Form 8-K - Current report

February 24 2025 - 10:15AM

Edgar (US Regulatory)

Gentherm Inc false 0000903129 0000903129 2025-02-24 2025-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 24, 2025

GENTHERM INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Michigan |

|

0-21810 |

|

95-4318554 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 28875 Cabot Drive, Novi, MI |

|

48377 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (248) 348-9735

Former name or former address, if changed since last report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, no par value |

|

THRM |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

In connection with the previously disclosed inducement award of restricted stock units (“RSUs”) to be granted by Gentherm Incorporated (the “Company”) on February 24, 2025 to William Presley, President and Chief Executive Officer, and Jonathan Douyard, Executive Vice President, Chief Financial Officer and Treasurer, respectively, of Gentherm Incorporated (the “Company”), the Company will enter into a Sign-on Inducement Restricted Stock Unit Award Agreement with each of Messrs. Presley and Douyard. Such award agreement has substantially the same terms and conditions of the form of RSU award agreement currently used for annual grants to executive officers of the Company. A copy of the Form of Sign-On Inducement Restricted Stock Unit Award Agreement is attached hereto as Exhibit 10 and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

| * |

Indicates management contract or compensatory plan or arrangement. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| GENTHERM INCORPORATED |

|

|

| By: |

|

/s/ Wayne Kauffman |

|

|

Wayne Kauffman |

|

|

Senior Vice President, General Counsel and Secretary |

Date: February 24, 2025

Exhibit 10

GENTHERM INCORPORATED

SIGN-ON INDUCEMENT RESTRICTED STOCK UNIT AWARD AGREEMENT

Gentherm Incorporated, a Michigan corporation (the

“Corporation”), hereby grants to the individual listed below (the “Grantee”), a sign-on award of Restricted Stock Units (“RSUs”) as

described herein, subject to the terms and conditions of this Sign-on Inducement Restricted Stock Unit Award Agreement (“Agreement”) to induce the Grantee to be employed by the

Corporation. This Agreement shall be construed as if such RSUs had been granted under the Gentherm Incorporated 2023 Equity Incentive Plan, as amended from time to time (the “Plan”), in accordance and consistent with, and

subject to, the provisions of the Plan, the terms of which are incorporated herein by reference, provided that such RSUs will not be deemed to be issued under such Plan. Except as expressly set forth herein, in the event of a conflict between the

terms and conditions of the Plan and the terms and conditions of this Agreement, the terms and conditions of this Agreement shall prevail.

Unless

otherwise defined in this Agreement, the terms used in this Agreement have the same meaning as defined in the Plan.

|

|

|

|

|

|

|

| |

|

Grantee: |

|

|

|

|

|

|

|

|

|

|

Grant Date: |

|

|

|

|

|

|

|

|

|

|

Number of RSUs in Award: |

|

|

|

|

| 2. |

GRANT OF RSU AWARD. The Corporation hereby grants to the Grantee, as of the Grant Date, the number of

RSUs set forth in the table above. By clicking the “ACCEPT” button, the Grantee agrees to the following: “This electronic contract contains my electronic signature, which I have executed with the intent to sign this

Agreement.” |

| 3. |

VESTING. Except as otherwise provided in this Agreement, the RSUs shall become vested in the following

amounts on the following dates; provided, however, that the portion of the RSUs scheduled to become vested on any such vesting date shall vest on such vesting date only if the Grantee remains continuously employed on a full-time basis with the

Corporation or its Subsidiaries from the Grant Date until the applicable Normal Vesting Date: |

|

|

|

| Anniversary of Grant Date

(each, a “Normal Vesting Date”) |

|

RSUs Vested on Normal

Vesting Date |

| First |

|

One-third |

| Second |

|

One-third |

| Third |

|

One-third |

| 4. |

QUALIFYING TERMINATION PRIOR TO ANY NORMAL VESTING DATE. Notwithstanding Section 3 hereof but

subject to the notice and release requirements set forth below in this Section 4, if there is a (i) termination of employment due to the Grantee’s death or Disability or (ii) an event of termination specified in Grantee’s

offer letter with the Corporation that specifies the vesting of the RSUs therefrom, then any unvested RSUs shall become vested as of the date of such termination of employment. The vesting of unvested RSUs under this Section 4 is conditioned

