Gentherm (NASDAQ:THRM), a global market leader of innovative

thermal management and pneumatic comfort technologies, today

announced its financial results for the fourth quarter and full

year ended December 31, 2024.

Bill Presley, the Company's President and CEO, said, “In 2024,

the Company leveraged its culture of innovation to launch new

products, record automotive new business awards well over $2

billion for the 2nd consecutive year, and achieved record Adjusted

EBITDA. Gentherm has a strong foundation, unique capabilities and

product offerings, as well as sustainable competitive advantages.

As we look to the future, we will leverage these capabilities,

scale our technologies, and optimize our operations to drive

shareholder value.”

Fourth Quarter Highlights

- Product revenues of $352.9 million decreased 3.8% from $366.9

million in the fourth quarter of 2023. Excluding the impact of

foreign currency translation, product revenues decreased 3.3% year

over year

- Automotive revenues decreased 4.3% year over year; excluding

the impact of foreign currency translation, automotive revenues

decreased 3.7% year over year

- GAAP diluted earnings per share was $0.49 as compared with

$0.56 for the prior-year period

- Adjusted diluted earnings per share was $0.29. Adjusted diluted

earnings per share in the prior-year period was $0.90

- Secured automotive new business awards totaling $640 million in

the quarter

Full Year 2024 Highlights

- Product revenues of $1,456.1 million decreased 0.9% from

$1,469.1 million in 2023. Excluding the impact of foreign currency

translation, product revenues decreased 0.4% year over year

- Automotive revenues decreased 1.2% year over year; excluding

the impact of foreign currency translation, automotive revenues

decreased 0.7% year over year

- GAAP diluted earnings per share was $2.06 as compared with

$1.22 for the prior year

- Adjusted diluted earnings per share was $2.33. Adjusted diluted

earnings per share in the prior year was $2.59

- Secured automotive new business awards totaling $2.4

billion

- Maintained net leverage ~0.5x while investing in operations,

and share repurchases

- Repurchased $50.2 million of the Company’s common stock

2024 Fourth Quarter Financial ReviewProduct

revenues for the fourth quarter of 2024 decreased by $14.0 million,

or 3.8%, as compared with the prior-year period. Excluding the

impact of foreign currency translation, product revenues decreased

3.3% year over year.

Automotive revenues decreased 4.3% year over year. Adjusting for

foreign currency translation, phasing out the non-automotive and

contract manufacturing electronics business as well as one-time

benefits from recoveries in the prior year, Automotive revenues

decreased 1.8% year over year. Revenues from Automotive Climate and

Comfort Solutions increased 1.7% in the fourth quarter compared to

the prior-year period.

According to S&P Global Mobility’s mid-February report,

actual light vehicle production increased by 0.4% in the fourth

quarter when compared with the same quarter of 2023 in the

Company’s key markets of North America, Europe, China, Japan, and

South Korea.

Gentherm Medical revenue increased 8.4% year over year.

Adjusting for the impact of foreign currency translation, Medical

revenues increased 8.9%.

Gross margin rate decreased to 24.4% in the current-year period,

as compared with 26.2% in the prior-year period. The decrease from

the prior-year period was driven by product mix, higher freight

costs, the impact of foreign exchange, and the costs related to our

new plants opening in Monterrey, Mexico and Tangier, Morocco.

Net research and development expenses of $21.1 million in the

quarter decreased slightly compared to the prior-year period

primarily as a result of lower third-party spend.

Selling, general and administrative expenses of $38.6 million in

the quarter decreased $3.3 million versus the prior-year period.

The year-over-year decrease was primarily driven by lower

compensation expenses, partially offset by leadership transition

expenses in 2024.

Restructuring expenses, net of $0.7 million in the current-year

period, decreased $0.6 million, versus the prior-year period

primarily as a result of higher costs associated with footprint

optimization in the prior-year.

The Company recorded Adjusted EBITDA of $41.4 million in the

quarter compared with $49.0 million in the prior-year period, a

decrease of $7.6 million or 15.6%.

Income tax expense in the quarter was $20.8 million, as compared

with income tax gain of $0.9 million in the prior-year period. The

year-over-year increase was primarily driven by one-time tax

settlements relating to prior period tax audits.

GAAP diluted earnings per share for the quarter was $0.49

compared with $0.56 for the prior-year period. Adjusted diluted

earnings per share for the quarter was $0.29 compared with $0.90

for the prior-year period.

2024 Full Year Financial Review

For full year 2024, the Company reported product revenues of

$1,456.1 million, a 0.9% decrease over the prior year. Excluding

the impact of foreign currency translation, product revenues

decreased 0.4% year over year.

In the Automotive segment, 2024 full-year revenue was $1,406.3

million, a 1.2% decrease compared to the prior year. Revenue

increases in the Lumbar and Massage Comfort Solutions and Steering

Wheel Heater product categories were offset by decreases in the

Climate Control Seat and Seat Heater categories and automotive

revenue not related to Automotive Climate and Comfort Solutions.

Adjusting for foreign currency translation Automotive revenue

decreased 0.7% year over year. Adjusting for foreign currency

translation, phasing out the non-automotive and contract

manufacturing electronics business as well as one-time benefits

from recoveries in the prior year, Automotive revenue increased

0.8% year over year.

