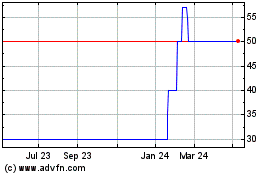

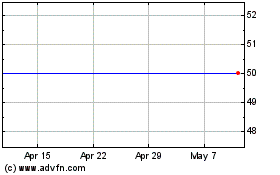

TIDMPLAZ

RNS Number : 3362M

Plaza Centers N.V.

23 August 2013

23 August 2013

PLAZA CENTERS N.V.

RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2013

PLAZA REPORTS OPERATIONAL PROGRESS at its ACTIVEly managed

ASSETS

AND ongoing success in REALIsing NON CORE ASSEts to reduce

LEVERAGE

Plaza Centers N.V. ("Plaza" / "Company" / "Group"), a leading

property developer and investor with operations in Central and

Eastern Europe ("CEE") and India, today announces its results for

the six months ended 30 June 2013.

Financial highlights:

-- Reduction in total assets to EUR793 million (31 December

2012: EUR886 million), mainly as a result of non-cash,

predominantly market-related impairment adjustments of EUR61

million booked in the period (decrease in the value of trading

properties to EUR561 million (31 December 2012: EUR612

million))

-- Total revenues more than doubled following the EUR16.7

million disposal of an Indian investment, and an increase in

revenue from operating shopping centres, to EUR14.3 million (H1

2012: EUR14.1 million), despite a decrease in revenue at Fantasy

Park (decrease of EUR1 million due to the closure of some gaming

and entertainment units) and Koregaon Park, which was partly closed

for the majority of the period

-- Loss for the six months of EUR81 million (30 June 2012: EUR10

million loss), stemming mainly from the non-cash EUR61 million

impairment of trading properties (of which 42% relates to assets in

Serbia, 21% to Czech Republic, 26% to India and 11% to Greece),

fair value adjustments and the share in loss of associated

companies

-- Basic and diluted loss per share of EUR0.27 (30 June 2012: EUR0.03 loss per share)

-- Cash position at the period end (including restricted bank

deposits and available for sale financial assets) of EUR100 million

(31 December 2012: EUR66 million) with working capital of EUR390

million (31 December 2012: EUR391 million); current cash position

of circa EUR32 million following a EUR67 million bond principal and

interest repayment on 1 July 2013

Operational highlights:

-- Plaza successfully completed its first exit in India

following the sale of its 50% stake in a vehicle which primarily

owns interests in an office complex project located in Pune,

Maharashtra. The transaction valued the assets collectively at

EUR33.4 million and, as a result, Plaza has received gross cash

proceeds of circa EUR16.7 million in line with its holding

-- Improved occupancy levels achieved across the Company's

existing shopping and entertainment centres, with the overall

portfolio occupancy rate increasing to 89% (31 December 2012: 88%)

as at the reporting date, with the following notable successes:

o At Zgorzelec Plaza, Poland, three contracted anchor tenants

opened their stores in the second quarter, increasing the turnover

by 65% and footfall by 42% compared to June last year

o At Kragujevac Plaza, occupancy reached 100% a year since

opening and turnover increased by 23% compared to June 2012

o At Riga Plaza, H&M was signed as a new anchor tenant,

bringing the mall to almost full occupancy. Turnover and footfall

at the centre has increased by 14% compared to June 2012

o At Torun Plaza, Poland, turnover increased by 24% and footfall

rose by 20% compared to the corresponding period last year

Key highlights since the period end:

-- Plaza has successfully completed the sale of 100% of its

stake in a vehicle which owns the interest in the Prague 3 project

("Prague 3"), a logistics and commercial centre in the third

district of Prague. Earlier this year, Plaza completed a successful

application to change the zoning use of Prague 3 to a residential

scheme. The transaction valued the asset at circa EUR11 million

and, as a result, further to related bank financing and other

balance sheet adjustments, Plaza received net proceeds of circa

EUR7.5 million in cash

-- Plaza has also sold its interest in a SPV which owns a site

in Roztoky, Czech Republic being held for a potential residential

development. The site was sold for circa EUR2 million, resulting in

net cash proceeds of EUR1.3 million after debt-related

deductions

Commenting on the results, Ran Shtarkman, the President and CEO

of Plaza Centers, said:

"We have seen sustained progress towards our key strategic and

operational objectives in the year to date, driven by our continued

commitment to the realisation of completed and non-core assets and

the management of both the level of our debt and active assets in

our portfolio.

"Across our portfolio of operating shopping centres, we have

seen increases against all of our three key performance metrics of

occupancy, footfall and turnover during the first half of the year,

with the most notable improvements shown at our assets in the more

resilient economies in Central and Eastern Europe. Of these, the

most outstanding performance has been at Zgorzelec Plaza in Poland

which, further to recent asset management initiatives,

significantly increased turnover and footfall in June by 65% and

42% respectively, compared to June 2012. The continued increase in

overall occupancy rates throughout our portfolio is indicative of

our ability to leverage our long-term, strong relationships with

leading international retailers.

"By contrast, the persistent uncertainty in the economic and

consumer environment across Europe leads us to maintain our

cautious approach to development, with the result that we will only

press forward with our pipeline of projects when external funding

becomes available. In addition, we will continue our track record

of successful asset disposals in order to deleverage the Company

and reallocate realised capital from stabilised completed projects

and non-core assets to the core yielding assets in the portfolio,

thereby creating additional capital value and driving income

growth."

For further details, please contact:

Plaza

Ran Shtarkman, President and CEO +36 1 462 7221

Roy Linden, CFO +36 1 462 7222

FTI Consulting

Stephanie Highett/Nina Legge +44 20 7831 3113

Notes to Editors

Plaza Centers N.V. (www.plazacenters.com) is a leading property

developer and investor with operations in Central and Eastern

Europe and India. It focuses on constructing new centres and, where

there is significant redevelopment potential, redeveloping existing

centres in both capital cities and important regional centres. The

Company is dual listed on the Main Board of the London Stock

Exchange and, as of 19 October 2007, the Warsaw Stock Exchange

(LSE:"PLAZ", WSE: "PLZ/PLAZACNTR"). Plaza Centers N.V. is an

indirect subsidiary of Elbit Imaging Ltd. ("EI"), an Israeli public

company whose shares are traded on both the Tel Aviv Stock Exchange

in Israel and the NASDAQ Global Market in the United States. Plaza

Centers is a member of the Europe Israel Group of companies which

is controlled by its founder, Mr Mordechay Zisser. It has been

active in real estate development in emerging markets for over 17

years.

Forward-looking statements

This press release may contain forward-looking statements with

respect to Plaza Centers N.V. future (financial) performance and

position. Such statements are based on current expectations,

estimates and projections of Plaza Centers N.V. and information

currently available to the company. Plaza Centers N.V. cautions

readers that such statements involve certain risks and

uncertainties that are difficult to predict and therefore it should

be understood that many factors can cause actual performance and

position to differ materially from these statements. Plaza Centers

N.V. has no obligation to update the statements contained in this

press release, unless required by law.

PRESIDENT AND CHIEF EXECUTIVE OFFICER'S STATEMENT

I am pleased to report that, during the first six months, Plaza

has again delivered improvements at the operational level of our

business, highlighted by the increases in occupancy, footfall and

turnover at our active assets. In addition, the realisations made

during and after the period have enabled the Group to recycle and

reallocate capital from completed and non-core assets to core

assets.