upon the Grantee (or, in the case of the Grantee’s death, an executor or administrator of the Grantee’s estate) signing and delivering to the Corporation, and there becoming irrevocable, within 30 days after the date of such employment

termination, a general release of claims (in form and substance reasonably acceptable to the Corporation) by which the Grantee releases the Corporation and its |

| |

affiliated entities and individuals from any claim arising from the Grantee’s employment by, and termination of employment with, the Corporation and its Subsidiaries, in consideration for

the receipt and vesting of the RSUs. Any RSUs that would have otherwise vested under this Section 4 shall be forfeited if the general release does not become effective and irrevocable on or before the 30th day following the Grantee’s

termination of employment. |

| 5. |

CHANGE IN CONTROL. Notwithstanding Section 3 hereof but subject to the notice and release

requirements set forth below in this Section 5, if there is a Change in Control prior to any Normal Vesting Date, and if within three months prior to or 12 months after the Change in Control, the Grantee’s employment is terminated by the

Corporation or a Subsidiary (or a successor thereof) without Cause or by the Grantee for Good Reason (as defined below), any unvested RSUs at the time of such termination of employment shall become vested upon such termination of employment. The

vesting of unvested RSUs under this Section 5 is conditioned upon the Grantee signing and delivering to the Corporation (or a successor thereof), and there becoming irrevocable, within 30 days after the date of such employment termination, a

general release of claims (in form and substance reasonably acceptable to the Corporation or its successor thereof) by which the Grantee releases the Corporation and its affiliated entities and individuals (including any successor thereof) from any

claim arising from the Grantee’s employment by, and termination of employment with, the Corporation and its Subsidiaries (including any successor thereof), in consideration for the receipt and vesting of the RSUs. Any RSUs that would have

otherwise vested under this Section 5 shall be forfeited if the general release does not become effective and irrevocable on or before the 30th day following the Grantee’s termination of employment. |

“Good Reason” means in respect of the Corporation and the Subsidiaries and without the Grantee’s consent: (i) the

occurrence of a material diminution in the Grantee’s authority, duties, or responsibilities (other than temporarily while the Grantee is physically or mentally incapacitated or as required by applicable law); (ii) a material adverse change in

the reporting structure applicable to the Grantee, provided that a change in Grantee’s hybrid working arrangement shall not constitute a relocation for purposes of this definition; (iii) a relocation of the Grantee’s principal place

of employment by more than 50 miles; or (iv) a material reduction in the Grantee’s aggregate base salary and target bonus (other than a general reduction that affects all similarly situated executives in substantially the same

proportions); provided, however, that the Grantee shall be considered to have terminated employment for Good Reason only if (A) the Grantee provides notice to the Corporation of the event or condition meeting the foregoing definition of Good

Reason within 30 days after the initial occurrence of such event or condition, (B) the Corporation or the applicable Subsidiary fails to correct such event or condition within 30 days of receiving notice thereof from the Grantee, and

(C) the Grantee terminates employment with the Corporation and the Subsidiaries within 30 days after the expiration of such correction period. Notwithstanding the foregoing, if the Grantee and the Corporation or any Subsidiary have entered into

an employment, offer letter, retention, change in control, severance or other similar agreement that specifically defines “Good Reason,” then with respect to the Grantee, “Good Reason” shall have the meaning defined in such

agreement.

| 6. |

FORFEITURE. Upon the Grantee’s termination of employment with the Corporation and its Subsidiaries

for any reason prior to any Normal Vesting Date, any RSUs that do not become vested upon such employment termination in accordance with the terms of this Agreement (including Sections 4 and 5 hereof) shall be immediately canceled and forfeited for

no consideration as of the Grantee’s termination of employment. Any RSUs that are outstanding but do not become vested on the third and final Normal Vesting Date in accordance with the terms of this Agreement shall be cancelled and forfeited

for no consideration as of such date. Notwithstanding anything to the contrary contained herein, the Committee may, in its Discretion, accelerate the vesting of all or a portion of the RSUs subject to this Award as of or prior to any cancellation or

forfeiture thereof. |

| 7. |

SETTLEMENT OF RSUS. Subject to the withholding tax provisions of Section 11 hereof and