According to S&P Global Mobility’s mid-February 2025 report,

actual light vehicle production decreased 1.0% for the full year

2024 compared to full year 2023 in the Company’s key markets of

North America, Europe, China, Japan and South Korea.

Medical segment revenue was $49.8 million for full year 2024, an

8.1% increase compared to the prior year. Adjusting for foreign

currency translation, Medical revenues increased 8.2%.

Gross margin rate was 25.2% in 2024, a 130 basis point increase

from 2023, primarily as a result of strong material performance,

productivity, and the impact of our previously announced exit of

the non-automotive electronics business, partially offset by annual

price reductions, wage inflation, and the costs related to our new

plants opening in Monterrey, Mexico and Tangier, Morocco.

Net research and development expenses of $88.7 million in 2024

decreased 6.0% primarily as a result of lower project spend and a

reduction in resources allocated to the battery performance

solutions product category.

Selling, general and administrative expenses of $155.1 million

in 2024 decreased $0.5 million, or 0.3%, versus the prior year

period. The year over year decrease was primarily driven by

acquisition and integration expenses in the prior year and lower

compensation expenses, partially offset by leadership transition

costs and increased investment in information technology in

2024.

The Company incurred $13.1 million in restructuring expenses,

net in 2024, compared to $4.7 million in the prior year period

primarily as a result of manufacturing footprint optimization and

reductions to the global salaried workforce. The Company recorded

impairment of goodwill charges of $19.5 million in 2023 related to

the Medical segment.

The Company recorded Adjusted EBITDA of $182.9 million in 2024

compared with $180.6 million in the prior year, an increase of $2.3

million or 1.3%.

Income tax expense in 2024 was $37.3 million, as compared with

$14.6 million in the prior year. The effective tax rate was 36.5%

for 2024. This rate differed from the Federal statutory rate of

21%, primarily due to unfavorable geographic mix of earnings as

well as the impact of one-time tax settlements relating to prior

period tax audits. Excluding the impact of prior period tax audits,

the effective tax rate was 26.9%. GAAP diluted earnings per share

for full year 2024 was $2.06 as compared with $1.22 for the prior

year. Adjusted diluted earnings per share for full year 2024 was

$2.33 as compared with $2.59 for the prior year.

The Company provides various non-GAAP financial measures in this

release. See “Use of Non-GAAP Measures” below for additional

information, including definitions, usefulness for investors and

limitations, as well as reconciliations below to the most directly

comparable GAAP financial measures.

Guidance

The Company is providing the following guidance for full year

2025:

- Product revenues between $1.4 billion and $1.5 billion

- Adjusted EBITDA between 12% and 13% of product revenues

- Full year effective tax rate between 26% and 29%

- Capital expenditures between $70 million and $80 million

Guidance assumptions:

- Based on the current forecast of customer orders, our

expectations of near-term conditions, and light vehicle production

in our key markets decreasing at low single digit rate for full

year 2025 versus 2024, and a EUR to USD exchange rate of

$1.03/Euro. These assumptions do not include any impact of

potential changes to tariffs.

Conference CallAs previously announced,

Gentherm will conduct a conference call today at 8:00 am Eastern

Time to review these results. The dial-in number for the call is

1-877-407-4018 (callers in the U.S.) or +1-201-689-8471 (callers

outside this U.S.). The passcode for the live call is 13751539.

A live webcast and one-year archived replay of the call can be

accessed on the Events page of the Investor section of Gentherm's

website at www.gentherm.com.

A telephonic replay will be available approximately two hours

after the call until 11:59 pm Eastern Time on March 5, 2025. The

replay can be accessed by dialing 1-844-512-2921 (callers in the

U.S.), or +1-412-317-6671 (callers outside the U.S.). The passcode

for the replay is 13751539.

Investor Contact Gregory

Blanchetteinvestors@gentherm.com 248.308.1702

Media Contact Melissa

Fischer media@gentherm.com 248.289.9702

About GenthermGentherm (NASDAQ: THRM)

is a global market leader of innovative thermal management and

pneumatic comfort technologies. Automotive products include

variable temperature Climate Control Seats®, heated automotive

interior systems (including heated seats, steering wheels, armrests

and other components), battery performance solutions, cable

systems, lumbar and massage comfort solutions, valve system

technologies, and other electronic devices. Medical products

include patient temperature management systems. The Company is also

developing a number of new technologies and products that will help

enable improvements to existing products and to create new product

applications for existing and new markets. Gentherm has

more than 14,000 employees in facilities in the United

States, Germany, China, Czech Republic, Hungary,

Japan, Malta, Mexico, Morocco, North

Macedonia, South Korea, United Kingdom, Ukraine,

and Vietnam. For more information, go

to www.gentherm.com.

