated statement of operations.

Goodwill of $0.6 million arising from the acquisition primarily consists of synergies from integrating MediGO’s technology with the current testing and digital solutions offered by the Company. The acquisition of MediGO will provide a comprehensive software platform that optimizes complex logistics from referral to recovery and during the critical movement of organs and teams and gives organ procurement organizations and transplant centers the ability to unify decentralized stakeholders, coordinate resources and make vital decisions with the goal of increasing organ utilization and improving equity and access to

transplantation. None of the goodwill is expected to be deductible for income tax purposes. All of the goodwill has been assigned to the Company’s existing operating segment.

The following table summarizes the fair values of the intangible assets acquired as of the acquisition date ($ in thousands):

| | | | | | | | | | | |

| Estimated Fair Value | | Estimated Useful Lives (Years) |

| Customer relationships | $ | 810 | | | 17 |

| Developed technology | 850 | | | 12 |

| Trademarks | 360 | | | 17 |

| Total | $ | 2,020 | | | |

Customer relationships acquired by the Company represent the fair value of future projected revenue that is expected to be derived from sales of MediGO’s products to existing customers. The customer relationships’ fair value has been estimated utilizing a multi-period excess earnings method under the income approach, which reflects the present value of the projected cash flows that are expected to be generated by the customer relationships, less charges representing the contribution of other assets to those cash flows that use projected cash flows with and without the intangible asset in place. The economic useful life was determined based on the distribution of the present value of the cash flows attributable to the intangible asset.

The acquired developed technology represents the fair value of MediGO’s proprietary software. The trademark acquired consists primarily of the MediGO brand and markings. The fair value of both the developed technology and the trademark were determined using the relief-from-royalty method under the income approach. This method considers the value of the asset to be the value of the royalty payments from which the Company is relieved due to its ownership of the asset. The royalty rates of 10% and 2% were used to estimate the fair value of the developed technology and the trademark, respectively.

A discount rate of 25% was utilized in estimating the fair value of these three intangible assets.

The pro forma impact of the MediGO acquisition is not material, and the results of operations of the acquisition have been included in the Company’s condensed consolidated statements of operations from the respective acquisition date.

Combined Consideration Paid

The following table summarizes the consideration paid for HLA Data Systems (final amount) and MediGO (provisional amount) of the assets acquired and liabilities assumed recognized at their estimated fair value at the acquisition date (in thousands):

| | | | | |

| Total |

Consideration | |

Cash | $ | 6,682 | |

Total consideration | $ | 6,682 | |

| |

Recognized amounts of identifiable assets acquired and liabilities assumed | |

| Current assets | $ | 1,413 | |

| Identifiable intangible assets | 6,120 | |

| Current liabilities | (1,060) | |

| Other current liabilities | (810) | |

| Contingent considerations | (1,620) | |

| Other liabilities | (7) | |

| Total identifiable net assets acquired | 4,036 | |

| Goodwill | 2,646 | |

| Total consideration | $ | 6,682 | |

The allocation of the purchase price to assets acquired and liabilities assumed was based on the fair value of such assets and liabilities as of the acquisition date.

Asset Acquisition