Section 15(h) of the Plan, within 45 days after the date upon which an RSU becomes vested in accordance with the terms of this Agreement, the Corporation shall issue or transfer to the Grantee stock certificates or, if applicable, book-entry

registration, one share of Common Stock per each vested RSU; provided, however, if RSUs vest in accordance with Section 5 hereof, the Corporation (or a successor thereto) shall issue or transfer to the Grantee such shares of Common Stock or

common stock of the successor having approximately equivalent value (and references herein to Common Stock issued on vesting shall include such successor common stock, if applicable), or the cash equivalent of such shares of Common Stock or common

stock if neither security is listed on a U.S. national securities exchange (including Nasdaq or the New York Stock Exchange). |

2

| 8. |

RIGHTS AS SHAREHOLDER. Until and if shares of Common Stock are issued in settlement of vested RSUs, the

Grantee shall not have any rights of a shareholder (including voting and dividend rights) in respect of the Common Stock underlying the RSUs; provided, however, the Committee, in its sole Discretion, shall pay unvested RSUs with dividend or

distribution equivalents equal to the amount of dividends and distributions, if any, that are paid on that number of shares with respect to the RSUs granted hereunder, in accordance with Section 15(g)(iv) of the Plan and any other conditions,

limitations and other restrictions determined by the Committee. |

| 9. |

ADJUSTMENTS. In the event of any stock dividend, stock split, recapitalization, merger, consolidation,

split up, spin-off, combinations, exchange of shares or reorganization of or by the Corporation affecting this Award, the rights of the Grantee will be adjusted as provided in Section 5(e) of the Plan.

|

| 10. |

NON-TRANSFERABILITY OF AWARD. Without the express written

consent of the Committee, which may be withheld for any reason in its sole Discretion, neither the RSUs nor any interest in the RSUs may be assignable, alienable, saleable, pledged, hypothecated, encumbered or transferable by the Grantee,

except for a transfer by will or by the laws of descent and distribution as a result of the death of the Grantee; provided that, unless approved by shareholders, in no event shall this Award be transferable for consideration. The terms of this

Agreement shall be binding upon the Grantee’s executors, administrators, heirs, successors and assigns. Any attempt to transfer, assign, pledge, hypothecate or borrow against the RSUs in violation of this Section 10 in any manner shall be

null and void and without legal force or effect. |

| 11. |

WITHHOLDING OBLIGATIONS. The Grantee shall be responsible for all taxes required by law to be withheld

by the Corporation or a Subsidiary in respect of the grant, vesting or settlement of the RSUs, and the Corporation may make any arrangements it deems appropriate to ensure payment of any such tax by the Grantee. The Committee may, in its Discretion,

permit the Grantee to satisfy such withholding obligations in accordance with Section 18(a) of the Plan. |

| 12. |

AMENDMENT. The Committee shall have the right, in its Discretion, to modify or amend the Agreement from

time to time in accordance with and as provided in the Plan. This Agreement may also be modified or amended by a writing signed by both the Corporation and the Grantee. The Corporation shall give written notice to the Grantee of any such

modification or amendment of this Agreement as soon as practicable after the adoption thereof. |

| 13. |

RIGHTS OF GRANTEE; REGULATORY REQUIREMENTS. Without limiting the generality of any other provision of

this Agreement, Sections 13 and 14 of the Plan pertaining to the limitations on the Grantee’s rights and certain regulatory requirements are hereby explicitly incorporated into this Agreement. |

| 14. |

NOTICES. Notices hereunder shall be mailed or delivered to the Corporation at its principal place of

business and shall be mailed or delivered to the Grantee at the address on file with the Corporation or, in either case, at such other address as one party may subsequently furnish to the other party in writing. |

| 15. |

GOVERNING LAW. This Agreement shall be legally binding and shall be governed, construed, and

administered in accordance with and governed by the laws of the State of Michigan (regardless of the laws that might otherwise govern under applicable principles of choice of law or conflicts of laws of such jurisdiction or any other jurisdiction

that would cause the application of the laws of any jurisdiction other than the State of Michigan). |

| 16. |

DATA PRIVACY NOTICE. The Grantee hereby acknowledges that the collection, use and transfer, in

electronic or other form, of the Grantee’s personal data as described in this Agreement and any other RSU grant materials by the Corporation (and its Subsidiaries) is necessary for the purpose of implementing, administering and managing the