Forward-Looking Statements Except for

historical information contained herein, statements in this release

are forward-looking statements that are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements represent Gentherm

Incorporated's goals, beliefs, plans and expectations about its

prospects for the future and other future events. The

forward-looking statements included in this release are made as of

the date hereof or as of the date specified herein and are based on

management's reasonable expectations and beliefs. In making these

statements we rely on assumptions and analysis based on our

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors we

consider appropriate under the circumstances. Such statements are

subject to a number of important assumptions, significant risks and

uncertainties (some of which are beyond our control) and other

factors that may cause actual results or performance to differ

materially from that described in or indicated by the

forward-looking statements, including but not limited to:

- macroeconomic, geopolitical and similar global factors in the

cyclical Automotive industry;

- increasing U.S. and global competition, including with

non-traditional entrants;

- our ability to effectively manage new product launches and

research and development, and the market acceptance of such

products and technologies;

- the evolution and recent challenges of the automotive industry

towards electric vehicles, autonomous vehicles and mobility on

demand services, and related consumer behaviors and

preferences;

- our ability to convert automotive new business awards into

product revenues;

- the recent supply-constrained environment, and inflationary and

other cost pressures;

- the production levels of our major customers and OEMs in our

key markets and sudden fluctuations in such production levels;

- our business in China, which is subject to unique operational,

competitive, regulatory and economic risks;

- the impact of our global operations, including our global

supply chain, operations within Ukraine, and foreign currency and

exchange risk;

- the impact of global economic and trade policies, including

increases in duties, tariffs and taxation on the import or export

of our products related to U.S. trade disputes;

- our ability to attract and retain highly skilled employees and

wage inflation;

- a tightening labor market, labor shortages or work stoppages

impacting us, our customers or our suppliers, such as recent labor

strikes among certain OEMs and suppliers;

- our achievement of product cost reductions to offset

customer-imposed price reductions or other pricing pressures;

- our product quality and safety and impact of product safety

recalls and alleged defects in products;

- our ability to execute efforts to optimize our global supply

chain and manufacturing footprint, including opening new facilities

and transferring production;

- our ability to integrate our recent acquisitions and realize

synergies, as well as to consummate additional strategic

acquisitions, investments and exits, and achieve planned

benefits;

- any security breaches and other disruptions to our information

technology networks and systems, as well as privacy, data security

and data protection risks, including risks associated with use of

artificial intelligence capabilities in our business

operations;

- any loss or insolvency of our key customers and OEMs, or key

suppliers;

- our ability to project future sales volume based on third-party

information, based on which we manage our business;

- the protection of our intellectual property in certain

jurisdictions;

- our compliance with global anti-corruption laws and

regulations;

- legal and regulatory proceedings and claims involving us or one

of our major customers;

- the extensive regulation of our patient temperature management

business;

- risks associated with our manufacturing processes;

- the effects of climate change and catastrophic events, as well

as regulatory and stakeholder-imposed requirements to address

climate change and other sustainability issues;

- our product quality and safety;

- our borrowing availability under our revolving credit facility,

as well ability to access the capital markets, to support our

planned growth; and

- our indebtedness and compliance with our debt covenants.

The foregoing risks should be read in conjunction with the

Company's reports filed with or furnished to the Securities and

Exchange Commission (the “SEC”), including “Risk Factors,” in its

most recent Annual Report on Form 10-K and subsequent SEC filings,

for a discussion of these and other risks and uncertainties. In

addition, with reasonable frequency, we have entered into business

combinations, acquisitions, divestitures, strategic investments and

other significant transactions. Such forward-looking statements do

not include the potential impact of any such transactions that may

be completed after the date hereof, each of which may present

material risks to the Company’s future business and financial

results.

Except as required by law, the Company expressly disclaims any

obligation or undertaking to update any forward-looking statements

to reflect any change in its expectations with regard thereto or

any change in events, conditions or circumstances on which any such

statement is based.

Use of Non-GAAP Financial Measures In addition

to the results reported in accordance with GAAP throughout this

release, the Company has provided here or elsewhere information

regarding: adjusted earnings before interest, taxes, depreciation

and amortization (“Adjusted EBITDA”); Adjusted EBITDA margin;

adjusted earnings per share (“Adjusted earnings per share” or

“Adjusted EPS”); free cash flow; Net Debt, net leverage ratio (“net

leverage”), revenue, segment revenue and product revenue excluding

foreign currency translation and other specified gains and losses;

Automotive Climate and Comfort Solutions revenues; and adjusted

operating expenses, each a non-GAAP financial measure. The Company

defines Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, deferred financing cost

amortization, non-cash stock based compensation expenses,

restructuring expenses, net, unrealized currency gain or loss and

other gains and losses not reflective of the Company’s ongoing

operations and related tax effects. The Company defines Adjusted

EBITDA margin as Adjusted EBITDA divided by product revenues. The

Company defines Adjusted EPS as earnings adjusted by restructuring

expenses, net, unrealized currency gain or loss and other gains and

losses not reflective of the Company’s ongoing operations and

related tax effects. The Company defines Free Cash Flow as Net cash

provided by operating activities less Purchases of property and

equipment. The Company defines Net Debt as the principal amount of

all Consolidated Funded Indebtedness (as defined in the Credit

Agreement) less cash and cash equivalents. The Company defines net

leverage as Net Debt divided by Adjusted EBITDA for the trailing

four fiscal quarters. The Company defines revenue, segment revenue

or product revenue excluding foreign currency translation and other

specified gains and losses as such revenue, excluding the estimated

effects of foreign currency exchange on revenue by translating

actual revenue using the prior period foreign currency exchange

rates and excluding the other items specified in the reconciliation

tables herein. The Company defines Automotive Climate and Comfort

Solutions revenues as Automotive revenue excluding specified

product revenues and the impact of non-automotive electronics and

contract manufacturing electronics revenues. The Company defines

adjusted operating expenses as operating expenses excluding related

non-cash stock based compensation, restructuring expenses, net, and

other losses not reflective of the Company’s ongoing

operations.