The economies in Central Europe are beginning to present signs

of a rebound in growth, with preliminary second-quarter GDP figures

showing that the Eurozone's economy expanded 0.3% compared with the

first quarter of 2013. We expect full recovery to be slow, however,

with the more resilient countries such as Poland and Latvia making

the most progress. The ongoing challenges resulted in a non-cash,

market driven writedown of EUR61 million in the first half and the

decision to maintain our prudent approach towards development,

whilst continuing to dispose of non-core and completed assets to

de-risk the Group by further deleveraging and strengthening our

balance sheet.

Key Events

During the year to date, Plaza has successfully disposed of

three non-core projects through the following transactions:

-- Plaza sold 100% of its stake in a vehicle which owns the

interest in the Prague 3 project ("Prague 3"), a logistics and

commercial centre in the third district of Prague, in a transaction

that was concluded in July 2013. Earlier in the year, Plaza had

completed a successful application to change the zoning use of

Prague 3 to a residential scheme. The disposal valued the asset at

circa EUR11 million and, as a result, further to related bank

financing and other balance sheet adjustments, Plaza received net

proceeds of circa EUR7.5 million in cash.

-- Plaza has also sold its interest in the SPV which owns a site

in Roztoky being held for a potential residential development. The

site was sold for circa EUR2 million, resulting in net cash

proceeds of EUR1.3 million after debt-related deductions.

-- Plaza also sold its 50% stake in a vehicle which primarily

holds interests in an office complex project located in Pune,

Maharashtra. The transaction valued the assets owned by the vehicle

collectively at EUR33.4 million and, as a result, Plaza received

gross cash proceeds of circa EUR16.7 million.

These sales were conducted in line with the Company's strategy

to deleverage and reallocate capital realised from the disposal of

stabilised completed projects and non-core assets to the core

yielding assets across our portfolio.

We have also made progress during the year through the active

management of our income-generating assets. In particular, we have

improved a number of key metrics at our operating shopping and

leisure centres, increasing occupancy, footfall and rental

income.

As reported in 2012, Koregaon Park Plaza was substantially

damaged by a fire caused by a tenant's faulty electrical equipment.

Although roughly two-thirds of the mall's rentable area was

reopened in August 2012, the remainder of the centre required

extensive renovation and these works were finally completed in the

second quarter of 2013. Plaza is pleased to report that, during

this reporting period, the project received approximately EUR6.9

million from the insurance policy which has covered all the

renovation costs.

Results

As a result of a EUR61 million non-cash impairment,

predominantly charged against the Company's trading assets in

Serbia, India, the Czech Republic and Greece, fair value

adjustments of bonds and the share in loss of associated companies,

Plaza ended the first half of the year with a loss attributable to

the owners of the Company of EUR81 million. In addition, the

Company recorded a loss of EUR5.1 million following the disposal of

an Indian investment largely as a result of foreign currency

losses. The revenue from operating shopping centres increased to

EUR14.3 million (H1 2012: EUR14.1 million) despite the decreasing

revenue from Fantasy Park gaming and entertainment centres (EUR1

million decrease as a result of some gaming and entertainment units

closing down) and Koregaon Park Plaza, which was partially closed

for most of the period.

Of the EUR61 million impairment charge, 53% related to the

writedown of assets in Serbia and Greece which, in turn, reflected

the well publicised worsening market and macroeconomic conditions

in those countries.

As at 30 June 2013, the Company had a cash position (including

restricted bank deposits and available for sale financial assets)

of approximately EUR100 million. As at the date of this

announcement, the Company has a current cash position of circa

EUR32 million following an EUR67 million bond principal and

interest repayment in July.

NAV

In line with previous half yearly results, Plaza's property

portfolio is revalued at the end of every financial year and

therefore no update on NAV is provided at the half year.

Portfolio progress

Currently the Company is engaged in 22 development projects and

owns seven operational shopping and entertainment centre assets,

and two office schemes, located across the Central and Eastern

European region

and in India. The location of the projects, as at 23 August

2013, is summarised as follows:

Number of assets (CEE and India)

---------------- --------------------------------------

Location Active Under development/ Offices

planning

---------------- ------- ------------------- --------

Romania - 8 1

---------------- ------- ------------------- --------

India 1 3 -

---------------- ------- ------------------- --------

Poland 3 4 -

---------------- ------- ------------------- --------

Hungary - 3 1

---------------- ------- ------------------- --------

Serbia 1 2 -

---------------- ------- ------------------- --------

Czech Republic 1 - -

---------------- ------- ------------------- --------

Bulgaria - 1 -

---------------- ------- ------------------- --------

Greece - 1 -

---------------- ------- ------------------- --------

Latvia 1 - -

---------------- ------- ------------------- --------

Total 7 22 2

---------------- ------- ------------------- --------

Liquidity & Financing

Plaza ended the period with a cash position (including

restricted bank deposits and available for sale financial assets)

of EUR100 million, compared to EUR66 million at the end of 2012.

Working capital at 30 June 2013 totalled EUR390 million (31

December 2012: EUR391 million). As mentioned above, the Company's

current consolidated cash position is circa EUR32 million following

an EUR67 million bond principal and interest repayment in July.

The Group continues to pursue a conservative financing policy

and has made progress, mindful of the wider macroeconomic climate,

in deleveraging its balance sheet. Whilst EUR18 million of debt was

repaid during the period, the level of debt increased to 50% of the

balance sheet (31 December 2012: 45%) primarily as a result of the

impairment losses booked in the period. The Company continues to

prioritise the deleveraging of its balance sheet, seeking a variety

of financing options alongside traditional bank debt and

additionally pursuing avenues to lengthen the date of its debt

facilities.

On 22 July 2013 Standard & Poor's Maalot, the Israeli credit

rating agency which is a division of International Standard &

Poor's Rating Services, updated the credit rating of Plaza's two

series of Notes from "ilBB+" on a local Israeli scale to "ilB",

with a negative outlook. The re-rating reflects the persistent

challenging economic environments in which Plaza operates.

Strategy and Outlook

In response to ongoing global economic uncertainty, Plaza

adjusted its activity in line with market conditions and limited

the commencement of new construction projects, instead choosing to

focus on the intensive management of its core active assets and the

paying down of debt to ensure the Group remains conservatively

geared and strongly positioned to resist any further macroeconomic

shocks.

Despite the current challenges which continue to impact the core

markets in which Plaza operates, the Group has successfully met a

number of its key strategic objectives over the last six months.

Notable improvements at the operational level of the portfolio

include improving overall occupancy, footfall and turnover and we

remain successful in ensuring that our centres continue to meet the

demands of our customers by delivering the dominant retail offering

in our regions.

Real estate finance from banks in the region remains scarce,

which is emphasised by the continued lack of transactional activity

in CEE during the period. Whilst we are seeking alternative

financing options to push out the maturity of our debt, we will

continue to focus on active asset management initiatives to

maximise the income and value of our shopping centres and are

confident that our strategy of enjoying the rental income our

completed assets provide, until sales prices that appropriately

reflect their current and existing potential are achieved, remains

the correct course for the Group.

Continuing the success of our realisations during the period,

which all delivered a satisfactory return on the equity invested,

the Company will seek to optimise opportunities to further reduce

its levels of gearing whilst advancing our limited development

programme into the strongest economies of the CEE. We therefore

hope to see a reduction in our gearing level during the second half

of the year.