Grantee’s participation in the Plan. The Grantee authorizes, agrees and unambiguously consents to the transmission by the Corporation (and its Subsidiaries) of any personal data information related to this Award for legitimate business

purposes. This authorization and consent is freely given by the Grantee. |

3

The Grantee understands that the Corporation and its Subsidiaries may hold certain personal

information about the Grantee, including, but not limited to, the Grantee’s name, home address and telephone number, email address, date of birth, social insurance, passport or other identification number (e.g., resident registration number),

salary, nationality, job title, details of all RSUs or any other entitlement to shares of Common Stock awarded, canceled, exercised, vested, unvested or outstanding in the Grantee’s favor (“Data”), for the purpose of

administering and managing the RSUs under this Award.

The Grantee understands that Data will be transferred to Merrill Lynch, Pierce,

Fenner & Smith Inc., and its related companies (“Merrill Lynch”) or any stock plan service provider as may be selected by the Corporation in the future, which is assisting the Corporation with the administering and

managing the RSUs under this Award. The Grantee understands that the recipients of the Data may be located in the United States or elsewhere, and that the recipients’ country of operation (e.g., the United States) may have different data

privacy laws and protections than the Grantee’s country. The Grantee understands that if he or she resides outside the United States, he or she may request a list with the names and addresses of any potential recipients of the Data by

contacting his or her local human resources representative. The Corporation, Merrill Lynch, any other stock plan service provider selected by the Corporation and any other possible recipients that may assist the Corporation (presently or in the

future) with administering and managing the RSUs under this Award and may receive, possess, use, retain and transfer the Data, in electronic or other form, for the sole purpose of administering and managing the RSUs under this Award. The Grantee

understands that Data will be held only as long as is necessary to administer and manage the RSUs under this Award plus any required period thereafter for purposes of complying with data retention policies and procedures. The Grantee understands

that based on where s/he resides, s/he may have additional rights with respect to personal data collected, used or transferred in connection with this Agreement or any other RSU grant materials by the Corporation (and its Subsidiaries), and the

Grantee may contact in writing his or her local human resources representative.

| 17. |

BINDING AGREEMENT; ASSIGNMENT. This Agreement shall inure to the benefit of, be binding upon, and be

enforceable by the Corporation and its successors and assigns. The Grantee shall not assign (except in accordance with Section 10 hereof) any part of this Agreement without the prior express written consent of the Corporation.

|

| 18. |

HEADINGS. The titles and headings of the various sections of this Agreement have been inserted for

convenience of reference only and shall not be deemed to be a part of this Agreement. |

| 19. |

COUNTERPARTS. This Agreement may be executed in one or more counterparts, each of which shall be deemed

to be an original, but all of which shall constitute one and the same instrument. |

| 20. |

ACQUIRED RIGHTS. The Grantee acknowledges and agrees that: (a) this Award of the RSUs made under

this Agreement is completely independent of any other award or grant and is made in the Discretion of the Corporation; (b) no past grants or awards (including, without limitation, the RSUs awarded hereunder) give the Grantee any right to any

grants or awards in the future whatsoever; and (c) none of the benefits granted under this Agreement are part of the Grantee’s ordinary salary or compensation, and shall not be considered as part of such salary or compensation in the event

of or for purposes of determining the amount of or entitlement to severance, redundancy or resignation or benefits under any employee benefit plan. |

| 21. |

RESTRICTIVE COVENANTS; COMPENSATION RECOVERY; OTHER POLICIES. By signing this Agreement, the Grantee

acknowledges and agrees that this Award or any other Award previously granted to the Grantee by the Corporation or a Subsidiary shall be subject to forfeiture as a result of the Grantee’s violation of any agreement with the Corporation

regarding non-competition, non-solicitation, confidentiality, inventions and/or other restrictive covenants (the “Restricted Covenant

Agreements”). For avoidance of doubt, compensation recovery rights to shares of Common Stock (including such shares acquired under previously granted equity awards) shall extend to the proceeds realized by the Grantee due to the sale or

other transfer of such shares. The Grantee’s prior execution of the Restricted Covenant Agreements was a material inducement for the Corporation’s grant of this Award. |