The Company’s reconciliations are included in this release or

can be found in the supplemental materials furnished as Exhibit

99.2 to the Company’s Form 8-K dated February 19, 2025.

In evaluating its business, the Company considers and uses Free

Cash Flow and Net Debt as supplemental measures of its liquidity

and the other non-GAAP financial measures as supplemental measures

of its operating performance. Management provides such non-GAAP

financial measures so that investors will have the same financial

information that management uses with the belief that it will

assist investors in properly assessing the Company's performance on

a period-over-period basis by excluding matters not indicative of

the Company’s ongoing operating or liquidity results and therefore

enhance the comparability of the Company's results and provide

additional information for analyzing trends in the business. In

evaluating our non-GAAP financial measures, you should be aware

that in the future we may incur revenues, expenses, and cash and

non-cash obligations that are the same as or similar to some of the

adjustments in our presentation of non-GAAP financial measures. Our

presentation of non-GAAP financial measures should not be construed

as an inference that our future results will be unaffected by

unusual or non-recurring items. There also can be no assurance that

we will not modify the presentation of our non-GAAP financial

measures in the future, and any such modification may be material.

Other companies in our industry may define and calculate these

non-GAAP financial measures differently than we do and those

calculations may not be comparable to our metrics. These non-GAAP

measures have limitations as analytical tools, and when assessing

the Company's operating performance or liquidity, investors should

not consider these non-GAAP measures in isolation, or as a

substitute for net income (loss), revenue or other consolidated

income statement or cash flow statement data prepared in accordance

with GAAP.

Non-GAAP measures referenced in this release and other public

communications may include estimates of future Adjusted EBITDA,

Adjusted EBITDA margin and Adjusted EPS. The Company has not

reconciled the non-GAAP forward-looking guidance included in this

release to the most directly comparable GAAP measures because this

cannot be done without unreasonable effort due to the variability

and low visibility with respect to taxes and non-recurring items,

which are potential adjustments to future earnings. We expect the

variability of these items to have a potentially unpredictable, and

a potentially significant, impact on our future GAAP financial

results.

|

GENTHERM INCORPORATEDCONSOLIDATED

CONDENSED STATEMENTS OF INCOME(Dollars in

thousands, except per share data)

(Unaudited) |

|

|

|

|

Three Months

EndedDecember 31, |

|

|

Year EndedDecember 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Product revenues |

|

$ |

352,914 |

|

|

$ |

366,933 |

|

|

$ |

1,456,124 |

|

|

$ |

1,469,076 |

|

| Cost of sales |

|

|

266,810 |

|

|

|

270,637 |

|

|

|

1,089,693 |

|

|

|

1,117,452 |

|

|

Gross margin |

|

|

86,104 |

|

|

|

96,296 |

|

|

|

366,431 |

|

|

|

351,624 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net research and development expenses |