Improving business activity and sentiment has provided evidence

that the Eurozone's tentative recovery will continue into the

second half of 2013 and into 2014. We are convinced of the

underlying fundamentals of the regions in which we operate but feel

a pragmatic yet opportunistic approach is still the right approach.

We will remain committed to our strategic objectives of improving

our active operational assets, while selling non-core and completed

assets to enable us to continue to deleverage. We will also

continue to seek alternative financing options to extend and

diversify our funding sources, which we believe will better

position the Company for further growth. It is through this

combination of factors, underpinned by our expert management

skills, which will ensure that we will remain well positioned to

create significant future value for our shareholders.

Ran Shtarkman

President and Chief Executive Officer

23 August 2013

OPERATIONAL REVIEW

Over the course of the year to date, Plaza has continued to make

good progress against its operational and strategic objectives,

delivering improved occupancy at the portfolio level and disposing

of non-core assets.

Highlights for the period included:

-- Operation: An improved performance of the Company's seven

operating shopping and entertainment centres located in five

countries over two continents, through the application of intensive

asset management skills

-- Disposals:

o Sale of Plaza's 50% interests in a vehicle which mainly holds

interests in an office complex project located in Pune,

Maharashtra, India

o Sale of the Prague 3 project following the successful change

of its zoning permit

o Sale of the Roztoky Project (Prague, Czech Republic)

o Dissolving the US holding entity and receiving a EUR32 million

residual payment from the subsidiary

As at the reporting date, Plaza has 31 assets in nine countries

across the CEE region and India, of which 22 are at various phases

of development. Of these, eight are located in Romania, five in

India, four in Poland, three in Hungary, two in Serbia, one in

Bulgaria and one in Greece. In addition to these developments,

Plaza retains the ownership of and operates seven shopping and

entertainment centres in Poland, Czech Republic, Serbia, India and

Latvia and two office buildings in Budapest and Bucharest.

Footfall

During the second quarter of 2013, the centres continued the

positive growth trend in terms of footfall shown in the first

quarter. A significant increase of 35% was achieved at Zgorzelec

Plaza in second quarter of 2013 compared to the same quarter last

year, with a particularly strong increase of 42% in June 2013

compared to June 2012.

The very pleasing growth trend also continues at Torun Plaza,

where the number of visitors in second quarter of 2013 rose by 20%

compared to the same quarter last year.

Riga Plaza also demonstrated strong growth in the second

quarter, with visitor growth up 12% compared to the corresponding

quarter in 2012.

Satisfactory increases in visitor numbers were also achieved in

the second quarter at Liberec Plaza, with 10% growth on last year,

and at Kragujevac Plaza with 6% growth compared to the same period

in 2012.

Turnover

All of the Company's operating shopping and leisure centres saw

strong performance during the second quarter of 2013, with May and

June recording particularly strong turnover figures.

Again, the greatest success was shown in Zgorzelec Plaza, where

the second quarter turnover was 53% higher than the corresponding

quarter last year. This was the result of the opening of three new

anchor tenants in May and June 2013, which led to the 66% growth in

turnover, compared to June last year.

A very high increase in turnover was also enjoyed at Torun Plaza

which recorded a rise of 24% in the second quarter compared to the

same period last year.

Riga Plaza also experienced buoyant growth with a total increase

of 20.5% in turnover during the second quarter of 2013, including a

25.6% increase in May 2013 (both compared to the same period last

year).

After one full year of operation, Kragujevac Plaza saw a 14%

increase in turnover over the quarter, with the best performance

month in June, when turnover rose 23% compared to June 2012.

Positive increases during the second quarter were also shown at

Liberec Plaza (up 11%) while Suwalki Plaza saw a 5% turnover

increase in June 2013.

Occupancy

The most notable proportional occupancy increase was achieved in

Zgorzelec Plaza where three new anchor stores (an electronic store,

Media Expert, a furniture store, Zarycki Furniture, and sports

store, Martes Sport) were opened during the second quarter of 2013.

In addition, leases were agreed for two smaller units. It is also

pleasing to report that at Riga Plaza contract terms were agreed

with H&M (including "H&M Home") during the second quarter

to take 2,900 sq m of space.

The Company's other development projects are at various stages

of the development cycle, with Plaza's skilled management teams

continuing actively to make progress with planning and design.

The Company's current assets and pipeline projects are

summarised in the table below:

Asset/Project Location Nature of asset Size sqm Plaza's Status (*)

(GLA) effective

ownership

%

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Retail and

Suwalki, entertainment Operating, opened

Suwalki Plaza Poland scheme 20,000 100 in May 2010

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Lodz (Residential) Lodz, Poland Residential scheme 80,000 100 Under planning

(GBA)

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

Retail and commence in 2014;

entertainment completion scheduled

Lodz Plaza Lodz, Poland scheme 35,000 100 for 2015

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Retail and

Zgorzelec Zgorzelec, entertainment Operating, opened

Plaza Poland scheme 13,000 100 in March 2010

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Retail and

Torun, entertainment Operating, opened

Torun Plaza Poland scheme 40,000 100 in November 2011

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

Retail and commence in 2014-2015;

Kielce, entertainment completion scheduled

Kielce Plaza Poland scheme 33,000 100 for 2015-2016

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

Retail and commence in 2015;

Leszno, entertainment completion scheduled

Leszno Plaza Poland scheme 16,000 100 for 2016

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Under planning.

Construction

scheduled to

commence in 2014;

Arena Plaza Budapest, completion scheduled

Extension Hungary Office scheme 40,000 100 for 2015

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Dream Island Budapest, Major business 350,000 43.5 Initial excavation

(Obuda) Hungary and leisure resort (GBA) (for and archaeological

rent and works commenced;

sale) Staged completion

scheduled for

2015-2017

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Operating. Currently

working on

refurbishment

plans, with the

Retail and building permit

Budapest, entertainment expected to be

Uj Udvar Hungary scheme 16,000 35 granted in 2014

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Budapest,

David House Hungary Office 2,000 100 Operational

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Retail and

Liberec, entertainment Operating, opened

Liberec Plaza Czech Rep. scheme 17,000 100 in March 2009

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Casa Radio Bucharest, Mixed-use retail 600,000 75 Under planning,

Romania and leisure plus (GBA including with completion

office scheme parking) scheduled for

2015-2018; approval

from the Urban

Technical Commission

has been obtained

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

Retail and commence in 2014;

Timisoara Timisoara, entertainment completion scheduled

Plaza Romania scheme 36,000 100 for 2015

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

commenced in

Miercurea Retail and late 2008; awaiting

Ciuc, entertainment external financing

Csiki Plaza Romania scheme 14,000 100 for completion

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

commence in 2014-2015;

Iasi, Retail, entertainment completion scheduled

Iasi Plaza Romania and office scheme 58,000 100 for 2016

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

Retail and commence in 2015;

Slatina, entertainment completion scheduled

Slatina Plaza Romania scheme 17,000 100 for 2016

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

Retail and commence in 2015;

Hunedoara Hunedoara, entertainment completion scheduled

Plaza Romania scheme 13,000 100 for 2016

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

Retail and commence in 2015;

Targu Mures Targu Mures, entertainment completion scheduled

Plaza Romania scheme 30,000 100 for 2016

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

Retail and commence in 2014;

Constanta Constanta, entertainment completion scheduled

Plaza Romania scheme 18,000 100 for 2015-2016

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Bucharest,

Palazzo Ducale Romania Office 700 100 Operational

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Belgrade Belgrade, Apart-hotel and 70,000 (GBA) 100 Construction

