New Breakthroughs Propel Render Price Up 11% – Here’s What’s Happening

August 25 2024 - 11:00AM

NEWSBTC

Render continues its bullish rally with a cool 11% increase as

noted by CoinGecko. Although the market has dipped slightly, the

majority of it is still flashing green with the major

cryptocurrencies reaching their respective targets. However, recent

developments in the Render network made this upward trajectory

possible. Related Reading: Optimism: Major Partnership Pushes

OP Price By 24% Enthusiasts of the network continue to see growth

after the platform released its Cinema 4D Wizard tool which sees

huge potential in the media industry. This new tool helps artists

achieve top-tier outputs while slashing work hours and streamlining

workflows. New Wizard Tool Shortens Artist Workflow

Render released the Cinema 4D Wizard last week, August 20, helping

3D artists to cut work time and streamline their workflows. This

plug-in works on the Cinema 4D application, one of the most used 3D

rendering software. According to Render’s knowledge base, the tool

has several features upon launch the most notable of which is the

scene checker that analyzes several factors that may affect the

final output. This assists artists in cleaning up their renders,

making sure that each piece is in tip-top shape.

https://t.co/Skl7nvhDBp — The Render Network (@rendernetwork)

August 20, 2024 NVIDIA Earnings Might Push RENDER Higher With the

Render network’s focus on decentralized computing, graphic cards

are the backbone of the platform’s niche in the decentralized

physical infrastructure (DePIN) industry. Nvidia’s nearing earnings

call will affect RENDER’s price movement in the coming weeks.

August 28 will be the date investors and traders should monitor.

Any positive or negative news will affect the token’s performance

once D-day lands. However, the company’s anticipated

next-generation AI chips might give RENDER a boost in the long

term. RENDER Exhausted After A Week Of Upward Momentum As of

writing, the token has been rejected by the $6.3 resistance level

as a red candle forms on today’s trading activity. This represents

a slight dip in the coming days, purely because of RENDER bulls

losing momentum in the short term. The token’s high relative

strength index indicates a strong struggle between the bulls and

bears, and the latter is currently winning in the short term.

RENDER’s correction period may have started, but it won’t last that

long. Investors and traders are still anticipating Nvidia’s

earnings call that can turn the correction into another week of

bullishness. Related Reading: Injective (INJ) Skyrockets 21%

As Proponents Weigh In On New Developments For now, the bulls

should focus on consolidating their position and stabilize the

token’s movement between the $5.8-$6.3 price range as this will be

their strongest platform for any upward movement. Any attempt in

the short term to retake lost ground won’t be enough and might give

the bears an opportunity to swing the little momentum RENDER has to

break through $5.8 to $5.3 in the short term. Featured image

from Medium, chart from TradingView

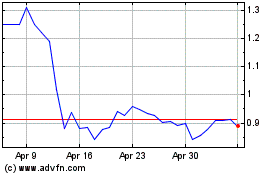

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024