4

By signing this Agreement, the Grantee also acknowledges and agrees that any Award

previously granted to the Grantee by the Corporation (under any current or prior equity plan of the Corporation or otherwise), including the RSUs subject to this Award, and any amounts or benefits arising from such Awards, including but not limited

to shares of Common Stock issued or cash paid pursuant to such Awards (including any dividends or distributions) or proceeds realized by the Grantee (on a pre-tax basis) due to the sale or other transfer of

shares of Common Stock issued pursuant to such Awards shall be subject to (i) any recoupment, clawback, equity holding, stock ownership or similar policies adopted and amended by the Corporation from time to time and (ii) recoupment,

clawback, equity holding, stock ownership or similar requirements law, regulation or listing standards applicable to the Corporation from time to time. The remedies under such policy are in addition, and are in no way limiting, to the remedies of

the recoupment provision set forth above.

| 22. |

CODE SECTION 409A. It is intended that this Award be exempt from or comply with Section 409A of the

Code and this Agreement shall be interpreted and administered in a manner which effectuates such intent; provided, however, that in no event shall the Corporation or any Subsidiary be liable for any additional tax, interest or penalty imposed upon

or other damage suffered by the Grantee on account of this Award being subject to but not in compliance with Section 409A of the Code. |

SIGNATURE PAGE FOLLOWS

5

|

|

|

| GENTHERM INCORPORATED |

|

|

| By: |

|

|

|

|

| Name: |

|

|

|

|

| Title: |

|

|

|

|

| Dated: |

|

|

THE GRANTEE ACKNOWLEDGES AND AGREES THAT NOTHING IN THIS RESTRICTED STOCK UNIT AWARD AGREEMENT, NOR IN THE

CORPORATION’S 2023 EQUITY INCENTIVE PLAN, AS AMENDED, WHICH IS INCORPORATED INTO THIS AGREEMENT BY REFERENCE, CONFERS ON THE GRANTEE ANY RIGHT WITH RESPECT TO CONTINUATION AS AN EMPLOYEE OF THE CORPORATION OR ANY PARENT OR ANY SUBSIDIARY OR

AFFILIATE OF THE CORPORATION, NOR INTERFERES IN ANY WAY WITH THE GRANTEE’S RIGHT OR THE CORPORATION’S RIGHT TO TERMINATE THE GRANTEE’S EMPLOYMENT WITH THE CORPORATION OR ANY PARENT OR ANY SUBSIDIARY OR AFFILIATE OF THE CORPORATION AT

ANY TIME, WITH OR WITHOUT CAUSE AND WITH OR WITHOUT PRIOR NOTICE.

BY ACCEPTING THIS AGREEMENT, THE GRANTEE ACKNOWLEDGES RECEIPT OF A COPY OF THE

PLAN AND REPRESENTS THAT THE GRANTEE IS FAMILIAR WITH THE TERMS AND PROVISIONS OF THE PLAN. THE GRANTEE ACCEPTS THE RSUs SUBJECT TO ALL OF THE TERMS AND PROVISIONS OF THIS AGREEMENT. THE GRANTEE HAS REVIEWED THE PLAN AND THIS AGREEMENT IN THEIR

ENTIRETY. THE GRANTEE AGREES TO ACCEPT AS BINDING, CONCLUSIVE AND FINAL ALL DECISIONS OR INTERPRETATIONS OF THE COMMITTEE UPON ANY QUESTIONS ARISING UNDER THIS AGREEMENT.

|

|

|

| By: |

|

|

|

| Name: [NAME OF GRANTEE] |

|

|

| Dated: |

|

|

6

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

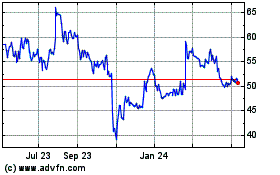

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Feb 2025 to Mar 2025

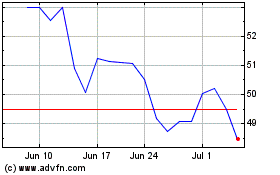

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Mar 2024 to Mar 2025