Plaza Serbia business centre scheduled to

(MUP) with a shopping commence in 2014;

gallery completion scheduled

for 2015-2016

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

commence at the

beginning of

Retail and 2014; completion

Belgrade Belgrade, entertainment scheduled for

Plaza (Visnjicka) Serbia scheme 32,000 100 2015

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Retail and

Kragujevac Kragujevac, entertainment Operating, opened

Plaza Serbia scheme 22,000 100 in March 2012

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

Retail and commence in 2015;

Shumen, entertainment completion scheduled

Shumen Plaza Bulgaria scheme 20,000 100 for 2016

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Retail and

Riga, entertainment Operating; opened

Riga Plaza Latvia scheme 49,000 50 in March 2009

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Construction

scheduled to

Retail and commence in 2014;

Athens, entertainment completion scheduled

Pireas Plaza Greece scheme 26,000 100 for 2015-2016

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Koregaon Pune, Retail, entertainment 110,000 100 Operating; opened

Park Plaza India and office scheme (GBA) in March 2012

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Bangalore Bangalore, Residential Scheme 310,000 23.75 Construction

India (GBA) scheduled to

commence at the

beginning of

2014; phased

completion scheduled

over 2014-2020

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Chennai Chennai, Residential Scheme 230,000 38 Construction

India (for sale) scheduled to

commence in 2014;

phased completion

scheduled over

2014-2018

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

Kochi Island Kochi, High-end residential 575,000 23.75 Under planning

India apartment buildings, (GBA)

office complexes,

a hotel and serviced

apartments complex,

retail area and

a marina

-------------------- -------------- ------------------------ ---------------- ----------- -----------------------

(*) all completion dates of the projects are subject to securing

external financing.

FINANCIAL REVIEW

Results

During the reporting period of the first six months of 2013 and

the months to date, Plaza has continued to execute its core

operations and implement its strategy.

Because Plaza focuses its business on the development and sale

of shopping and entertainment centres, the Group classifies its

current projects under development or self-developed projects as

trading properties (or equity accounted investees, where

appropriate), rather than investment properties. Accordingly,

revenues from the sale of trading properties are presented as gross

amounts. The Group does not revalue its trading properties, and

profits from these assets therefore represent actual cash-based

profits due to realisations. On the other hand, an impairment of

value is booked in the consolidated income statement where

applicable.

Following the adoption of IFRS 11 Joint Arrangements, the

comparative figures for the year end of 2012 were restated. The

effect of this restatement is detailed in the Company's condensed

consolidated financial information for the six-month period ended

on 30 June 2013 in note 6 to the Accounts. The adoption of IFRS 11

affected the accounting treatment of the following projects:

Kharadi, Trivandrum, Chennai, Bangalore, Dream Island, Uj Udvar and

our US operations.

Revenue for the period largely comprised rental income in Europe

(EUR8.3 million in H1 2013 compared to EUR8 million in H1 2012),

but rental income improvement in our operating centres in CEE was

offset by a reduction in rental income collected from Koregaon Park

which was partially closed for most of the period. Management fees

from operating malls increased by 30% (EUR3 million in H1 2013

compared to EUR2.3 million in H1 2012), but income derived from the

Group's subsidiary, Fantasy Park, which provides gaming and

entertainment services in active shopping centres decreased to

EUR2.3 million (H1 2012: EUR3.3 million) during the period as a

result of closing down some of these centres. Aside from income

from operating assets, EUR16.7 million of income was also generated

from the sale of a stake in an Indian JV company.

The total cost of operation amounted to EUR88 million (H1 2012:

EUR8 million). The increase, and majority of the cost of

operations, is largely attributable to the EUR61 million impairment

charge recorded in connection with the value of trading properties,

as compared to a charge of EUR1.7 million in the period H1 2012.

42% related to impairments of assets in Serbia, 21% to Czech

Republic, 26% to India and the remaining to Greece. The EUR21.8

million cost of the Indian vehicle which was sold was booked in the

total cost of operations and included approximately EUR4.5 million

of foreign currency exchange differences. The cost of property

operation and maintenance has decreased during the period when

compared to the reclassified H1 2012 period amount, from EUR4

million to EUR2.9 million in H1 2013, as a result of ongoing

operational efficiencies and successful asset management

initiatives at the Company's operating shopping centres.

Administrative expenses amounted to EUR6.2 million (H1 2012:

EUR7.5 million after restatement). Of these, general and

administrative expenses decreased from EUR5.8 million in H1 2012 to

EUR5.1 million in H1 2013 as a result of further optimization of

the Company's operations. Sales and marketing expenses decreased

from EUR1.7 million in H1 2012 to EUR1.1 million for the six month

period ended 30 June 2013 as no promotion of newly opened shopping

centres occurred in the period.

A net finance cost of EUR9 million was recorded in H1 2013 (H1

2012: net finance loss of EUR9.1 million). The main components of

the loss comprised:

-- Interest expense on bank loans and debentures (EUR7.4

million), an increase compared to the H1 2012 expense of EUR7.1

million where the interest on bank loans was increasing in line

with the higher volume of investment financing loans, while on the

other hand the interest expense on bonds was decreasing as a result

of principal repayments

-- Net cost related to the companies debentures (revaluation,

hedge and loss on reissuance) of EUR3.9 million

-- Net income from interest on deposits, foreign exchange

differences and interest rate swap hedging related to bank loan

interest EUR2.3 million.

As a result of the above, the loss for the period amounted to

circa EUR81 million in H1 2013, compared to a EUR10 million loss in

H1 2012.

Basic and diluted loss per share for the period were EUR0.27 (H1

2012: EUR0.03 loss).

Balance sheet and cash flow

The balance sheet as at 30 June 2013 showed total assets of

EUR793 million compared to total assets of EUR886 million at the

end of 2012, largely as a result of the decrease in the value of

trading properties due to impairment adjustments.

The Company's cash position deriving from cash, restricted cash

and available for sale financial assets increased to EUR100 million

(31 December 2012: EUR66 million), as a result of proceeds from the

sale of an Indian investment and the dissolution of our US venture.

The gearing position stood at 50% of the balance sheet (31 December

2012: 45%) as a result of losses realised from the impairment of

trading properties. After the end of the period Plaza collected the

proceeds from the sale of Prague 3 and the Roztoky projects (in

Prague, Czech Republic) and paid a EUR67 million bond principal and

interest repayment, leaving the Company with a cash position of

circa EUR32 million.

The value of trading properties has decreased from EUR612

million as at 31 December 2012 to EUR561 million at the end of the

period after the impairment losses relating to projects in Serbia,

Czech Republic, India and Greece were recorded.

Investments in investee companies decreased by 41% (30 June

2013: EUR92 million; 31 December 2012: EUR155 million) after the

above-mentioned dissolution of the US holding entity and the sale

of Plaza's share in the project company holding which primarily

owns interests in an office complex project located in Pune,

India.

Total bank borrowings (long and short term) amounted to EUR186

million (30 June 2012: EUR212 million). This decrease is primarily

as a result of loans repaid in relation to the bond buyback and the

change in the value of foreign exchange denominated loans.

Aside from bank financing, Plaza has a balance sheet liability

of EUR206 million (with an adjusted par value of circa EUR257

million including a EUR5.8 million bond B held in treasury) from

issuing debentures on the Tel Aviv Stock Exchange and to Polish

institutional investors. These debentures are presented at their

fair value, with the exception of the debentures issued from August

2009 onward, which are presented at amortised cost.