|

|

21,078 |

|

|

|

21,367 |

|

|

|

88,697 |

|

|

|

94,358 |

|

|

Selling, general and administrative expenses |

|

|

38,646 |

|

|

|

41,899 |

|

|

|

155,108 |

|

|

|

155,579 |

|

|

Restructuring expenses, net |

|

|

768 |

|

|

|

1,327 |

|

|

|

13,110 |

|

|

|

4,739 |

|

|

Impairment of intangible assets and property and equipment |

|

|

1,971 |

|

|

|

— |

|

|

|

2,501 |

|

|

|

— |

|

|

Impairment of goodwill |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

19,509 |

|

|

Total operating expenses |

|

|

62,463 |

|

|

|

64,593 |

|

|

|

259,416 |

|

|

|

274,185 |

|

| Operating income |

|

|

23,641 |

|

|

|

31,703 |

|

|

|

107,015 |

|

|

|

77,439 |

|

| Interest expense, net |

|

|

(3,344 |

) |

|

|

(5,197 |

) |

|

|

(15,300 |

) |

|

|

(14,641 |

) |

| Foreign currency gain (loss) |

|

|

15,812 |

|

|

|

(6,302 |

) |

|

|

9,599 |

|

|

|

(5,918 |

) |

| Other (loss) income |

|

|

(1 |

) |

|

|

(2,984 |

) |

|

|

951 |

|

|

|

(1,926 |

) |

| Earnings before income tax |

|

|

36,108 |

|

|

|

17,220 |

|

|

|

102,265 |

|

|

|

54,954 |

|

| Income tax expense (gain) |

|

|

20,787 |

|

|

|

(867 |

) |

|

|

37,318 |

|

|

|

14,611 |

|

| Net income |

|

$ |

15,321 |

|

|

$ |

18,087 |

|

|

$ |

64,947 |

|

|

$ |

40,343 |

|

| Basic earnings per share |

|

$ |

0.50 |

|

|

$ |

0.57 |

|

|

$ |

2.08 |

|

|

$ |

1.23 |

|

| Diluted earnings per share |

|

$ |

0.49 |

|

|

$ |

0.56 |

|

|

$ |

2.06 |

|

|

$ |

1.22 |

|

| Weighted average number of shares

– basic |

|

|

30,912 |

|

|

|

31,974 |

|

|

|

31,293 |

|

|

|

32,778 |

|

| Weighted average number of shares

– diluted |

|

|

31,054 |

|

|

|

32,200 |

|

|

|

31,476 |

|

|

|

33,067 |

|

|

GENTHERM INCORPORATEDREVENUE BY PRODUCT

CATEGORY AND RECONCILIATION OF FOREIGN CURRENCY TRANSLATION

IMPACT(Dollars in

thousands)(Unaudited) |

|

|

|

|

Three Months

EndedDecember 31, |

|

|

Year EndedDecember 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

|

Climate Control Seat |

|

$ |

116,031 |

|

|

$ |

121,797 |

|

|

|

(4.7 |

)% |

|

$ |

468,820 |

|

|

$ |

482,665 |

|

|

|

(2.9 |

)% |

| Seat Heaters |

|

|

70,752 |

|

|

|

77,456 |

|

|

|

(8.7 |

)% |

|

|

297,866 |

|

|

|

308,588 |

|

|

|

(3.5 |

)% |

| Lumbar and Massage Comfort

Solutions |

|

|

45,494 |

|

|

|

35,321 |

|

|

|

28.8 |

% |

|

|

178,584 |

|

|

|

144,923 |

|

|

|

23.2 |

% |

| Steering Wheel Heaters |

|

|

42,824 |

|

|

|

38,777 |

|

|

|

10.4 |

% |

|

|

169,763 |

|

|

|

153,943 |

|

|

|

10.3 |

% |

| Valve Systems |

|

|

23,082 |

|

|

|

23,746 |

|

|

|

(2.8 |

)% |

|

|

105,056 |

|

|

|

106,262 |

|

|

|

(1.1 |

)% |

| Automotive Cables |

|

|

15,906 |

|

|

|

19,862 |

|

|

|

(19.9 |

)% |

|

|

73,091 |

|

|

|

79,993 |

|

|

|

(8.6 |

)% |

| Battery Performance

Solutions |

|

|

11,643 |

|

|

|

18,346 |

|

|

|

(36.5 |

)% |

|

|

58,183 |

|

|

|

75,484 |

|

|

|

(22.9 |

)% |

| Electronics |

|

|

6,847 |

|

|

|

9,931 |

|

|

|

(31.1 |

)% |

|

|

33,065 |

|

|

|

40,387 |

|

|

|

(18.1 |

)% |

| Other Automotive |

|

|

6,255 |

|

|

|

8,709 |

|

|

|

(28.2 |

)% |

|

|

21,850 |

|

|

|

30,707 |

|

|

|

(28.8 |

)% |

|

Subtotal Automotive segment |

|

|

338,834 |

|

|

|

353,945 |

|

|

|

(4.3 |

)% |

|

|

1,406,278 |

|

|

|

1,422,952 |

|

|

|

(1.2 |

)% |

| Medical segment |

|

|

14,080 |

|

|

|

12,988 |

|

|

|

8.4 |

% |

|

|

49,846 |

|

|

|

46,124 |

|

|

|

8.1 |

% |

|

Total Company |

|

$ |

352,914 |

|

|

$ |

366,933 |

|

|

|

(3.8 |

)% |

|

$ |

1,456,124 |

|

|

$ |

1,469,076 |

|

|

|

(0.9 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

impact(a) |

|

|

(1,995 |

) |

|

|

— |

|

|

|

|

|

|

(7,129 |

) |

|

|

— |

|

|

|

|

|

Total Company, excluding foreign currency translation impact |

|

$ |

354,909 |

|

|

$ |

366,933 |

|

|

|

(3.3 |

)% |

|

$ |

1,463,253 |

|

|

$ |

1,469,076 |

|

|

|

(0.4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Foreign

currency translation impacts for the Automotive segment and Medical

segment were $(1,931) and $(64), respectively, for the three months

ended December 31, 2024. Foreign currency translation impacts for

the Automotive segment and Medical segment were $(7,060) and $(70),

respectively, for the twelve months ended December 31, 2024. |

|

|

GENTHERM INCORPORATEDRECONCILIATION OF NET

INCOME TO ADJUSTED EBITDA AND ADJUSTED EBITDA

MARGIN(Dollars in

thousands)(Unaudited) |

|

|

|

|

Three Months

EndedDecember 31, |

|

|

Year EndedDecember 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net income |

|

$ |

15,321 |

|

|

$ |

18,087 |

|

|

$ |

64,947 |

|

|

$ |

40,343 |

|

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

12,587 |

|

|

|

12,062 |

|

|

|

51,329 |

|

|

|

50,416 |

|

|

Income tax expense (benefit) (a) |

|

|

20,787 |

|

|

|

(867 |

) |

|

|

37,318 |

|

|

|

14,611 |

|

|

Interest expense, net (b) |

|

|

3,344 |

|

|

|

5,197 |

|

|

|

15,300 |

|

|

|

14,641 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash stock based compensation |

