Euro Falls As Weak Eurozone PMI Data Spurs ECB Rate Cut Bets

July 24 2024 - 4:15AM

RTTF2

The euro weakened against other major currencies in the European

session on Wednesday, as a survey showed business activity in the

eurozone slowed further in July, signaling a "near-stagnation" and

raising concerns about economic recovery.

The Composite PMI fell to 50.1, hitting a five-month low due to

a slowdown in services growth and worsening contraction in the

manufacturing sector.

The European central Bank is expected to cut interest rates two

times more by the end of 2024.

The euro showed mixed trading against its major counterparts in

the Asian trading today. While the euro rose against the pound, it

fell against the yen. Against the U.S. dollar and the Swiss franc,

the euro held steady.

In the European trading now, the euro fell to a 2-week low of

1.0825 against the U.S. dollar and a 1-week low of 0.8397 against

the pound, from early highs of 1.0854 and 0.8418, respectively. If

the euro extends its downtrend, it is likely to find support around

1.07 against the greenback and 0.82 against the pound.

Against the Swiss franc and the yen, the euro dropped to nearly

a 4-week low of 0.9612 and 167.23 from early highs of 0.9677 and

169.21, respectively. On the downside, 0.94 against the franc and

164.00 against the yen are seen as the next support levels for the

euro.

Looking ahead, U.S. MBA mortgage approvals data, building

permits for June, Goods trade balance for June, retail inventories

for June, new home sales data for June, U.S. S&P PMI data for

July, U.S. EIA crude oil data, Canada's new housing price index for

June, manufacturing sales data for June are slated for release in

the New York session.

At 9:45 am ET, the Bank of Canada is set to announce its

monetary policy decision. The bank is expected to cut its overnight

rate by 25 bps to 4.5%.

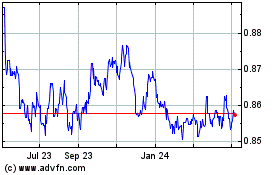

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Jun 2024 to Jul 2024

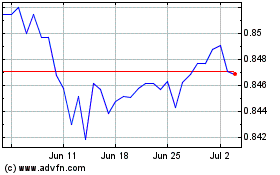

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Jul 2023 to Jul 2024