Trade payables decreased to EUR3.5 million (2012: EUR7.6

million), due to the completion of reconstruction works in

India.

Derivatives liabilities recorded at the period end were EUR1.2

million comprising interest rate swaps relating to project

financing loans, compared to EUR3.3 million as at 31 December 2012,

which had also included cross currency swap transactions to hedge

interest rates and foreign exchange risks associated with the

Group's NIS and PLN denominated bonds.

Other current liabilities have increased mainly due to accrued

interest on the issued bonds of the Company.

Roy Linden

Chief Financial Officer

23 August 2013

Plaza Centers N.V.

Condensed consolidated interim statement of Profit or loss

For the six months period ended

June 30,

----------------------------------

2013 2012 restated(*)

------------ --------------------

EUR '000 EUR '000

------------ --------------------

Unaudited Unaudited

------------ --------------------

Continuing operations

Revenue 14,298 14,148

Proceeds from disposal of equity 16,699

accounted investee -

------------ --------------------

Total revenue 30,997 14,148

Write-down of Trading properties (60,906) (1,688)

Cost of equity accounted investee (21,842)

disposed -

Cost of operations (5,490) (6,551)

------------ --------------------

Gross profit (loss) (57,241) 5,909

Administrative expenses (6,212) (7,538)

Other income 318 363

Other expenses (4,771) (672)

------------ --------------------

Results from operating activities (67,906) (1,938)

Finance income 6,671 12,836

Finance costs (15,636) (21,927)

Net finance costs (8,965) (9,091)

------------ --------------------

Share in results of equity-accounted

investees, net of tax (4,472) (935)

------------ --------------------

Loss before income tax (81,343) (11,964)

Tax benefit 754 4,048

Loss from continuing operations (80,589) (7,916)

------------ --------------------

Discontinued operation

Loss from discontinued operation,

net of tax (454) (1,892)

Loss for the period (81,043) (9,808)

------------ --------------------

Loss attributable to:

Owners of the Company (81,043) (9,808)

Earnings per share

Basic and diluted loss per

share (in EURO) (0.27) (0.03)

Earnings per share - continuing

operations

Basic and diluted loss per

share (in EURO) (0.27) (0.03)

(*) Restated due to Retrospective application - refer to Note 4

and 6 regarding initial application of the new suite of

standards

Plaza Centers N.V.

Condensed consolidated interim statement of other comprehensive

income

For the six months period ended

June 30,

-----------------------------------

2013 2012 restated(*)

--------------- ------------------

EUR '000 EUR '000

--------------- ------------------

Unaudited Unaudited

--------------- ------------------

Loss for the period (81,043) (9,808)

Other comprehensive income

Items that may be reclassified

to profit or loss in subsequent

periods:

Net changes in fair value

on Available for sale financial

assets transferred to income

statement (723) 1,942

Change in fair value of available

for sale financial assets (14) (161)

Foreign currency translation

differences - foreign operations

(Discontinued operation) - (6,912)

Foreign currency translation

differences - foreign operations

(Equity accounted investees) (3,650) (4,107)

Foreign currency translation

differences - foreign operations

(Other) (2,006) (932)

Income tax effect on other

comprehensive income due

to change in fair value of

Available for sale financial

assets 184 (445)

Other comprehensive loss

for the period, net of income

tax (6,209) (10,615)

--------------- ------------------

Total comprehensive loss

for the period, net of tax (87,252) (20,423)

Total comprehensive loss

attributable to:

Owners of the Company: (87,200) (20,402)

Non-controlling interests (52) (21)

(*) Restated due to Retrospective application - refer to Note 4

and 6 regarding initial application of the new suite of

standards

Plaza Centers N.V.

Condensed consolidated interim statement of financial

position

June 30, December 31,

---------- --------------

2013 2012 Restated

(*)

---------- --------------

EUR '000 EUR '000

---------- --------------

Unaudited Audited

---------- --------------

ASSETS

Cash and cash equivalents 86,934 35,374

Restricted bank deposits 12,128 18,759

Available for sale financial assets 883 11,714

Trade receivables 3,551 3,399

Other receivables and prepayments 9,103 19,313

Trading properties 560,831 612,475

Assets held for sale 12,865 -

---------- --------------

Total current assets 686,295 701,034

---------- --------------

Equity accounted investees 91,549 154,830

Loan to equity accounted investees 6,994 6,949

Property and equipment 6,838 7,381

Investment property - 14,489

Restricted bank deposits 495 779

Other non-current assets 393 356

Total non-current assets 106,269 184,784

---------- --------------

Total assets 792,564 885,818

========== ==============

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities

Interest bearing loans from banks 186,452 205,977

Liabilities held for sale 3,997 -

Debentures at fair value through

profit or loss 33,929 34,966

Debentures at amortized cost 37,899 34,184

Trade payables 3,504 7,569

Related parties 698 546

Provisions 15,597 15,597

Derivatives 1,170 3,320

Other liabilities 13,159 7,648

Total current liabilities 296,405 309,807

---------- --------------

Non-current liabilities

Interest bearing loans from banks - 5,773

Debentures at fair value through

profit or loss 80,618 81,181

Debentures at amortized cost 53,483 39,010

Other liabilities 147 185

Deferred tax liabilities 6,016 6,930

Total non-current liabilities 140,264 133,079

---------- --------------

Equity

Share capital 2,972 2,972

Translation reserve (31,963) (26,359)

Other reserves 14,218 14,556

Share premium 261,773 261,773

Retained earnings 108,231 189,274

Total equity attributable to equity

holders of the Company 355,231 442,216

---------- --------------

Non-controlling interests 664 716

---------- --------------

Total equity 355,895 442,932

---------- --------------

Total equity and liabilities 792,564 885,818

========== ==============

(*) Restated due to Retrospective application - refer to Note 4

and 6 regarding initial application of the new suite of

standards

22 August 2013

----------------------- ------------------------ -----------------------

Date of approval of the Ran Shtarkman Shimon Yitzchaki

financial statements Director, President and Director and Chairman

Chief Executive Officer of the Audit Committee

Plaza Centers N.V.

Condensed consolidated interim statement of cash flows

For the six month period ended June

30,

2013 2012 restated (*)

------------- -----------------------

EUR 000' EUR 000'

------------- -----------------------

Unaudited Unaudited

------------- -----------------------

Cash flows from operating activities

Loss for the period (81,043) (9,808)

Adjustments for:

Depreciation and write-down 60,962 2,035

Change in fair value of Investment 3,439

property -

Loss from disposal of equity accounted 5,143

investee -

Net finance costs 8,965 9,091

Interest received in cash 385 2,901

Interest paid (6,558) (5,745)

Share of loss of equity accounted

investee, net of tax 4,472 935

Gain on sale of property and equipment (19) (30)

Tax benefit (754) (4,048)

Share based payments 262 3,206

------------- -----------------------

(4,746) (1,463)

Changes in:

Trade receivables (223) 652

Other accounts receivable 7,083 2,959

Trading properties (3,232) (27,640)

Trade payables (2,443) (146)

Other liabilities, related parties

and provisions (146) 806

1,039 (23,369)

Income tax paid (344) (144)

------------- -----------------------

Net cash used in operating activities (4,051) (24,976)

------------- -----------------------

Cash flows from investing activities

Purchase of property, equipment and

other non-current assets (4) (107)

Proceeds from disposal of fixed assets 44 56

Proceeds from dissolving of equity 32,438

accounted investee -

Investment in short term deposits - 3,102

Investment in equity accounted investees (1,684) (1,711)

Proceeds from selling equity accounted 16,699

investee -

Purchase of available for sale financial

assets (155) (2,187)

Proceeds from sale of available for

sale financial assets 11,014 26,496

Changes in long term deposits - 50,663

Net cash from investing activities 58,352 76,312

------------- -----------------------

(*) Restated due to Retrospective application - refer to Note 4

and 6 regarding initial application of the new suite of

standards

Plaza Centers N.V.