|

|

98 |

|

|

|

3,164 |

|

|

|

10,432 |

|

|

|

11,756 |

|

|

Restructuring expenses, net |

|

|

768 |

|

|

|

1,327 |

|

|

|

13,110 |

|

|

|

4,739 |

|

|

Unrealized currency (gain) loss |

|

|

(16,970 |

) |

|

|

4,898 |

|

|

|

(10,719 |

) |

|

|

9,125 |

|

|

Leadership transition expenses |

|

|

3,802 |

|

|

|

— |

|

|

|

3,802 |

|

|

|

— |

|

|

Impairment of intangible assets and property and equipment |

|

|

1,971 |

|

|

|

— |

|

|

|

2,501 |

|

|

|

— |

|

|

Acquisition and integration expenses |

|

|

— |

|

|

|

578 |

|

|

|

— |

|

|

|

5,308 |

|

|

Impairment of goodwill |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

19,509 |

|

|

Non-automotive electronics inventory (benefit) charge |

|

|

(103 |

) |

|

|

575 |

|

|

|

(4,554 |

) |

|

|

6,064 |

|

|

Other (c) |

|

|

(231 |

) |

|

|

4,001 |

|

|

|

(574 |

) |

|

|

4,072 |

|

| Adjusted EBITDA |

|

$ |

41,374 |

|

|

$ |

49,022 |

|

|

$ |

182,892 |

|

|

$ |

180,584 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product revenues |

|

$ |

352,914 |

|

|

$ |

366,933 |

|

|

$ |

1,456,124 |

|

|

$ |

1,469,076 |

|

| Net income margin |

|

|

4.3 |

% |

|

|

4.9 |

% |

|

|

4.5 |

% |

|

|

2.7 |

% |

| Adjusted EBITDA margin |

|

|

11.7 |

% |

|

|

13.4 |

% |

|

|

12.6 |

% |

|

|

12.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Includes

$2,423 of deferred income tax benefit associated with the goodwill

impairment of the Medical reporting unit for the twelve months

ended December 31, 2023. |

|

| (b) Includes $186

and $1,343 of interest expense for the three months and twelve

months ended December 31, 2024, related to mark-to-market

adjustment of our floating-to-fixed interest rate swap agreement

with a notional amount of $100,000. |

|

| (c) Includes

$2,900 of non-cash impairment charges related to our Carrar Ltd.

Investment for the three and twelve months ended December 31,

2023. |

|

|

GENTHERM INCORPORATEDRECONCILIATION OF NET

INCOME TO ADJUSTED NET INCOME AND ADJUSTED

EARNINGS PER SHARE(Dollars in thousands, except

per share data)(Unaudited) |

|

| |

|

Three Months

EndedDecember 31, |

|

|

Year EndedDecember 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net income |

|

$ |

15,321 |

|

|

$ |

18,087 |

|

|

$ |

64,947 |

|

|

$ |

40,343 |

|

|

Non-cash purchase accounting impact |

|

|

1,572 |

|

|

|

1,604 |

|

|

|

6,369 |

|

|

|

7,397 |

|

|

Restructuring expenses, net |

|

|

768 |

|

|

|

1,327 |

|

|

|

13,110 |

|

|

|

4,739 |

|

|

Unrealized currency (gain) loss |

|

|

(16,970 |

) |

|

|

4,898 |

|

|

|

(10,719 |

) |

|

|

9,125 |

|

|

Leadership transition expenses |

|

|

3,802 |

|

|

|

— |

|

|

|

3,802 |

|

|

|

— |

|

|

Impairment of intangible assets and property and equipment |

|

|

1,971 |

|

|

|

— |

|

|

|

2,501 |

|

|

|

— |

|

|

Acquisition and integration expenses |

|

|

— |

|

|

|

578 |

|

|

|

— |

|

|

|

5,308 |

|

|

Impairment of goodwill |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

19,509 |

|

|

Non-automotive electronics inventory (benefit) charge |

|

|

(103 |

) |

|

|

575 |

|

|

|

(4,554 |

) |

|

|

6,064 |

|

|

Other (a) |

|

|

(231 |

) |

|

|

4,001 |

|

|

|

(574 |

) |

|

|

4,072 |

|

|

Tax effect of above |

|

|

2,964 |

|

|

|

(2,179 |

) |

|

|

(1,582 |

) |

|

|

(10,814 |

) |

| Adjusted net income |

|

$ |

9,094 |

|

|

$ |

28,891 |

|

|

$ |

73,300 |

|

|

$ |

85,743 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

30,912 |

|

|

|

31,974 |

|

|

|

31,293 |

|

|

|

32,778 |

|

|

Diluted |

|

|

31,054 |

|

|

|

32,200 |

|

|

|

31,476 |

|

|

|

33,067 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share, as

reported: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.50 |

|

|

$ |

0.57 |

|

|

$ |

2.08 |

|

|

$ |

1.23 |

|

|

Diluted |

|

$ |

0.49 |

|

|

$ |

0.56 |

|

|

$ |

2.06 |

|

|

$ |

1.22 |

|

| Adjusted earnings per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.29 |

|

|

$ |

0.90 |

|

|

$ |

2.34 |

|

|

$ |

2.62 |

|

|

Diluted |

|

$ |

0.29 |

|

|

$ |

0.90 |

|

|

$ |

2.33 |

|

|

$ |

2.59 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Includes

$2,900 of non-cash impairment charges related to our Carrar Ltd.