Condensed consolidated interim statement of cash flows

continued

For the six

month period

ended June 30,

2013 2012 restated (*)

---------------- ------------------

EUR 000' EUR 000'

---------------- ------------------

Unaudited Unaudited

---------------- ------------------

Cash flows from financing activities

Proceeds from bank loans and financial

institutions 509 25,222

Changes in restricted cash 3,193 8,381

Net cash resulting from currency

options (1,950) 5,320

Reselling (repurchase) of own debentures 13,772 (9,836)

Proceeds from settlement of SWAP - 238

Repayment of loans to banks and financial

institutions (17,833) (46,711)

Net cash used in financing activities (2,309) (17,386)

---------------- ------------------

Effect of exchange rate fluctuation

on cash held (432) (36)

Net increase in cash and cash equivalents 51,560 33,914

Cash and cash equivalents at the

beginning of the period 35,374 51,433

Cash and cash equivalents at the

end of the period 86,934 85,347

================ ==================

(*) Restated due to Retrospective application - refer to Note 4

and 6 regarding initial application of the new suite of

standards

Plaza Centers N.V.

Notes to the condensed consolidated interim financial

information

1. Reporting entity

Plaza Centers N.V. ("the Company") was incorporated and is

registered in the Netherlands. The Company's registered office is

at Keizersgracht 241, Amsterdam, the Netherlands. The Company

conducts its activities in the field of establishing, operating and

selling of shopping and entertainment centres, as well as other

mixed-use projects (retail, office, residential) in Central and

Eastern Europe (starting 1996), India (from 2006), and, between

2010 and 2012, also in the USA.

The Company is dual listed on the Main Board of the London Stock

Exchange ("LSE") and, starting October 2007, on the Warsaw Stock

Exchange ("WSE").

The Company's immediate parent company is Elbit Ultrasound

(Luxembourg) B.V. / S.à r.l. ("EUL"), which holds 62.5% of the

Company's shares, as of the end of the reporting period. The

ultimate parent company is Elbit Imaging Limited ("EI"), which is

indirectly controlled by Mr. Mordechay Zisser.

The condensed consolidated interim financial information of the

Company as at June 30, 2013 and for the six months then ended

comprise the Company and its subsidiaries (together referred to as

the "Group") and the Group's interests in joint ventures.

The consolidated financial statements of the Group as at and for

the year ended December 31, 2012 are available on the Company's

website (www.plazacenters.com) and also upon request from the

Company's registered office at Keizersgracht 241, 1016EA Amsterdam,

The Netherlands.

During the six months period ended June 30, 2013, two

significant changes occurred in theCompany's holdings, being the

dissolving of EPUS, the Company's 50% equity accounted investee in

the USA (refer to note 12(e)), and the selling of the Company

subsidiary in India ("P-One")(refer to note 12b).

2. Basis of presentation

a. Statement of compliance

This condensed consolidated interim financial information has

been prepared in accordance with IAS 34 Interim Financial

Reporting, as adopted by the EU. It does not include all of the

information required for full annual financial statements, and

should be read in conjunction with the annual consolidated

financial statements of the Group for the year ended December 31,

2012.

However, selected explanatory notes are included to explain

events and transactions that are significant to an understanding of

the changes in the Group's financial position and performance since

the last annual consolidated financial statements as at and for the

year ended December 31, 2012.

The condensed consolidated interim financial information was

authorized for issue by the Company's Board of Directors on August

22, 2013.

b. Judgments and estimates

The preparation of interim financial information requires

management to make judgments, estimates and assumptions that affect

the application of policies and reported amounts of assets and

liabilities, income and expenses. Actual results may differ from

these estimates.

In preparing this condensed consolidated interim financial

information, the significant judgments made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were principally the same as those that

applied to the consolidated financial statements as at and for the

year ended December 31, 2012. However, management reassessment of

the business plans of certain properties is done on an ongoing

basis, and resulted in impairments in 2013, as described in note

12a below.

c. Going concern

The condensed consolidated interim financial informationhave

been prepared on the assumption that the Group will continue as a

going concern in the foreseeable future, for at least but not

limited to twelve months from the end of the reporting period.

As forecast relates to future events, inherently it is subject

to uncertainties and therefore, the Management cannot guarantee

that all assumptions relating to cash flows will materialize,

however it believes that as of the date of the financial statements

these assumptions are reasonably achievable.

For a detailed discussion about the group's liquidity position

refer to note 8.

3. Significant accounting policies

Except as described in Note 4, the accounting policies applied

by the Group in this condensed consolidated interim financial

statements are the same as those applied by the Group in its

consolidated financial statements as at and for the year ended

December 31, 2012. The following change in accounting policies will

also be reflected in the Group's consolidated financial statements

as at and for the year ending December 31, 2013 (For the effect of

the changes on the Company statement of financial position for

December 31, 2012, the statement of profit or loss and the

statement of other comprehensive income and statement of cash flows

for the six months period ended June 30, 2012 and the equity as of

January 1, 2012, refer to Note 6).

4. Initial application of new standards

The Group has early adopted IFRS 10 Consolidated Financial

Statements, IFRS 11 Joint Arrangements and IFRS 12 Disclosure of

Interests in Other Entities, as well as the consequential

amendments to IAS 28 Investments in Associates and Joint Ventures

(2011) and IFRS 13 Fair value measurement, with a date of initial

application of January 1, 2013. The adoption of these standards has

the following effect on the interim condensed consolidated

financial statements.

-- IFRS 11 Joint Arrangements

-- IFRS 12 Disclosure of Interests in Other Entities

As a result of the adoption of IFRS 11, the Group has changed

its accounting policy with respect to its interests in joint

arrangements.

Under IFRS 11, the Group classifies its interests in joint

arrangements as either joint operations or joint ventures depending

on the Group's rights to the assets and obligations for the

liabilities of the arrangements. When making this assessment, the

Group considered the structure of the arrangements, the legal form

of any separate vehicles, the contractual terms of the arrangements

and other facts and circumstances. Previously, the structure of the

arrangement was the sole focus of classification.

The Group evaluated its involvement in the joint arrangements it

holds and classified them as joint ventures. Following the

application of IFRS 11 joint ventures will henceforward be

accounted for using the equity method, whereas until application of

the standard the Company's accounting policy was the proportionate

consolidation method.

Since the Company did not provide guarantees to the joint

ventures, losses from the joint ventures will be accounted for

until the investment is reduced to zero. If the joint venture

subsequently reports profits, the Company resumes recognizing its

share of those profits only after its share of the profits equals

the share of the losses not recognized. Any unrecorded losses at

the date of transition are recorded at the retained earnings. The

Group disclosed the interests at the joint ventures as required

under IFRS 12 (refer to Note 5).Note 6 includes a summary of the

adjustments made to the Group's statements of financial position at

December 31, 2012, and its statements of profit or loss and the

statement of other comprehensive income and cash flows for the six

months period ended at June 30, 2012 as a result of the

implementation of the equity method instead of proportionate

consolidation.

IFRS 10 Consolidated Financial Statements and the consequential

amendments to IAS 28 Investments in Associates and Joint Ventures

(2011) did not have any material effect on the Company condensed

consolidated interim financial report.

IFRS 13, fair value measurement, provides a single framework for

measuring fair value. The measurement of the fair value of an asset

or liability is based on assumptions that market participants would

use when pricing the asset or liability under current market

conditions, including assumptions about risk. The company adopted

IFRS 13 on January 1, 2013 on a prospective basis. The adoption of

IFRS 13 did not require any adjustments to the valuation techniques

used by the Company to measure fair value and did not result in any

measurement adjustments as at January 1, 2013

Presentation of Items of Other Comprehensive Income (Amendments

to IAS 1) - as a result of the amendments to IAS 1, the Group has

modified the presentation of items of other comprehensive income in

its condensed consolidated statement of profit or loss and other

comprehensive income, to present separately items that would be

reclassified to profit or loss in the future from those that would

never be. Comparative information has also been re-presented

accordingly. The adoption of the amendment to IAS 1 has no impact

on the recognised assets, liabilities and comprehensive income of

the Group

Apart from the above, the Company has not early adopted any

other standard, interpretation or amendment that has been issued

but is not yet effective.

5. Interests at the joint ventures

The Company has the following interest (directly and indirectly)

in the below joint ventures, as of June 30, 2013 and December 31,

2012:

Company name Country Interest of holding (percentage)

June 30, 2013 December 31,

2012

--------- ------------------ ---------------

Elbit Plaza USA LP (1) USA N/A 50%

Elbit Plaza USA II LP USA 50% 50%

P-One Infrastructure Pvt. Ltd.

(2) India N/A 50%

Elbit Plaza India Real Estate

Holdings Ltd. Cyprus 47.5% 47.5%

Adams Invest S.R.L Romania 25% 25%

Colorado Invest S.R.L Romania 25% 25%

Spring Invest S.R.L Romania 25% 25%

Sunny Invest S.R.L Romania 25% 25%

Primavera Invest S.R.L Romania 25% 25%

Bas development S.R.L Romania 25% 25%

SIA Diksna Latvia 50% 50%

Erocorner Gazdasagi Szolgaltato

Kft. Hungary 50% 50%

SBI Hungary Ingatlanforgalmazo

es Epito Kft. Hungary 35% 35%

(1) Refer also to note 12 (e) for the dissolving of

investee.

(2) Refer also to note 13 (c) for the selling of the

investee.

6. Effect of initial application of new standards

(1) Effect on the statement of financial position

December 31, 2012

-------------------------------------------------------

Effect of

retrospective As presented

in

As presented application these financial

of

in the past IFRS 11 statements

--------------------- -------------- ----------------

EUR 000' EUR 000' EUR 000'

--------------------- -------------- ----------------

Assets

Cash and cash equivalents 64,440 (29,066) 35,374

Restricted bank deposits 25,518 (6,759) 18,759

Available for sale financial

assets 11,714 - 11,714

Trade receivables 4,687 (1,288) 3,399

Other receivables and prepayments 46,749 (27,436) 19,313

Trading properties 780,963 (168,488) 612,475

Total current assets 934,071 (233,037) 701,034

-------- -------------- ----------------

Equity accounted investees - 154,830 154,830

Loans to equity accounted

investee - 6,949 6,949

Property and equipment 8,109 (728) 7,381

Investment property 14,489 - 14,489

Restricted bank deposits 978 (199) 779

Other non-current assets 358 (2) 356

Total non-current assets 23,934 160,850 184,784

-------- -------------- ----------------

Total assets 958,005 (72,187) 885,818

======== ============== ================

Liabilities

Interest bearing loans from

banks 264,296 (58,319) 205,977

Debentures at fair value

through profit or loss 34,966 - 34,966

Debentures at amortized cost 34,184 - 34,184

Trade payables 8,748 (1,179) 7,569

Related parties 511 35 546

Provisions 15,597 - 15,597

Derivatives 3,320 - 3,320

Other liabilities 14,094 (6,446) 7,648

Total current liabilities 375,716 (65,909) 309,807

-------- --------- --------

Interest bearing loans from

banks 5,773 - 5,773

Debentures at fair value

through profit or loss 81,181 - 81,181

Debentures at amortized cost 39,010 - 39,010

Other liabilities 232 (47) 185

Deferred tax liabilities 6,947 (17) 6,930

Total non-current liabilities 133,143 (64) 133,079

-------- --------- --------

Total liabilities 508,859 (65,973) 442,886

======== ========= ========

Non-controlling interests 6,930 (6,214) 716

-------- --------- --------

Equity attributable to owners

of the Company 442,216 - 442,216

-------- --------- --------

Total equity 449,146 (6,214) 442,932

-------- --------- --------

Total liabilities and equity 958,005 (72,187) 885,818

======== ========= ========

(2) Effect on equity

January 1, 2012

-----------------------------------------------

Effect of

retrospective As presented

in

As presented application these financial

of

in the past IFRS 11 statements

------------- -------------- ----------------

EUR 000' EUR 000' EUR 000'

------------- -------------- ----------------

Non-controlling interests 8,040 (7,289) 751

-------- -------- --------

Equity attributable to owners

of the Company 542,122 - 542,122

-------- -------- --------

Total equity 550,162 (7,289) 542,873

-------- -------- --------

June 30, 2012

-----------------------------------------------

Effect of

retrospective As presented

in

As presented application these financial

of

in the past IFRS 11 statements

------------- -------------- ----------------

EUR 000' EUR 000' EUR 000'

------------- -------------- ----------------

Non-controlling interests 10,322 (9,592) 730

-------- --------- --------

Equity attributable to owners

of the Company (1) 524,052 (2,590) 521,462

-------- --------- --------

Total equity 534,374 (12,182) 522,192

-------- --------- --------

(1) The change in equity attributable to owners of the Company

is stemming entirely from decrease in the retained earnings, due to

non-specific finance expenses which were de-capitalized as equity

accounted investees assets are not qualified assets as defined IAS

23.

(3) Effect on the statement of profit or loss and statement of

comprehensive income

For the six months ended

June 30, 2012

-----------------------------------------------

Effect

of

retrospective As presented

in

As presented application these financial

of

in the past IFRS 11 statements

------------- -------------- ----------------

EUR 000' EUR 000' EUR 000'

------------- -------------- ----------------

Continuing operations

Revenue 33,650 (19,502) 14,148

Change in fair value of Investment

properties (2,314) 2,314 -

------------- -------------- ----------------

31,336 (17,188) 14,148

Write-down of Trading properties (2,799) 1,111 (1,688)

Cost of operations (15,505) 8,954 (6,551)

Gross profit 13,032 (7,123) 5,909

Administrative expenses (11,457) 3,919 (7,538)

Gain from sale of Investment

property, net 390 (390) -

Other income 363 - 363

Other expenses (672) - (672)

------------- -------------- ----------------

Results from operating activities 1,656 (3,594) (1,938)

Finance income 12,941 (105) 12,836

Finance costs (25,809) 3,882 (21,927)

Net finance costs (12,868) 3,777 (9,091)

------------- -------------- ----------------

Share in loss of equity-accounted

investees (14) (921) (935)

------------- -------------- ----------------

Loss before income tax (11,226) (738) (11,964)

Tax benefit 4,076 (28) 4,048

Loss from continuing operations (7,150) (766) (7,916)