Investment for the three and twelve months ended December 31,

2023. |

|

|

GENTHERM INCORPORATEDCONSOLIDATED

CONDENSED BALANCE SHEETS (Dollars in thousands,

except share data) (Unaudited) |

|

| |

|

December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| ASSETS |

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

134,134 |

|

|

$ |

149,673 |

|

|

Accounts receivable, net |

|

|

258,112 |

|

|

|

253,579 |

|

|

Inventory, net |

|

|

227,356 |

|

|

|

205,892 |

|

|

Other current assets |

|

|

64,413 |

|

|

|

78,420 |

|

|

Total current assets |

|

|

684,015 |

|

|

|

687,564 |

|

| Property and equipment, net |

|

|

252,970 |

|

|

|

245,234 |

|

| Goodwill |

|

|

99,603 |

|

|

|

104,073 |

|

| Other intangible assets, net |

|

|

57,251 |

|

|

|

66,482 |

|

| Operating lease right-of-use

assets |

|

|

43,954 |

|

|

|

27,358 |

|

| Deferred income tax assets |

|

|

75,041 |

|

|

|

81,930 |

|

| Other non-current assets |

|

|

34,722 |

|

|

|

21,730 |

|

|

Total assets |

|

$ |

1,247,556 |

|

|

$ |

1,234,371 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

226,815 |

|

|

$ |

215,827 |

|

|

Current lease liabilities |

|

|

7,517 |

|

|

|

7,700 |

|

|

Current maturities of long-term debt |

|

|

137 |

|

|

|

621 |

|

|

Other current liabilities |

|

|

105,824 |

|

|

|

100,805 |

|

|

Total current liabilities |

|

|

340,293 |

|

|

|

324,953 |

|

| Long-term debt, less current

maturities |

|

|

220,064 |

|

|

|

222,217 |

|

| Non-current lease

liabilities |

|

|

37,052 |

|

|

|

16,175 |

|

| Pension benefit obligation |

|

|

4,017 |

|

|

|

3,209 |

|

| Other non-current

liabilities |

|

|

29,183 |

|

|

|

23,095 |

|

|

Total liabilities |

|

$ |

630,609 |

|

|

$ |

589,649 |

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

Common Stock: |

|

|

|

|

|

|

|

No par value; 55,000,000 shares authorized 30,788,639 and

31,542,001 issued and outstanding at December 31, 2024 and

December 31, 2023, respectively |

|

|

2,049 |

|

|

|

50,503 |

|

|

Paid-in capital |

|

|

4,290 |

|

|

|

— |

|

|

Accumulated other comprehensive loss |

|

|

(85,193 |

) |

|

|

(30,160 |

) |

|

Accumulated earnings |

|

|

695,801 |

|

|

|

624,379 |

|

|

Total shareholders’ equity |

|

|

616,947 |

|

|

|

644,722 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

1,247,556 |

|

|

$ |

1,234,371 |

|

|

GENTHERM INCORPORATED CONSOLIDATED

CONDENSED STATEMENTS OF CASH FLOWS (Dollars in

thousands) (Unaudited) |

|

|

|

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| Operating Activities: |

|

|

|

|

|

|

|

Net income |

|

$ |

64,947 |

|

|

$ |

40,343 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

52,975 |

|

|

|

50,948 |

|

|

Deferred income taxes |

|

|

10,580 |

|

|

|

(13,072 |

) |

|

Stock based compensation |

|

|

10,432 |

|

|

|

11,627 |

|

|

Provisions for inventory |

|

|

6,437 |

|

|

|

6,867 |

|

|

Impairment of intangible assets and property and equipment |

|

|

2,501 |

|

|

|

— |

|

|

Loss on disposition of property and equipment |

|

|

(1,603 |

) |

|

|

721 |

|

|

Impairment of goodwill |

|

|

— |

|

|

|

19,509 |

|

|

Other |

|

|

(1,156 |

) |

|

|

2,920 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

(12,077 |

) |

|

|

(4,195 |

) |

|

Inventory |

|

|

(34,195 |

) |

|

|

6,907 |

|

|

Other assets |

|

|

(44,696 |

) |

|

|

(26,179 |

) |

|

Accounts payable |

|

|

16,222 |

|

|

|

31,029 |

|

|

Other liabilities |

|

|

39,279 |

|

|

|

(8,160 |

) |

|

Net cash provided by operating activities |

|

|

109,646 |

|

|

|

119,265 |

|

| Investing Activities: |

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(73,314 |

) |

|

|

(37,602 |

) |

|

Proceeds from the sale of property and equipment |

|

|

7,862 |

|

|

|

391 |

|

|

Proceeds from deferred purchase price of factored receivables |

|

|

12,876 |

|

|

|

13,903 |

|

|

Cost of technology investments |

|

|

(955 |

) |

|

|

(815 |

) |

|

Net cash used in investing activities |

|

|

(53,531 |

) |

|

|

(24,123 |

) |

| Financing Activities: |

|

|

|

|

|

|

|

Borrowings on debt |

|

|

68,000 |

|

|

|

60,000 |

|

|

Repayments of debt |

|

|

(70,615 |

) |

|

|

(72,280 |

) |

|

Proceeds from the exercise of Common Stock options |

|

|

5,791 |

|

|

|

263 |

|

|

Taxes withheld and paid on employee's share-based payment

awards |

|

|

(3,296 |

) |

|

|

(2,940 |

) |

|

Cash paid for the repurchase of Common Stock |

|

|

(51,585 |

) |

|

|

(91,094 |

) |

|

Net cash used in financing activities |

|

|

(51,705 |

) |

|

|

(106,051 |

) |

|

Foreign currency effect |

|

|

(19,949 |

) |

|

|

6,691 |

|

|

Net decrease in cash and cash equivalents |

|

|

(15,539 |

) |

|

|

(4,218 |

) |

|

Cash and cash equivalents at beginning of period |

|

|

149,673 |

|

|

|

153,891 |

|

|

Cash and cash equivalents at end of period |

|

$ |

134,134 |

|

|

$ |

149,673 |

|

| Supplemental disclosure of cash

flow information: |

|

|

|

|

|

|

|

Cash paid for taxes |

|

$ |

20,837 |

|

|

$ |

23,273 |

|

|

Cash paid for interest |

|

|

13,007 |

|

|

|

13,242 |

|

|

GENTHERM INCORPORATEDOTHER NON-GAAP

RECONCILIATIONS(Dollars in

thousands)(Unaudited) |

|

| |

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Automotive revenues |

|

$ |

338,834 |

|

|

$ |

353,945 |

|

|

$ |

1,406,278 |

|

|

$ |

1,422,952 |

|

|

Less: Non-automotive electronics revenues and contract

manufacturing electronics |

|

|

2,755 |

|

|

|

5,729 |

|

|

|

15,719 |

|

|

|

27,866 |

|

|

Less: One-time benefits from recoveries and retrofits |

|

|

— |

|

|

|

3,877 |

|

|

|

— |

|

|

|

7,974 |

|

| Adjusted Automotive revenues |

|

|

336,079 |

|

|

|

344,339 |

|

|

|

1,390,559 |

|

|

|

1,387,112 |

|

|

Foreign currency translation impact |

|

|

(1,934 |

) |

|

|

— |

|

|

|

(6,982 |

) |

|

|

— |

|

| Adjusted Automotive revenues,

excluding foreign currency translation impact |

|

$ |

338,013 |

|

|

$ |

344,339 |

|

|

$ |

1,397,541 |

|

|

$ |

1,387,112 |

|

| Year over Year % change |

|

|

(1.8 |

)% |

|

|

|

|

|

0.8 |

% |

|

|

|

| |

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Automotive revenues |

|

$ |

338,834 |

|

|

$ |

353,945 |

|

|

$ |

1,406,278 |

|

|

$ |

1,422,952 |

|

|

Less: Valve Systems |

|

|

23,082 |

|

|

|

23,746 |

|

|

|

105,056 |

|

|

|

106,262 |

|

|

Less: Automotive Cables |

|

|

15,906 |

|

|

|

19,862 |

|

|

|

73,091 |

|

|

|

79,993 |

|

|

Less: Battery Performance Solutions |

|

|

11,643 |

|

|

|

18,346 |

|

|

|

58,183 |

|

|

|

75,484 |

|

|

Less: Non-automotive and contract manufacturing electronics |

|

|

2,755 |

|

|

|

5,729 |

|

|

|

15,719 |

|

|

|

27,866 |

|

| Automotive Climate and Comfort

Solutions revenues |

|

|

285,448 |

|

|

|

286,262 |

|

|

|

1,154,229 |

|

|

|

1,133,347 |

|

|

Less: One-time benefits from recoveries and retrofits |

|

|

— |

|

|

|

3,877 |

|

|

|

— |

|

|

|

7,974 |

|

| Adjusted Automotive Climate and

Comfort Solutions revenues |

|

|

285,448 |

|

|

|

282,385 |

|

|

|

1,154,229 |

|

|

|

1,125,373 |

|

|

Foreign currency translation impact |

|

|

(1,630 |

) |

|

|

— |

|

|

|

(6,337 |

) |

|

|

— |

|

| Adjusted Automotive Climate and

Comfort Solutions revenues, excluding foreign currency translation

impact |

|

$ |

287,078 |

|

|

$ |

282,385 |

|

|

$ |

1,160,566 |

|

|

$ |

1,125,373 |

|

| Year over Year % change |

|

|

1.7 |

% |

|

|

|

|

|

3.1 |

% |

|

|

|

| |

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Total operating expenses |

|

$ |

62,463 |

|

|

$ |

64,593 |

|

|

$ |

259,416 |

|

|

$ |

274,185 |

|

|

Restructuring expense, net |

|

|

(768 |

) |

|

|

(1,327 |

) |

|

|

(13,110 |

) |

|

|

(4,739 |

) |

|

Non-cash stock based compensation |

|

|

(192 |

) |

|

|

(3,164 |

) |

|

|

(9,909 |

) |

|

|

(11,382 |

) |

|

Leadership transition expenses |

|

|

(3,802 |

) |

|

|

— |

|

|

|

(3,802 |

) |

|

|

— |

|

|

Impairment of intangible assets and property and equipment |

|

|

(1,971 |

) |

|

|

— |

|

|

|

(2,501 |

) |

|

|

— |

|

|

Impairment of goodwill |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(19,509 |

) |

|

Acquisition and Integration expenses |

|

|

— |

|

|

|

(578 |

) |

|

|

— |

|

|

|

(5,308 |

) |

|

Other |

|

|

231 |

|

|

|

(1,139 |

) |

|

|

(990 |

) |

|

|

(1,729 |

) |

| Adjusted operating

expenses |

|

$ |

55,961 |

|

|

$ |

58,385 |

|

|

$ |

229,104 |

|

|

$ |

231,518 |

|

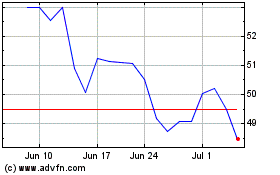

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Feb 2025 to Mar 2025

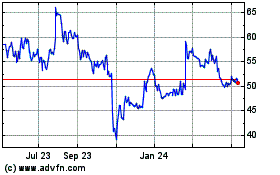

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Mar 2024 to Mar 2025