------------- -------------- ----------------

Discontinued operation

Loss from discontinued operation,

net of tax - (1,892) (1,892)

Loss for the period (7,150) (2,658) (9,808)

------------- -------------- ----------------

Loss attributable to:

Owners of the Company (7,218) (2,590) (9,808)

Non-controlling interests 68 (68) -

Earnings per share

Basic and diluted loss per

share (in EURO) (0.02) - (0.03)

Earnings per share - continuing

operations

Basic and diluted loss per

share (in EURO) (0.02) - (0.03)

For the six months ended

June 30, 2012 (unaudited)

-----------------------------------------------

Effect

of

retrospective As presented

in

As presented application these financial

of

in the past IFRS 11 statements

------------- -------------- ----------------

EUR 000' EUR 000' EUR 000'

------------- -------------- ----------------

Loss for the period (7,150) (2,658) (9,808)

Other comprehensive income

Items that may be reclassified to

profit or loss in subsequent periods:

Net changes in fair value on Available

for sale financial assets transferred

to income statement 1,942 - 1,942

Change in fair value of available

for sale financial assets (161) - (161)

Foreign currency translation differences

- foreign operations (Discontinued

operation) - (6,912) (6,912)

Foreign currency translation differences

- foreign operations (other) (12,440) 7,401 (5,039)

Income tax effect on other comprehensive

income due to change in fair value

of Available for sale financial assets (445) - (445)

Other comprehensive loss for the period,

net of income tax (11,104) 489 (10,615)

Total comprehensive loss for the period,

net of tax (18,254) (2,169) (20,423)

Total comprehensive loss attributable

to:

Owners of the Company (17,812) (2,590) (20,402)

Non-controlling interests (442) 421 (21)

(4) Effect on the statement of cash flows

For the six months ended June

30, 2012 (unaudited)

-----------------------------------------------

Effect of

retrospective As presented

in

As presented application these financial

of

in the past IFRS 11 statements

------------- -------------- ----------------

EUR 000' EUR 000' EUR 000'

------------- -------------- ----------------

Net cash used in operating activities (29,097) 4,121 (24,976)

========= ========== =========

Net cash from investing activities 209,771 (133,459) 76,312

========= ========== =========

Net cash used in financing activities (62,996) 45,610 (17,386)

========= ========== =========

Effect of exchange rate fluctuations

on cash and cash equivalents (421) 385 (36)

Net increase in cash and cash equivalents 117,257 (83,343) 33,914

Cash and cash equivalents as at the

beginning of the period 58,261 (6,828) 51,433

--------- ---------- ---------

Cash and cash equivalents at the

end of the period 175,518 (90,171) 85,347

========= ========== =========

7. Segment reporting

The Group comprises the following main geographical segments:

CEE and India. In presenting information on the basis of

geographical segments, segment revenue is based on the revenue

resulting from either selling or operating of Trading properties

and Investment property geographically located in the relevant

segment.

Data regarding the geographical analysis in the six months

period ended June 30, 2013 and 2012 is as follows:

Central

& Eastern

Europe India Total

----------- --------- ---------

EUR 000' EUR 000' EUR 000'

----------- --------- ---------

Six months period ended June 30,

2013:

Revenue 13,915 383 14,298

Proceeds from disposal of equity

accounted investee - 16,699 16,699

Cost of equity accounted investee

disposed - (21,842) (21,842)

Operating loss by segment (1) (44,709) (16,726) (61,435)

Net finance costs (2,555) (1,899) (4,454)

Other expenses, net (2) (4,121) (332) (4,453)

Share in profit ( loss) of equity-accounted

investees (3) 537 (5,009) (4,472)

Reportable segment loss before tax (51,582) (23,297) (74,814)

Less - unallocated general and administrative

expenses (2,018)

Discontinued operations (454)

Less - unallocated finance costs (4,511)

Loss before income taxes (81,797)

Tax benefit 754

---------

Loss for the period (81,043)

Assets and liabilities as of June

30, 2013

Total segment assets 555,026 131,756 686,782

Unallocated assets 105,782

---------

Total assets 792,564

Segment liabilities 182,585 33,934 216,519

Unallocated liabilities 220,150

---------

Total liabilities 436,669

(1) CEE - including impairment of EUR 45.3 million. India -

including impairment of EUR 15.6 million.

(2) CEE- including fair value negative adjustment of Investment

property of EUR 3.4 million.

(3) India - including equity accounted investees loss mainly due

to impairment of EUR 4.3 million

Central

& Eastern

Europe India Total

----------- --------- ---------

EUR 000' EUR 000' EUR 000'

----------- --------- ---------

Six months period ended June

30, 2012:

Revenue 13,116 1,032 14,148

Operating profit (loss) by segment 1,546 (503) 1,043

Net finance costs (4,939) (802) (5,741)

Other expenses, net (309) - (309)

Share in loss of equity-accounted

investees (1) (23) (912) (935)

Reportable segment loss before

tax (3,725) (2,217) (5,942)

Less - unallocated general and

administrative expenses (2,672)

Discontinued operations (1,892)

Unallocated finance costs (3,350)

Loss before income taxes (13,856)

Tax benefit 4,048

---------

Loss for the period (9,808)

Assets and liabilities as of

December 31, 2012

Total segment assets 603,071 180,723 783,794

Unallocated assets 102,024

---------

Total assets 885,818

Segment liabilities 205,530 37,765 243,295

Unallocated liabilities 199,591

---------

Total liabilities 442,886

(1) - India - including equity accounted investees loss mainly

due to impairment of EUR 1.2 million.

8. Financial risk management

As a result of the ongoing euro area crisis and in particular

the prolonged credit conditions tightening and reduced investment

market activity which continue to impact the core markets in which

the Group operates, management decided to continue with the

deleveraging process (described in detail below) of its financial

position commenced in the previous year. Mindful of the approaching

maturities dates of the Group's financial liabilities the Group has

taken the following steps in order to increase its liquidity

position:

-- Increased the efforts of realization of operating commercial

centres as well as certain land banks where development is not

economically viable. In addition, management continue to take a

cautious approach and evaluate the local economic environment

before any development program is commenced.

-- Disposed of the majority of its available for sale financial assets

-- Sell non-core real estate assets or assets that are close to

fulfilling their valuation potential

As of June 30, 2013 the Group has a cash balance of EUR 87

million and total commitments of principal and interest to

bondholders until the end of the current year of EUR 98 million, of

which EUR 67 million were paid (principal and interest) to holders

of the Israeli Series bonds on July 1, 2013. The cash needed by the

end of the year 2013 is planned to be raised by realization of

certain properties, some of which already consummated as disclosed

in note 13c, or by ways of achieving alternative financing or

capital increase.

Management believes the Group has sufficient Trading Properties

that can be realized in a value that will produce sufficient cash

flows to service its debt over the coming 24 months. The Group is

in the process of such realization program.

Furthermore, management believes that the Company's statement of

financial position reflects sufficient value to enable the

achievement of alternative financing or increase in capital.

Management believes that similarly to prior years all expiring

asset loan contracts will be renewed and covenants technically in

breach will not be called by the lender because historic evidence

shows that loans expiring in the previous years were prolonged or

waived by the same lender and also some covenants technically in

breach were in the same status in recent periods.

In addition, the Company suspended its currency options

activity, and is currently seeking other possibilities of

mitigating the currency risks resulting from having bonds

denominated in NIS.

Other aspects of the Group's financial risk management